Errante 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive errante review examines a multi-regulated online broker that has been serving traders since 2019. Errante operates under dual regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. This setup provides traders with multiple layers of protection and diverse trading conditions.

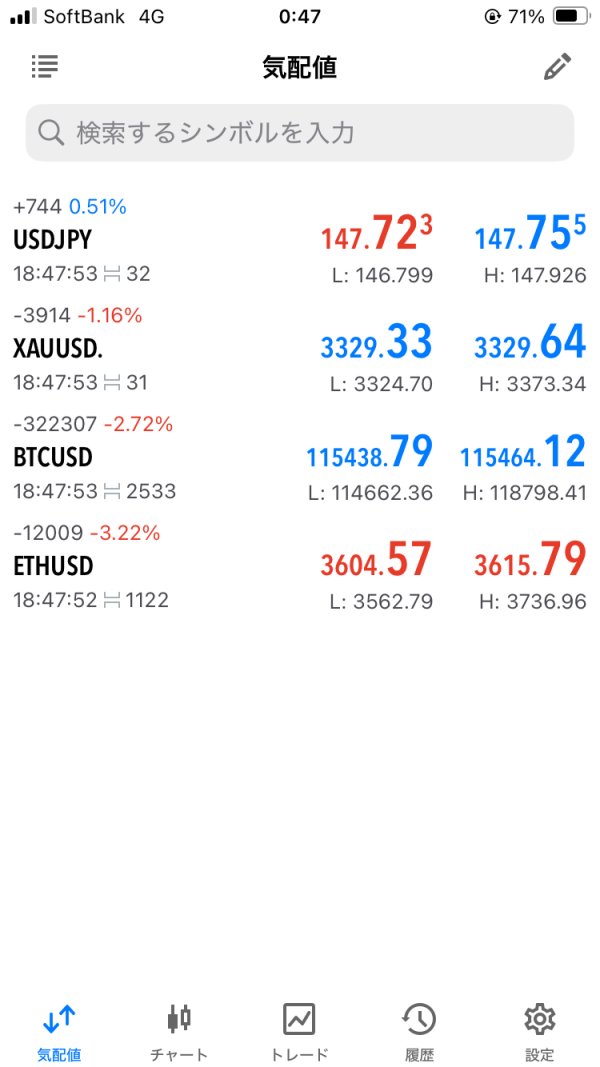

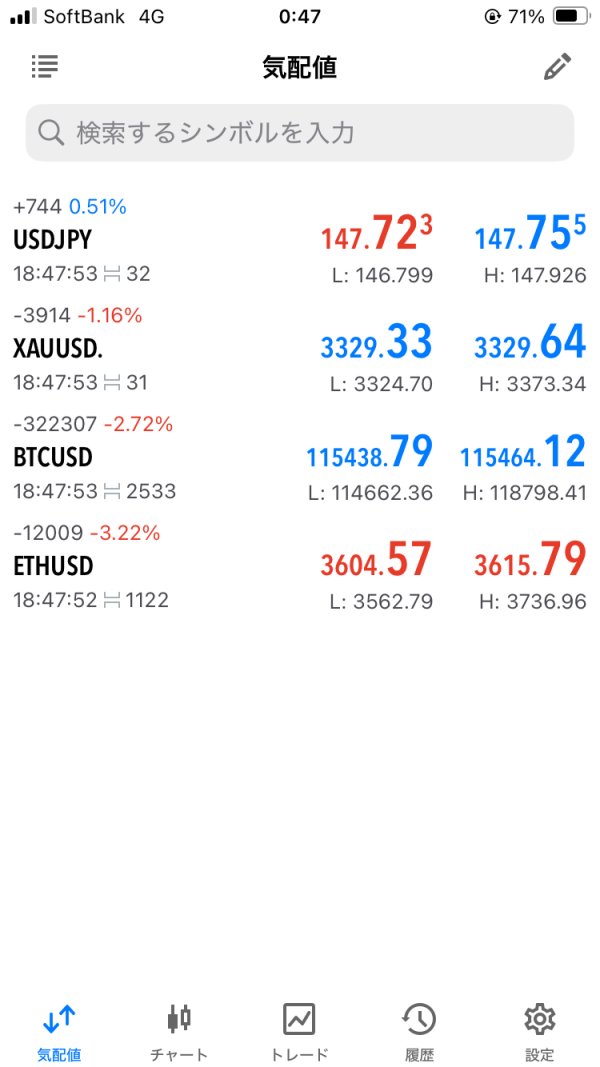

Errante stands out in the competitive brokerage landscape by offering three popular trading platforms - MetaTrader 4, MetaTrader 5, and cTrader. The broker also provides a comprehensive range of financial instruments including forex, CFDs, stocks, commodities, energies, metals, indices, and cryptocurrencies. The broker's flexible leverage structure is particularly noteworthy, offering up to 1:30 under CySEC regulation and up to 1:500 under FSA regulation. This setup caters to traders with varying risk appetites and regulatory preferences.

With a minimum deposit requirement of just $50, Errante positions itself as accessible to both novice and experienced traders. The broker seeks flexibility in their trading tools and leverage options. However, our analysis reveals mixed user feedback, with an overall user rating of 5 out of 10. This rating indicates areas for improvement in service delivery and customer satisfaction.

Important Notice

Regulatory Entity Differences: Errante operates through two distinct legal entities under different regulatory frameworks. Traders must understand that leverage ratios, trading conditions, and client protections may vary significantly between the CySEC-regulated entity (offering 1:30 leverage) and the FSA Seychelles-regulated entity (offering 1:500 leverage). This regulatory structure affects available trading conditions based on your jurisdiction and chosen entity.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, regulatory documentation, official broker information, and market research conducted across multiple independent sources. All data presented reflects publicly available information as of 2025.

