SICH 2025 Review: Everything You Need to Know

Summary

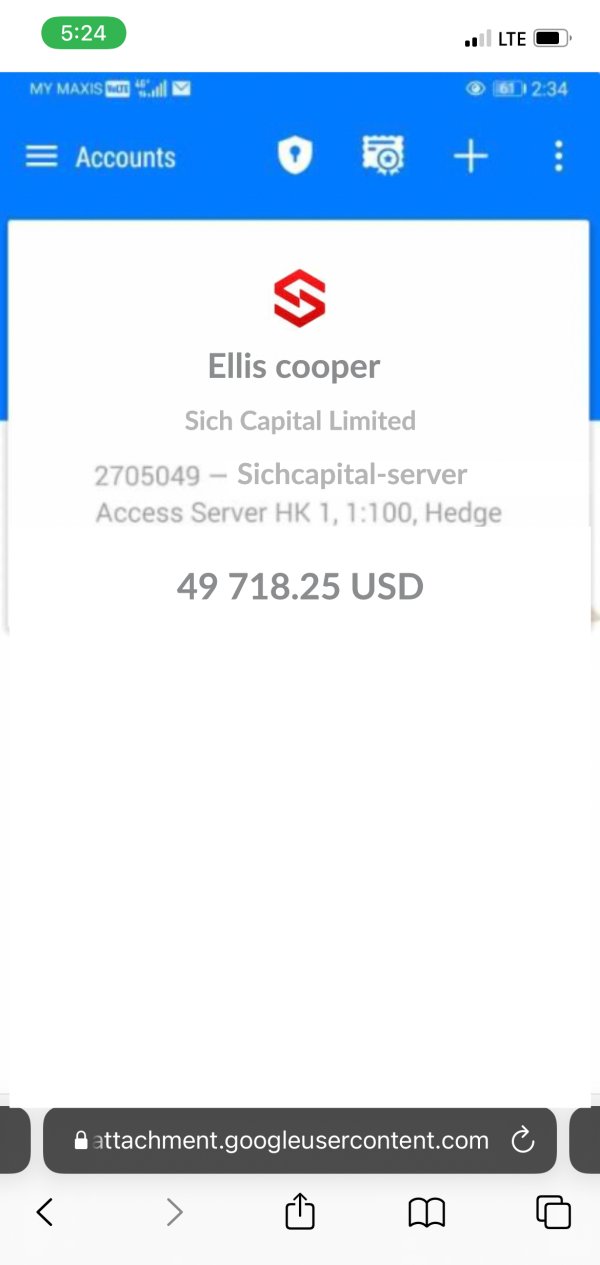

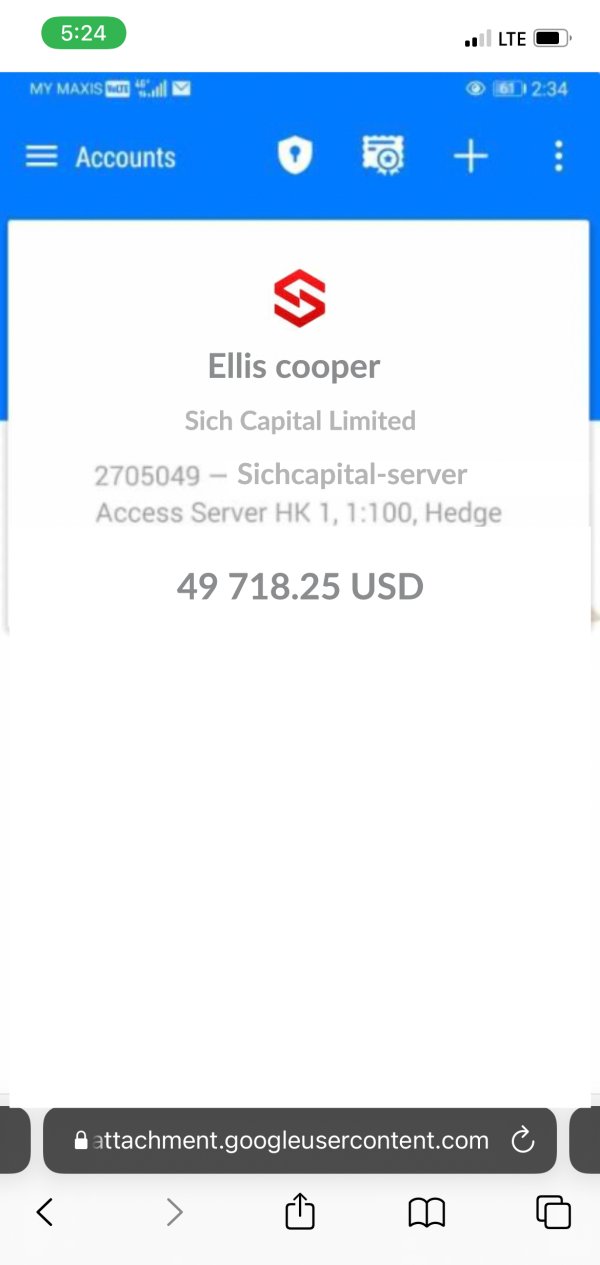

SICH Capital presents a complex case in the forex brokerage landscape. Its legitimacy and transparency face significant scrutiny from regulatory authorities and industry analysts. This sich review reveals a broker operating without proper regulatory oversight, lacking essential legal documentation and transparency measures that are standard in the industry.

According to WikiFX monitoring reports, SICH has received mixed feedback from users, with some positive reviews balanced against numerous exposure reports highlighting potential concerns. The broker claims to be operated by an experienced management team from the trading industry. Yet it fails to provide basic company information or regulatory credentials that would typically support such claims.

User reviews on platforms like Trustburn show diverse opinions, with some clients supporting the broker's services while others raise questions about operational practices. SICH appears to target traders with some experience who are seeking diversified trading conditions. Though the lack of regulatory protection raises significant concerns for potential clients.

Based on available information, SICH Capital operates primarily in the forex trading space, though specific details about trading conditions, platform offerings, and account structures remain largely undisclosed. The broker's positioning suggests it aims to serve intermediate-level traders. But the absence of proper regulatory backing and transparent operational information creates substantial uncertainty about its reliability and safety for client funds.

Important Notice

Traders should be aware that different regional clients may encounter varying regulatory frameworks and service terms when dealing with SICH Capital. The broker's operations appear to span multiple jurisdictions, though specific regulatory compliance in each region remains unclear based on available documentation.

This review is conducted based on publicly available information, user feedback from various platforms, and regulatory reports from industry monitoring services. Due to limited transparency from SICH Capital itself, some aspects of their operations could not be independently verified through official company disclosures.

