Regarding the legitimacy of Errante forex brokers, it provides CYSEC, FSA and WikiBit, .

Is Errante safe?

Pros

Cons

Is Errante markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 7

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Notely Trading Ltd

Effective Date:

2020-02-03Email Address of Licensed Institution:

info@errante.euSharing Status:

No SharingWebsite of Licensed Institution:

www.errante.euExpiration Time:

--Address of Licensed Institution:

67 Spyrou Kyprianou, 1st Floor, Office 101, 4042, LimassolPhone Number of Licensed Institution:

+357 25 253 300Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Errante Securities (Seychelles) Limited

Effective Date:

--Email Address of Licensed Institution:

info@errante.comSharing Status:

Website of Licensed Institution:

https://www.errante.com, https://www.errante-global.com, https://www.errante.io, https://www.errante.coExpiration Time:

--Address of Licensed Institution:

Office 15 (b), Third Floor, Vairam Building, Providence, Mahé, SeychellesPhone Number of Licensed Institution:

(+248) 4671981Licensed Institution Certified Documents:

Is Errante A Scam?

Introduction

Errante is a relatively new player in the forex market, having been established in 2019. Based in Seychelles, with a regulatory presence in Cyprus, Errante aims to provide a range of trading services across various asset classes, including forex, commodities, and cryptocurrencies. As the online trading landscape continues to evolve, traders must exercise caution when selecting a broker. The potential for scams in the industry necessitates thorough due diligence. This article aims to assess whether Errante is a trustworthy broker or a scam, utilizing a comprehensive evaluation framework that covers regulatory compliance, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

Regulation is a crucial factor in determining the legitimacy of a forex broker. Errante is regulated by two authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). CySEC is known for its stringent regulatory standards, providing a higher level of investor protection, while the FSA operates in a more lenient regulatory environment.

Regulatory Information Table

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 383/20 | Cyprus | Verified |

| FSA | SD 038 | Seychelles | Verified |

The dual regulation of Errante offers a layer of security for traders. CySEC's oversight ensures that Errante adheres to European Union regulations, including client fund protection and transparency in operations. However, the FSA's less stringent regulations may raise concerns for traders prioritizing high regulatory standards.

Historically, Errante has maintained compliance with regulatory requirements, but potential clients should remain vigilant and consider the implications of trading under different regulatory jurisdictions.

Company Background Investigation

Errante was founded in 2019, positioning itself as a modern broker catering to both novice and experienced traders. The company operates under the ownership of Notely Trading Ltd in Cyprus and Errante Securities (Seychelles) Ltd in Seychelles. The management team comprises industry veterans with extensive experience in finance and trading, which adds credibility to the firm.

Errante's commitment to transparency is evident in its operational practices. The broker provides detailed information about its services, regulatory status, and trading conditions on its website. However, the company's relatively short history in the industry could be a concern for some traders who prefer established firms with a long track record.

Trading Conditions Analysis

Errante offers a competitive trading environment with various account types tailored to different trading styles. The overall fee structure includes spreads, commissions, and overnight financing fees.

Trading Costs Comparison Table

| Cost Type | Errante | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.5 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

Errante's spreads for major currency pairs are slightly higher than the industry average, which may deter some traders. Additionally, while there are no commissions on most accounts, the tailor-made account incurs a commission based on trade volume, which could be considered a drawback for high-frequency traders.

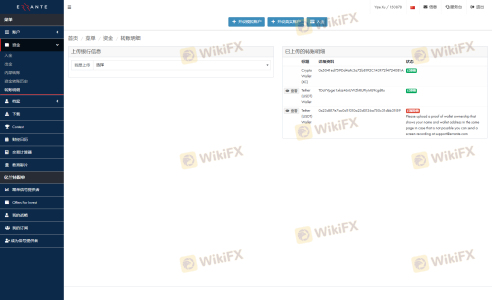

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. Errante employs several measures to protect client funds, including segregating client accounts from the company's operational funds. This practice minimizes the risk of misuse of client funds.

Errante also offers negative balance protection, ensuring that traders cannot lose more than their account balance. Furthermore, the broker provides an insurance program covering client investments up to €1,000,000, which enhances the overall safety of funds.

Historically, there have been no significant reports of fund safety issues related to Errante, which is a positive indicator for potential clients.

Customer Experience and Complaints

Customer feedback is essential in evaluating the reliability of any broker. Overall, user experiences with Errante have been mixed, with some traders praising its services while others have raised concerns.

Common Complaint Types Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Poor Customer Service | Medium | Generally responsive |

| High Spreads | Medium | Addressed in FAQs |

Common complaints include delays in withdrawals and high spreads. While Errante has responded to some of these issues, the effectiveness of its customer service has been questioned by users. A few traders reported difficulties in accessing their funds, which raises concerns about the broker's reliability.

Platform and Trade Execution

Errante offers popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are well-regarded for their reliability and extensive features. The broker claims to provide fast order execution; however, reports of slippage and rejections have surfaced among traders.

The overall user experience on Errante's platforms is generally positive, but concerns about execution quality and potential manipulation have been noted. Traders should remain cautious and monitor their trading activity closely.

Risk Assessment

Using Errante for trading involves several risks that traders should consider.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation but varies by region |

| Fund Safety | Low | Strong safety measures in place |

| Execution Quality | Medium | Reports of slippage and rejections |

| Customer Service | Medium | Mixed feedback on responsiveness |

To mitigate these risks, traders should conduct thorough research before engaging with Errante. Utilizing demo accounts to test the platform and services can also help traders make informed decisions.

Conclusion and Recommendations

In conclusion, Errante is a regulated broker that offers a range of trading services. While it holds licenses from CySEC and FSA, which provide a level of legitimacy, potential clients should be aware of the mixed reviews regarding customer experience and execution quality.

Is Errante a scam? Based on the evidence and analysis presented, Errante does not appear to be a scam; however, traders should exercise caution and conduct their own due diligence. It is advisable for novice traders to consider alternative brokers with a longer track record and more robust regulatory oversight, such as brokers regulated by the FCA or ASIC.

For those who choose to trade with Errante, utilizing a demo account and being mindful of trading conditions will be crucial for a positive trading experience.

Is Errante a scam, or is it legit?

The latest exposure and evaluation content of Errante brokers.

Errante Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Errante latest industry rating score is 6.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.