traling 2025 Review: Everything You Need to Know

1. Summary

In this traling review, we provide an in-depth analysis of the broker's offerings. We focus on trailing measures and trailing stop orders, which are critical for traders looking to capture longer-term trends and manage risk effectively. Trailing measures help reveal underlying, longer-term trends to support better financial, investment, or business decision making . Meanwhile, trailing stop orders protect gains during volatile market movements .

The overall evaluation of the broker is neutral. The available information does not show specific strengths or weaknesses regarding additional services. The review is particularly relevant for traders seeking long-term trend analysis and robust risk management strategies. It is important to note that several aspects such as the broker's background, regulatory information, and client feedback have not been detailed in the provided data.

This analysis is solely based on the information currently available. Further insights may be necessary for a comprehensive opinion.

2. Cautions

This review does not account for potential regulatory or operational differences across regions. The information provided does not detail these aspects. The evaluation methodology is based strictly on the available data, and no insights from user experience or extensive market feedback have been included.

Users should consider that many critical details remain unspecified. Therefore, the conclusions drawn here are primarily informational.

3. Rating Framework

4. Broker Overview

The broker's background, including the year of establishment and detailed company history, is information not provided in the available data. Consequently, the review is limited to analyzing the available trading tools and risk management features rather than the corporate legacy or long-term market presence.

The core business model remains undefined in the current resources. This makes it challenging to assess the broader market positioning of the broker. Despite this gap, the focus on trailing measures for risk protection and trend analysis signals an emphasis on advanced trading methodologies.

In addition, details about the trading platform types, asset classes offered, and primary regulatory oversight are also information not provided. The absence of key data concerning digital platforms and the regulated environment further complicates a thorough evaluation. Nevertheless, the broker appears to concentrate on methodology-based trading practices, particularly emphasizing trailing stop orders to assist in safeguarding gains during market volatility.

-

Regulatory Regions :

The specific regulatory regions for the broker are information not provided. As a result, there is no clear insight into the regional regulatory authorities or any distinctions between jurisdictions that the broker might be operating in.

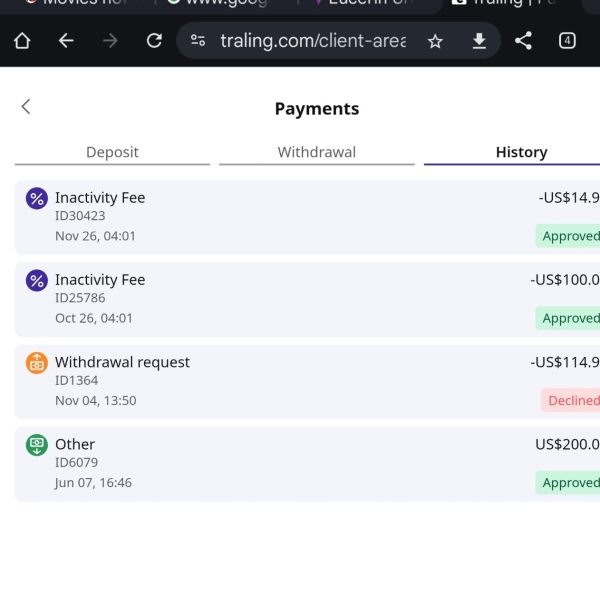

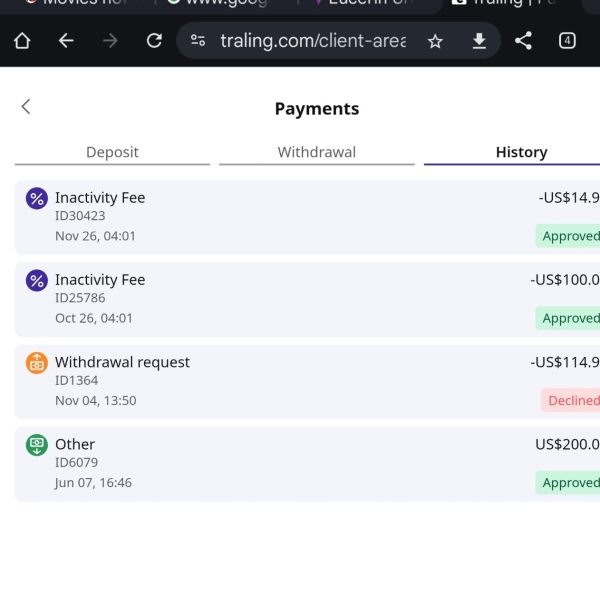

Deposit and Withdrawal Methods :

The available data does not detail the deposit and withdrawal methods accepted by the broker. Information not provided regarding the variety or security of these financial transactions.

