Monaxa 2025 Review: Everything You Need to Know

Executive Summary

This monaxa review shows a concerning picture of a forex broker that presents significant risks to traders. Monaxa maintains a relatively high Trustpilot rating of 4.7/5 with 87% of users giving five-star reviews, but industry watchdogs have flagged it as a potentially risky forex broker. User feedback presents a stark contradiction. Some praise the platform's professional team and quality service delivery, while others have reported substantial financial losses and warn potential users to exercise extreme caution.

The broker appears to cater to traders seeking rapid deposit and withdrawal processing alongside premium customer service. However, mounting evidence of user-reported fund losses and risk warnings from financial monitoring services suggests that Monaxa may not be suitable for risk-averse traders. Available user testimonials show that the Monaxa team demonstrates professionalism in their business development and customer relations, with particularly swift transaction processing times. Nevertheless, the underlying safety concerns overshadow these operational strengths. This makes the broker a questionable choice for serious forex trading activities.

Important Notice

Regional Variations: Monaxa may be unable to accept clients from certain jurisdictions due to legal or regulatory restrictions. Some user reviews indicate that the broker's services are subject to geographical limitations. These could affect accessibility for international traders.

Review Methodology: This evaluation is primarily based on user feedback collected from third-party review platforms and financial industry monitoring websites. Due to limited official documentation available, certain aspects of the broker's operations remain unclear or unverified.

Rating Framework

Broker Overview

Monaxa operates as a forex broker in an increasingly competitive market. Specific details about its establishment date and corporate background remain unclear from available sources. The company's business model appears to focus on providing rapid transaction processing and customer service excellence. It positions itself as a service-oriented platform for forex traders. However, the lack of transparent corporate information raises questions about the broker's operational foundation and long-term stability.

The broker's approach to client relations emphasizes professional business development management and responsive customer support. According to user testimonials, Monaxa's team maintains high standards of professionalism in client interactions. Despite these positive operational aspects, the platform has attracted scrutiny from financial monitoring services due to reported client fund losses and questionable business practices. This monaxa review must therefore balance the reported service quality against the significant safety concerns that have emerged from user experiences and industry analysis.

The trading environment offered by Monaxa appears to prioritize speed and efficiency, particularly in deposit and withdrawal processing. However, the absence of detailed information about trading platforms, asset classes, and regulatory oversight creates uncertainty about the broker's comprehensive service offering. The platform's regulatory status remains unclear. This is particularly concerning given the reported financial losses experienced by some users.

Regulatory Status: Specific regulatory oversight information is not detailed in available source materials. This represents a significant transparency concern for potential clients.

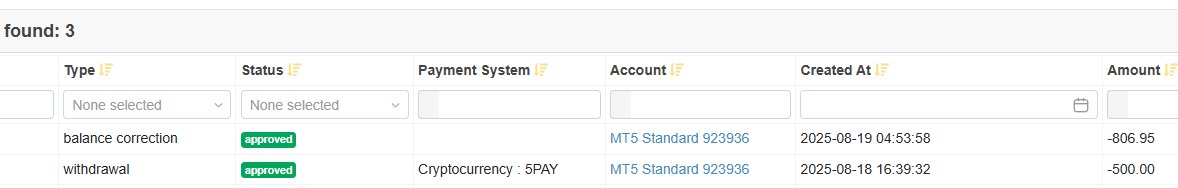

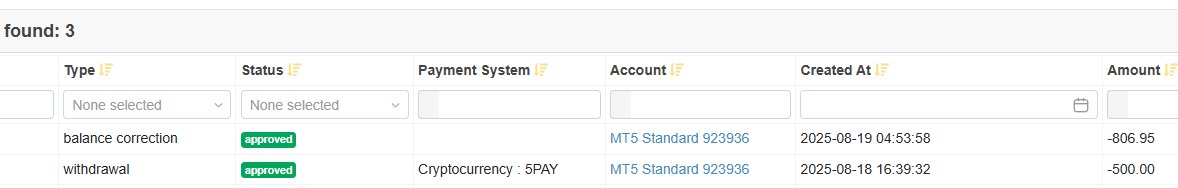

Deposit and Withdrawal Methods: While users report rapid processing times for financial transactions, specific payment methods and procedures are not detailed in available documentation.

