AximTrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive aximtrade review examines a forex broker that has generated significant discussion in the trading community since its establishment in 2020. AximTrade is an offshore forex broker registered in Saint Vincent and the Grenadines. It operates without clear regulatory oversight from major financial authorities, which raises important questions about client protection. While the broker attracts traders with its extremely high leverage ratios of up to 1:1000 and low minimum deposit requirement of just $1, user feedback reveals concerning patterns including unpaid salary complaints and scam warnings. Potential investors should carefully consider these issues before making any decisions.

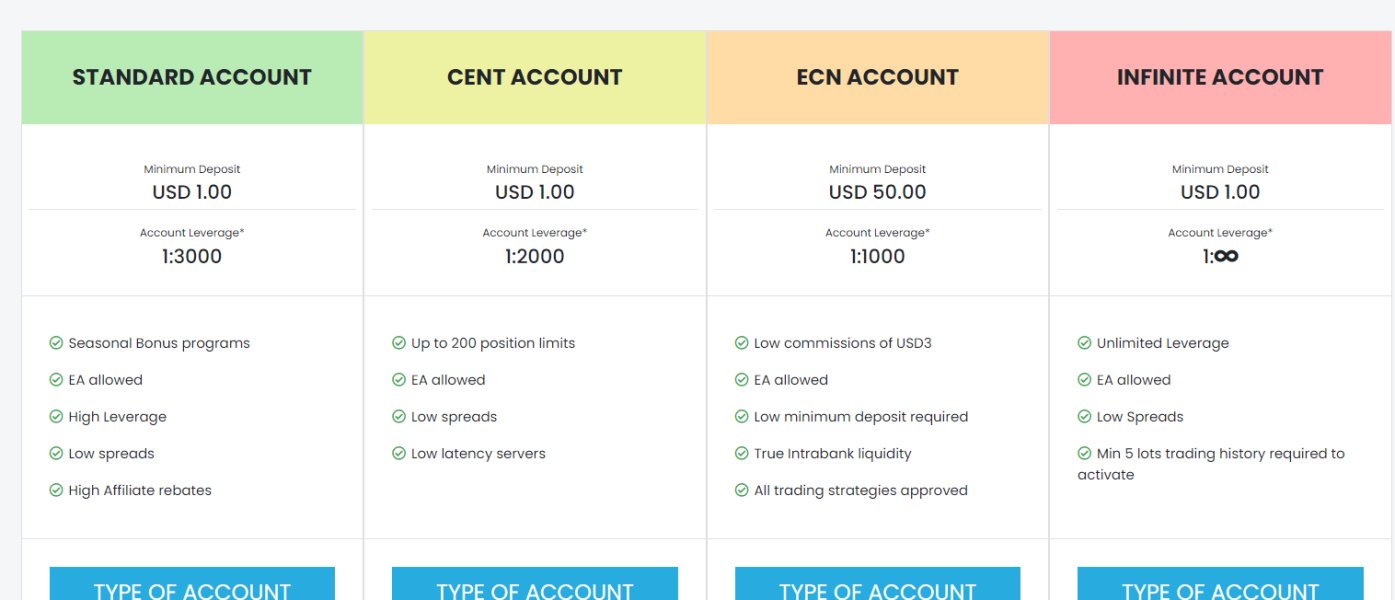

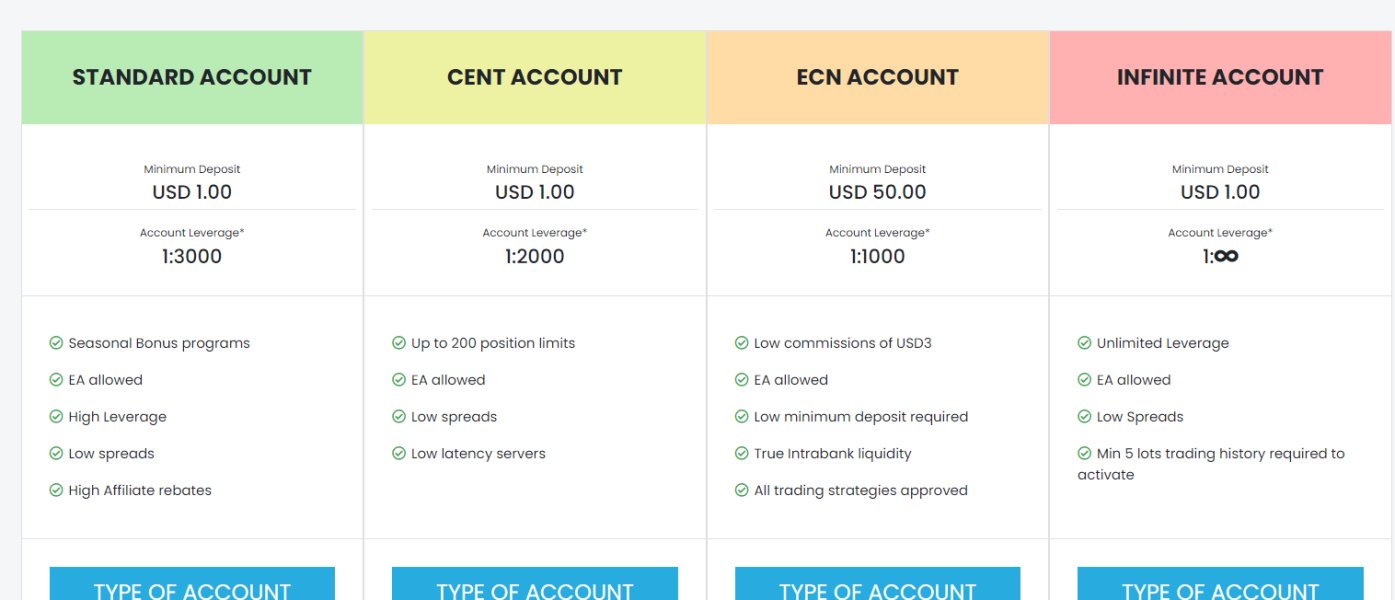

The broker offers multiple account types including Cent, Standard, ECN, and Infinite accounts. These options cater to different trading preferences and experience levels across the spectrum. AximTrade provides access to popular MetaTrader 4 and MetaTrader 5 platforms, supporting various asset classes including forex, cryptocurrencies, indices, precious metals, energy, and stocks. However, the lack of transparent regulatory information and the presence of negative user reviews regarding payment issues raise significant concerns. The broker's reliability and trustworthiness remain questionable based on available evidence.

This review targets traders seeking high-leverage trading opportunities, particularly those interested in forex and cryptocurrency markets. We emphasize the importance of thorough due diligence given the mixed user feedback and regulatory uncertainties surrounding this offshore broker.

Important Disclaimers

Due to AximTrade's registration in an offshore jurisdiction, Saint Vincent and the Grenadines, investors should exercise extreme caution when evaluating the broker's legitimacy and safety. The absence of specific regulatory authority oversight and license numbers creates uncertainty regarding investor protection and fund security. Different regulatory frameworks apply across various jurisdictions, and offshore brokers typically operate under less stringent oversight compared to those regulated by major financial authorities. Major regulators like the FCA, ASIC, or CySEC provide much stronger client protections.

This review is based on publicly available information and user feedback collected from various online sources. The analysis presented here has not involved actual trading testing or direct interaction with the broker's services, which limits our ability to verify certain claims. Potential investors should conduct their own comprehensive research and consider consulting with financial advisors before making any investment decisions with AximTrade or any offshore broker.

Rating Framework

Broker Overview

AximTrade emerged in the competitive forex brokerage landscape in 2020. The company established its operations from Saint Vincent and the Grenadines, a jurisdiction known for hosting offshore financial services companies. As a relatively new player in the forex market, the broker has positioned itself as a provider of high-leverage trading opportunities, targeting traders who seek maximum capital efficiency through leverage ratios that can reach up to 1:1000. This aggressive leverage offering, combined with extremely low entry barriers, has attracted attention from both novice and experienced traders looking for flexible trading conditions.

The broker operates under an offshore business model that provides operational flexibility but also presents certain regulatory challenges and transparency concerns. According to available information from various trading platforms and review sites, AximTrade has built its service offering around accessibility and high-risk trading opportunities. This approach has generated mixed responses from the trading community, with some praising the accessibility while others raising concerns about safety. The company's relatively short operational history means that long-term performance data and established reputation metrics remain limited compared to more established brokers in the industry.

