Is RUI WIN CAPITAL safe?

Business

License

Is Rui Win Capital A Scam?

Introduction

Rui Win Capital is an online forex broker that positions itself as a provider of trading services in the foreign exchange market. With claims of offering a diverse range of trading instruments and competitive leverage, it aims to attract both novice and experienced traders. However, the need for traders to exercise caution when selecting a forex broker cannot be overstated. The forex market is rife with scams and unregulated entities that can jeopardize traders' investments. Therefore, it is crucial to thoroughly assess the legitimacy and reliability of brokers like Rui Win Capital. This article employs a comprehensive evaluation framework, analyzing the broker's regulatory status, company background, trading conditions, customer fund security, and user experiences to determine whether Rui Win Capital is a safe option for traders.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount, as it ensures that the broker adheres to industry standards and protects traders' interests. Rui Win Capital claims to operate under the jurisdiction of Australia; however, it lacks a valid license from a recognized regulatory authority. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Regulated |

The absence of a valid regulatory license raises significant concerns about Rui Win Capital's legitimacy. Regulation serves as a safety net for traders, ensuring that their funds are protected in segregated accounts and that the broker operates transparently. The lack of oversight from a reputable authority like the Australian Securities and Investments Commission (ASIC) indicates that Rui Win Capital may not comply with necessary legal and ethical standards. Furthermore, historical compliance issues and numerous complaints suggest that this broker may not prioritize the safety and security of its clients' funds.

Company Background Investigation

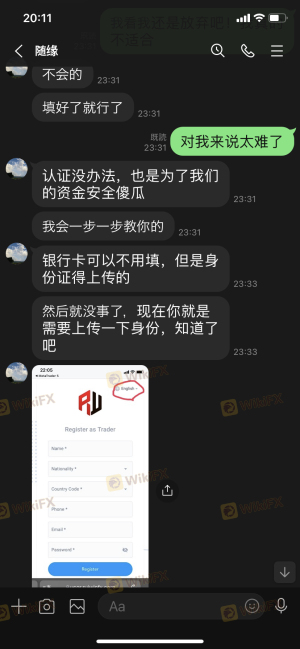

Rui Win Capital is operated by Rui Win Capital Ltd., a company that claims to be based in Australia and the UK. However, the company's history and ownership structure are shrouded in ambiguity. Established in 2021, the broker's operational timeline is relatively short, and there is little information available regarding its management team. A lack of transparency in company ownership and management can be a red flag for potential investors.

The broker's website does not provide any meaningful details about its founders or executive team, which is crucial for evaluating the credibility of a financial institution. A transparent broker typically shares information about its leadership and their professional backgrounds. The absence of such information raises questions about the company's legitimacy and operational integrity. Furthermore, the inconsistent claims regarding its location further complicate the broker's credibility, leading to skepticism about its intentions.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Rui Win Capital claims to provide competitive trading conditions, including spreads as low as 0.2 pips on major currency pairs. However, the broker does not clearly outline its fee structure, which is a cause for concern. The following table compares the core trading costs associated with Rui Win Capital against industry averages:

| Fee Type | Rui Win Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.2 - 0.3 pips | 0.5 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the low spreads may appear attractive, the lack of transparency regarding commissions and overnight interest rates suggests that traders may encounter hidden fees that could erode their profits. Moreover, the absence of a demo account limits traders' ability to assess the trading conditions firsthand before committing real funds. This lack of clarity and transparency in trading conditions raises significant doubts about whether Rui Win Capital is a safe option for traders.

Customer Fund Security

The security of customer funds is a critical aspect of any forex broker's operations. Rui Win Capital's website does not provide clear information regarding its fund security measures. A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in case of financial difficulties. However, the absence of such information from Rui Win Capital raises concerns about the safety of traders' investments.

