FinPros 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

FinPros is an online broker that stands out due to its cost-efficient trading environments and ultra-fast order execution capabilities. Founded in 2020 and regulated by the Seychelles Financial Services Authority (FSA), it appeals largely to retail traders and experienced individuals seeking to reduce trading costs. Traders can benefit from no commission fees, spreads starting as low as 0.0 pips, and high leverage ratios of up to 1:500 coupled with a sophisticated MetaTrader 5 (MT5) platform designed for various trading strategies. However, the offshore regulatory status raises concerns about fund safety, transaction smoothness, and the overall reliability of the platform. While the high-speed trading framework and low-cost structure are significant advantages, potential traders need to weigh these benefits against the heightened risks associated with offshore operations.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Trading with offshore brokers like FinPros comes with inherent risks due to limited regulatory oversight. Traders should be aware that fund safety cannot be guaranteed in the same way as with onshore brokers.

Steps to Verify Legitimacy:

- Check Regulatory Status: Visit the Seychelles FSA website and verify FinPros registration.

- Review User Experiences: Read online reviews and user feedback on forums or trusted review platforms.

- Evaluate Communication: Reach out to FinPros' customer support for inquiries on operations and notice response times.

- Assess Withdrawal Policies: Ensure clarity on withdrawal processes and fee structure before opening an account.

Trading with FinPros involves significant risk. Ensure you fully understand these risks and only invest with funds you can afford to lose.

Rating Framework

Broker Overview

Company Background and Positioning

FinPros, officially known as Fin Quotes Financial Ltd, was established in 2020, based in Seychelles. Its competitive positioning is largely attributed to offering a highly favorable trading infrastructure characterized by speed and cost-effectiveness in forex and CFD trading. With a strong focus on retail traders, FinPros has tailored its offerings to support various trading strategies, providing a unique value proposition despite operating under offshore regulation.

Core Business Overview

FinPros offers over 400 financial instruments, including forex, stocks, commodities, indices, energies, and cryptocurrencies. The broker is regulated under the Seychelles Financial Services Authority (FSA), which allows for trading under less stringent conditions compared to onshore regulatory regimes. Clients can access leverage as high as 1:500, which may amplify both potential returns and risks significantly.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching Users to Manage Uncertainty

The regulatory framework for FinPros is centered on its affiliation with the Seychelles FSA. While it possesses a regulatory status, this is often perceived as lacking compared to tier-1 regulators, which raises concerns about the overall safety of traders funds.

- Analysis of Regulatory Information Conflicts: The license from the Seychelles FSA may offer basic regulatory oversight, but it does not provide the same level of protection as brokers regulated by major authorities like FCA, ASIC, or SEC. Reported concerns involve withdrawal difficulties and unsatisfactory customer service experiences, which could indicate transparency issues.

- User Self-Verification Guide:

- Visit the official Seychelles FSA website.

- Search for FinPros registration using the license number.

- Cross-reference found data with user reviews to gauge real user experiences.

