WB 2025 Review: Everything You Need to Know

Summary

Our wb review shows a broker that calls itself WB Trade EU Ltd. It offers CFD trading services through the MetaTrader 5 platform. WB Trade requires a minimum deposit of $50, which makes it easy for beginner and intermediate traders to start trading in financial markets. The broker says it follows regulated and transparent trading practices, but we cannot find clear details about its regulation in the available documents.

The platform focuses on CFD trading across different financial instruments. It uses the well-known MT5 platform for executing orders and analyzing markets. However, our review finds big gaps in information about regulatory oversight, customer service quality, and detailed trading conditions. The broker does not provide specific regulatory license numbers, and there is limited user feedback, which makes us uncertain about its credibility and transparency.

Based on what we know, WB Trade might work for new traders because of its low entry cost. But the lack of clear regulatory information and limited operational details mean you should think carefully before opening an account.

Important Notice

This wb review uses publicly available information and general market knowledge. WB Trade EU Ltd used to be called Windsor Brokers Ltd and operates as an investment company, though we cannot find clear information about which regulators oversee it or what licenses it holds. Different regional offices may work under different regulatory standards and oversight systems.

Our evaluation uses data from official sources, industry databases, and standard ways of assessing brokers. Readers should check the current regulatory status and trading conditions directly with the broker before making investment decisions, since information may be different in different places and can change over time.

Rating Framework

Broker Overview

WB Trade EU Ltd works as a financial services provider that focuses on CFD trading across multiple asset classes. The company says it is committed to giving clients access to financial markets while emphasizing regulated and transparent trading practices. According to available information, the broker changed from its previous name Windsor Brokers Ltd but still focuses on retail trading services.

The broker's business model centers on giving market access through advanced trading technology, specifically the MetaTrader 5 platform. WB Trade targets both new and experienced traders by offering a low minimum deposit of $50, which makes it accessible to people just starting their trading journey. The company emphasizes its commitment to transparency and regulatory compliance, though we cannot find specific details about regulatory oversight in publicly available documents.

Our wb review shows that WB Trade operates mainly in the CFD space, offering derivative products that let traders speculate on price movements without owning the actual assets. The broker's approach seems focused on providing essential trading infrastructure rather than comprehensive educational or research resources, positioning itself as a straightforward trading service provider in the competitive retail forex and CFD market.

Regulatory Status

Available information does not tell us the exact regulatory jurisdiction or license numbers under which WB Trade EU Ltd operates. This lack of transparency about regulatory oversight is a big concern for potential clients who want assurance about fund safety and operational compliance.

Deposit and Withdrawal Methods

We cannot find specific information about available deposit and withdrawal methods in accessible materials. The minimum deposit requirement is $50, making it accessible for beginner traders, though processing times and fees for different payment methods are not specified.

Minimum Deposit Requirements

WB Trade sets its minimum deposit at $50, which makes it competitive for entry-level traders. This low amount removes big barriers for newcomers to forex and CFD trading.

Current promotional offerings and bonus structures are not detailed in available information. Potential clients should ask directly about any available incentives or promotional terms.

Tradeable Assets

The broker offers CFD trading services, though we cannot find comprehensive information about specific asset categories, instrument counts, and market coverage details in accessible documentation.

Cost Structure

Information about spreads, commissions, overnight financing charges, and other trading costs is not detailed in available materials, making cost comparison challenging.

Leverage Ratios

Specific leverage offerings across different asset classes are not specified in accessible information, though regulatory limits likely apply based on jurisdiction.

WB Trade provides access to MetaTrader 5, a widely recognized and feature-rich trading platform supporting advanced charting, automated trading, and comprehensive market analysis tools.

Detailed Rating Analysis

Account Conditions Analysis

Our wb review of account conditions shows limited information about the variety and features of available account types. The $50 minimum deposit requirement stands out as particularly accessible for beginning traders, removing big financial barriers that might prevent market entry. This low amount compares well with industry standards and shows the broker's commitment to inclusivity.

