SHENGHUI Review 45

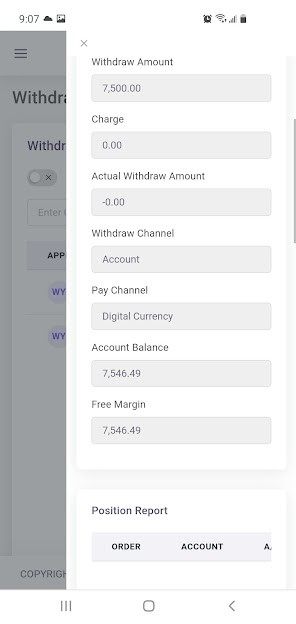

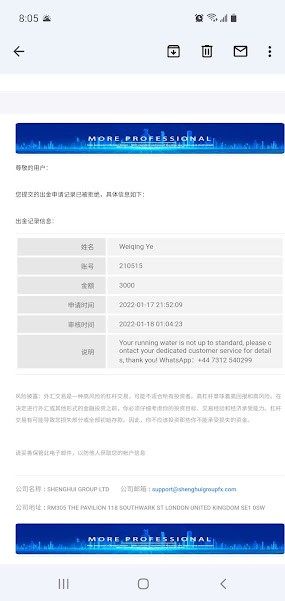

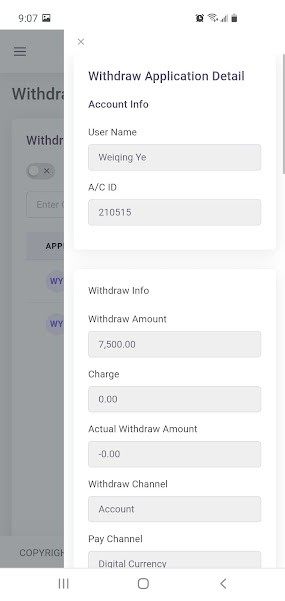

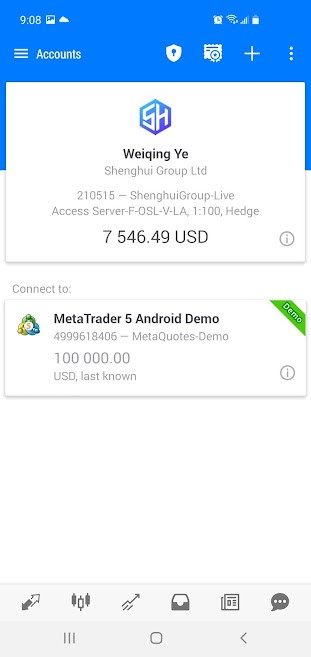

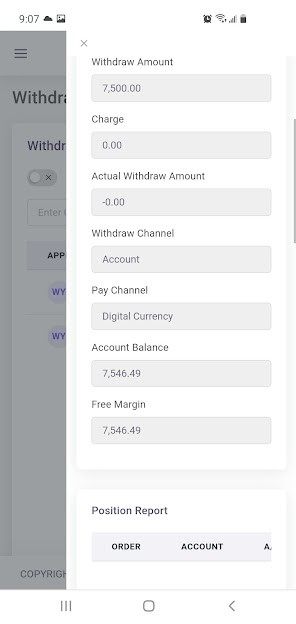

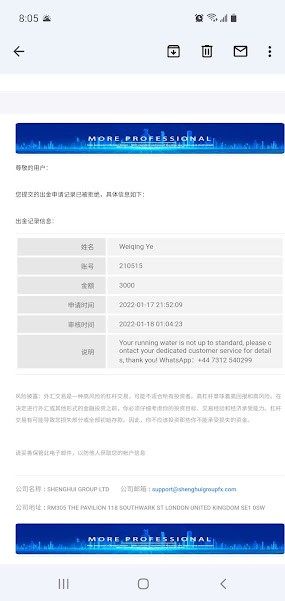

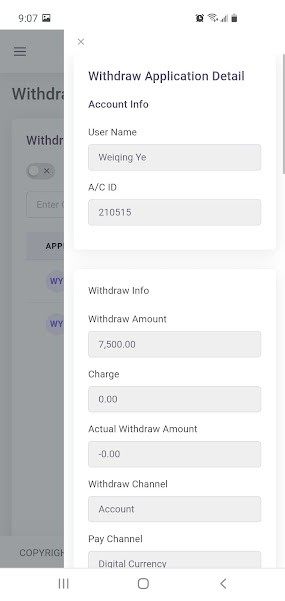

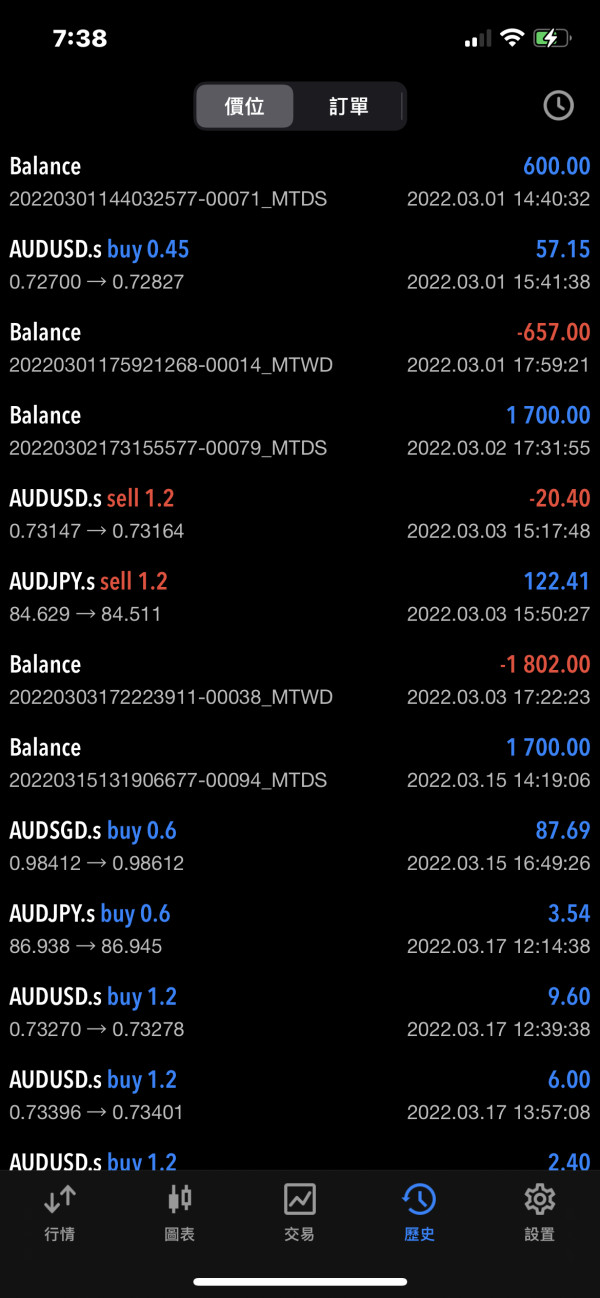

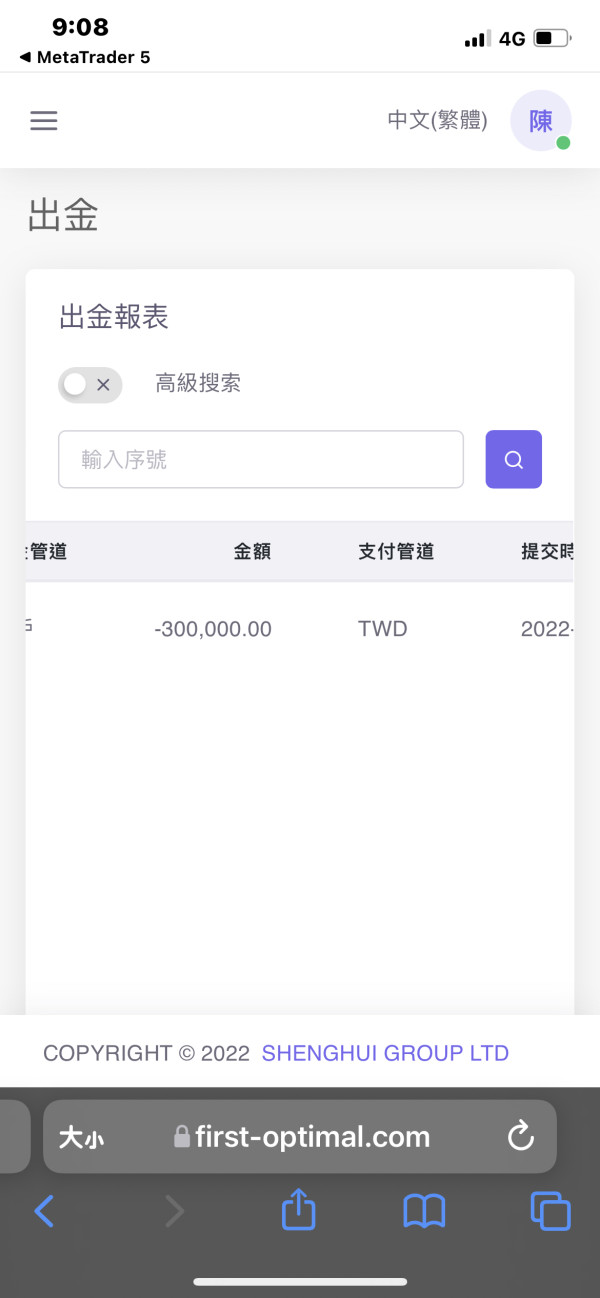

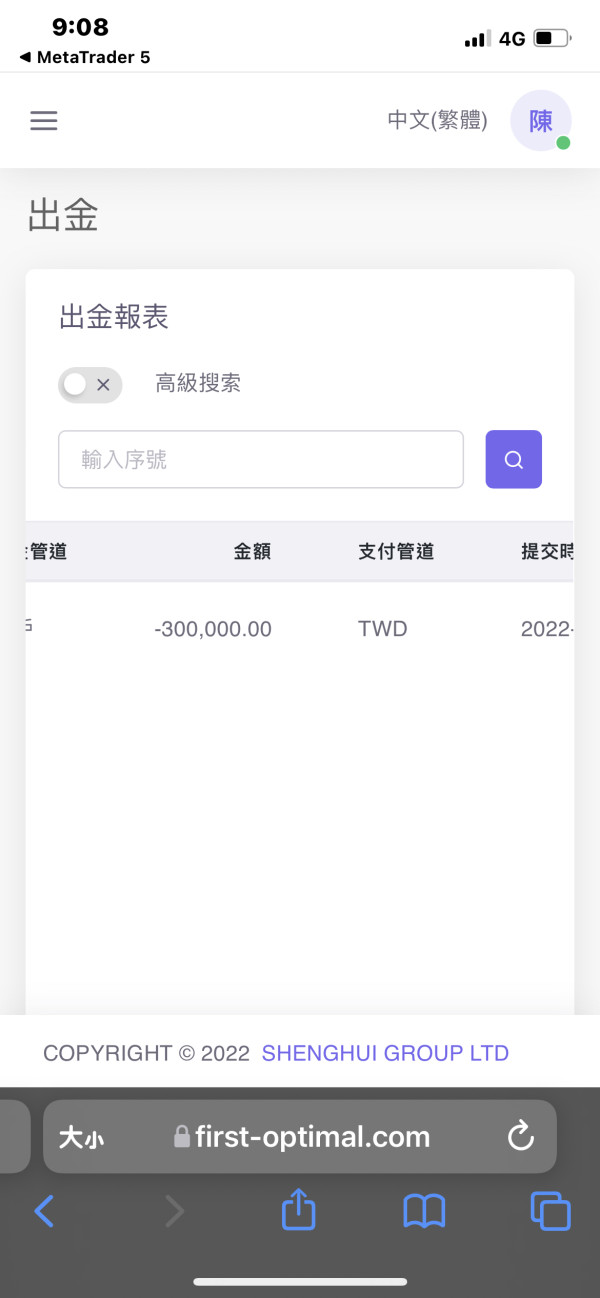

At the end of December 2021, I registered and deposited funds through Shenghui Group Ltd (https://client.shenghuigroupfx.com/login) to trade in MetaTrader 5. The Shenghui Group trading account number is 210515. On January 17, 2022, my application for withdrawal of USD7500 was rejected. The newly updated website of Shenghui Group is: https://www.shenghuigroupax.com/ Company Name: SHENGHUI GROUP LTD Company Email: support@shenghuigroupfx.com Company Address: RM305 THE PAVILION 118 SOUTHWARK ST LONDON UNITED KINGDOM SE1 0SW Customer Service 1 whatsapp: +44 7312 540299 Customer Service 2 whatsapp: +44 7832 526621

