Regarding the legitimacy of tegasFX forex brokers, it provides VFSC and WikiBit, .

Is tegasFX safe?

Pros

Cons

Is tegasFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Clover Markets Ltd

Effective Date: Change Record

2018-08-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TegasFX A Scam?

Introduction

TegasFX is a forex broker that has emerged in the competitive landscape of online trading since its inception in 2016. Operating under the name of Clover Markets Limited, it positions itself as a provider of ECN/STP trading services, boasting low latency and tight spreads. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. In this article, we will analyze whether TegasFX is safe or a potential scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. TegasFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is known for its relatively lenient regulatory framework. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14697 | Vanuatu | Active, but with concerns |

While the VFSC does provide a form of oversight, it lacks the stringent requirements found in jurisdictions like the UK‘s FCA or Australia’s ASIC. This raises concerns about the effectiveness of investor protection measures. The VFSC has been criticized for its lack of rigorous enforcement and oversight, which can leave traders vulnerable to potential fraud or mismanagement. Furthermore, reviews suggest that many brokers operating under VFSC licenses have been implicated in scams or unethical practices. Therefore, while TegasFX is technically regulated, the quality of that regulation is questionable, leading many to ask, "Is TegasFX safe?"

Company Background Investigation

TegasFX is owned by Clover Markets Limited and is headquartered in Vanuatu. The company has been operational since 2016, but details about its ownership structure and management team remain sparse. This lack of transparency can be a red flag for potential investors. The absence of publicly available information regarding the management teams qualifications and experience further complicates the assessment of the broker's reliability.

A well-structured company typically discloses its leadership and their backgrounds to instill confidence among clients. However, TegasFX does not provide such information, which can lead to skepticism about its credibility. The lack of transparency raises questions about its operational practices and overall integrity, making it imperative for traders to consider whether their funds would be secure with TegasFX. In light of this information, many potential clients may wonder again, "Is TegasFX safe?"

Trading Conditions Analysis

TegasFX offers various trading accounts, with a minimum deposit requirement of $200. The broker claims to provide competitive trading conditions, including low spreads and commissions. However, it is essential to dig deeper into the fee structure to understand any hidden costs associated with trading. Heres a comparison of core trading costs:

| Fee Type | TegasFX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.2 pips | 1.0 pips |

| Commission Model | $4 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads appear attractive, the commission structure may not be as favorable when compared to other brokers. Moreover, some reviews indicate that clients have experienced unexpected fees, which raises concerns about the broker's transparency regarding its fee policies. Traders must be cautious and fully understand the terms before committing to any broker. The question remains, "Is TegasFX safe?" given its fee structure and potential hidden costs.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. TegasFX claims to hold client funds in segregated accounts at reputable banks, which is a standard practice intended to protect traders capital. However, the effectiveness of these measures is heavily reliant on the regulatory framework governing the broker.

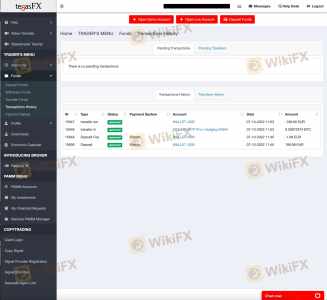

The VFSC does not provide the same level of investor protection as more reputable regulators. There is no guarantee of compensation in the event of a broker's insolvency or fraudulent activity. Furthermore, historical complaints about withdrawal issues and fund accessibility have emerged, casting doubt on the broker's commitment to safeguarding client funds. This leads to the pressing question: "Is TegasFX safe?" when it comes to the security of your investments.