Rating Framework

Broker Overview

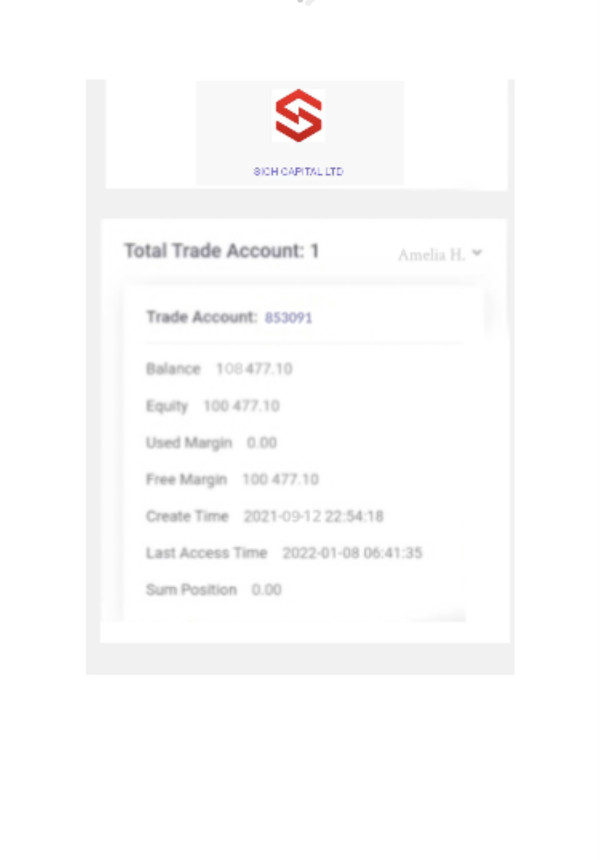

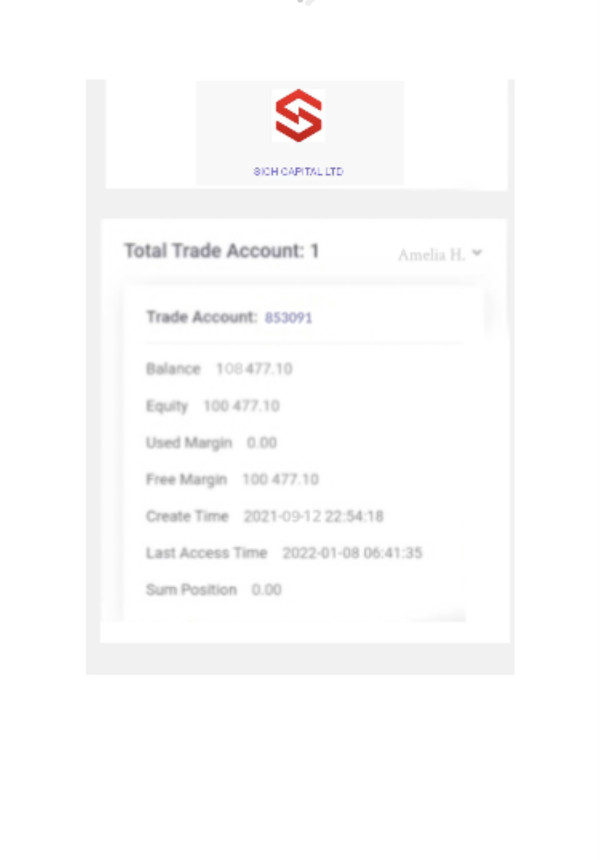

SICH Capital positions itself as a forex brokerage operated by what it claims to be an experienced management team from the trading industry. However, the company's background remains largely opaque. Fundamental information about its establishment date, corporate structure, and operational history is not readily available through official channels.

The broker's primary business model appears to focus on forex trading services, though specific details about trading conditions, execution methods, and operational frameworks have not been comprehensively disclosed. The lack of basic corporate information and legal documentation represents a significant concern for potential clients seeking transparency and accountability from their chosen broker.

While SICH Capital maintains an online presence and continues to operate, the absence of verifiable company credentials raises questions about its long-term viability and commitment to industry standards. Regarding platform offerings and asset coverage, sich review findings indicate that the broker primarily operates in the forex market space.

Though comprehensive details about additional asset classes remain unclear. The company has not obtained legitimacy from recognized European regulatory authorities, which significantly impacts its credibility within the broader financial services sector.

This regulatory gap creates uncertainty about client protections, dispute resolution mechanisms, and operational oversight that are typically provided by established regulatory frameworks.

Regulatory Status: Available information indicates that SICH Capital has not secured authorization from recognized European regulatory authorities. This creates significant concerns about operational legitimacy and client protection measures.

