Is Trader’s Way safe?

Pros

Cons

Is Trader's Way A Scam?

Introduction

Trader's Way is an online forex broker established in 2011, headquartered in Dominica. The company offers a variety of trading services, including forex, commodities, indices, and cryptocurrencies, through popular platforms like MetaTrader 4, MetaTrader 5, and cTrader. As the forex market continues to grow, so does the number of brokers, making it essential for traders to carefully evaluate their options. Unregulated brokers, like Trader's Way, often present significant risks, including potential fraud and lack of investor protection. In this article, we will investigate Trader's Way's regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a trustworthy broker or a potential scam.

Our assessment framework will include an analysis of regulatory compliance, company history, fees and charges, customer feedback, and security measures. By combining narrative insights with structured information, we aim to provide a comprehensive overview of Trader's Way and its operations.

Regulation and Legality

The regulatory status of a broker is a critical factor for traders when assessing safety and legitimacy. Trader's Way is not regulated by any major financial authority, which raises significant concerns regarding the security of client funds and the transparency of its operations. The lack of regulation means that Trader's Way is not held accountable to any governing body, which can lead to potential issues such as fund mismanagement or unfair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation can expose traders to various risks, including the potential for fraud, as there are no formal mechanisms in place to protect clients' interests. Furthermore, Trader's Way has received warnings from several regulatory bodies, including the Securities Commission of Malaysia, which disclosed that the broker was involved in unlicensed capital market activities. This raises serious red flags for potential clients, as it indicates a history of non-compliance with regulatory standards.

In summary, the lack of regulatory oversight for Trader's Way is a significant concern. Traders should be cautious when dealing with unregulated brokers, as they may not provide the same level of protection and recourse as regulated firms.

Company Background Investigation

Trader's Way was founded in 2011 by a group of financial market professionals with the goal of providing unrestricted access to global trading opportunities. The company is registered in Dominica, a jurisdiction known for its lenient regulatory environment, which allows brokers to operate without stringent oversight. This has attracted many brokers seeking to cater to traders who prefer less regulated environments.

The management team at Trader's Way comprises individuals with backgrounds in finance and trading, although specific details about their experience and qualifications are not extensively disclosed on the company's website. This lack of transparency regarding the management team's credentials can be concerning for potential clients who seek reassurance about the expertise behind the broker.

In terms of information disclosure, Trader's Way provides basic information on its website, including account types, trading platforms, and available instruments. However, the overall transparency regarding its operations, financial stability, and compliance history is lacking. This can make it difficult for traders to make informed decisions about whether to trust the broker with their funds.

Trading Conditions Analysis

Trader's Way offers a competitive trading environment with various account types and trading platforms. The broker provides different fee structures, including spreads and commissions, which can vary depending on the account type chosen. However, the lack of transparency regarding fees raises concerns for potential clients.

| Fee Type | Trader's Way | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.2 pips | 0.1 pips |

| Commission Model | $3 per $100,000 | $2.5 per $100,000 |

| Overnight Interest Range | Varies | Varies |

The spreads on Trader's Way can be competitive, especially for ECN accounts, which offer spreads starting from 0.0 pips. However, the commission structure can add to overall trading costs. For example, while the MT4 variable account does not charge commissions, the ECN accounts do, which may deter high-frequency traders looking for cost-effective trading solutions.

Moreover, the overnight interest rates, or swaps, can vary significantly, and traders should be aware of the potential costs associated with holding positions overnight. The lack of clarity regarding these fees can lead to unexpected trading expenses, making it essential for traders to thoroughly understand the fee structure before opening an account.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Trader's Way claims to implement several security measures, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This is a positive aspect, as it provides some level of protection for clients in the event of the broker's insolvency.

However, it is essential to note that Trader's Way does not offer negative balance protection, which means that traders can lose more than their initial deposit. This is a significant risk, especially for inexperienced traders or those using high leverage, as it can lead to substantial financial losses.

Historically, Trader's Way has faced scrutiny regarding its fund security practices. There have been complaints from clients about difficulties in withdrawing funds, which raises concerns about the broker's overall reliability and commitment to safeguarding client assets. Traders should carefully consider these factors when deciding whether to engage with Trader's Way.

