TradersWay 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

TradersWay is an offshore forex broker that touts high leverage options and low minimum deposit requirements, making it particularly appealing to experienced traders looking to maximize their trading potential. With offerings including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside the user-friendly cTrader platform, TradersWay caters to a diverse audience keen on varied trading instruments, including forex pairs, cryptocurrencies, and CFDs. However, the broker's lack of regulation raises significant concerns regarding fund safety and withdrawal reliability, marking it a riskier option for traders who value security alongside competitive trading conditions.

Given the tempting conditions on offer, TradersWay is best suited for seasoned traders familiar with offshore brokers and willing to accept the associated risks. Conversely, new and risk-averse traders should consider these factors carefully, as the mixed user experiences reported about withdrawal issues and operational practices suggest potential pitfalls.

⚠️ Important Risk Advisory & Verification Steps

It's essential to acknowledge the risks associated with trading through unregulated brokers. Here are key points to consider before trading with TradersWay:

- Lack of Regulation: TradersWay is not regulated by recognized financial authorities, which may expose clients to significant risk in terms of fund safety.

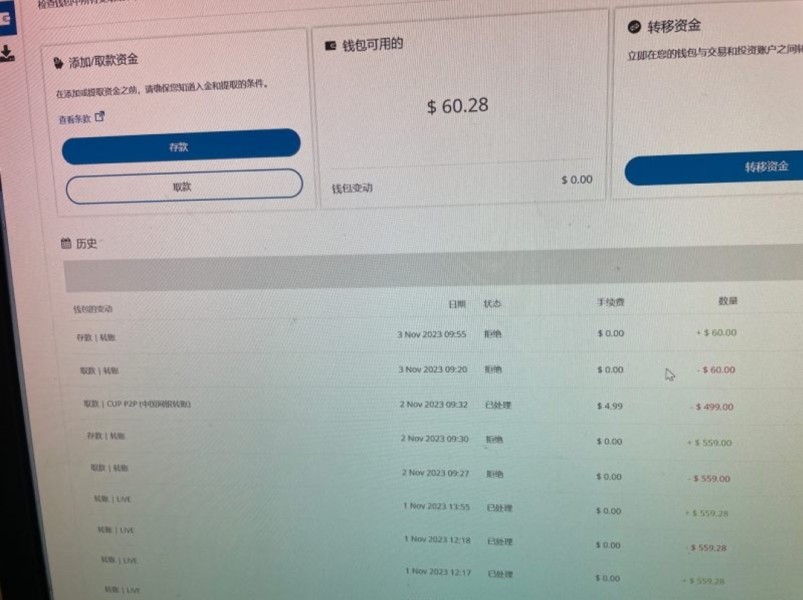

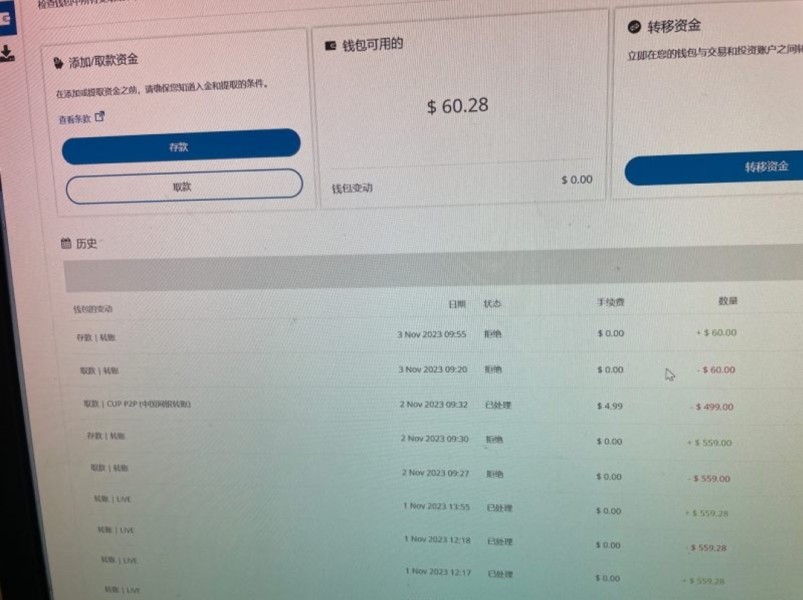

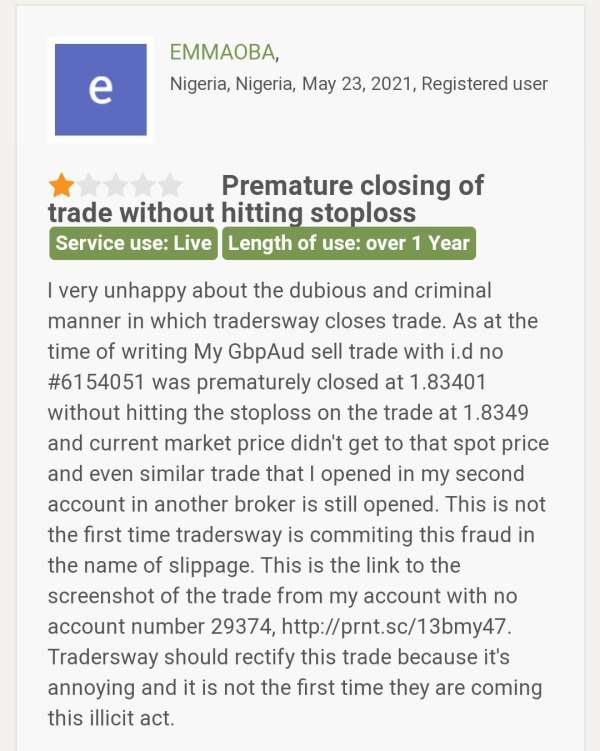

- Withdrawal Issues: Numerous user complaints indicate potential withdrawal challenges, including delays and complications.

- Uncertain Trading Environment: Without robust oversight, rely on self-verified research and user testimonials before engaging with the broker.

Verification Steps:

- Research regulatory information about the broker on financial oversight websites.

- Review user feedback on forums and independent review sites to gauge experiences.