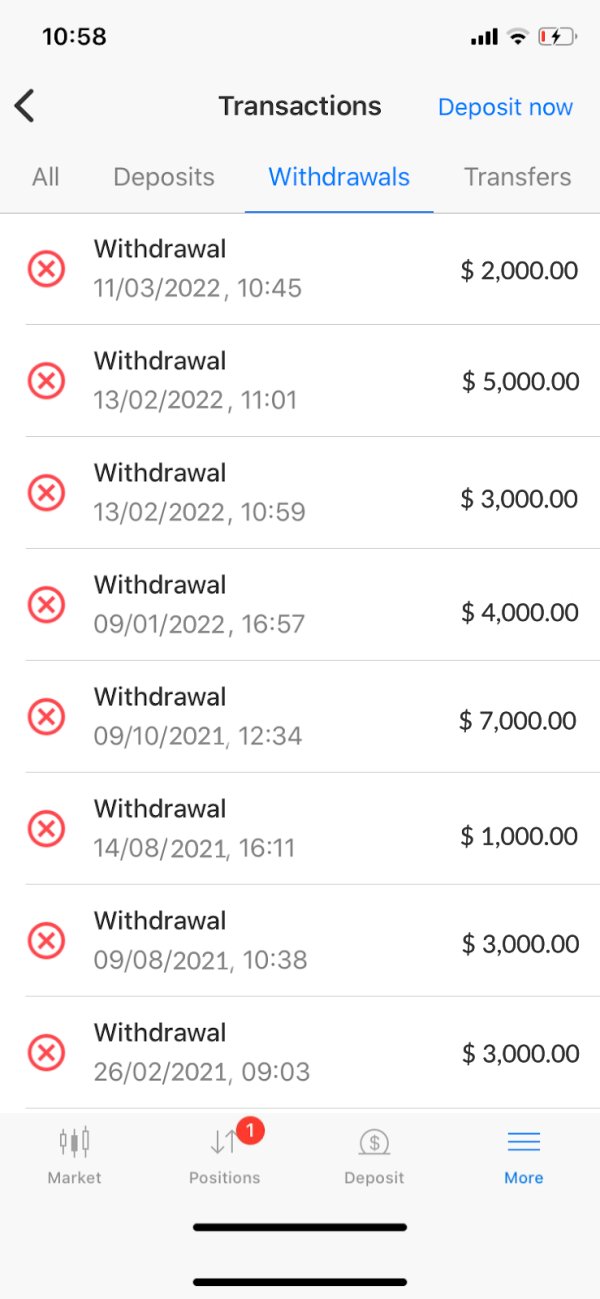

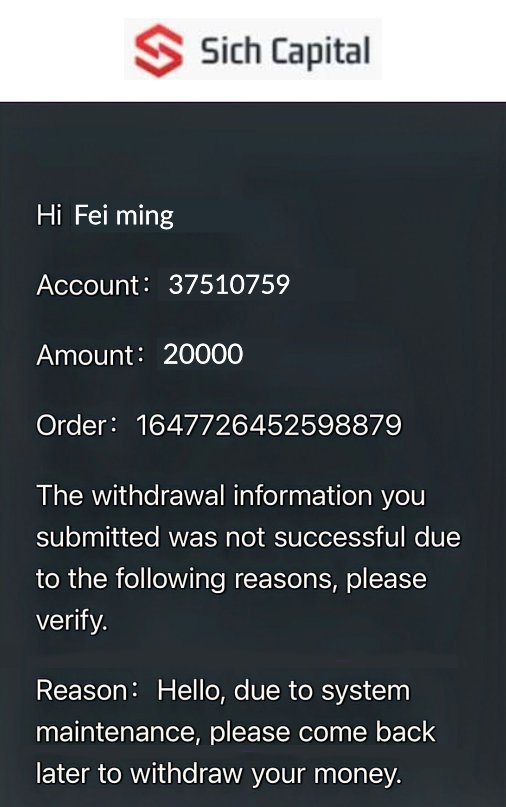

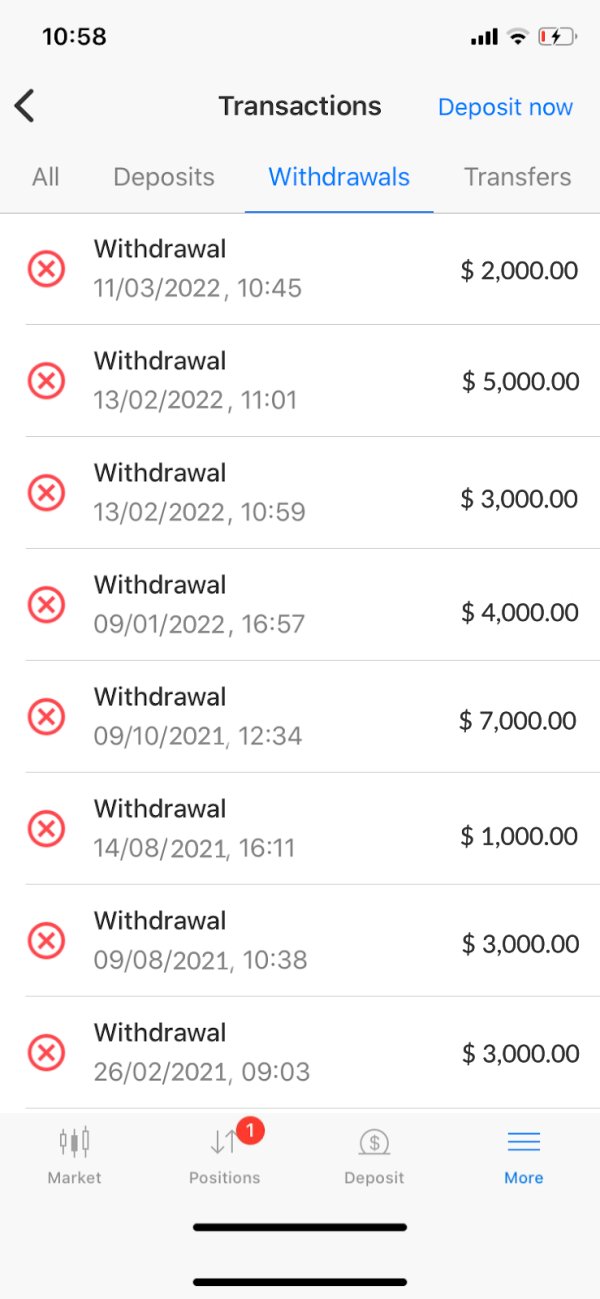

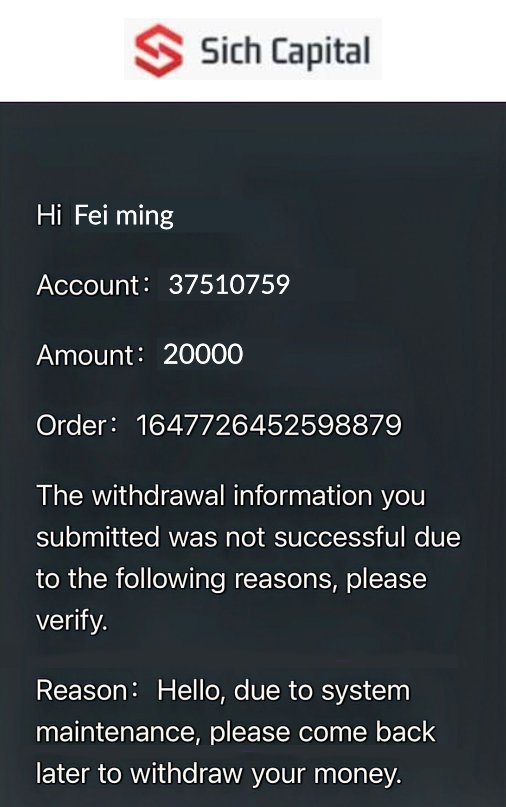

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees has not been detailed in available documentation, requiring direct inquiry with the broker.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for different account types. This makes it difficult for potential clients to assess accessibility.

Bonus and Promotions: No information about promotional offers, bonus structures, or incentive programs has been identified in current sich review materials.

Tradeable Assets: While the broker appears to focus primarily on forex trading, comprehensive details about currency pairs, exotic options, and additional asset classes have not been specified.

Cost Structure: Critical information about spreads, commission rates, overnight fees, and other trading costs remains undisclosed. This prevents accurate cost analysis for potential clients.

Leverage Ratios: Specific leverage offerings and risk management parameters have not been detailed in available broker information.

Platform Options: The trading platform infrastructure, including software providers, mobile applications, and advanced trading tools, has not been comprehensively documented.

Regional Restrictions: Information about geographical limitations and compliance requirements for different jurisdictions has not been specified.

Customer Support Languages: Available language support for client services has not been detailed in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

