Regarding the legitimacy of LION forex brokers, it provides SFC, MAS, CIMA and WikiBit, (also has a graphic survey regarding security).

Is LION safe?

Pros

Cons

Is LION markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Lion Futures Limited

Effective Date: Change Record

2016-12-29Email Address of Licensed Institution:

cs@liongroup.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.libkr.com.hkExpiration Time:

--Address of Licensed Institution:

香港九龍灣常悅道1號恩浩國際中心 22 樓 F 室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

LION INTERNATIONAL FINANCIAL (SINGAPORE) PTE. LTD.

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

3 PHILLIP STREET #15-04 ROYAL GROUP BUILDING 048693Phone Number of Licensed Institution:

+65 68659159Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Lion Brokers Limited

Effective Date: Change Record

2018-08-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LION Safe or Scam?

Introduction

LION is a brokerage firm that positions itself within the competitive landscape of the foreign exchange (forex) market, offering a range of trading services to clients globally. As the forex market continues to grow, it becomes increasingly crucial for traders to thoroughly evaluate the brokers they choose to work with. Given the prevalence of scams and unregulated entities in this sector, assessing the legitimacy and reliability of a broker like LION is essential for safeguarding investments. This article investigates LION's regulatory status, company background, trading conditions, customer experiences, and overall risk profile to determine whether it is a trustworthy platform or a potential scam.

Regulation and Legitimacy

Regulation is a key factor in determining the safety of a forex broker. Brokers that are regulated by reputable authorities are generally considered safer, as these regulators impose strict compliance standards to protect investors. LION claims to be regulated by multiple authorities, which raises questions about the quality and reliability of its regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | Bid 234 | Hong Kong | Verified |

| Monetary Authority of Singapore (MAS) | CMS101140 | Singapore | Verified |

| Cayman Islands Monetary Authority (CIMA) | 1455005 | Cayman Islands | Verified |

While LION is regulated by the SFC and MAS, which are considered top-tier regulators, it also holds a license from CIMA, an offshore regulator. This dual regulatory status could indicate potential risks, as offshore regulations often lack stringent oversight. Furthermore, LION has faced two regulatory disclosures in 2023, which could be indicative of compliance issues. The presence of both positive and negative regulatory statuses necessitates a careful evaluation of LIONs overall credibility.

Company Background Investigation

LION was established in 2016 and is headquartered in the Cayman Islands, with additional operational bases in Hong Kong and Singapore. The company has made strides in building a presence in the global financial markets, but its relatively short history raises concerns about its long-term viability and reliability.

The management team at LION consists of professionals with backgrounds in finance and trading, but detailed information about their qualifications and experience is not widely available. This lack of transparency regarding the management team may deter potential clients who prioritize a broker's leadership stability and expertise. Furthermore, LION's ownership structure is not clearly disclosed, which is another red flag for potential investors.

Trading Conditions Analysis

LION offers a variety of trading conditions, but a closer examination reveals several areas of concern. The broker's fee structure appears competitive at first glance, but the absence of clear information regarding potential hidden fees is troubling.

| Fee Type | LION | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.3 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | -7.23 to 2.76 | -5.0 to 3.0 |

The spreads offered by LION are relatively in line with industry averages; however, traders must be cautious about the commission structure, which lacks clarity. Additionally, the overnight interest rates could lead to unexpected costs for traders holding positions overnight. This lack of transparency in fees can lead to dissatisfaction among clients who may feel misled about the true cost of trading.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. LION claims to implement measures to protect clients' funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is often contingent upon the regulatory environment in which the broker operates.