Minimum Deposit Requirements: Exact minimum deposit thresholds are not specified in the source materials reviewed.

Promotional Offers: Information regarding bonuses or promotional campaigns is not available in current source materials.

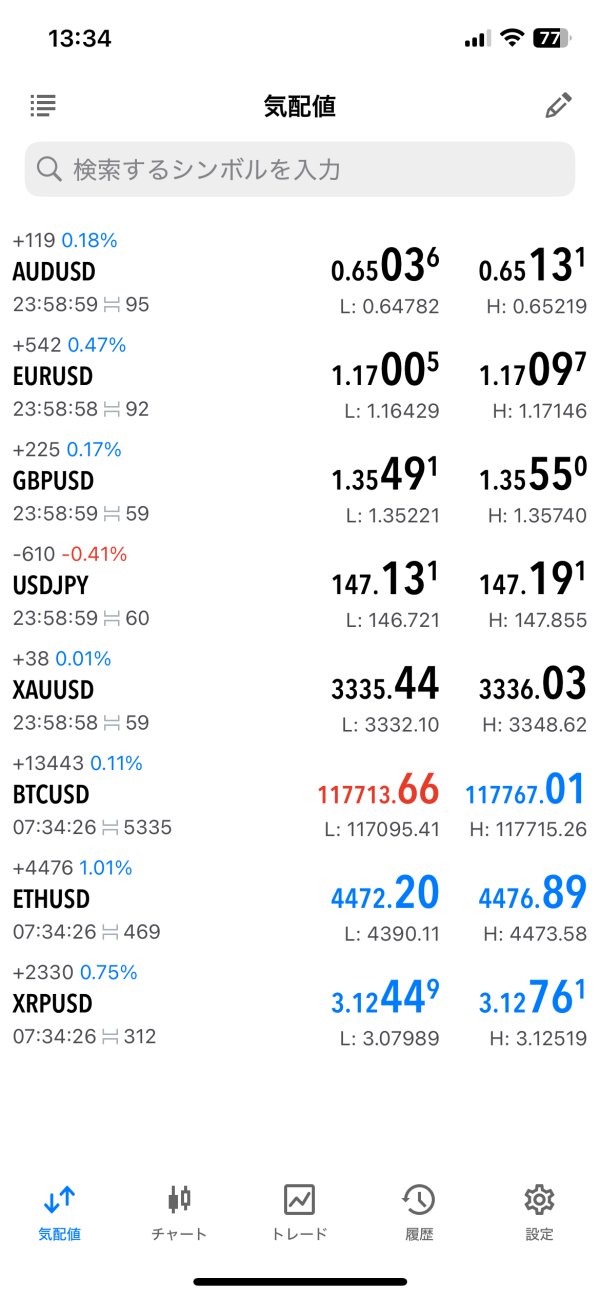

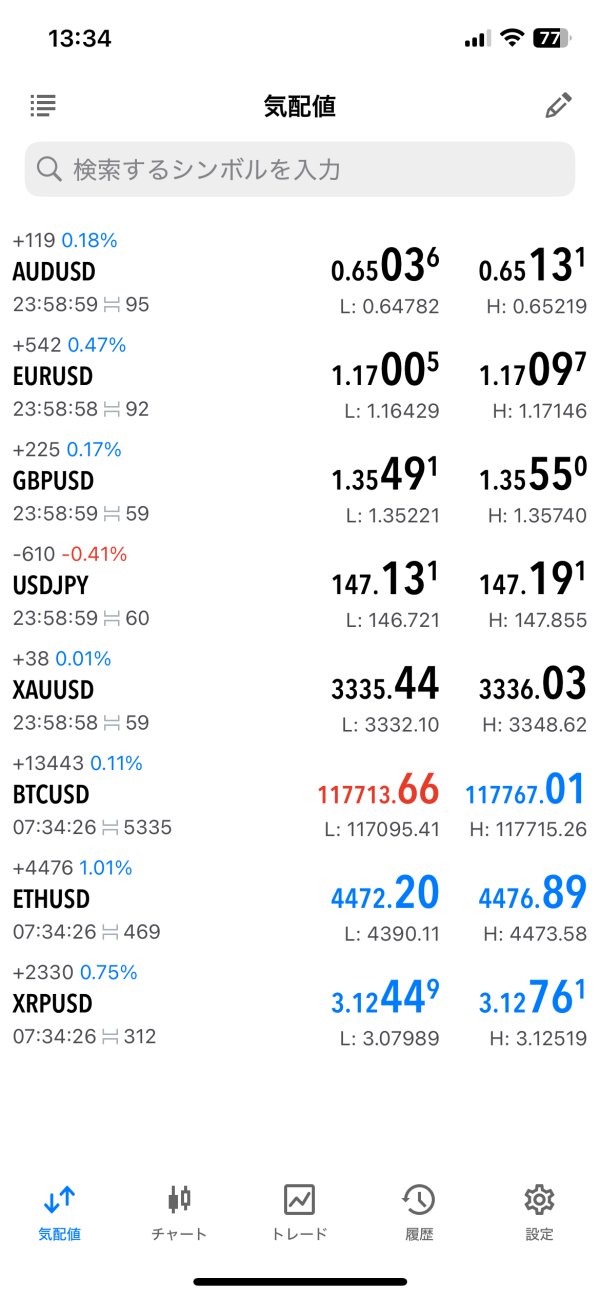

Tradeable Assets: The range of available trading instruments and asset classes is not detailed in available broker information.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not provided in source materials. This makes cost comparison difficult.

Leverage Options: Available leverage ratios and margin requirements are not specified in current documentation.

Platform Selection: Details about trading platform options and technological infrastructure are not available in source materials.

Geographic Restrictions: The broker may be unable to accept clients from certain countries due to legal or regulatory limitations. Specific restricted jurisdictions are not detailed though.

Customer Service Languages: Supported languages for customer service are not specified in available information. This monaxa review highlights the need for greater transparency in operational details.

Detailed Rating Analysis

Account Conditions Analysis (Score: Not Rated)

The evaluation of Monaxa's account conditions proves challenging due to the absence of comprehensive information in available source materials. Standard account features such as account type varieties, minimum deposit requirements, and opening procedures remain unspecified. This lack of transparency regarding basic account parameters raises concerns. It suggests the broker may not be fully committed to client transparency.

Without access to detailed account specifications, potential traders cannot adequately assess whether Monaxa's offering aligns with their trading requirements. The absence of information about specialized account features, such as Islamic accounts or professional trading accounts, further limits the ability to evaluate the broker's accommodation of diverse client needs.

