Lion 2025 Review: Everything You Need to Know

Summary

This lion review gives you a complete analysis of Lion forex broker. Lion operates under the Cayman Islands Monetary Authority (CIMA) with license number 321368, which provides regulatory oversight for their business activities. The company works as both a broker and market maker, offering trading services across multiple financial instruments including securities, forex, and commodities such as gold.

Lion's main technology uses the MetaTrader4 platform. They also provide educational resources through Lion Academy, which shows they focus on serving traders who want both strong trading tools and learning opportunities. Our assessment stays neutral because we found limited user feedback and detailed trading condition information in public sources.

Lion works best for new and intermediate traders who want educational resources and a regulated trading environment. The broker's educational program through Lion Academy shows they care about trader development, while the MT4 platform gives you industry-standard trading tools. However, you should know that complete details about account conditions, fee structures, and user experiences need more research directly with the broker.

Important Notice

This evaluation recognizes that regulatory frameworks and service offerings can vary across different jurisdictions. The Cayman Islands regulatory environment may differ significantly from other major financial centers, which could affect the scope of investor protections and operational standards available to international clients.

Our assessment method relies mainly on publicly available regulatory documentation and platform feature information. We found limited verified user testimonials and detailed trading condition data, so this review may not capture the complete user experience spectrum. You should conduct additional research and consult multiple sources before making trading decisions.

Rating Framework

Broker Overview

Lion forex broker operates from the Cayman Islands. The company works as both a brokerage service provider and market maker in the financial trading sector, which means they provide liquidity for client trades while also offering brokerage services across multiple asset classes. Lion has established its regulatory foundation through licensing with the Cayman Islands Monetary Authority, positioning itself within an offshore financial jurisdiction known for its business-friendly regulatory approach.

The broker's services include securities trading, foreign exchange markets, and commodity trading with particular focus on gold trading capabilities. Lion's technology centers on the widely-recognized MetaTrader4 platform, which gives clients industry-standard charting, analysis, and order execution tools. The broker has also developed Lion Academy as an educational resource, suggesting they focus on trader development and long-term client relationships rather than purely transactional business models.

Regulatory Jurisdiction: Lion operates under the supervision of the Cayman Islands Monetary Authority (CIMA) with license number 321368. This provides a legal framework for its operations within this offshore financial center.