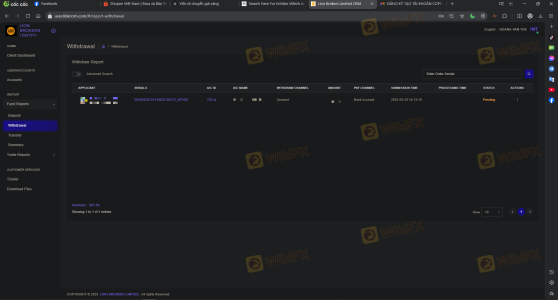

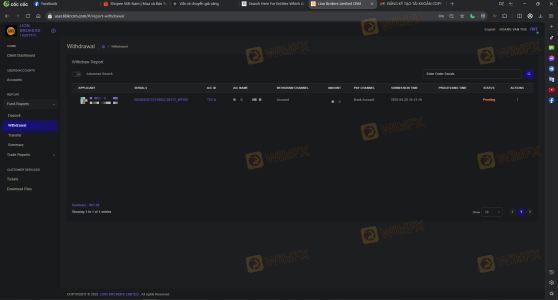

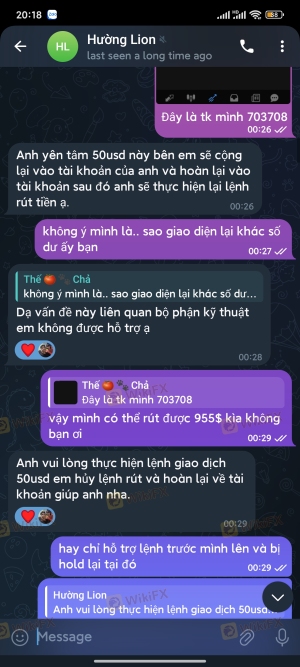

LION's use of segregated accounts is a positive aspect, as it ensures that client funds are kept separate from the broker's operational funds. This practice is essential for minimizing the risk of loss in the event of insolvency. However, there have been historical issues related to fund withdrawals, with complaints from users indicating difficulties in accessing their funds. Such incidents raise concerns about the broker's operational integrity and commitment to client security.

Customer Experience and Complaints

Customer feedback is a vital component of evaluating a broker's reliability. LION has received mixed reviews from clients, with several complaints surfacing regarding withdrawal issues and account restrictions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Restrictions | Medium | Unresponsive |

Common complaints include difficulties in withdrawing funds, with some users reporting that their accounts were blocked after they attempted to withdraw profits. Such experiences can create a negative perception of the broker and may indicate underlying operational issues. In some cases, clients have reported that customer service was unhelpful or slow to respond, exacerbating their frustrations.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for traders. LION utilizes the MetaTrader 4 and 5 platforms, which are industry standards known for their robustness and user-friendly interfaces. However, users have reported varying experiences regarding order execution quality, with some noting instances of slippage and rejected orders.

The reported slippage rates at LION are concerning, as they can significantly impact a trader's profitability, particularly in volatile market conditions. Additionally, there have been allegations of potential platform manipulation, which could further erode trust among users.

Risk Assessment

Engaging with LION involves several risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory status |

| Withdrawal Risk | High | Complaints of fund access issues |

| Transparency Risk | Medium | Lack of clear information |

Given the mixed regulatory status, historical issues with withdrawals, and transparency concerns, traders should approach LION with caution. It is advisable to conduct thorough research and consider alternative brokers with stronger reputations and clearer operational practices.

Conclusion and Recommendations

In conclusion, while LION presents itself as a legitimate broker with regulatory backing, there are significant concerns regarding its operational integrity, transparency, and customer experiences. The presence of regulatory disclosures and customer complaints about fund withdrawals suggest that traders should exercise caution when considering this broker.

For traders seeking reliable alternatives, it may be prudent to explore other brokers that are regulated by top-tier authorities and have positive reputations within the trading community. Options such as brokers regulated by the FCA, ASIC, or SEC may offer more robust protections and a more transparent trading environment. Ultimately, due diligence is essential to ensure the safety of investments in the forex market.

Is LION a scam, or is it legit?

The latest exposure and evaluation content of LION brokers.

LION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LION latest industry rating score is 6.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.