AximTrade provides access to the industry-standard MetaTrader 4 and MetaTrader 5 trading platforms. These platforms support a comprehensive range of financial instruments across multiple asset classes. The broker's asset portfolio includes traditional forex currency pairs, cryptocurrencies, stock indices, precious metals, energy commodities, and individual stocks, offering traders diversified investment opportunities within a single platform. However, this aximtrade review notes that specific regulatory authority information remains absent from publicly available sources. This represents a significant consideration for potential clients evaluating the broker's legitimacy and operational standards.

Regulatory Jurisdiction: AximTrade operates from Saint Vincent and the Grenadines, an offshore jurisdiction that typically provides less stringent regulatory oversight compared to major financial centers. Specific regulatory authority details and license numbers are not clearly disclosed in available public information, which raises questions about transparency.

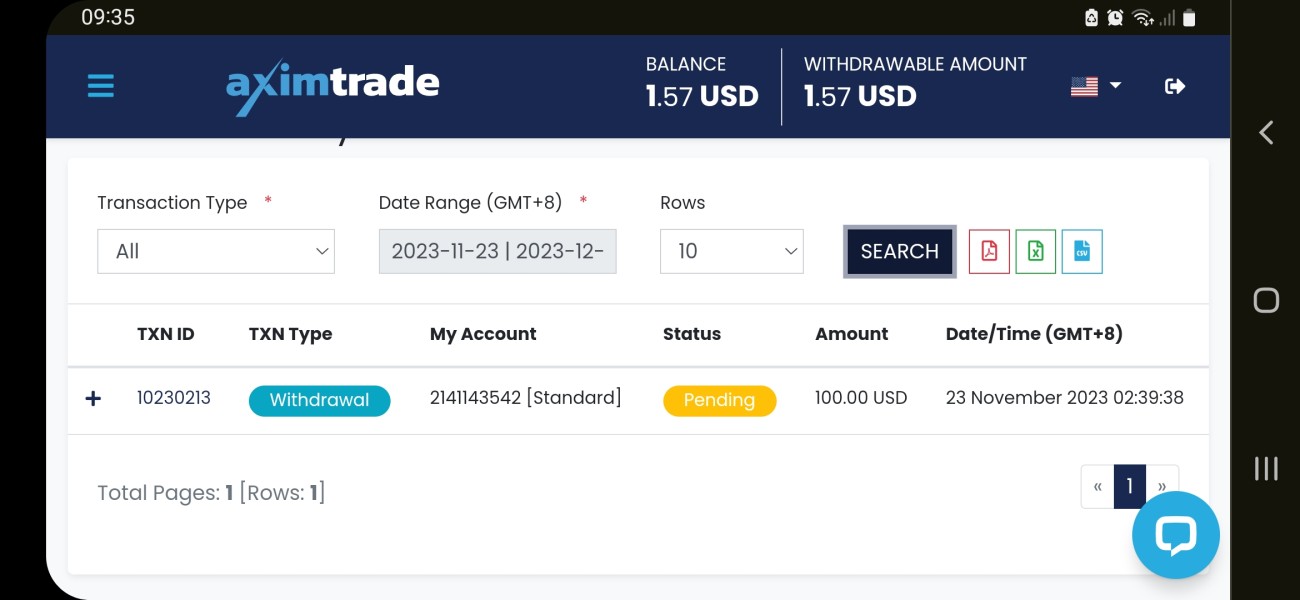

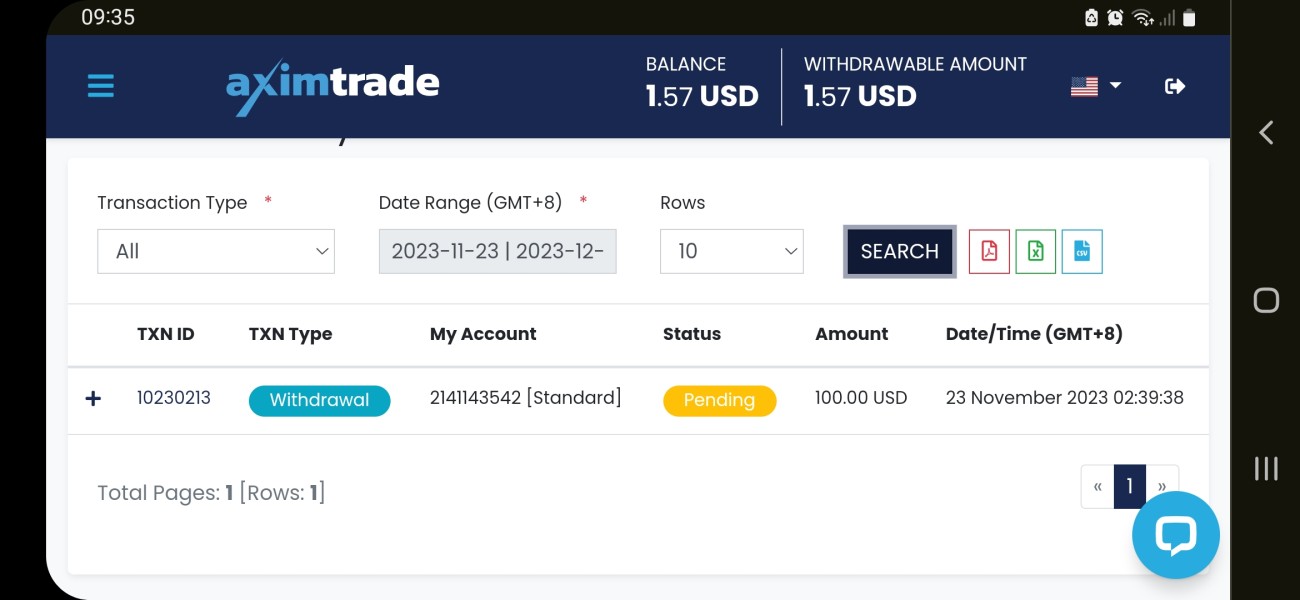

Deposit and Withdrawal Methods: Available public information does not provide comprehensive details about supported funding methods, processing times, or associated fees for deposits and withdrawals. This lack of clarity can create problems for traders trying to plan their funding strategies.

Minimum Deposit Requirements: The broker offers an extremely low minimum deposit requirement of just $1. This makes it accessible to traders with limited initial capital and those seeking to test the platform with minimal financial commitment.

Bonus and Promotional Offers: Current information sources do not detail any specific bonus programs, promotional offers, or incentive structures that may be available to new or existing clients. The absence of this information makes it difficult to compare value propositions with other brokers.

Available Trading Instruments: AximTrade supports a diverse range of tradeable assets including major and minor forex currency pairs, popular cryptocurrencies, global stock indices, precious metals such as gold and silver, energy commodities, and individual stock securities across various markets. This variety gives traders multiple options for portfolio diversification.

Cost Structure and Pricing: The broker advertises spreads starting from 0.0 pips, suggesting competitive pricing for certain account types. However, specific commission structures, overnight financing rates, and additional fees are not clearly detailed in available public sources, making it hard to calculate true trading costs.

Leverage Options: Maximum leverage ratios reach up to 1:1000, representing some of the highest leverage offerings in the retail forex market. Such high leverage significantly increases both profit potential and risk exposure for traders.

Platform Selection: Trading is conducted through MetaTrader 4 and MetaTrader 5 platforms, providing access to advanced charting tools, technical indicators, automated trading capabilities, and mobile trading applications. These platforms are industry standards that most traders find familiar and reliable.

Geographic Restrictions: Available information does not specify particular geographic limitations or restricted jurisdictions for account opening and trading activities. This creates uncertainty for potential international clients about their eligibility.

Customer Support Languages: Specific details regarding supported languages for customer service and platform interfaces are not provided in current information sources. This aximtrade review acknowledges this information gap for potential international clients who may need support in their native languages.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

AximTrade's account structure presents a mixed picture of accessibility and transparency concerns that significantly impact the overall evaluation. The broker offers four distinct account types - Cent, Standard, ECN, and Infinite - designed to accommodate different trading styles and experience levels. The Cent account appears particularly suited for beginners or those testing strategies with smaller positions, while the ECN and Infinite accounts target more experienced traders seeking advanced execution and potentially lower costs.

