AccuIndex 2025 Review: Everything You Need to Know

Executive Summary

AccuIndex stands out as a notable forex broker in 2025. However, concerns about its regulatory status need careful thought. Despite these challenges, the broker's remarkable growth in the Middle East and North Africa regions continues to attract traders worldwide. This comprehensive accuindex review looks at the broker's complete service offering. We examine both its strengths and potential limits.

The broker sets itself apart through several key features. These include leverage ratios up to 1:400 and competitive commission structures that appeal to cost-conscious traders. AccuIndex provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This gives traders flexibility in their platform choices and access to comprehensive trading tools.

AccuIndex mainly targets traders in the Middle East and North Africa regions. It especially focuses on those seeking low-cost trading opportunities across multiple asset classes. The broker serves investors who prioritize multi-asset trading capabilities. It combines forex, commodities, indices, and cryptocurrency trading under a single platform. With a minimum deposit requirement of $100, AccuIndex positions itself as accessible to both novice and experienced traders seeking diversified trading opportunities.

Important Notice

AccuIndex operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). This may result in varying levels of legal protection for users across different geographical regions. Traders should know that regulatory frameworks and investor protections may differ significantly depending on their country of residence and the specific AccuIndex entity serving their region.

This review is based on comprehensive analysis of user feedback and publicly available information from multiple sources. All assessments and ratings reflect current market conditions and available data as of 2025. However, individual trading experiences may vary based on account types, trading volumes, and geographical location.

Rating Framework

Broker Overview

AccuIndex has established itself as a prominent multi-asset broker headquartered in Dubai, United Arab Emirates. The company earned recognition as one of the fastest-growing brokerages in the Middle East and North Africa regions. The company's rapid expansion reflects its commitment to serving traders across diverse geographical markets while maintaining competitive trading conditions. According to industry reports, AccuIndex has successfully positioned itself within the competitive online trading landscape. It focuses on technological innovation and customer-centric service delivery.

The broker operates as a comprehensive financial services provider. It offers online trading access across multiple asset categories. AccuIndex's business model centers on providing retail and institutional clients with direct market access through sophisticated trading platforms. The company emphasizes transparency and competitive pricing structures. The company's growth strategy focuses particularly on emerging markets, where demand for accessible trading services continues to expand rapidly.

AccuIndex provides trading services through the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This ensures traders have access to familiar and robust trading environments. The broker supports trading across foreign exchange markets, commodities, stock indices, and cryptocurrency markets. This creates a comprehensive trading ecosystem for diverse investment strategies. Regulatory oversight comes from the Cyprus Securities and Exchange Commission (CySEC), providing European Union-standard regulatory framework and investor protection measures.

Regulatory Jurisdiction: AccuIndex operates under the regulatory authority of the Cyprus Securities and Exchange Commission (CySEC). This provides EU-standard regulatory oversight and investor protection frameworks for eligible clients.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available documentation. However, industry-standard methods are typically supported by brokers of this caliber.

Minimum Deposit Requirements: The broker maintains an accessible minimum deposit threshold of $100. This makes it suitable for traders with varying capital levels and investment goals.

