Regarding the legitimacy of FinPros forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is FinPros safe?

Pros

Cons

Is FinPros markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP) 5

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Finquotes Financial (Cyprus) Ltd

Effective Date:

--Email Address of Licensed Institution:

info@finpros.euSharing Status:

No SharingWebsite of Licensed Institution:

www.finpros.euExpiration Time:

--Address of Licensed Institution:

Shop 4, Anna City Court, 6 Laiou St., 3015, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 261 361Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

FinPros Financial Ltd

Effective Date:

--Email Address of Licensed Institution:

proconnect@finpros.comSharing Status:

No SharingWebsite of Licensed Institution:

https://finpros.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4A, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4344692Licensed Institution Certified Documents:

Is FinPros A Scam?

Introduction

FinPros is an online forex and CFD broker that has been operating since 2020, with its headquarters located in Seychelles. The broker positions itself as a low-cost trading option for both novice and experienced traders, offering a wide range of financial instruments, including forex pairs, cryptocurrencies, commodities, and indices. Given the proliferation of online trading platforms, traders must exercise caution when selecting a broker, as the potential for scams and fraudulent activities is significant in the financial markets. This article aims to provide a comprehensive evaluation of FinPros, assessing its legitimacy and reliability based on various criteria, including regulatory status, company background, trading conditions, and customer experiences.

To conduct this investigation, we utilized multiple sources, including reviews from financial experts, regulatory databases, and user feedback. Our assessment framework focuses on key aspects such as regulatory compliance, company transparency, trading costs, customer fund security, and overall user experience.

Regulation and Legitimacy

The regulatory environment is a crucial factor when evaluating the safety and legitimacy of a forex broker. FinPros is regulated by the Financial Services Authority (FSA) of Seychelles, which is considered a low-tier regulatory authority. While having a license from a regulatory body indicates some level of oversight, the quality of regulation varies significantly across jurisdictions. Below is a summary of FinPros' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | sd 087 | Seychelles | Verified |

The FSA of Seychelles has a reputation for being less stringent compared to tier-one regulators such as the FCA (UK), ASIC (Australia), or the SEC (USA). This means that while FinPros is regulated, investors may not benefit from the same level of protection as they would with a broker regulated by a more reputable authority. For instance, tier-one regulators often require brokers to participate in compensation schemes that protect clients in case of insolvency or other financial issues. Unfortunately, such protections are generally absent with the FSA.

Furthermore, there have been no significant historical compliance issues reported against FinPros, but the nature of offshore regulation means that traders might have limited recourse in the event of a dispute. Overall, while FinPros is a regulated entity, the quality of its regulation raises concerns regarding investor protection.

Company Background Investigation

FinPros, officially known as Fin Quotes Financial Ltd, was established in 2020 and has since aimed to cater to a global audience of traders. The companys headquarters in Seychelles is strategically chosen, as it allows for more lenient regulatory oversight compared to jurisdictions like the UK or the US. The ownership structure of FinPros is not extensively disclosed, which can be a red flag for potential investors seeking transparency.

The management teams background is another important aspect to consider. While specific details about the team are limited, it is essential for a broker to have experienced professionals at the helm to ensure operational integrity and compliance with regulatory standards. Transparency in management and ownership can significantly impact a broker's reputation and trustworthiness.

In terms of information disclosure, FinPros provides basic details about its services and operations on its website. However, it lacks comprehensive insights into its management team and operational practices, which may leave potential clients with unanswered questions. Overall, the lack of transparency regarding the company's ownership and management team can be a cause for concern for prospective traders.

Trading Conditions Analysis

FinPros claims to offer competitive trading conditions, including low spreads and no commission fees on certain account types. However, it is essential to analyze the overall fee structure and any potential hidden costs that may affect trading profitability. The following table summarizes the core trading costs associated with FinPros:

| Cost Type | FinPros | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.6 pips | 1.0 - 2.0 pips |

| Commission Model | $2 per lot (Raw+ account) | Varies widely |

| Overnight Interest Range | Varies by asset | Varies widely |

The spreads offered by FinPros, particularly on its Raw+ account, are highly competitive, starting from 0.0 pips during periods of high liquidity. This is significantly lower than the industry average. However, traders should be aware that spreads can widen during volatile market conditions, which may impact trading costs.

The commission structure is relatively straightforward, with a charge of $2 per lot on the Raw+ account, while other accounts may have zero commissions. This can be attractive for high-frequency traders, but its essential to factor in the potential for high overnight interest charges, especially for positions held long-term.

