IPCAPITAL 2025 Review: Everything You Need to Know

Summary: The overall consensus regarding IPCAPITAL is largely negative, with numerous reports of it being unregulated and potentially fraudulent. Key findings reveal significant issues with fund withdrawals and customer support, raising serious concerns about the broker's legitimacy.

Note: It is important to highlight that IPCAPITAL operates under different entities in various regions, which complicates its regulatory status. This review is based on a comprehensive analysis of multiple sources to ensure fairness and accuracy.

Ratings Overview

We assess brokers based on a combination of user feedback, expert analysis, and regulatory information.

Broker Overview

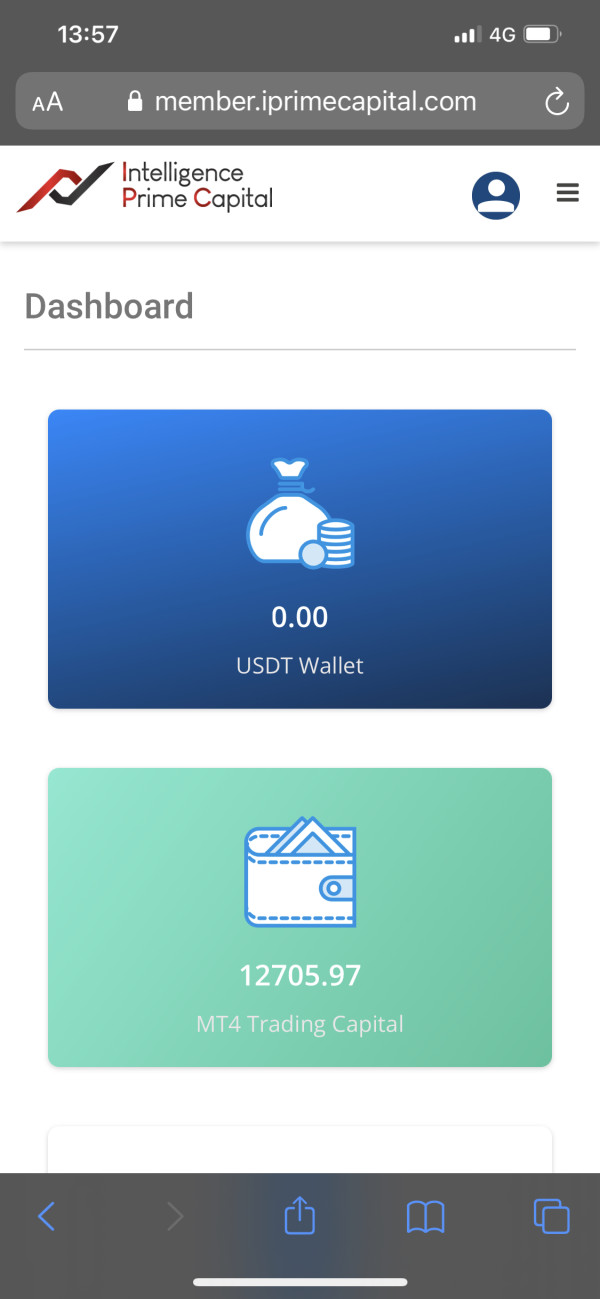

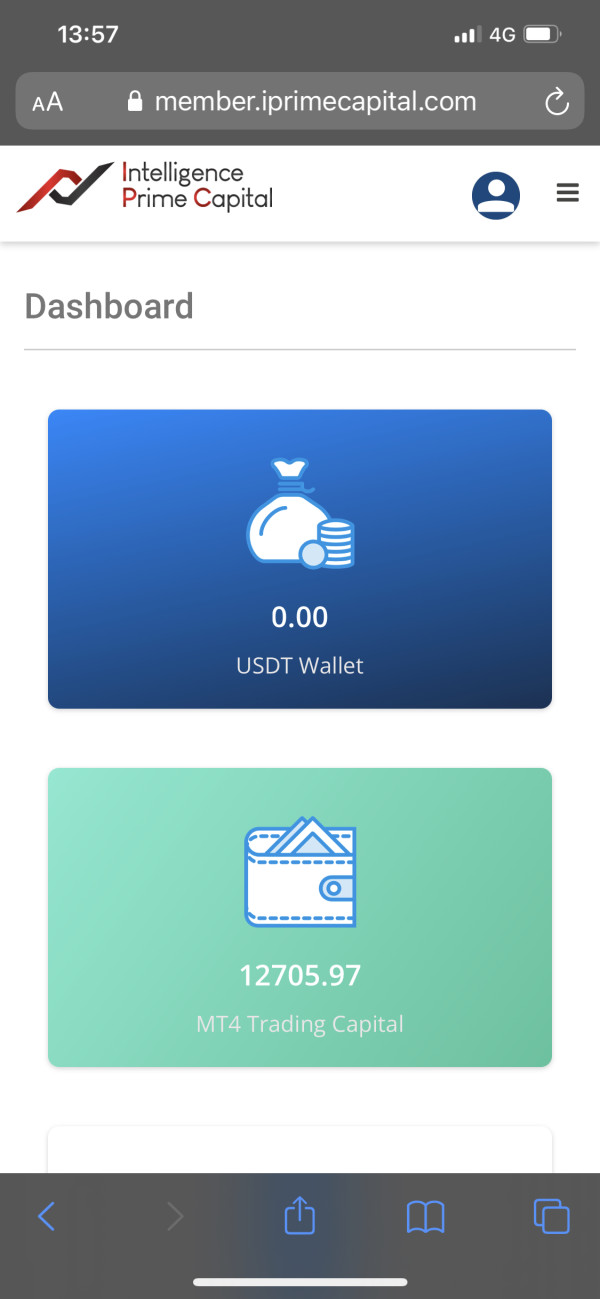

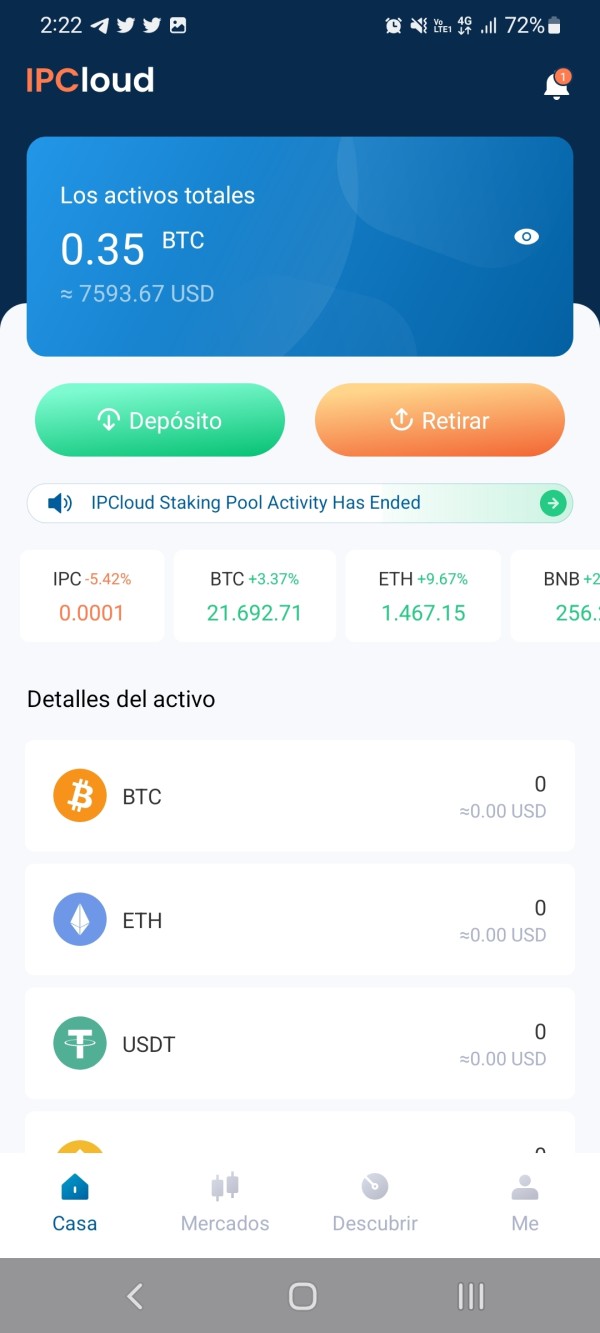

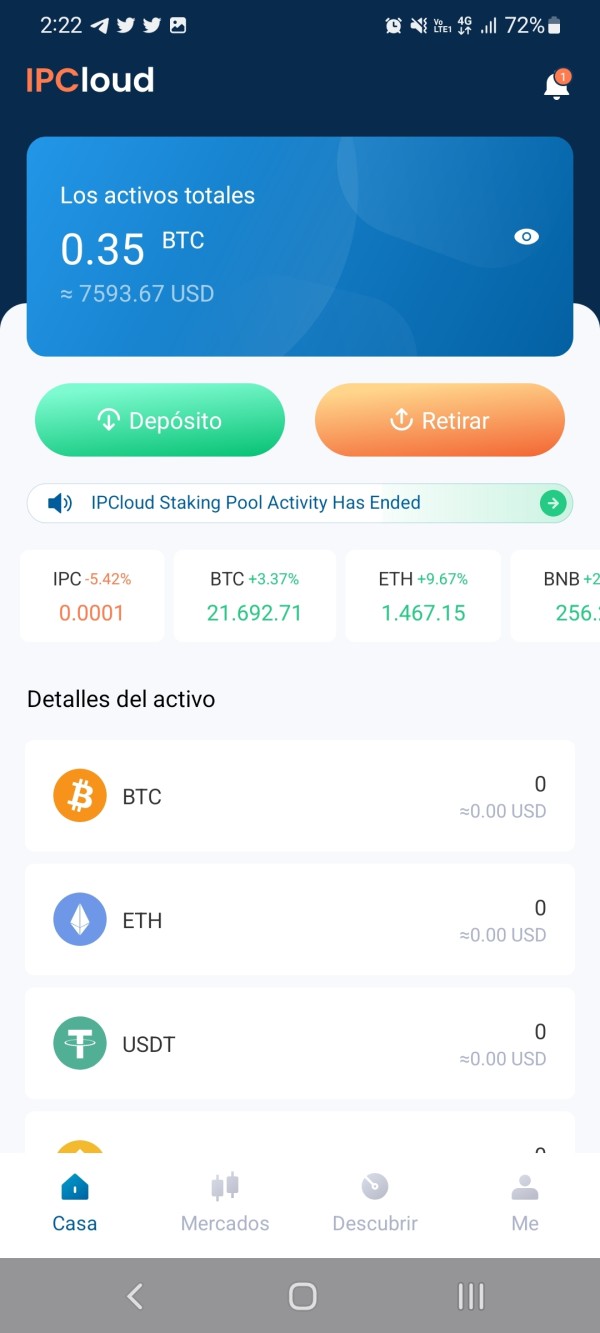

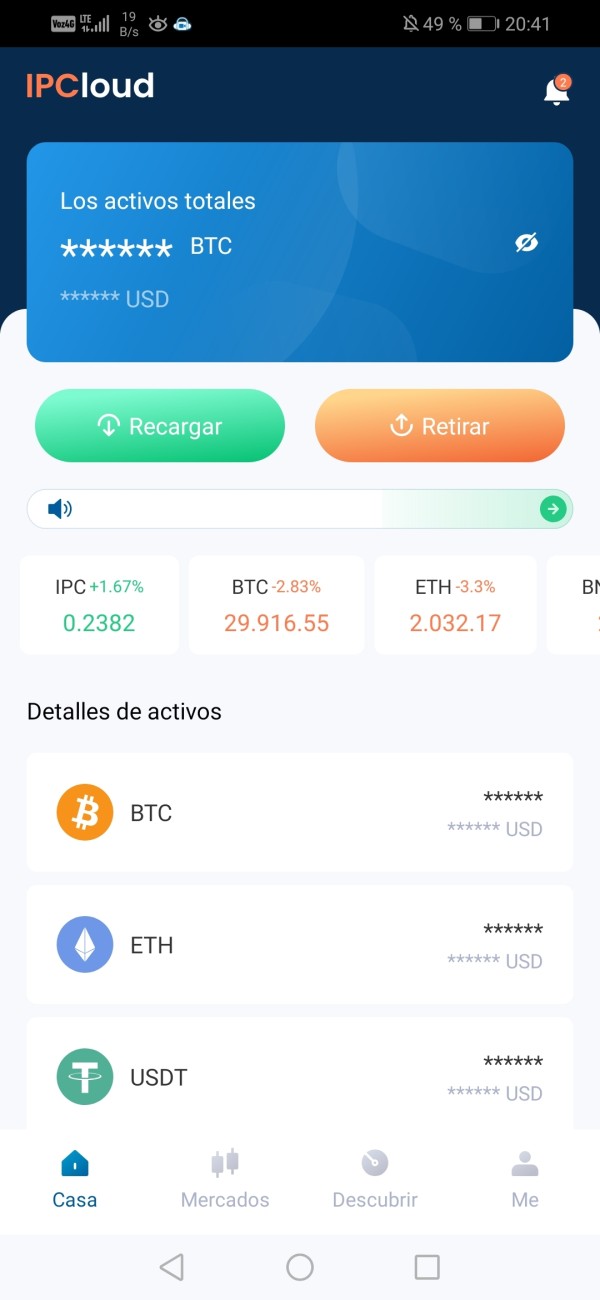

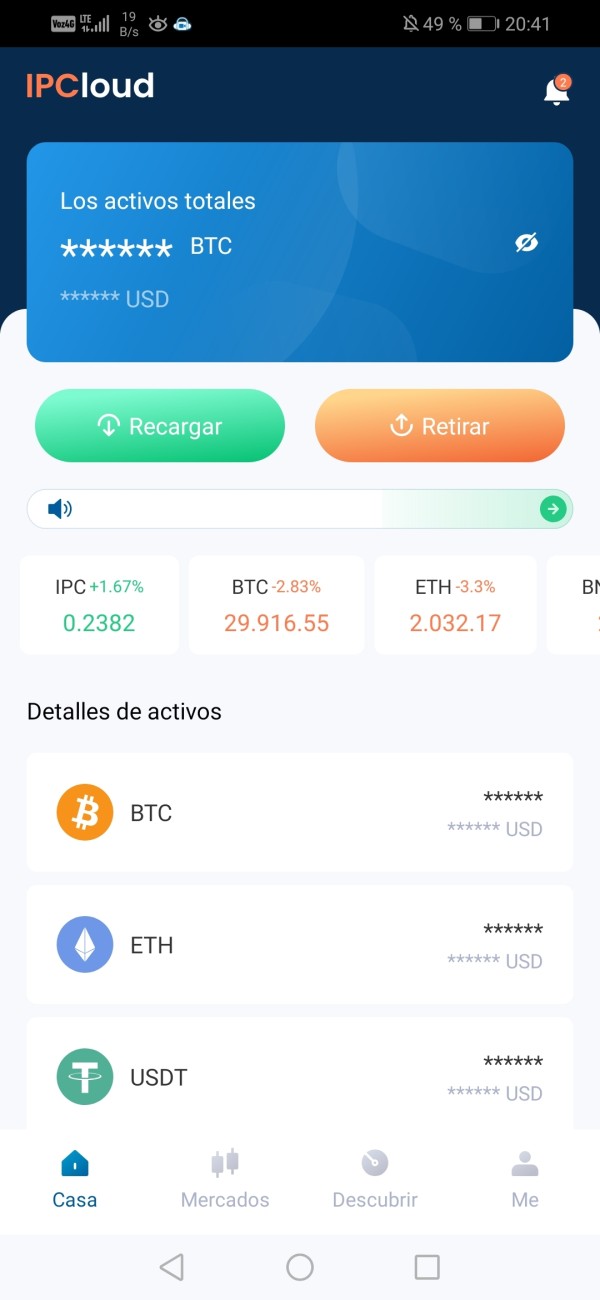

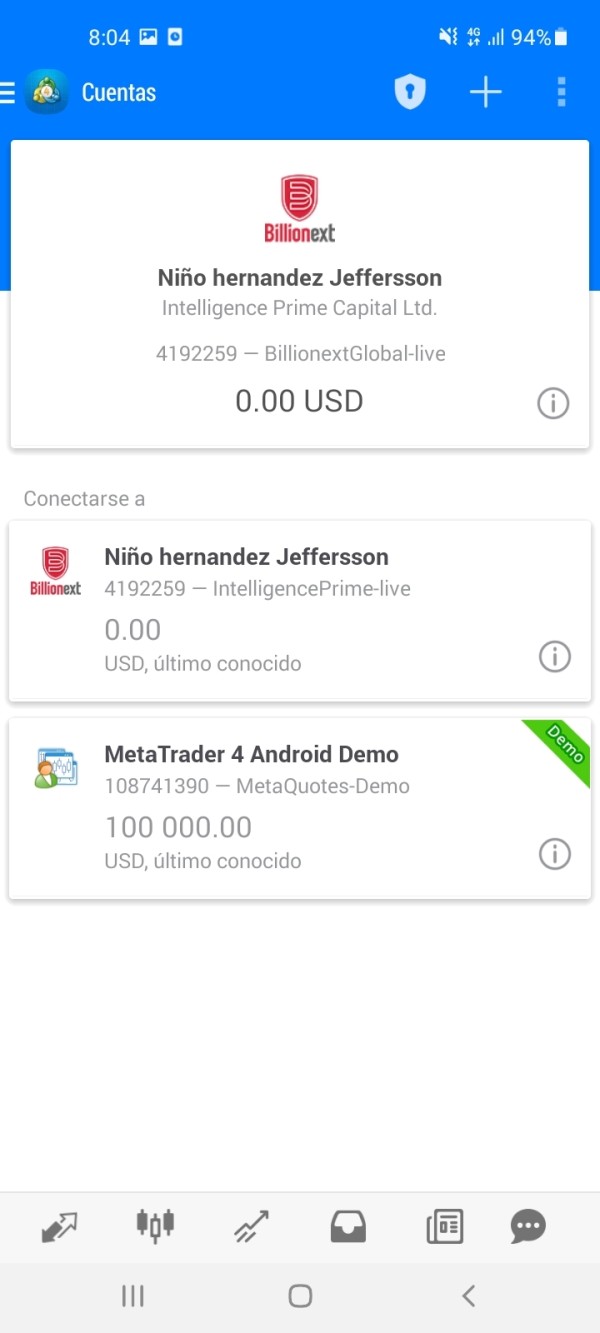