Rating Framework

Broker Overview

Errante emerged in the online trading landscape in 2019. The company established its headquarters in Cyprus while building a reputation as a technology-focused brokerage firm. The company operates under the business model of providing multi-asset trading services through advanced technological infrastructure. This positioning places it as a bridge between traditional financial markets and modern trading demands. Errante's approach centers on offering traders maximum flexibility through multiple platform options and diverse regulatory pathways.

The broker's dual-entity structure reflects a strategic approach to serving global markets while maintaining compliance with varying international regulatory standards. This structure allows Errante to offer different trading conditions tailored to specific regional requirements and trader preferences. However, it requires clients to carefully understand which entity and regulatory framework applies to their trading activities.

Errante's trading ecosystem encompasses MetaTrader 4, MetaTrader 5, and cTrader platforms. These platforms provide traders with industry-standard tools alongside competitive trading conditions. The broker offers access to major asset classes including forex pairs, contract for differences (CFDs), individual stocks, commodities, energy products, precious metals, global indices, and cryptocurrency instruments. Under its CySEC and FSA regulatory oversight, Errante maintains operational standards designed to protect client interests while facilitating efficient market access across multiple financial instruments and markets.

Regulatory Jurisdictions: Errante operates under dual regulation through Notely Trading Limited (CySEC license 383/20) and Errante Securities (Seychelles) Ltd (FSA license SD038). This provides comprehensive regulatory coverage across European and international markets.

