Swift Trader 2025 Review: Everything You Need to Know

Executive Summary

This swift trader review shows big concerns about the broker's legitimacy and service quality. Swift Trader started in 2023 and says it offers multi-asset trading with competitive spreads from 0 and leverage up to 1:2000. Our detailed analysis finds troubling patterns in user feedback and regulatory oversight that raise serious red flags.

The broker operates under Mwali International Services Authority (MISA) regulation with license number T2023364. This carries much less regulatory weight compared to major financial authorities like the FCA or ASIC. User ratings stay around 30/1000, which shows widespread dissatisfaction and trust issues among traders. Swift Trader targets high-risk traders with aggressive leverage offerings and a low minimum deposit of $100 USD, but the overwhelming negative feedback suggests significant operational and transparency challenges.

Key features include MetaTrader 5 platform integration and support for forex, cryptocurrencies, and CFDs. However, these technical offerings are overshadowed by persistent user complaints about service quality and legitimacy concerns. The broker's STP and ECN business model sounds good in theory, but appears to struggle with execution quality based on available user testimonials.

Important Notice

Regional Entity Differences: Swift Trader operates under MISA regulation from the Comoros. This represents a significantly different regulatory environment compared to established financial authorities such as the UK's FCA, Australia's ASIC, or Cyprus's CySEC. This regulatory framework may offer substantially less investor protection and oversight compared to major financial jurisdictions. Traders should know that MISA's supervisory capabilities and enforcement mechanisms may not match the standards expected from tier-one regulators.

Review Methodology Disclaimer: This evaluation is based on publicly available information, user feedback, and official broker documentation accessible at the time of writing. The assessment may not reflect the complete operational picture, and individual trading experiences may vary. Given the limited transparency and conflicting information available about Swift Trader, this review should be considered alongside additional due diligence before making any trading decisions.

Rating Framework

Broker Overview

Swift Trader entered the forex market in 2023 as a new company. The company established its headquarters in Fomboni, Comoros. It operates using both STP (Straight Through Processing) and ECN (Electronic Communication Network) business models, positioning itself to provide margin and spot trading services to retail and institutional clients. Despite its recent establishment, Swift Trader has tried to capture market share by offering aggressive trading conditions, including exceptionally high leverage ratios and competitive spread structures.

The broker's operational framework centers around providing multi-asset trading opportunities through established platforms. It claims to maintain institutional-grade execution standards. However, the company's brief operational history and limited regulatory oversight have contributed to significant skepticism within the trading community. According to reports from fx-list.com and other industry sources, Swift Trader's rapid market entry has been accompanied by mixed reception from traders who question both the sustainability of its offered conditions and the transparency of its operational practices.

The company chose to establish operations in Comoros under MISA regulation as a strategic decision. This prioritizes regulatory flexibility over the credibility associated with major financial centers. This swift trader review finds that while such positioning may allow for more aggressive product offerings, it simultaneously raises questions about investor protection and operational oversight that potential clients must carefully weigh against the advertised benefits of the platform's trading conditions.

Regulatory Jurisdiction: Swift Trader operates under the oversight of Mwali International Services Authority (MISA) with license number T2023364. This regulatory framework is legitimate within its jurisdiction but operates with different standards and enforcement capabilities compared to major financial regulators. This potentially affects the level of investor protection available to clients.

Minimum Deposit Requirements: The broker maintains an accessible entry point with a minimum deposit requirement of $100 USD. This makes it theoretically available to traders with limited initial capital. However, this low barrier to entry should be evaluated alongside the high-risk nature of the leverage offerings.

Available Asset Classes: Swift Trader provides access to multiple asset categories including foreign exchange pairs, cryptocurrency CFDs, and traditional CFDs across various markets. The diversity of offerings suggests an attempt to capture different trader preferences and market opportunities.

Cost Structure Analysis: Spreads begin from 0 pips according to broker specifications, which appears competitive within the industry. However, comprehensive information regarding commission structures, overnight fees, and other trading costs remains unclear in available documentation. This raises transparency concerns.