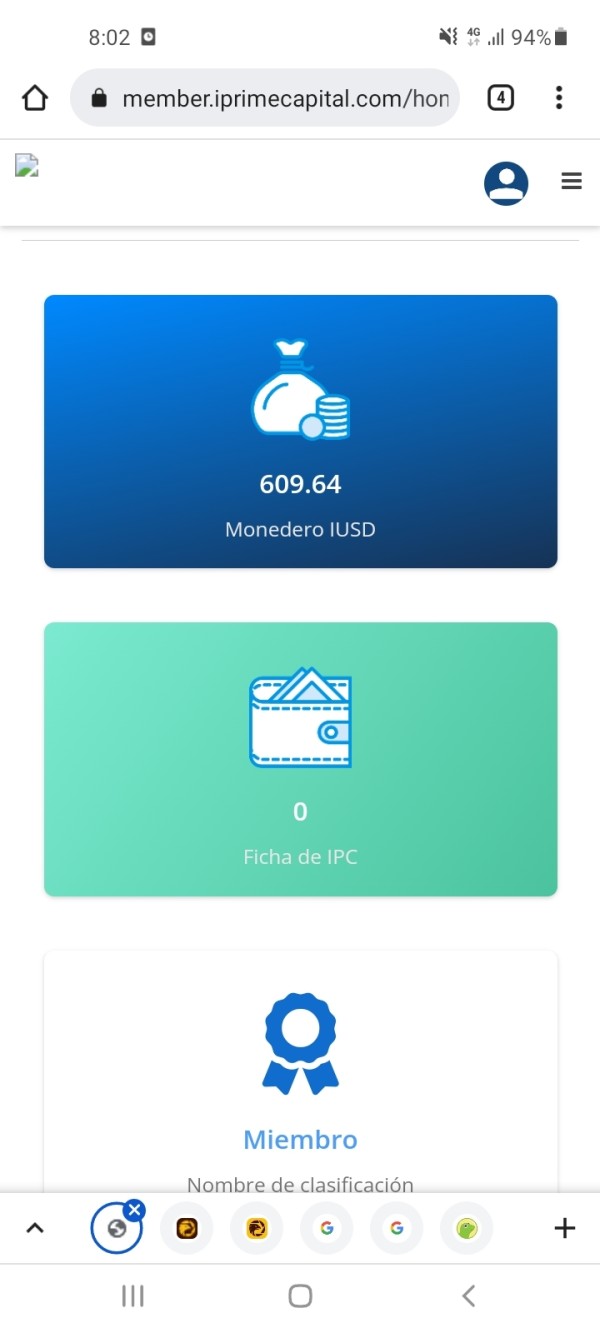

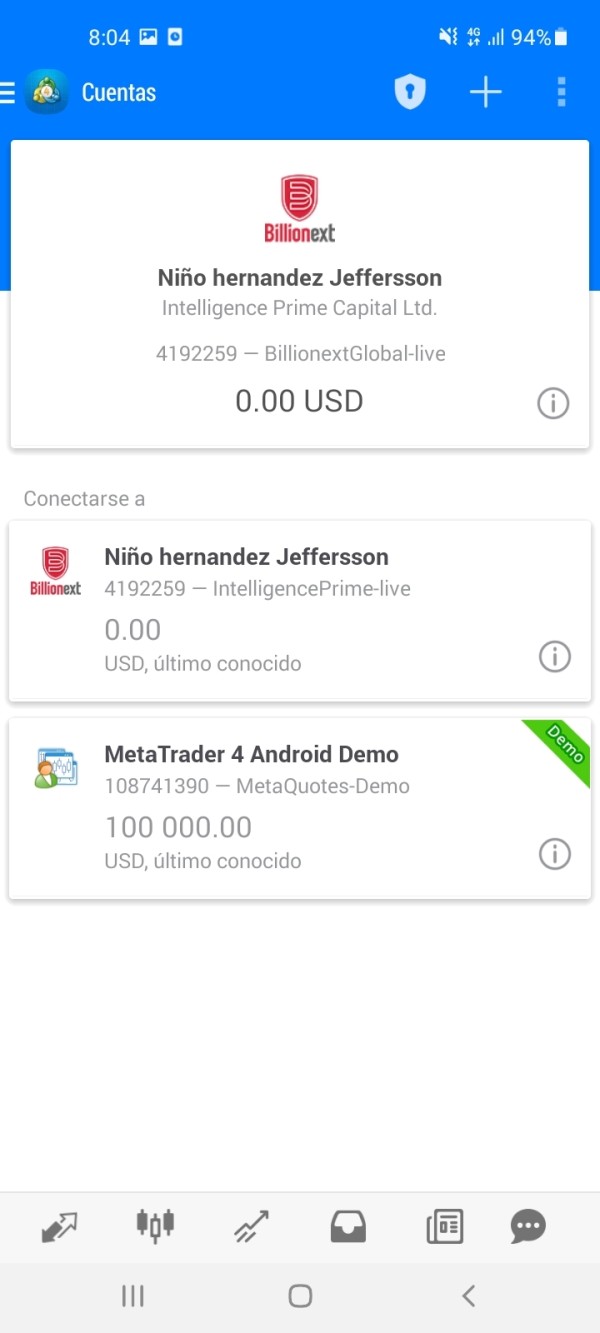

Founded in 2021, IPCAPITAL, also known as Intelligence Prime Capital, claims to provide a comprehensive trading platform for forex and CFD traders. The broker offers the widely-used MetaTrader 4 (MT4) platform, along with proprietary tools. However, it lacks clear regulatory oversight, raising concerns about its operations. Reports indicate that it offers a variety of trading assets, including over 50 forex pairs, cryptocurrencies, stocks, commodities, and indices.

Detailed Analysis

Regulatory Regions

IPCAPITAL claims to operate in various jurisdictions, including Canada and Australia, but has faced multiple warnings from financial regulators such as the British Columbia Securities Commission (BCSC) and the Financial Markets Authority (FMA) in New Zealand. These warnings highlight that IPCAPITAL is not authorized to provide financial services, making it a significant red flag for potential investors.