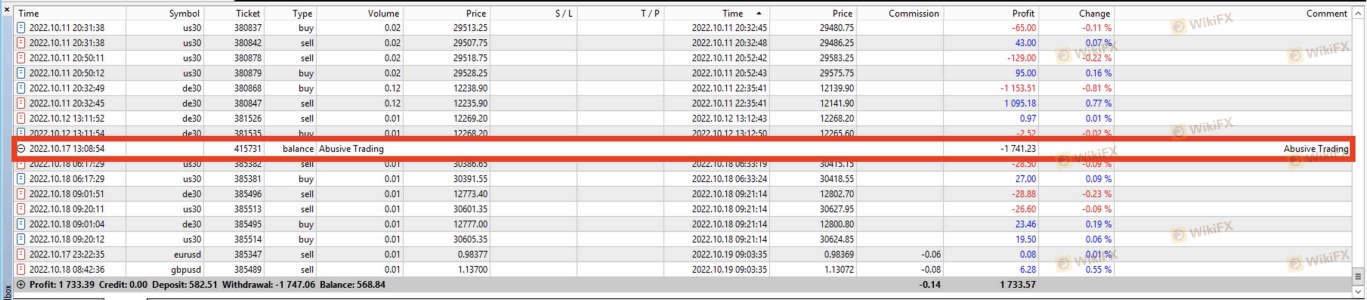

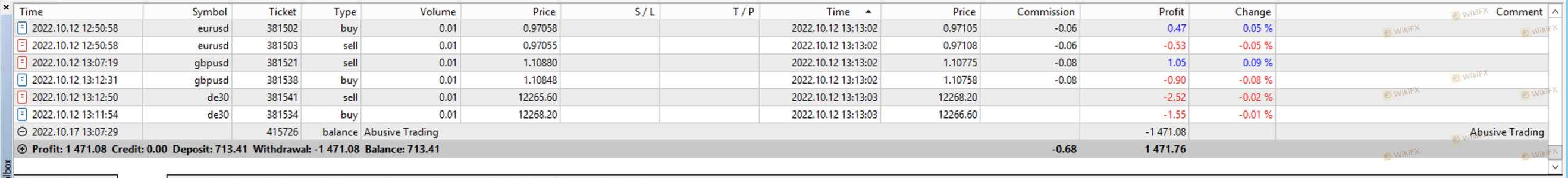

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing the reliability of any broker. Reviews of TegasFX reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service. Common complaints include delays in processing withdrawal requests and lack of effective communication from the support team. Below is a summary of the primary complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Inconsistent support |

| Account Verification Issues | High | Lengthy process |

Some users have reported being unable to withdraw their funds altogether, which is a significant red flag. These complaints indicate a pattern of behavior that could suggest deeper issues within the companys operational practices. As potential clients assess whether "Is TegasFX safe?", these experiences warrant serious consideration.

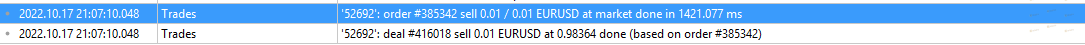

Platform and Execution

TegasFX utilizes popular trading platforms, including MetaTrader 4 and MetaTrader 5, which are known for their robust functionality and user-friendly interfaces. However, the quality of trade execution is a critical aspect that can significantly impact a trader's experience. Reports of slippage and order rejections have surfaced, leading to concerns about the reliability of TegasFX's execution.

Traders have noted inconsistencies in order fills, which can adversely affect trading outcomes. If a broker consistently fails to execute trades as expected, it can lead to substantial financial losses. Therefore, potential traders must question, "Is TegasFX safe?" especially regarding execution quality and reliability.

Risk Assessment

Engaging with any forex broker carries inherent risks, and it is essential to evaluate these before proceeding. Below is a risk assessment summary for TegasFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak oversight from VFSC |

| Fund Security Risk | High | No strong investor protection measures |

| Withdrawal Risk | High | Reports of delays and issues |

| Transparency Risk | Medium | Lack of information on management |

Given the above risk factors, potential traders should exercise caution. It is advisable to consider alternative brokers with stronger regulatory frameworks and proven track records.

Conclusion and Recommendations

After a thorough investigation into TegasFX, it is evident that there are multiple concerns regarding its safety and reliability. The combination of weak regulation, customer complaints, and transparency issues raises significant red flags. As such, it is reasonable to conclude that many traders should be wary and ask themselves, "Is TegasFX safe?"

For those considering trading in the forex market, it is advisable to look for brokers with robust regulatory oversight, strong client reviews, and transparent practices. Trusted alternatives include brokers regulated by the FCA or ASIC, such as IC Markets or AvaTrade. In summary, while TegasFX may offer appealing trading conditions, the associated risks and concerns make it a less than ideal choice for serious traders.

Is tegasFX a scam, or is it legit?

The latest exposure and evaluation content of tegasFX brokers.

tegasFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

tegasFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.