Is FXKOVNER safe?

Business

License

Is FX Kovner Safe or Scam?

Introduction

FX Kovner is an online forex broker that claims to provide trading services to a diverse clientele across the globe. With promises of competitive spreads, high leverage, and a user-friendly trading platform, FX Kovner positions itself as a viable option for traders looking to enter the forex market. However, given the prevalence of scams in the online trading world, it is crucial for traders to carefully evaluate the legitimacy of any broker before committing their funds. This article investigates whether FX Kovner is a safe trading platform or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client funds. Unfortunately, FX Kovner does not hold any licenses from major financial regulatory authorities, which raises significant concerns about its operation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation indicates that FX Kovner is not subject to oversight by any financial authority, which poses a significant risk to traders. While the broker claims to operate under a “multi-agency regulation,” these assertions lack verification and transparency. Furthermore, a search through the Financial Conduct Authority (FCA) registers reveals no record of FX Kovner or its parent company, FX Kovner Capital Holding Group Ltd. This lack of oversight raises red flags, suggesting that FX Kovner may not be a safe option for trading.

Company Background Investigation

FX Kovner is reportedly owned by FX Kovner Capital Holding Group Ltd., which claims to be based in the United Kingdom. However, the information surrounding the companys history and ownership structure is sparse and lacks transparency. There is little available data about the management team, their professional backgrounds, or any relevant experience in the financial sector.

The company's website does not provide clear information about its operational history or any physical address, which is a critical aspect of transparency for any financial institution. The lack of information about the company's leadership and operational practices further diminishes trust in FX Kovner.

Given these factors, it is essential for potential traders to question the credibility of FX Kovner and its claims about being a reputable brokerage. Without a solid foundation of transparency and accountability, the broker's safety is highly questionable.

Trading Conditions Analysis

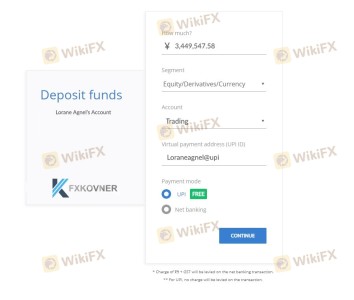

FX Kovner advertises a minimum deposit requirement of $100 and offers leverage ratios of up to 1:300, which may seem attractive to new traders. However, the overall fee structure and trading conditions remain unclear, raising concerns about hidden fees or unfavorable trading practices.

| Fee Type | FX Kovner | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information regarding spreads, commissions, and overnight fees can be alarming. Transparency in these areas is essential for traders to make informed decisions. The absence of clear fee structures may indicate that traders could face unexpected costs, further compromising the safety of their investments with FX Kovner.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. FX Kovner does not provide any information regarding the segregation of client funds, investor protection measures, or negative balance protection policies. This lack of information raises serious concerns about the security of traders' investments.

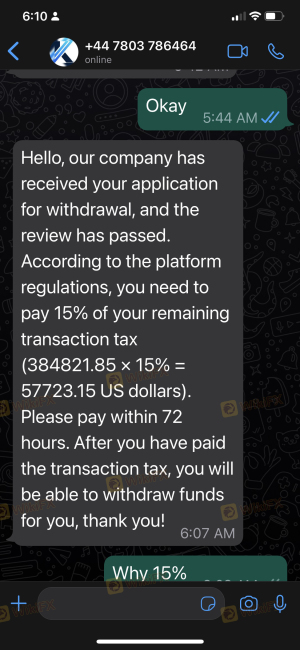

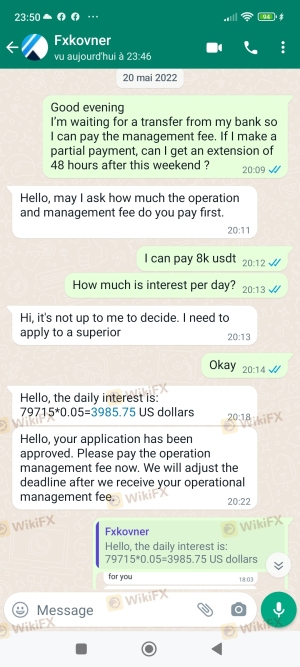

Without regulatory oversight, FX Kovner may not be obligated to maintain client funds in segregated accounts, which means that your money could be at risk. Additionally, the absence of any insurance or guarantees for deposits further exacerbates the risks associated with trading on this platform. Historical complaints and negative reviews about fund withdrawal issues only add to the skepticism surrounding FX Kovner's safety.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Unfortunately, many reviews of FX Kovner highlight significant issues, including difficulty in withdrawing funds, lack of customer support, and misleading information about trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints often revolve around the inability to withdraw funds once deposited, with customers reporting that their requests are either ignored or met with unreasonable conditions. This pattern of complaints raises serious concerns about the broker's integrity and reinforces the notion that FX Kovner may not be safe for traders.

Platform and Trade Execution

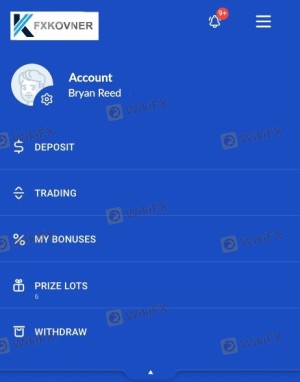

FX Kovner claims to offer the popular MetaTrader 5 trading platform, known for its advanced features and user-friendly interface. However, without proper regulation, the quality of execution and reliability of the platform cannot be guaranteed.

Concerns about execution quality, slippage, and order rejections are prevalent among traders using unregulated brokers. The potential for platform manipulation or unfair trading practices is also a significant risk factor. Traders should be wary of any broker that does not provide transparent information about its trading platform and execution policies.

Risk Assessment

Engaging with FX Kovner poses various risks that potential traders should consider before investing.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk of fraud. |

| Fund Safety Risk | High | Lack of segregation and protection measures. |

| Withdrawal Risk | High | Numerous complaints about fund withdrawals. |

| Execution Risk | Medium | Potential for slippage and unfair practices. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with a proven track record. Engaging in trading with unregulated brokers like FX Kovner can lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that FX Kovner is not a safe option for forex trading. The lack of regulatory oversight, transparency issues, and numerous complaints regarding fund withdrawals raise serious concerns about the broker's legitimacy.

Traders are advised to exercise caution and avoid FX Kovner, as the risks associated with this broker far outweigh any potential benefits. Instead, consider opting for well-regulated brokers that offer transparency, robust customer support, and a solid track record of protecting client funds. If you are looking for safe trading alternatives, brokers regulated by the FCA, ASIC, or CySEC are generally more reliable options.

In summary, is FX Kovner safe? Based on the available evidence, it is prudent to conclude that FX Kovner exhibits numerous characteristics of a scam and should be approached with extreme caution.

Is FXKOVNER a scam, or is it legit?

The latest exposure and evaluation content of FXKOVNER brokers.

FXKOVNER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXKOVNER latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.