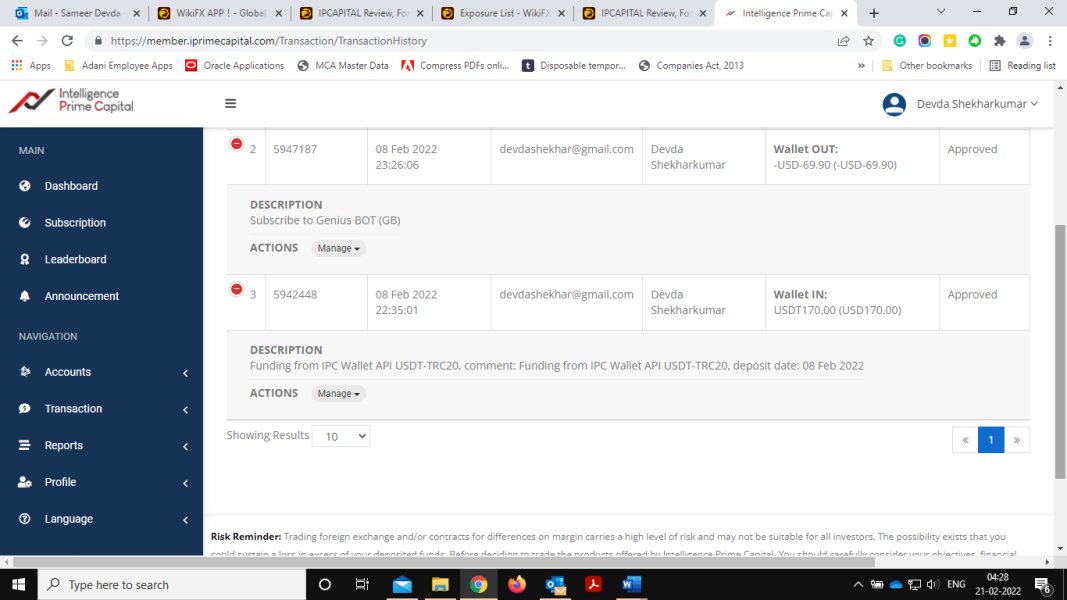

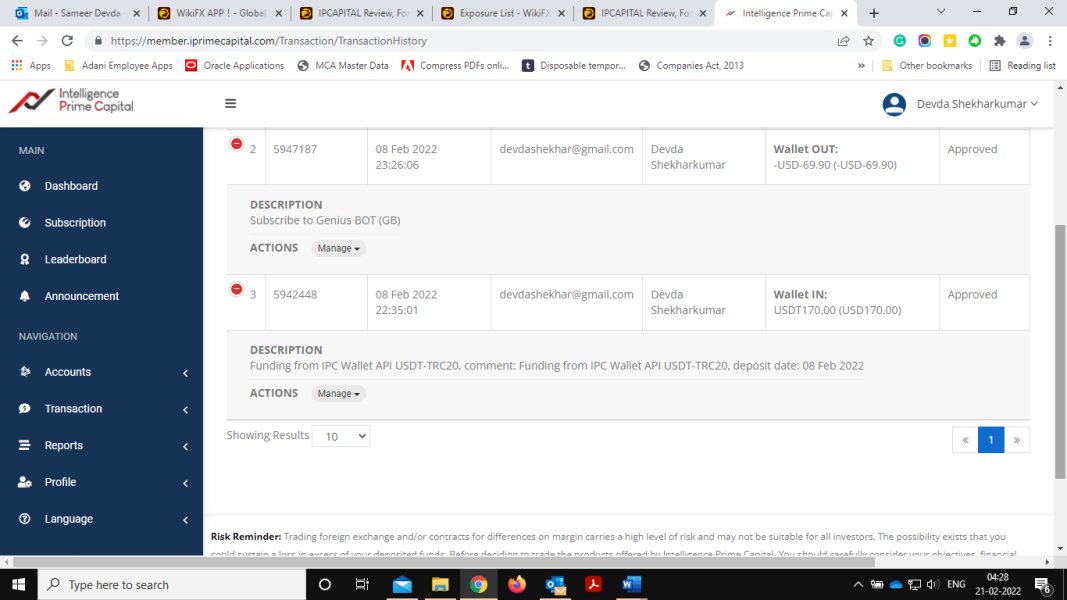

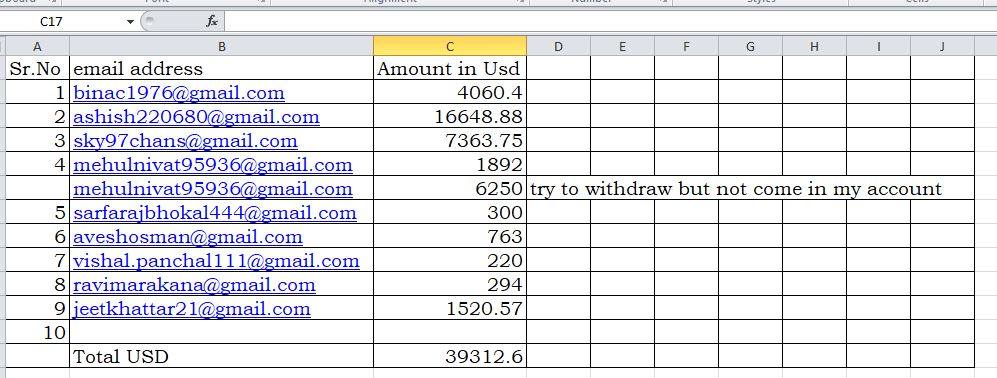

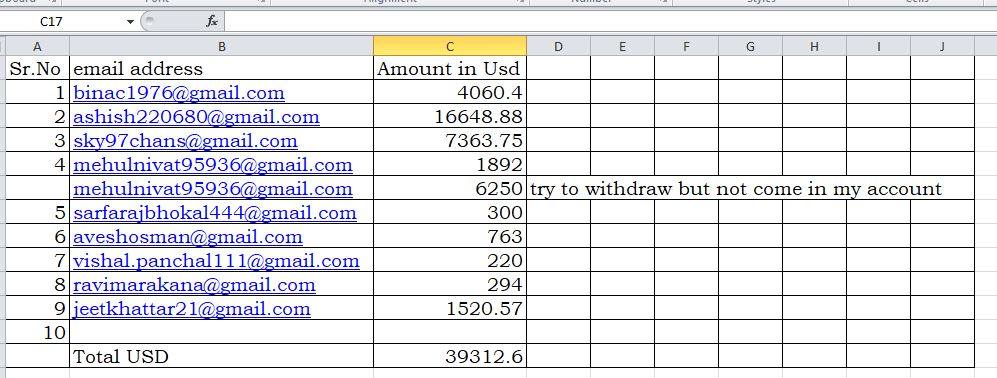

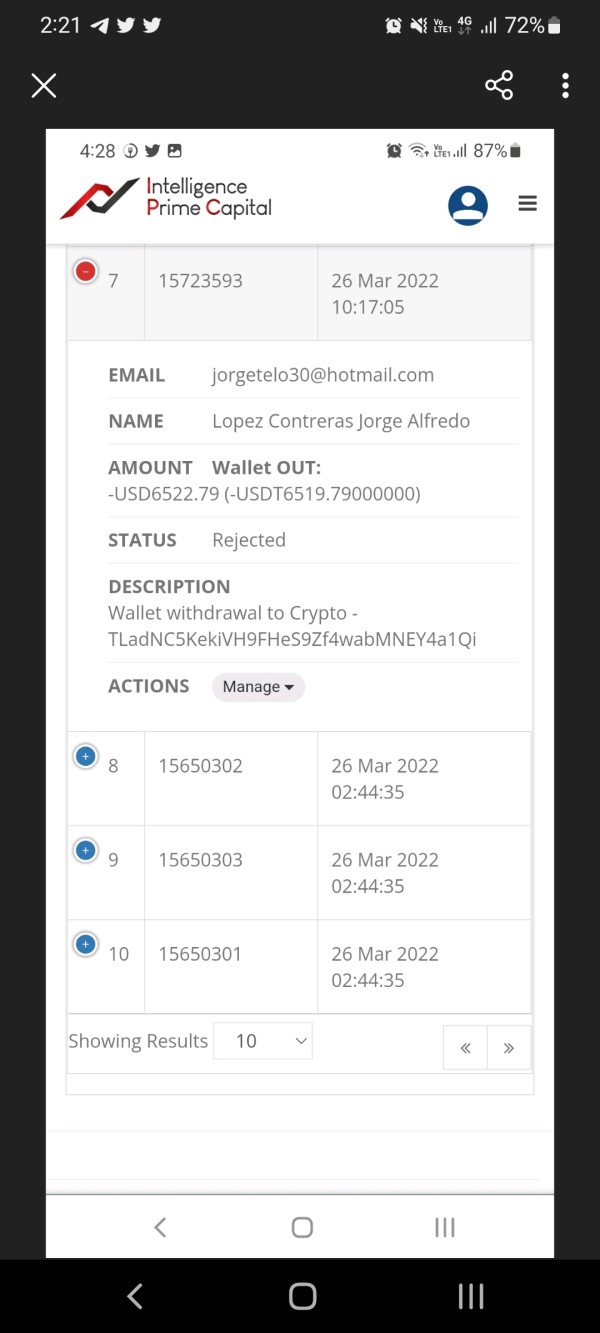

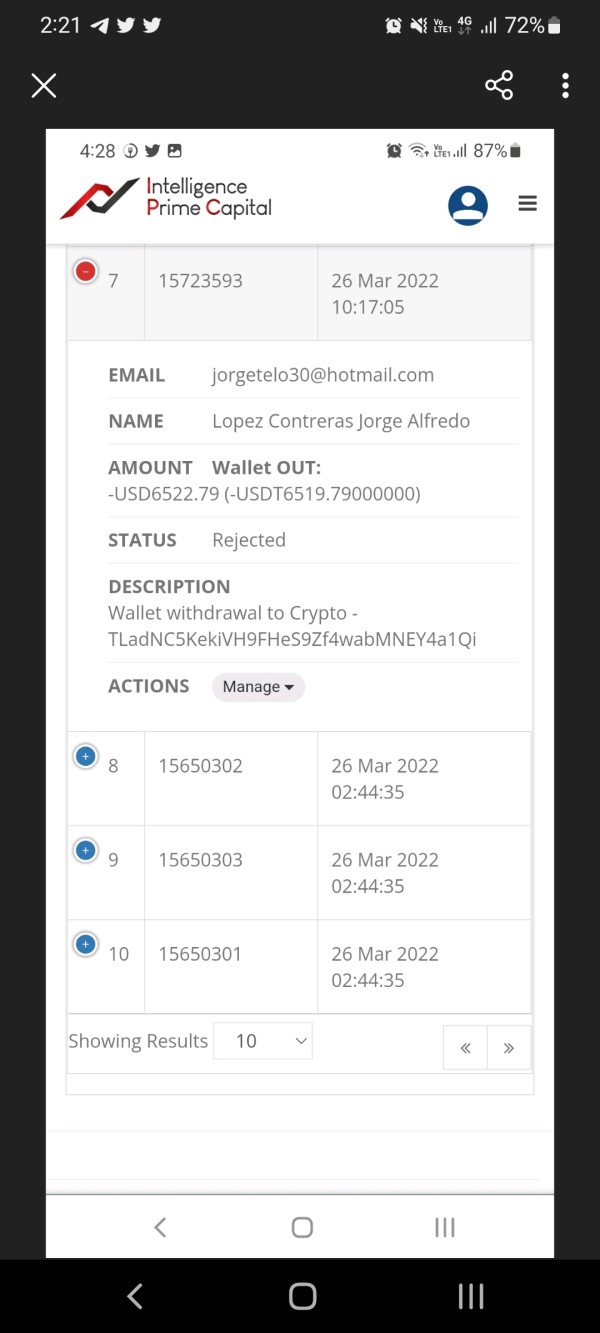

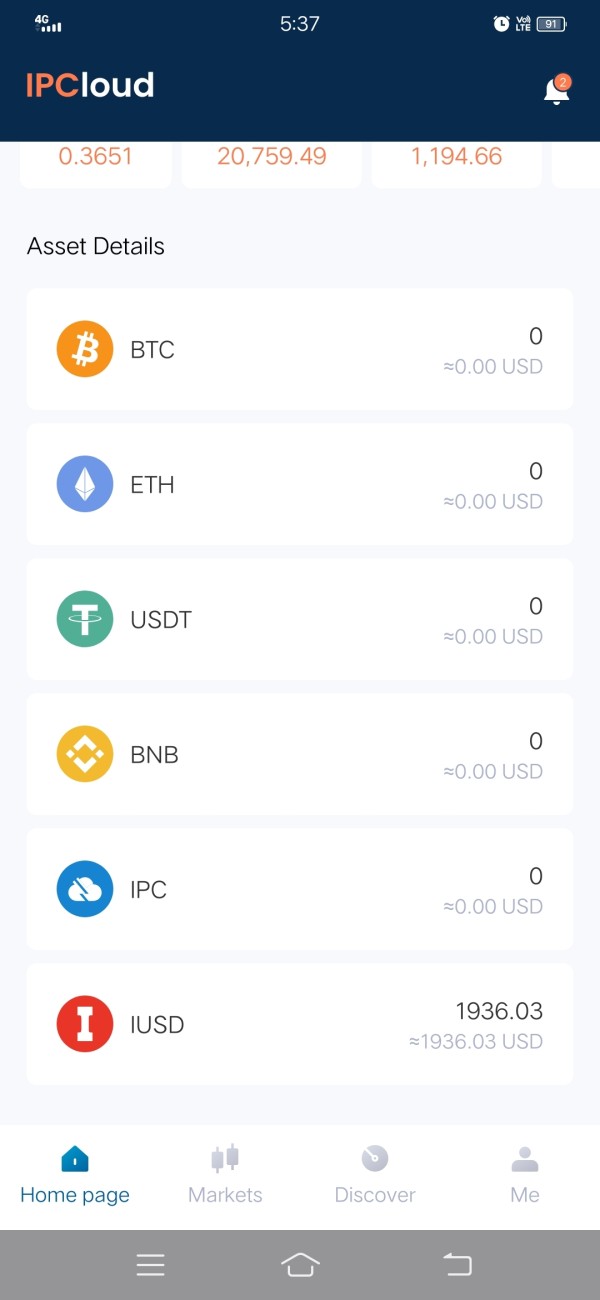

Deposit/Withdrawal Methods

The specifics regarding deposit and withdrawal methods are not clearly outlined on IPCAPITAL's website. This lack of transparency is concerning, especially since user reviews frequently mention difficulties in withdrawing funds. Many traders report that their withdrawal requests were either ignored or outright denied, leading to frustrations and losses.

Minimum Deposit

There is no clear information on the minimum deposit required to open an account with IPCAPITAL. This ambiguity can be a deterrent for potential traders who prefer to know upfront the financial commitment required.