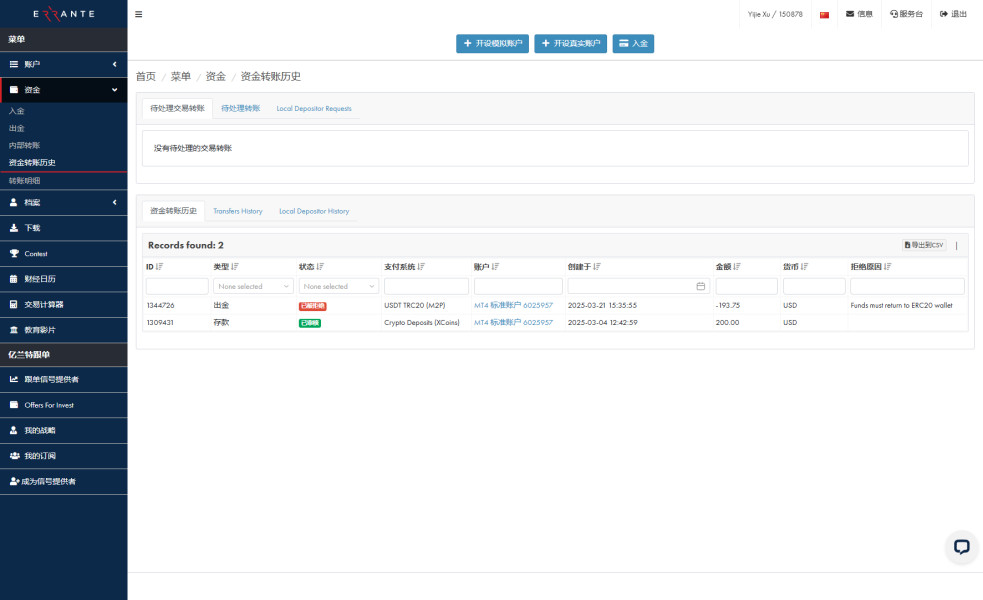

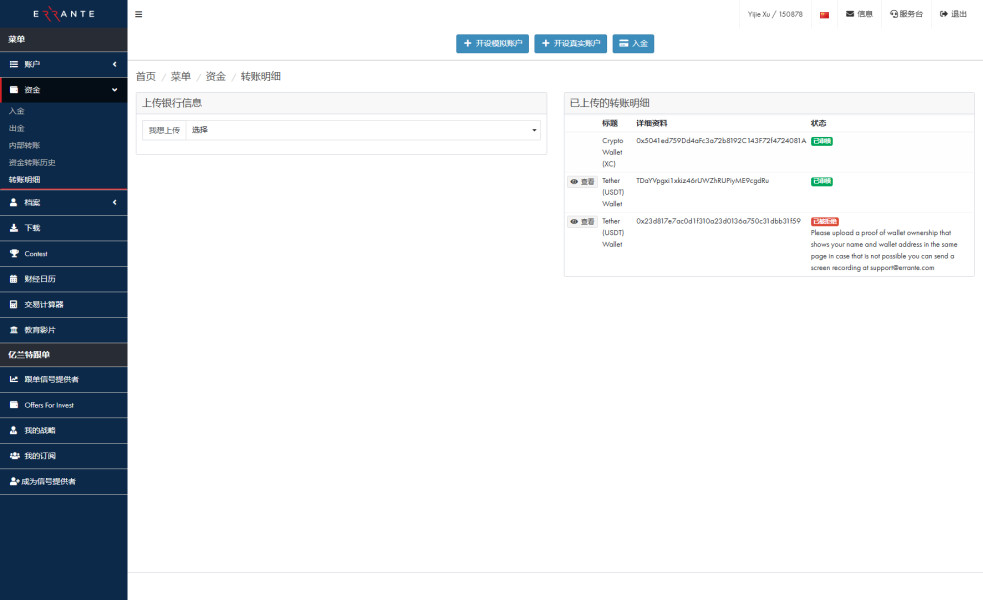

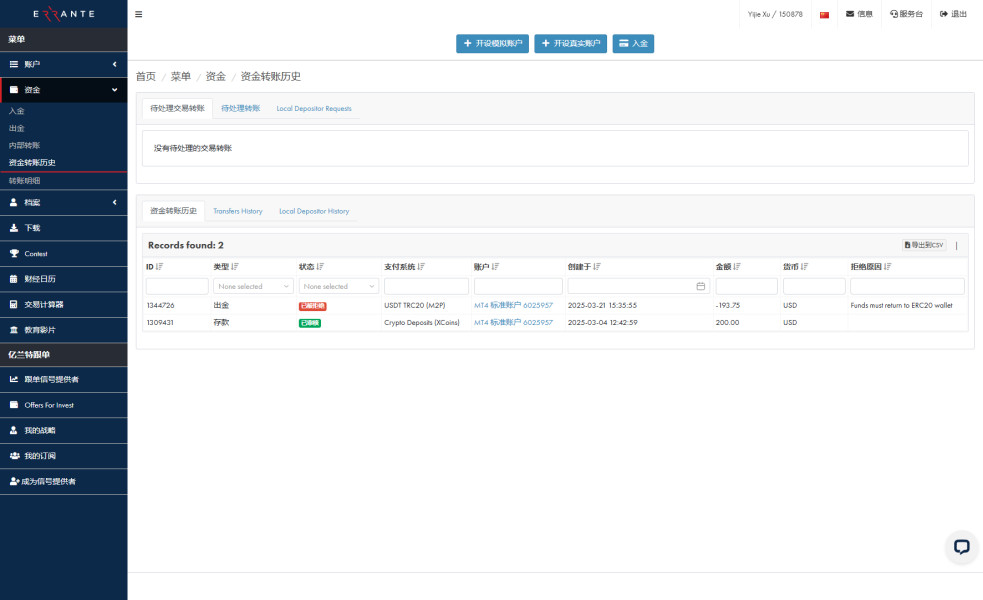

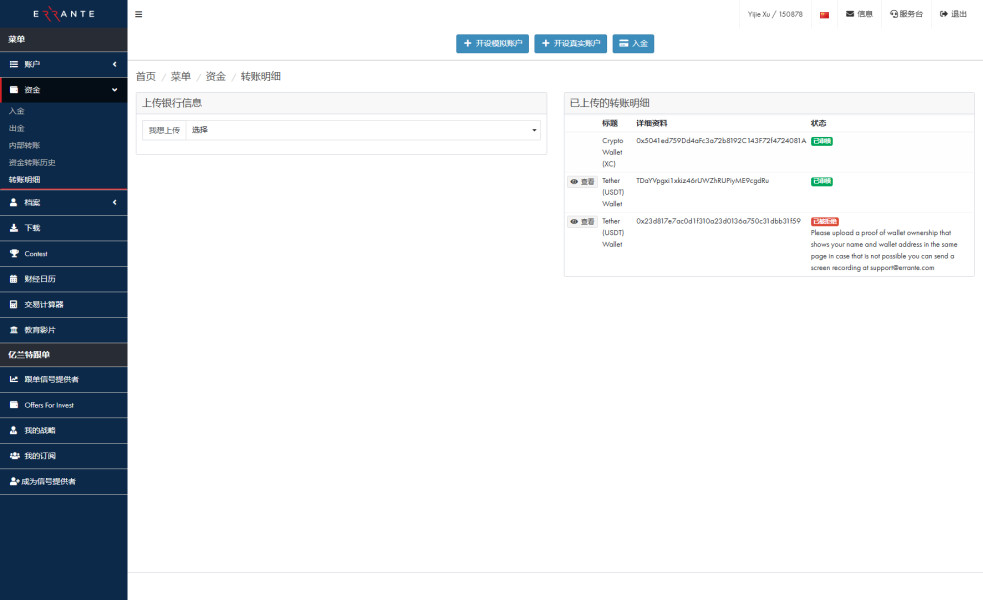

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in available documentation. These require direct verification with the broker.

Minimum Deposit Requirements: The broker maintains an accessible entry point with a minimum deposit of $50 USD. This makes it suitable for traders with varying capital levels.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available materials. These should be confirmed directly with Errante.

Available Trading Assets: The platform provides access to forex currency pairs, CFDs on various underlying assets, individual stocks, commodity futures, energy products, precious metals, major global indices, and cryptocurrency trading instruments.

Cost Structure: Detailed information regarding spreads, commissions, and additional fees requires direct confirmation with the broker. Specific pricing structures are not outlined in available documentation.

Leverage Ratios: CySEC-regulated accounts offer leverage up to 1:30, while FSA-regulated accounts provide leverage up to 1:500. This reflects different regulatory requirements and risk management approaches.

Platform Options: Traders can choose from MetaTrader 4, MetaTrader 5, and cTrader platforms. Each offers distinct features and capabilities for different trading styles.

Geographic Restrictions: Specific jurisdictional limitations and availability restrictions are not detailed in current documentation.

Customer Support Languages: Available language support options are not specified in accessible materials.

This errante review continues with detailed analysis of each rating criterion. It provides comprehensive insight into the broker's offerings and performance across key areas of trader concern.

Account Conditions Analysis (Score: 7/10)

Errante's account structure demonstrates accessibility with its $50 minimum deposit requirement. This positions it favorably for traders seeking low-barrier entry into financial markets. This threshold makes the broker particularly attractive to beginning traders and those looking to test services without significant initial capital commitment. However, specific account types and their distinct features are not detailed in available documentation. This limits our ability to assess the full range of account options.

The broker's dual regulatory structure creates interesting dynamics in account conditions. Traders can potentially access different leverage ratios and protections depending on their chosen regulatory entity. CySEC regulation provides European-standard investor protections with conservative 1:30 leverage, while FSA regulation offers more aggressive 1:500 leverage for traders seeking higher risk-reward ratios.

