Regarding the legitimacy of RIFA FINANCE forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is RIFA FINANCE safe?

Business

Risk Control

Is RIFA FINANCE markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Rifa Futures Limited

Effective Date:

2008-12-01Email Address of Licensed Institution:

compliance@rffg.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.rffg.com.hkExpiration Time:

--Address of Licensed Institution:

香港軒尼詩道28號7樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Rifa A Scam?

Introduction

Rifa, officially known as Rifa Technology Company Limited, is a brokerage firm that positions itself within the forex trading market, offering a variety of trading instruments including forex currency pairs, precious metals, crude oil, and CFDs. As the forex market continues to grow, the presence of numerous brokers like Rifa has increased, making it crucial for traders to exercise caution and conduct thorough evaluations before engaging with any trading platform. The potential for scams and fraudulent activities is significant in the unregulated trading environment, leading to the necessity for traders to assess the legitimacy and safety of brokers rigorously.

In this article, we will analyze Rifa's regulatory status, company history, trading conditions, customer experiences, and overall risk to determine if Rifa is a safe trading platform or if it exhibits characteristics of a scam. Our investigation is based on various online resources, user reviews, and regulatory information, providing a comprehensive overview of Rifa's operations and credibility.

Regulation and Legitimacy

The regulatory status of a brokerage is a vital indicator of its legitimacy. Rifa currently operates under an NFA unauthorized regulatory status, which raises significant concerns regarding its compliance with established financial regulations. This lack of regulatory oversight can expose traders to substantial risks, including the potential for fraud and mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

The absence of proper regulation means that Rifa does not adhere to the stringent guidelines set by major financial authorities. This lack of oversight can lead to a lack of accountability, making it difficult for traders to recover funds in the event of disputes or fraudulent activities. Furthermore, the unavailability of Rifas official website, which has been reported as non-functional, further erodes confidence in its operations.

In addition, there have been multiple complaints and reports from users regarding withdrawal issues and unresponsive customer service, which are red flags that potential traders should consider. Overall, the regulatory landscape surrounding Rifa suggests that it operates in a high-risk environment, making it imperative for traders to be cautious and informed.

Company Background Investigation

Rifa was established with the intent to provide a global trading platform, claiming to cater to various markets. However, the company's history reveals a complex background. Despite being registered in the United Kingdom, Rifa operates primarily in Hong Kong, which raises questions about its operational transparency and corporate governance.

The ownership structure of Rifa is not clearly defined, which can complicate accountability. The management teams background is also obscure, with limited information available regarding their experience and qualifications in the financial sector. This lack of transparency can be concerning for potential investors, as it may indicate a lack of professionalism or expertise in managing a trading platform.

In terms of information disclosure, Rifas practices seem inadequate. The absence of a functional website and clear communication channels hinders potential clients from obtaining essential information about trading conditions, fees, and support services. This opacity can lead to mistrust and uncertainty among traders, further questioning Rifa's credibility and safety.

Trading Conditions Analysis

When evaluating a brokerage, understanding its trading conditions is crucial for assessing its reliability. Rifa offers a low minimum deposit requirement of just $10, which may attract novice traders. However, the overall fee structure and trading conditions remain ambiguous, with limited information available regarding spreads, commissions, and overnight interest rates.

| Fee Type | Rifa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 0.1 - 1.0 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The lack of transparency regarding fees can be a significant concern. Traders may encounter unexpected costs or unfavorable trading conditions that are not clearly outlined. Furthermore, the absence of industry-standard trading platforms like MT4 or MT5 could limit traders' access to essential trading tools and resources.

Additionally, Rifa's high leverage offerings of up to 1:500 can be enticing but also pose substantial risks. High leverage can amplify both profits and losses, making it essential for traders to understand the associated risks before engaging in leveraged trading.