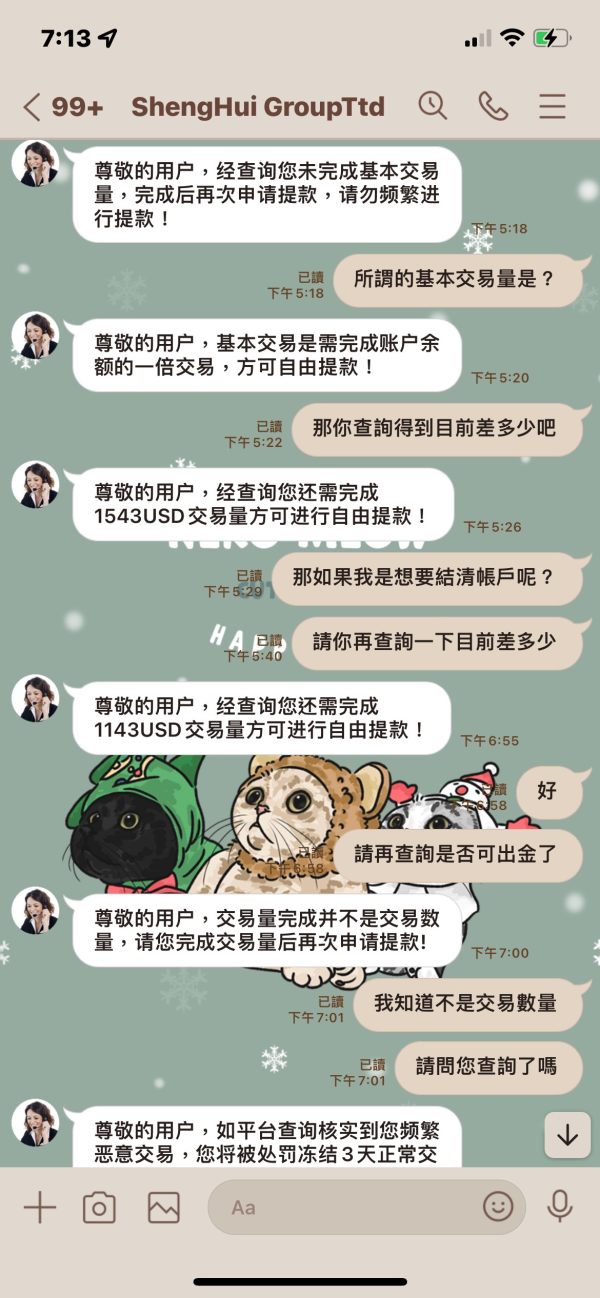

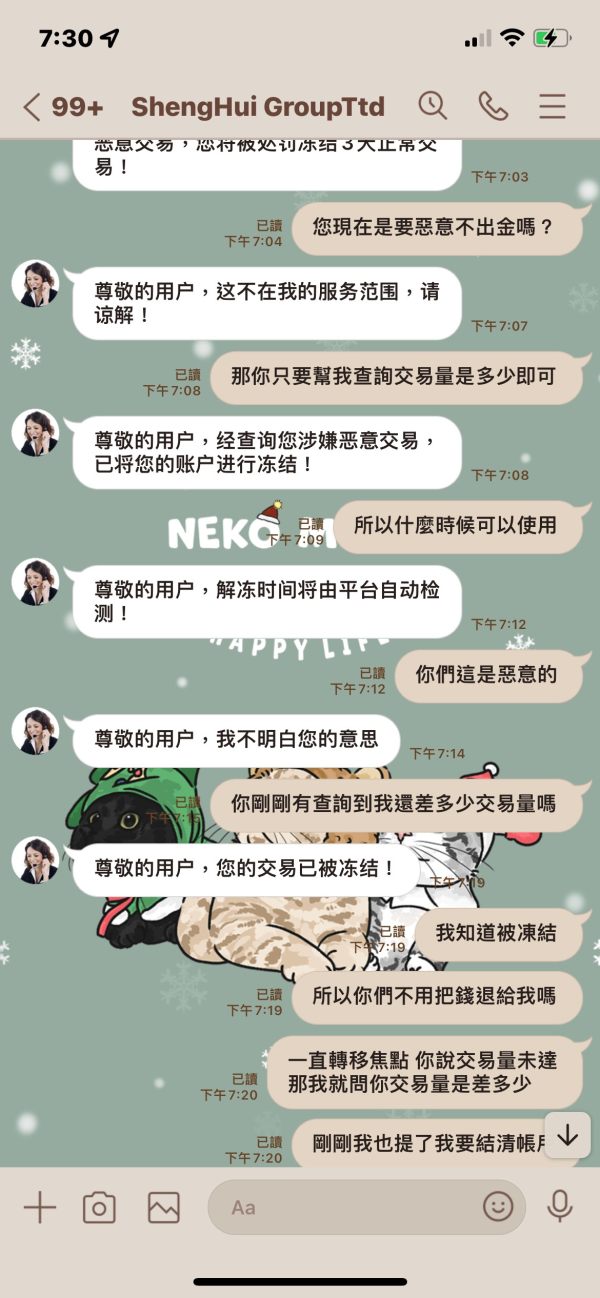

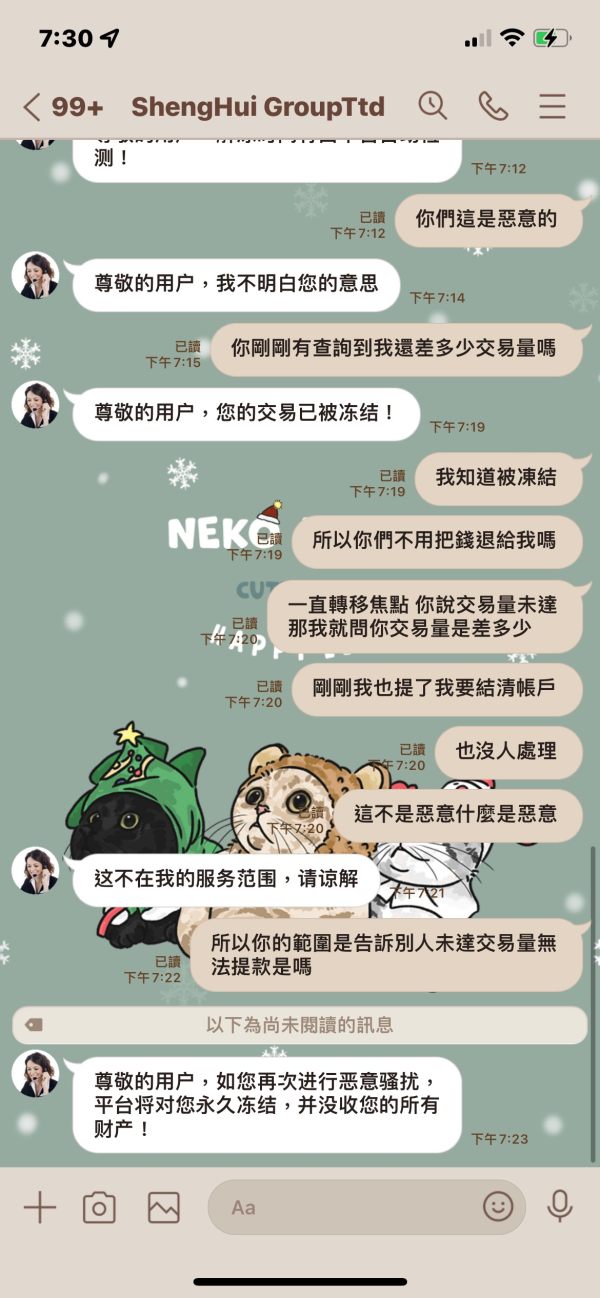

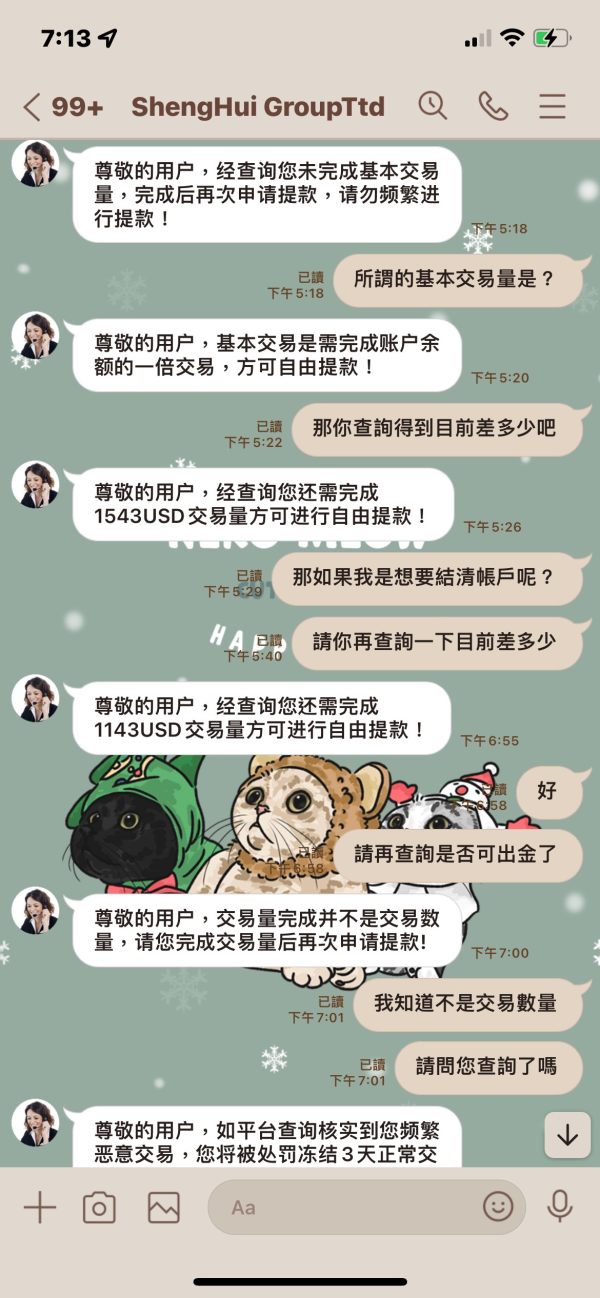

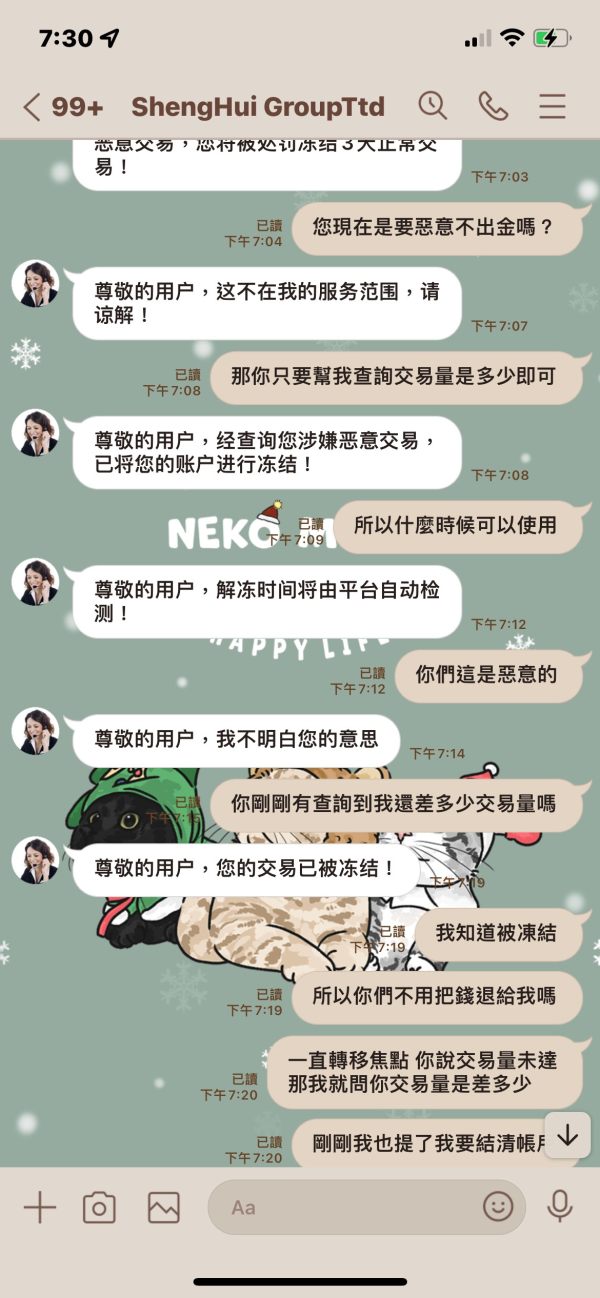

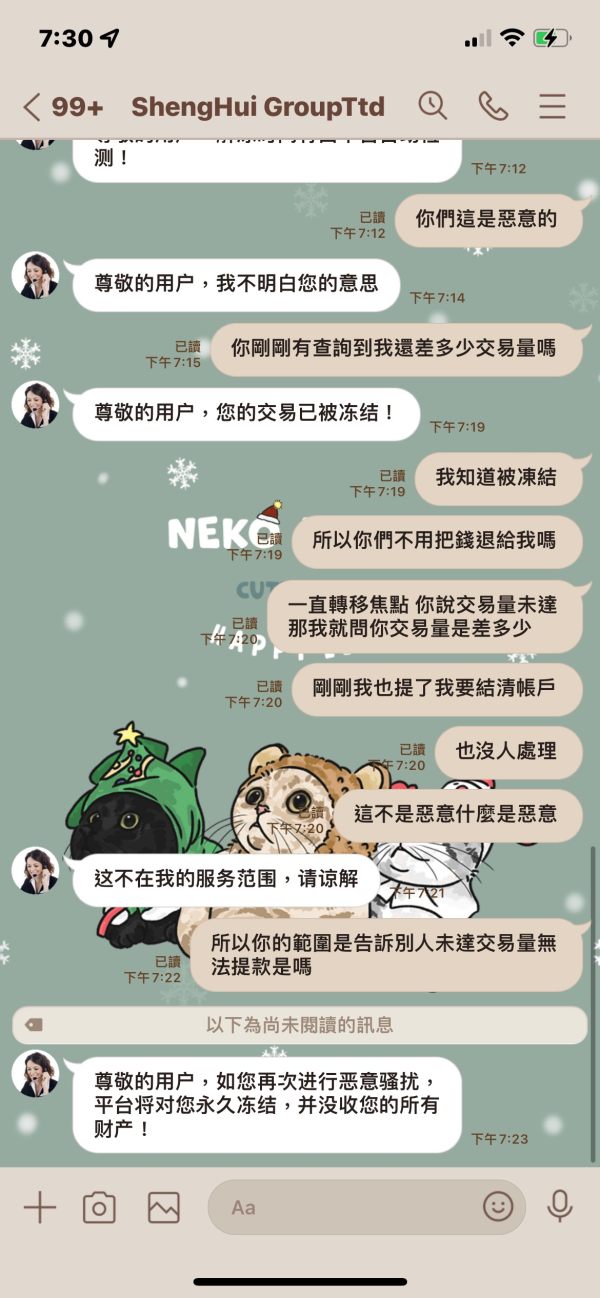