- Confirm the legitimacy of claims made on TradersWays website through independent sources.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2011 and registered in the Commonwealth of Dominica, TradersWay operates as an offshore forex broker with minimal regulatory oversight, capitalizing on the light regulatory environment of its registered location. This has allowed the broker to offer enticing features, such as higher leverage ratios (up to 1:1000) and low minimum deposit requirements (as low as $1), making it attractive for traders seeking to maximize capital efficiency.

Core Business Overview

TradersWay provides various trading instruments, including over 45 forex pairs, cryptocurrencies, and CFDs linked to stock indices, precious metals, and commodities. The broker claims to have implemented strict Anti-Money Laundering (AML) and Know Your Customer (KYC) policies, although the lack of formal oversight lacks the reassuring framework typically found in regulated establishments.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Analytical Angle: "Teaching users to manage uncertainty."

The absence of regulation from established financial authorities such as the FCA or ASIC raises significant red flags regarding the brokers operational transparency and safety. Traders should remain cautious when dealing with an unregulated entity like TradersWay, where discrepancies in trading conditions and withdrawal practices have been commonly reported.

Analysis of Regulatory Information Conflicts:

The lack of regulation coupled with multiple claims of operational reliability creates a deceptive illusion of safety. This conflicting imagery can lead inexperienced traders to overlook essential diligence checks.

User Self-Verification Guide:

- Check regulatory bodies listings through sites such as the FCA, ASIC, and similar.

- Validate the broker's registration details via financial services registries.

- Use community feedback on forums like Forex Peace Army to obtain additional perspectives on the broker's credibility.