Leverage Specifications: Maximum leverage reaches 1:2000, representing one of the highest ratios available in the retail trading market. While this may appeal to aggressive traders, such leverage levels carry extreme risk potential that can result in rapid account depletion.

Trading Platform Infrastructure: The broker provides access through MetaTrader 5, a well-established and widely recognized trading platform. It offers comprehensive charting tools, automated trading capabilities, and mobile accessibility for traders across different experience levels.

Geographic Restrictions: Specific information regarding regional trading restrictions and compliance with various international regulations remains limited in available broker documentation. This potentially creates uncertainty for international clients.

Customer Support Languages: Available documentation does not clearly specify the range of languages supported for customer service. This may impact accessibility for international traders seeking assistance in their native languages.

This swift trader review notes that several critical operational details remain unclear or inadequately disclosed. This contributes to the overall transparency concerns surrounding the broker's operations.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

Swift Trader's account structure presents a mixed picture of accessibility and risk management concerns. The $100 USD minimum deposit requirement positions the broker as accessible to entry-level traders. This aligns with industry trends toward lower barriers to entry. However, the absence of clearly defined account tiers or specific feature differentiation raises questions about service customization and client segmentation strategies.

The most concerning aspect of Swift Trader's account conditions lies in its leverage offering of up to 1:2000. Some experienced traders may view this as an opportunity for amplified returns, but financial experts widely recognize such extreme leverage as inappropriate for retail traders due to the exponential increase in loss potential. According to industry analysis, leverage ratios above 1:500 typically indicate brokers targeting inexperienced traders who may not fully understand the associated risks.

User feedback regarding account conditions reveals significant inconsistencies in reported experiences. Some traders have noted flexibility in account management, while others have raised concerns about transparency in fee structures and account maintenance requirements. The lack of clearly published information about account types, Islamic account availability, and specific terms for different trader categories contributes to uncertainty about the broker's actual service offerings.

The account opening process appears to follow standard industry practices, though it's not extensively documented in available sources. However, verification procedures and documentation requirements remain unclear, potentially creating obstacles for international clients seeking to establish trading relationships. This swift trader review emphasizes that prospective clients should request detailed account documentation before committing funds to better understand the actual terms and conditions governing their trading relationship.

Swift Trader's technology infrastructure centers around the MetaTrader 5 platform. This provides a solid foundation for trading operations. MT5 offers comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and multi-asset trading functionality that aligns with the broker's stated offerings. The platform's established reputation and widespread industry adoption represent positive aspects of Swift Trader's technical approach.

However, user feedback suggests inconsistent experiences with platform performance and reliability. Some traders report satisfactory functionality, while others have noted concerns about execution speeds, platform stability during volatile market conditions, and occasional connectivity issues. The absence of proprietary trading tools or unique platform enhancements means Swift Trader relies entirely on MetaTrader's standard feature set without additional value-added services.

Research and analysis resources appear limited based on available information. Unlike established brokers that provide comprehensive market analysis, economic calendars, and educational content, Swift Trader's offering in this area remains unclear. This gap in analytical support may disadvantage traders who rely on broker-provided research for their decision-making processes.

Educational resources and trader development programs are not prominently featured in available documentation. This suggests a potential weakness in client support and development. Modern traders increasingly expect comprehensive educational materials, webinars, and market insights as standard broker offerings, and the apparent absence of such resources may limit Swift Trader's appeal to developing traders seeking to improve their skills and market understanding.