The standout feature of AximTrade's account conditions is the remarkably low minimum deposit requirement of just $1. This removes traditional barriers to entry and allows virtually anyone to begin trading. This accessibility factor represents a significant advantage for new traders or those with limited capital who want to experience live market conditions without substantial financial commitment. However, this low barrier may also attract inexperienced traders who underestimate the risks associated with high-leverage forex trading.

The account opening process details remain unclear in available public information. This creates uncertainty about verification requirements, documentation needs, and approval timeframes for new clients. Additionally, the absence of clear information about Islamic account availability may limit options for traders requiring Sharia-compliant trading conditions. The lack of transparent fee structures and detailed account specifications beyond basic leverage and spread information further complicates the evaluation of these account conditions.

Most concerning is the absence of clear regulatory protection for client accounts. This is typically a fundamental requirement for reputable brokers in the industry. Without specific information about client fund segregation, deposit insurance, or regulatory oversight, potential clients cannot adequately assess the safety of their deposited funds. This aximtrade review emphasizes that while the low entry requirements are attractive, the lack of regulatory transparency significantly undermines confidence in the overall account conditions.

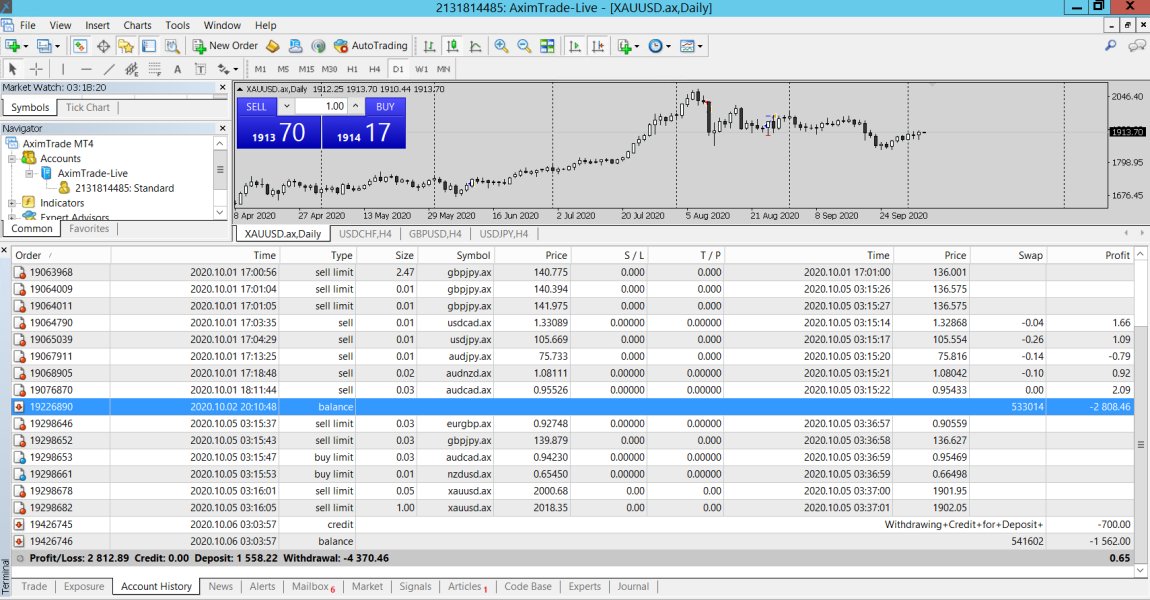

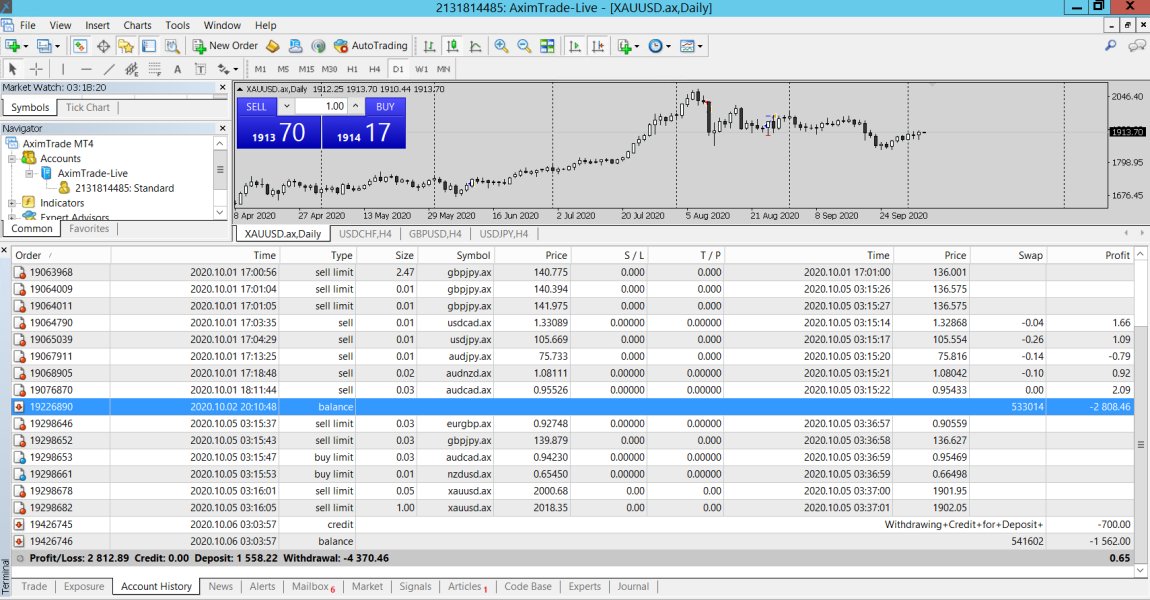

AximTrade's platform offering centers on the widely recognized MetaTrader 4 and MetaTrader 5 platforms. These represent industry standards for retail forex trading worldwide. These platforms provide comprehensive charting capabilities, extensive technical indicator libraries, automated trading support through Expert Advisors, and mobile trading applications for iOS and Android devices. The availability of both MT4 and MT5 allows traders to choose based on their specific preferences, with MT4 offering simplicity and widespread third-party support, while MT5 provides more advanced features and multi-asset trading capabilities.

The broker's instrument selection spans multiple asset classes, including forex currency pairs, cryptocurrencies, stock indices, precious metals, energy commodities, and individual stocks. This diversification allows traders to implement cross-market strategies and access different market opportunities within a single trading account. However, specific details about the number of available instruments, trading hours for different markets, and contract specifications are not clearly provided in available information sources.

A significant weakness in AximTrade's offering appears to be the limited educational and research resources available to clients. Most established brokers provide comprehensive educational materials, market analysis, economic calendars, and trading tutorials to support client development and informed decision-making. The absence of detailed information about such resources suggests that AximTrade may not prioritize client education and market research support. This could disadvantage less experienced traders who need guidance to develop their skills.

The platform's automated trading capabilities through MetaTrader's Expert Advisor functionality provide some advanced trading options. However, without specific information about signal services, copy trading features, or proprietary trading tools, the overall technology offering appears standard rather than innovative. Additionally, the lack of detailed information about platform stability, execution speeds, and server reliability makes it difficult to assess the quality of the trading infrastructure supporting these tools and resources.