However, the lack of detailed information about different account tiers, their features, and any premium services available to higher-tier clients creates uncertainty about the broker's full service offering. Standard features such as Islamic account availability, professional trader classifications, and institutional services are not specified in available documentation.

The account opening process details are not clearly outlined, making it hard to assess how efficient it is and what requirements new clients face. Without specific information about documentation requirements, verification procedures, and account activation timelines, potential clients cannot prepare adequately for the registration process or set appropriate expectations for account setup completion.

The provision of MetaTrader 5 represents a significant strength in WB Trade's offering, as this platform is widely regarded as one of the most comprehensive trading environments available. MT5 provides advanced charting capabilities, multiple timeframes, extensive technical indicators, and support for automated trading strategies through Expert Advisors.

However, beyond the platform provision, we cannot find specific details about additional trading tools, research resources, and educational materials. Modern traders typically expect access to market analysis, economic calendars, trading signals, and educational content to support their decision-making processes. The absence of information about these supplementary resources suggests either limited offerings or poor communication of available services.

Automated trading support through MT5 is inherently available, but specific policies about Expert Advisor usage, VPS services, or strategy development resources are not detailed. The lack of information about proprietary tools, market research, or analytical resources limits our ability to assess the broker's comprehensive service quality beyond basic platform access.