Customer Service and Support Analysis (4/10)

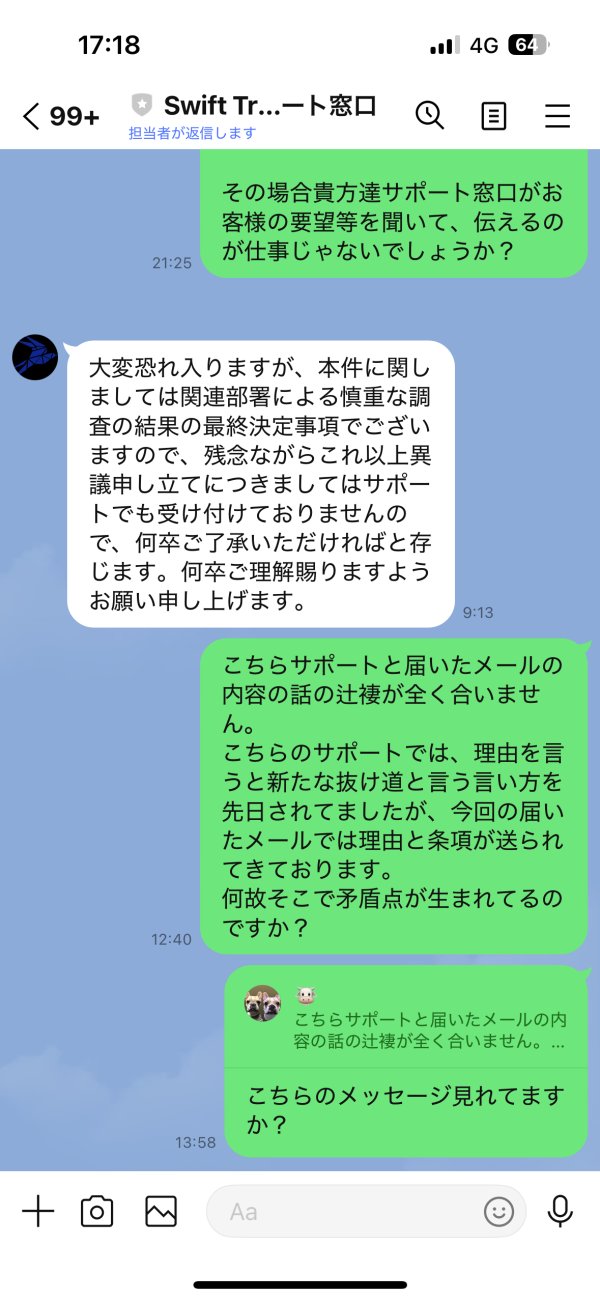

Customer service represents one of Swift Trader's most significant challenges based on available user feedback and operational transparency. The broker's support infrastructure lacks clear definition regarding available contact methods, response time commitments, and service level standards that clients can reasonably expect. This ambiguity creates uncertainty for traders who require reliable assistance, particularly during critical trading situations.

User testimonials reveal inconsistent support experiences. Some clients report adequate assistance while others describe difficulties in reaching qualified support personnel. The absence of clearly published customer service hours, available communication channels, and escalation procedures suggests an underdeveloped support framework that may struggle to meet client needs effectively.