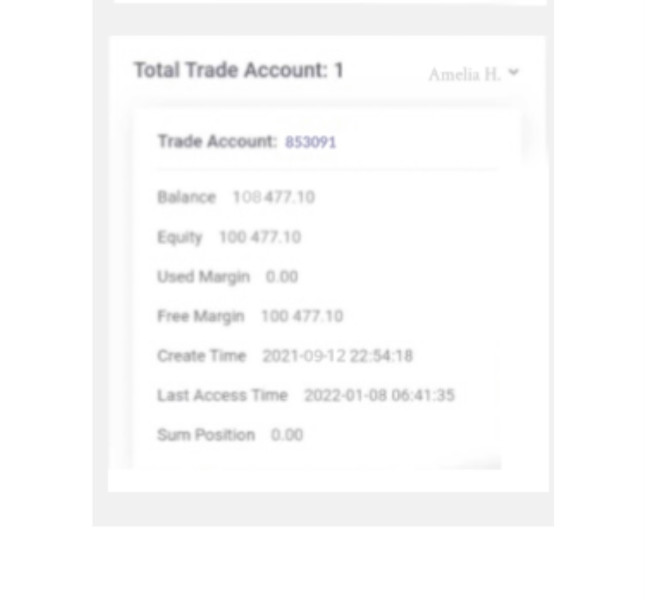

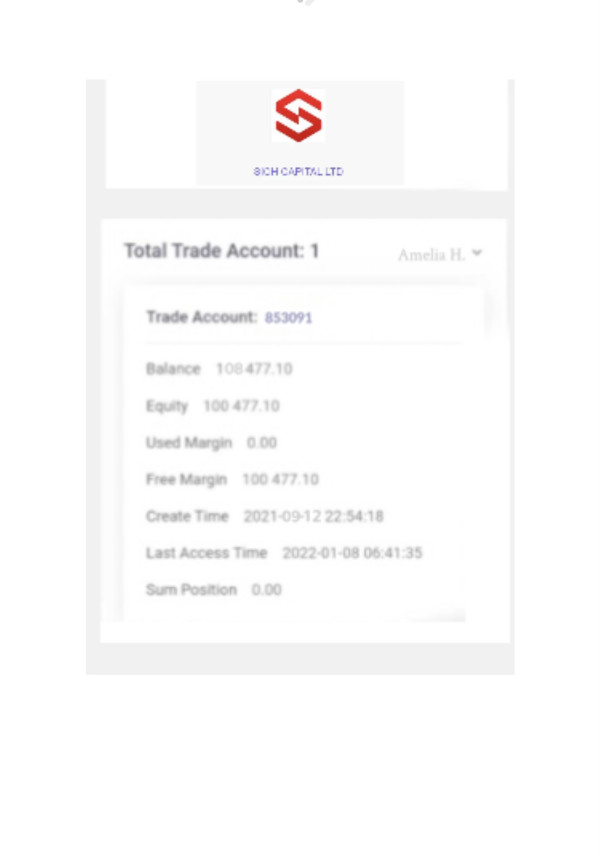

The account conditions offered by SICH Capital remain largely undisclosed. This creates significant challenges for potential clients attempting to evaluate the broker's suitability for their trading needs.

Without comprehensive information about account types, minimum deposit requirements, or special features, traders cannot make informed decisions about whether the broker's offerings align with their specific requirements and risk tolerance levels. The absence of detailed account structure information suggests either a lack of transparency in the broker's operations or potentially limited account options compared to established industry players.

Most reputable brokers provide clear documentation about their account tiers, associated benefits, and qualification requirements. SICH Capital's opacity in this area is particularly concerning for prospective clients.

Account opening procedures and verification requirements have not been detailed in available materials, leaving questions about the broker's compliance with know-your-customer and anti-money laundering standards. The lack of information about specialized account options, such as Islamic accounts for Sharia-compliant trading, further highlights the limited transparency in the broker's service offerings.

This sich review finds that the unclear account conditions represent a significant barrier to client confidence and decision-making, particularly for traders who require specific account features or have particular trading volume requirements that would typically influence account selection at other brokers.

SICH Capital's trading tools and educational resources remain largely undocumented in available public information. This creates uncertainty about the broker's commitment to supporting client success through comprehensive trading infrastructure.

The absence of detailed information about analytical tools, market research capabilities, and educational materials suggests either limited offerings or poor communication of available resources to potential clients. Most established forex brokers provide extensive trading tools including technical analysis software, economic calendars, market sentiment indicators, and automated trading support.

The lack of specific information about such tools at SICH Capital raises questions about the broker's technological infrastructure and commitment to providing competitive trading environments for its clients. Educational resources play a crucial role in trader development, particularly for intermediate-level traders who appear to be the broker's target demographic.

Without clear information about webinars, tutorials, market analysis, or trading guides, potential clients cannot assess whether SICH Capital provides adequate support for skill development and market understanding. The absence of information about third-party tool integration, API access for algorithmic trading, or advanced charting capabilities further limits the ability to evaluate the broker's suitability for more sophisticated trading strategies and approaches.