The account opening process, verification requirements, and ongoing account maintenance procedures are not detailed in available documentation. This information gap makes it difficult for potential clients to understand the commitment required to establish and maintain a trading relationship with Monaxa. Industry best practices typically require clear disclosure of all account-related terms and conditions.

The lack of available information about account conditions significantly impacts this monaxa review. It suggests that potential clients should seek direct clarification from the broker before proceeding with account opening. This transparency deficit represents a notable weakness in Monaxa's client communication strategy.

Assessment of Monaxa's trading tools and educational resources cannot be completed based on available source materials. The broker's provision of market analysis tools, research capabilities, and educational content remains unspecified. This information void prevents potential clients from understanding the analytical support available for their trading decisions.

Modern forex brokers typically provide comprehensive research libraries, market analysis tools, and educational resources to support client trading success. The absence of information about such offerings raises questions about Monaxa's commitment to client development and trading support. Without access to quality research and analysis tools, traders may find themselves at a disadvantage in market analysis and decision-making.

Educational resources, including webinars, tutorials, and market commentary, play crucial roles in trader development. The lack of available information about Monaxa's educational offerings suggests either a limited commitment to client education or poor communication of available resources. Both scenarios represent potential weaknesses in the broker's service proposition.

Automated trading support, including Expert Advisor compatibility and algorithmic trading infrastructure, remains unspecified. This absence of technical trading support information limits the assessment of Monaxa's suitability for sophisticated trading strategies and automated trading systems.