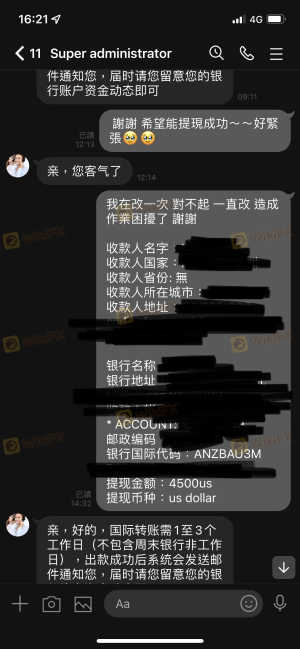

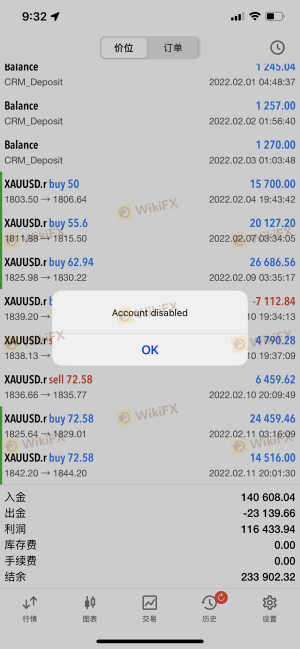

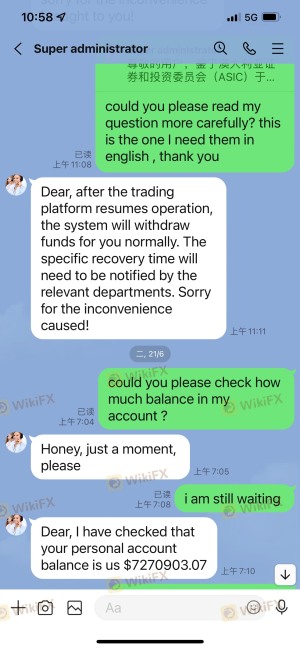

Furthermore, the broker does not offer any investor protection schemes or negative balance protection policies, which are essential for safeguarding traders against significant losses. Historical reports indicate that Rui Win Capital has faced issues related to fund withdrawals, with numerous complaints from users who were unable to access their money. Such incidents highlight the risks associated with trading with an unregulated broker and reinforce the notion that Rui Win Capital may not be a safe choice for traders.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience associated with a broker. Numerous reviews and complaints about Rui Win Capital indicate a pattern of withdrawal difficulties and poor customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

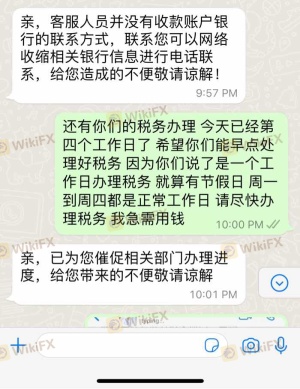

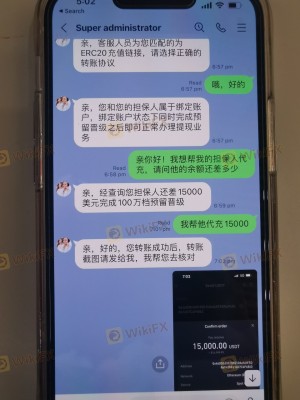

Many traders have reported being unable to withdraw their funds after depositing money, often citing unreasonable demands for additional fees or taxes that were not disclosed initially. In one case, a trader mentioned paying a 20% tax on profits before being informed of further withdrawal conditions. Such experiences indicate a troubling trend of customer dissatisfaction and a lack of accountability from Rui Win Capital.

Platform and Trade Execution

The quality of the trading platform and execution is vital for a successful trading experience. Rui Win Capital claims to offer the popular MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, there are concerns regarding the platform's performance and reliability. Reports of slippage and order rejections have surfaced, raising questions about the broker's execution quality.

Additionally, the broker's website has faced accessibility issues, which could hinder traders' ability to access their accounts or execute trades promptly. The lack of transparency regarding the platform's operational stability further complicates the assessment of whether Rui Win Capital is a safe and reliable trading option.

Risk Assessment

Engaging with Rui Win Capital presents several risks that potential traders should be aware of. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | No segregation of funds or investor protection. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Customer Support Risk | Medium | Poor response times and limited support options. |

Given these risks, it is essential for traders to approach Rui Win Capital with caution. Potential clients should consider alternative brokers that offer robust regulatory oversight and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the legitimacy and safety of Rui Win Capital. The lack of regulatory oversight, transparency in trading conditions, and numerous customer complaints suggest that this broker may not be a safe choice for traders. It is advisable for potential clients to exercise caution and consider reputable, regulated alternatives in the forex market. Traders seeking a reliable trading experience should prioritize brokers with strong regulatory frameworks, transparent fee structures, and positive customer feedback to ensure the safety of their investments.

Is RUI WIN CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of RUI WIN CAPITAL brokers.

RUI WIN CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RUI WIN CAPITAL latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.