FXORO Review 2025: Everything You Need to Know

Executive Summary

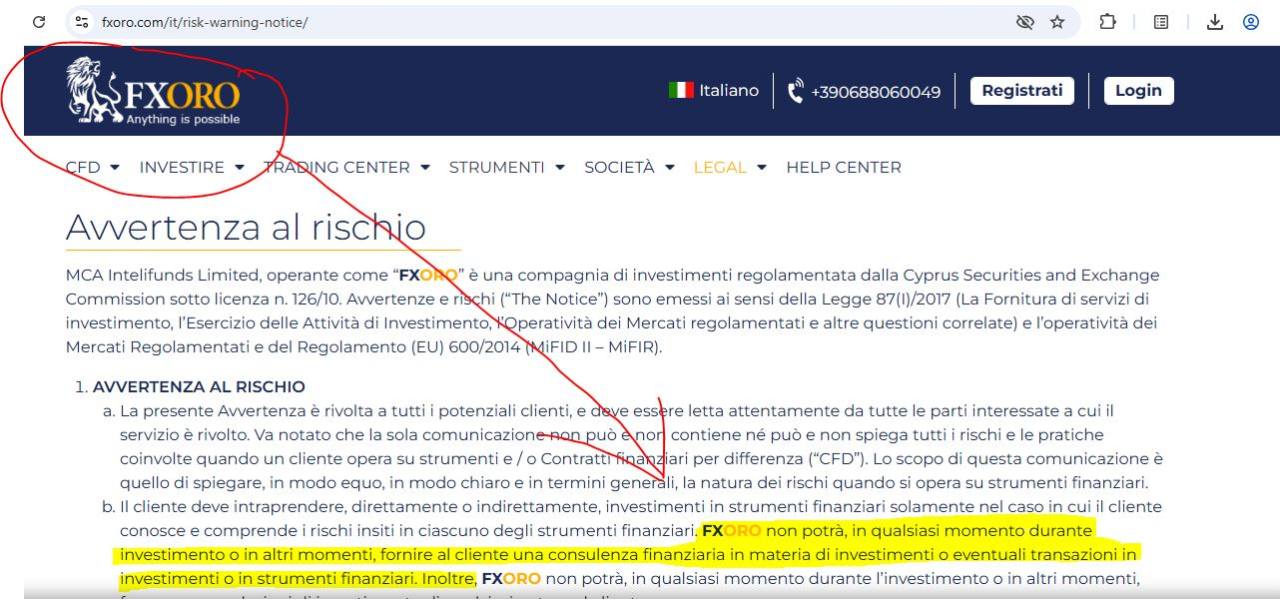

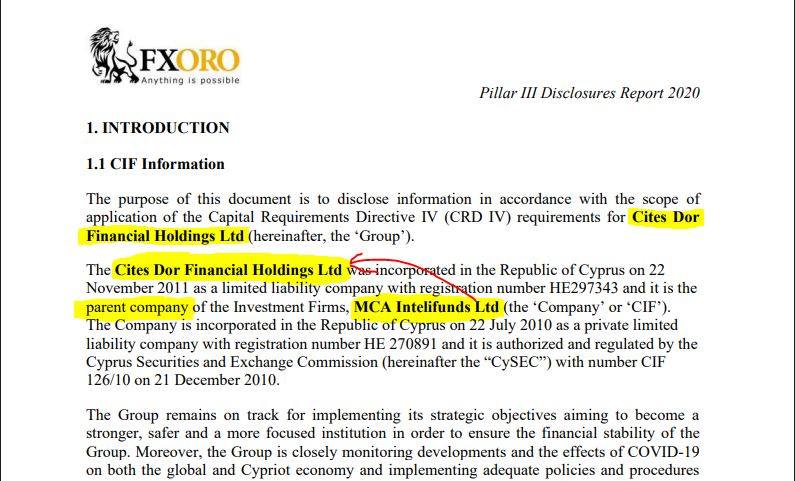

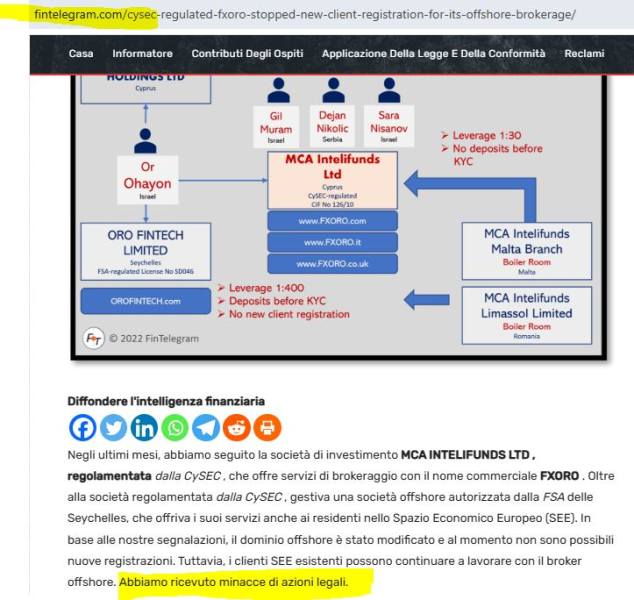

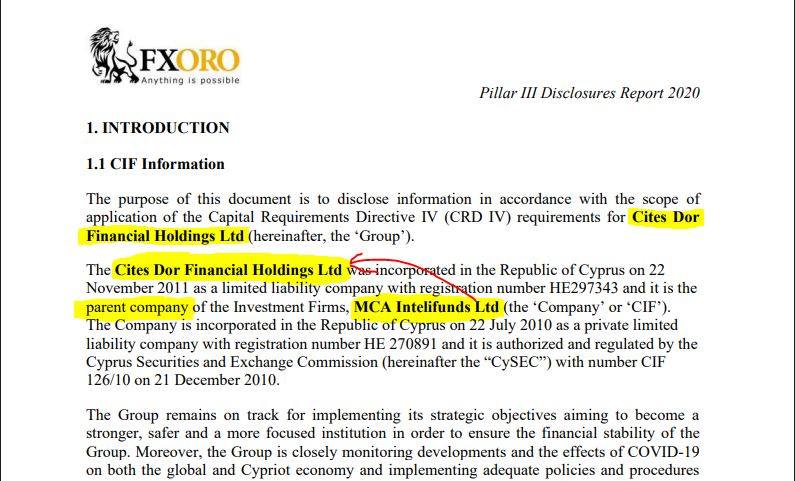

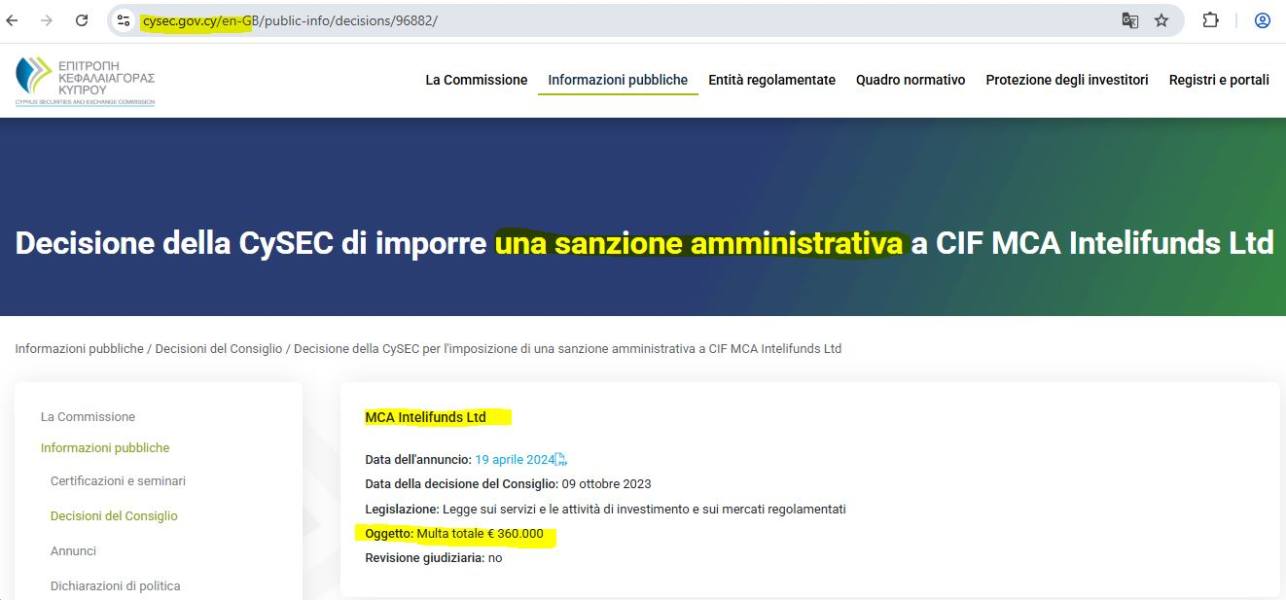

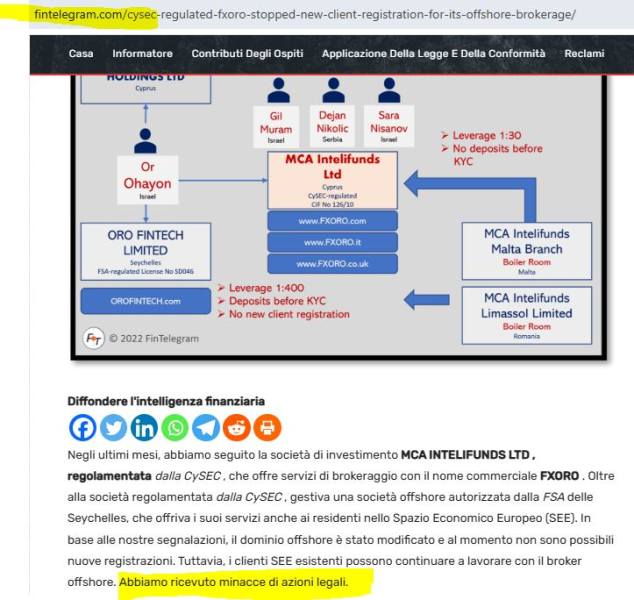

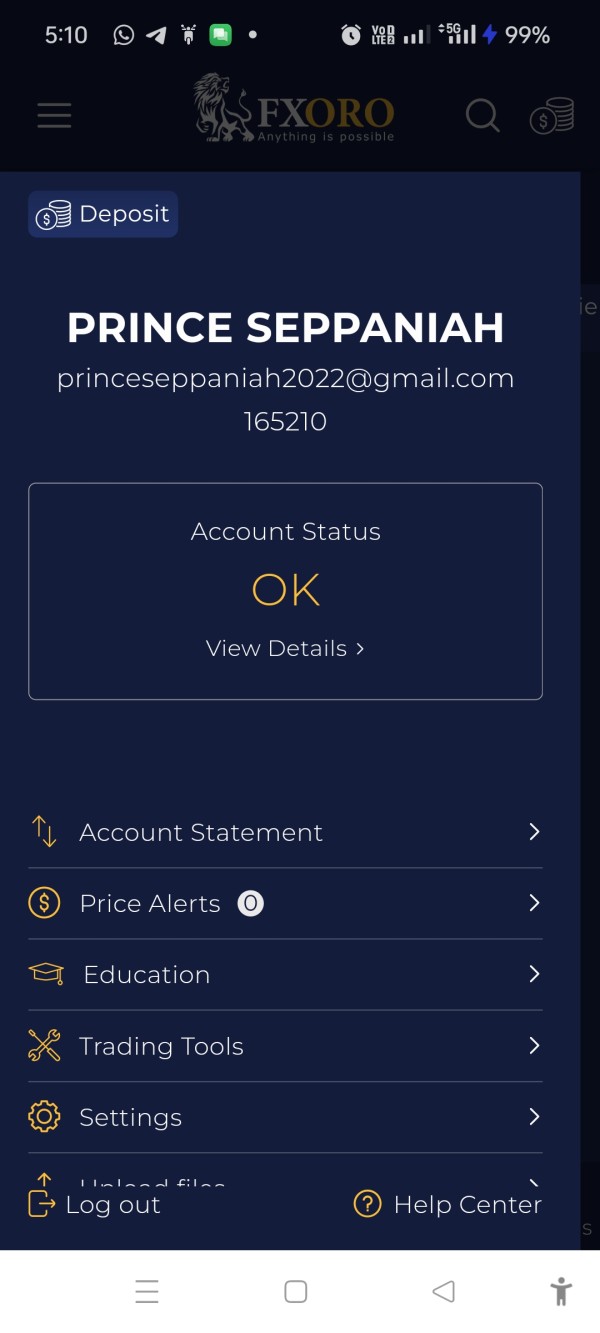

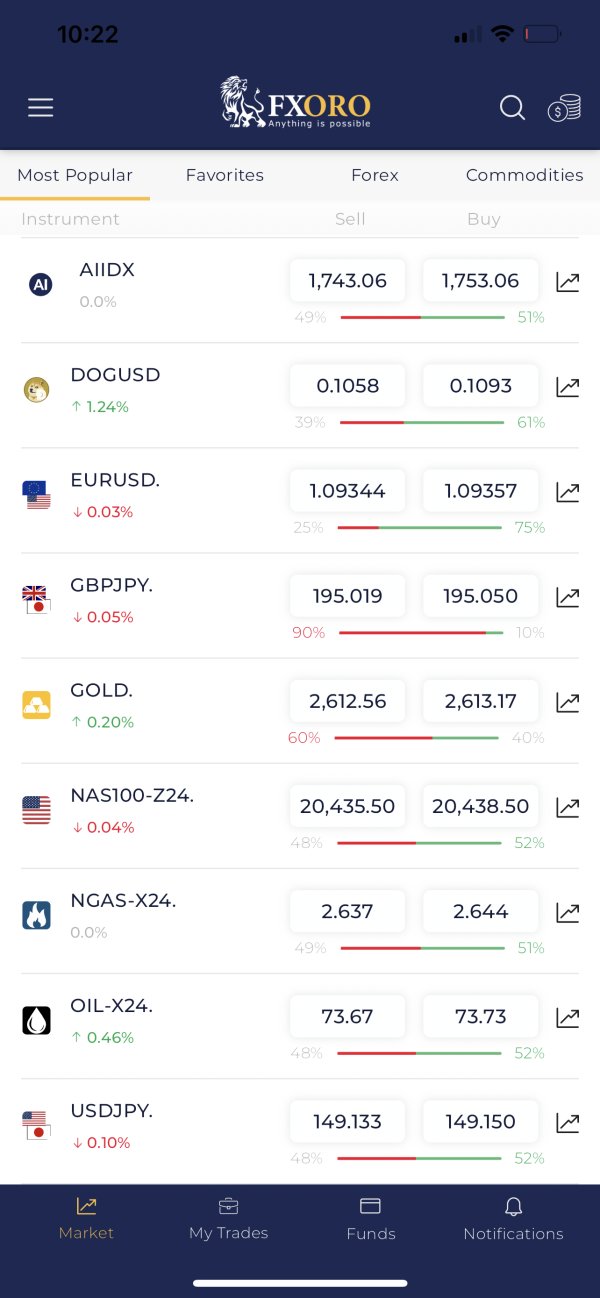

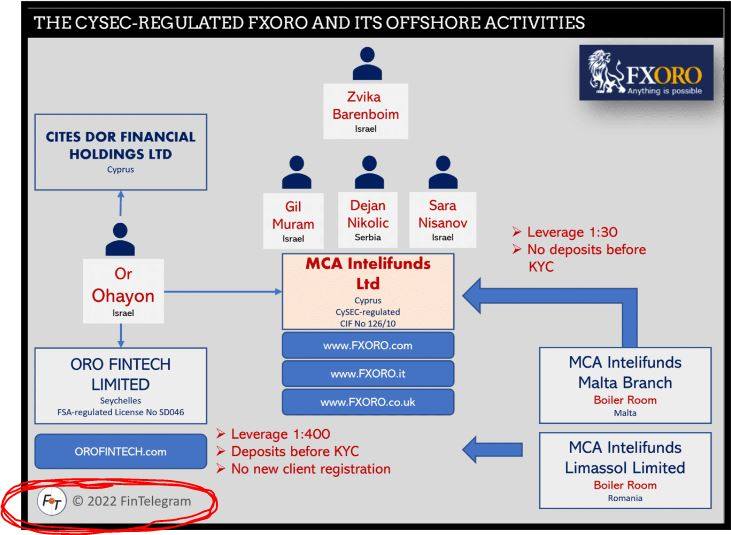