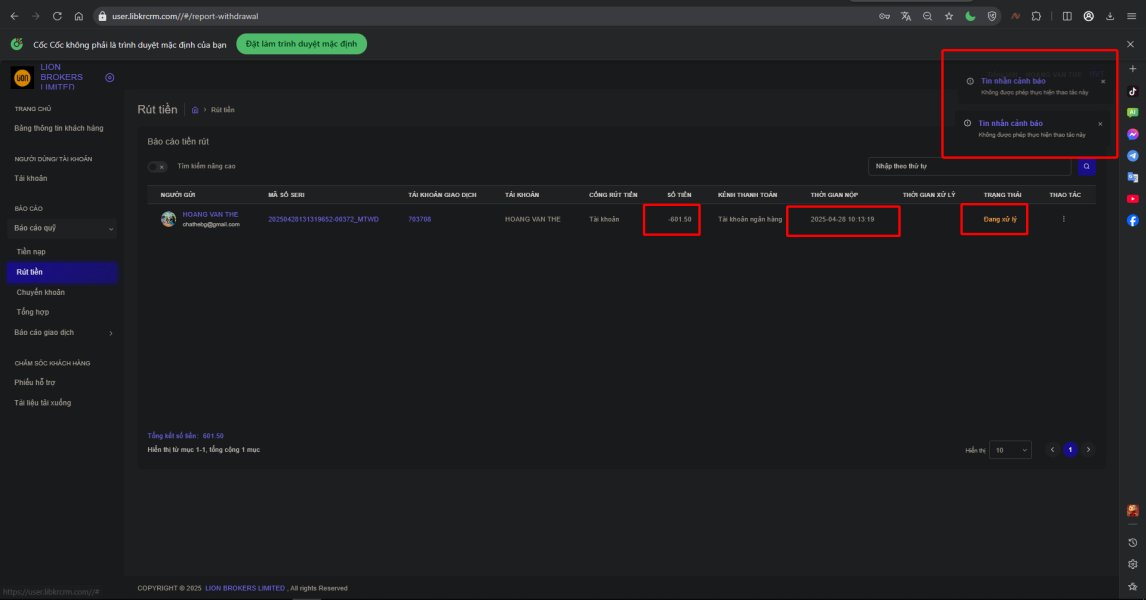

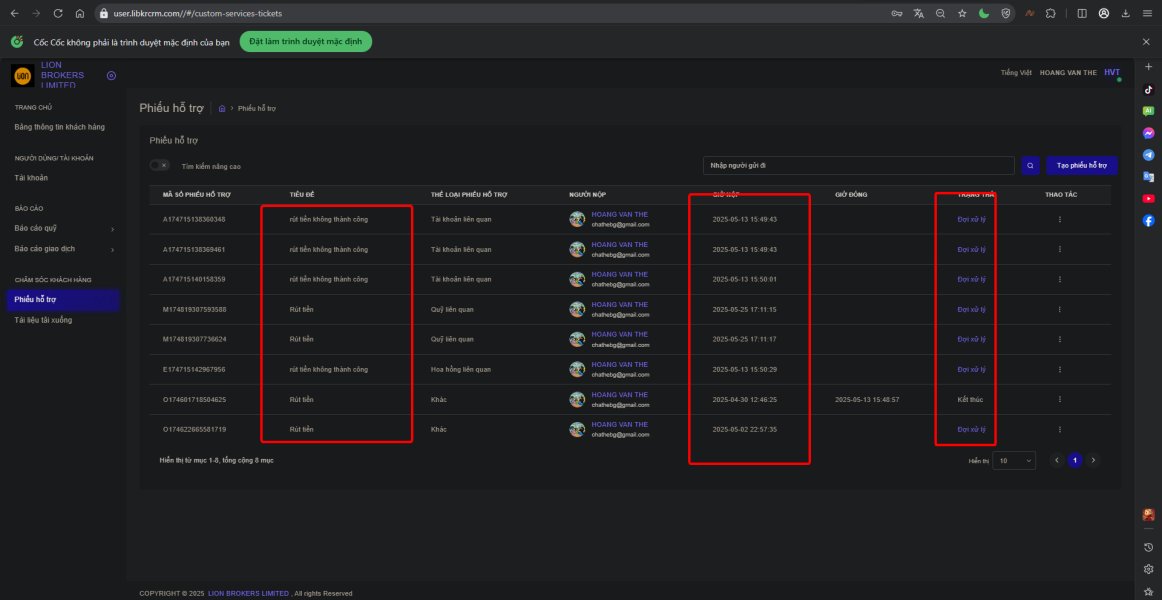

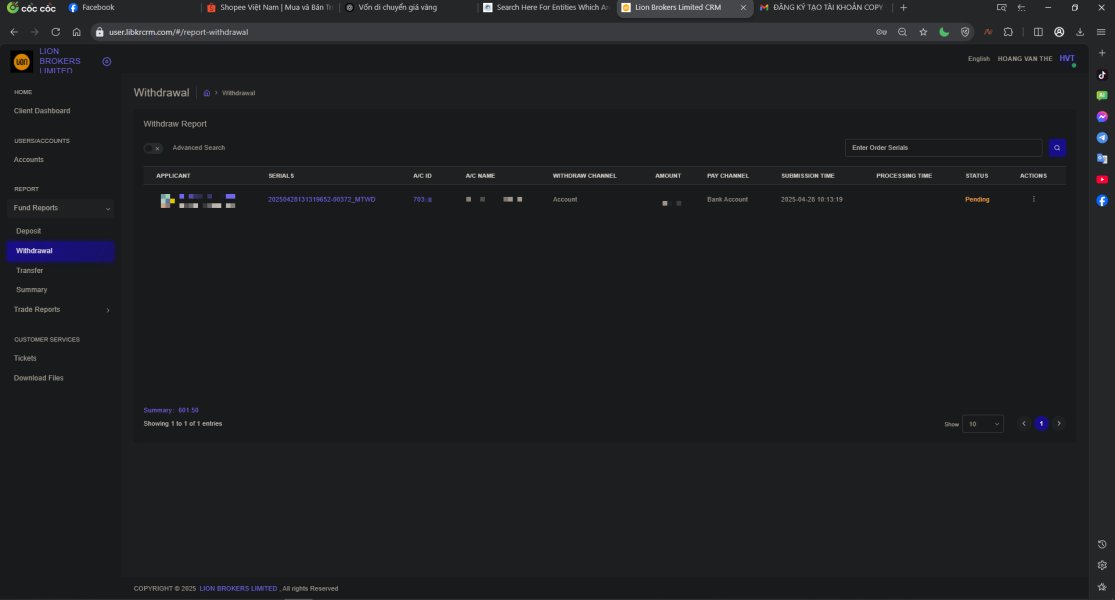

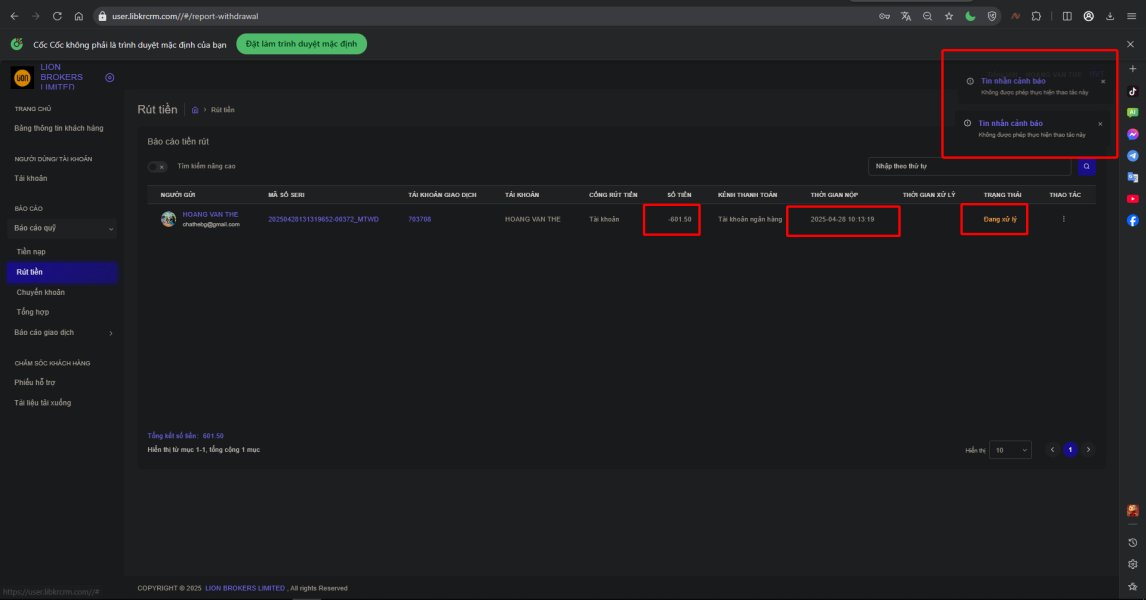

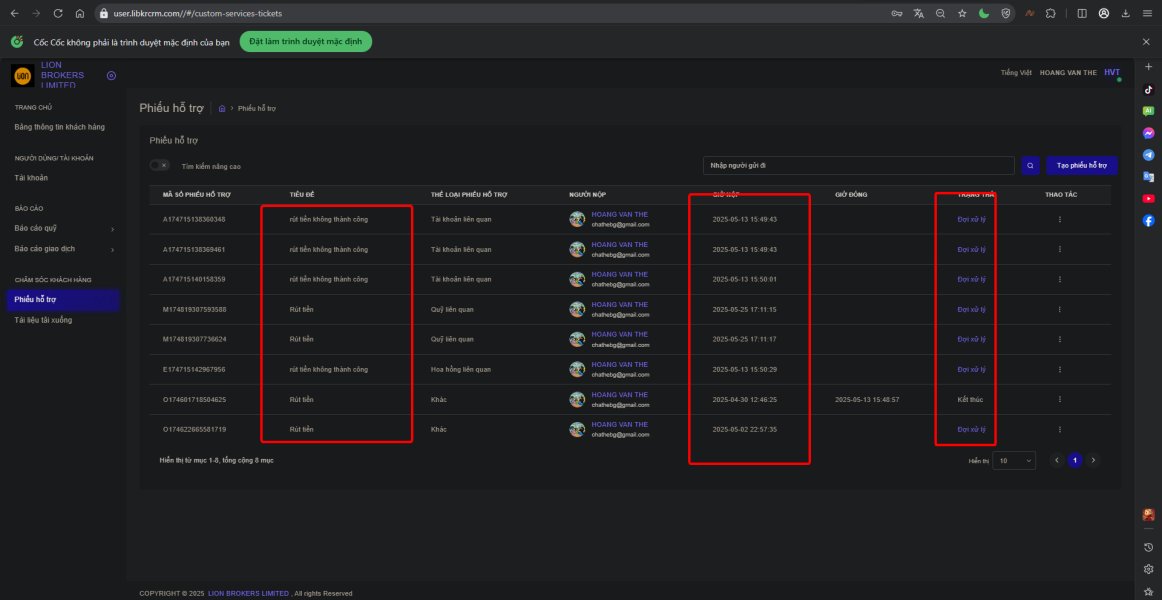

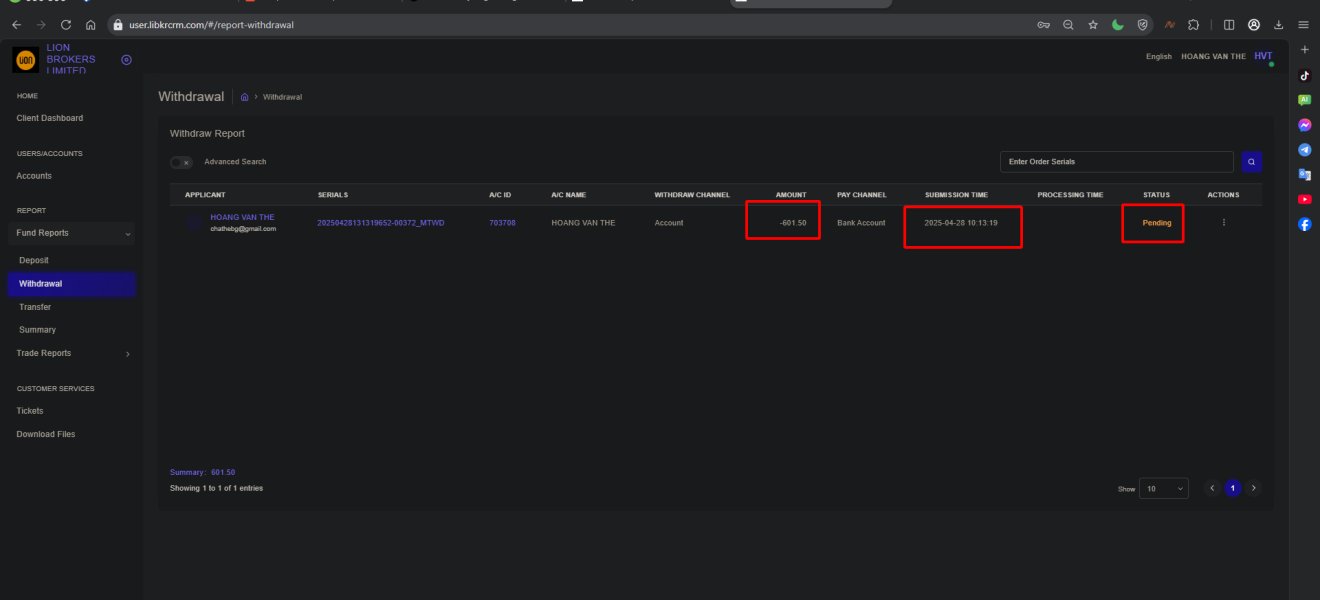

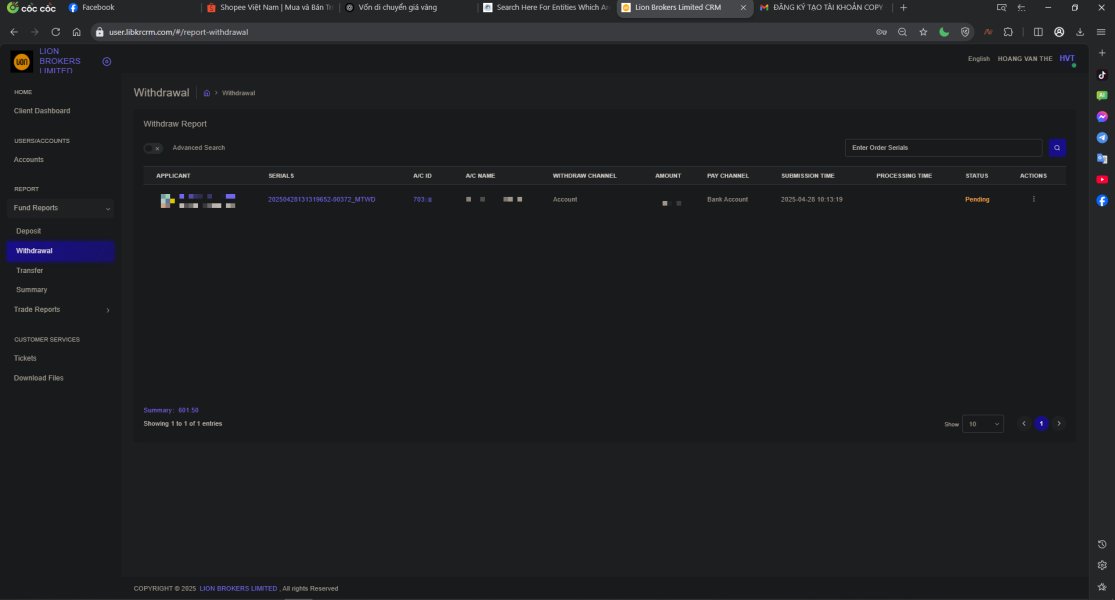

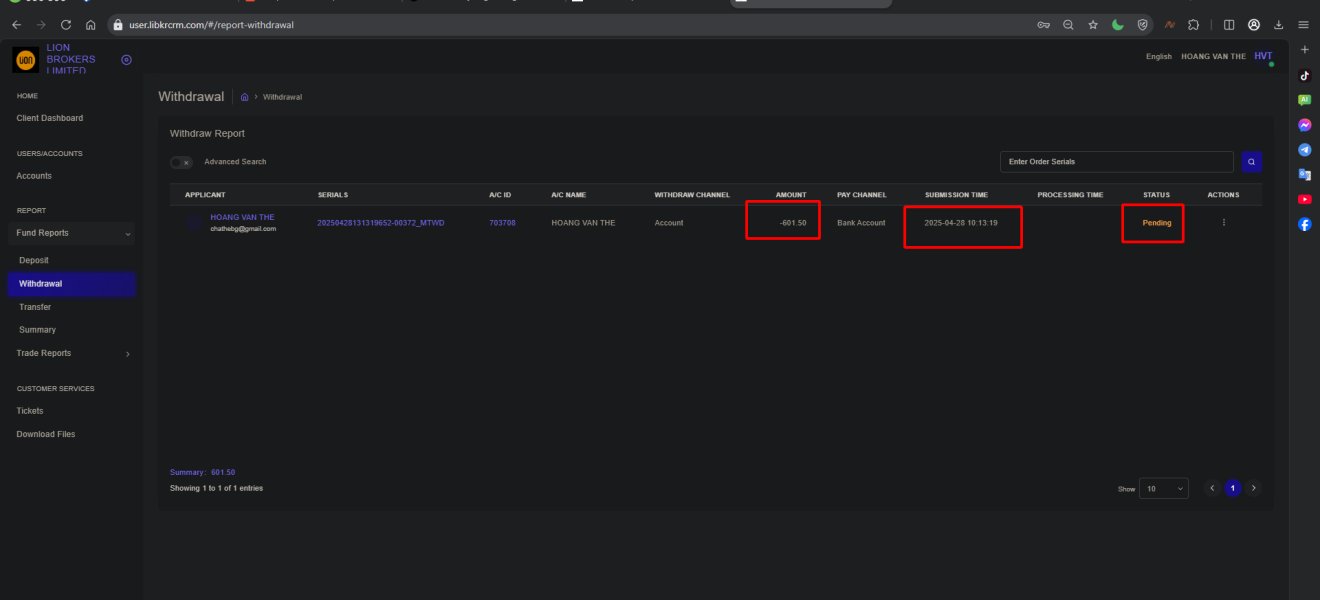