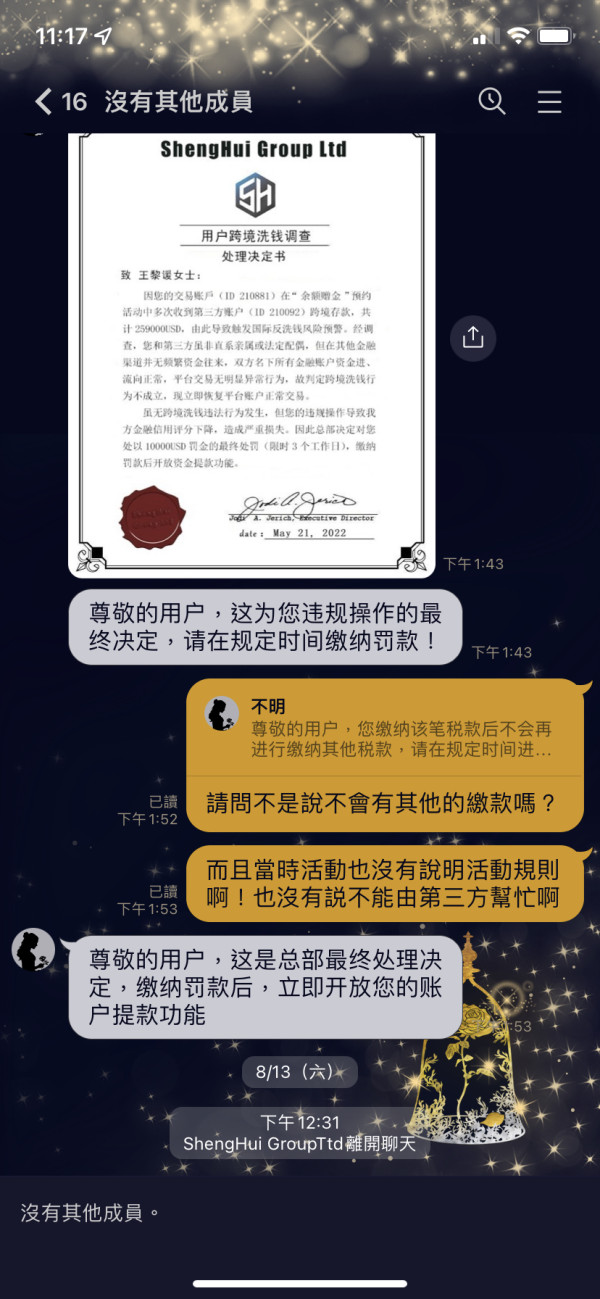

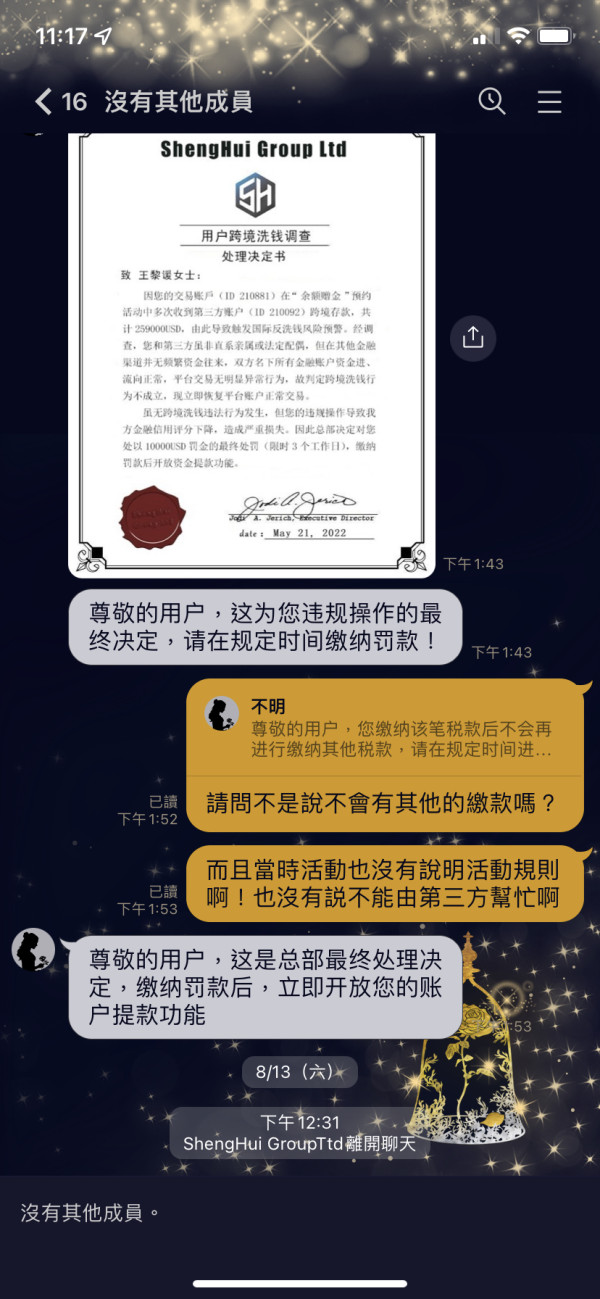

The first two withdrawals were normal, and they refused to withdraw due to insufficient transaction volume for third time. Today, they