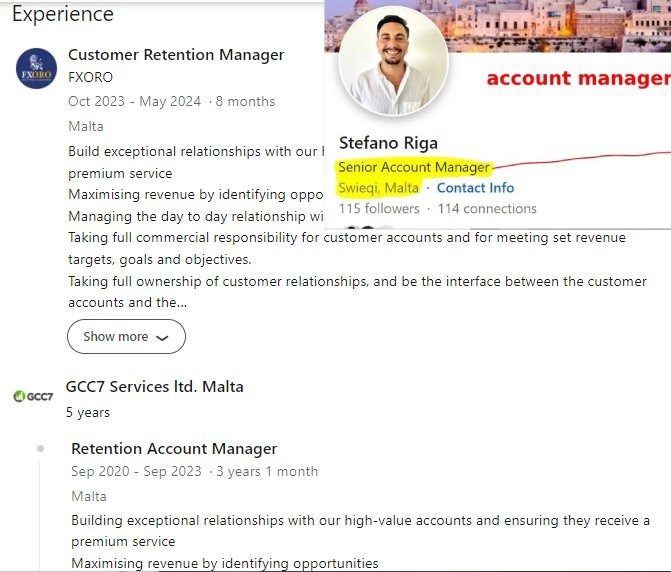

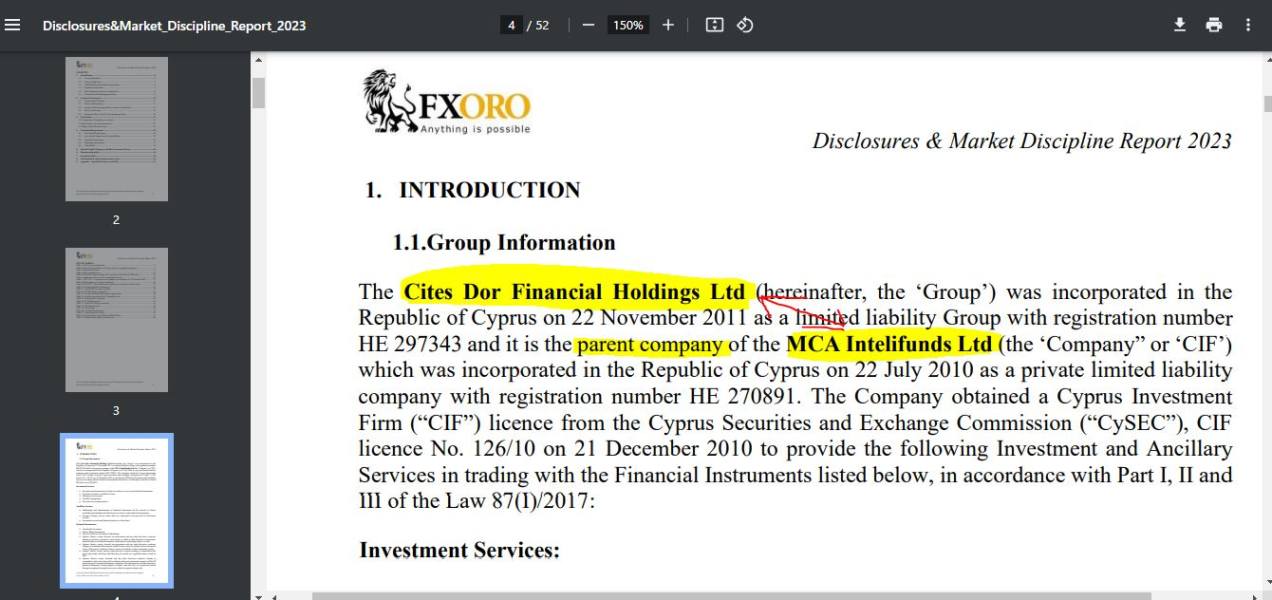

This comprehensive FXORO review examines a well-regulated online trading broker that has been serving clients since 2012. FXORO operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC) with license number 126/10. The broker provides traders with access to multiple financial instruments including forex, cryptocurrencies, indices, precious metals, energies, soft commodities, and stocks.

