Regarding the legitimacy of XPro Markets forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is XPro Markets safe?

Pros

Cons

Is XPro Markets markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Ukuchuma Financial Services (PTY) LTD

Effective Date:

2007-09-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

OFFICE 1-14 1ST FLOOR WORKSHOP 17138 WEST STREETSANDOWN2196Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is XPro Markets A Scam?

Introduction

XPro Markets is a forex and CFD broker that positions itself as a reliable trading platform for traders seeking access to various financial instruments. Established in 2019 and headquartered in South Africa, XPro Markets claims to offer competitive trading conditions, including low minimum deposits and a wide range of trading instruments. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of evaluating a brokers credibility cannot be overstated, as it directly impacts the safety of traders' investments. This article aims to provide an objective analysis of XPro Markets by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory and Legitimacy

The regulatory status of a broker is a crucial factor that determines its legitimacy and trustworthiness. XPro Markets is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, which is considered a tier-2 regulatory body. While FSCA regulation provides some level of oversight, it is generally perceived as less stringent compared to tier-1 regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FSCA | 32535 | South Africa | Active |

The FSCA is responsible for overseeing the financial services industry in South Africa, ensuring that firms comply with relevant laws and regulations. However, it lacks an investor compensation fund, which means traders may not have the same level of protection as they would with brokers regulated by tier-1 authorities. Furthermore, reports indicate that XPro Markets may not have the necessary permissions to offer derivative trading, raising concerns about its compliance history.

Company Background Investigation

XPro Markets is operated by Ukuchuma Financial Services (Pty) Ltd, a company registered in South Africa. The firms ownership structure and management team are critical to understanding its reliability. While specific details about the management team are sparse, the company has been in operation since 2019, indicating a relatively short track record in the competitive forex market.

Transparency is essential for building trust with clients, and the lack of detailed information about the company's history, ownership, and management raises questions. Investors should be cautious, as a lack of transparency can often be a red flag in the financial services industry.

Trading Conditions Analysis

XPro Markets offers a variety of trading conditions, including competitive spreads and multiple account types. However, the overall fee structure warrants scrutiny. The broker imposes a minimum deposit requirement of $250, which is relatively standard in the industry.

| Fee Type | XPro Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 pips | 1.2 pips |

| Commission Structure | Variable | Variable |

| Overnight Interest Range | High | Moderate |

While XPro Markets claims to have tight spreads, the average spread for major currency pairs is notably higher than the industry average. Additionally, the broker may impose withdrawal fees, which can deter traders. Such high costs can significantly affect a trader's profitability and should be carefully considered before opening an account.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. XPro Markets claims to implement robust security measures, including the segregation of client funds from company operating funds. This practice is essential for protecting traders' capital in the event of financial difficulties faced by the broker. However, the absence of an investor compensation scheme, as is common with tier-1 regulators, means that traders may not have adequate recourse if the broker fails.

Additionally, the broker offers negative balance protection, which is a positive feature that prevents traders from losing more than their account balance. Despite these measures, past reports of withdrawal issues and customer complaints about fund access raise concerns about the overall reliability of XPro Markets.

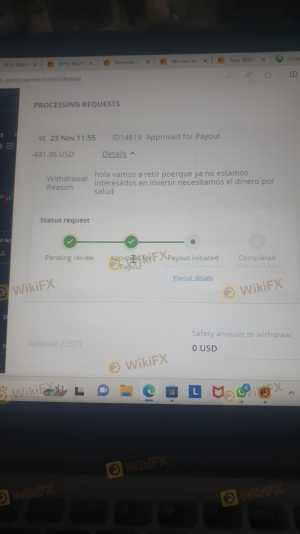

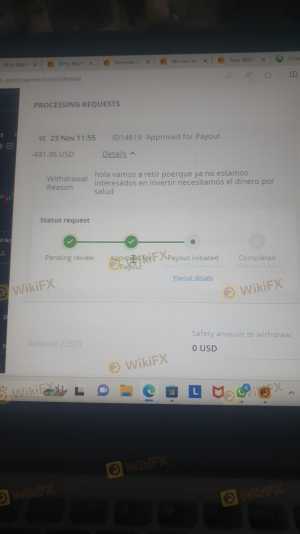

Customer Experience and Complaints

Customer feedback is often a telling indicator of a broker's reliability. Reviews of XPro Markets reveal a mixed bag of experiences. While some traders report satisfactory interactions, others express frustration over withdrawal delays and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inconsistent |

| Account Management | Low | Generally Responsive |

Common complaint patterns include difficulties in withdrawing funds and aggressive sales tactics from account managers. For instance, one trader reported being pressured to deposit additional funds to access profits, a tactic often associated with less reputable brokers. These issues highlight the need for potential clients to exercise caution and conduct thorough research before engaging with XPro Markets.

Platform and Trade Execution

The trading platform is a critical component of any trading experience. XPro Markets offers the widely popular MetaTrader 4 (MT4) platform, known for its reliability and extensive features. However, the performance and execution quality on this platform are crucial for traders. Reports indicate that while MT4 is generally stable, some users have experienced slippage and order rejections, which can be detrimental during volatile market conditions.

Risk Assessment

Using XPro Markets presents several risks that potential traders should consider. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Tier-2 regulation with limited protections |

| Financial Risk | Medium | High spreads and fees can erode profits |

| Operational Risk | Medium | Reports of withdrawal issues and customer complaints |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining a cautious approach to fund allocation and withdrawal requests can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while XPro Markets is a regulated brokerage, its tier-2 regulatory status, coupled with mixed customer feedback and reports of withdrawal issues, raises significant concerns. The broker does not exhibit clear signs of being a scam, but potential clients should remain vigilant and conduct thorough research before proceeding.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternatives with stronger regulatory oversight and proven track records. Brokers such as IG Markets or OANDA, which are regulated by tier-1 authorities, might offer a more secure trading experience. Ultimately, the choice of broker should align with individual trading goals, risk tolerance, and the need for reliable customer support.

Is XPro Markets a scam, or is it legit?

The latest exposure and evaluation content of XPro Markets brokers.

XPro Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XPro Markets latest industry rating score is 2.14, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.14 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.