User feedback regarding account conditions appears mixed. Some traders express satisfaction with the flexibility offered through multiple regulatory options. However, the lack of detailed information about account tiers, special features, or additional services like Islamic accounts limits the comprehensive evaluation of Errante's account offerings. The account opening process specifics are not outlined in available materials. This requires potential clients to engage directly with the broker for complete procedural information.

Compared to industry standards, Errante's minimum deposit sits in the lower range. This makes it competitive with other accessible brokers. However, the absence of detailed account feature descriptions and tier structures suggests that this errante review cannot fully evaluate the complete value proposition of their account conditions without additional information from direct broker sources.

Errante excels in platform diversity by offering three of the industry's most respected trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. This comprehensive platform selection caters to different trading preferences and strategies. It ranges from MT4's widespread familiarity and expert advisor support to MT5's advanced features and cTrader's superior order management capabilities.

The broker's commitment to automated trading is evident through its support for Expert Advisors (EAs) and signal services. This allows traders to implement sophisticated trading strategies and copy trading solutions. This technological infrastructure supports both discretionary and algorithmic trading approaches, appealing to traders across the experience spectrum.

However, specific information about research and analysis resources, educational materials, and market research tools is not detailed in available documentation. This gap prevents a complete assessment of Errante's value-added services beyond platform access. Many successful brokers differentiate themselves through comprehensive educational resources, daily market analysis, and trading tools that extend beyond basic platform functionality.

User feedback suggests satisfaction with the platform variety and functionality. However, detailed assessments of tool quality and resource depth are limited in available reviews. The absence of information about proprietary tools, market analysis, or educational content represents a significant gap in evaluating Errante's complete offering to traders seeking comprehensive support beyond basic market access.

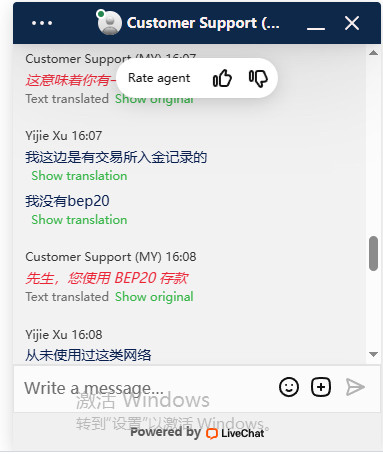

Customer Service and Support Analysis (Score: 6/10)

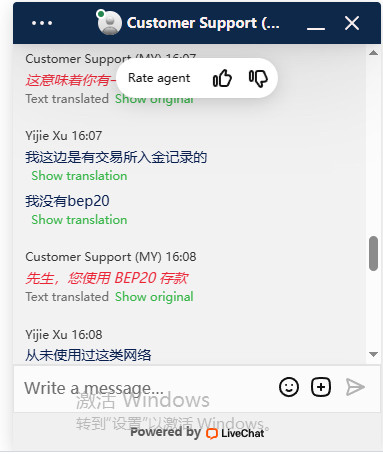

Customer service represents a notable area of concern in this errante review. Available user feedback indicates inconsistent service quality and mixed customer satisfaction levels. While specific customer service channels, availability hours, and response time metrics are not detailed in accessible documentation, user reports suggest variability in support quality and responsiveness.

The lack of detailed information about customer service infrastructure limits comprehensive evaluation of Errante's support capabilities. This includes available communication channels, multilingual support options, and service hours. Professional brokers typically provide multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections, but Errante's specific offerings in these areas require direct verification.

User feedback compilation reveals divided opinions about service quality. Some clients report satisfactory interactions while others express dissatisfaction with support responsiveness and problem resolution efficiency. This mixed feedback pattern suggests inconsistency in service delivery that could impact overall client experience and satisfaction.

The absence of detailed case studies, response time guarantees, or service level commitments in available materials indicates that potential clients should carefully evaluate support quality during initial interactions. Effective customer service is crucial for traders who may need urgent assistance with account issues, technical problems, or trading-related inquiries. This makes it an important consideration for prospective Errante clients.

