Land FX 2025 Review: Everything You Need to Know

Executive Summary

Land FX is an FCA-regulated forex and CFD broker. The company has been working in global financial markets since 2013. This Land FX review shows a broker with moderate overall trustworthiness, backed by solid regulatory credentials from the UK's Financial Conduct Authority. The platform stands out by offering the popular MetaTrader 4 and MetaTrader 5 trading platforms. It provides access to multiple forex pairs and CFD instruments.

Based on available user feedback, Land FX maintains a 3.01 TrustScore from 27 user reviews. This indicates average customer satisfaction levels. The broker mainly targets traders seeking FCA-regulated trading environments. This makes it particularly suitable for beginner to intermediate-level traders who prioritize regulatory protection over advanced features.

Land FX's core strengths lie in its regulatory compliance and platform reliability. However, specific details about account conditions, spreads, and customer service quality require further investigation. The broker operates under the EU single market passport system. This makes it accessible to European traders seeking regulated forex and CFD trading opportunities.

Important Disclaimers

Regional Entity Differences: Land FX operates in Europe through the EU single market passport system under FCA regulation. This makes it particularly suitable for European traders. Different regulatory frameworks may apply to clients in other jurisdictions. Traders should verify their local regulatory status before opening accounts.

Review Methodology: This comprehensive analysis is based on publicly available information, user reviews, and regulatory filings. Our assessment methodology combines quantitative data from user feedback platforms with qualitative analysis of broker features and regulatory standing.

Rating Framework

Broker Overview

Company Background and Establishment

Land FX was established in 2013 as a global forex and CFD broker. The company positioned itself to serve international markets through comprehensive trading services. The company has built its reputation around providing regulated trading environments. It focuses particularly on European markets through its FCA authorization. Over its operational history, Land FX has maintained a steady presence in the competitive forex brokerage landscape. The company emphasizes regulatory compliance and platform reliability.

The broker's business model centers on providing access to global financial markets through established trading platforms. It particularly targets retail traders seeking regulated alternatives. Land FX operates under a traditional market-making model. The company offers competitive trading conditions while maintaining regulatory oversight through its FCA license.

Platform and Asset Coverage

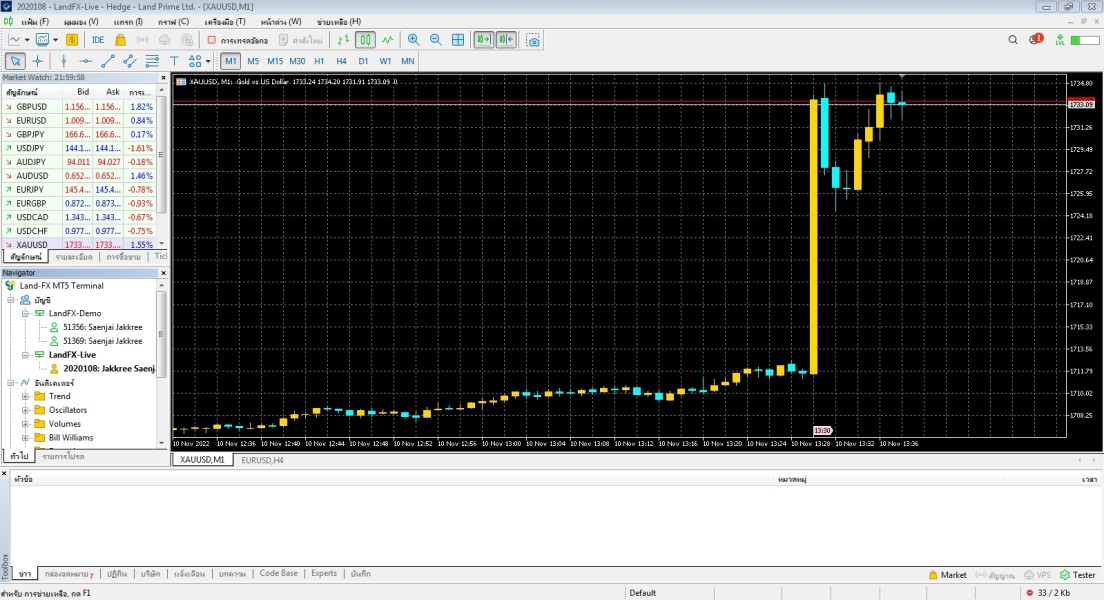

Land FX provides trading access through both MetaTrader 4 and MetaTrader 5 platforms. This ensures compatibility with different trading preferences and strategies. The broker's asset coverage includes multiple forex pairs and CFD instruments. However, specific details about the exact number of tradeable instruments vary across different sources. This Land FX review confirms that the platform supports standard forex trading alongside CFD opportunities. This makes it suitable for diverse trading approaches.