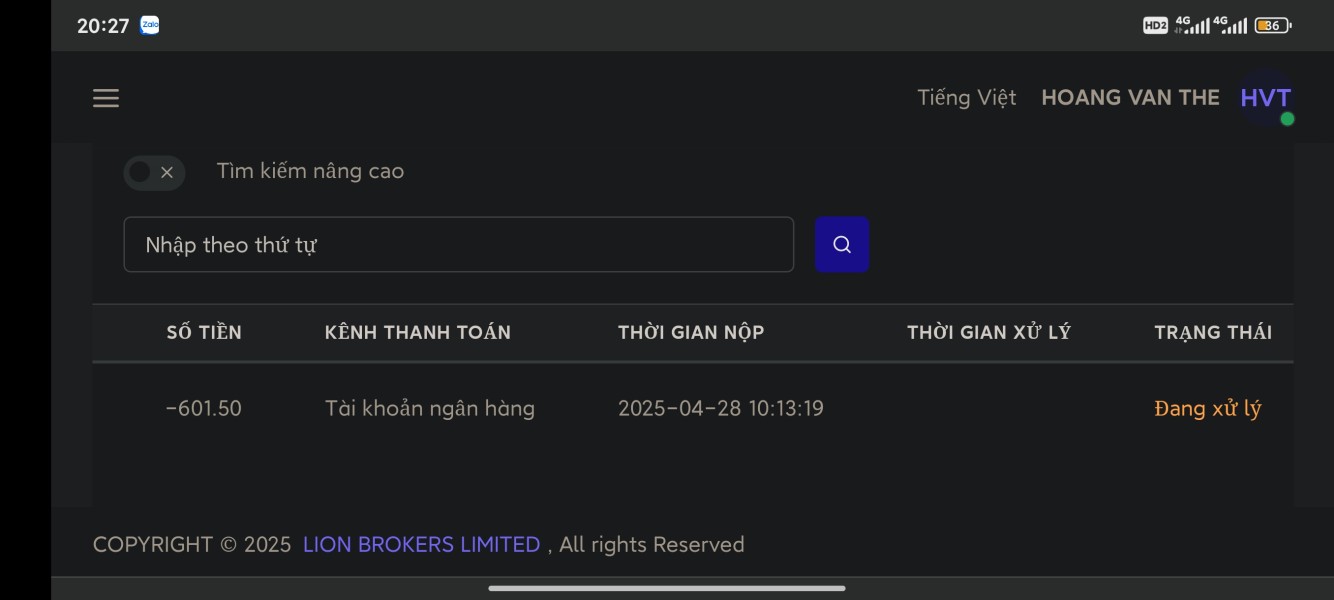

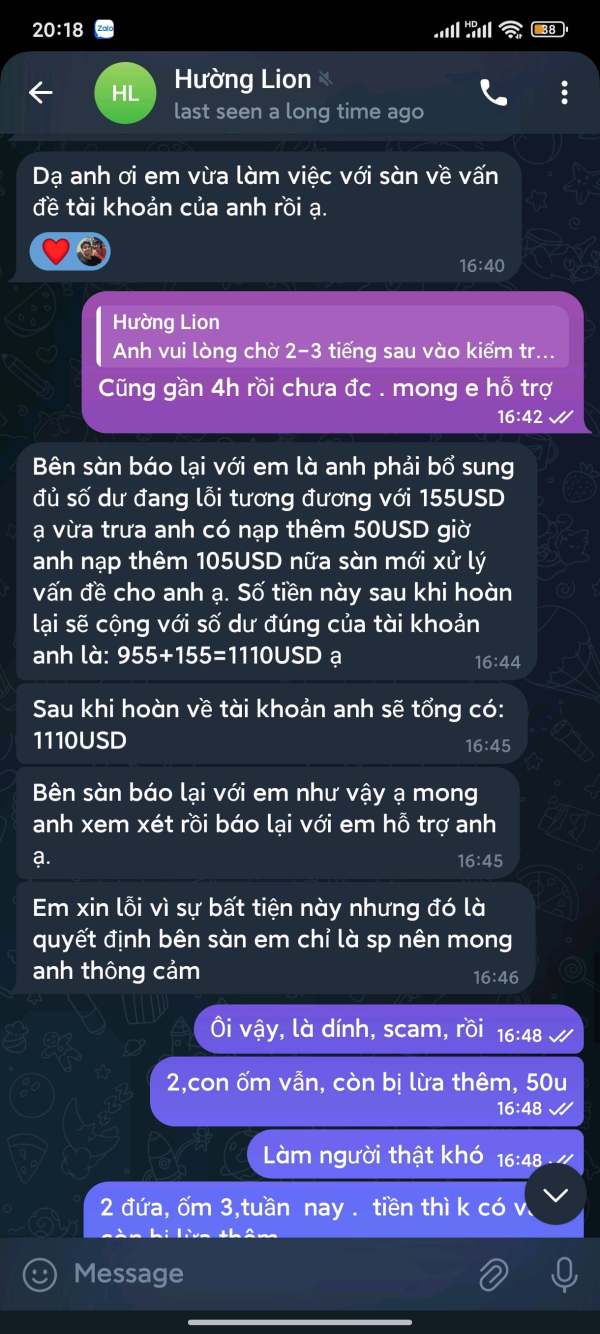

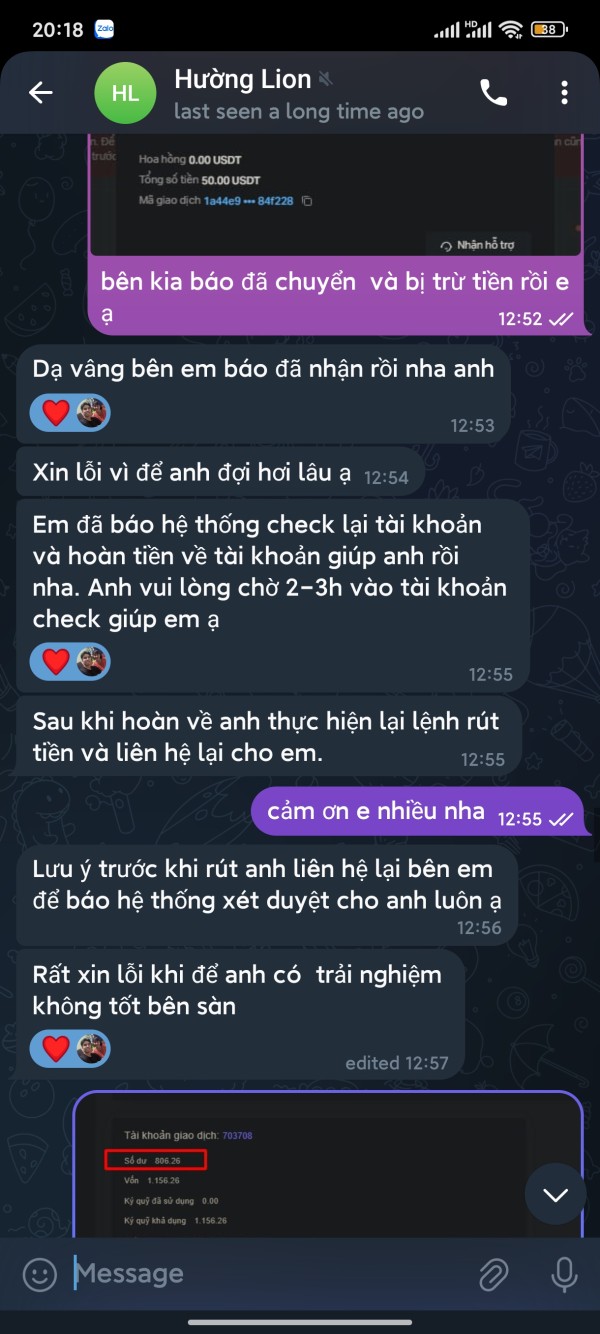

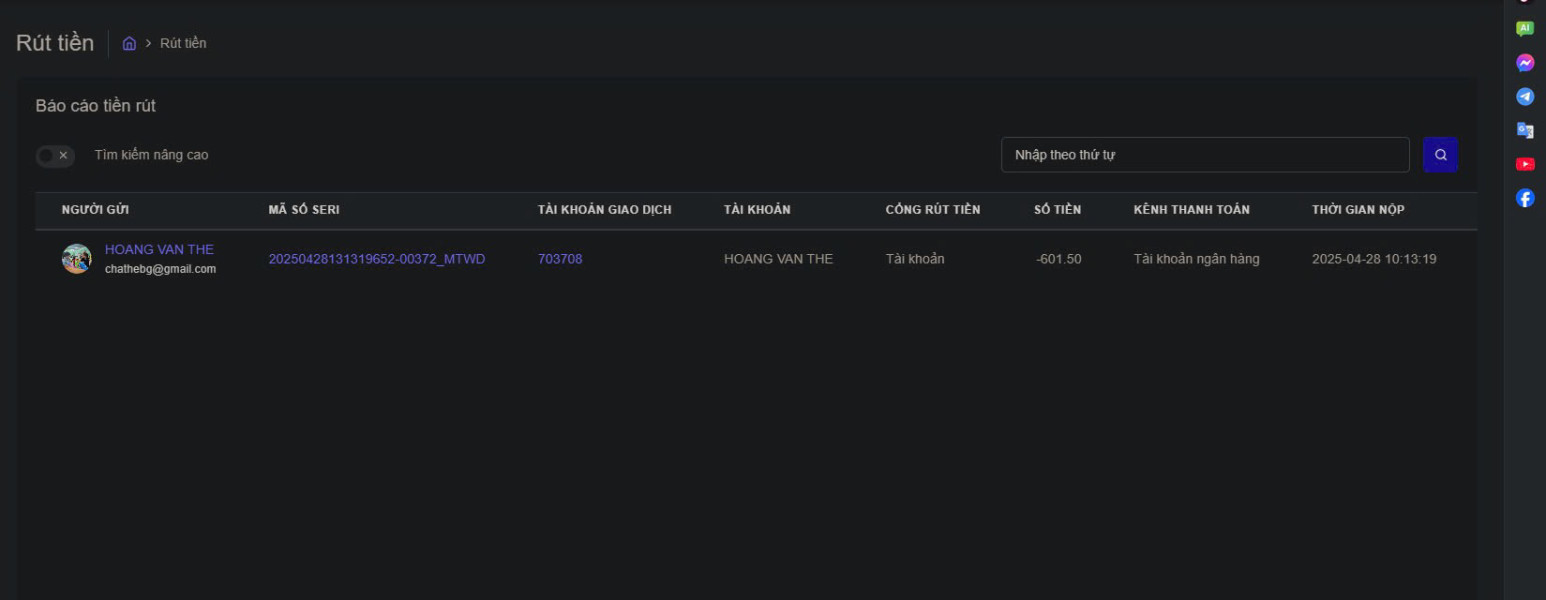

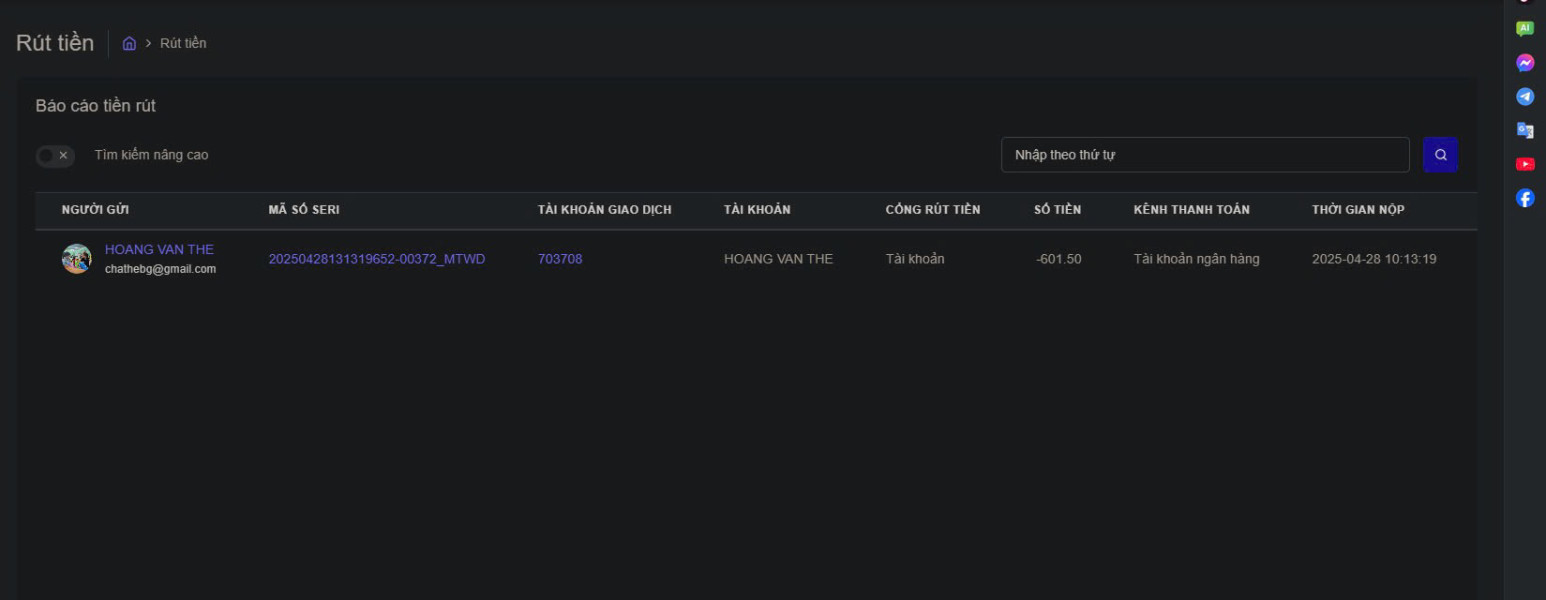

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes is not detailed in currently available documentation.

Minimum Deposit Requirements: The broker's minimum deposit amounts are not specified in accessible materials. You need to contact them directly for this information.

Bonus and Promotional Offers: Details about promotional campaigns or bonus structures are not mentioned in available sources.

Tradeable Assets: Lion provides access to securities markets, foreign exchange trading, and commodity trading with specific mention of gold trading opportunities.

Cost Structure: Complete fee schedules, spread information, and commission structures are not detailed in publicly available materials.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current documentation.

