TD Markets 2025 Review: Everything You Need to Know

TD Markets has garnered mixed reviews from various sources, with a significant emphasis on its regulatory status and user experience. While some traders appreciate its low minimum deposit and competitive leverage, others express concerns about withdrawal delays and customer support responsiveness.

Note: It's crucial to recognize that TD Markets operates in different regions under various regulatory frameworks, which may affect the trading experience and safety of funds. This review aims to provide a balanced view based on multiple sources to ensure fairness and accuracy.

Rating Overview

We evaluate brokers based on user feedback, expert opinions, and factual data regarding their offerings and performance.

Broker Overview

Founded in 2015, TD Markets is a South African-based broker regulated by the Financial Sector Conduct Authority (FSCA). The broker primarily focuses on providing forex and CFD trading services, utilizing the popular MetaTrader 4 (MT4) platform. Traders can access a diverse range of assets, including currency pairs, commodities, indices, and stocks.

Detailed Breakdown

Regulatory Regions

TD Markets is regulated by the FSCA in South Africa, which is considered a tier-2 regulatory authority. However, its offshore registration in St. Vincent and the Grenadines raises concerns about the level of investor protection offered. According to various sources, the lack of tier-1 regulation may pose risks for traders, especially those prioritizing safety.

Deposit/Withdrawal Currencies and Cryptocurrencies

TD Markets supports deposits in multiple currencies, including USD and ZAR, and allows withdrawals via bank transfer, credit/debit cards, and cryptocurrencies. Notably, the broker processes withdrawals within 24 hours, although some users have reported delays, with one instance taking up to 23 days for funds to be reflected in their accounts.

Minimum Deposit

The minimum deposit to open an account with TD Markets is set at $50, making it accessible for beginner traders. However, users have noted that while the low entry barrier is appealing, the associated trading costs can be higher than competitors.

Currently, TD Markets does not offer any welcome bonuses or promotional incentives. This absence may deter some traders looking for additional value upon opening an account.

Tradable Asset Classes

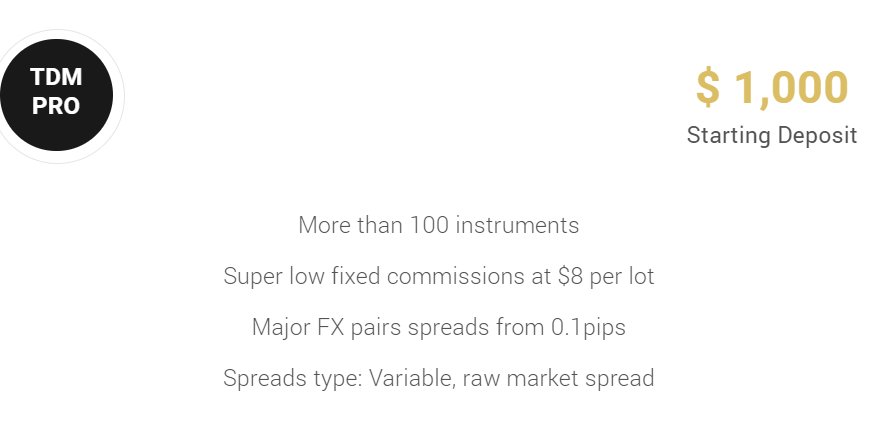

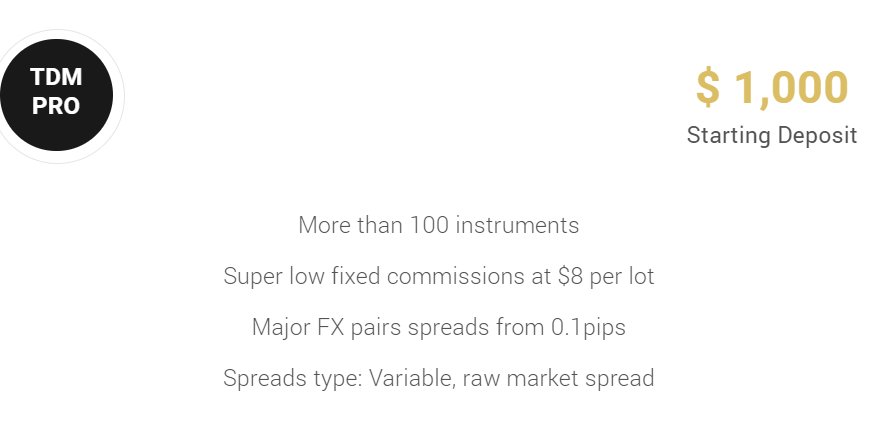

TD Markets provides access to over 100 financial instruments, including more than 60 forex pairs, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different trading strategies.

Costs (Spreads, Fees, Commissions)

The broker's spreads start from 0.1 pips on pro accounts and 1.8 pips on standard accounts. While there are no deposit or inactivity fees, a commission of $8 per lot is charged on pro accounts. This pricing structure is competitive but varies based on market conditions.

Leverage

TD Markets offers a maximum leverage of up to 1:500, which can amplify both potential profits and losses. Traders are advised to use such high leverage cautiously, particularly given the associated risks.

The primary trading platform offered by TD Markets is MetaTrader 4 (MT4), known for its user-friendly interface and extensive analytical tools. However, some traders have expressed a desire for additional platforms, as MT4 may not meet the needs of more advanced users.

Restricted Areas

TD Markets does not provide services to residents of certain countries, including the USA, Canada, and several others. This limitation may affect potential clients in those regions.

Available Customer Support Languages

Customer support at TD Markets is available in multiple languages, primarily English. However, feedback on the responsiveness and effectiveness of support has been mixed, with some users reporting delays and unhelpful interactions.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

While TD Markets offers a low minimum deposit, the associated trading costs can be higher than those of its competitors. The account types available include a standard account with a minimum deposit of $50 and a pro account requiring $1,000, which charges commissions.

The broker's educational resources are considered lacking in depth, with many users wishing for more comprehensive learning materials. The availability of webinars and tutorials is a positive aspect, but more advanced traders may find the offerings insufficient.

Customer Service and Support

Customer service has received mixed reviews, with some users praising the responsiveness of the support team while others reported long wait times and unhelpful responses. This inconsistency may deter potential clients from relying on TD Markets for support.

Trading Setup (Experience)

The overall trading experience has been described as user-friendly, particularly for beginners. However, advanced traders may find the platform lacking in sophisticated tools and features, which could limit their trading strategies.

Trust Level

The trust level for TD Markets is considered low due to its offshore registration and the lack of tier-1 regulatory oversight. This aspect is crucial for traders who prioritize safety and security in their investments.

User Experience

User experiences vary widely, with some traders appreciating the low entry barriers and competitive leverage, while others express frustration over withdrawal delays and customer service issues. This dichotomy highlights the importance of conducting thorough research before engaging with this broker.

In conclusion, while TD Markets presents some attractive features such as a low minimum deposit and high leverage, potential clients should weigh these benefits against the risks associated with its regulatory status and user feedback.