The broker's regulatory framework operates under FCA oversight. This provides client protection through the UK's established financial regulatory system. This regulatory backing ensures compliance with European financial standards. It also provides traders with recourse through established dispute resolution mechanisms.

Regulatory Framework and Compliance

Land FX operates under FCA regulation. This ensures its trading activities comply with stringent UK financial regulations. This regulatory oversight provides traders with established protections and dispute resolution mechanisms.

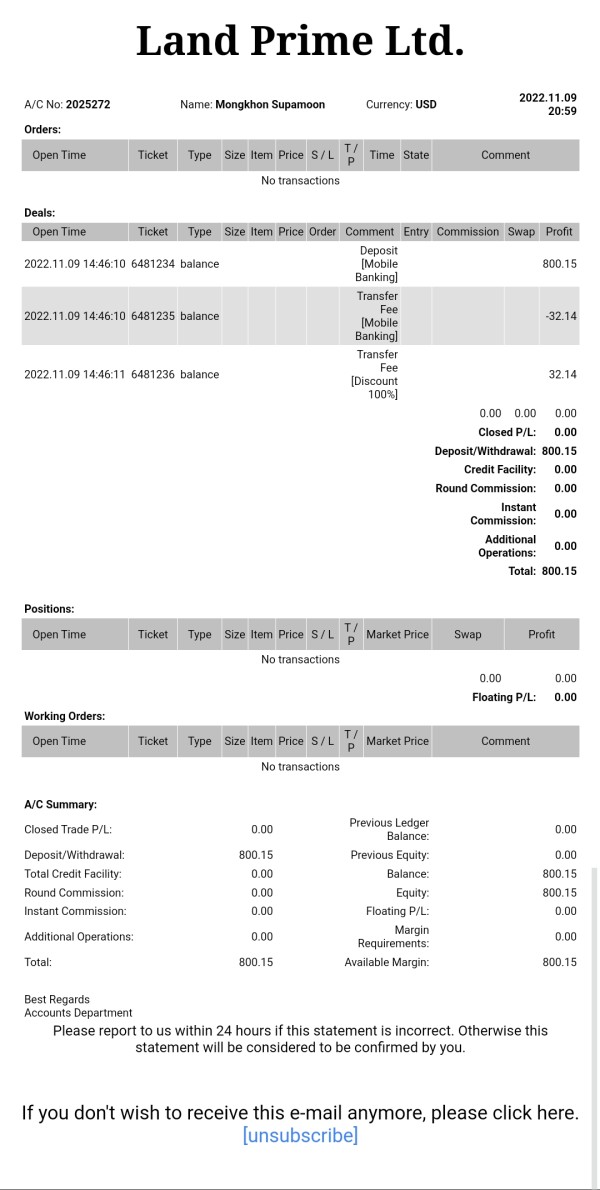

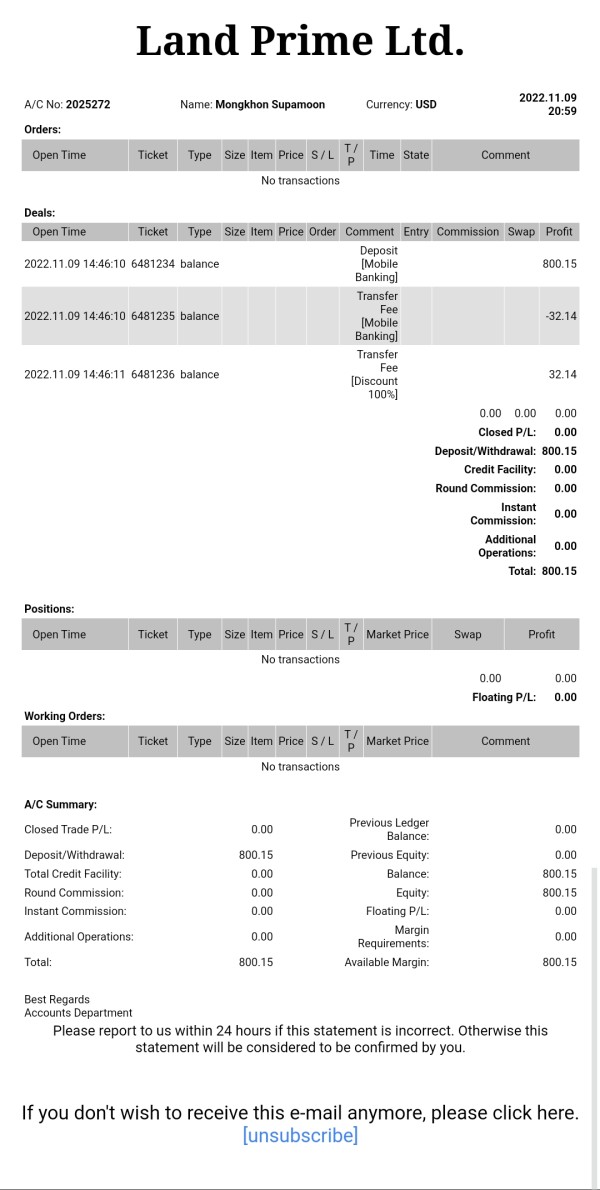

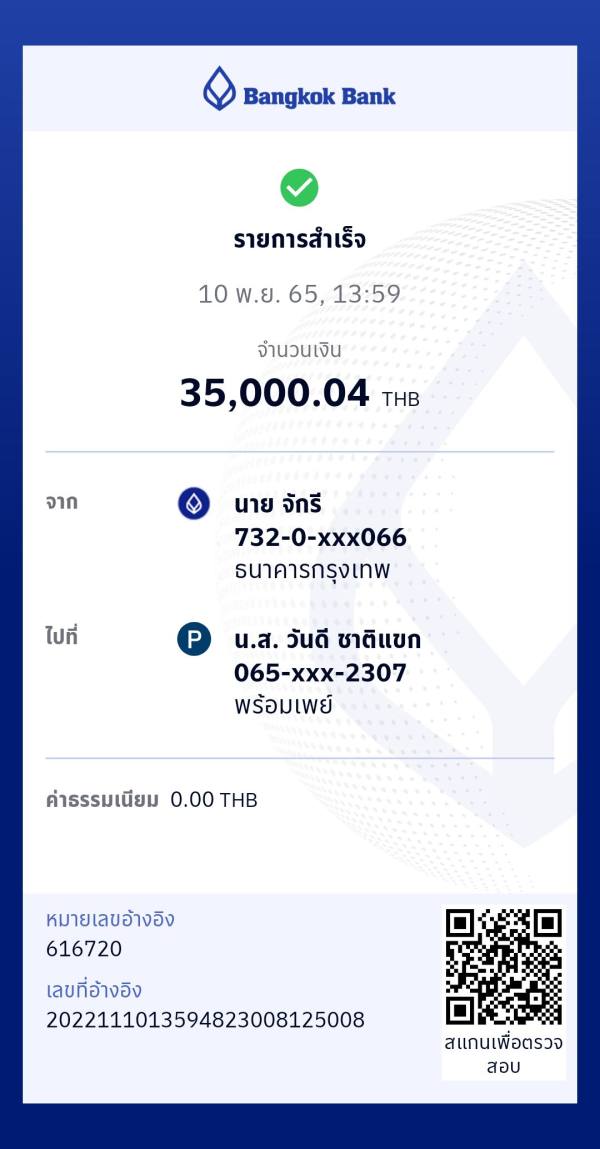

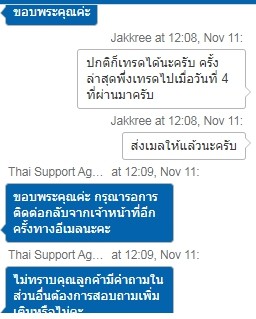

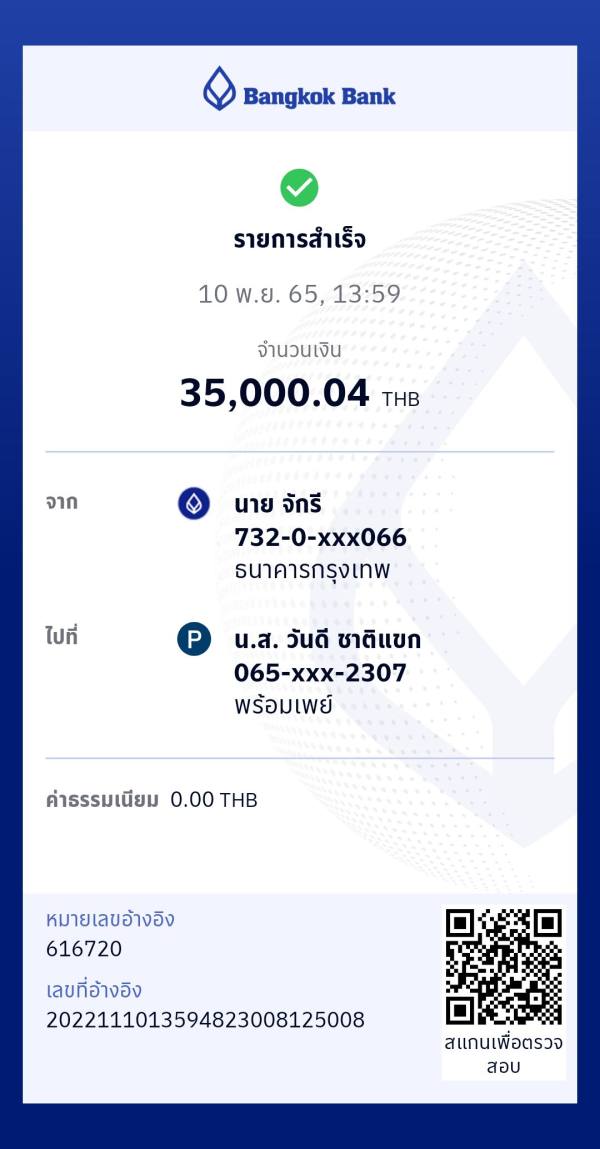

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods was not detailed in available sources. Traders should contact Land FX directly to confirm available payment options and processing timeframes.

Minimum Deposit Requirements

Available sources do not specify minimum deposit requirements. Prospective clients should verify current minimum deposit levels directly with the broker.

