Is SHENGHUI safe?

Pros

Cons

Is Shenghui Safe or Scam?

Introduction

Shenghui Group Ltd, a forex and CFD broker based in the United Kingdom, has garnered attention in the trading community for its diverse range of trading instruments and appealing trading conditions. However, the question arises: Is Shenghui safe for traders? As the forex market continues to expand, the need for traders to carefully evaluate their brokers has become paramount. The potential for scams and unregulated brokers poses significant risks to investors, making thorough research essential before engaging with any trading platform. This article aims to investigate Shenghui's credibility through a structured analysis, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its reliability and safety. Regulatory bodies impose stringent standards that brokers must adhere to, providing a layer of protection for traders. Unfortunately, Shenghui currently operates without valid regulatory oversight, as its license from the Australian Securities and Investments Commission (ASIC) has been revoked.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001293752 | Australia | Revoked |

The revocation of Shenghuis ASIC license raises serious concerns regarding its compliance with financial regulations. Without a valid license, traders are left vulnerable, as unregulated brokers are not subject to the same level of scrutiny and oversight. This lack of regulation significantly heightens the risk of fraudulent activities and misconduct. Furthermore, the absence of a functional official website further exacerbates concerns about the broker's legitimacy, suggesting a potential attempt to evade regulatory scrutiny. Therefore, it is essential for prospective traders to consider these factors when evaluating whether Shenghui is safe for trading.

Company Background Investigation

Shenghui Group Ltd has been operating for approximately 2 to 5 years, primarily targeting a global clientele across Europe, Asia, South America, and Africa. However, the companys opacity regarding its ownership structure and management team raises red flags. There is limited information available about the individuals behind the company, which contributes to a lack of transparency.

The management team's background is crucial in assessing the broker's credibility, as experienced professionals typically ensure better governance and operational integrity. Unfortunately, the lack of publicly available information about Shenghui's management diminishes confidence among potential investors. Moreover, the companys failure to provide clear details about its operations and regulatory compliance further underscores the need for caution. In light of these findings, it is imperative for traders to ask themselves: Is Shenghui safe? The answer remains uncertain, given the significant gaps in transparency and information disclosure.

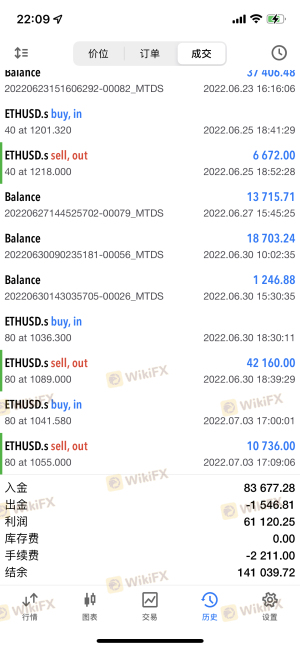

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is vital. Shenghui claims to offer competitive trading conditions, including low spreads and zero commissions, which appear attractive on the surface. However, potential traders should approach these claims with caution, as the absence of detailed information regarding fees could indicate hidden costs.

| Fee Type | Shenghui | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1-3 pips |

| Commission Model | Zero | $5-10 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

The promise of zero commissions and minimal spreads may entice traders, but it is crucial to verify these claims through a demo account before committing real funds. Additionally, the lack of transparency surrounding overnight interest rates and other potential fees raises concerns about the broker's overall fee structure. Traders must remain vigilant and conduct thorough due diligence to ensure they are not caught off guard by unexpected costs. Thus, when considering Is Shenghui safe, the answer may lean towards caution due to the unclear trading conditions.

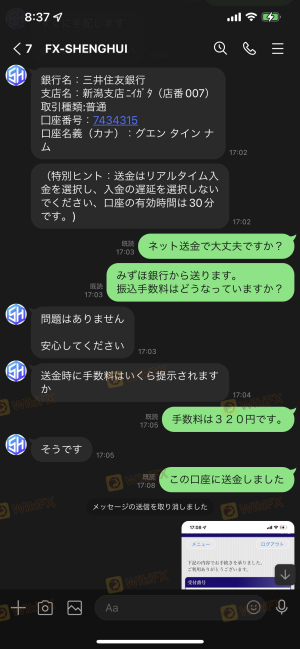

Customer Funds Security

The safety of customer funds is paramount when evaluating any broker. It is essential to ascertain whether a broker implements robust measures to protect clients' capital. Unfortunately, Shenghui has not provided sufficient information regarding its security protocols, such as fund segregation, investor protection schemes, or negative balance protection policies.

Without a clear outline of these security measures, traders are left to speculate about the safety of their investments. The absence of a functional website and credible regulatory oversight further complicates this assessment. Historical complaints and reports of withdrawal issues from users raise additional concerns about the broker's commitment to safeguarding client funds. Therefore, potential investors must carefully consider whether Shenghui is safe for their trading activities, as the lack of transparency regarding fund security could expose them to significant risks.

