Is IPCAPITAL safe?

Pros

Cons

Is IPCapital A Scam?

Introduction

IPCapital, also known as Intelligence Prime Capital, has emerged as a player in the forex trading market, positioning itself as a platform that offers a variety of trading instruments, including forex, CFDs, stocks, and cryptocurrencies. Given the vast number of trading platforms available today, potential investors must exercise caution and conduct thorough evaluations before committing their funds. The forex market is notoriously susceptible to scams, and traders can easily fall victim to fraudulent operations if they do not perform due diligence. This article aims to provide a comprehensive analysis of IPCapital's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The information presented is derived from various online reviews, regulatory warnings, and user feedback, ensuring a balanced and objective evaluation.

Regulation and Legitimacy

One of the most critical aspects of any forex broker is its regulatory status. Regulatory bodies are responsible for overseeing trading activities and ensuring that brokers adhere to industry standards, thereby protecting traders from fraud and mismanagement. Unfortunately, IPCapital's regulatory standing raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001294622 | Australia | Revoked |

| FINTRAC | N/A | Canada | Unverified |

| FMA | N/A | New Zealand | Unverified |

As indicated in the table, IPCapital claims to hold licenses from various regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, multiple reports suggest that these licenses are either revoked or unverified, casting doubt on the broker's legitimacy. The lack of a valid regulatory framework means that IPCapital does not have the legal authority to operate in many jurisdictions, which is a significant red flag for potential investors questioning is IPCapital safe.

Moreover, the absence of oversight from tier-1 regulatory bodies like the FCA (UK) or SEC (USA) further complicates the broker's credibility. In light of these findings, it is crucial for traders to consider the risks associated with engaging with an unregulated broker such as IPCapital.

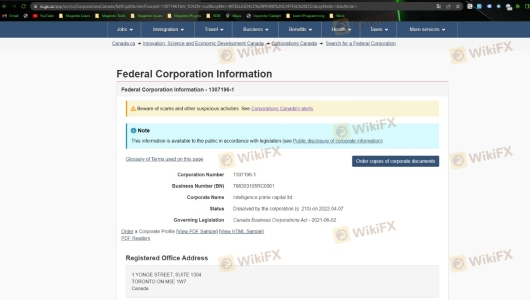

Company Background Investigation

IPCapital was established in 2021, claiming to provide innovative trading solutions and advanced trading technology. However, the company's brief history raises questions about its credibility. The website states that IPCapital has been in operation for 15 years, which contradicts its registration date. This discrepancy suggests a lack of transparency and may indicate that the company is attempting to mislead potential clients.

The ownership structure of IPCapital remains unclear, with limited information available regarding its management team and their professional backgrounds. The absence of detailed disclosures about the company's leadership raises concerns about accountability and operational integrity. Investors should be wary of companies that lack transparency, as this can often be a sign of underlying issues.

Additionally, the company has faced multiple complaints regarding its operations, including allegations of fraudulent activities and misleading marketing practices. This historical context further complicates the question of is IPCapital safe for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value and transparency. IPCapital claims to offer various trading instruments, including forex pairs, CFDs, commodities, and cryptocurrencies. However, the specifics regarding trading costs, such as spreads and commissions, are not clearly outlined on the platform, which raises further concerns.

| Cost Type | IPCapital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

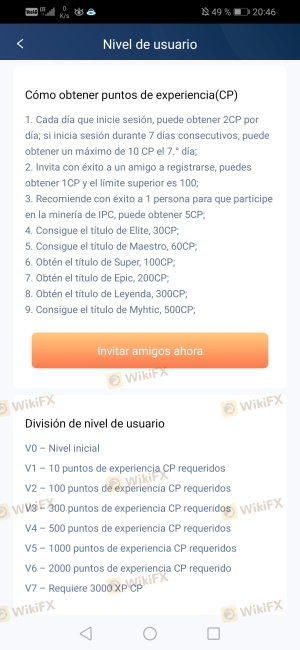

The lack of clarity surrounding trading costs can lead to unexpected expenses for traders, making it difficult for them to accurately assess their potential profitability. Moreover, IPCapital's claims of high returns—up to 45% monthly—are unrealistic and should be approached with skepticism. Such promises are often indicative of high-risk schemes, leading to the question: is IPCapital safe for investment purposes?

Additionally, any broker that does not provide transparent information about its fees may be attempting to obscure hidden costs, which could significantly impact a trader's bottom line.

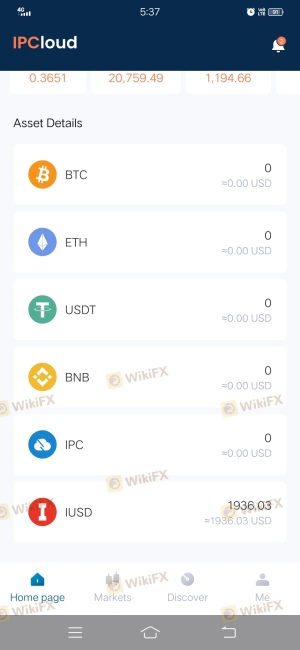

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. IPCapital's approach to fund security appears to be lacking. There is little information available regarding how the broker manages client funds, including whether they are held in segregated accounts. The absence of such measures can expose traders to significant risks, especially in the event of the broker's insolvency.

Furthermore, IPCapital does not appear to offer investor protection schemes, which are often essential for safeguarding client funds. The lack of a clearly defined policy on negative balance protection further complicates the situation. Traders should be cautious when dealing with brokers that do not prioritize the safety of their clients' funds, as this raises serious questions about is IPCapital safe for investment.