IPCAPITAL does not appear to offer any bonuses or promotional incentives, which is a common practice among many reputable brokers. This absence may suggest a lack of competitive strategies to attract and retain clients.

Tradable Asset Classes

Traders can access a wide range of financial instruments through IPCAPITAL, including forex, cryptocurrencies, stocks, and commodities. However, the lack of clarity on trading conditions, such as spreads and commissions, makes it difficult for traders to assess the actual costs of trading.

Costs (Spreads, Fees, Commissions)

There is limited information available on the costs associated with trading on IPCAPITAL. The absence of clear details regarding spreads, fees, and commissions raises questions about the overall transparency and fairness of the trading environment.

Leverage

IPCAPITAL offers leverage, but the specific ratios are not well-defined in the available resources. High leverage can amplify both potential profits and risks, so it is essential for traders to understand the implications before engaging.

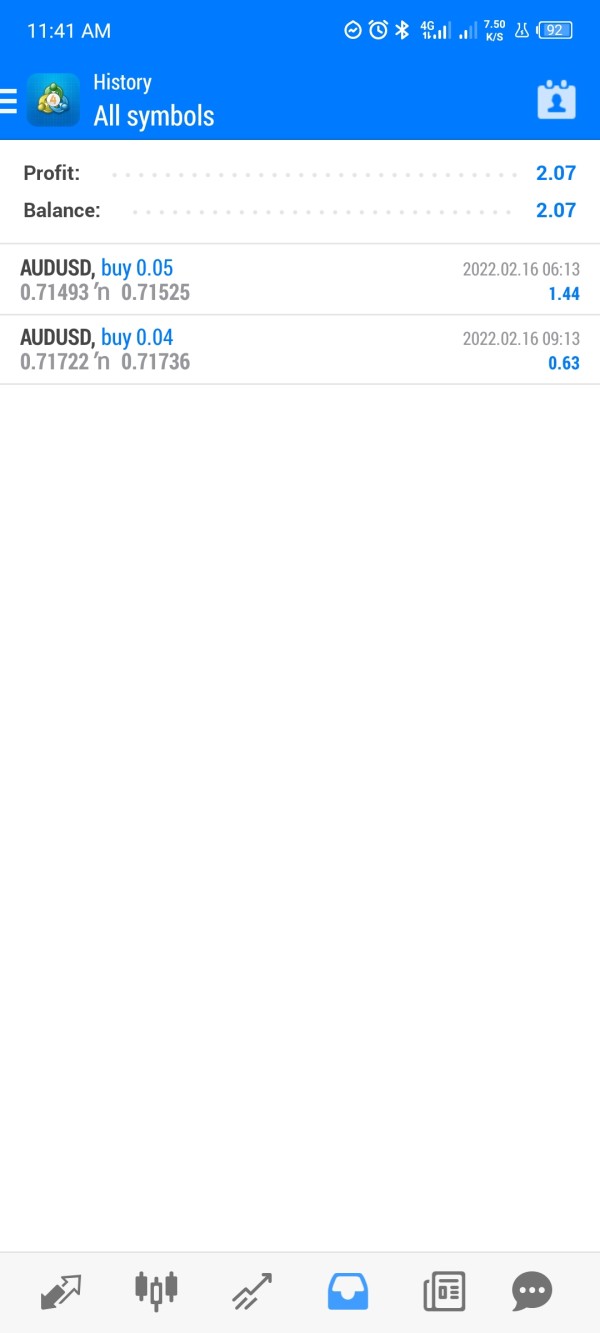

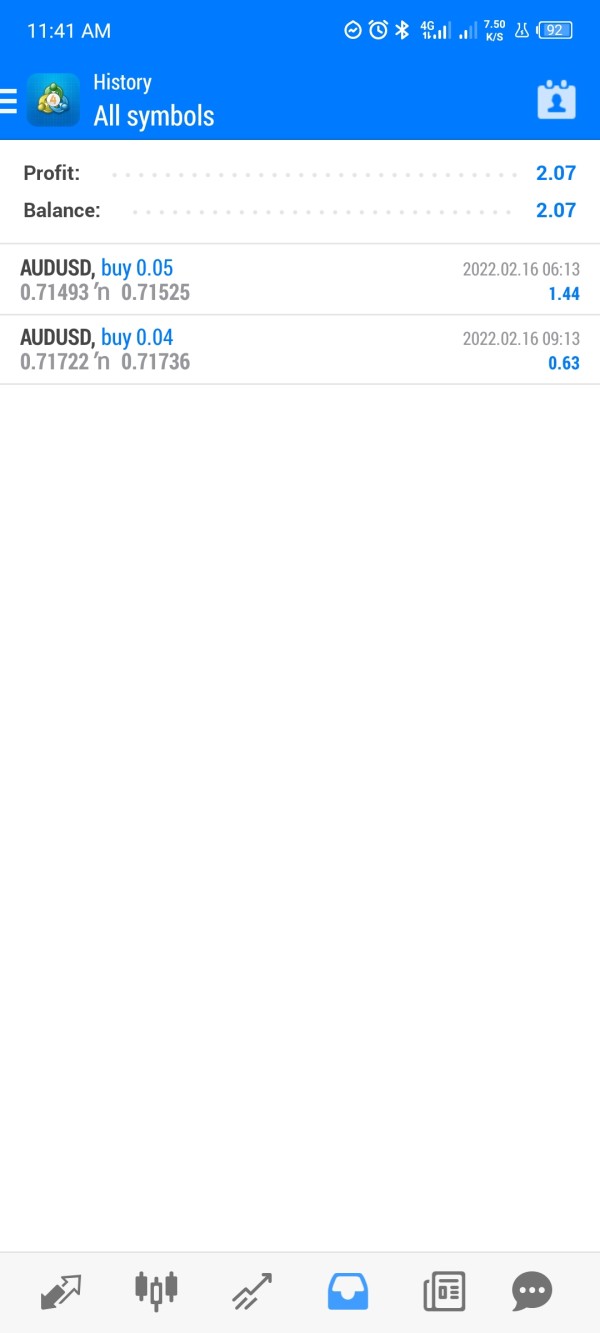

The primary trading platform offered is MT4, known for its user-friendly interface and advanced trading tools. However, some sources indicate that the platform may not be fully operational, with users encountering issues accessing it.

Restricted Regions

Due to its unregulated status, IPCAPITAL may not be available to traders in certain jurisdictions, including the United States and regions with stringent financial regulations.

Available Customer Service Languages

IPCAPITAL claims to provide customer support in multiple languages, but user reviews suggest that the quality of support is lacking. Many traders report difficulties in reaching customer service representatives and receiving timely responses.