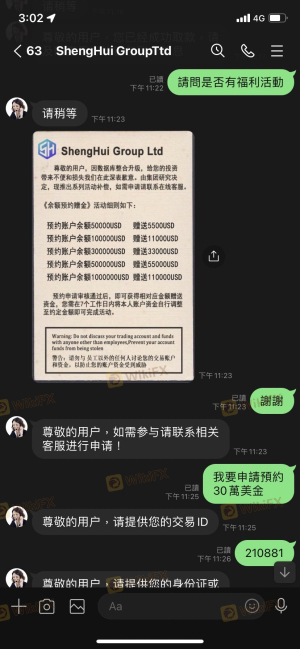

Customer Experience and Complaints

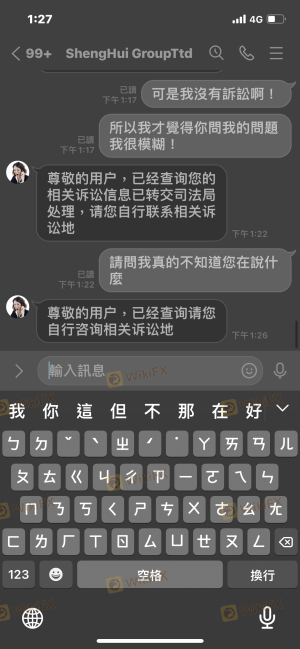

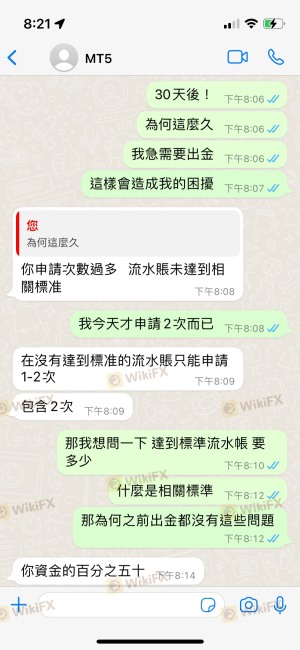

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Shenghui, numerous complaints have surfaced, particularly regarding withdrawal difficulties and unresponsive customer support. Many users have reported being unable to withdraw their funds, with some alleging that their accounts were blocked after raising complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Responsiveness | Medium | Slow |

| Transparency Concerns | High | Unclear |

The prevalence of withdrawal issues and the company's inadequate response to customer complaints serve as significant red flags. Traders must be cautious when considering this broker, as the inability to access funds can lead to substantial financial losses. Thus, it is essential to evaluate whether Shenghui is safe based on the experiences of existing users, who have raised serious concerns about the broker's practices.

Platform and Trade Execution

The trading platform's performance and execution quality are critical aspects of the trading experience. Shenghui offers access to the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, the platform's stability and execution speed remain questionable, especially in light of user complaints regarding slippage and order rejections.

Traders have reported experiencing significant delays in order execution, which can adversely affect trading outcomes. Additionally, any signs of platform manipulation or unfair practices should be taken seriously, as they can undermine the integrity of the trading environment. Consequently, traders must carefully assess whether Shenghui is safe, as issues related to trade execution can significantly impact their trading success.

Risk Assessment

Engaging with a broker like Shenghui entails various risks that traders must consider. The lack of regulation, transparency, and customer support raises serious concerns about the broker's reliability. Additionally, the prevalence of withdrawal issues and negative user experiences further compounds these risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Reports of withdrawal difficulties |

| Operational Risk | Medium | Unclear trading conditions |

To mitigate these risks, traders should conduct thorough research, consider alternative regulated brokers, and remain vigilant about their investments. It is crucial to prioritize safety and transparency when selecting a trading platform. As such, the question remains: Is Shenghui safe? The evidence suggests significant risks that warrant caution.

Conclusion and Recommendations

In conclusion, the investigation into Shenghui Group Ltd reveals several concerning factors that suggest the broker may not be a safe option for traders. The lack of valid regulatory oversight, coupled with numerous complaints regarding withdrawal issues and poor customer support, raises significant red flags. Furthermore, the opacity surrounding the company's operations and trading conditions further complicates the assessment of its credibility.

For traders seeking a reliable and safe trading environment, it is advisable to explore alternative options with established regulatory oversight and positive user experiences. Brokers regulated by reputable authorities, such as the FCA or ASIC, offer a higher level of protection and transparency. Ultimately, potential investors must weigh the risks carefully and prioritize safety when considering Is Shenghui safe for their trading activities.

Is SHENGHUI a scam, or is it legit?

The latest exposure and evaluation content of SHENGHUI brokers.

SHENGHUI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHENGHUI latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.