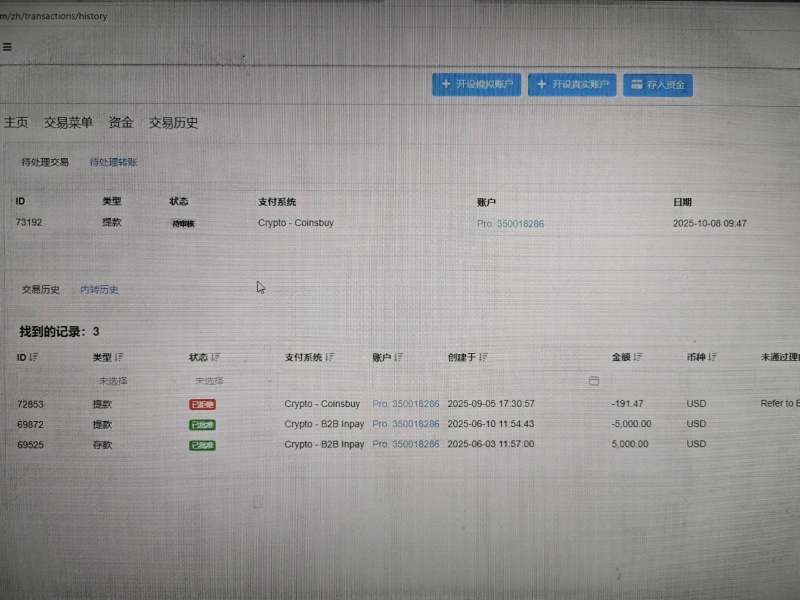

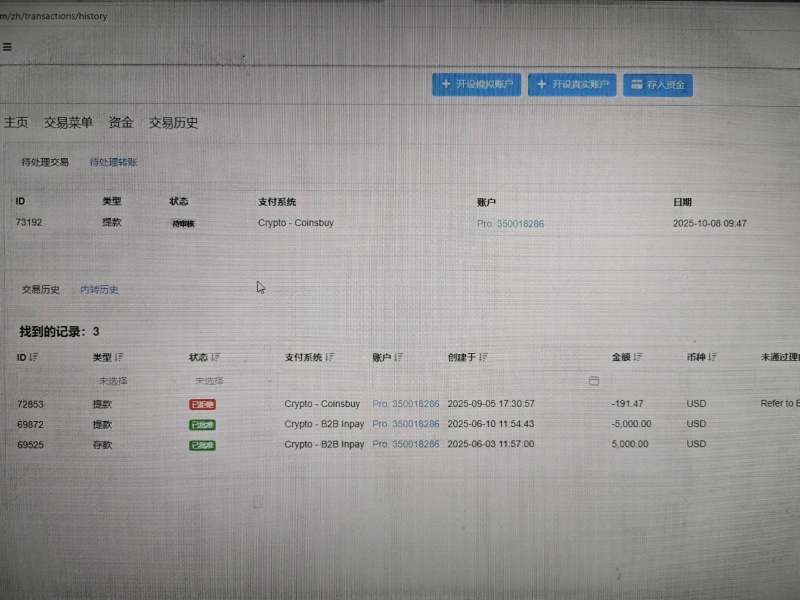

- Industry Reputation and Summary: Overall, user feedback presents a mixed reputation, with several negative experiences concerning withdrawals and customer service being a glaring issue that potential clients should consider seriously.

Trading Costs Analysis

The Double-Edged Sword Effect

FinPros provides an alluring structure regarding trading costs, marketed as low-cost and efficient.

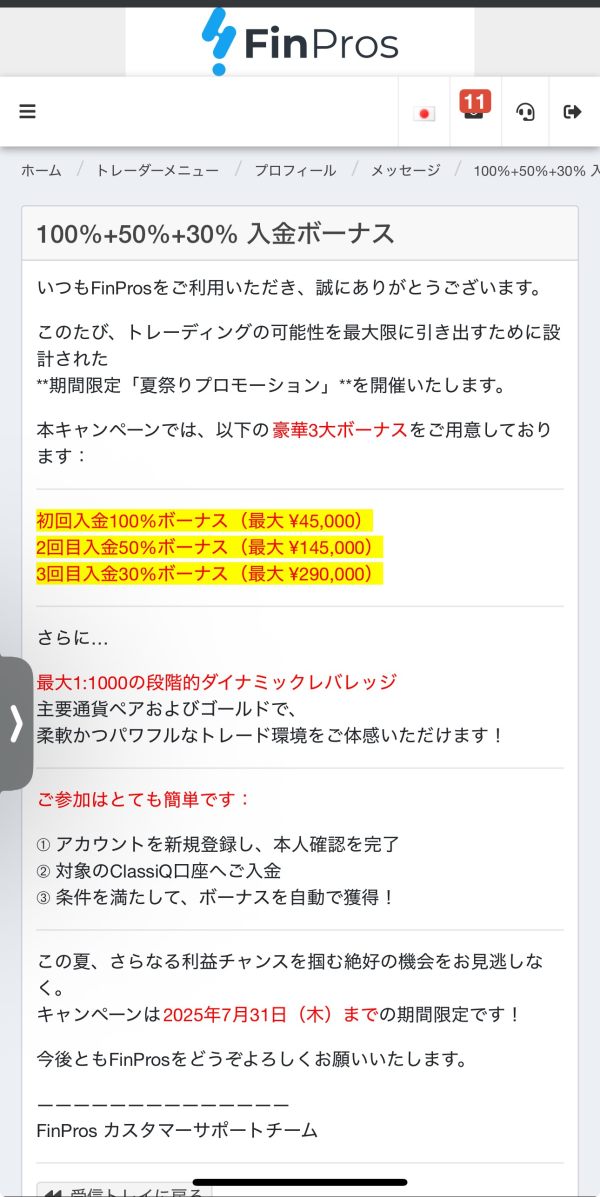

- Advantages in Commissions: The broker's no-commission model, alongside promising low spreads (as low as 0.0 pips), appeals to cost-conscious traders. The fee structure positions the classiq account as beginner-friendly with a minimum deposit of just $100.