Customer Service and Support Analysis (Score: 4/10)

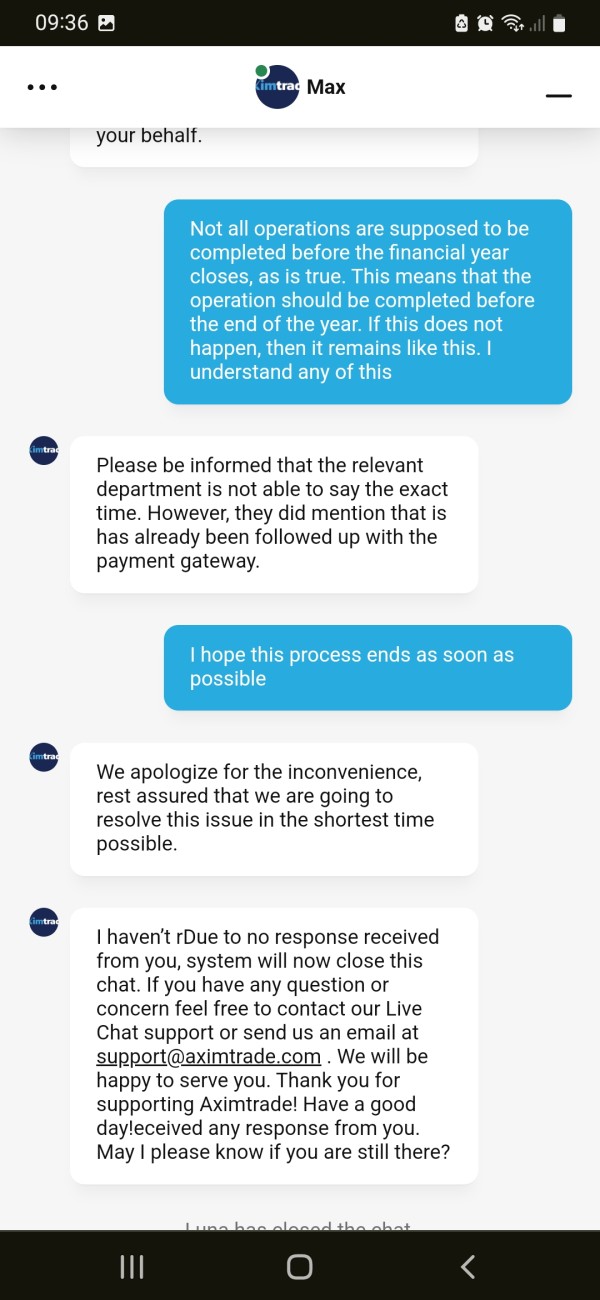

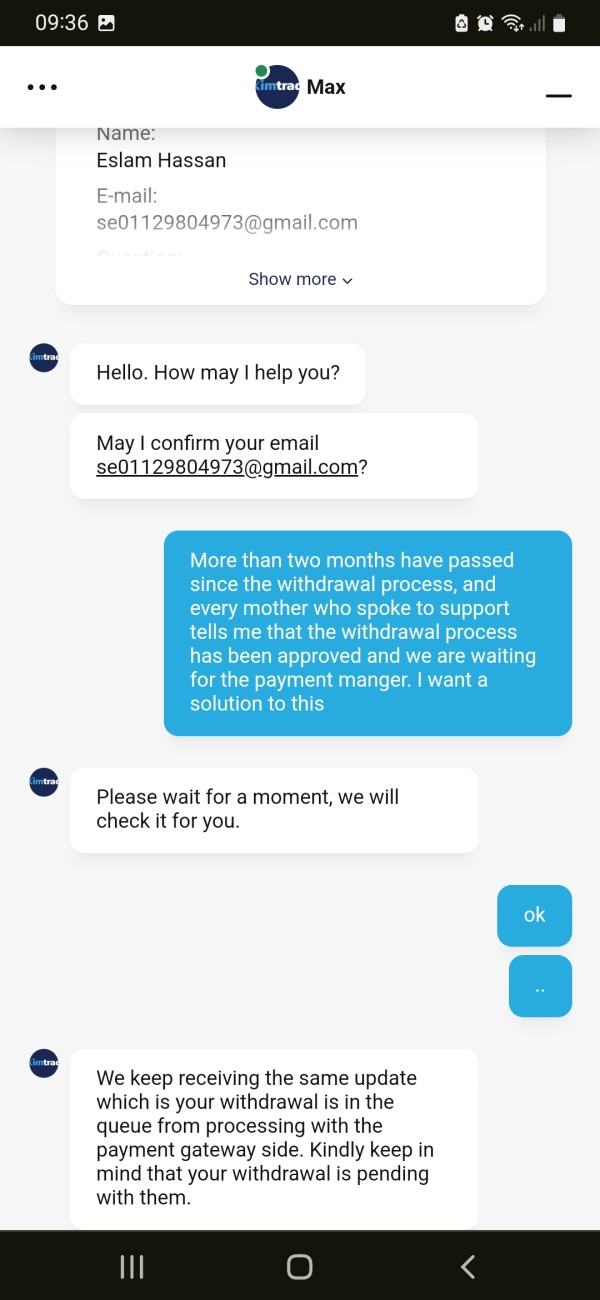

Customer service represents one of the most concerning aspects of AximTrade's operations based on available user feedback and complaint information. Reports of unpaid salary complaints within the organization raise serious questions about the company's internal financial management and operational stability. Such internal issues often translate into customer service problems, as financial stress within a brokerage can lead to reduced staff quality, high turnover rates, and inadequate resource allocation for client support functions.