Bonus and Promotional Offerings

No specific bonus or promotional activities were mentioned in available information sources. Current promotional offerings should be confirmed through official broker channels.

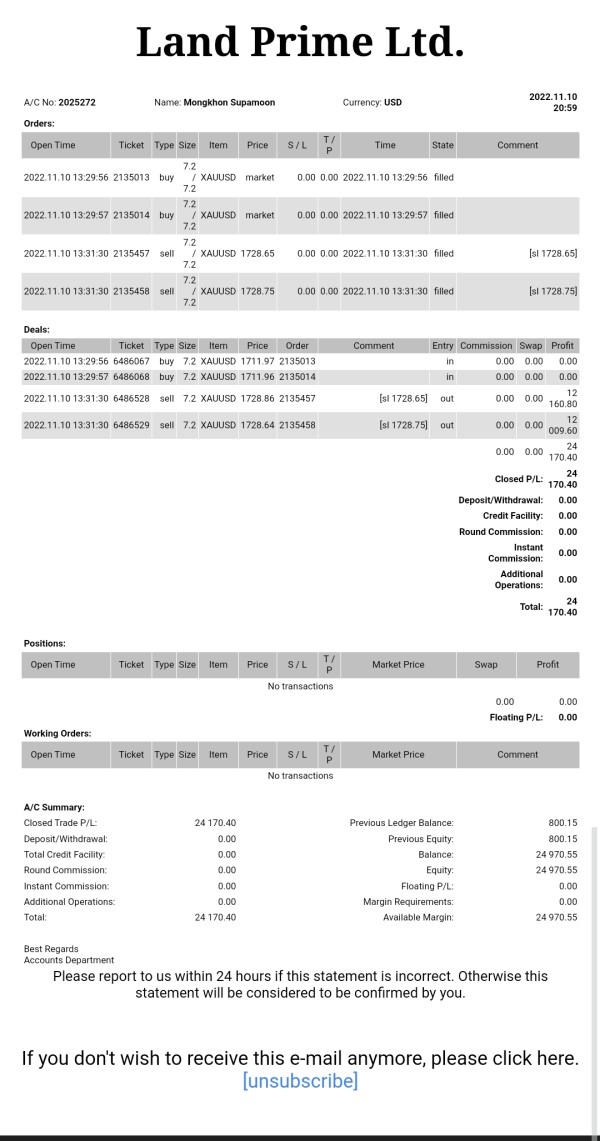

Available Trading Assets

Land FX supports multiple forex pairs and CFD trading. This accommodates various trading strategies from scalping to swing trading. The platform provides access to major, minor, and exotic currency pairs alongside CFD instruments.