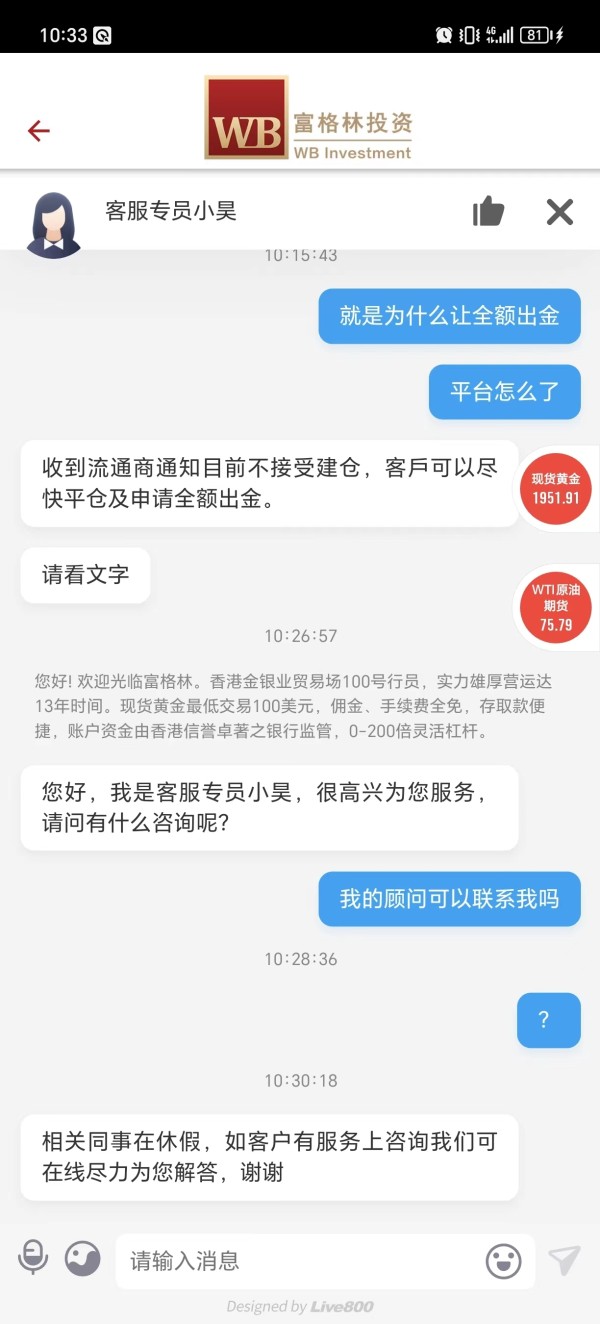

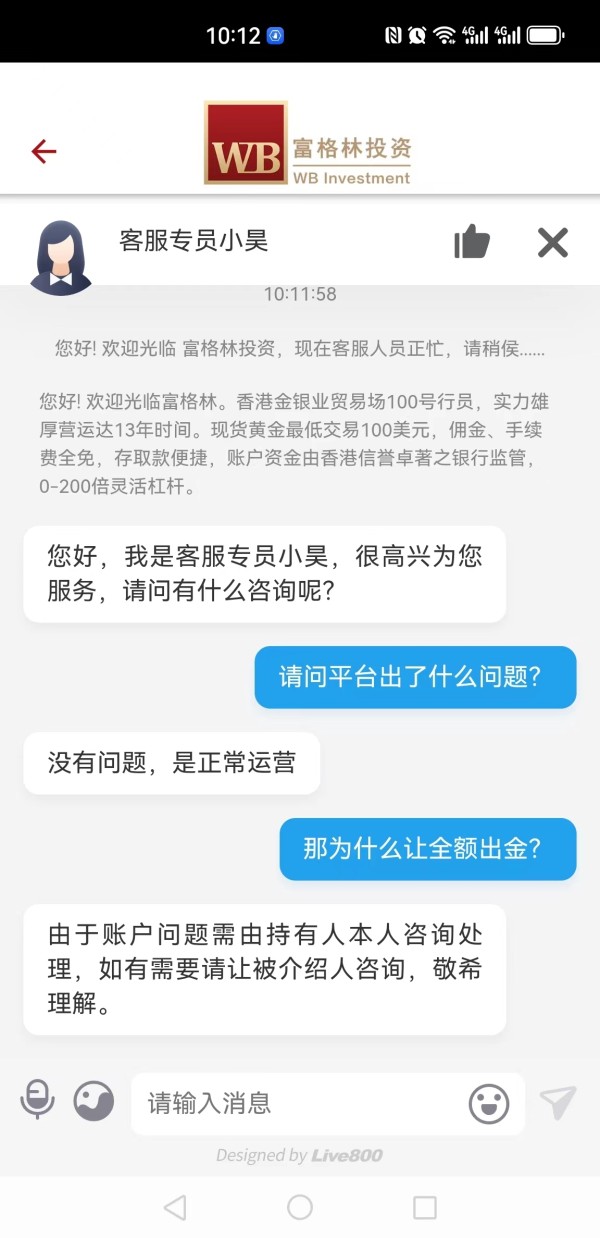

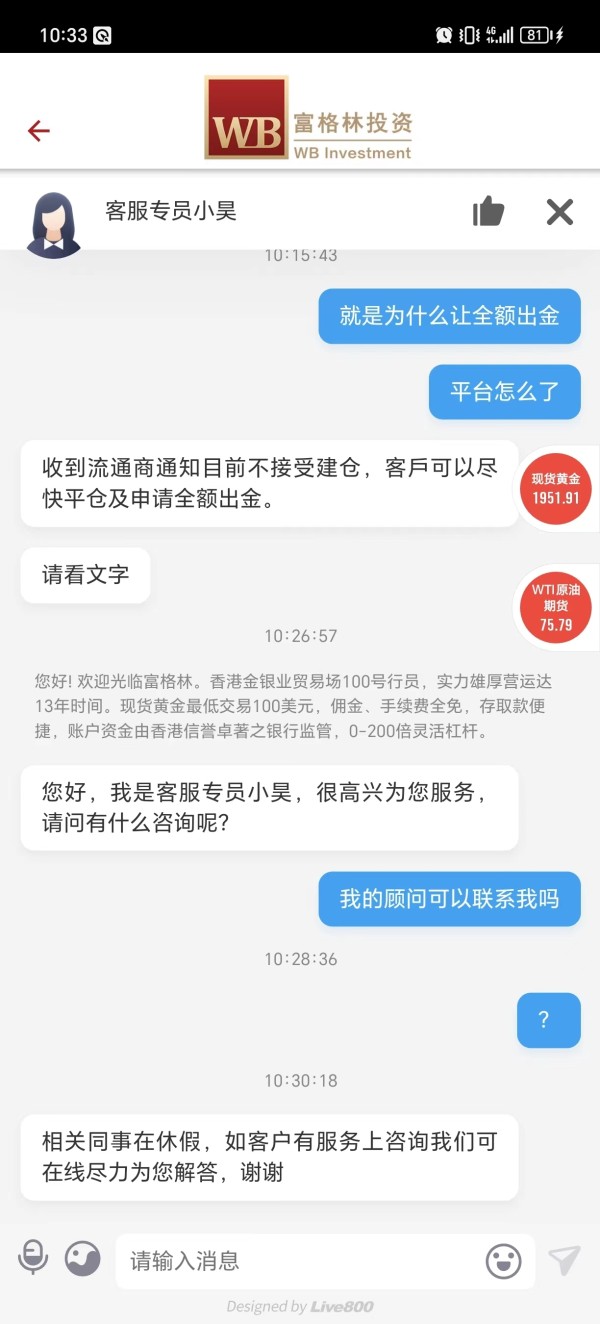

Customer Service and Support Analysis

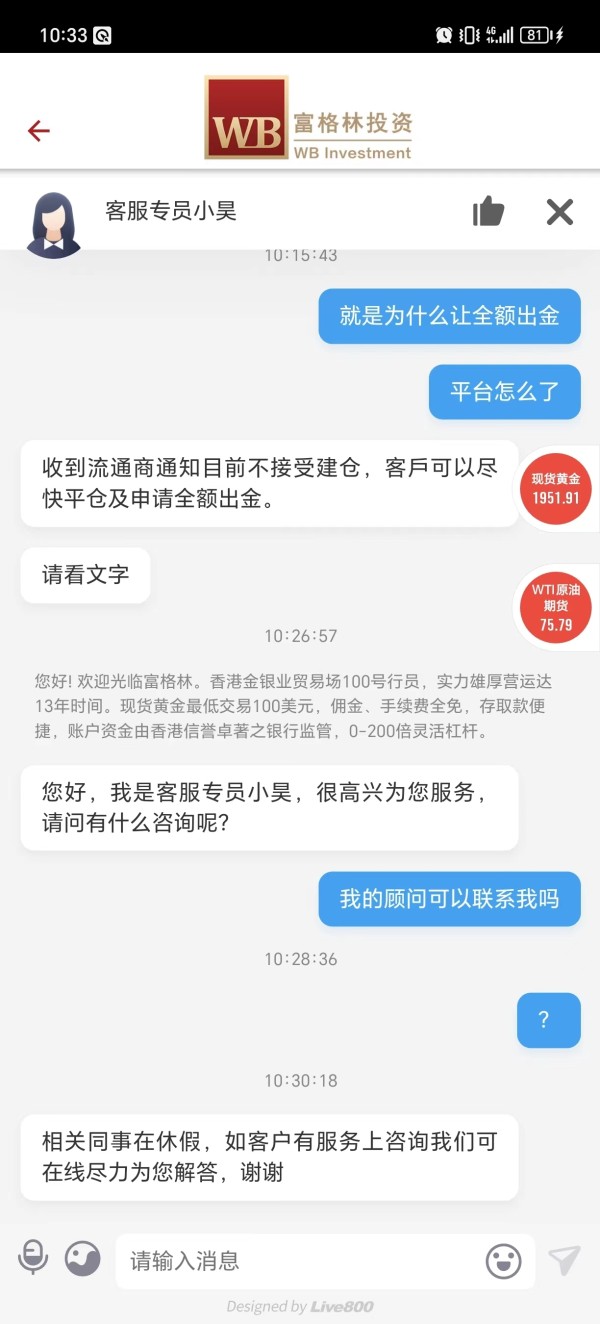

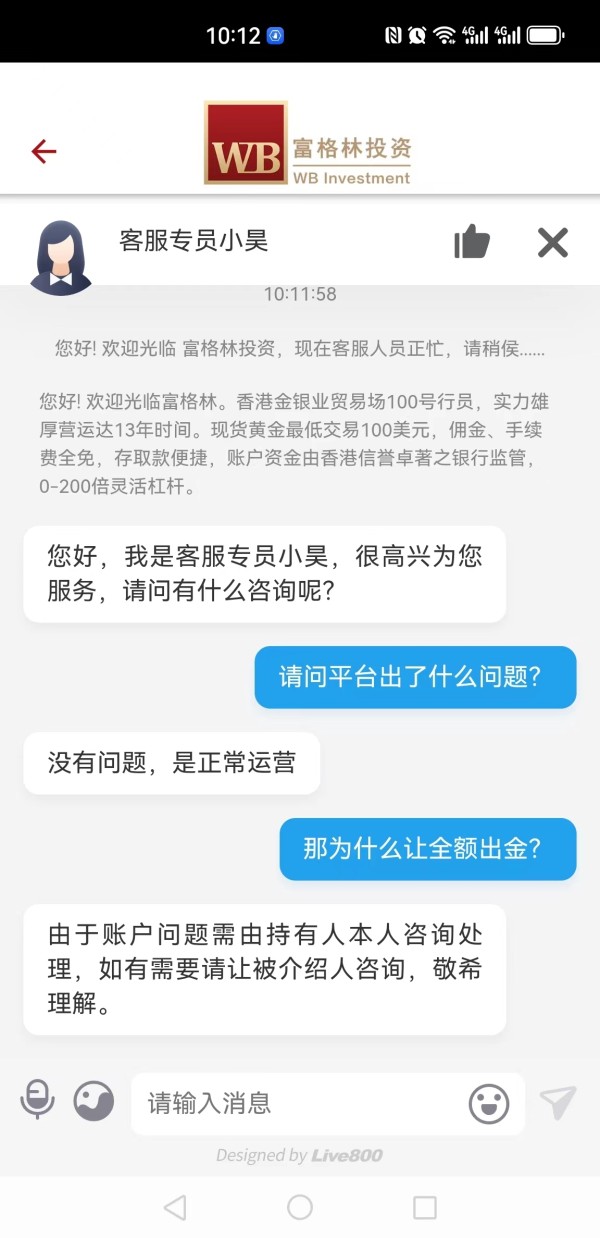

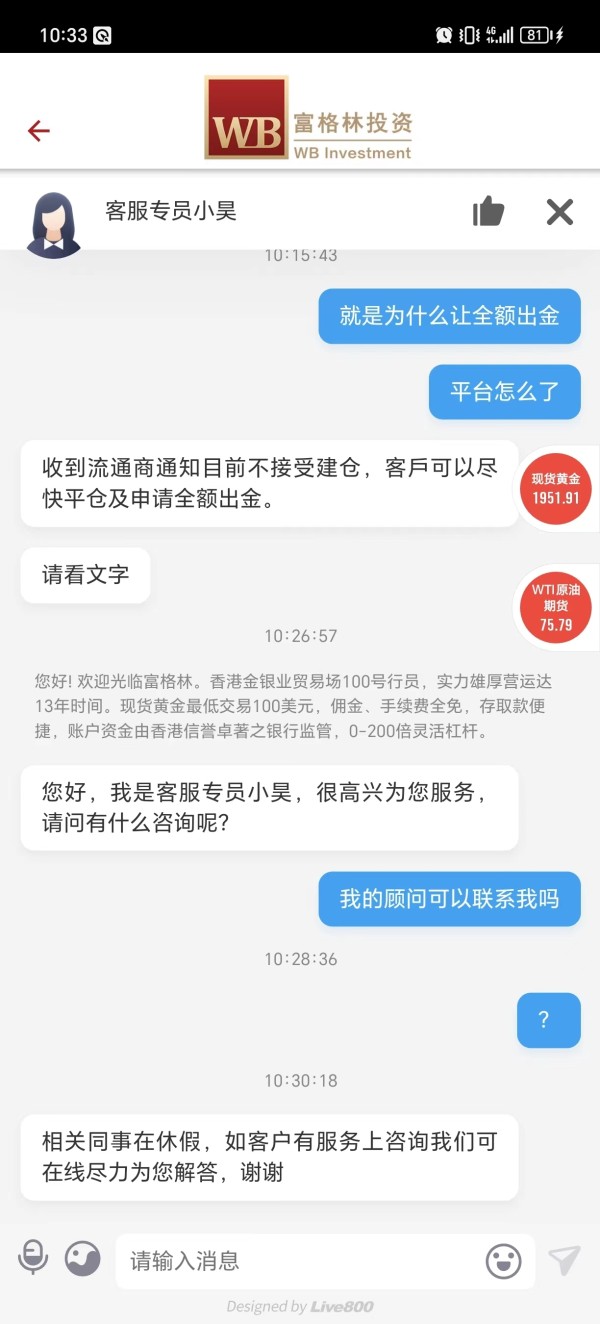

Customer service quality assessment is significantly hampered by the lack of specific information about support channels, availability hours, and service standards. Modern trading requires reliable customer support across multiple channels including phone, email, live chat, and potentially social media platforms.

Response time expectations, multilingual support capabilities, and technical support quality cannot be evaluated based on available information. The absence of customer service details raises questions about the broker's commitment to client support and problem resolution efficiency.

Without specific information about support team expertise, escalation procedures, or service level agreements, potential clients cannot assess whether the broker's support infrastructure meets their needs. The lack of documented customer service policies or support channel information suggests either limited service offerings or inadequate communication of available support resources.