Customer Service and Support Analysis (Score: 8/10)

Monaxa demonstrates notable strength in customer service delivery according to available user feedback. Multiple testimonials highlight the professionalism of the Monaxa team, particularly in business development and client relationship management. Users consistently report positive interactions with customer service representatives. This suggests a well-trained and responsive support team.

The broker's approach to client communication appears to prioritize responsiveness and professionalism. User feedback indicates that the Monaxa team maintains high standards in client interactions, contributing to positive customer experiences. The business development management receives particular praise for professional conduct and effective client relationship handling.

Transaction processing represents another strength in Monaxa's customer service offering. Users report rapid deposit and withdrawal processing times, indicating efficient back-office operations and commitment to client convenience. This operational efficiency contributes significantly to overall customer satisfaction. It represents a competitive advantage in the forex brokerage sector.

However, the absence of detailed information about customer service channels, availability hours, and multilingual support capabilities limits the comprehensive assessment of support quality. While user feedback suggests strong performance in client interactions, the lack of specific operational details prevents full evaluation of the customer service infrastructure.

Trading Experience Analysis (Score: Not Rated)

The evaluation of Monaxa's trading experience proves impossible due to insufficient information about platform performance, execution quality, and trading infrastructure. Key elements such as platform stability, order execution speed, and trading environment characteristics are not detailed in available source materials.

Trading platform functionality, including charting capabilities, order management features, and analytical tools, remains unspecified. This information gap prevents assessment of the platform's suitability for different trading styles and experience levels. Modern traders require sophisticated platform capabilities to execute effective trading strategies.

Mobile trading experience, increasingly important for contemporary forex trading, is not addressed in available documentation. The absence of information about mobile platform capabilities, synchronization features, and mobile-specific functionality represents a significant evaluation limitation.

Order execution quality, including slippage rates, rejection frequencies, and execution speeds, cannot be assessed based on available information. These technical performance metrics are crucial for evaluating a broker's trading environment quality. The lack of such data makes it impossible to assess Monaxa's competitive position in trading execution. This monaxa review emphasizes the need for greater transparency in trading performance metrics.

Trust and Safety Analysis (Score: 4/10)