Cost Structure Analysis

Specific spread and commission information was not detailed in available sources. This requires further investigation for accurate cost analysis. This Land FX review recommends contacting the broker directly for current pricing structures.

Leverage Ratios

Available sources do not specify leverage ratios offered by Land FX. European regulatory standards typically limit retail trader leverage, and specific ratios should be confirmed with the broker.

Platform Selection

The broker supports both MT4 and MT5 platforms. This allows traders to choose their preferred trading environment based on individual needs and experience levels.

Geographic Restrictions

Specific geographic restrictions were not detailed in available information sources.

Customer Support Languages

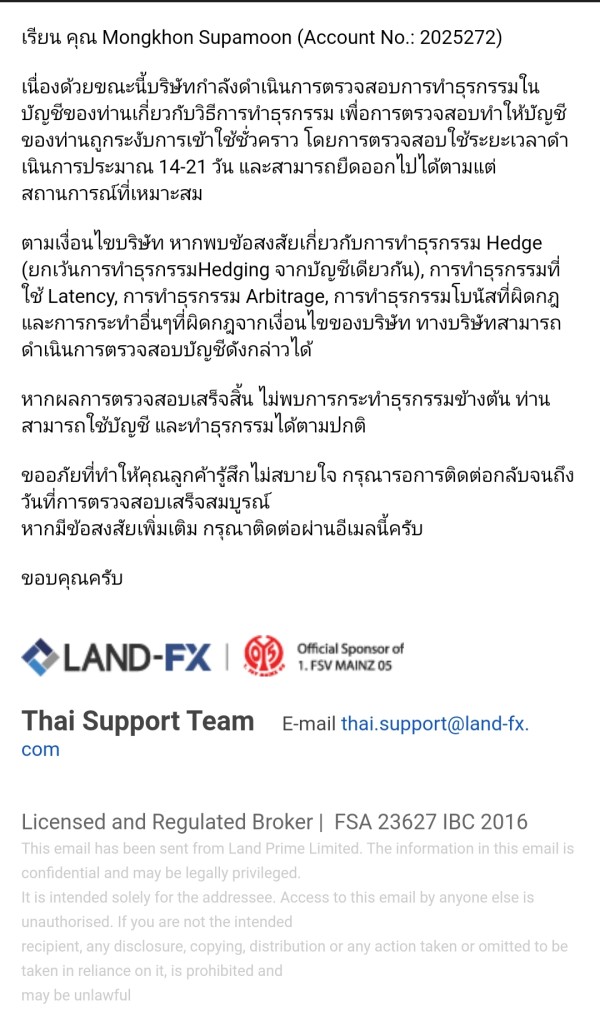

Information about supported customer service languages was not specified in available sources.

Detailed Rating Analysis

Account Conditions Analysis

Land FX's account conditions remain somewhat unclear based on available public information. This contributes to the moderate 5/10 rating in this category. While the broker operates under FCA regulation, which typically ensures standardized account protection measures, specific details about account types, minimum deposits, and tier-based benefits are not readily available in public sources.

The absence of detailed account information presents challenges for potential clients seeking to understand the broker's offerings fully. Without clear information about different account tiers, minimum funding requirements, or special account features such as Islamic accounts, traders cannot make fully informed decisions about account suitability.

This Land FX review notes that prospective clients should contact the broker directly to obtain comprehensive account condition details. The lack of transparent account information on public platforms may indicate either limited marketing presence or a preference for direct client consultation rather than public disclosure of account terms.

The regulatory framework under FCA oversight does provide some assurance regarding account protection standards. However, specific implementation details require direct broker communication for clarification.

Land FX demonstrates solid performance in tools and resources. The company earns a 7/10 rating primarily due to its support for both MetaTrader 4 and MetaTrader 5 platforms. These industry-standard platforms provide comprehensive trading tools, including advanced charting capabilities, technical indicators, and automated trading support through Expert Advisors.

The MT4 and MT5 platforms offer extensive analytical resources. These include multiple timeframe charts, drawing tools, and market analysis features. These platforms support algorithmic trading strategies and provide robust order management systems suitable for various trading styles from scalping to position trading.