Customer Experience and Complaints

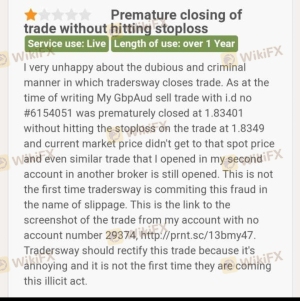

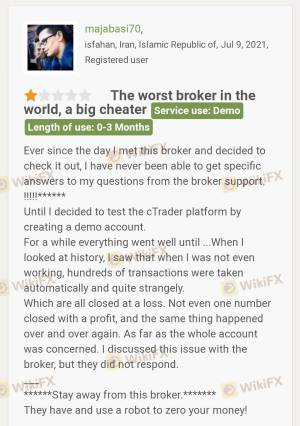

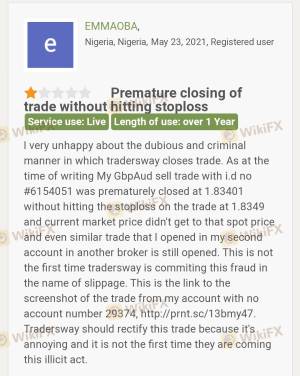

Customer feedback provides valuable insights into a broker's performance and reliability. Reviews of Trader's Way are mixed, with some users praising the broker for its fast deposit and withdrawal processes, while others express frustration over issues related to fund access and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Limited information |

| Account Manipulation Allegations | High | No clear response |

Common complaints include difficulties in withdrawing funds, with some clients reporting that their requests were delayed or denied without adequate explanations. Additionally, there have been allegations of account manipulation, where traders experienced unexplained losses. These issues highlight the importance of conducting thorough research before engaging with Trader's Way, as they may pose significant risks to traders' investments.

One notable case involved a trader who reported a sudden loss of funds without any clear explanation. Despite reaching out to customer support, the response was slow, and the trader felt that their concerns were not adequately addressed. This type of feedback raises concerns about the broker's commitment to customer service and support.

Platform and Trade Execution

The trading platforms offered by Trader's Way, including MetaTrader 4, MetaTrader 5, and cTrader, are well-regarded in the industry for their reliability and advanced features. However, the overall user experience can vary, with some traders reporting issues related to order execution quality and slippage.

Trader's Way claims to provide direct market access through its ECN accounts, which can lead to faster execution speeds and tighter spreads. However, some users have experienced delays in order execution, particularly during high-volatility market conditions. This can result in slippage, where orders are filled at prices different from those expected, potentially impacting trading outcomes.

Furthermore, there have been concerns about the broker's transparency regarding order execution practices. Some traders suspect that Trader's Way may operate as a market maker, which could lead to conflicts of interest and a lack of fairness in trade execution. This raises questions about the reliability of the trading environment provided by Trader's Way.

Risk Assessment

Engaging with Trader's Way involves several risks that traders should be aware of before opening an account. The absence of regulation, potential difficulties in accessing funds, and the lack of negative balance protection are significant concerns.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Access Risk | Medium | Withdrawal issues reported by clients |

| Trading Risk | High | High leverage can amplify losses |

Given these risks, traders should exercise caution when considering Trader's Way as their broker. It is advisable to implement risk management strategies, such as setting stop-loss orders and limiting leverage usage, to mitigate potential losses.

Conclusion and Recommendations

In conclusion, Trader's Way presents a mixed picture for potential clients. While the broker offers competitive trading conditions, a wide range of instruments, and popular trading platforms, the lack of regulation and transparency raises significant concerns about its reliability and safety. The mixed customer feedback, particularly regarding withdrawal issues and customer support, further complicates the decision to engage with this broker.

For traders who prioritize safety and regulatory oversight, it may be wise to consider alternatives that are well-regulated and have a proven track record of reliability. Brokers like AvaTrade, IC Markets, and FP Markets offer robust regulatory protection and a more transparent trading environment.

Ultimately, while Trader's Way may appeal to experienced traders seeking high leverage and low minimum deposits, it is essential to weigh the risks carefully and consider whether the potential rewards outweigh the inherent dangers associated with trading with an unregulated broker.

Is Trader’s Way a scam, or is it legit?

The latest exposure and evaluation content of Trader’s Way brokers.

Trader’s Way Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trader’s Way latest industry rating score is 2.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.