Trading Experience Analysis (Score: 7/10)

The trading experience at Errante centers around its multi-platform approach. This offers traders flexibility in choosing their preferred trading environment. MetaTrader 4 and MetaTrader 5 provide familiar interfaces for traders accustomed to these industry standards, while cTrader offers advanced order management and superior charting capabilities for more sophisticated trading strategies.

Platform stability and execution quality metrics are not specifically detailed in available documentation. However, user feedback suggests generally satisfactory performance across the offered platforms. The broker's ability to provide multiple platform options indicates technological capability and commitment to meeting diverse trader preferences and requirements.

However, specific information about order execution speeds, slippage rates, requote frequency, and platform uptime statistics is not available in current documentation. These technical performance metrics are crucial for active traders and scalpers who depend on reliable, fast execution for their trading strategies.

Mobile trading experience details are not specified in available materials. This represents a significant information gap given the importance of mobile trading capabilities in today's market environment. Most professional traders require seamless mobile access for position monitoring and trade management, making mobile platform quality an important consideration that requires direct evaluation with Errante's offerings.

The overall trading environment assessment suggests competence in platform provision. However, the lack of detailed performance metrics and mobile trading information limits complete evaluation of the trading experience quality that this errante review can provide.

Trust and Reliability Analysis (Score: 8/10)

Errante's regulatory framework provides a solid foundation for trust and reliability through its dual regulation by CySEC and FSA. The Cyprus Securities and Exchange Commission regulation offers European Union-standard investor protections, while FSA Seychelles regulation provides international oversight. This creates multiple layers of regulatory accountability.

CySEC License 383/20 held by Notely Trading Limited ensures compliance with MiFID II regulations. This provides client fund segregation, investor compensation scheme participation, and strict operational oversight. Similarly, FSA License SD038 held by Errante Securities (Seychelles) Ltd provides international regulatory standards and oversight, though with different protection mechanisms than European regulation.

The regulatory verification confirms active licensing status for both entities. This indicates ongoing compliance with respective regulatory requirements. However, specific information about client fund protection measures, segregated account arrangements, and insurance coverage is not detailed in available documentation. This limits complete assessment of financial security measures.

Company transparency regarding ownership structure, financial backing, and operational history beyond the 2019 founding date is not extensively documented in available materials. While regulatory oversight provides fundamental protection, additional transparency about company structure and financial stability would enhance the overall trust assessment for potential clients considering Errante's services.

User Experience Analysis (Score: 6/10)

User satisfaction with Errante presents a mixed picture. An overall user rating of 5 out of 10 reflects divided opinions about the broker's service quality and performance. This moderate rating suggests that while some clients find satisfactory value in Errante's offerings, others experience issues that impact their overall satisfaction with the broker.

Available user feedback indicates that Errante appeals primarily to traders seeking flexibility in leverage options and trading tools. This particularly includes those who value the ability to choose between different regulatory frameworks and platform options. However, the same feedback reveals concerns about service consistency and customer support quality that affect overall user experience.

Interface design and platform usability details are not specifically addressed in available user reviews. However, the provision of multiple established platforms suggests adequate functionality for most trading needs. The registration and verification process specifics are not detailed in accessible documentation. This requires direct experience or broker contact for complete procedural understanding.

Common user complaints center around customer service responsiveness and support quality. This indicates areas where Errante could improve client satisfaction. The mixed feedback pattern suggests that user experience may vary significantly based on individual needs, chosen regulatory entity, and specific service interactions, making personal evaluation important for prospective clients.

Conclusion

This comprehensive errante review reveals a multi-regulated broker that offers solid regulatory foundations and platform diversity while facing challenges in service consistency and customer satisfaction. Errante's dual regulatory structure through CySEC and FSA provides flexibility for different trader preferences and regulatory requirements. This is supported by competitive minimum deposit requirements and multiple platform options.

The broker appears most suitable for intermediate traders who value regulatory choice and platform flexibility over premium service features and comprehensive support resources. Errante's strength lies in its accessible entry requirements, multiple platform options, and flexible leverage structures. This makes it potentially attractive for traders who prioritize trading condition flexibility over extensive educational resources or premium customer service.

Primary advantages include low minimum deposits, multiple regulatory options, diverse platform selection, and flexible leverage ratios. Notable limitations encompass inconsistent customer service feedback, limited information about additional resources, and mixed user satisfaction ratings that suggest room for service improvement across multiple operational areas.