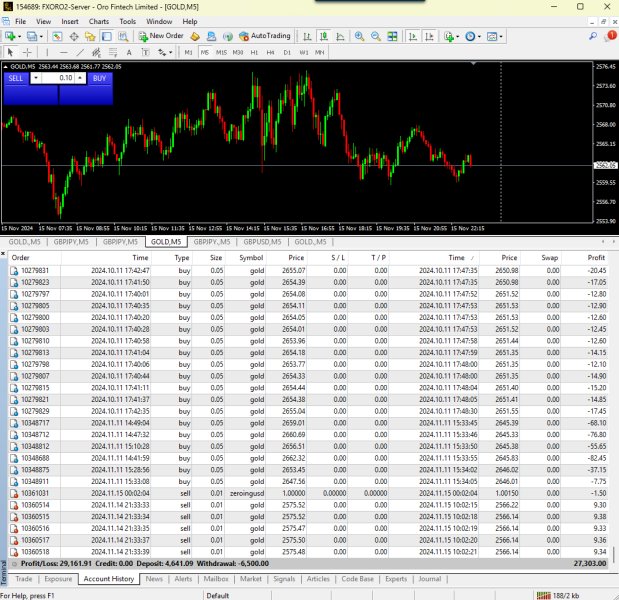

The broker stands out through several attractive features. These include commission-free trading on select instruments, a competitive 50% deposit bonus for new clients, and a cashback program offering $4 per lot traded. FXORO primarily uses the MetaTrader 4 platform. This platform provides both web-based and downloadable trading solutions with comprehensive charting tools and technical indicators.

With a minimum deposit requirement of just $100, FXORO positions itself as an accessible option for beginner traders. The broker also offers sufficient sophistication for more experienced investors seeking portfolio diversification. User feedback generally reflects positive experiences, particularly regarding the platform's stability, customer support quality, and competitive trading costs. However, some detailed information regarding specific commission structures and withdrawal processes requires further investigation by potential clients.

This broker appears most suitable for novice traders entering the forex market. It also works well for experienced traders looking for a regulated platform with diverse asset offerings and attractive promotional incentives.

Important Notice

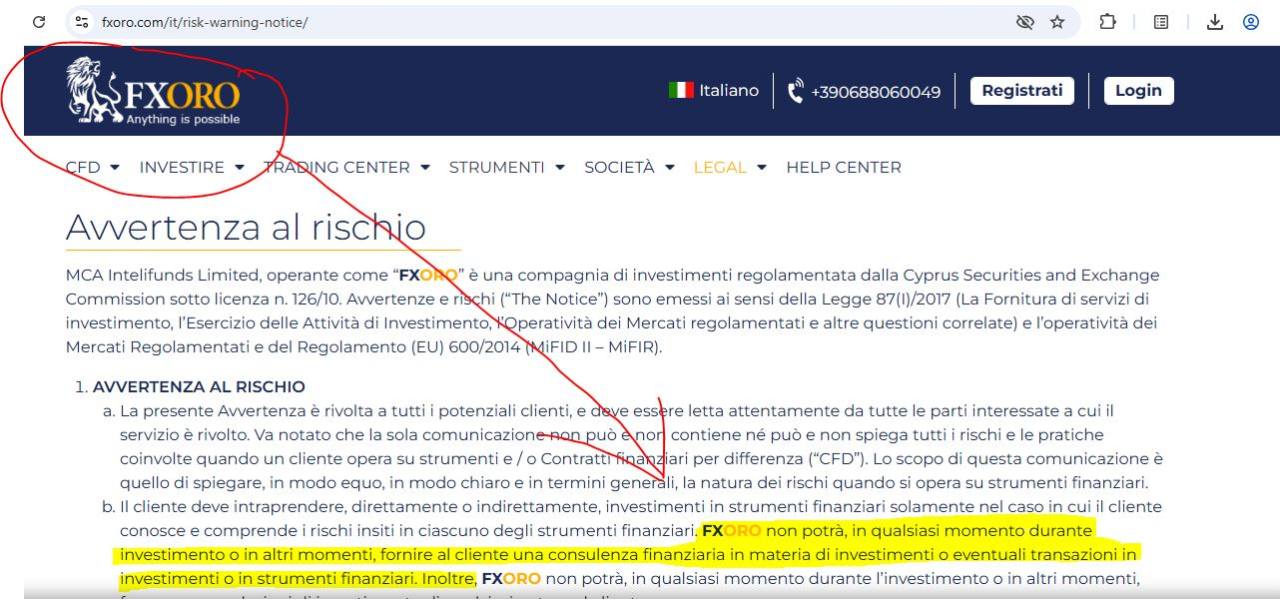

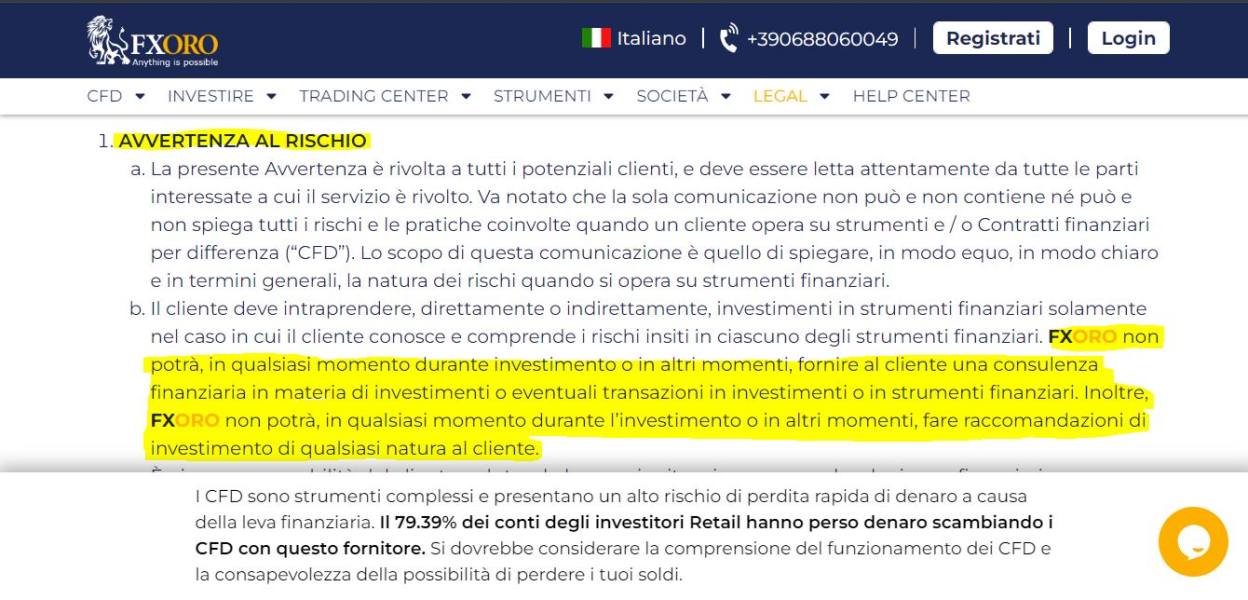

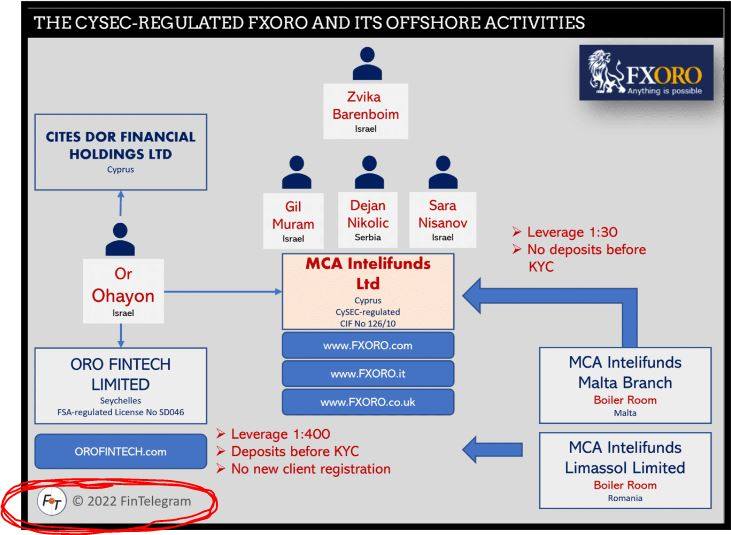

FXORO operates across different jurisdictions with varying regulatory frameworks. Traders should familiarize themselves with the applicable legal requirements and investor protections in their specific region. The regulatory policies and available services may differ depending on the client's country of residence. This is particularly true regarding leverage limits, negative balance protection, and compensation schemes.