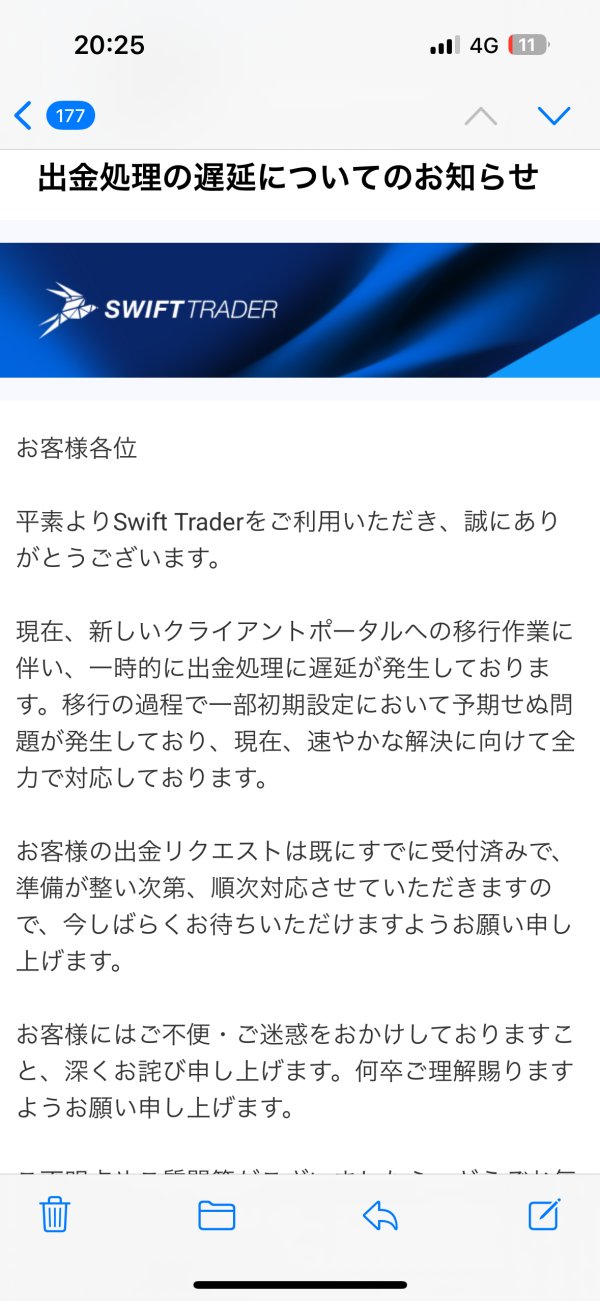

Response time performance appears variable based on user reports, with some traders experiencing delayed responses to critical inquiries. In the fast-paced trading environment, prompt customer support can be crucial for resolving account issues, technical problems, or trading disputes. The uncertainty surrounding Swift Trader's support capabilities raises concerns about the broker's ability to provide reliable assistance when needed.

Multilingual support capabilities remain unclear from available documentation. This potentially creates barriers for international clients who prefer assistance in their native languages. Established brokers typically provide comprehensive language support as a standard service feature, and any limitations in this area could restrict Swift Trader's appeal to diverse international markets.

Trading Experience Analysis (5/10)

The actual trading experience with Swift Trader presents a complex picture of competitive marketing claims versus user-reported reality. The broker advertises spreads starting from 0 pips, but user feedback suggests that actual trading conditions may not consistently meet these promotional standards. Execution quality, a critical factor in trading success, appears to vary significantly based on available testimonials.

Platform stability and execution speed have generated mixed reviews from users. Some report satisfactory performance while others note delays and technical issues during active trading sessions. The reliability of order execution, particularly during high-volatility periods, remains questionable based on user feedback patterns. Slippage and requote incidents appear to be concerns raised by some traders, though they're not extensively documented.

The MetaTrader 5 platform provides comprehensive functionality including advanced charting tools, technical indicators, and automated trading capabilities. However, the quality of the trading environment depends heavily on the broker's infrastructure and execution capabilities rather than just the platform interface. User reports suggest potential issues with the underlying execution framework that may impact the overall trading experience.

Mobile trading experience through MT5's mobile applications should theoretically provide full functionality for on-the-go trading. However, specific user feedback about Swift Trader's mobile trading performance remains limited, making it difficult to assess the quality of the mobile trading environment. This swift trader review notes that the gap between advertised capabilities and user-reported experiences represents a significant concern for potential clients evaluating the broker's suitability for their trading needs.

Trust and Safety Analysis (3/10)

Trust and safety concerns represent the most significant challenges facing Swift Trader. Multiple factors contribute to credibility questions within the trading community. The broker's regulation under MISA is technically legitimate but carries substantially less weight and recognition compared to major financial authorities. This regulatory framework may not provide the same level of investor protection and oversight that traders expect from established financial jurisdictions.

The overall user rating of 30/1000 represents an extremely concerning indicator of client satisfaction and trust levels. Such low ratings typically indicate systematic issues with broker operations, transparency, or service delivery that extend beyond isolated incidents. The consistency of negative feedback suggests fundamental challenges in the broker's operational approach that potential clients must carefully consider.