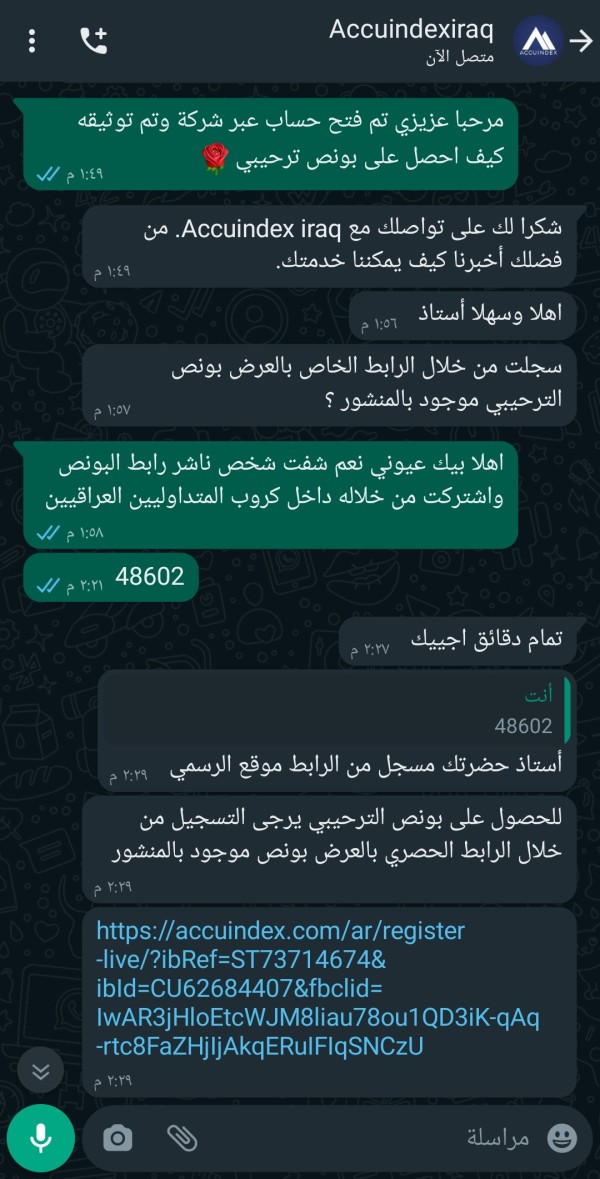

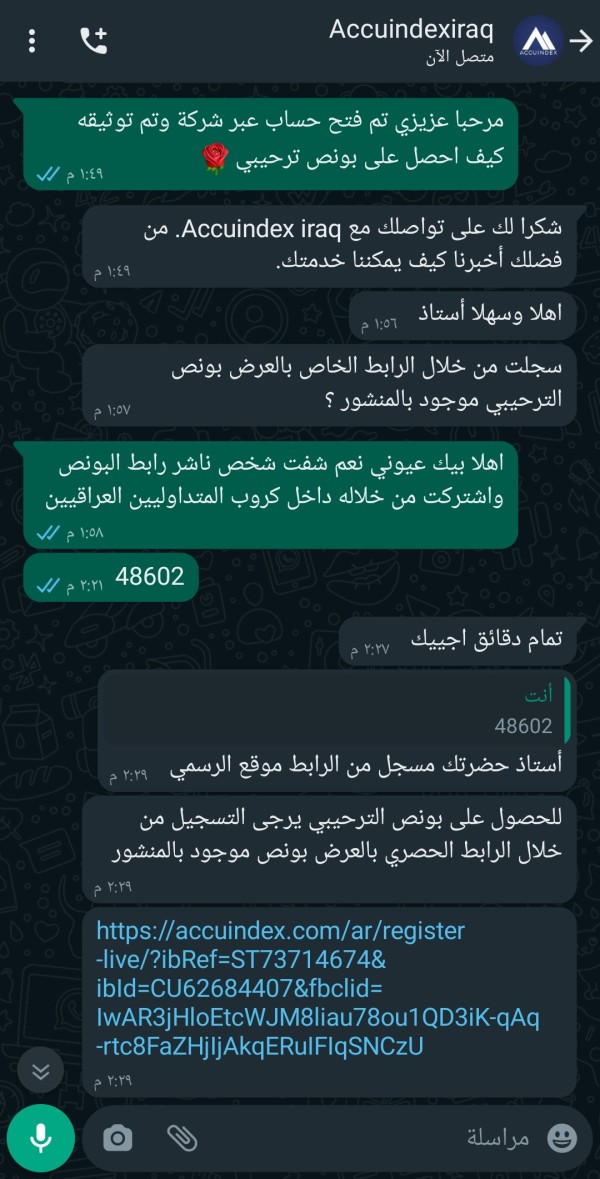

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not specified in available materials. This suggests traders should contact the broker directly for current incentive programs.

Tradeable Assets: AccuIndex provides access to foreign exchange pairs, commodity markets, stock indices, and cryptocurrency trading opportunities. This creates a diversified trading environment for multiple asset class strategies.

Cost Structure: Commission and fee structures maintain moderate levels according to user feedback. Fee ratings average 6/10, though specific spread information requires direct broker consultation for accurate pricing details.

Leverage Ratios: The broker offers competitive leverage ratios reaching up to 1:400. This provides significant trading flexibility for qualified clients while maintaining risk management protocols.

Platform Options: Traders can access MT4 and MT5 trading platforms. Both offer comprehensive charting tools, technical analysis capabilities, and automated trading support through Expert Advisors.

Geographical Restrictions: Specific regional limitations are not detailed in current documentation. They may vary based on local regulatory requirements.

Customer Service Languages: Available customer support languages are not specified in current materials. However, regional focus suggests Arabic and English support capabilities.

This comprehensive accuindex review continues with detailed analysis of each evaluation criterion. We provide complete assessment information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

AccuIndex demonstrates solid performance in account conditions. However, specific account type varieties remain unclear in available documentation. The broker's $100 minimum deposit requirement positions it favorably for traders seeking accessible entry points into international markets. This threshold strikes an effective balance between accessibility for novice traders and maintaining professional service standards expected by experienced investors.

The account opening process appears streamlined based on user feedback patterns, while not detailed in current materials. Traders consistently report reasonable onboarding experiences. However, specific procedural steps require direct broker consultation. The absence of detailed information regarding specialized account features, such as Islamic accounts or institutional-grade offerings, represents a transparency gap that potential clients should address through direct inquiry.

User feedback regarding account conditions remains generally positive. Traders appreciate the combination of low entry barriers and high leverage availability. Compared to industry competitors, AccuIndex's minimum deposit requirement falls within the lower range. This makes it particularly attractive for traders in emerging markets where capital accessibility may be limited. The 1:400 leverage ratio provides significant trading flexibility while requiring appropriate risk management consideration.