Trading Experience Analysis

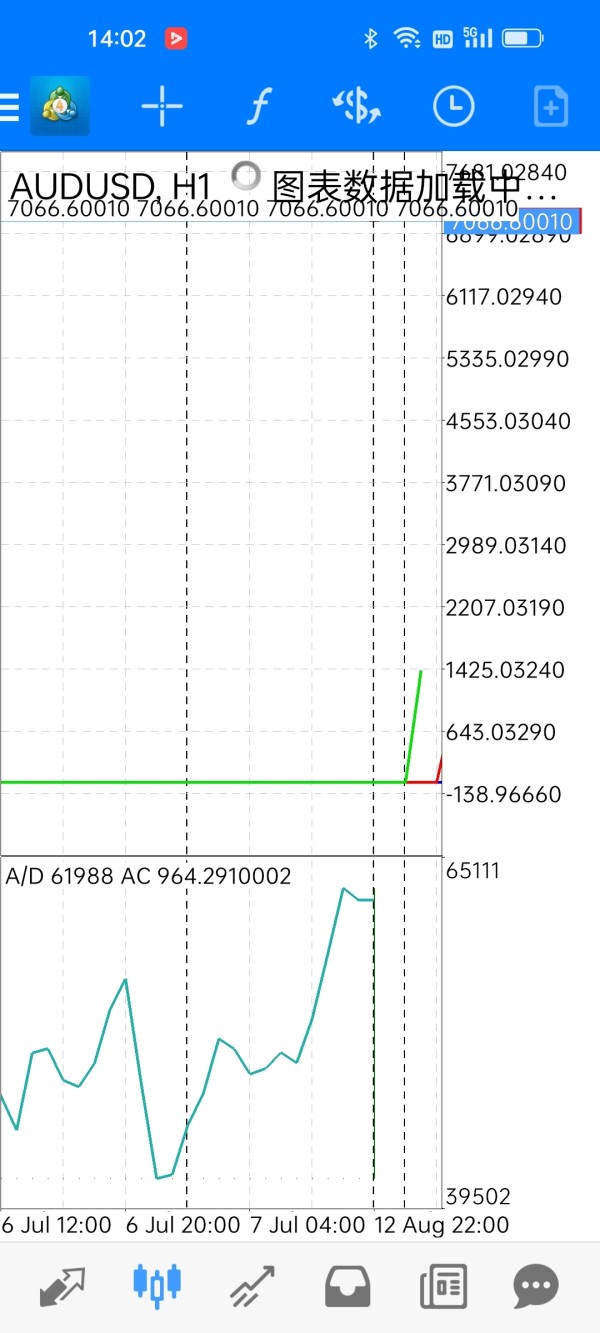

The MetaTrader 5 platform provision suggests a solid foundation for trading experience, as MT5 offers robust functionality for order management, technical analysis, and strategy implementation. However, we cannot find specific information about platform customization, execution speed, and system reliability for assessment.

Order execution quality, including fill rates, slippage statistics, and execution speed metrics, remains undocumented. These factors are crucial for evaluating the practical trading experience that clients can expect. Without performance data or execution quality metrics, our wb review cannot provide definitive assessment of the actual trading environment quality.

Mobile trading capabilities, while likely available through standard MT5 mobile applications, are not specifically addressed in available information. The absence of details about platform stability, server uptime, or technical performance metrics limits our ability to assess the reliability of the trading environment during various market conditions.

Trust and Regulation Analysis

The most significant concern in our evaluation centers on the lack of specific regulatory information. While WB Trade EU Ltd presents itself as committed to regulated and transparent practices, the absence of clearly stated regulatory licenses, supervisory authorities, and compliance frameworks creates substantial uncertainty about operational oversight.

Fund safety measures, including client money segregation, deposit protection schemes, and regulatory capital requirements, are not detailed in available information. These elements are fundamental to trader confidence and represent critical factors in broker selection decisions.

The company's transparency regarding corporate structure, ownership, and regulatory standing appears limited based on accessible information. Without clear regulatory disclosure, potential clients cannot adequately assess the legal protections available for their funds or verify the broker's compliance with industry standards and regulatory requirements.

User Experience Analysis

Overall user satisfaction assessment is challenging due to the absence of documented user feedback, testimonials, or independent reviews in available information. The user experience encompasses multiple touchpoints including platform usability, account management efficiency, and overall service satisfaction.

Interface design and platform accessibility cannot be thoroughly evaluated without specific information about customization options, user interface features, and accessibility accommodations. The registration and verification process efficiency remains undocumented, preventing assessment of the initial user experience quality.

Fund operation experiences, including deposit and withdrawal processes, processing times, and fee structures, are not detailed in available materials. Common user concerns and complaint resolution procedures are not addressed, limiting our ability to identify potential friction points in the customer journey or assess the broker's responsiveness to client concerns.

Conclusion

Our comprehensive wb review reveals a broker that provides basic trading functionality through the reputable MetaTrader 5 platform with an accessible $50 minimum deposit. However, significant information gaps regarding regulatory oversight, detailed service offerings, and user feedback create uncertainty about the broker's overall credibility and service quality.

WB Trade appears most suitable for beginning traders seeking low-cost market entry, though the lack of comprehensive regulatory disclosure and limited operational transparency warrant careful consideration. The primary advantages include low minimum deposit requirements and access to professional trading software, while key disadvantages center on insufficient regulatory information and limited service detail disclosure.

Potential clients should conduct thorough due diligence and verify current regulatory status before account opening, as the available information does not provide sufficient detail for confident broker selection decisions.