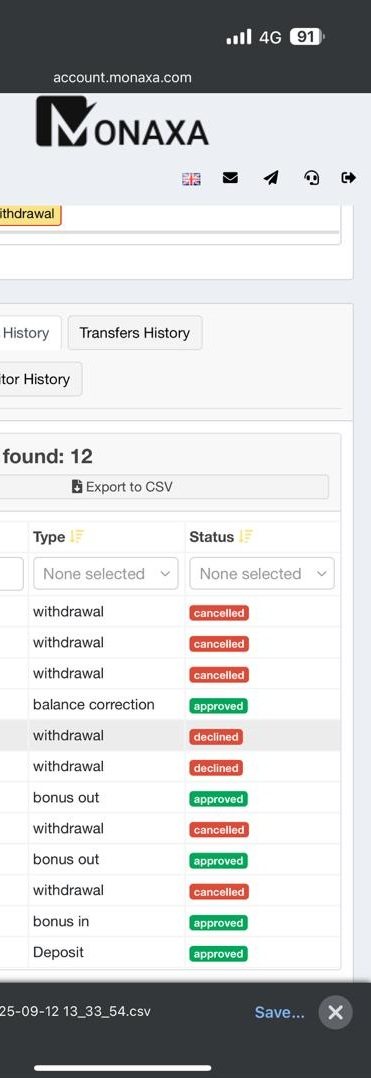

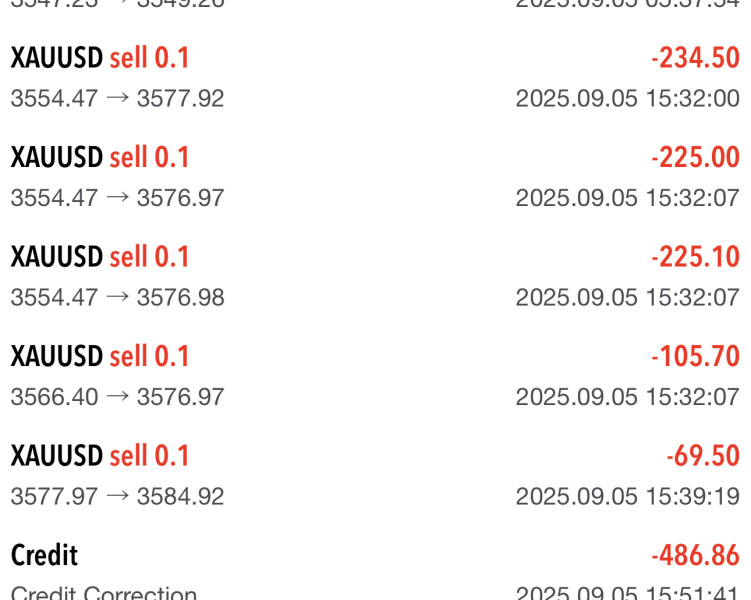

Monaxa's trust and safety profile presents significant concerns that overshadow positive operational aspects. Industry monitoring services have flagged the broker as potentially risky, with multiple user reports of financial losses raising serious questions about client fund security. These safety concerns represent the most critical weakness in Monaxa's service proposition.

User reports of fund losses suggest potential issues with the broker's business practices or operational integrity. While some users report positive experiences, the presence of financial loss claims creates uncertainty about the broker's reliability and safety standards. Such reports typically indicate either poor risk management practices or more serious operational issues.

The absence of clear regulatory oversight information compounds trust concerns. Legitimate forex brokers typically maintain transparent regulatory compliance and provide clear information about supervisory authorities. The lack of such transparency in Monaxa's case raises questions about regulatory compliance and client protection measures.

Industry risk warnings and negative assessments from financial monitoring services provide additional evidence of potential safety concerns. These third-party evaluations suggest that Monaxa may not meet standard industry safety and reliability benchmarks. The convergence of user complaints and industry warnings creates a compelling case for extreme caution when considering this broker.

User Experience Analysis (Score: 6/10)

Monaxa's user experience presents a complex picture of high service quality offset by significant safety concerns. The broker maintains a high Trustpilot rating of 4.7/5, with 87% of users awarding five-star reviews, indicating generally positive user experiences. However, this positive feedback must be weighed against reports of financial losses and risk warnings.

Users consistently praise the rapid deposit and withdrawal processing, suggesting efficient operational systems and commitment to client convenience. The speed of financial transactions represents a notable competitive advantage and contributes to positive user experiences. This operational efficiency indicates well-designed back-office systems and effective transaction processing capabilities.

The professional conduct of the Monaxa team receives frequent positive mentions in user feedback. Business development management and customer service interactions are consistently rated highly, suggesting effective training and client relationship management systems. This human element of service delivery appears to be a genuine strength in Monaxa's offering.

However, risk warnings from some users temper these positive aspects. The presence of cautionary feedback suggests that while operational service quality may be high, underlying safety concerns create negative experiences for some clients. This mixed feedback profile indicates that user experience quality may depend significantly on individual circumstances and risk exposure levels.

Conclusion

This monaxa review reveals a forex broker with notable operational strengths undermined by serious safety concerns. While Monaxa demonstrates excellence in customer service delivery and transaction processing speed, the reported financial losses and industry risk warnings create significant concerns about client fund safety. The broker may appeal to traders prioritizing rapid transaction processing and professional customer service. However, the underlying risk factors make it unsuitable for risk-averse investors.

The primary advantages include professional customer service, efficient transaction processing, and positive user feedback regarding team interactions. However, these benefits are overshadowed by substantial disadvantages including reported fund losses, industry risk warnings, and lack of regulatory transparency. Potential clients should exercise extreme caution and conduct thorough due diligence before considering any engagement with this broker.

The mixed user feedback and safety concerns suggest that Monaxa represents a high-risk trading environment despite operational service quality. Traders seeking reliable and secure forex trading platforms should prioritize brokers with clear regulatory oversight and established safety records over those offering primarily operational convenience.