Regarding the legitimacy of FXORO forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is FXORO safe?

Pros

Cons

Is FXORO markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

MCA Intelifunds Ltd

Effective Date:

2010-12-21Email Address of Licensed Institution:

info@fxoro.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxoro.com, www.fxoro.it, www.tk.fxoro.co.uk, www.fxoro.aeExpiration Time:

--Address of Licensed Institution:

82, Petrou Tsirou, Mesa Geitonia, CY-3076 LimassolPhone Number of Licensed Institution:

+357 25 205 515Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ORO FINTECH LIMITED

Effective Date:

--Email Address of Licensed Institution:

compliance@global.fxoro.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Block B, Room 2, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

+248 254 8988Licensed Institution Certified Documents:

Is FXORO A Scam?

Introduction

FXORO is a forex and CFD broker established in 2010, primarily operating from Cyprus and Seychelles. It offers a variety of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies, through the widely used MetaTrader 4 platform. Given the rapid expansion of the forex market and the increasing number of brokers, traders must exercise caution when selecting a trading partner. The potential for scams and unscrupulous practices in the industry necessitates a thorough evaluation of any broker's legitimacy and reliability.

In this article, we will conduct a comprehensive analysis of FXORO, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. Our assessment will be based on data gathered from multiple reputable sources, including regulatory filings, user reviews, and expert analyses, providing a well-rounded view of FXORO's standing in the forex market.

Regulation and Legitimacy

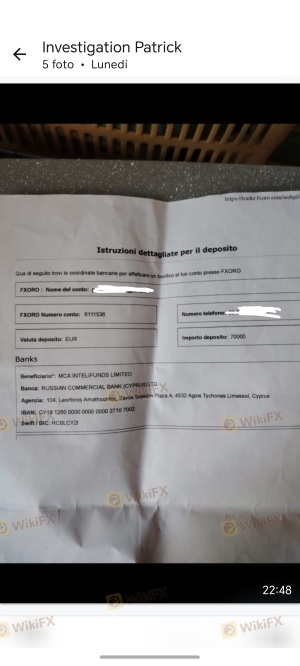

FXORO operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). Regulation is crucial in the forex industry as it ensures that brokers adhere to specific standards and provides a safety net for traders' funds. Below is a summary of FXORO's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 126/10 | Cyprus | Verified |

| FSA | SD 046 | Seychelles | Verified |

CySEC is considered a reputable regulatory body within the European Union, imposing strict rules on financial services firms to enhance transparency and protect investors. FXOROs compliance with CySEC regulations means it is required to maintain client funds in segregated accounts and participate in an investor compensation fund that covers up to €20,000 per client in case of insolvency.

However, the presence of an offshore entity regulated by the FSA raises concerns. The FSA does not impose the same stringent regulations as CySEC, which could expose traders to higher risks. Additionally, FXORO has faced regulatory scrutiny in the past, including warnings from authorities in Romania and Poland regarding its offshore operations. This dual regulatory structure necessitates careful consideration by potential clients, as it may impact the level of protection they receive.

Company Background Investigation

FXORO is operated by MCA Intelifunds Ltd, a company incorporated in Cyprus, and Oro Fintech Ltd, which operates under the Seychelles jurisdiction. The company has been in business for over a decade, establishing itself as a player in the forex market. The management team comprises experienced professionals with backgrounds in finance and trading, contributing to the firm's operational integrity.

Despite its regulatory compliance, FXORO has faced criticism regarding transparency and information disclosure. While the broker provides essential information about its services and trading conditions, some users have reported difficulties in accessing comprehensive details about fees and operational practices. This lack of transparency can be a red flag for potential clients seeking a clear understanding of the broker's operations.

The company's history of expansion into offshore markets may also raise concerns about its commitment to regulatory compliance and ethical practices. Traders should be aware of the potential implications of dealing with a broker that operates in multiple jurisdictions, particularly when one of those jurisdictions has less stringent regulatory oversight.

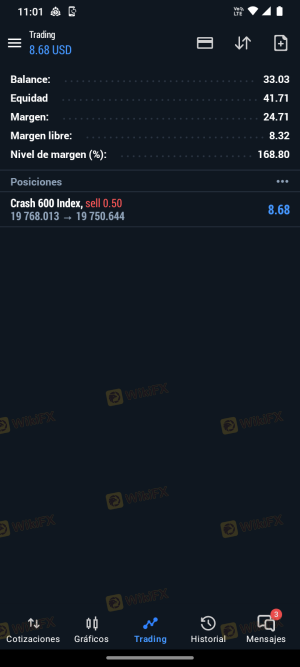

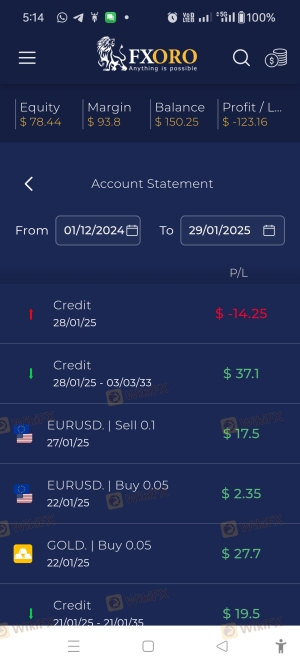

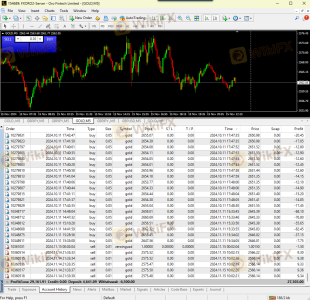

Trading Conditions Analysis

FXORO offers various trading accounts, including fixed spread, floating spread, and ECN accounts, catering to different trading styles and preferences. The overall fee structure is relatively competitive, but certain fees may raise concerns among users. Below is a summary of FXORO's core trading costs:

| Fee Type | FXORO | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.2 pips | From 0.6 pips |

| Commission Model | None (fixed) / $6 per lot (ECN) | Varies widely |

| Overnight Interest Range | Varies | Varies |

FXORO's spreads are generally in line with industry averages for fixed accounts, starting at 2 pips, while floating spreads begin at 1.2 pips. However, the lack of a spread-free account option may deter high-frequency traders who prefer to pay commissions rather than higher spreads. Additionally, the inactivity fee of $25 after three months of inactivity can be a disadvantage for traders who do not trade frequently.

The commission structure for ECN accounts, while competitive, may be a point of contention for traders who are accustomed to lower trading costs. Overall, while FXORO's trading conditions are generally favorable, potential clients should carefully review the fee structure to ensure it aligns with their trading strategies and expectations.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. FXORO implements several measures to protect client funds, including segregated accounts that keep client deposits separate from the broker's operational funds. This segregation is a critical safety feature, ensuring that in the event of the broker's insolvency, clients can still access their funds.

Additionally, FXORO offers negative balance protection, which prevents traders from losing more than their account balance. This is particularly important in the volatile forex market, where rapid price movements can lead to significant losses. However, the effectiveness of these safety measures can vary, especially with the broker's offshore operations in Seychelles, where regulatory oversight is less stringent.

Historically, FXORO has faced some scrutiny regarding fund safety, particularly in relation to its offshore entity. Traders should be aware of the potential risks associated with trading through an offshore broker and consider whether the protections offered by FXORO are sufficient for their needs.

Customer Experience and Complaints

Customer feedback regarding FXORO is mixed, with some users reporting positive experiences while others express significant concerns. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trading signals provided by account managers. Below is a summary of the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Inconsistent |

| Misleading Trading Signals | High | Poor resolution |

Several users have reported that they encountered challenges when trying to withdraw their funds, with delays and unresponsive support being recurring themes. In some instances, clients have alleged that their accounts were manipulated to prevent withdrawals, a serious accusation that raises concerns about the broker's operational integrity.

For example, one user reported being unable to withdraw their remaining balance after trading, citing a lack of communication from the broker. Such experiences highlight the importance of thorough research and consideration of user feedback when evaluating a broker's reliability.

Platform and Trade Execution

FXORO provides access to the MetaTrader 4 (MT4) trading platform, which is well-regarded for its user-friendly interface and robust features. The platform supports various trading strategies, including automated trading through Expert Advisors (EAs). However, the execution quality and potential for slippage are critical factors for traders to consider.

Users have reported mixed experiences regarding order execution, with some experiencing minimal slippage, while others noted instances of significant delays during volatile market conditions. Such discrepancies can impact trading outcomes, particularly for scalpers and high-frequency traders who rely on precise execution.

Additionally, there have been concerns about potential platform manipulation, although no concrete evidence has been presented. Traders should remain vigilant and monitor their trading activity closely, especially in high-stakes situations.

Risk Assessment

Trading with FXORO presents several risks, which potential clients should carefully evaluate. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation may complicate investor protections. |

| Fund Safety Risk | High | Offshore operations pose heightened risks. |

| Execution Risk | Medium | Mixed feedback on order execution quality. |

| Customer Support Risk | High | Reports of poor responsiveness and unresolved issues. |

To mitigate these risks, traders should conduct thorough due diligence, remain informed about regulatory updates, and consider diversifying their trading activities across multiple brokers or platforms.

Conclusion and Recommendations

In conclusion, while FXORO is a regulated broker with a decade of experience in the forex market, potential clients should exercise caution. The presence of an offshore entity, mixed customer feedback, and historical compliance issues warrant careful consideration.

FXORO does not appear to be a scam in the traditional sense, as it operates under regulatory oversight from CySEC. However, the dual regulatory structure and the challenges reported by users raise significant concerns about the broker's overall reliability and customer service quality.

For traders who prioritize regulatory protection and responsive support, it may be prudent to consider alternative brokers with a stronger track record and more transparent practices. Recommended alternatives could include brokers like eToro or IG, both of which are well-regulated and offer a range of trading instruments with robust customer support.

Ultimately, traders should assess their individual needs and risk tolerance before engaging with FXORO or any other broker.

Is FXORO a scam, or is it legit?

The latest exposure and evaluation content of FXORO brokers.

FXORO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXORO latest industry rating score is 5.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.