- Industry Reputation and Summary:

"The lack of tangible regulation and reports of withdrawal difficulties place TradersWay amongst the riskier options in the marketplace."

Trading Costs Analysis

Analytical Angle: "The double-edged sword effect."

Advantages in Commissions:

TradersWay offers competitive commission structures, especially for those using the ECN accounts, making it attractive for high-frequency or volume traders. Variable spreads starting from 0.2 pips on major pairs attract professional traders who prioritize low transaction costs.

The "Traps" of Non-Trading Fees:

Despite low trading costs, various user complaints highlight issues with unnecessary withdrawal fees and slow processing times. For example, “I waited weeks for a bank withdrawal” and “There were charges I didnt see coming” suggest a lack of transparency.

Cost Structure Summary:

The operational cost alongside hidden fees poses a significant trade-off for users. While trading conditions may seem favorable, they may quickly incur unexpected fees, especially upon withdrawal.

Analytical Angle: "Professional depth vs. beginner-friendliness."

Platform Diversity:

TradersWay provides access to multiple trading platforms including MT4, MT5, and cTrader. MT4 is particularly popular for its user-friendliness and advanced trading tools, while cTrader stands out for advanced charting and execution features desired by experienced traders.

Quality of Tools and Resources:

Tools like Calgo for automated trading provide additional depth, though many users express a longing for more educational resources and market insights directly from the broker.

Platform Experience Summary:

"Users often report satisfaction with the available platforms but express a need for more educational content to harness these tools effectively."

User Experience Analysis

Analytical Angle: "Navigating Challenges in User Interaction."

Interface and Usability:

The user interface is generally intuitive, but inconsistencies during critical trading times (like news events) have raised concerns about execution delays or freezes.

Feedback on Execution & Order Management:

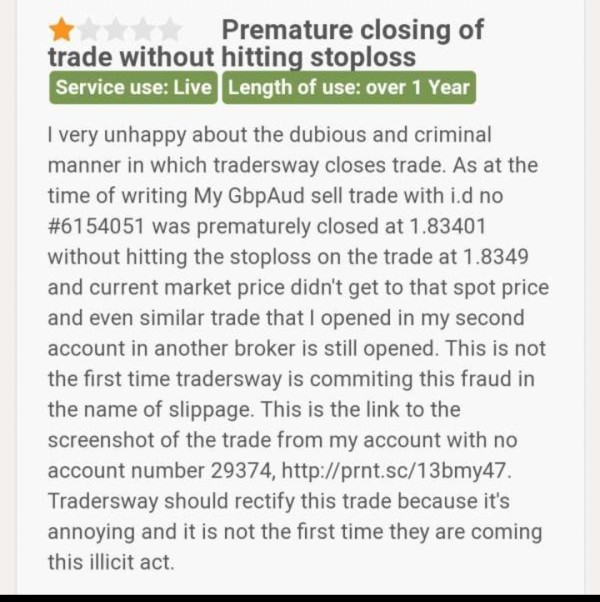

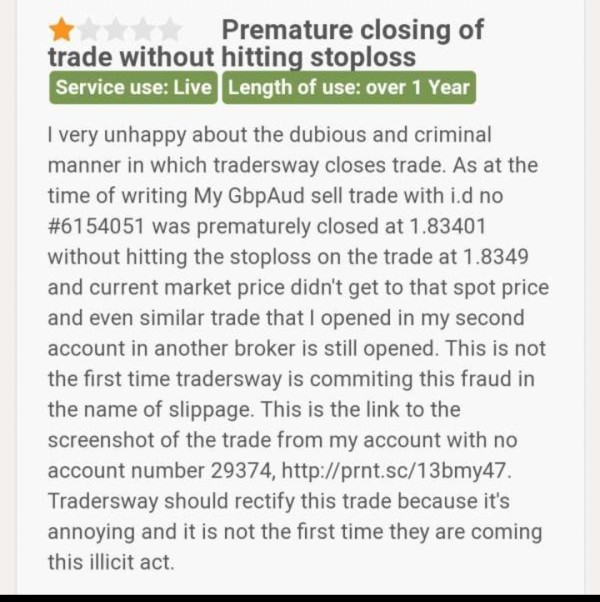

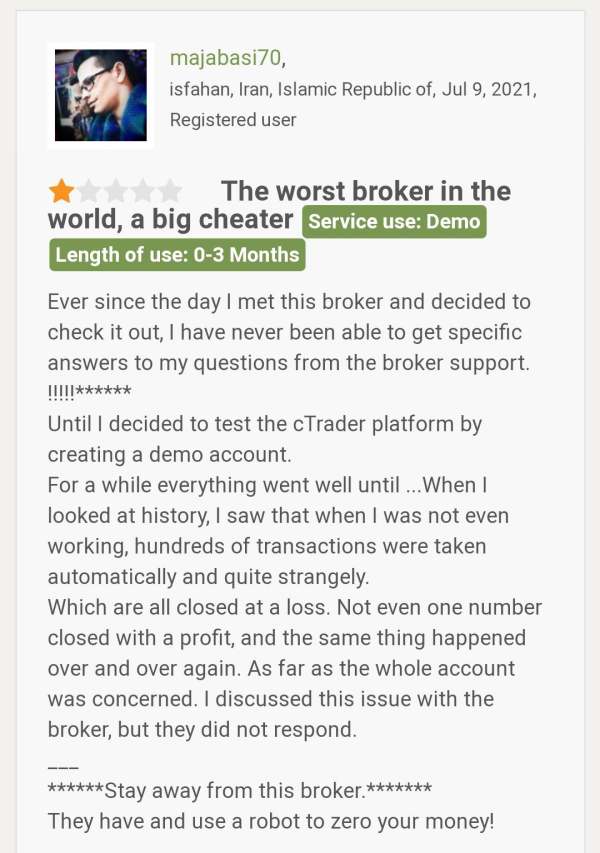

The mixed reports surrounding order execution reflect the challenges of using an ECN model under an unregulated environment, with slippage reported during volatile market conditions.

Summary of User Reviews:

"While many users praise the low spreads and customer support, alarming experiences regarding trading execution and withdrawal delays cloud the brokers reputation."

Customer Support Analysis

Analytical Angle: "Support Structures in a High-Risk Trading Environment."

Accessibility and Responsiveness:

Support is generally available through various channels, including email and live chat. However, response times can vary significantly, particularly during peak trading hours when many clients seek assistance.

User Reviews on Support Experience:

Mixed feedback suggests that while some users express satisfaction with personalized service, others highlight delays in responses during critical trading phases.

Support Summary:

"TradersWays customer service is responsive but inconsistent, reflecting challenges in maintaining support during high-volume trading."

Account Conditions Analysis

Analytical Angle: "Flexibility versus Reliability."

Account Types Offered:

TradersWay provides several accounts with varying conditions to suit diverse trading styles, from standard to ECN accounts, making it an attractive option for flexible trading strategies.

Leverage and Margin Requirements:

High leverage available creates opportunities for substantial gains but also heightens the risk of significant losses—a duality that traders should navigate cautiously.

Account Summary:

"While the diversity in account offerings and flexible deposit conditions are favorable, the lack of regulation adds a risk dimension that traders cannot ignore."

Conclusion

In sum, TradersWay presents a range of enticing features that can attract experienced traders eager to exploit high-leverage conditions and low fees. However, the brokers unregulated nature, coupled with numerous user complaints regarding withdrawal issues and execution practices, necessitates careful consideration. While it may serve well as a tool for skilled traders familiar with the nuances of offshore trading environments, it poses substantial risks for less experienced individuals or those prioritizing safety and investment reliability. As always, thorough research and due diligence remain paramount in navigating the world of forex trading, especially with brokers operating in high-risk settings.