said that I was a malicious transaction and froze my account.

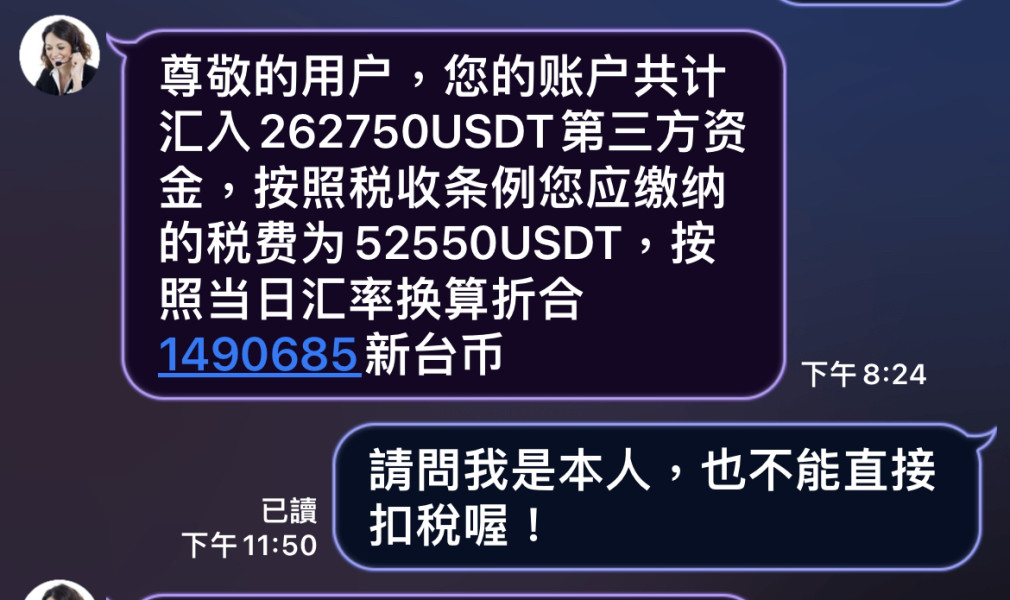

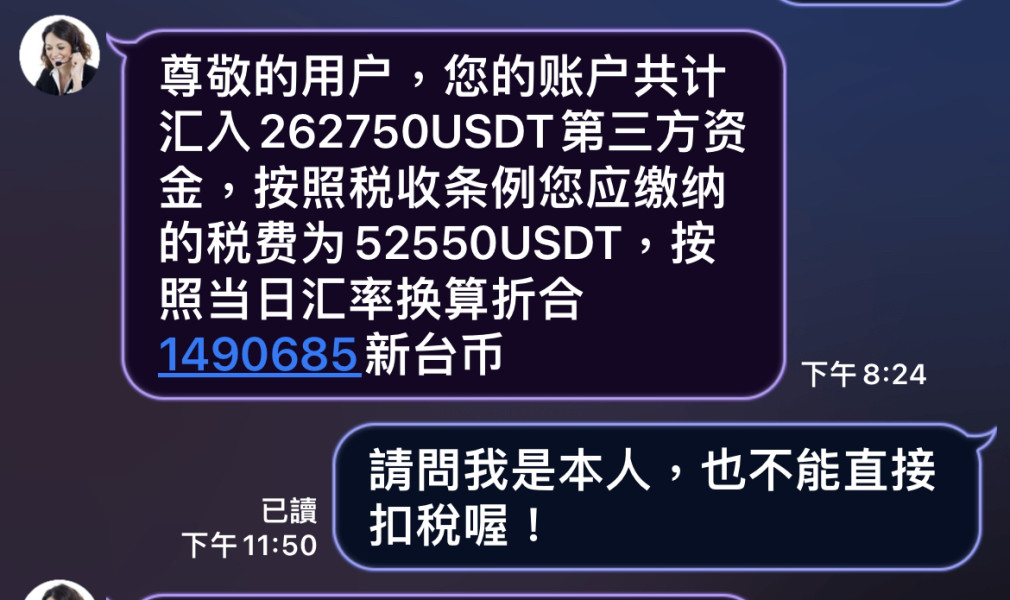

The customer service keep asking me to pay 20% tax. There is no such thing after inquiry.