Minimum Deposit Requirements :

Information regarding minimum deposit requirements is not provided. There are no specifics on entry-level amounts or deposit incentives.

Bonus Promotions :

Details on any bonus or promotional offers from the broker are information not provided. This leaves potential incentive programs undefined in this review.

Tradable Assets :

The range of tradable assets, including forex, indices, commodities, or stocks, is information not provided. There is no clarity on whether the broker supports a broad or niche set of asset classes.

Cost Structure :

The cost structure, including spreads, commissions, and other fees, is information not provided. Without clear data on these charges, it is difficult to determine the overall competitive positioning regarding transaction costs. Users are advised that potential fees and cost transparency should be further verified.

Leverage Ratio :

Specifics regarding leverage ratios offered by the broker are information not provided. This makes it challenging to evaluate potential leverage limits.

Platform Options :

Information on trading platform options and flexibility is information not provided. It is unclear which platforms are available or if they include advanced features like mobile trading.

Regional Restrictions :

There are no details on any regional restrictions or market limitations. This is information not provided.

Customer Service Languages :

The range of languages offered by customer service is information not provided. It is unknown if multilingual support is available.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The analysis of account conditions focuses on the types of trading accounts available, the minimum deposit requirements, account opening procedures, and any special account features, such as Islamic accounts. However, the available information does not provide any of these details, which limits our ability to offer a robust evaluation.

Consequently, aspects like account variety and execution efficiency remain unclear. User feedback on the account signing-up process or account-specific promotions is also not available. Without this critical information, no meaningful comparative analysis can be undertaken against industry benchmarks.

This review is thus based solely on what has been explicitly provided, which is essentially nothing concrete.

In assessing the broker's available tools and resources, one would expect detailed information on trading tools such as charting software, algorithmic trading support, market research materials, and educational resources. Unfortunately, none of these components are explicitly noted in the provided summary.

There is no data concerning research tools, the breadth or quality of analysis offered, or the presence of automated trading capabilities. The absence of such details prevents any assessment of how the broker compares with competitors that offer state-of-the-art resources. As such, the evaluation remains speculative, and potential users are encouraged to seek further details directly from the broker.

6.3 Customer Service and Support Analysis

For a comprehensive view of customer service and support, critical factors include the range of contact channels , response times, service quality, language support, and available hours of operation. Unfortunately, the information provided does not include any of these metrics.

There are no user testimonials or case studies regarding the effectiveness of the broker's support team. Without these insights, it is impossible to judge whether the support structure meets the needs of traders, particularly those requiring multi-language assistance or prompt assistance during volatile market periods. This limitation diminishes the reliability of any assessment regarding the broker's customer service performance.

6.4 Trading Experience Analysis

Evaluating the trading experience involves examining platform stability, order execution speed, feature comprehensiveness, mobile trading functionality, and overall market connectivity. However, the details needed to address these issues are entirely absent from the provided data.

The available summary does not discuss technical performance, nor does it reveal any specific user feedback regarding trading conditions. As such, our analysis lacks any substantive basis to rate the efficiency or reliability of order execution, platform responsiveness, or the ease of use of mobile applications. Given these omissions, traders seeking a fluid and efficient trading experience are advised to proceed with caution.

6.5 Trustworthiness Analysis

Trustworthiness analysis typically covers aspects such as regulatory oversight, the safety of funds, corporate transparency, industry reputation, and the handling of negative incidents. However, the summary fails to provide details on any of these critical points.

There is no information regarding which regulatory bodies oversee the broker, nor are there specifics on the measures in place to secure client funds. Similarly, the overall industry reputation and any records of past issues are unmentioned. As result, this review is limited in its ability to assess trustworthiness, leaving potential users without a clear picture of the broker's dependability within a highly competitive market.

6.6 User Experience Analysis

Assessing user experience requires a detailed examination of overall satisfaction, user interface design, ease of registration and verification, operational fluidity in fund management, and the resolution of common user complaints. The available information does not include any user feedback or insights into how intuitive and user-friendly the trading platform is.

Moreover, specific details about the account setup process and operational challenges are entirely missing. This lack of data prevents us from identifying frequent user pain points or recommending improvements based on actual user interactions. Without concrete examples or testimonial evidence, the overall user experience remains indeterminate, thereby limiting the practical utility of this review for end users.

7. Conclusion

In conclusion, this traling review maintains a neutral stance due to the lack of specific details on vital aspects such as account conditions, trading tools, customer service, and regulatory oversight. The broker appears to place a significant focus on trailing measures and trailing stop orders, which could cater to traders vested in long-term trends and risk control.

However, without comprehensive data on operational particulars, potential users are encouraged to conduct further research. This review is thus most applicable to traders prioritizing long-term investment strategies and risk management considerations.