This review is based on publicly available information, user feedback, and regulatory filings current as of 2025. The analysis aims to provide potential users with comprehensive information to make informed decisions. Trading involves significant risk, and past performance does not guarantee future results. Prospective clients should carefully consider their financial situation and risk tolerance before opening an account.

Rating Framework

Broker Overview

FXORO established its presence in the online trading industry in 2012. The company positions itself as a dedicated CFD trading specialist headquartered in Seychelles. The company has built its business model around providing accessible financial markets access to retail traders. FXORO focuses particularly on forex trading while expanding into cryptocurrency and other asset classes to meet evolving market demands.

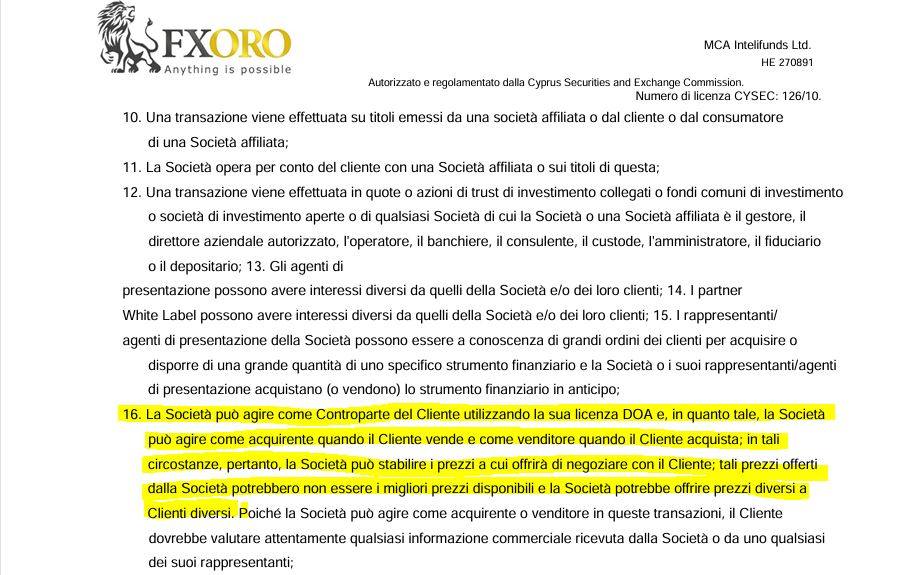

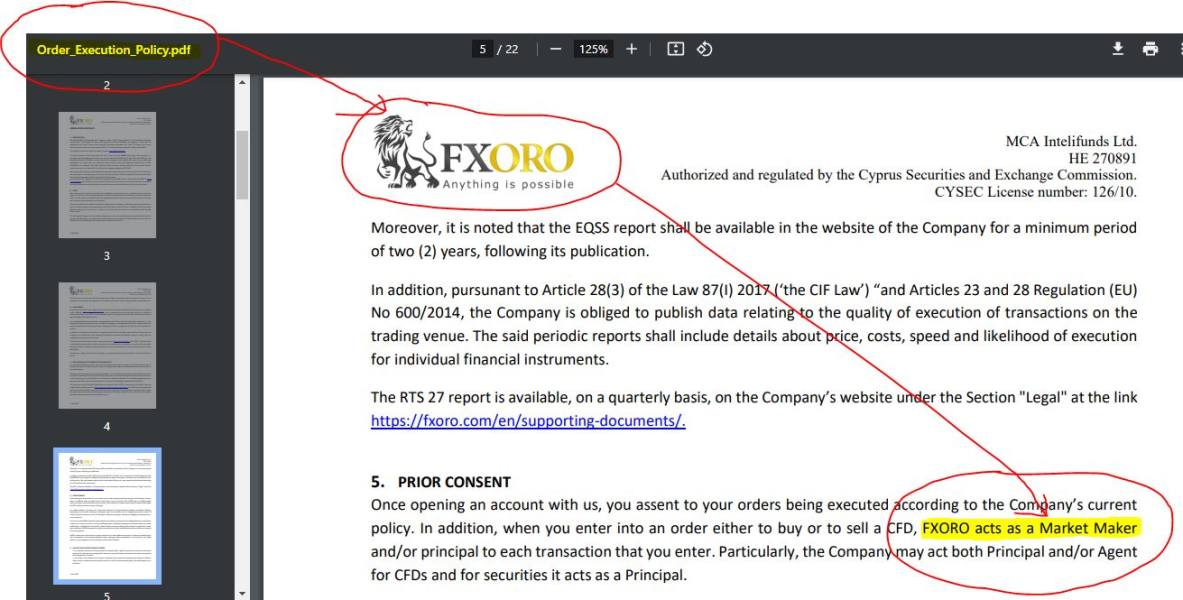

According to available information, FXORO operates as a market maker. The broker facilitates trades across multiple financial instruments while maintaining competitive spreads and execution speeds. The company has developed its services to cater to both novice traders seeking entry-level access and more sophisticated investors requiring advanced trading tools and diverse portfolio options.

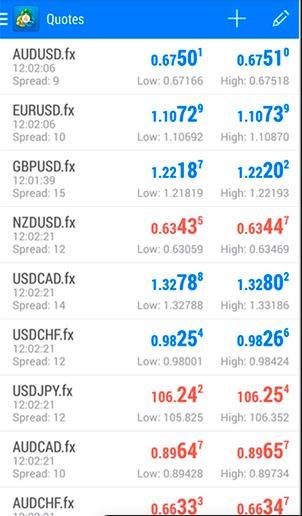

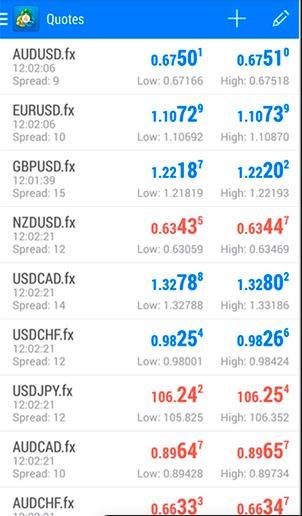

The company's primary trading platform centers on MetaTrader 4. This is a widely recognized and trusted trading environment that supports comprehensive technical analysis, automated trading capabilities, and multi-asset trading functionality. FXORO's asset coverage spans seven major categories: foreign exchange pairs, cryptocurrency CFDs, stock indices, precious metals, energy commodities, soft commodities, and individual equity CFDs. This provides traders with substantial diversification opportunities.

Operating under Cyprus Securities and Exchange Commission (CySEC) supervision with license number 126/10, FXORO maintains regulatory compliance within European Union standards. The broker offers clients regulatory protections and oversight. This FXORO review confirms that the broker's regulatory standing provides an important foundation for client trust and operational transparency.

Regulatory Jurisdiction: FXORO operates under CySEC regulation (license 126/10). This ensures compliance with European Union financial services directives and provides clients with regulatory protections including investor compensation schemes and segregated client fund requirements.

Minimum Deposit Requirements: The broker maintains an accessible $100 minimum deposit threshold. This makes it particularly attractive for beginning traders who want to start with limited capital while learning market dynamics.

Promotional Offerings: New clients can access a substantial 50% deposit bonus program. The broker also offers a cashback system providing $4 per lot traded, creating additional value for active traders and reducing effective trading costs.

Available Trading Assets: FXORO's instrument selection encompasses currencies, cryptocurrencies, indices, metals, energies, soft commodities, and stocks. This provides comprehensive market exposure across traditional and emerging asset classes.

Cost Structure: While specific commission details require verification, user feedback suggests competitive trading costs. The broker advertises commission-free trading on select instruments. However, spread information and potential fees warrant careful examination by prospective clients.

Platform Technology: MetaTrader 4 serves as the primary trading platform. It offers both web-based access and downloadable applications with full charting capabilities, technical indicators, and automated trading support.

Geographic Restrictions: Specific information regarding country restrictions was not detailed in available materials. This requires direct broker consultation for jurisdiction-specific availability.

This FXORO review notes that certain operational details require additional verification through direct broker contact or account opening procedures. These include funding methods, withdrawal procedures, and leverage ratios.

Account Conditions Analysis

FXORO's account structure centers around accessibility and beginner-friendly requirements. The $100 minimum deposit represents a significant advantage for traders with limited starting capital. This threshold positions the broker competitively against industry standards while reducing barriers to market entry for novice traders.

User feedback indicates positive experiences with the account opening process. However, specific details regarding verification requirements, document submission procedures, and account activation timeframes were not extensively detailed in available materials. The broker appears to streamline onboarding while maintaining necessary compliance procedures.