The overall account conditions framework supports AccuIndex's positioning as an accessible yet professional trading service provider. However, the lack of detailed account tier information and specific feature descriptions limits the ability to provide comprehensive assessment. This accuindex review recommends potential clients request detailed account specifications directly from the broker. This ensures alignment with individual trading requirements and regulatory considerations.

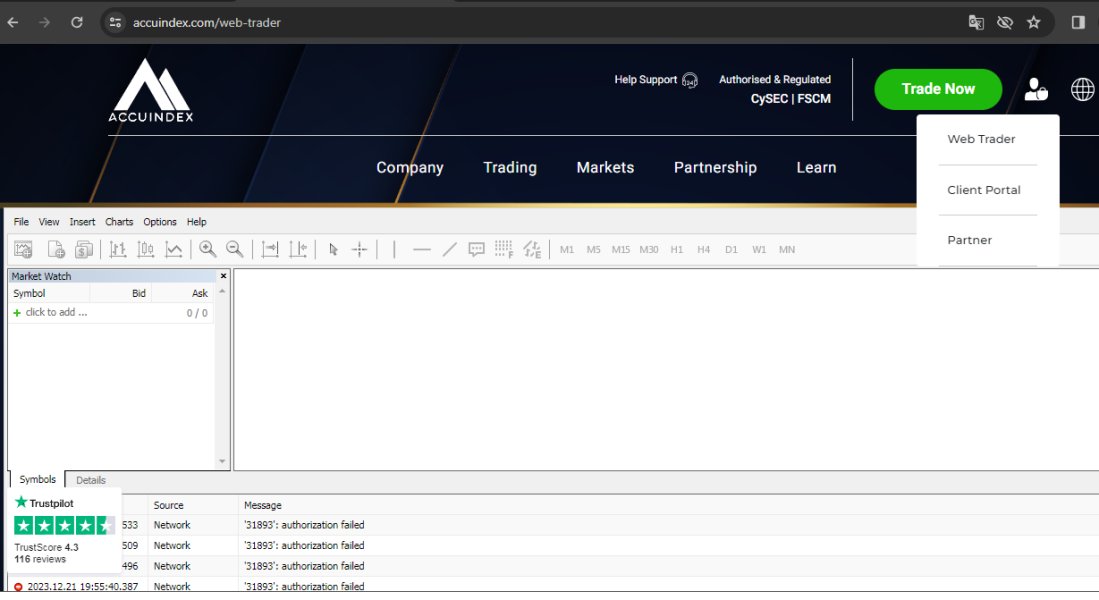

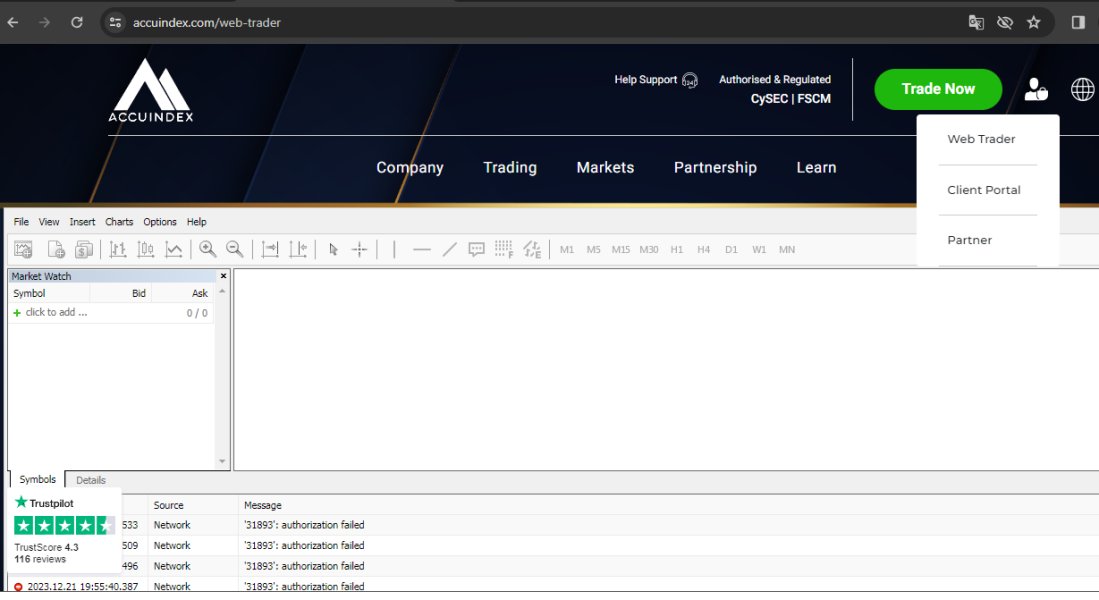

AccuIndex excels in providing comprehensive trading tools through its MT4 and MT5 platform offerings. It delivers professional-grade trading environments with extensive technical analysis capabilities. Both platforms support advanced charting tools, multiple timeframe analysis, and comprehensive indicator libraries that meet the demands of both technical and fundamental analysis approaches. The dual-platform strategy ensures traders can select the environment that best matches their trading style and technical requirements.

