Is SWIFT TRADER safe?

Pros

Cons

Is Swift Trader A Scam?

Introduction

Swift Trader, a relatively new player in the forex market, claims to provide a diverse trading platform with a range of financial instruments, including forex, commodities, and cryptocurrencies. As with any trading platform, it is crucial for traders to carefully evaluate the legitimacy and reliability of the broker they choose to work with. The potential for scams in the forex industry is significant, with many unregulated brokers operating under questionable practices. This article aims to provide a comprehensive analysis of Swift Trader, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The evaluation is based on a thorough review of online sources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory environment in which a broker operates is one of the most critical factors in assessing its legitimacy. Swift Trader claims to be regulated by the Mwali International Services Authority (MISA) in the Comoros Islands. However, it lacks any licensing from more reputable authorities such as the Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA) in the UK.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T 2023364 | Comoros | Active |

The MISA license allows Swift Trader to operate as a broker; however, the regulatory framework in the Comoros is less stringent than that of many other jurisdictions. This raises concerns about the level of oversight and investor protection provided. Brokers regulated by MISA often face minimal requirements, which can lead to a lack of accountability. Furthermore, Swift Trader's failure to obtain a license from ASIC is a significant red flag, as ASIC is known for its rigorous regulatory standards designed to protect traders.

Company Background Investigation

Swift Trader is registered in the Comoros Islands, with claims of having an office in Sydney, Australia. However, the legitimacy of this Australian office is questionable, as there is no evidence of compliance with ASIC regulations. The company was established in September 2023, which means it has a very short operational history. This lack of a proven track record can be concerning for potential clients looking for stability and reliability in their trading activities.

The management team behind Swift Trader remains largely anonymous, with little information available regarding their professional backgrounds or expertise in the financial sector. Transparency is a vital aspect of trust in the forex industry, and the lack of publicly available information about the company's leadership raises concerns. A well-structured company should disclose its ownership and management details to foster trust among its clients.

Trading Conditions Analysis

Swift Trader offers a variety of trading conditions, including a minimum deposit requirement of $50, leverage of up to 1:1000, and multiple account types. However, the high leverage ratio is a cause for concern, as it can significantly increase the risk of losses for traders.

| Fee Type | Swift Trader | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.9 pips | 1.5 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Swift Trader are higher than the industry average, which can eat into potential profits. Additionally, the absence of a clear commission structure can lead to confusion regarding the total cost of trading. Traders should be cautious of brokers that do not provide transparent information on fees as this may indicate hidden costs.

Customer Funds Security

The safety of customer funds is paramount in the trading industry. Swift Trader claims to implement measures to segregate client funds and offers negative balance protection; however, the effectiveness of these measures remains questionable due to the lack of robust regulatory oversight. The absence of a reputable regulator means that there is no external authority ensuring compliance with industry standards for fund protection.

Historically, many brokers operating under lax regulations have faced issues with fund mismanagement or fraud. Traders should be aware of the risks associated with depositing funds into an unregulated broker and consider the potential consequences of losing their investments.

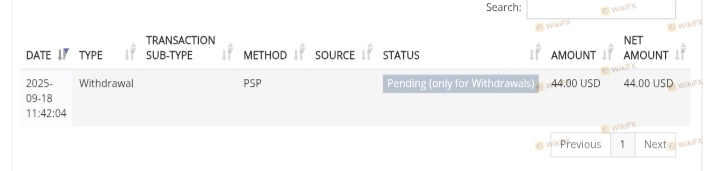

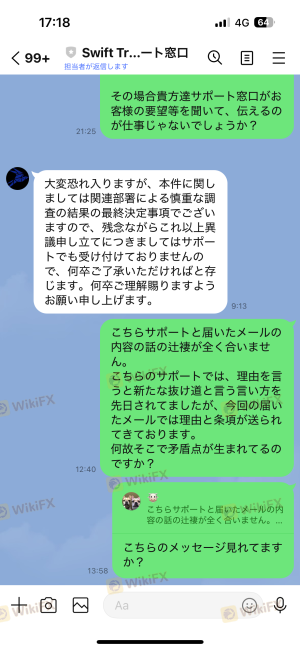

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Swift Trader reveal a mixed bag of experiences, with many users reporting difficulties in withdrawing funds and poor customer service. Common complaints include high-pressure sales tactics and unresponsive support teams, which are typical red flags associated with potentially fraudulent brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow, often ignored |

| Customer Support | Medium | Unresponsive |

| Misleading Promotions | High | No resolution |

Two notable cases involve users who reported being unable to access their funds after making significant deposits. Such incidents raise serious concerns about the broker's practices and should be taken into account by potential clients.

Platform and Trade Execution

Swift Trader utilizes the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the overall performance of the platform has been called into question, with reports of execution delays and slippage during volatile market conditions.

The quality of trade execution is crucial for traders, particularly in the fast-paced forex market. Any signs of platform manipulation or excessive slippage can significantly impact trading outcomes, leading to potential losses.

Risk Assessment

Using Swift Trader comes with several risks, primarily due to its unregulated status and lack of transparency. Traders should be aware of the potential for loss and the challenges associated with withdrawing funds.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under lax oversight from MISA. |

| Fund Security Risk | High | No robust protections in place for client funds. |

| Customer Service Risk | Medium | Reports of poor response and support quality. |

To mitigate these risks, traders should conduct thorough research, consider starting with smaller amounts, and avoid using high leverage when trading.

Conclusion and Recommendations

In conclusion, Swift Trader raises several red flags that suggest it may not be a trustworthy broker. The absence of reputable regulation, combined with a lack of transparency regarding its management and operational history, makes it a risky choice for traders. The feedback from users further corroborates these concerns, with numerous complaints regarding fund withdrawals and customer service.

For traders seeking a reliable forex broker, it is advisable to explore alternatives that are well-regulated and have established a positive reputation in the market. Brokers licensed by ASIC or FCA are generally more trustworthy and provide better protections for client funds. Always prioritize due diligence when selecting a trading partner to safeguard your investments.

Is SWIFT TRADER a scam, or is it legit?

The latest exposure and evaluation content of SWIFT TRADER brokers.

SWIFT TRADER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SWIFT TRADER latest industry rating score is 2.01, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.01 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.