However, information about additional research resources, market analysis, or educational materials provided by Land FX specifically was not detailed in available sources. Many modern brokers supplement platform tools with proprietary research, daily market analysis, or educational webinars, but such offerings from Land FX require direct verification.

The platform choice between MT4 and MT5 allows traders to select based on their specific needs. MT4 offers proven reliability and MT5 provides enhanced features for multi-asset trading and improved analytical capabilities.

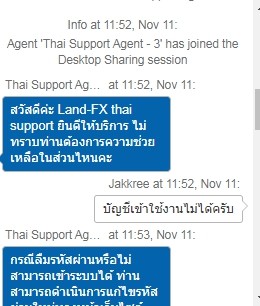

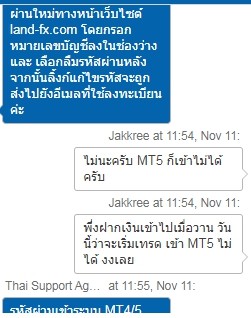

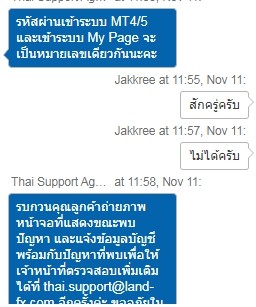

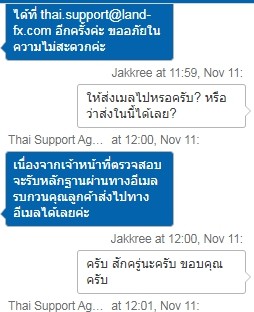

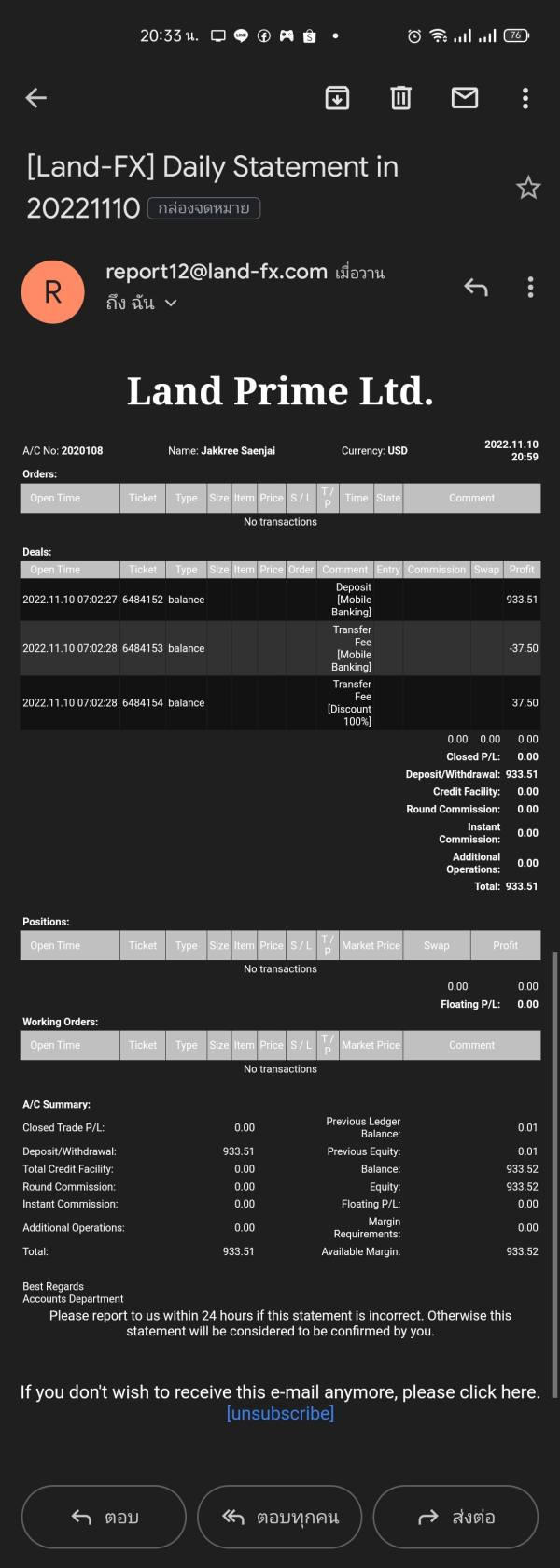

Customer Service and Support Analysis

Land FX receives a 6/10 rating for customer service and support. This reflects satisfactory but not exceptional service levels based on available information. The broker's customer service framework operates within standard industry parameters. However, specific details about service quality, response times, and support channels were not comprehensively detailed in available sources.