I recently attempted to access SHENGHUI's website, but found that it was displaying a 403 Forbidden error. This was frustrating, as I was interested in learning more about the company and potentially becoming a customer. However, I was able to find some information online that raised some concerns for me. Several users reported difficulties with account verification and withdrawals, which is a red flag.

I don't know why when I open this company's website, it shows that access is forbidden. I see so many complaints on wikifx, horrible scam company!

The company name has changed and I can't even log in. Worst company ever. run away with money.

I complained that the deposit was not paid, and the other party replied: "The person in charge of the company has paid attention to the withdrawal incident and has notified the legal department of the company to conduct a thorough investigation. Please wait for the investigation result of the legal department." The next day I was blocked by the customer service...! ? Is this the result of the investigation given by the other party?

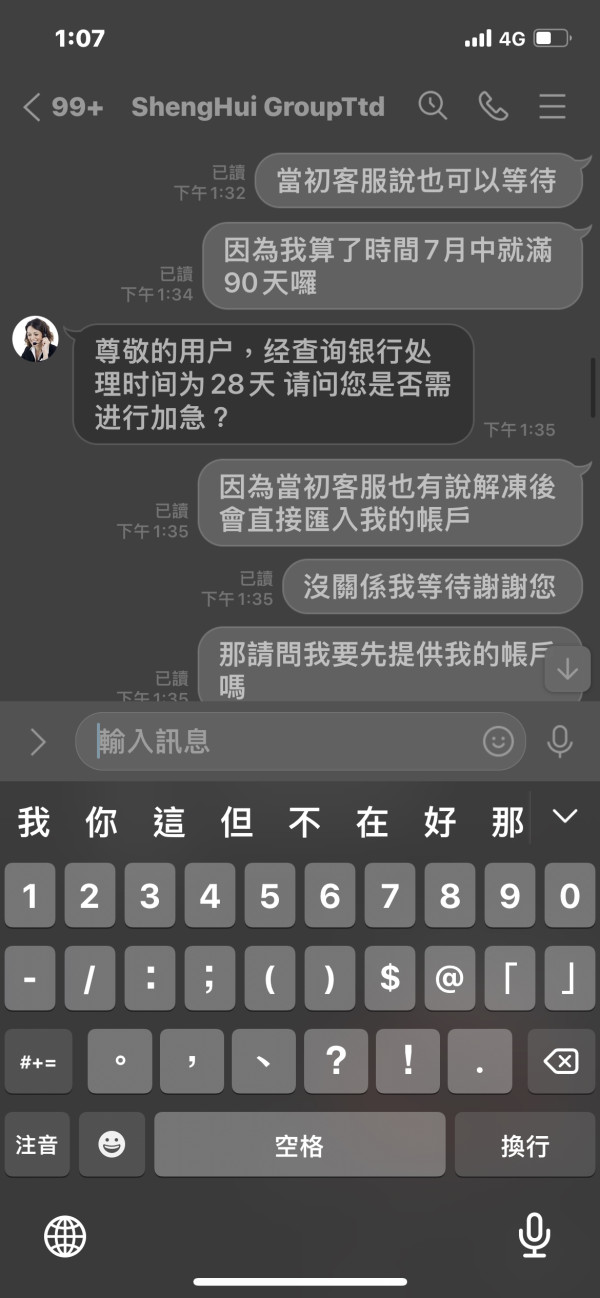

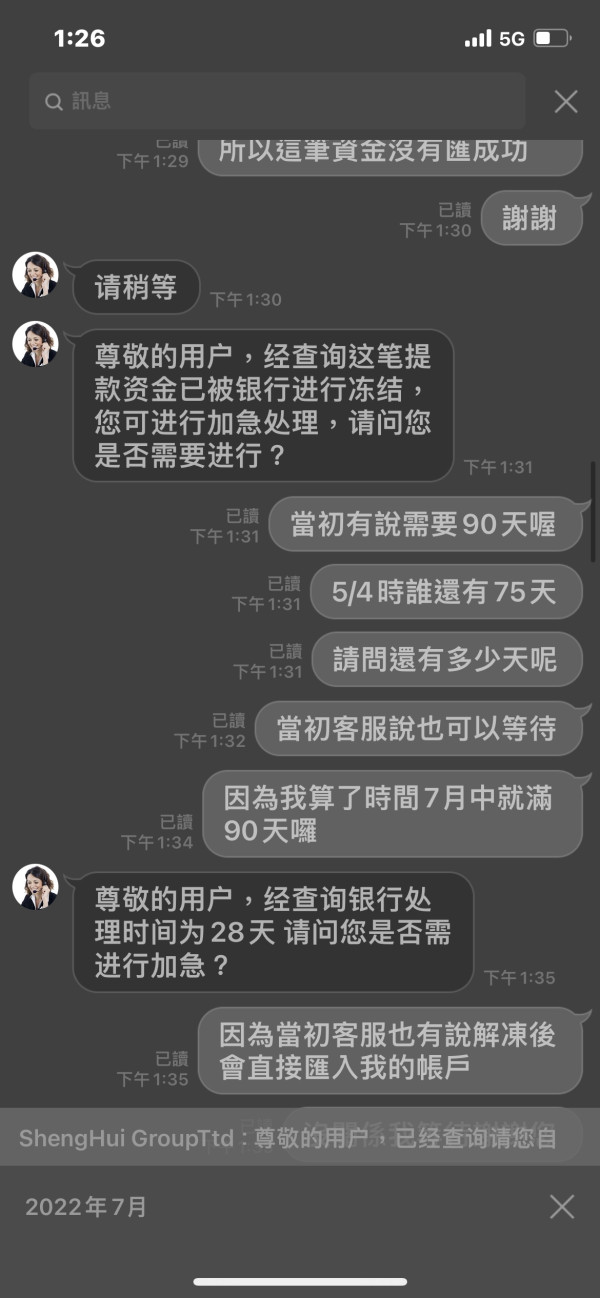

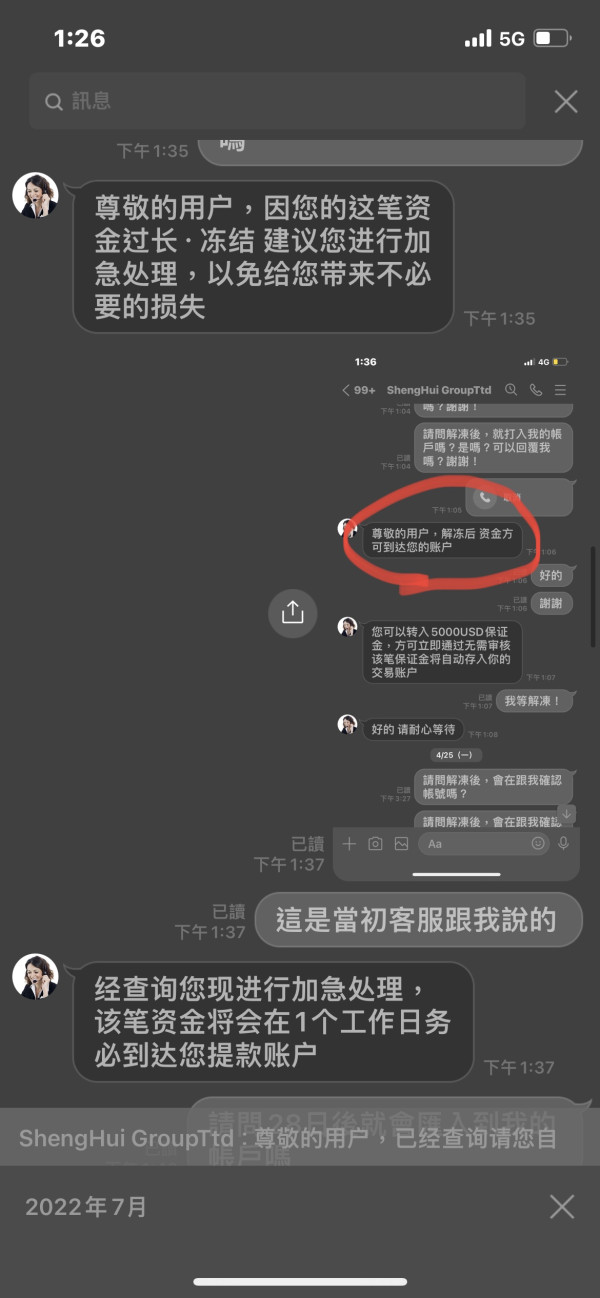

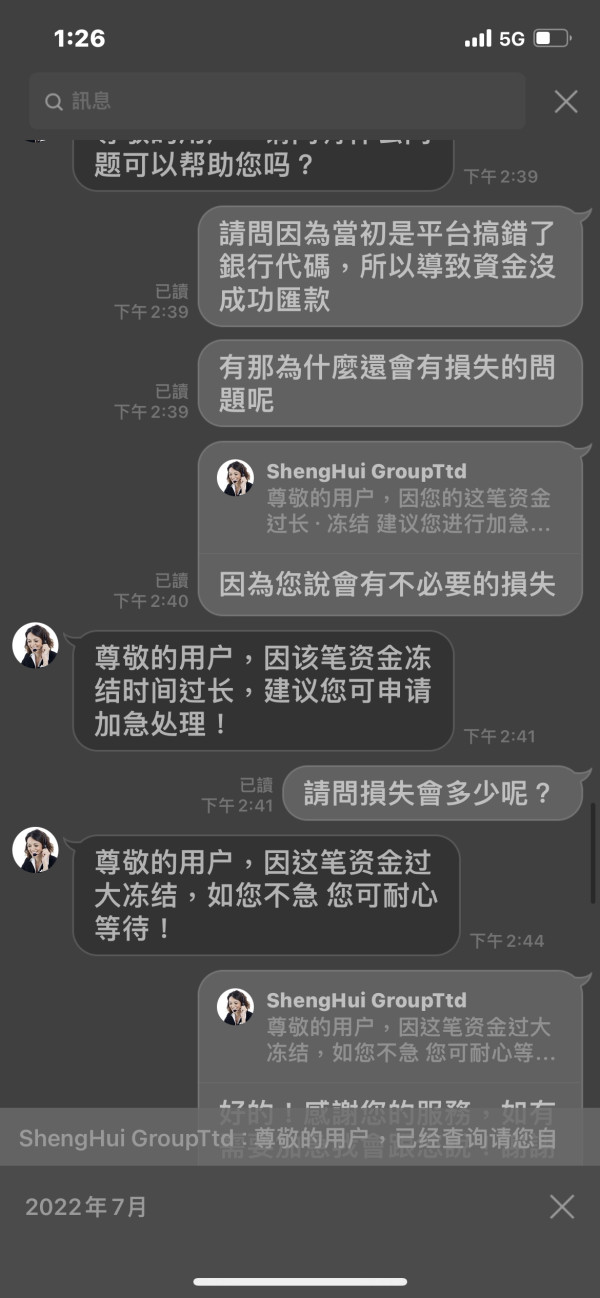

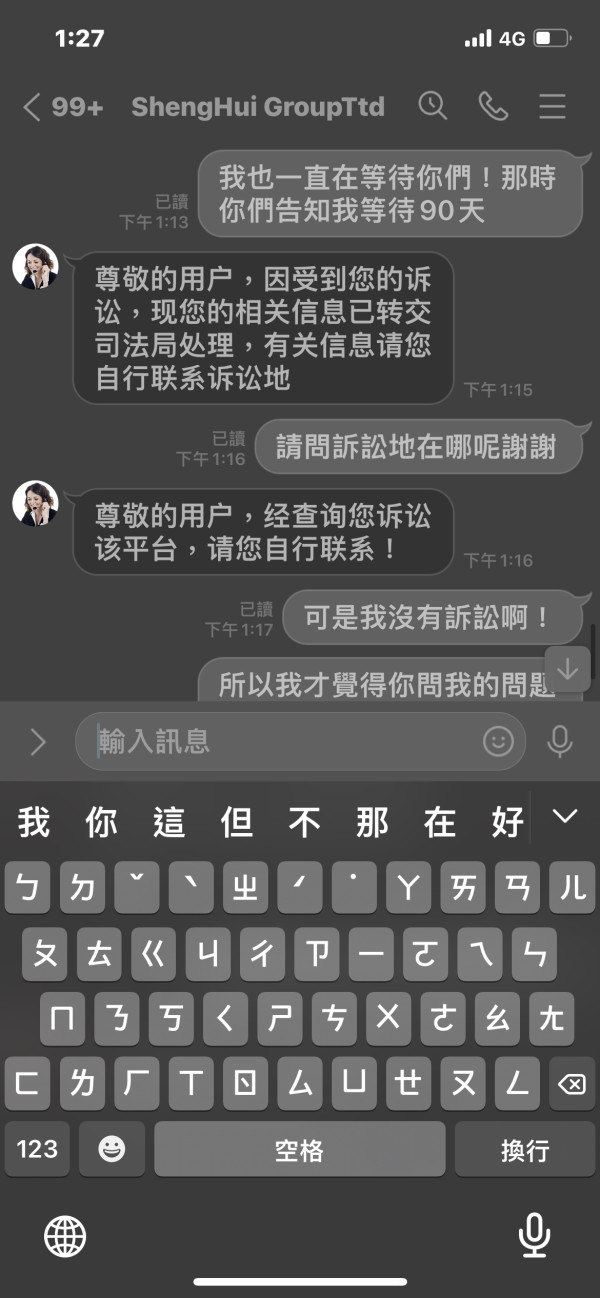

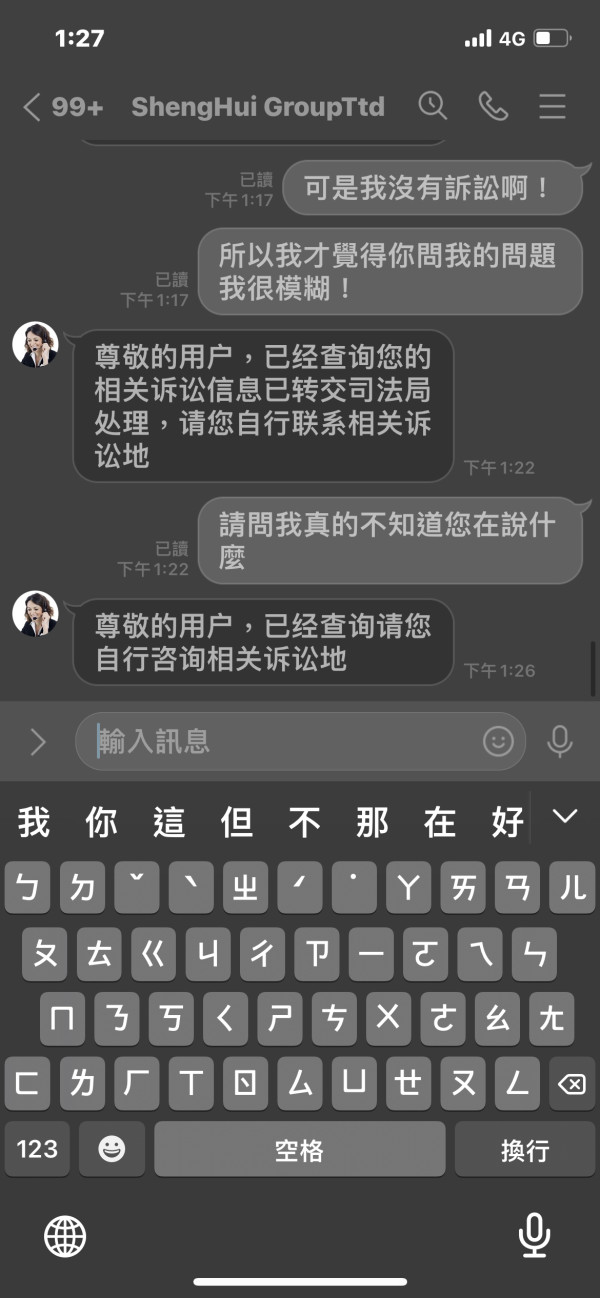

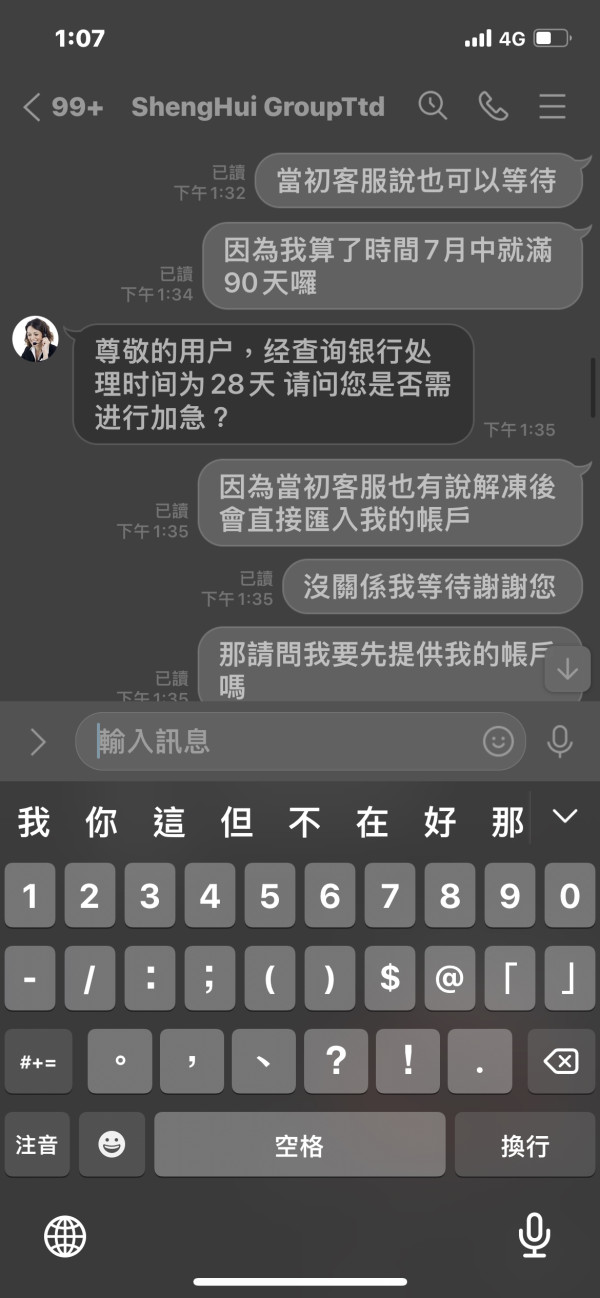