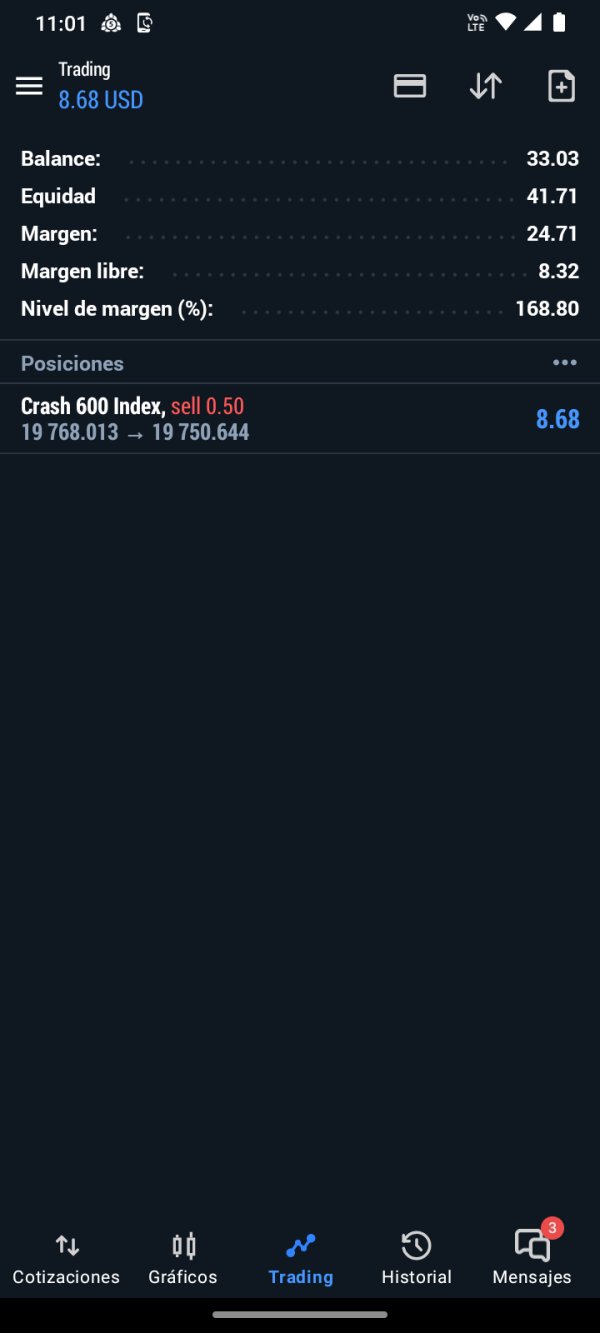

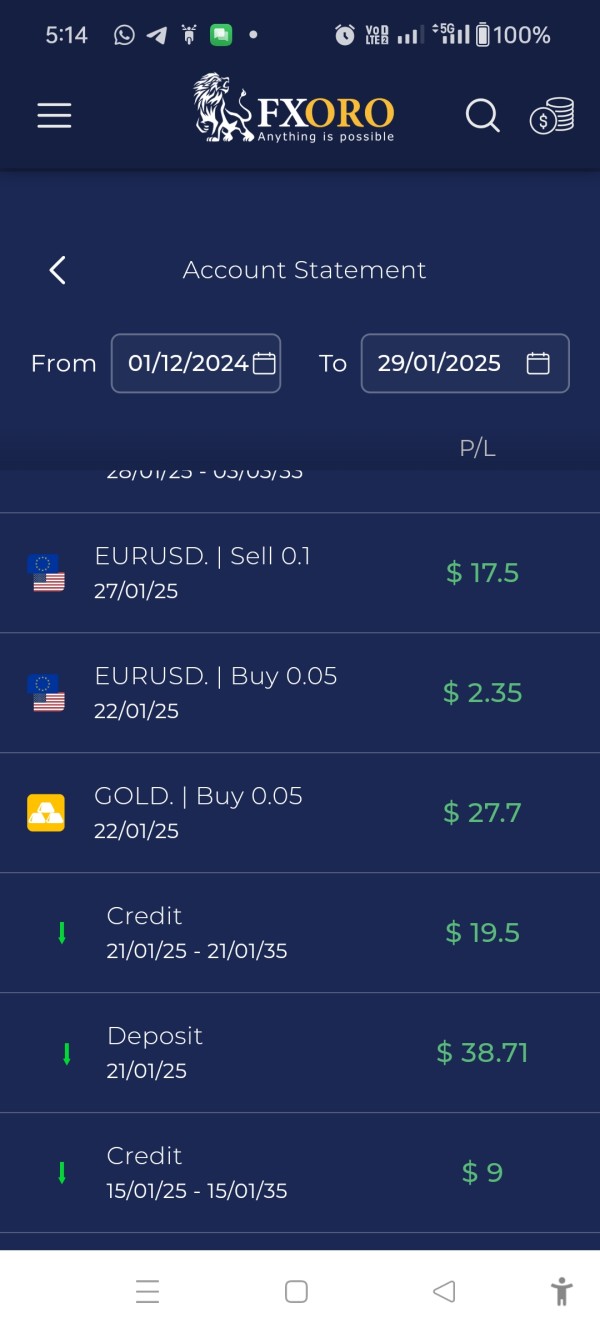

According to user testimonials, traders have reported successful profit generation using FXORO's services. One specific example mentioned a trader from Bangalore who started with $2,000 and earned $200 within one week with assistance from the FXORO team. This suggests active client support and guidance services.

The broker's account conditions appear designed to accommodate different trading styles and experience levels. However, specific account tier information requires direct inquiry with the broker. This includes premium account features, enhanced leverage options, or reduced costs for higher-volume traders.

Compared to industry competitors, FXORO's low minimum deposit threshold provides a clear advantage for new traders. The promotional offerings add additional value that can offset initial trading costs and provide extra capital for position sizing.

This FXORO review emphasizes that while basic account conditions appear favorable, traders should verify specific terms and conditions before committing funds. These include any restrictions on bonus withdrawals, minimum trading volume requirements, or account maintenance fees.