User feedback suggests adequate customer service experiences. However, the limited number of reviews makes comprehensive service quality assessment challenging. The 3.01 TrustScore indicates mixed customer experiences, with some clients expressing satisfaction while others report areas for improvement.

Available information does not specify customer service hours, multilingual support availability, or specialized support for different account types. Modern forex brokers typically offer 24/5 support during market hours, but Land FX's specific service schedule requires direct confirmation.

The regulatory framework under FCA oversight does provide additional client protection through established complaint procedures and dispute resolution mechanisms. This offers recourse beyond direct broker customer service channels.

Trading Experience Analysis

The trading experience with Land FX receives a 6/10 rating. This reflects satisfactory platform performance based on available user feedback. The broker's reliance on MetaTrader platforms provides proven trading infrastructure. However, specific performance metrics regarding execution speed, slippage, and platform stability were not detailed in available sources.

Platform stability and execution quality represent critical factors for trading success. This is particularly important for short-term trading strategies. While MT4 and MT5 platforms generally provide reliable performance, individual broker implementation can vary significantly in terms of server quality, execution speed, and price feed accuracy.

User feedback suggests acceptable trading conditions. However, the limited review sample size makes comprehensive assessment challenging. This Land FX review notes that trading experience quality often depends on individual trading styles, account sizes, and market conditions during trading periods.

Mobile trading capabilities through MT4 and MT5 mobile applications provide flexibility for traders requiring access outside traditional trading hours. However, specific mobile platform customizations or enhancements by Land FX were not detailed in available information.

Trust Factor Analysis

Land FX achieves a solid 7/10 rating for trust factor. This is primarily supported by its FCA regulatory status. The Financial Conduct Authority represents one of the world's most respected financial regulators. It provides comprehensive oversight of broker operations and client fund protection through established regulatory frameworks.

FCA regulation ensures compliance with strict capital adequacy requirements, client fund segregation, and operational transparency standards. This regulatory oversight provides traders with established protections including access to the Financial Services Compensation Scheme for eligible claims up to £85,000 per person per firm.

The broker's operational history since 2013 demonstrates reasonable market longevity. However, specific information about company financial strength, ownership structure, or industry reputation was not detailed in available sources. Transparency regarding company background and operational metrics would strengthen overall trust assessment.

No significant negative events or regulatory actions were identified in available information. This suggests consistent regulatory compliance. However, the limited public information about company operations and financial standing prevents a higher trust rating.

User Experience Analysis

Land FX receives a 5/10 rating for user experience. This is largely influenced by the 3.01 TrustScore from 27 user reviews indicating average customer satisfaction levels. This moderate rating suggests mixed user experiences, with some clients finding the service adequate while others encounter areas requiring improvement.

The limited number of user reviews makes comprehensive user experience assessment challenging. Twenty-seven reviews provide a relatively small sample size for drawing definitive conclusions about overall service quality. User experience typically encompasses multiple factors including platform usability, account opening processes, customer service interactions, and fund management procedures.

Available information does not provide specific details about user interface design, account opening timeframes, or deposit/withdrawal processing experiences. These operational aspects significantly impact overall user satisfaction and require direct verification through broker contact or trial account testing.

The broker's focus on European markets through FCA regulation suggests targeting of users seeking regulatory protection. However, specific user demographic information or satisfaction surveys were not available in public sources.

Conclusion

Land FX presents itself as a competent FCA-regulated forex and CFD broker suitable for traders prioritizing regulatory oversight and platform reliability. This comprehensive Land FX review reveals a broker with solid regulatory credentials and proven platform infrastructure. However, limited public information about specific account conditions and service details presents challenges for comprehensive evaluation.

The broker appears most suitable for beginner to intermediate traders seeking regulated trading environments with established platform technology. The combination of FCA oversight and MetaTrader platform support provides a foundation for secure trading. However, prospective clients should conduct direct broker consultation to clarify specific account terms and service offerings.

Key strengths include regulatory compliance and platform reliability. Areas for improvement include transparency regarding account conditions and expanded public information about service offerings. Traders considering Land FX should weigh the benefits of FCA regulation against the need for more detailed service information before making account opening decisions.