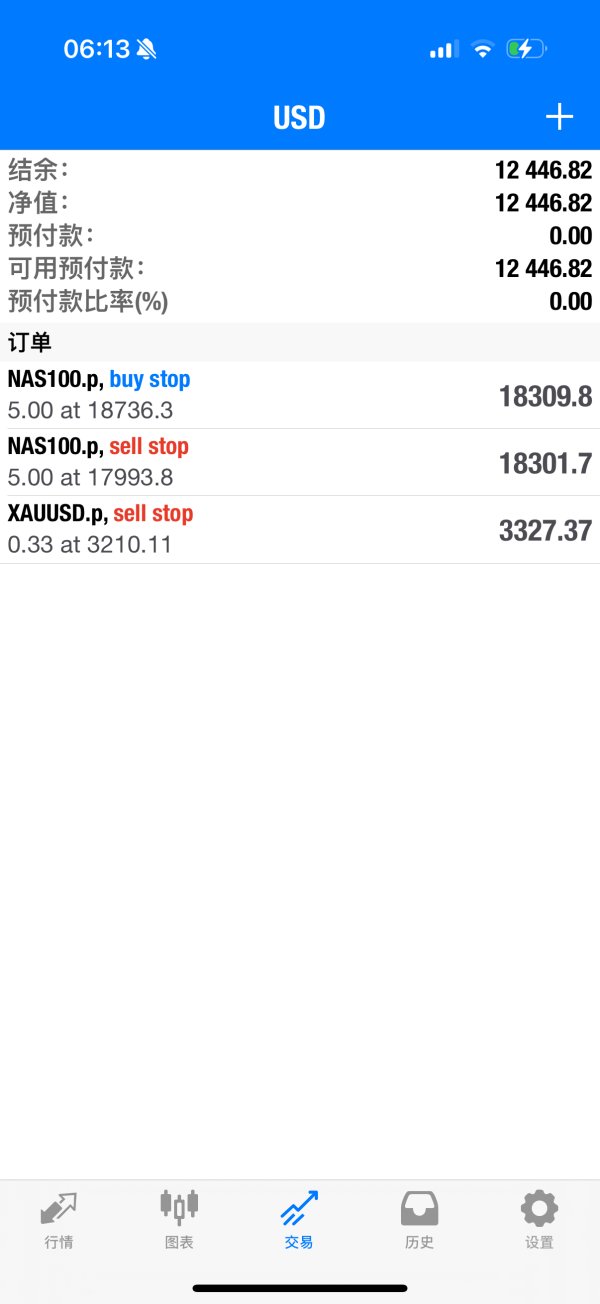

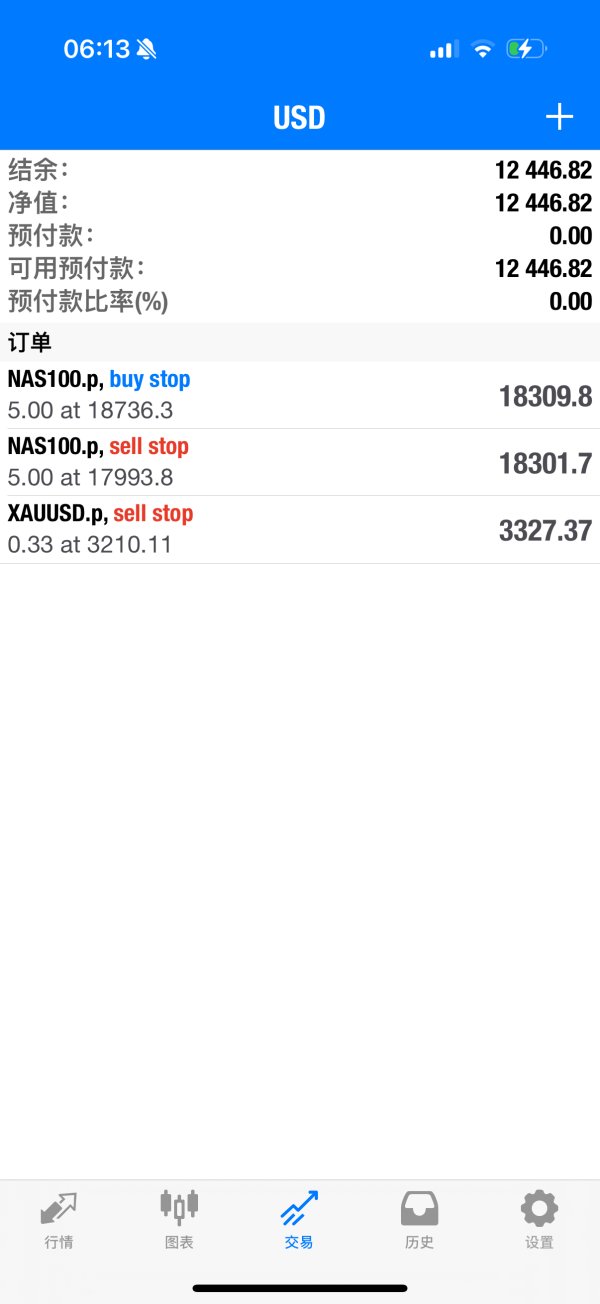

Platform Options: The broker provides MetaTrader4 as its primary trading platform. This offers complete charting and analytical capabilities for traders.

Geographic Restrictions: Specific jurisdictional limitations or restricted territories are not outlined in available information.

Customer Support Languages: Language support options for customer service are not detailed in accessible materials.

This lion review shows that while basic operational information is available, many important trading details require direct communication with the broker for clarification.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Lion's account conditions faces significant limitations because of insufficient publicly available information about account structures and requirements. Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread configurations, and feature sets, but Lion's specific account architecture remains undisclosed in accessible documentation.

Potential clients cannot properly assess whether Lion's account conditions align with their trading capital and strategy requirements without detailed information about account types, minimum funding requirements, or tier-specific benefits. The absence of information about Islamic accounts, professional trader classifications, or institutional account options further limits our ability to evaluate how well the broker accommodates diverse trader needs.

Account opening procedures, verification requirements, and documentation standards also lack detailed public disclosure. This information gap represents a significant consideration for traders who prioritize transparency in account setup processes and ongoing account management requirements.

This lion review cannot provide a definitive account conditions rating because of these information limitations. You need to consult directly with the broker to understand specific account offerings and requirements.

Lion demonstrates a solid foundation in trading tools through its MetaTrader4 platform implementation. This provides traders with industry-standard functionality including advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, which represents a significant strength in Lion's technological offering.

The broker's educational initiative through Lion Academy suggests they are committed to trader development beyond basic platform provision. Educational resources can significantly impact trader success rates, particularly for beginning and intermediate market participants who benefit from structured learning programs and market analysis guidance.

However, the specific scope and quality of Lion Academy's educational content requires further investigation. We don't know whether it offers live webinars, market analysis, trading signals, or comprehensive course structures, and the absence of detailed information about research resources, market commentary, or analytical tools beyond the standard MT4 package limits our ability to fully assess the broker's value proposition in this area.

Additional trading tools such as VPS services, advanced order types beyond MT4 standards, or proprietary analytical software are not mentioned in available documentation. This suggests a relatively standard tool offering focused primarily on the MT4 ecosystem.