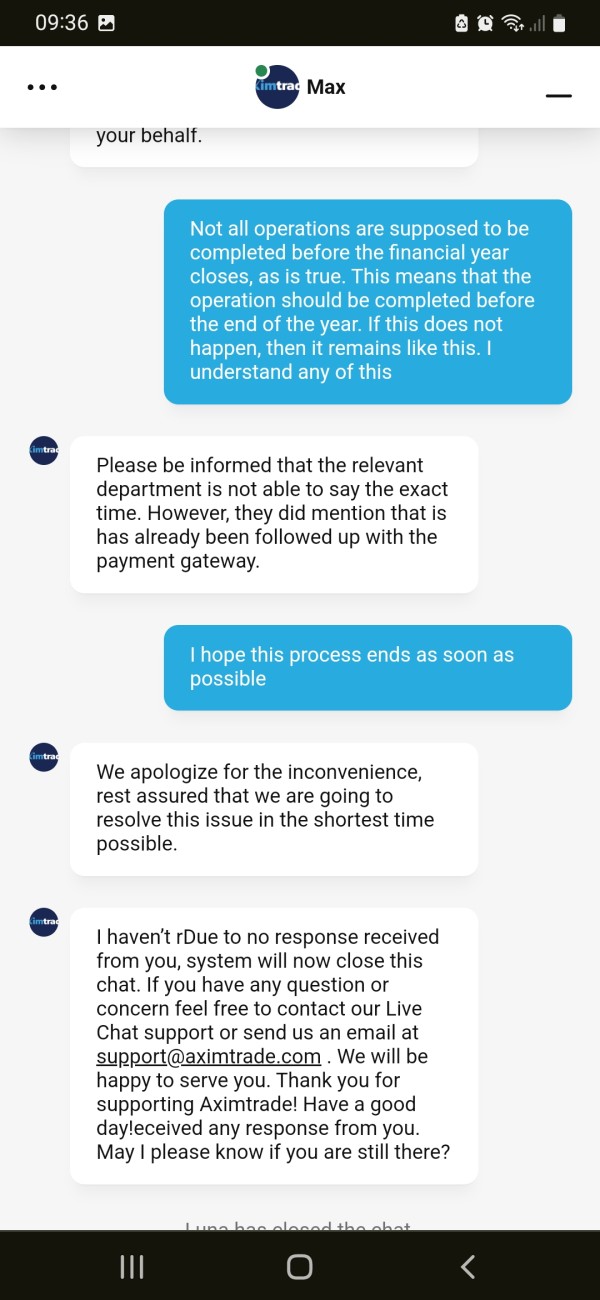

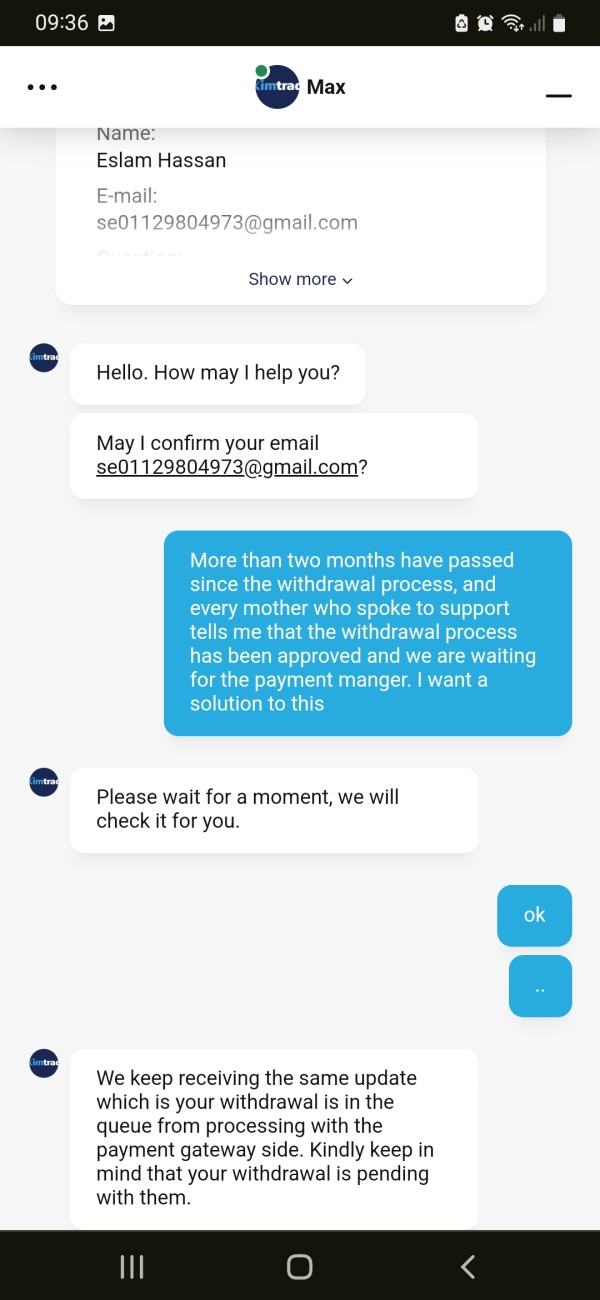

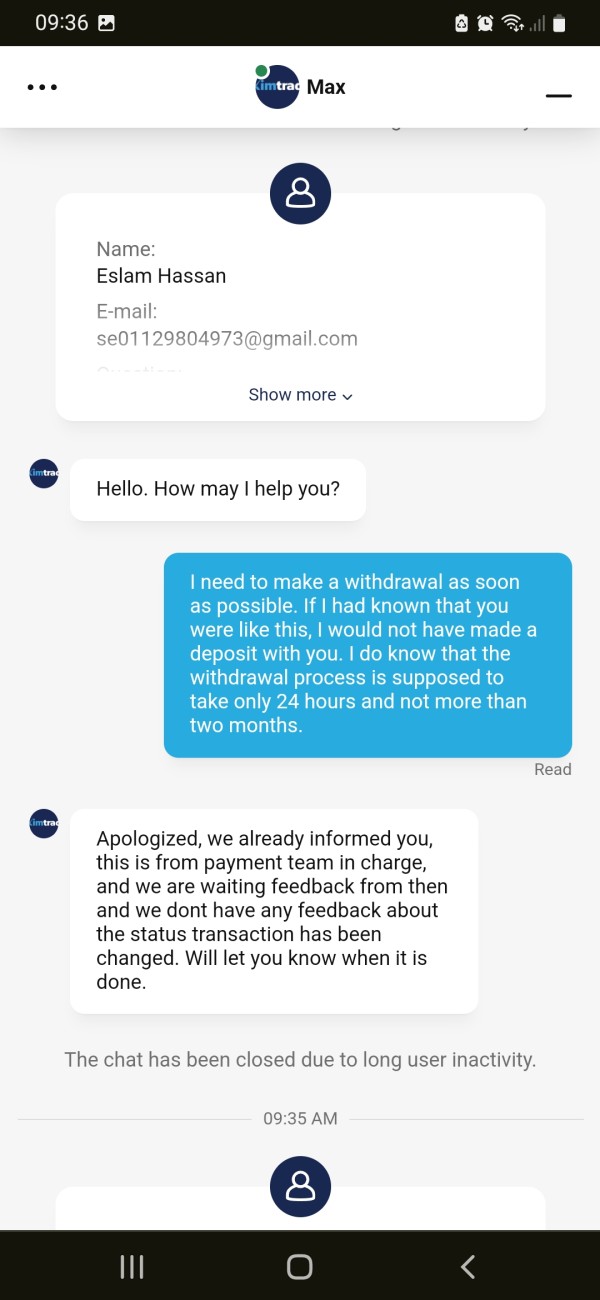

The specific customer service channels, availability hours, and response time commitments are not clearly documented in available public information. This creates uncertainty about how clients can access support when needed. Most reputable brokers provide multiple contact methods including phone support, live chat, email ticketing systems, and comprehensive FAQ sections. The absence of clear information about these basic support infrastructure elements suggests potential deficiencies in customer service accessibility.

Language support details are also unavailable, which could significantly impact international clients who require assistance in their native languages. Given the global nature of forex trading and AximTrade's apparent targeting of international markets, the lack of clear multilingual support information represents a potential barrier. Non-English speaking traders may struggle to get reliable customer assistance when they need it most.