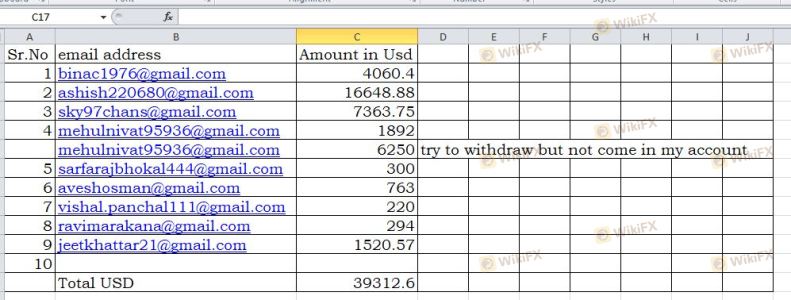

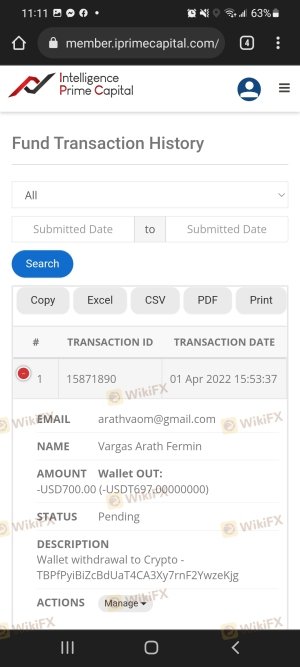

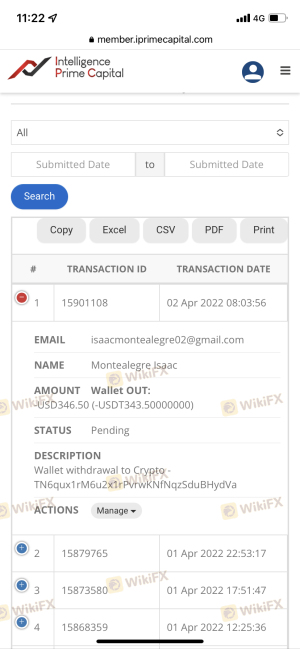

Historical complaints also indicate that many users have faced challenges when attempting to withdraw their funds, with reports of delays and unresponsive customer service. Such issues further highlight the potential risks associated with investing through IPCapital.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of any trading platform. Unfortunately, IPCapital has garnered numerous complaints from users, primarily centered around withdrawal difficulties and unresponsive customer support. These issues can significantly impact a trader's overall experience and trust in the platform.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include users being unable to withdraw their funds, with some alleging that their accounts were frozen or that they were given vague reasons for the delays. The company's failure to address these issues in a timely and satisfactory manner raises concerns about its operational integrity and customer service quality.

In some cases, users have reported that IPCapital's customer support is unresponsive, leaving them without any means of resolving their issues. This pattern of complaints further reinforces the skepticism surrounding is IPCapital safe for potential investors.

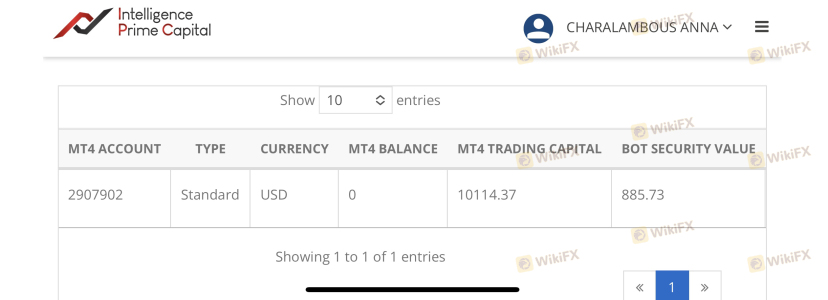

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. IPCapital claims to offer a user-friendly interface with access to popular trading platforms like MetaTrader 4 (MT4). However, many users have reported issues related to platform stability, order execution quality, and instances of slippage.

Traders have expressed concerns about the execution speed of their trades, with reports of delays and rejected orders. Such experiences can lead to significant financial losses, especially in a fast-paced trading environment. The potential for platform manipulation, combined with a lack of transparency regarding execution practices, raises further questions about is IPCapital safe for trading.

Risk Assessment

Engaging with IPCapital presents several risks that potential investors should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status and revoked licenses. |

| Withdrawal Risk | High | Numerous complaints regarding fund access. |

| Transparency Risk | Medium | Lack of clear information on fees and conditions. |

| Platform Stability Risk | High | Reports of execution issues and platform failures. |

Given these risks, it is essential for traders to approach IPCapital with caution. To mitigate these risks, potential investors should conduct thorough research, seek out user reviews, and consider alternative, more reputable trading platforms.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that IPCapital exhibits several characteristics typical of a potentially fraudulent broker. The lack of valid regulatory oversight, combined with numerous complaints regarding customer service and fund withdrawals, raises significant concerns about its legitimacy. Given these factors, it is prudent for traders to be skeptical about engaging with IPCapital.

For those considering forex trading, it is advisable to explore alternative brokers that are well-regulated, transparent about their fees, and have a proven track record of customer satisfaction. Some recommended alternatives include reputable platforms with strong regulatory backing and positive user reviews. Ultimately, ensuring the safety of your investments should be the top priority when navigating the forex trading landscape.

Is IPCAPITAL a scam, or is it legit?

The latest exposure and evaluation content of IPCAPITAL brokers.

IPCAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IPCAPITAL latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.