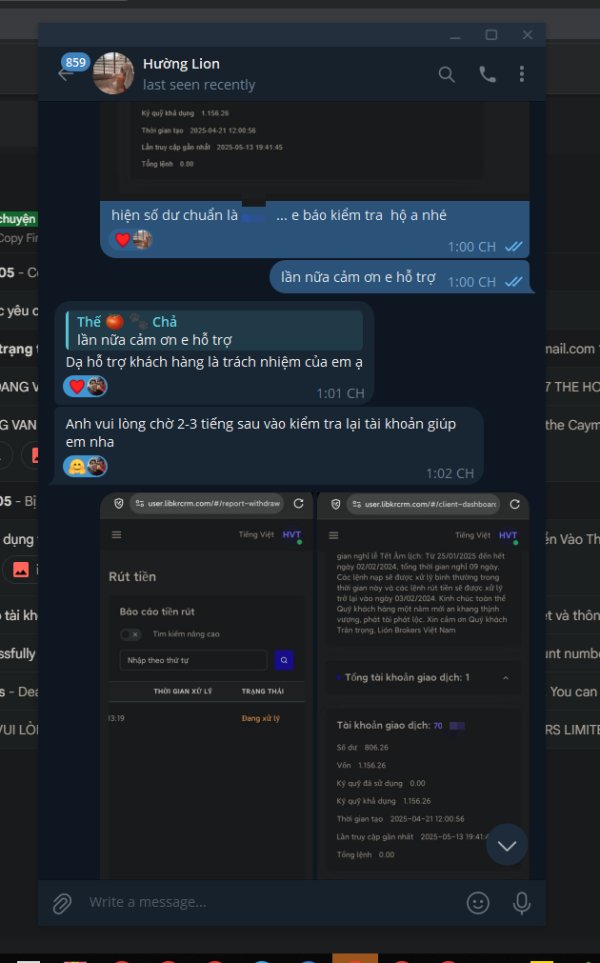

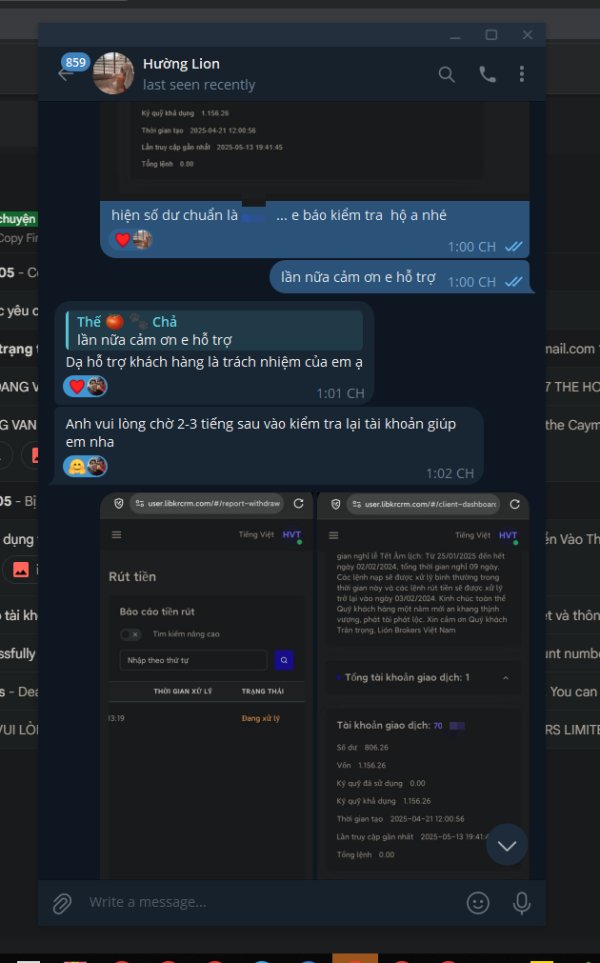

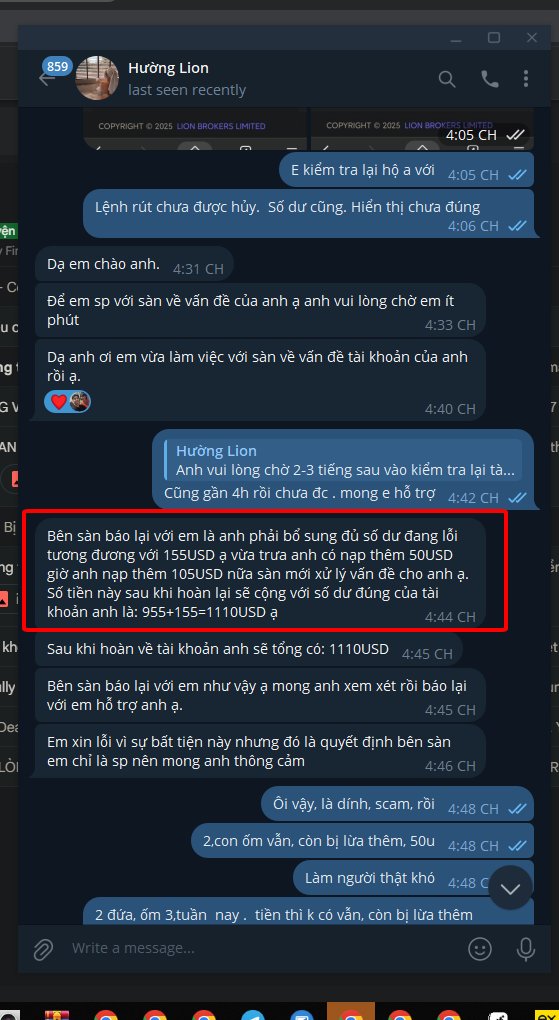

Customer Service and Support Analysis

The assessment of Lion's customer service capabilities faces substantial limitations because of the absence of detailed support structure information in publicly available sources. Effective customer support represents a crucial element in forex brokerage services, particularly given the 24-hour nature of global currency markets and the technical complexity of trading platforms.

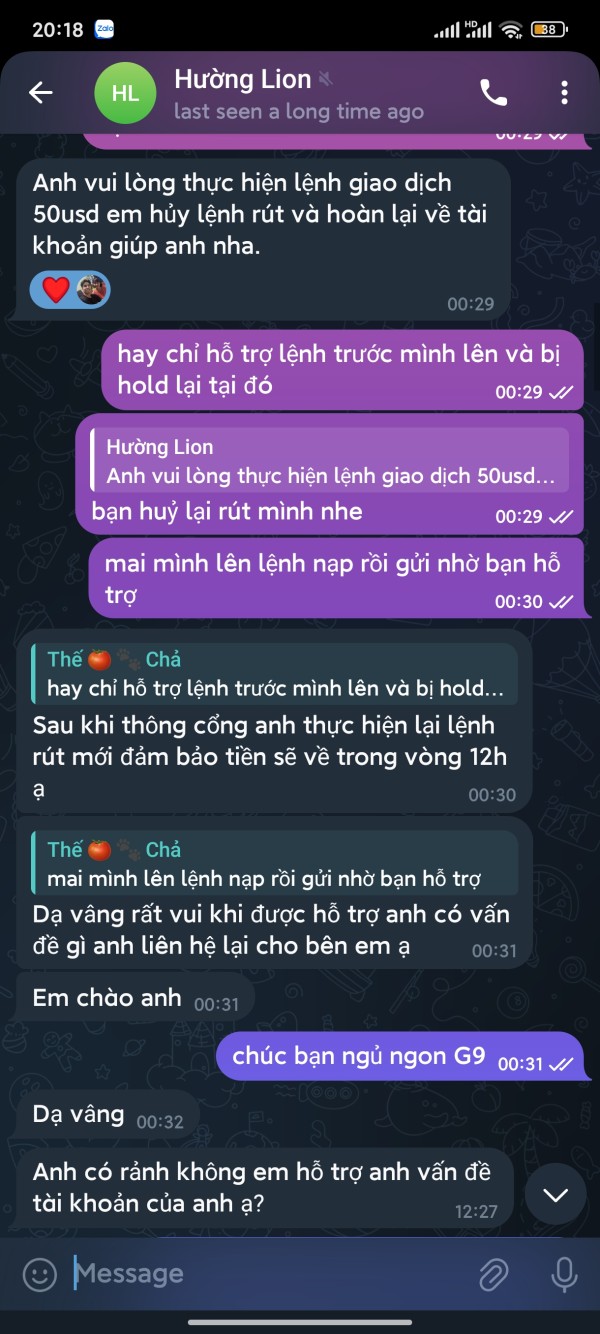

Standard industry practices include multiple communication channels such as live chat, telephone support, email ticketing systems, and potentially social media engagement. However, Lion's specific support channel availability, operating hours, and response time commitments are not detailed in accessible materials.