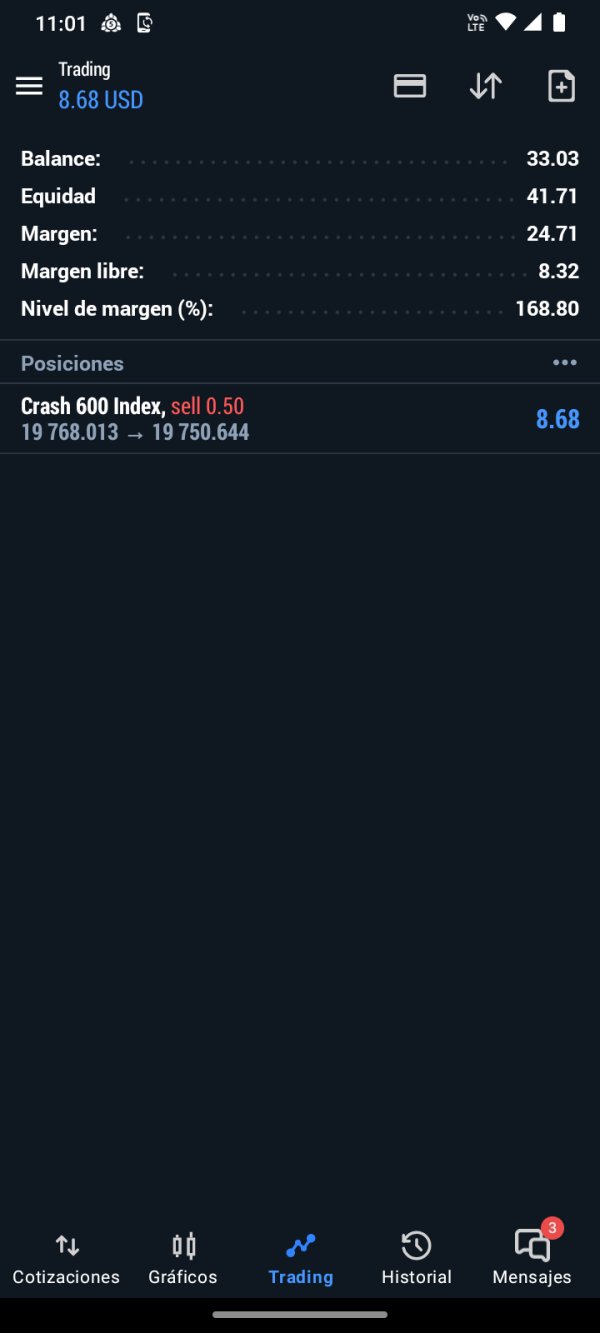

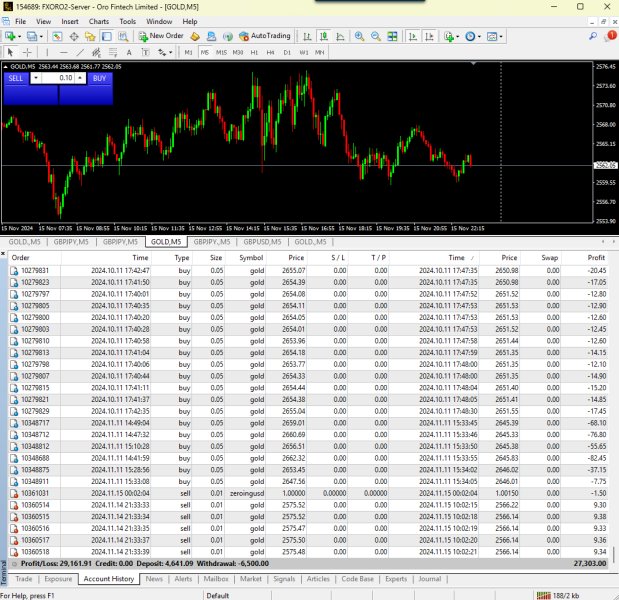

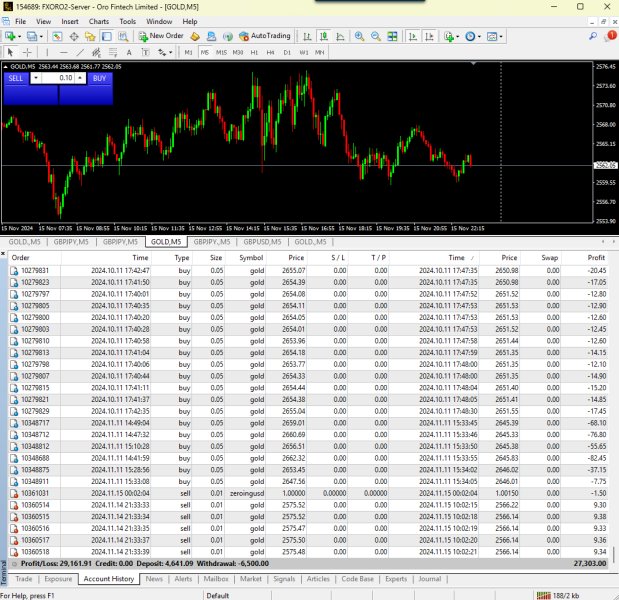

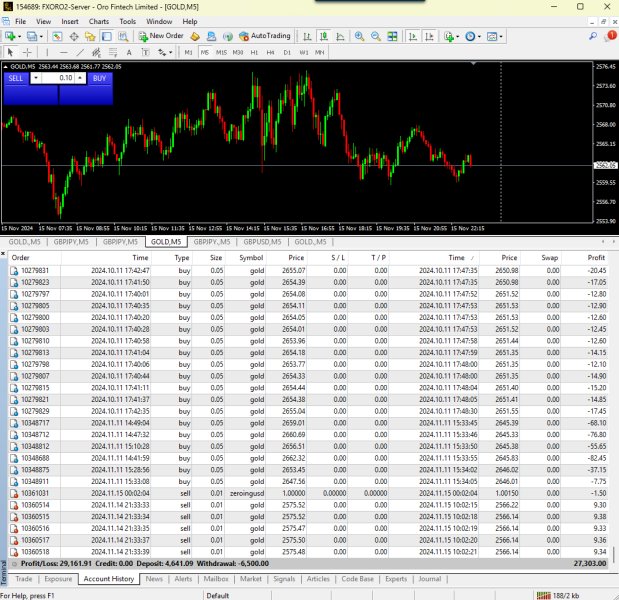

FXORO's trading infrastructure centers on the MetaTrader 4 platform. This provides clients with a comprehensive suite of trading tools and analytical resources. MT4's reputation for stability, functionality, and user-friendly interface makes it an appropriate choice for both beginning and experienced traders seeking reliable trade execution and analysis capabilities.

The platform includes extensive charting functionality with multiple timeframes, technical indicators, and drawing tools essential for technical analysis. Traders can access real-time price feeds, historical data, and customizable workspace configurations to support their individual trading strategies and preferences.

User feedback suggests satisfaction with the platform's performance and tool availability. This indicates stable operation and responsive execution. The web-based platform option provides accessibility across devices without requiring software downloads, while the downloadable version offers enhanced functionality for more intensive trading activities.

While specific details regarding proprietary trading tools, market research resources, or educational materials were not extensively covered in available information, the MT4 platform typically includes expert advisor support for automated trading strategies and custom indicator development capabilities.

The broker's multi-asset offering requires sophisticated platform integration to handle different instrument types effectively. MT4's proven track record across asset classes supports FXORO's diversified trading environment.

However, this analysis notes that specific information regarding additional research tools, market analysis resources, economic calendar features, or educational content was not detailed in available materials. This may require direct broker consultation to fully evaluate the complete resource offering.

Customer Service and Support Analysis

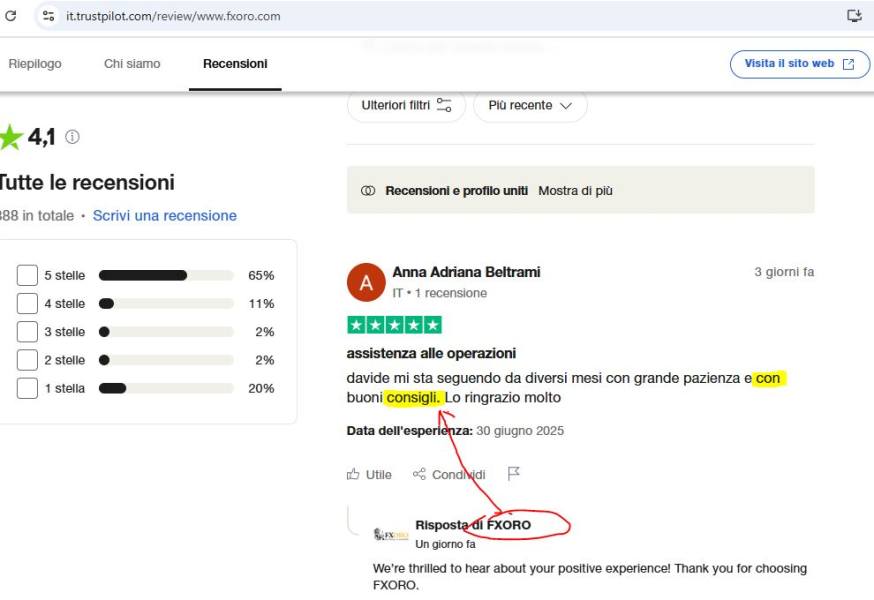

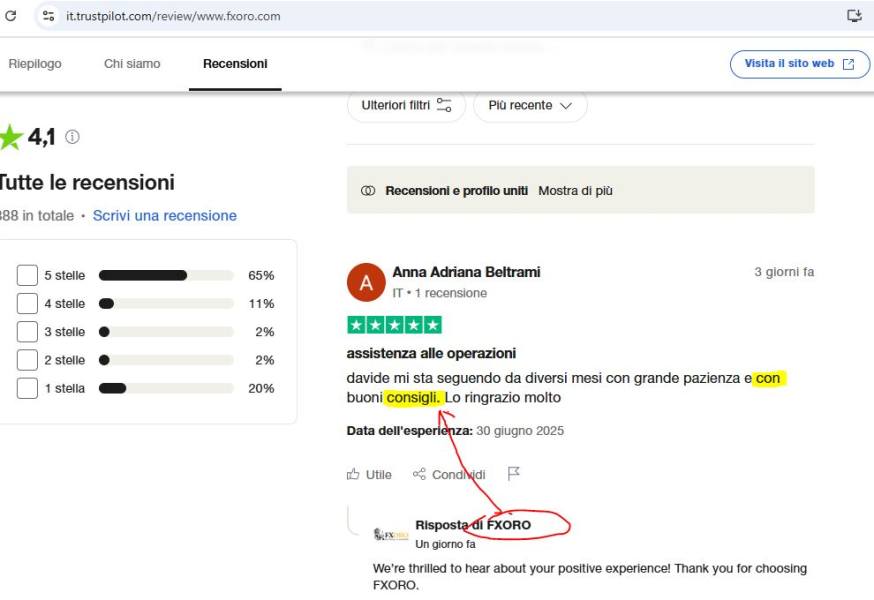

User feedback regarding FXORO's customer service indicates generally positive experiences. Traders report helpful assistance and responsive support interactions. The testimonials suggest that the broker provides active guidance to clients, particularly newer traders who may require additional assistance with platform navigation and trading strategies.

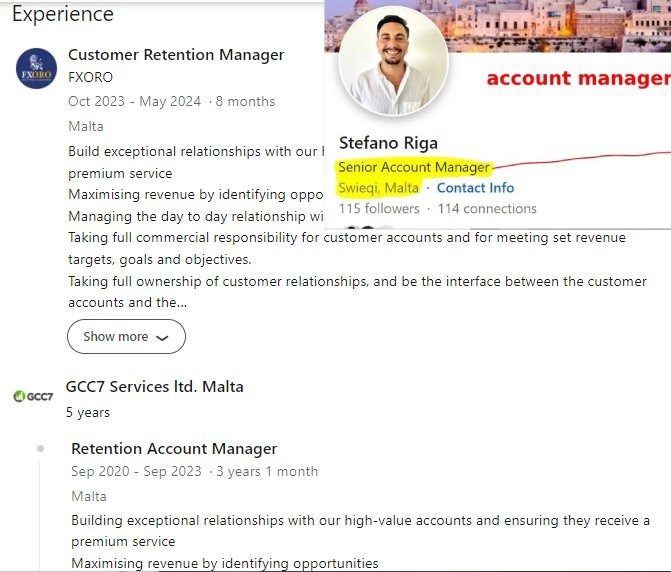

One specific user testimonial mentioned receiving support from a dedicated team leader. This suggests that FXORO may offer personalized account management or advisory services for clients. This level of individual attention can be particularly valuable for beginning traders who need guidance during their initial trading experiences.

However, specific information regarding customer service channels, availability hours, response time guarantees, or multilingual support capabilities was not detailed in the available materials. These operational details are crucial for traders who may need assistance during different market hours or prefer communication in their native language.

The quality of customer support often reflects a broker's overall commitment to client satisfaction and operational excellence. Positive user feedback suggests that FXORO maintains reasonable service standards. However, comprehensive evaluation would require direct experience or more detailed user reviews.

Professional traders typically require prompt resolution of technical issues, account inquiries, and trading-related questions. This makes customer service quality a critical factor in broker selection. The available feedback suggests FXORO meets basic service expectations, though specific service level commitments require verification.

This evaluation notes that detailed information regarding support ticket systems, live chat availability, phone support options, or dedicated account management services was not extensively covered in available materials.

Trading Experience Analysis

User testimonials indicate that FXORO provides a satisfactory trading experience with stable platform performance and reliable execution. The MetaTrader 4 platform's proven track record contributes to consistent trading operations. Users report smooth functionality and responsive interface performance.

The broker's multi-asset trading environment allows traders to diversify their portfolios and take advantage of opportunities across different market sectors. This flexibility can enhance trading strategies and provide risk management benefits through asset class diversification.