Repeat Ratings Overview

Detailed Breakdown

Account Conditions

User feedback indicates that the account conditions at IPCAPITAL are not favorable. Many potential traders express concerns about the lack of transparency surrounding account types and minimum deposit requirements.

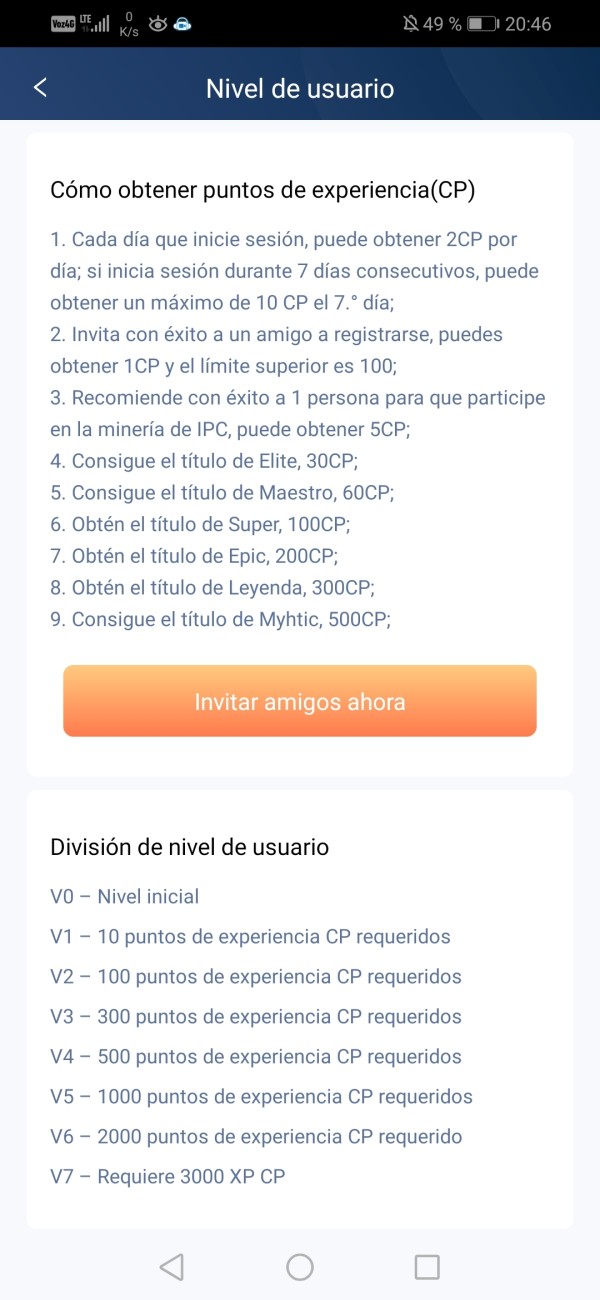

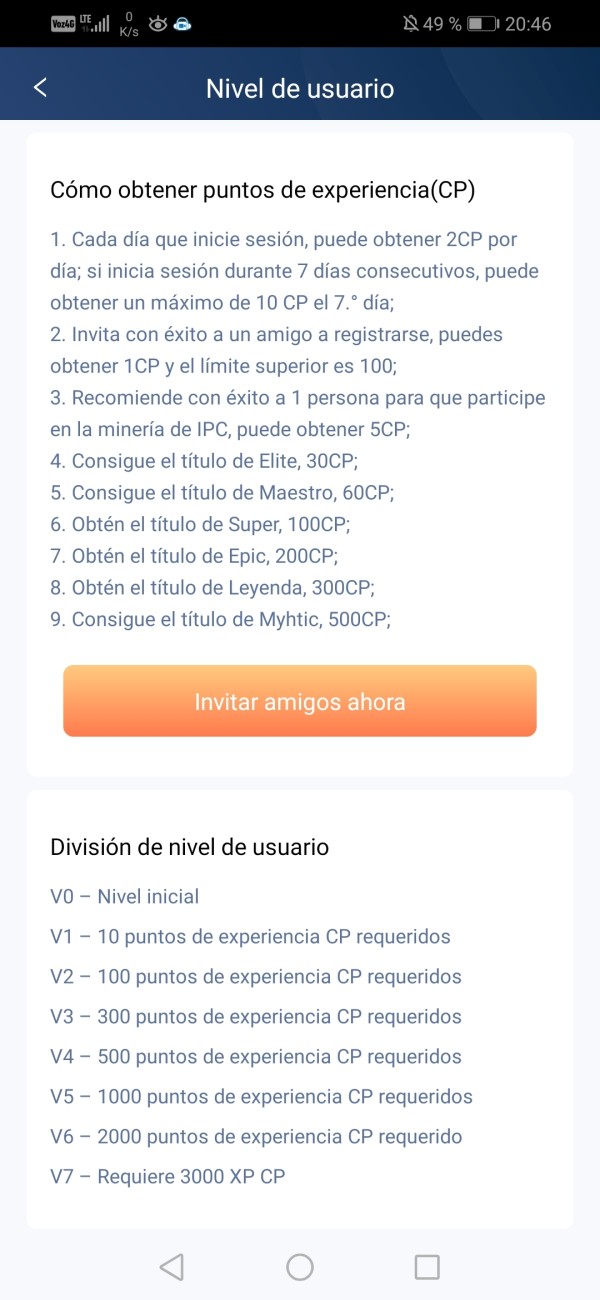

While IPCAPITAL claims to offer a range of trading tools, including an AI-based trading system, the effectiveness and reliability of these tools remain questionable. Users have reported that many features are either underdeveloped or non-functional.

Customer Service and Support

Customer service is a significant pain point for IPCAPITAL. Numerous complaints highlight unresponsive support, with traders often left without assistance when attempting to resolve issues related to withdrawals or platform functionality.

Trading Setup (Experience)

The trading experience on IPCAPITAL is marred by technical issues and a lack of clarity regarding trading conditions. Traders report difficulties navigating the platform, which can hinder effective trading.

Trustworthiness

The trustworthiness of IPCAPITAL is severely compromised by its unregulated status and numerous complaints from users regarding fund withdrawals and customer service. The warnings from multiple financial authorities further emphasize the risks associated with this broker.

User Experience

Overall user experience is negatively impacted by the lack of transparency, poor customer support, and unresolved technical issues. Many users express dissatisfaction with their experiences, leading to a general consensus that IPCAPITAL is not a reliable trading platform.

In conclusion, while IPCAPITAL offers a range of trading options and tools, the significant red flags regarding its regulatory status, user experiences, and customer support raise serious concerns. Potential investors should exercise caution and conduct thorough research before engaging with this broker.