Language support capabilities remain unspecified, which could significantly impact international clients' ability to receive effective assistance. Given the global nature of forex markets, multilingual support often determines a broker's accessibility to diverse trader populations.

We cannot evaluate the quality of support staff training, their ability to handle technical platform issues versus account-related inquiries, and escalation procedures for complex problems based on available information. User testimonials or case studies demonstrating problem resolution effectiveness are not present in current documentation.

Trading Experience Analysis

Evaluating Lion's trading experience requires assessment of platform performance, execution quality, and overall trading environment, but available information provides limited insight into these crucial areas. The MetaTrader4 platform foundation suggests standard functionality including real-time price feeds, one-click trading, and comprehensive order management capabilities.

Platform stability and execution speed represent critical factors in trading experience quality, particularly during high-volatility market periods when rapid price movements can significantly impact trade outcomes. However, specific performance metrics, server infrastructure details, or third-party execution quality assessments are not available in current documentation.

Mobile trading capabilities through MT4's mobile applications likely provide basic trading functionality. The quality of mobile implementation, feature completeness compared to desktop versions, and mobile-specific tools or optimizations remain unspecified.

The trading environment's competitiveness depends heavily on factors such as spread consistency, slippage rates, requote frequency, and order rejection rates, none of which are detailed in available materials. Without user feedback or performance statistics, assessing the practical trading experience quality becomes impossible.

This lion review emphasizes that trading experience evaluation requires direct platform testing or access to verified user testimonials to provide meaningful assessment.

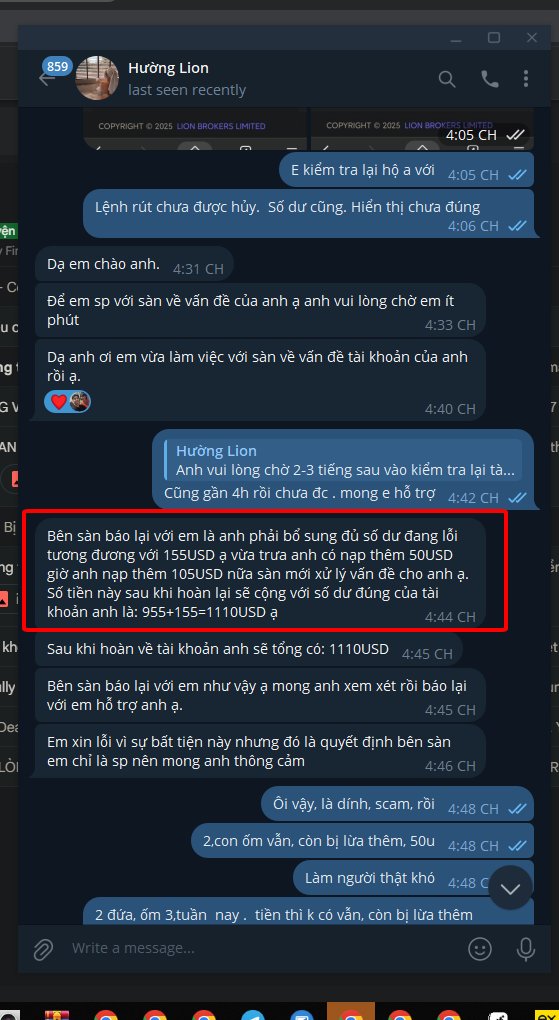

Trust and Reliability Analysis

Lion's regulatory standing with the Cayman Islands Monetary Authority provides a foundation for operational legitimacy. License number 321368 represents formal authorization to conduct financial services within this jurisdiction, and CIMA regulation offers certain operational standards and oversight mechanisms, though the specific investor protection levels may differ from major financial centers like the UK, Australia, or Cyprus.

The Cayman Islands' reputation as an offshore financial center brings both advantages and considerations. While the jurisdiction offers business flexibility and tax efficiency, some traders prefer brokers regulated by tier-one authorities with more comprehensive investor compensation schemes and stricter operational requirements.

Client fund protection measures, segregated account policies, and insurance coverage details are not specified in available documentation. These factors significantly impact the overall security profile of client funds and represent crucial considerations for risk-conscious traders.

The broker's operational transparency could benefit from enhanced public disclosure of company background, management team information, and detailed operational policies. The absence of readily available corporate information may concern traders who prioritize comprehensive research in broker selection.

User Experience Analysis

Assessing Lion's user experience presents challenges because of limited available feedback from actual platform users and the absence of detailed interface design information beyond the standard MetaTrader4 implementation. User experience encompasses multiple touchpoints including account registration, platform navigation, trade execution efficiency, and ongoing account management processes.

The educational focus through Lion Academy suggests recognition of user development needs, particularly for traders who benefit from guided learning experiences and structured market education. This educational emphasis may particularly appeal to beginning and intermediate traders seeking comprehensive broker support beyond pure execution services.

Registration and account verification processes, while not detailed in available materials, represent crucial user experience elements that can significantly impact initial broker interaction quality. Streamlined onboarding procedures and clear verification requirements contribute to positive early user experiences.

The absence of user testimonials, satisfaction surveys, or third-party user experience assessments limits our ability to evaluate real-world user satisfaction levels. Common user concerns, frequently reported issues, or particularly praised features remain unknown based on current information availability.

Interface customization options beyond standard MT4 capabilities, account management portal functionality, and mobile app user experience quality require direct evaluation or access to verified user feedback for meaningful assessment.

Conclusion

This comprehensive lion review reveals a forex broker with legitimate regulatory foundations through CIMA licensing, but significant information gaps limit our ability to provide definitive assessments across multiple crucial evaluation dimensions. Lion's strengths appear to center on regulatory compliance and educational resource provision through Lion Academy, combined with the reliable MetaTrader4 platform infrastructure.

The broker seems most suitable for beginning and intermediate traders who value educational support and prefer regulated trading environments, particularly those comfortable with offshore regulatory jurisdictions. However, the absence of detailed user feedback, specific trading conditions, and comprehensive fee structures makes direct broker consultation necessary for complete evaluation.

You should prioritize obtaining detailed information about account conditions, fee structures, customer support capabilities, and execution quality before making final broker selection decisions. While Lion's regulatory status and educational focus present positive indicators, thorough research remains essential given the limited publicly available operational details.