The broker's support for automated trading through Expert Advisors (EA) and signal services enhances its appeal to algorithmic traders and those seeking automated trading solutions. This functionality, combined with the platforms' native programming languages, enables sophisticated trading strategy implementation and backtesting capabilities. These support both novice and professional trading approaches.

Research and analysis resources appear integrated within the platform environments based on user experiences, while not specifically detailed in available documentation. However, the absence of detailed information regarding proprietary research offerings, market analysis publications, or educational resource libraries represents an area where additional transparency would benefit potential clients.

User feedback consistently highlights the quality and variety of available trading tools. Traders particularly appreciate the platforms' stability and functionality. Industry experts recognize MT4 and MT5 as gold-standard platforms, lending credibility to AccuIndex's technological infrastructure. The broker's tool offerings support multi-asset trading strategies effectively. This enables traders to implement diversified approaches across forex, commodities, indices, and cryptocurrency markets within unified trading environments.

Customer Service and Support Analysis (Score: 6/10)

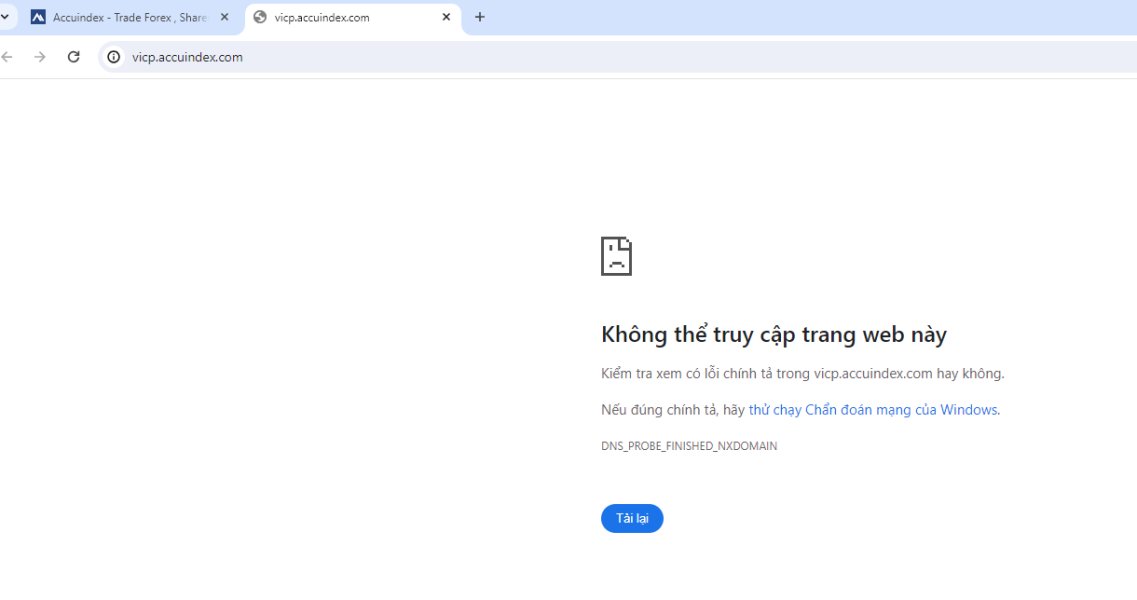

Customer service represents a mixed performance area for AccuIndex. User feedback indicates neutral experiences regarding support quality and response times. Available documentation does not specify particular customer service channels, operating hours, or geographical coverage. This creates uncertainty about support accessibility and scope.

Response time evaluations from user feedback suggest moderate performance levels. Some traders report satisfactory resolution times while others indicate longer-than-expected wait periods. The variability in response experiences may reflect resource allocation challenges or varying complexity levels in customer inquiries. However, specific performance metrics remain unavailable for detailed assessment.

Service quality assessments reveal room for improvement in professional competency and problem-solving capabilities, according to user reports. While some clients report positive interactions with knowledgeable support staff, others indicate experiences with representatives requiring additional technical knowledge or authorization levels. This affects their ability to resolve complex trading-related inquiries effectively.

Multi-language support capabilities remain unspecified in available materials. However, the broker's regional focus suggests Arabic and English language support at minimum. The absence of detailed information regarding support channels, such as live chat, telephone, or email options, limits the ability to assess accessibility convenience. This affects different user preferences and urgency levels.

Trading Experience Analysis (Score: 7/10)

AccuIndex generally delivers positive trading experiences according to user feedback. Traders report good platform stability and execution speeds across the MT4 and MT5 environments. The platforms' reliability appears consistent during normal market conditions. However, specific performance data during high-volatility periods or major economic events remains limited in available documentation.

Order execution quality receives moderate assessment. Limited user feedback is available regarding slippage rates, requote frequency, or execution speed metrics. The absence of detailed execution statistics makes it challenging to provide comprehensive assessment of trading environment quality. This particularly affects high-frequency or scalping trading strategies that require optimal execution conditions.