- The "Traps" of Non-Trading Fees: Despite some advantages, users have reported hidden fees, notably regarding swap fees and inactivity fees after an extended period. “Traders have expressed dissatisfaction regarding high swap fees and sudden withdrawal limitations”, leading to concerns regarding the overall transparency of costs.

- Cost Structure Summary: For scalpers and active traders, the raw+ and edge accounts provide excellent opportunities to minimize costs. However, those relatively inexperienced may find potential pitfalls due to unexpected fees.

Professional Depth vs. Beginner-Friendliness

FinPros utilizes the MetaTrader 5 platform, widely recognized for its advanced capabilities.

- Platform Diversity: MT5 is accessible through desktop, web, and mobile applications, enabling a wide range of trading strategies. The integration of features like automated trading via Expert Advisors caters excellently to both novice and experienced traders.

- Quality of Tools and Resources: While MT5 offers numerous indicators and analytical tools, the absence of additional trading platforms may limit options for traders looking for variety.

- Platform Experience Summary: Users have generally praised the interface for ease of use, although some have noted that the support for beginners could be improved as documented experiences reveal a steep learning curve for those unacquainted with MT5.

User Experience Analysis

Navigating the User Journey

A critical aspect of any trading platform is how users interact with it from registration through trading.

- Account Registration Process: FinPros boasts a remarkably efficient account activation process that takes less than one minute, facilitated by an innovative AI-driven KYC procedure to enhance speed and streamline user experience.

- Day-to-Day Trading Experience: Feedback indicates users have varying trading experiences, with reports of fast execution speeds being a strong point. However, overshadowing this benefit are complaints about the slow, often unresponsive customer support during crucial trading hours.

- Community Feedback: Although fast execution is a positive feature, many users express fears regarding ongoing operational issues. “Some traders have voiced their frustrations on forums, detailing difficulties in accessing support when needed,” emphasizing the need for improved customer service.

Customer Support Analysis

Assessing Availability and Responsiveness

Customer support forms another essential layer to how effectively a broker operates.

- Contact Channels: FinPros offers several support methods, including email, live chat, and phone support. However, there have been mixed experiences regarding the promptness of responses.

- Reported User Experiences: While some users commend quick response times (averaging about 21 seconds), many share instances where issues went unresolved for extended periods, creating further skepticism towards the support team's reliability.

- Customer Satisfaction Summary: A significant portion of trader feedback reflects disappointment in the customer service experience. Industry professionals often stress the importance of responsive support, especially during volatile trading periods, indicating a risk area for FinPros.

Account Conditions Analysis

Tailored Options for Diverse Trading Strategies

FinPros provides a mix of accounts designed to suit a range of trading styles.

- Account Types Offered: Investors can choose from four accounts: Raw+, Edge, Vantage, and Classiq, with diverse requirements and operational features catering to varying trader needs.

- Comparative Conditions: The Classiq account is recommended for beginners due to its low barrier for entry, whereas the Raw+ account provides a cost-effective option for high-frequency traders seeking tight spreads.

- Practice Accounts Availability: Free demo accounts are accessible for potential clients eager to familiarize themselves with the platform, an attractive feature for both novice and experienced traders looking to test strategies risk-free.

Conclusion

In conclusion, FinPros offers a compelling blend of low-cost trading opportunities and swift execution times, which undoubtedly attract many traders. However, the underlying risks associated with its offshore regulation, combined with varying user experiences, necessitate caution. New traders or those lacking familiarity with trading environments may find themselves vulnerable in this brokerage's context. Ultimately, potential users should conduct thorough research and carefully assess their risk tolerance before embarking on their trading journey with FinPros.

With this comprehensive review, traders now have the insights required to make informed decisions about utilizing FinPros for their trading activities. Overall, while the potential for cost savings and execution efficiency exists, the cautionary advice surrounding investment safety should not be overlooked.