Overall, while FinPros presents a competitive fee structure, traders should remain vigilant regarding the potential for additional costs, particularly concerning overnight financing and wider spreads during volatile periods.

Client Fund Security

When it comes to the safety of client funds, FinPros claims to implement several protective measures. The broker holds client funds in segregated accounts, which is a standard practice designed to protect client assets in the event of the broker's insolvency. Additionally, FinPros offers negative balance protection, ensuring that clients cannot lose more than their initial deposit.

However, the effectiveness of these measures is somewhat diminished by the low-tier regulatory status of the FSA. Unlike brokers regulated by more stringent authorities, there may be fewer safeguards in place to protect client funds. There have been no significant historical issues reported regarding fund security at FinPros, but the nature of offshore regulation means that traders might face challenges in recovering funds in the event of a dispute.

In conclusion, while FinPros does implement some standard safety measures for client funds, the overall level of protection may not be as robust as that offered by brokers regulated in more reputable jurisdictions.

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews of FinPros indicate a mixed experience among users. Many traders appreciate the competitive pricing and fast execution speeds, but there are also complaints regarding customer service responsiveness and withdrawal issues. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed responses |

| Customer Support Issues | Medium | Somewhat responsive |

| Platform Stability | Low | Generally stable |

Typical complaints revolve around delays in processing withdrawals, which can be a significant concern for traders needing quick access to their funds. While some users report satisfactory experiences with customer support, others have expressed frustration over slow response times and unresolved issues.

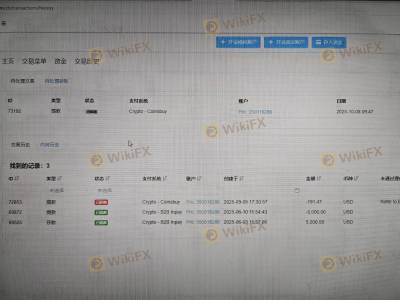

One notable case involved a trader who faced delays in withdrawing funds after a period of inactivity. The trader reported that the customer support team was unresponsive for several days, leading to frustration and a negative perception of the broker.

Overall, while FinPros offers a range of attractive features, the mixed customer feedback suggests that potential clients should proceed with caution and be aware of the possibility of encountering service-related issues.

Platform and Trade Execution

The trading platform is a critical component of the overall trading experience. FinPros utilizes the popular MetaTrader 5 (MT5) platform, which is known for its advanced charting tools and user-friendly interface. Many users report a satisfactory experience with platform stability and functionality. However, there are some concerns regarding order execution quality, particularly during volatile market conditions.

Traders have noted instances of slippage and requotes, which can impact trading outcomes. While slippage is a common occurrence in forex trading, excessive slippage or frequent refusals of orders can indicate underlying issues with the broker's execution model.

Overall, while FinPros provides a robust trading platform, traders should remain cautious regarding the execution quality, especially during high volatility.

Risk Assessment

Using FinPros as a trading platform carries inherent risks, particularly due to its offshore regulatory status and mixed customer feedback. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation offers limited protection. |

| Withdrawal Risk | Medium | Complaints regarding withdrawal delays. |

| Execution Risk | Medium | Potential slippage and requotes during trading. |

To mitigate these risks, traders should conduct thorough research before committing funds to FinPros. It is advisable to start with a demo account to familiarize themselves with the platform and trading conditions before using real capital.

Conclusion and Recommendations

In conclusion, while FinPros presents itself as a legitimate forex broker with competitive trading conditions, there are several areas of concern. The offshore regulatory status poses significant risks, particularly regarding investor protection and fund security. Additionally, the mixed customer feedback related to withdrawals and customer service suggests that traders may encounter challenges when dealing with the broker.

For traders considering FinPros, it is essential to weigh the potential benefits against the risks involved. Those who prioritize stringent regulation and robust customer support may want to explore alternative brokers with a proven track record and higher regulatory standards. Recommended alternatives include brokers like Pepperstone or IG, which are regulated by tier-one authorities and offer comprehensive customer support.

Ultimately, traders should conduct their own due diligence and ensure they are comfortable with the level of risk associated with trading with FinPros before proceeding.

Is FinPros a scam, or is it legit?

The latest exposure and evaluation content of FinPros brokers.

FinPros Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FinPros latest industry rating score is 6.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.