According to available feedback, traders have experienced competitive trading costs. However, specific spread information, commission structures, and execution speed data were not detailed in the materials reviewed. These factors significantly impact trading profitability and overall experience quality.

The platform's technical analysis capabilities support informed trading decisions through comprehensive charting tools and indicator options. This functionality is essential for traders who rely on technical analysis for market timing and position management.

Mobile trading capabilities, while not extensively detailed in available information, are typically supported through MT4's mobile applications. This provides traders with market access and position management capabilities while away from desktop platforms.

This FXORO review notes that specific performance metrics were not available in the reviewed materials but represent important factors for serious traders evaluating broker performance. These include average execution speeds, slippage rates, or platform uptime statistics.

The overall trading environment appears designed to support both short-term trading strategies and longer-term investment approaches. This is achieved through diverse asset availability and platform functionality.

Trust and Security Analysis

FXORO's regulatory standing under Cyprus Securities and Exchange Commission (CySEC) supervision provides important credibility and client protection measures. The CySEC license number 126/10 can be verified through regulatory databases. This confirms the broker's authorized status to provide investment services within the European Union framework.

CySEC regulation typically includes requirements for client fund segregation, where trader deposits are held separately from company operational funds. This provides protection in the event of broker financial difficulties. However, specific details regarding FXORO's client fund protection measures, deposit insurance coverage, or compensation scheme participation were not detailed in available materials.

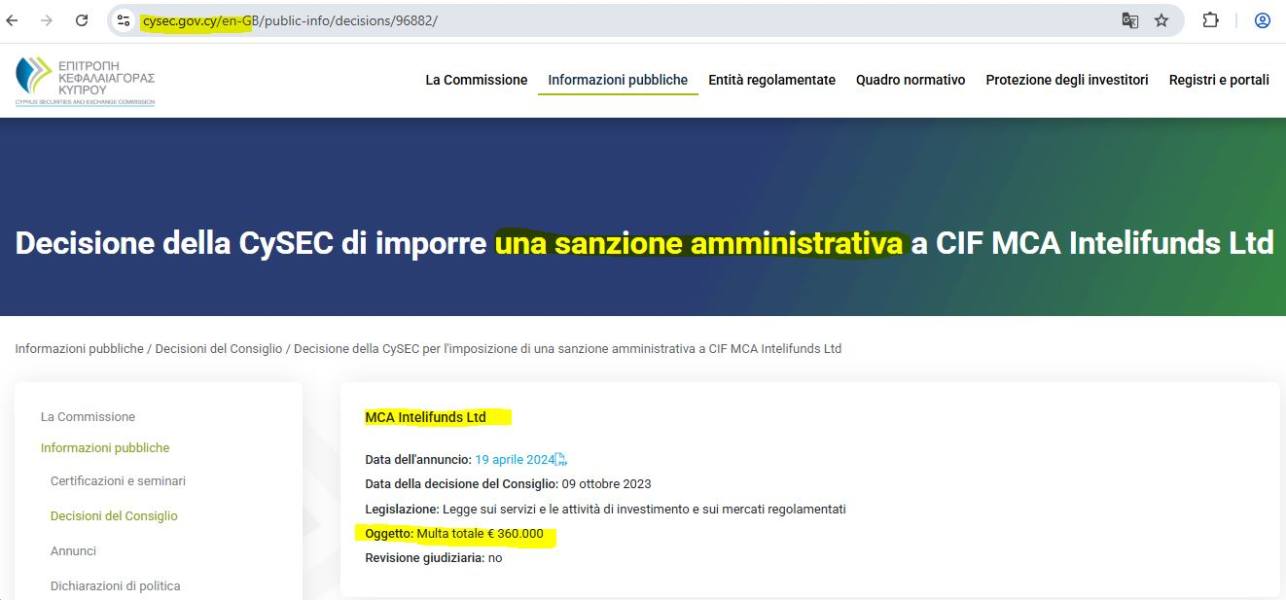

User trust indicators appear generally positive based on available feedback. Traders express confidence in the broker's services and report successful trading experiences. The absence of significant negative publicity or regulatory actions in reviewed materials suggests reasonable operational standards.

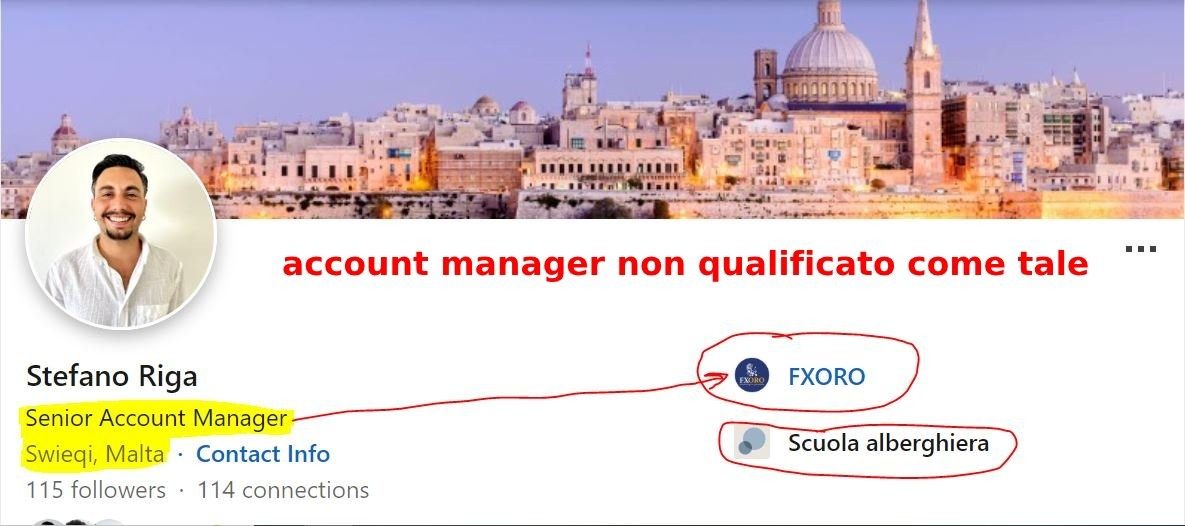

The broker's operational transparency was not extensively covered in available materials. This includes company ownership information, financial reporting, or management team details. This information can be important for traders seeking to understand the company's financial stability and operational governance.

Industry reputation and third-party evaluations provide additional trust indicators. However, specific ratings from financial industry organizations or independent review platforms were not detailed in the materials examined.

This analysis emphasizes that while regulatory supervision provides important baseline protections, traders should verify specific security measures before committing significant funds. These include fund protection details, withdrawal policies, and dispute resolution procedures.

User Experience Analysis

Overall user satisfaction with FXORO appears moderately positive based on available feedback. Traders report successful experiences and profitable trading outcomes. The broker's focus on beginner-friendly features, including low minimum deposits and educational support, appears to resonate well with newer traders entering the market.

The MetaTrader 4 platform provides a familiar and user-friendly interface that most traders can navigate effectively. This reduces the learning curve for platform adoption. The web-based access option eliminates software installation requirements while maintaining essential trading functionality.

Account registration and verification processes, while not detailed in available materials, appear to follow standard industry practices based on regulatory requirements. The streamlined approach suggested by user feedback indicates reasonable onboarding efficiency.