Platform functionality completeness scores highly through MT4 and MT5 integration. This provides traders with access to comprehensive trading tools, advanced order types, and professional-grade analysis capabilities. Both platforms support the full range of trading strategies, from manual discretionary trading to fully automated algorithmic approaches. This ensures flexibility for diverse trading methodologies.

Mobile trading experience details remain unspecified in current documentation. However, both MT4 and MT5 platforms offer mobile applications that typically maintain functionality parity with desktop environments. User feedback suggests stable spread conditions and adequate liquidity access. This contributes to positive overall trading environment assessments.

This accuindex review notes that while general trading experience feedback remains positive, the absence of detailed performance metrics and execution statistics limits the ability to provide comprehensive technical assessment. We cannot fully evaluate trading environment quality.

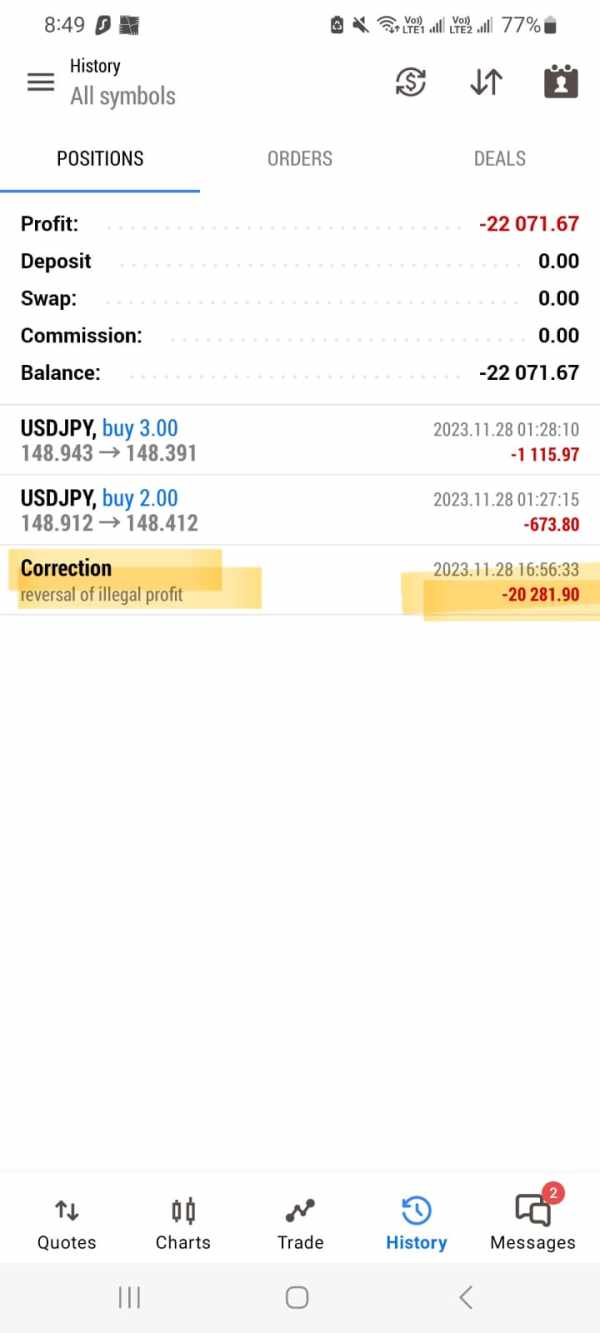

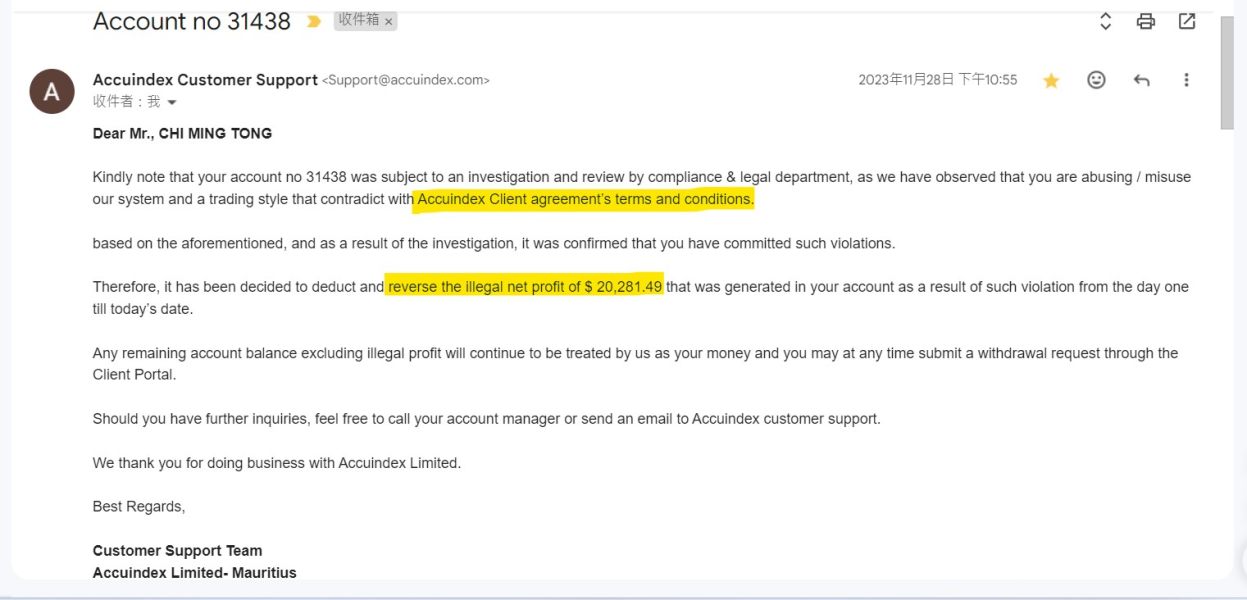

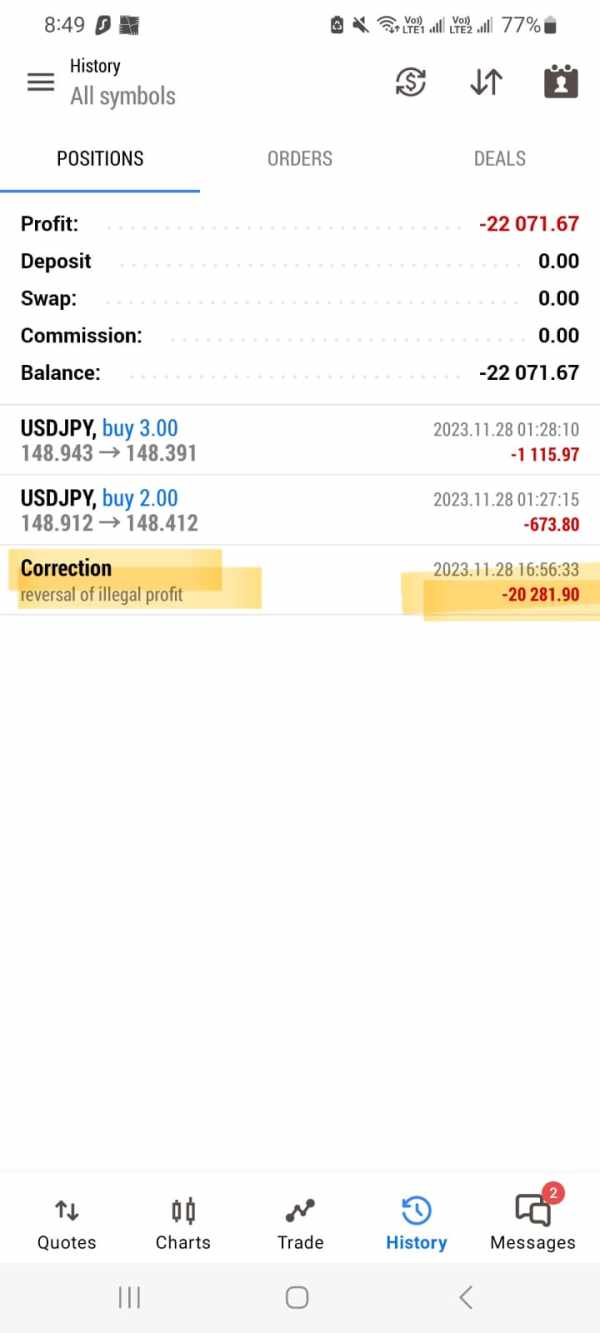

Trust and Reliability Analysis (Score: 6/10)

