Is MONAXA safe?

Pros

Cons

Is Monaxa A Scam?

Introduction

Monaxa is a relatively new player in the forex market, having been established in 2023. Positioned as an offshore broker, it offers a range of trading services including forex, CFDs, and cryptocurrencies. Given the proliferation of unregulated brokers in the industry, traders must exercise caution when assessing the legitimacy and safety of their chosen trading platforms. This article aims to provide an objective evaluation of Monaxa by analyzing its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The assessment is based on a comprehensive review of available online resources, including broker reviews and user feedback.

Regulation and Legitimacy

Monaxa operates under a dual structure, with one entity registered in Saint Vincent and the Grenadines (SVG) and another regulated by the Australian Securities and Investments Commission (ASIC). The SVG entity lacks robust regulatory oversight, which raises concerns about its legitimacy. In contrast, ASIC is known for its stringent regulatory framework that mandates high capital requirements and ensures client fund protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001301357 | Australia | Verified |

| SVG | N/A | Saint Vincent | Unregulated |

The regulatory quality is critical because it directly impacts the safety of client funds and the broker's operational transparency. While ASIC oversees Monaxa's Australian operations, the SVG branch operates without such stringent regulations, which can expose traders to higher risks. Historically, offshore brokers from SVG have been linked to various fraudulent activities, making it essential for traders to be vigilant.

Company Background Investigation

Monaxa Ltd is part of a larger Monaxa Group, which includes Monaxa AU Pty Ltd, the entity regulated by ASIC. The company claims to offer competitive trading conditions, but its offshore registration raises questions about transparency and accountability. The management teams background is not widely publicized, which limits the ability to assess their experience and expertise in the financial sector. Transparency in company operations and ownership structure is vital for building trust, and Monaxa's lack of detailed information may deter potential clients.

Trading Conditions Analysis

Monaxa offers a variety of trading accounts with different fee structures. The broker claims to provide competitive spreads and high leverage; however, the absence of a demo account is a red flag, as it prevents traders from testing the platform before committing real funds.

| Fee Type | Monaxa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | From 1.5 pips |

| Commission Model | $6 per lot (Zero Account) | Varies |

| Overnight Interest Range | Varies | Varies |

The trading conditions, including high leverage of up to 1:4000, can be attractive but also pose significant risks. High leverage can amplify losses as easily as profits, which is a crucial consideration for traders. The fee structure appears to be slightly above average for spreads, particularly for the standard account, which may not be competitive compared to more established brokers.

Customer Fund Safety

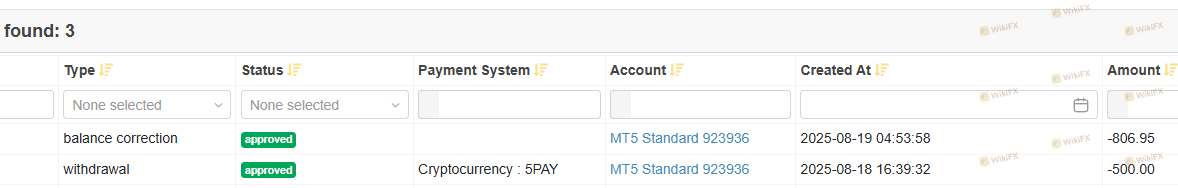

Monaxa's approach to customer fund safety is mixed. While it claims to offer negative balance protection, there is no regulatory obligation for the SVG entity to adhere to such policies. The lack of segregation of client funds raises additional concerns, as funds could potentially be misused by the broker. Without stringent regulatory oversight, traders may find it challenging to recover their funds in the event of insolvency or fraud.

Customer Experience and Complaints

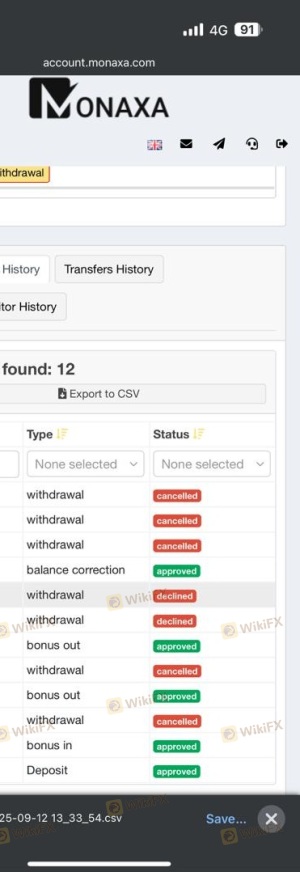

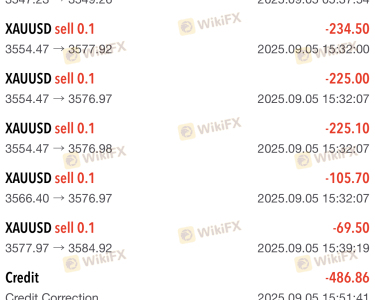

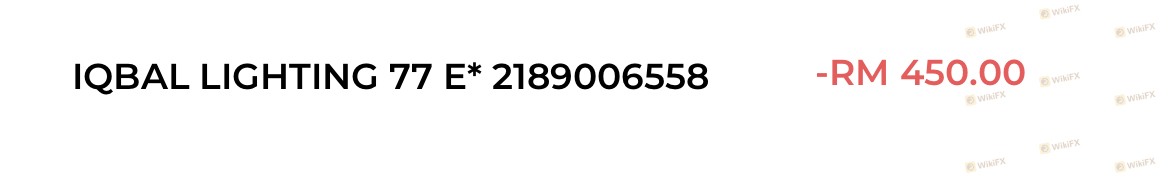

User feedback regarding Monaxa is varied, with several complaints highlighting issues with withdrawals and customer service responsiveness. Many users report difficulties in accessing their funds, which is a significant concern for any trader.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent |

Typical cases involve users who have reported being unable to withdraw their funds despite meeting the necessary conditions. Such complaints often indicate deeper issues related to the broker's legitimacy and operational practices.

Platform and Trade Execution

Monaxa utilizes the cTrader platform, which is known for its user-friendly interface and advanced trading features. While the platform performs well in terms of execution speed and reliability, concerns about potential manipulation and slippage have been raised by users.

Risk Assessment

The overall risk associated with trading through Monaxa can be categorized as high due to its offshore status, lack of robust regulatory oversight, and user complaints regarding fund safety.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under lax regulations |

| Fund Safety Risk | High | Potential misuse of client funds |

| Withdrawal Risk | Medium | Complaints about access to funds |

Traders should consider these risks carefully and may want to implement risk management strategies, such as setting strict limits on their investments and ensuring they do not invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, while Monaxa offers attractive trading conditions such as high leverage and a variety of trading instruments, the overall assessment leans towards caution. The lack of robust regulatory oversight, combined with user complaints and potential issues regarding fund safety, suggests that Monaxa may not be a reliable choice for many traders. It is advisable for potential clients to consider alternative brokers with stronger regulatory frameworks and proven track records. Reliable alternatives may include brokers regulated by ASIC or those under the oversight of the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

Is MONAXA a scam, or is it legit?

The latest exposure and evaluation content of MONAXA brokers.

MONAXA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MONAXA latest industry rating score is 2.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.