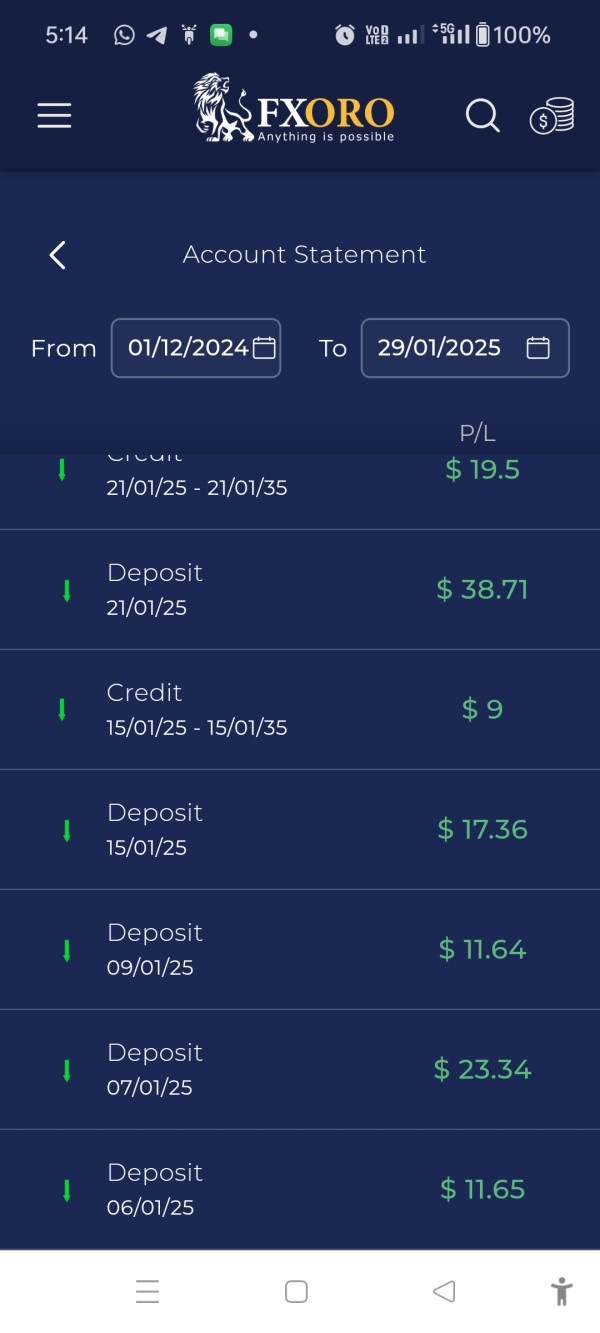

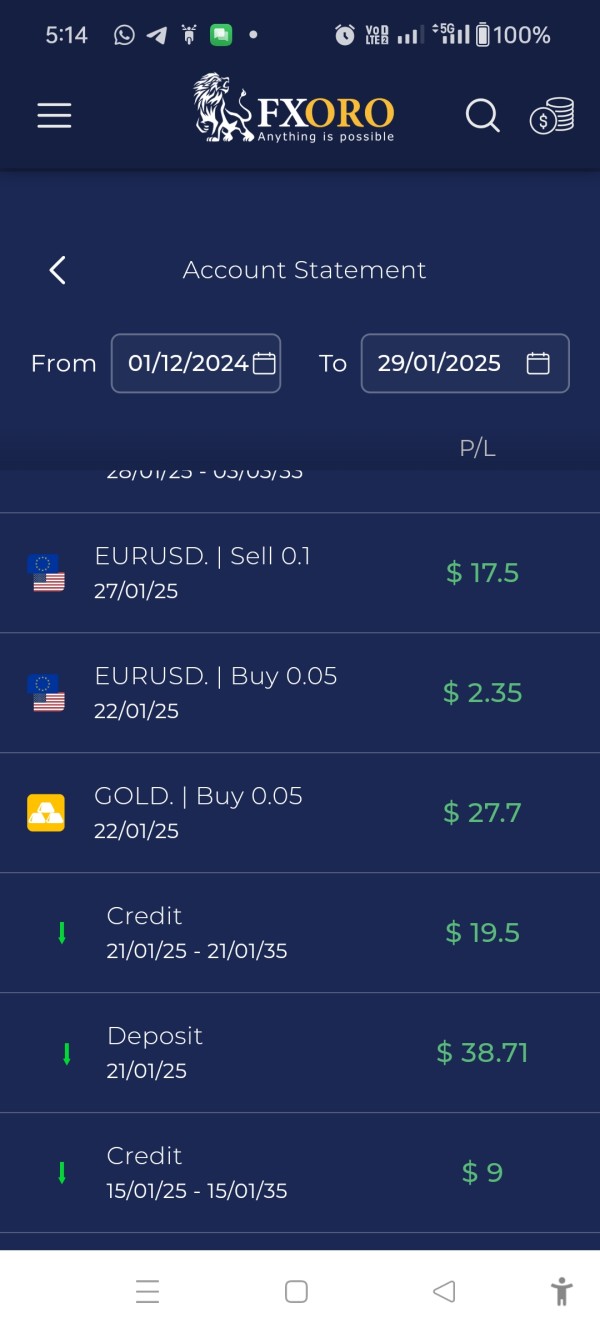

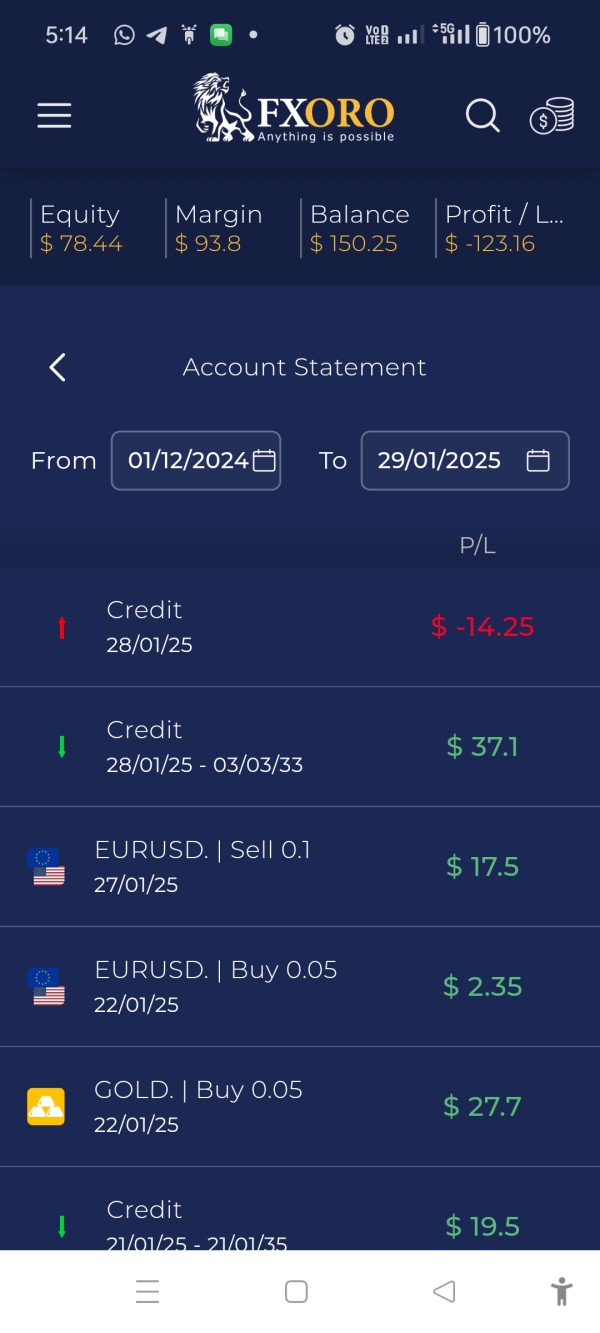

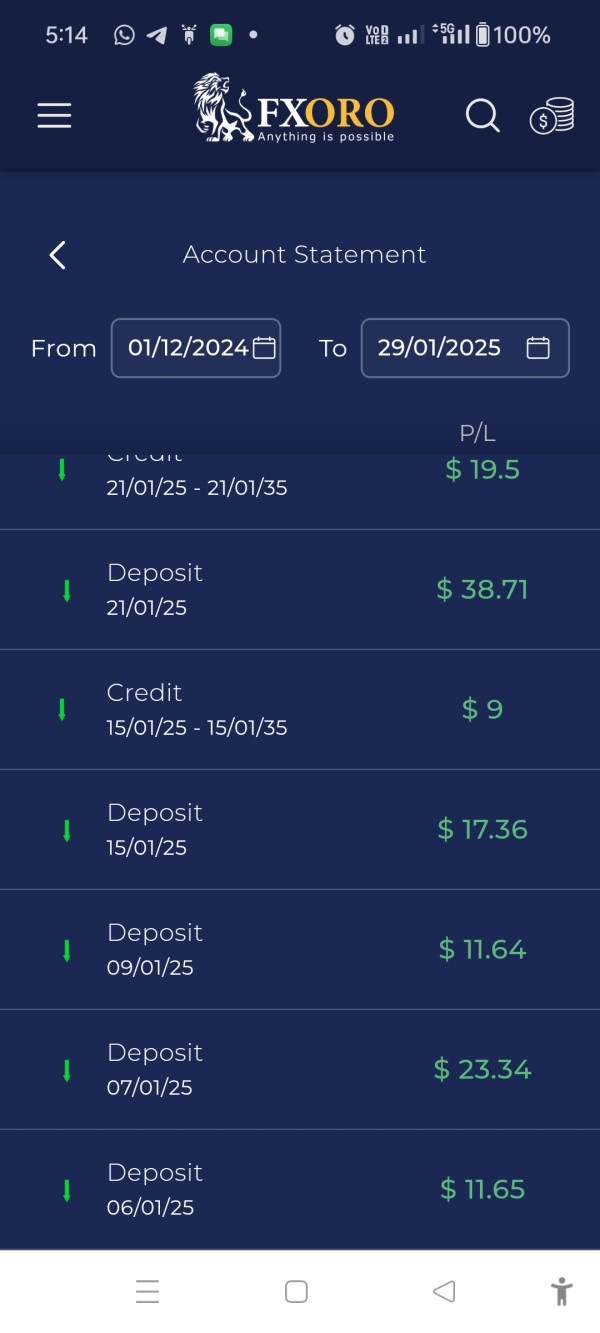

Funding and withdrawal experiences represent critical user experience factors. However, specific information regarding payment method options, processing times, or associated fees was not extensively covered in reviewed materials. These operational details significantly impact overall user satisfaction and trading convenience.

User demographic analysis suggests that FXORO appeals particularly to beginning traders and those seeking diversified asset access. However, the platform's capabilities can accommodate more experienced traders requiring advanced functionality.

Areas for potential improvement might include enhanced educational resources, expanded customer service options, and more detailed fee transparency. However, specific user complaints or improvement suggestions were not detailed in available feedback.

The broker's promotional offerings, including deposit bonuses and cashback programs, appear to enhance user value perception. They also provide additional incentives for active trading.

Conclusion

This comprehensive FXORO review reveals a regulated online trading platform that successfully balances accessibility for beginners with sufficient sophistication for experienced traders. The broker's CySEC regulation, low minimum deposit requirements, and MetaTrader 4 platform foundation provide a solid framework for retail trading activities.

FXORO appears most suitable for novice traders seeking an entry point into financial markets. It also works well for experienced traders looking for diversified asset access and competitive promotional offerings. The broker's multi-asset approach allows for portfolio diversification across traditional and emerging market sectors.

Key advantages include regulatory oversight, accessible account minimums, commission-free trading on select instruments, attractive bonus programs, and positive user feedback regarding platform stability and customer support quality. However, areas requiring additional clarification include detailed commission structures, specific leverage ratios, comprehensive withdrawal procedures, and expanded educational resource offerings.

Prospective clients should conduct direct due diligence regarding specific trading conditions. They should also verify regulatory protections applicable to their jurisdiction and carefully review all terms and conditions before opening accounts. While user feedback suggests positive experiences, individual results may vary based on trading strategies, market conditions, and personal risk management practices.