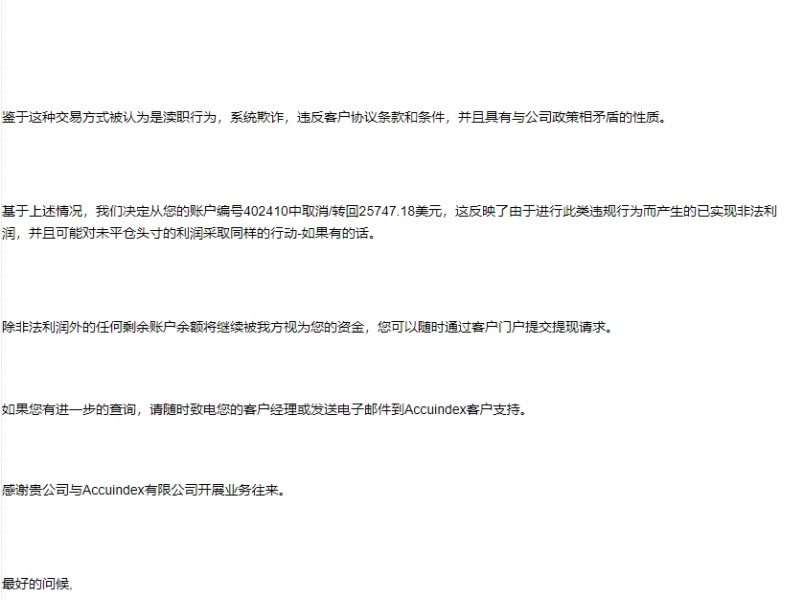

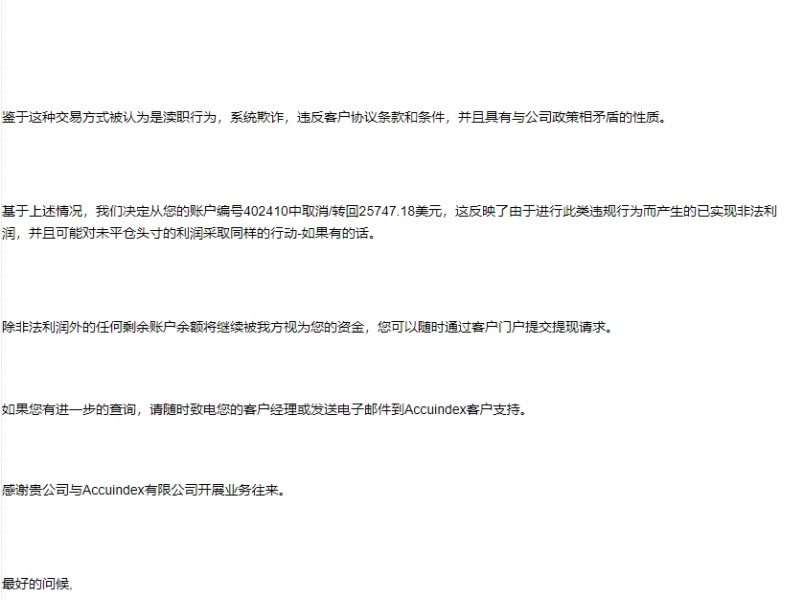

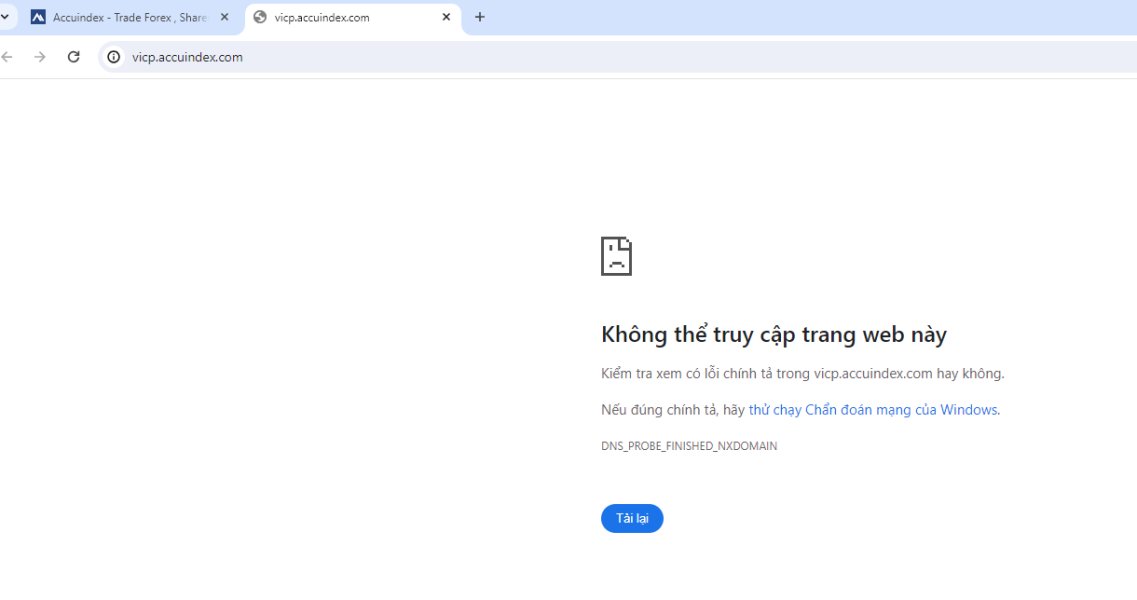

AccuIndex operates under Cyprus Securities and Exchange Commission (CySEC) regulatory oversight with license number 340/17. This provides European Union-standard regulatory framework and investor protection measures. This regulatory status offers significant credibility compared to unregulated alternatives. However, some user concerns regarding regulatory compliance and transparency continue to impact overall trust assessments.

Fund safety measures and client money protection protocols are not detailed in available documentation. This represents a transparency gap that affects trust evaluations. While CySEC regulation typically requires segregated client accounts and investor compensation schemes, specific implementation details and protection limits should be confirmed directly with the broker. This is necessary for complete assessment.

Company transparency regarding ownership structure, financial reporting, and operational procedures remains limited in publicly available materials. Enhanced disclosure of company background, financial stability indicators, and operational transparency would strengthen trust foundations. This would benefit potential clients considering the broker's services.