Financial safety measures and client fund protection protocols remain unclear from available documentation. Established brokers typically provide detailed information about segregated accounts, compensation schemes, and financial safeguards that protect client deposits. The absence of clear information about such protections raises additional concerns about the security of client funds and the broker's commitment to financial transparency.

Company transparency regarding ownership, management, and financial standing appears limited. This makes it difficult for potential clients to assess the stability and credibility of the organization. The lack of detailed corporate information, financial reports, or management profiles contrasts sharply with the transparency standards expected from reputable financial service providers in the modern trading environment.

User Experience Analysis (4/10)

Overall user satisfaction with Swift Trader remains significantly below industry standards. This is reflected in the consistently low rating of 30/1000 across user review platforms. This score indicates widespread dissatisfaction that extends beyond isolated incidents to suggest systematic issues with the broker's service delivery and operational approach.

Interface design and platform usability feedback reveals mixed experiences. Some users find the MetaTrader 5 environment satisfactory while others report difficulties with navigation and functionality. However, platform-specific issues may relate more to Swift Trader's implementation and support rather than inherent MT5 limitations, suggesting potential problems with the broker's technical infrastructure or client onboarding processes.

The registration and account verification process appears to follow standard industry practices, though it's not extensively documented. However, user reports suggest potential delays and complications in account setup procedures that may frustrate new clients seeking to begin trading quickly. Clear documentation about required verification documents and processing timelines remains limited in available sources.

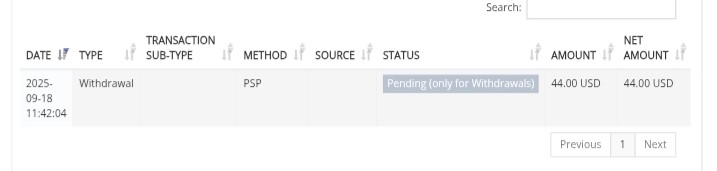

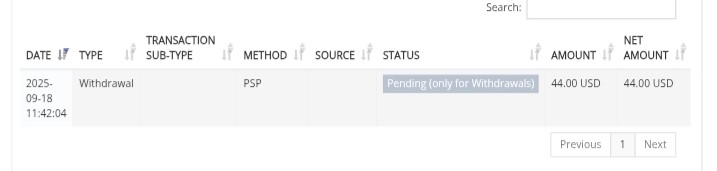

Fund management operations, including deposit and withdrawal procedures, represent a critical aspect of user experience. This lacks comprehensive documentation in available sources. The absence of detailed information about processing times, available payment methods, and associated fees creates uncertainty for potential clients who need to understand the complete cost and convenience of fund operations.

Common user complaints center around legitimacy concerns, service quality issues, and transparency questions. These collectively contribute to the low satisfaction ratings. The pattern of negative feedback suggests that Swift Trader faces significant challenges in meeting basic client expectations for professional service delivery and operational transparency that characterize reputable brokers in the competitive forex market.

Conclusion

This comprehensive swift trader review reveals a broker struggling with fundamental credibility and operational challenges. Potential traders must carefully weigh these against any perceived benefits. Swift Trader offers seemingly attractive conditions such as low spreads starting from 0 and high leverage up to 1:2000, but these marketing features are overshadowed by significant concerns about regulatory oversight, user satisfaction, and operational transparency.

The broker's regulation under MISA, combined with consistently low user ratings of 30/1000, suggests systematic issues. These extend beyond typical service challenges to fundamental questions about legitimacy and reliability. Swift Trader may appeal to high-risk preference traders seeking aggressive leverage and low entry barriers, but such traders should be aware that these features come with substantial risks both from market exposure and potential operational concerns.

The primary advantages of competitive spreads and accessible minimum deposits are significantly outweighed by persistent user complaints. These include service quality issues, transparency problems, and legitimacy questions that permeate available feedback. Potential clients should exercise extreme caution and conduct thorough additional due diligence before considering Swift Trader for their trading needs, particularly given the availability of more established and transparently regulated alternatives in the competitive forex market.