Customer Service and Support Analysis

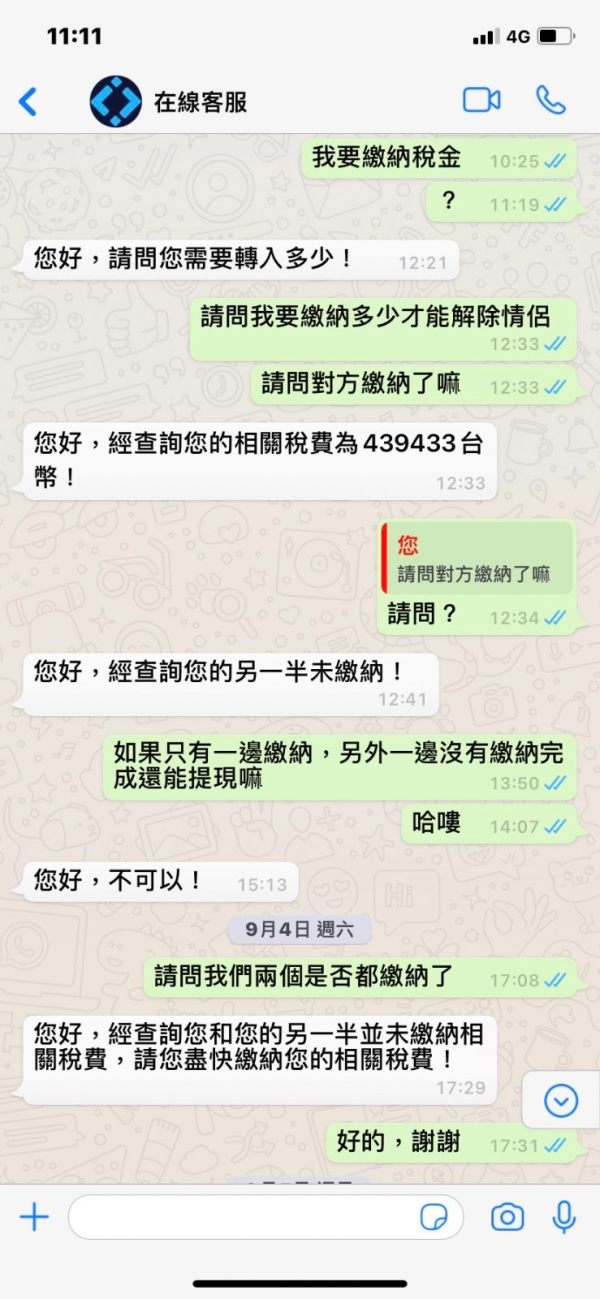

Customer service experiences with SICH Capital appear to vary significantly based on user feedback available on platforms like Trustburn. Reviews range from positive to neutral with some concerning exposure reports.

The inconsistency in user experiences suggests potential issues with service standardization or resource allocation within the broker's support infrastructure. Response times and service quality appear to fluctuate according to user reports, indicating possible challenges in maintaining consistent support standards across different client interactions.

Some users have provided positive feedback about their service experiences, while others have raised concerns about communication effectiveness and problem resolution capabilities. The availability of multiple communication channels, support hours, and multilingual assistance has not been clearly documented in available materials.

This makes it difficult for potential clients to assess whether the broker can provide adequate support for their specific needs and time zone requirements. Without comprehensive information about escalation procedures, complaint handling mechanisms, or service level agreements, clients cannot adequately assess the broker's commitment to maintaining high standards of customer care and dispute resolution.