Client Funds Safety

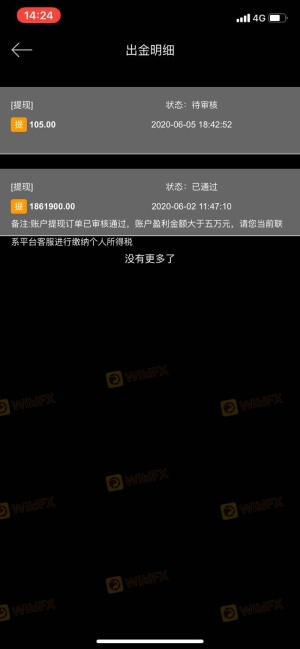

The safety of client funds is a paramount concern for any trading platform. Rifa's measures for safeguarding client funds remain unclear. The company does not provide detailed information regarding fund segregation, investor protection, or negative balance protection policies.

The absence of these critical safety measures can expose traders to significant risks, particularly in the event of financial instability or operational failure. Historical issues regarding fund security have been reported, with multiple complaints highlighting difficulties in withdrawing funds, which raises alarms about the overall safety of client investments.

Traders must be vigilant and consider these factors when evaluating whether Rifa is a safe platform for trading. The lack of transparency surrounding fund security measures is a critical red flag that should not be overlooked.

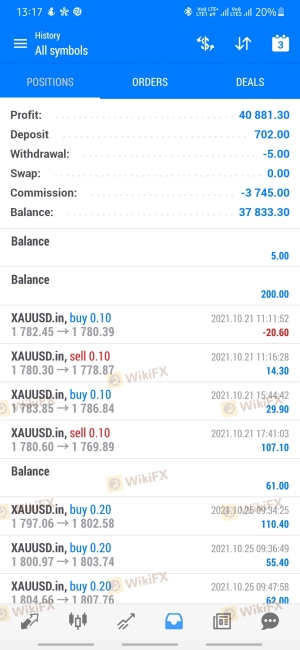

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding a brokerage's reliability. Rifa has received numerous complaints from users, primarily centered around withdrawal issues and unresponsive customer service. Many users report difficulties in accessing their funds, with some alleging that their accounts have been frozen or that they have been asked to pay additional fees before withdrawals can be processed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Two typical cases illustrate these concerns. One user reported being unable to withdraw their funds after repeated requests, leading to frustration and financial loss. Another user claimed they were pressured to deposit more money to access their existing funds, which raises significant ethical concerns about Rifa's practices.

These complaints indicate a pattern of behavior that suggests a lack of accountability and transparency, further raising questions about Rifa's legitimacy and whether it can be deemed a safe trading environment.

Platform and Execution

The trading platform's performance is a critical aspect of any brokerage. Rifa claims to provide proprietary trading platforms; however, detailed information about their functionality, stability, and user experience is scarce. The absence of widely recognized platforms like MT4 or MT5 may limit traders' ability to utilize advanced trading tools and analytics, which are essential for effective trading strategies.

Furthermore, the quality of order execution is a vital consideration. Reports of slippage and rejected orders can significantly impact a trader's experience and profitability. Without clear data on execution quality, traders may find themselves at a disadvantage, making it essential to scrutinize these aspects before committing to Rifa.

Risk Assessment

Using Rifa as a trading platform presents several risks that potential traders should consider. The lack of regulation, transparency issues, and numerous user complaints contribute to a high-risk environment for trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No major regulatory oversight |

| Financial Risk | High | Potential for loss of funds due to scams |

| Operational Risk | Medium | Issues with platform stability and support |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative regulated brokers, and approach trading with caution. It is crucial to understand the risks involved and to only invest what one can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rifa exhibits several characteristics commonly associated with scams. The lack of regulatory oversight, transparency, and numerous user complaints regarding withdrawal issues raise significant concerns about its legitimacy.

For traders considering Rifa, it is essential to exercise extreme caution and to explore alternative, regulated options that prioritize safety and transparency. Reliable brokers such as Forex.com or TD Ameritrade offer better regulatory protection and a more trustworthy trading environment.

Ultimately, potential traders must weigh the risks and benefits carefully before deciding to trade with Rifa. The consensus from various sources indicates that Rifa may not be a safe choice for forex trading, and traders should prioritize their financial security by choosing reputable and regulated brokers.

Is RIFA FINANCE a scam, or is it legit?

The latest exposure and evaluation content of RIFA FINANCE brokers.

RIFA FINANCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RIFA FINANCE latest industry rating score is 5.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.