Is Traling safe?

Pros

Cons

Is Traling A Scam?

Introduction

Traling is an online forex and commodities broker that has emerged in the competitive landscape of financial trading. With promises of advanced trading platforms and a wide variety of financial instruments, it aims to attract both novice and experienced traders. However, the importance of thoroughly evaluating a broker cannot be overstated; the forex market is fraught with risks, and the presence of unregulated or fraudulent brokers can lead to significant financial losses. This article aims to provide an objective analysis of Traling by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The investigative framework for this evaluation is based on a review of multiple online sources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Traling claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa; however, its license status has raised concerns among traders and reviewers. The absence of a valid license or regulatory oversight is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 53006 | South Africa | Exceeded |

The FSCA is known for enforcing strict compliance standards among financial institutions. Brokers operating under its jurisdiction are expected to adhere to transparency, client protection, and ethical trading practices. However, Traling's current status as "exceeded" indicates that it may be operating outside the regulatory framework, which poses a considerable risk to traders. This lack of regulatory oversight can lead to issues such as fund mismanagement, withdrawal difficulties, and a general absence of consumer protection. The historical compliance record of a broker significantly influences its credibility, and in the case of Traling, the absence of a strong regulatory backing raises significant concerns.

Company Background Investigation

Traling operates under the ownership of Harvest Risk Solutions Ltd, but detailed information about its history and management team is scarce. The broker's website lacks transparency regarding its operational history, and many reviews indicate that it does not disclose its physical office location. This opacity is often a tactic employed by fraudulent brokers to evade accountability.

The management team behind Traling has not been adequately profiled in available resources, making it challenging to assess their qualifications and experience in the financial services industry. Transparency and information disclosure are crucial for building trust, and the lack of these elements in Traling's operations raises questions about its reliability. The absence of a clear company history and the inability to verify key personnel's backgrounds further contribute to the perception of Traling as a potentially dubious broker.

Trading Conditions Analysis

Traling advertises competitive trading conditions, including low spreads and high leverage, which are appealing to traders. However, a closer examination of its fee structure reveals potential pitfalls. The broker claims to offer spreads as low as 0 pips, but such offers are often accompanied by hidden fees and unfavorable trading conditions.

| Fee Type | Traling | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0 pips | 1-3 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The lack of clarity regarding commissions and overnight interest further complicates the evaluation of Traling's trading conditions. Traders should be cautious of brokers that promote "zero commission" trading without clearly outlining how they generate revenue. This opacity can lead to unexpected costs that diminish overall profitability.

Client Fund Safety

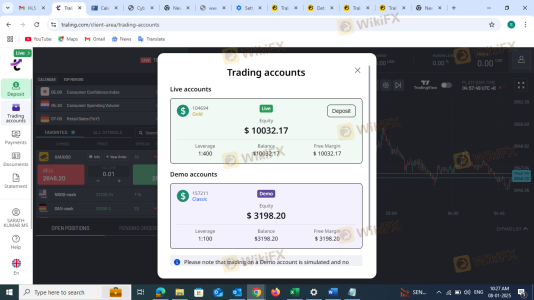

The safety of client funds is paramount when evaluating a broker. Traling claims to implement several safety measures, such as segregating client funds and offering negative balance protection. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Traling's website does not provide sufficient information about its fund security protocols, which is a critical aspect for any trader considering an investment. Historical complaints from users indicate issues with fund withdrawals, which is a common red flag associated with fraudulent brokers. The absence of a robust investor protection scheme means that traders could potentially lose their funds without recourse.

Customer Experience and Complaints

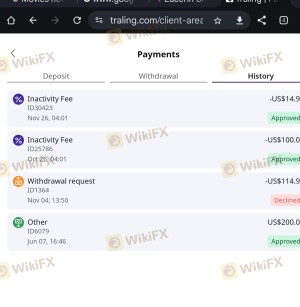

Customer feedback is invaluable in assessing a broker's reliability. Reviews of Traling reveal a pattern of negative experiences, particularly regarding fund withdrawals and customer service. Many users report difficulties in accessing their funds and express frustration over the lack of responsive support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

| Misleading Information | High | Poor |

Typical cases involve clients who have been unable to withdraw their funds after repeated requests, with some reporting that their accounts were blocked entirely. Such complaints are serious and warrant caution. A broker that fails to address customer grievances effectively poses a significant risk to its clients.

Platform and Execution Quality

The trading platform offered by Traling is another critical aspect to evaluate. User reviews indicate that the platform is not only slow but also prone to technical issues that can affect trading execution. Factors such as slippage and order rejections can significantly impact a trader's performance.

The absence of established trading software like MetaTrader 4 or 5 raises concerns about the platform's reliability. Many traders prefer these industry-standard platforms due to their proven track record and robust features. The lack of such integration suggests that Traling may not prioritize user experience and functionality.

Risk Assessment

Using Traling involves several risks that potential traders should consider. The absence of regulation, coupled with negative user feedback, creates an environment where traders may face significant challenges.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases fraud risk. |

| Financial Risk | High | Difficulty in withdrawing funds reported. |

| Operational Risk | Medium | Platform stability and execution issues. |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to start with a small deposit to test the platform and ensure that it meets their trading needs.

Conclusion and Recommendations

In conclusion, Traling exhibits multiple signs of being a potentially fraudulent broker. The lack of regulatory oversight, poor customer feedback, and transparency issues raise significant concerns for prospective investors. While the broker may offer enticing trading conditions, the risks associated with it outweigh the potential benefits.

For traders seeking reliable options, it is recommended to consider well-regulated brokers with a proven track record of customer satisfaction and transparent operations. Alternatives include brokers regulated by reputable authorities such as the FCA, ASIC, or SEC, which provide a safer trading environment. Ultimately, safeguarding your investments should be the top priority when choosing a trading partner.

Is Traling a scam, or is it legit?

The latest exposure and evaluation content of Traling brokers.

Traling Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Traling latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.