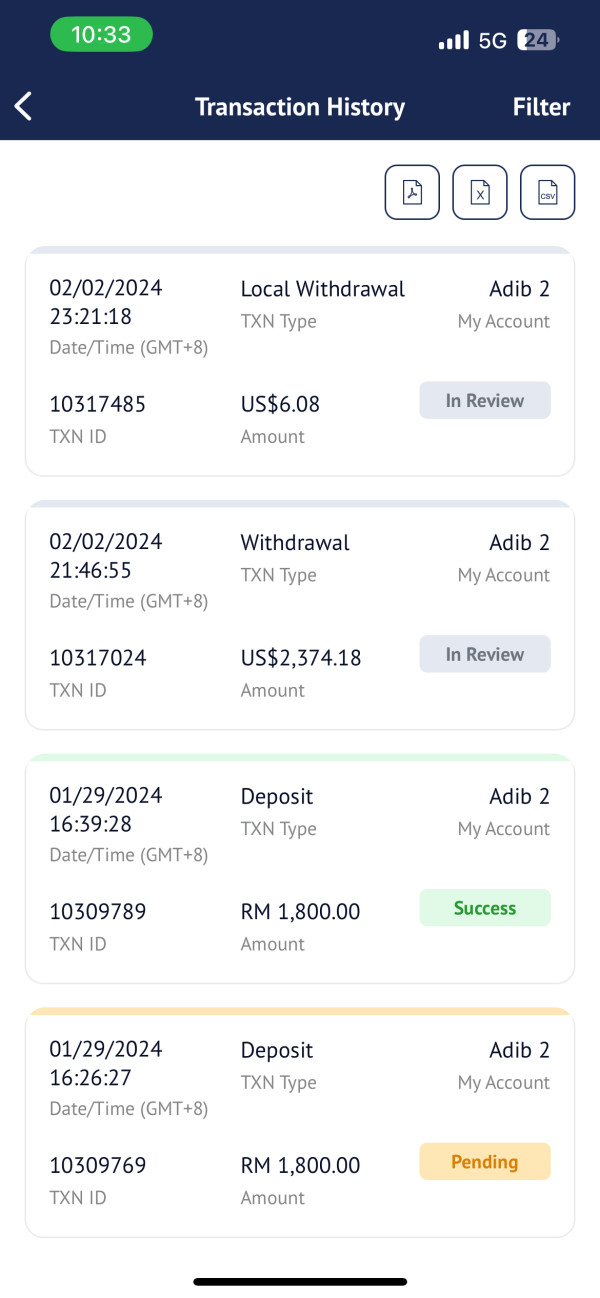

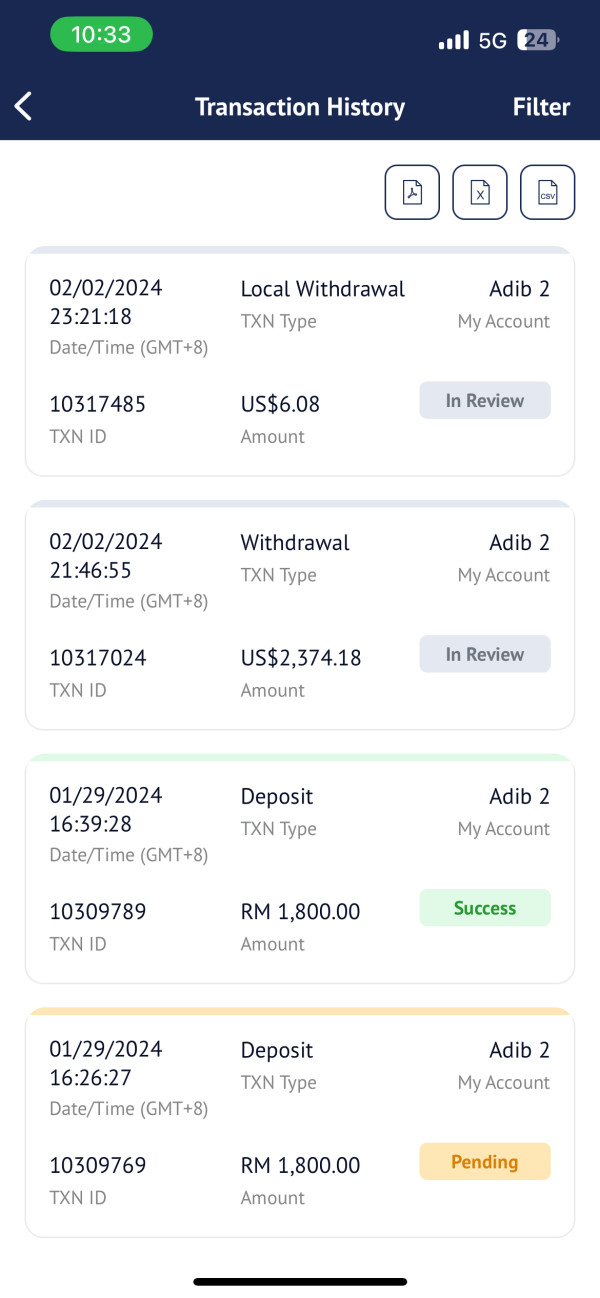

Perhaps most troubling are the user reports and complaints that suggest broader service quality issues beyond simple response times or communication preferences. When customer complaints escalate to include concerns about payment processing, account access, or withdrawal difficulties, these issues indicate systemic problems rather than isolated service incidents. The presence of such complaints, combined with limited transparent information about complaint resolution procedures and client protection measures, significantly undermines confidence in the customer service and support infrastructure.

Trading Experience Analysis (Score: 6/10)

The trading experience offered by AximTrade centers on high-leverage opportunities and competitive spread pricing that appeals to active traders seeking maximum capital efficiency. With leverage ratios reaching up to 1:1000 and advertised spreads starting from 0.0 pips, the broker positions itself as offering favorable trading conditions for those prioritizing cost efficiency and position sizing flexibility. These conditions can be particularly attractive for scalping strategies and high-frequency trading approaches where small price movements and position costs significantly impact profitability.

The MetaTrader 4 and MetaTrader 5 platform infrastructure provides a familiar and feature-rich trading environment that most forex traders recognize and understand. These platforms offer advanced charting capabilities, comprehensive technical analysis tools, automated trading support, and mobile accessibility that enables trading from virtually any location. The platform's order management features, including various order types and risk management tools, provide the technical foundation necessary for implementing diverse trading strategies.

However, critical aspects of the trading experience remain unclear due to limited user feedback and absence of detailed performance metrics. Platform stability, execution speeds, slippage rates, and requote frequency are essential factors that determine the quality of the actual trading experience. Yet specific data about these performance indicators is not readily available from reliable sources. Without reliable information about order execution quality and platform reliability during volatile market conditions, potential clients cannot adequately assess whether the advertised trading conditions translate into satisfactory real-world performance.

The high leverage offering, while attractive for profit potential, also significantly amplifies risk exposure and requires sophisticated risk management practices. The combination of extreme leverage and limited educational resources could create challenging trading conditions for inexperienced clients. These traders may not fully understand the implications of their position sizing decisions. This aximtrade review notes that while the basic trading infrastructure appears adequate, the lack of comprehensive performance data and user experience feedback limits confidence in the overall trading experience quality.

Trustworthiness Analysis (Score: 3/10)

Trustworthiness represents the most significant concern in evaluating AximTrade as a forex broker. Multiple factors contribute to a low confidence rating that potential clients should carefully consider. The absence of clear regulatory oversight from recognized financial authorities creates fundamental uncertainty about client protection, operational standards, and dispute resolution mechanisms. Most reputable brokers operate under licenses from established regulators like the FCA, ASIC, CySEC, or other recognized authorities that enforce strict capital requirements, client fund segregation, and operational transparency standards.

The registration in Saint Vincent and the Grenadines, while legally legitimate, provides minimal regulatory protection compared to major financial jurisdictions. Offshore registration often indicates reduced regulatory compliance requirements, limited government oversight, and fewer client protection mechanisms in case of broker default or operational problems. This regulatory environment may offer operational flexibility for the broker but creates significant uncertainty for client fund safety and legal recourse options.

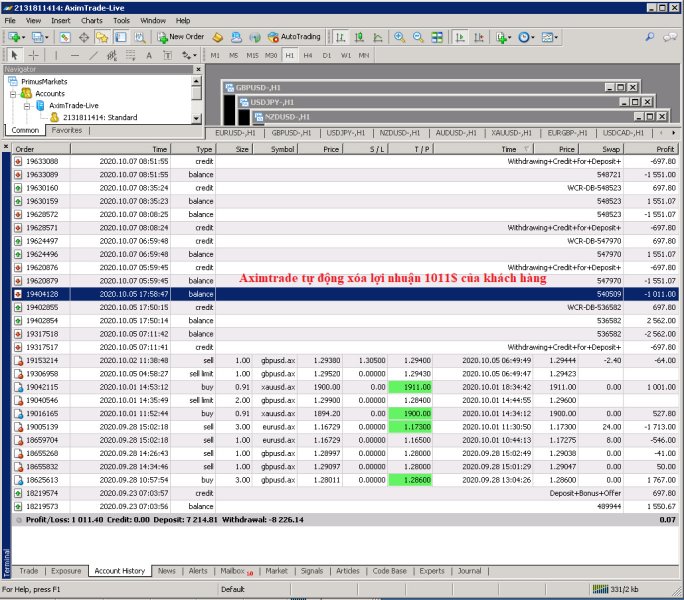

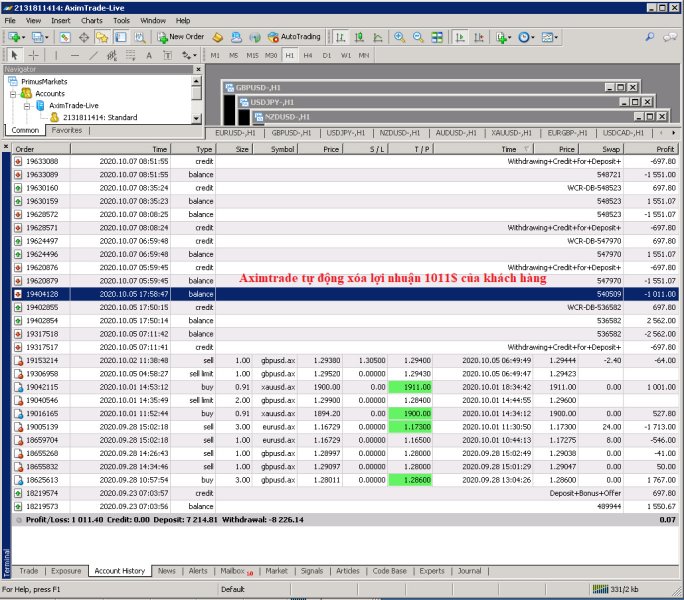

User feedback and online reports include concerning references to scam warnings and payment-related complaints that further undermine trustworthiness assessments. When multiple independent sources raise similar concerns about a broker's reliability, these patterns typically indicate systemic issues rather than isolated incidents. The presence of such warnings, combined with limited transparent information about company ownership, financial statements, and operational procedures, creates substantial credibility challenges.

The company's relatively short operational history since 2020 means that long-term track record data is unavailable for evaluation. Established brokers typically build trustworthiness through years of consistent operations, transparent communication, and positive client relationships. Without this historical foundation and given the presence of negative feedback patterns, potential clients face significant uncertainty about the broker's long-term reliability and commitment to client interests. The lack of third-party audits, industry certifications, or independent verification of operational claims further compounds these trustworthiness concerns.

User Experience Analysis (Score: 5/10)

User experience evaluation for AximTrade reveals a mixed landscape of accessibility benefits offset by significant operational concerns that impact overall client satisfaction. The extremely low minimum deposit requirement and high leverage availability create an accessible entry point for traders with diverse capital levels and risk appetites. This accessibility factor represents a genuine advantage for users seeking flexible account options and low barriers to market participation.

The MetaTrader platform selection provides a familiar and feature-rich user interface that most forex traders can navigate effectively without extensive learning curves. Both MT4 and MT5 offer comprehensive functionality for chart analysis, order management, automated trading, and mobile access that supports diverse trading styles and preferences. The platform's widespread industry adoption means that users can leverage existing knowledge and third-party resources to maximize their trading effectiveness.