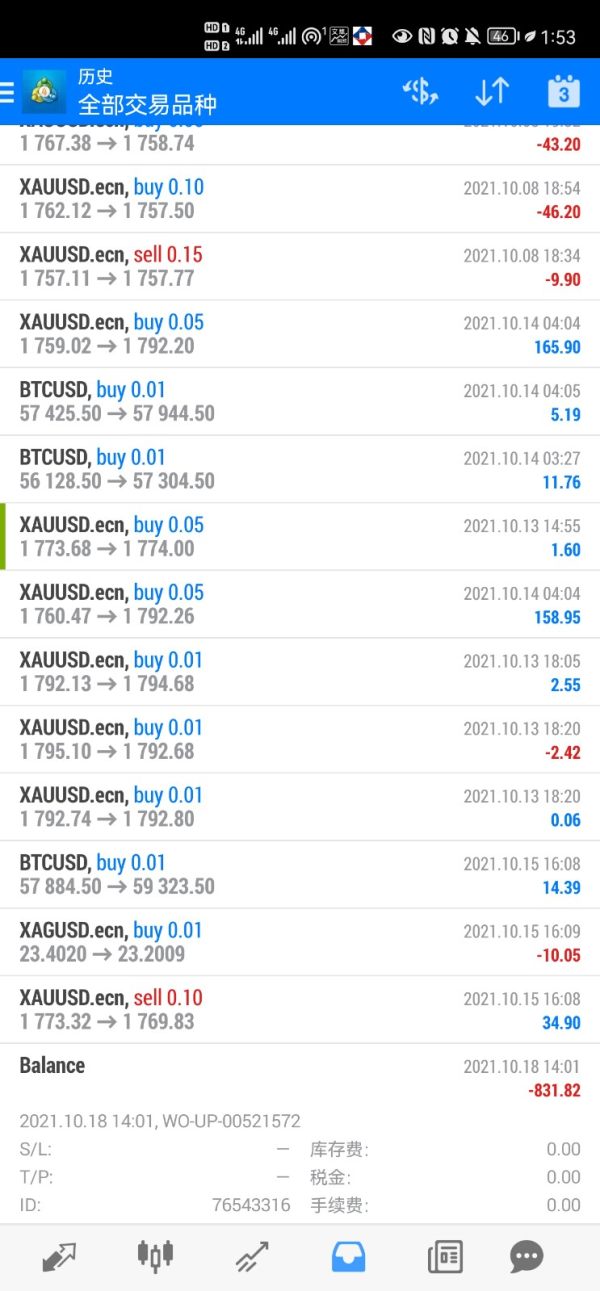

Trading Experience Analysis

The trading experience offered by SICH Capital cannot be comprehensively evaluated due to limited information about platform stability, execution quality, and overall trading environment. Without specific data about order execution speeds, slippage rates, or platform uptime statistics, potential clients cannot assess whether the broker provides a competitive trading experience.

Platform functionality and user interface quality remain undocumented, preventing evaluation of whether the trading environment supports efficient order management, comprehensive market analysis, and effective risk management tools. The absence of information about mobile trading capabilities particularly limits assessment for traders who require flexible access to markets.

Order execution quality represents a critical factor in trading success, yet specific information about execution methods, price improvement rates, and rejection frequencies has not been disclosed by SICH Capital. This opacity prevents traders from understanding how their orders will be handled and whether they can expect fair and efficient execution.

The lack of performance data about trading conditions during volatile market periods, major economic announcements, or high-volume trading sessions creates additional uncertainty about the broker's ability to maintain service quality under challenging market conditions.

Trust Factor Analysis

SICH Capital faces significant trust-related challenges due to its lack of regulatory authorization from recognized European authorities and the absence of comprehensive transparency measures typically expected from legitimate financial service providers. The broker's failure to obtain proper regulatory oversight creates substantial concerns about client protection, fund security, and operational accountability.

The absence of basic legal documentation, company registration details, and regulatory compliance information severely undermines confidence in the broker's legitimacy and long-term viability. Most reputable brokers provide clear information about their regulatory status, segregated account arrangements, and investor protection schemes.

SICH Capital's opacity is particularly concerning. Fund security measures, including client money protection protocols and segregated account arrangements, have not been detailed in available information, creating uncertainty about how client deposits are safeguarded and whether adequate protections exist in case of operational difficulties or insolvency.

Industry reputation and third-party validation through awards, certifications, or professional recognition have not been documented, further limiting the ability to assess the broker's standing within the financial services community and its commitment to industry best practices.

User Experience Analysis

User experiences with SICH Capital demonstrate considerable diversity, with feedback ranging from supportive to concerning across different review platforms. This variation in user satisfaction suggests inconsistencies in service delivery or potentially different experiences based on account types, trading volumes, or regional factors.

The overall user satisfaction pattern indicates that while some clients have found value in the broker's services, others have encountered issues that led to negative feedback and exposure reports. This mixed reception pattern often indicates operational challenges or service standardization issues within the brokerage.

Interface design and platform usability cannot be adequately assessed due to limited information about the trading environment and user interface quality. Without comprehensive details about navigation efficiency, feature accessibility, and overall user experience design, potential clients cannot evaluate whether the broker's platforms meet their usability requirements.

Registration and verification processes, fund management procedures, and general account administration experiences have not been thoroughly documented, preventing assessment of whether SICH Capital provides streamlined and efficient operational procedures for its clients.

Conclusion

SICH Capital presents a challenging case for potential forex traders, offering some market presence but lacking the transparency and regulatory backing that characterize trustworthy brokers in the industry. While user feedback shows some positive experiences, the absence of proper regulatory oversight and comprehensive operational transparency creates significant concerns about the broker's reliability and client protection capabilities.

The broker appears most suitable for experienced traders who are comfortable with higher risk levels and can conduct their own due diligence. Though even experienced traders should carefully consider the implications of working with an unregulated entity.

The main advantages include some positive user feedback and continued market presence, while significant disadvantages include lack of regulatory protection, limited transparency, and inconsistent service experiences reported by users.