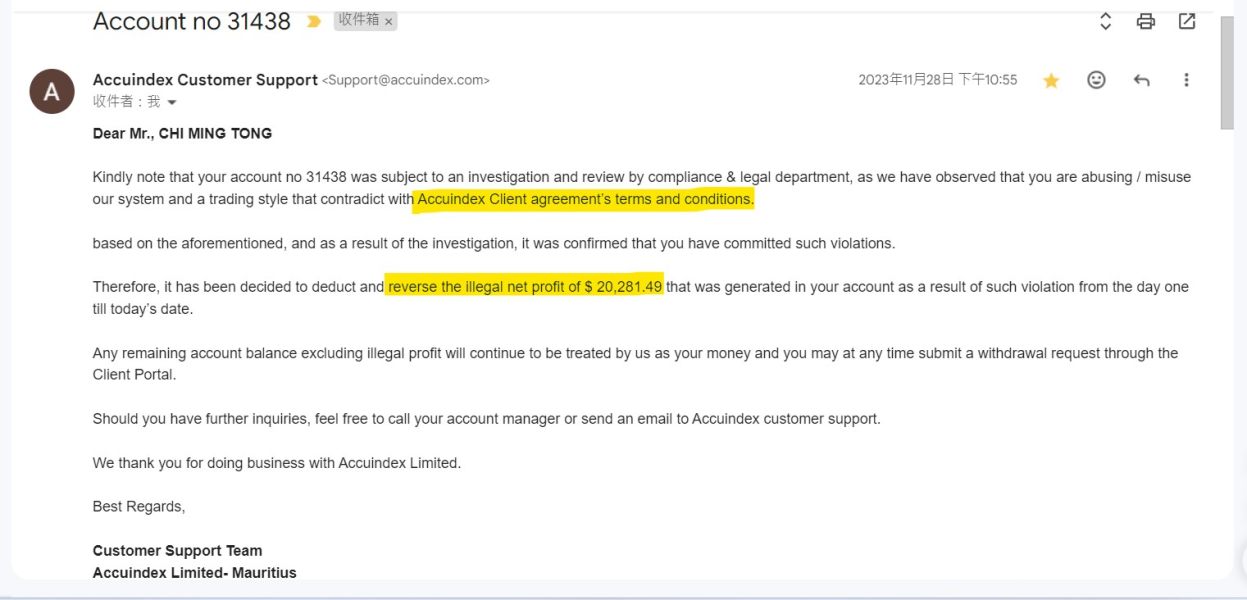

Industry reputation assessment reveals recognition as a fast-growing broker in the Middle East and North Africa regions. This indicates market acceptance and business momentum. However, user concerns regarding regulatory status continue to influence trust perceptions. This suggests the need for enhanced transparency and communication regarding compliance frameworks and client protection measures.

Third-party evaluations and industry assessments provide relatively positive feedback regarding AccuIndex's market position. However, the limited availability of independent reviews and ratings constrains comprehensive reputation assessment. User trust feedback indicates cautious optimism. Traders appreciate service quality while maintaining awareness of regulatory transparency considerations.

User Experience Analysis (Score: 7/10)

Overall user satisfaction with AccuIndex demonstrates positive trends. However, the presence of some negative feedback prevents higher satisfaction scores. Traders generally appreciate the broker's combination of competitive trading conditions, platform quality, and multi-asset access. They express concerns about customer support consistency and regulatory transparency.

Platform interface design and usability receive positive assessment through the MT4 and MT5 environments. These provide familiar and intuitive navigation for traders across experience levels. The platforms' user-friendly design and comprehensive functionality support efficient trading workflow management and strategy implementation.

Registration and verification processes are not detailed in available documentation. However, user feedback patterns suggest reasonable onboarding experiences without significant procedural complications. Specific timeline expectations and documentation requirements should be confirmed directly with the broker for accurate planning.

Fund operation experiences receive neutral evaluations from users. There is mixed feedback regarding deposit and withdrawal convenience and processing times. The absence of detailed information about payment methods, processing timelines, and fee structures for financial transactions represents an area where enhanced transparency would benefit user experience.

Common user complaints focus primarily on customer support responsiveness and regulatory transparency concerns. Positive feedback emphasizes competitive trading conditions and platform quality. The user profile analysis suggests AccuIndex appeals most effectively to cost-conscious traders seeking multi-asset trading opportunities. They want professional-grade platform access.

Conclusion

AccuIndex presents itself as a noteworthy forex and multi-asset broker that merits consideration from traders seeking competitive trading conditions and professional platform access. While regulatory transparency concerns require careful evaluation, the broker's rapid growth in the Middle East and North Africa regions demonstrates market acceptance and business momentum. This supports its credibility within the competitive online trading landscape.

The broker particularly suits traders in the Middle East and North Africa regions, especially those prioritizing low-cost trading opportunities across multiple asset classes. AccuIndex appeals most effectively to investors seeking diversified trading capabilities with access to forex, commodities, indices, and cryptocurrency markets. They want this through industry-standard MT4 and MT5 platforms.

Primary advantages include competitive commission structures, high leverage availability up to 1:400, and comprehensive multi-platform trading access. Potential drawbacks center on regulatory transparency concerns and customer support consistency that may impact overall user confidence. Prospective clients should carefully evaluate these factors against their individual trading requirements and risk tolerance levels before making final broker selection decisions.