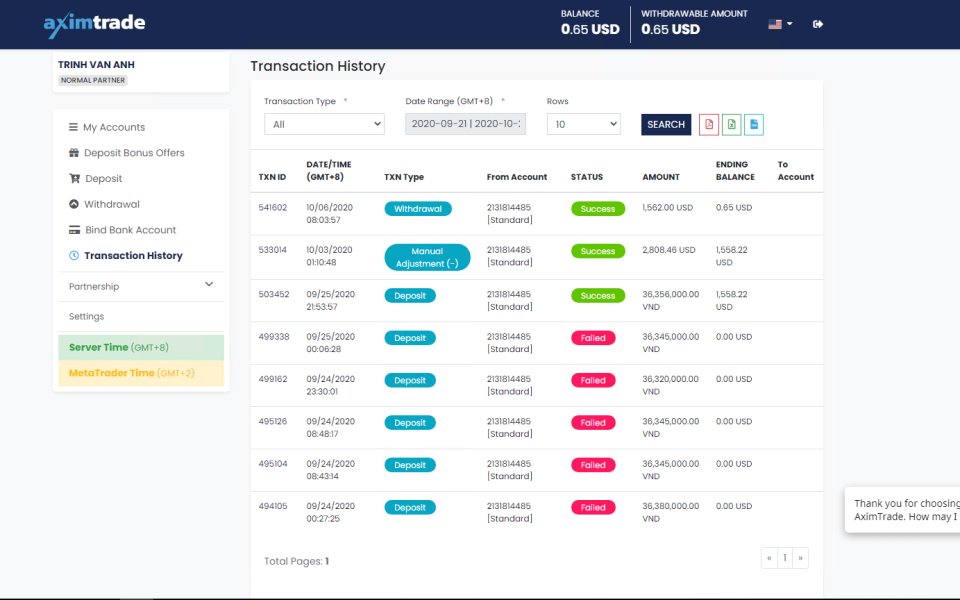

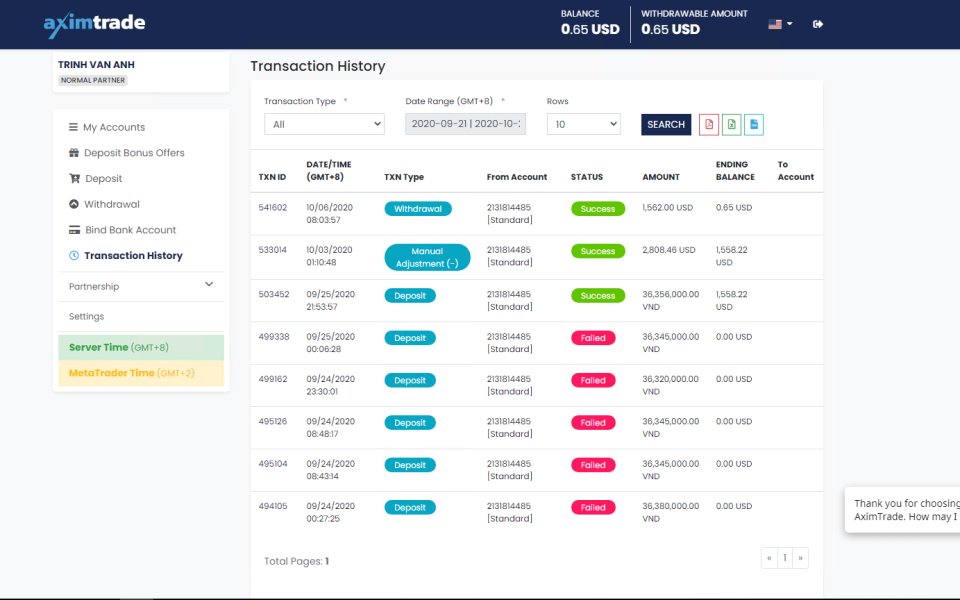

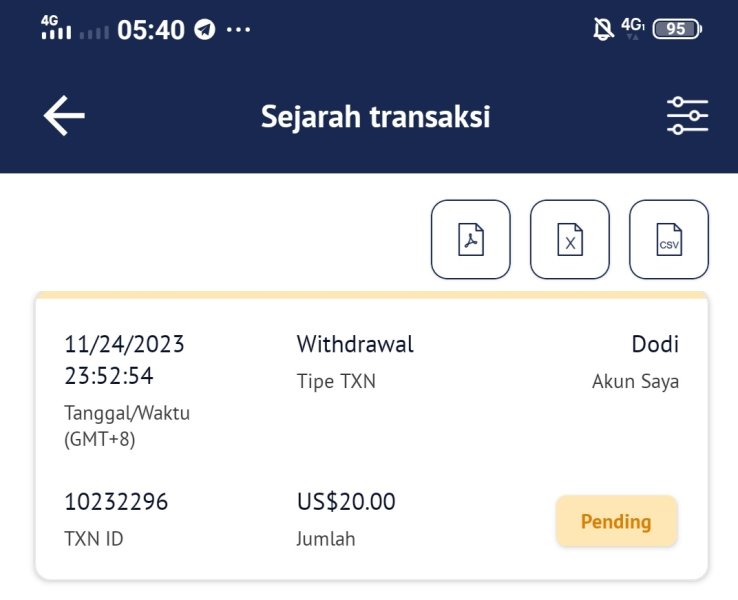

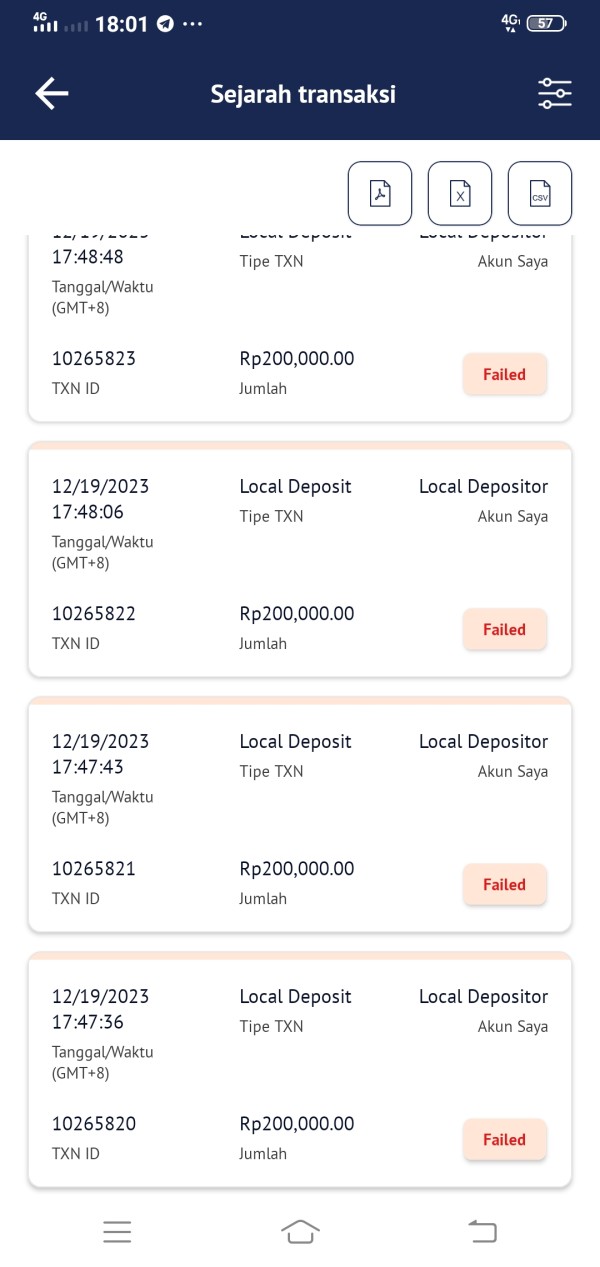

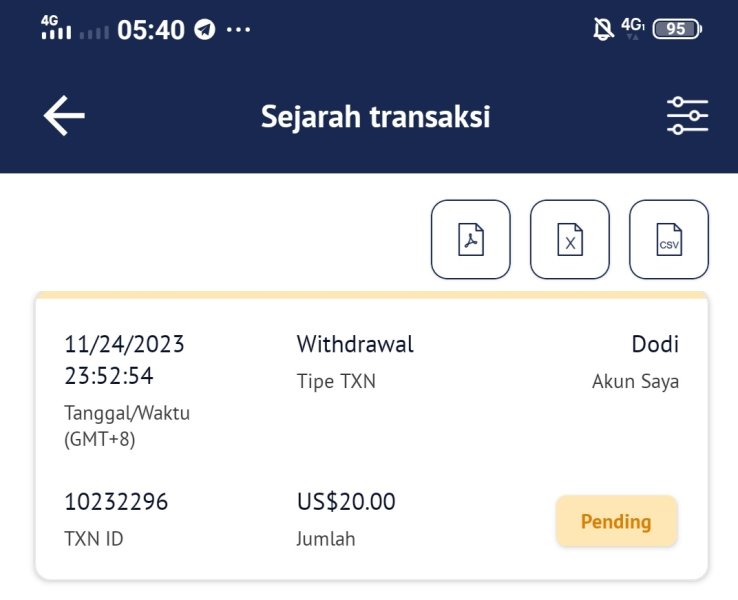

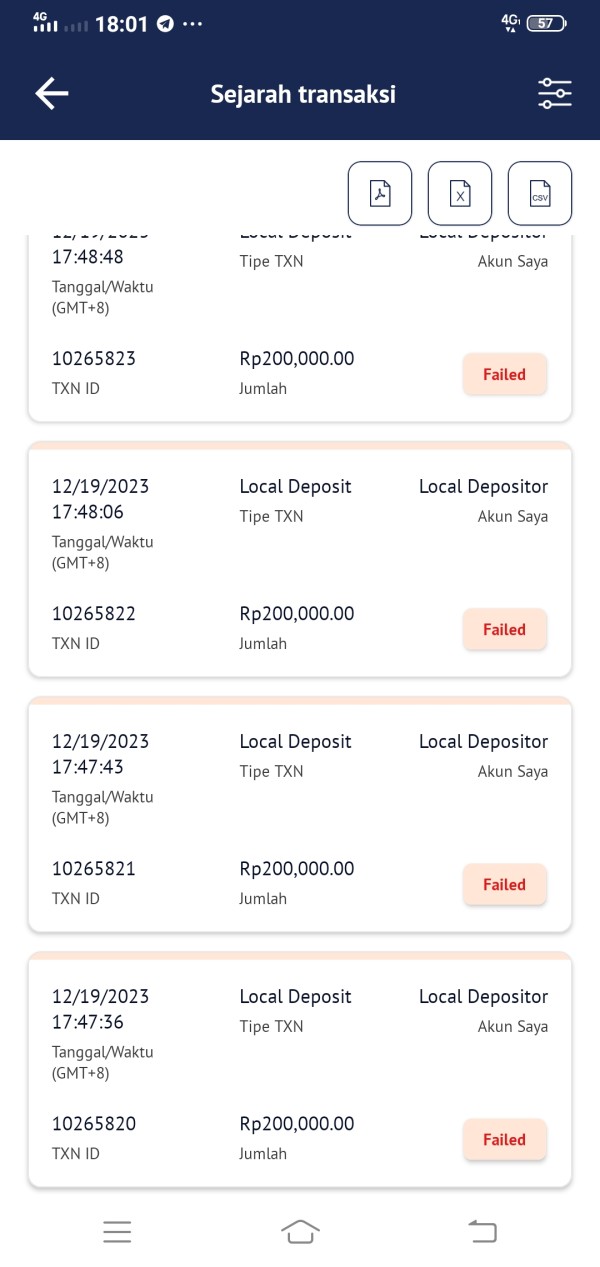

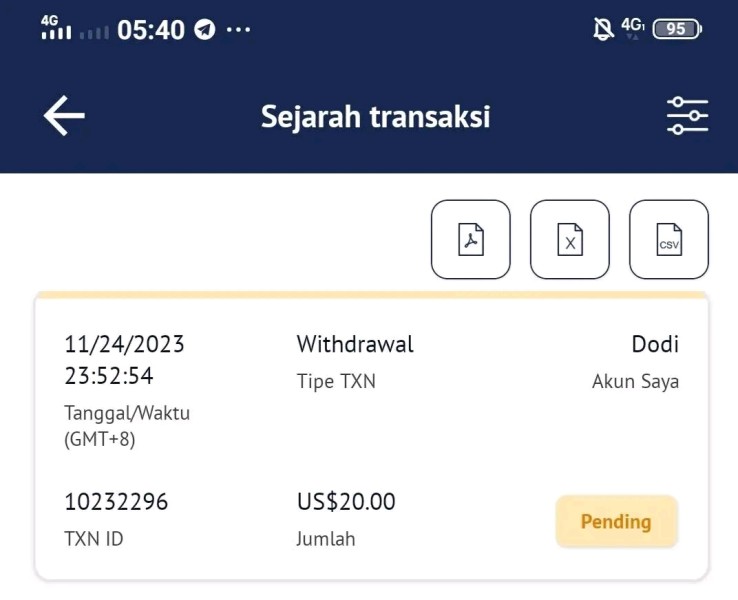

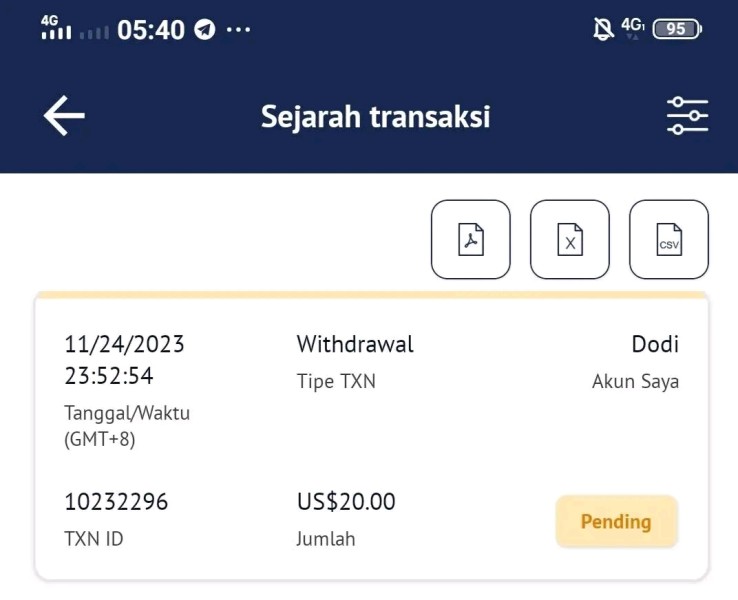

However, significant gaps in user experience information create uncertainty about critical operational aspects that directly impact client satisfaction. Registration procedures, account verification processes, funding and withdrawal experiences, and customer service interactions are fundamental elements of user experience that lack clear documentation or reliable user feedback. Without comprehensive information about these essential touchpoints, potential clients cannot adequately assess the practical aspects of working with AximTrade.

The presence of negative user feedback, including complaints about payment issues and service quality problems, suggests that the actual user experience may fall short of expectations despite potentially attractive initial conditions. User experience encompasses not only platform functionality and account features but also reliability, transparency, and support quality throughout the entire client relationship. The combination of concerning user reports and limited transparent information about operational procedures indicates that while AximTrade may offer appealing initial conditions, the overall user experience may present significant challenges and frustrations for clients seeking reliable, long-term trading relationships.

Conclusion

This comprehensive aximtrade review reveals a forex broker that presents significant contrasts between attractive initial offerings and concerning operational realities. While AximTrade offers compelling features such as extremely high leverage up to 1:1000, a minimal $1 minimum deposit, and access to popular MetaTrader platforms, these advantages are substantially overshadowed by serious trustworthiness and transparency concerns. Potential clients must carefully consider these issues before making any investment decisions.

The broker appears most suitable for experienced traders who understand offshore broker risks and seek high-leverage trading opportunities with minimal capital requirements. However, the absence of clear regulatory oversight, presence of scam warnings, and user complaints about payment issues make AximTrade inappropriate for traders prioritizing fund safety and regulatory protection. The lack of comprehensive educational resources and transparent operational information further limits its suitability for novice traders who require guidance and reliable support structures.

The primary advantages include accessibility through low minimum deposits and multiple account options, while the significant disadvantages encompass regulatory uncertainty, concerning user feedback, and limited transparency about operational procedures and client protections.