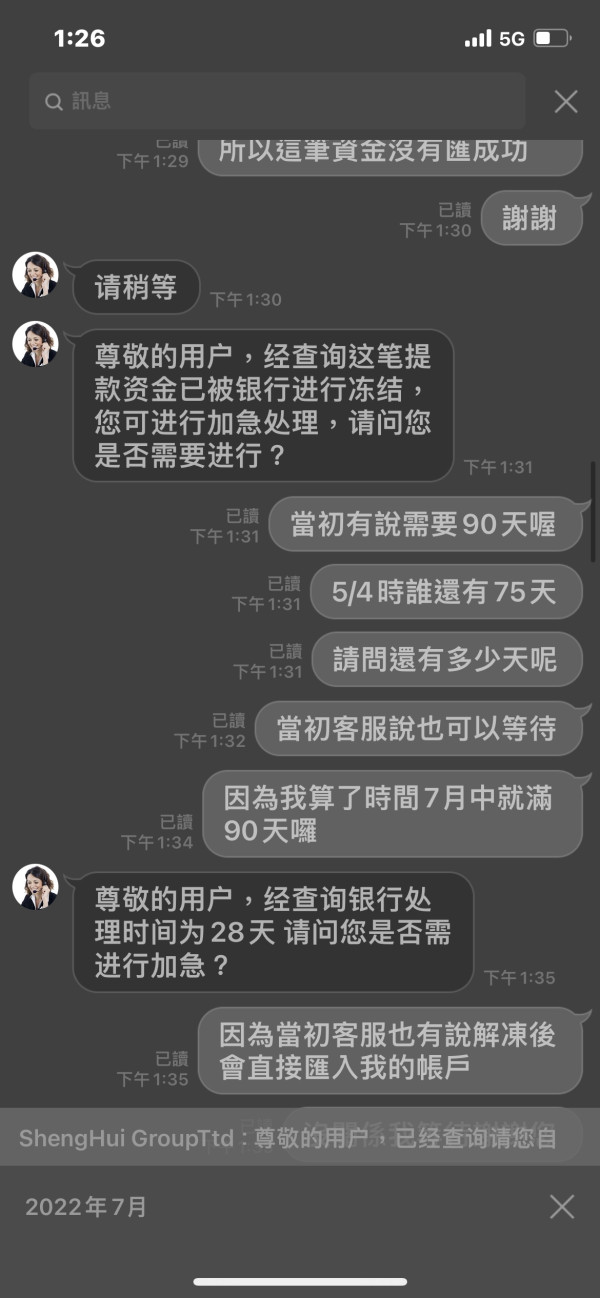

On March 29, the platform failed to remit funds because of the wrong bank code. The platform told me that it would take 30 to 50 days to unfreeze funds. On May 4, I asked the platform again, and the platform told me that there were 75 days left. I asked the platform at that time, and didn't I say 30 to 50 days! The platform told me that the time limit was 90 days! On July 3, I asked the platform again, and the platform told me that there were 28 days left, but on August 1, the platform told me that because of my lawsuit, I was asked to inquire by myself, but I had no lawsuit at all! The platform doesn't want to withdraw at all!