TegasFX 2025 Review: Everything You Need to Know

Summary

This tegasfx review looks at a forex broker that started in 2016. The company now serves over 400,000 clients around the world. TegasFX calls itself a True ECN/STP broker that offers instant funding for retail and institutional traders. The broker works under rules from the Vanuatu Financial Services Commission, which might worry traders who want stronger oversight from major financial centers.

TegasFX gives access to forex, CFDs, and social trading through its ECN/STP system. The platform works mainly for retail and institutional traders who want good trading conditions. But clients should know about the high minimum deposit of $20,000 USD, which makes it hard for new traders to join. TegasFX has a 4 out of 5 star rating on Trustpilot, showing that users generally like it, though some investors worry about unclear fee information.

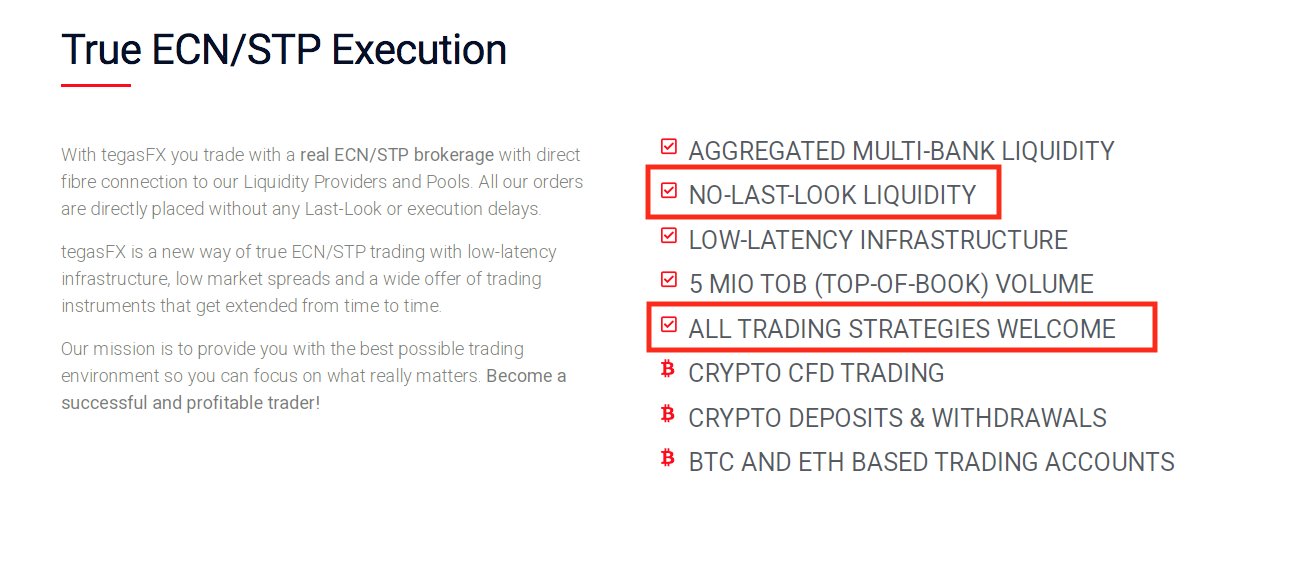

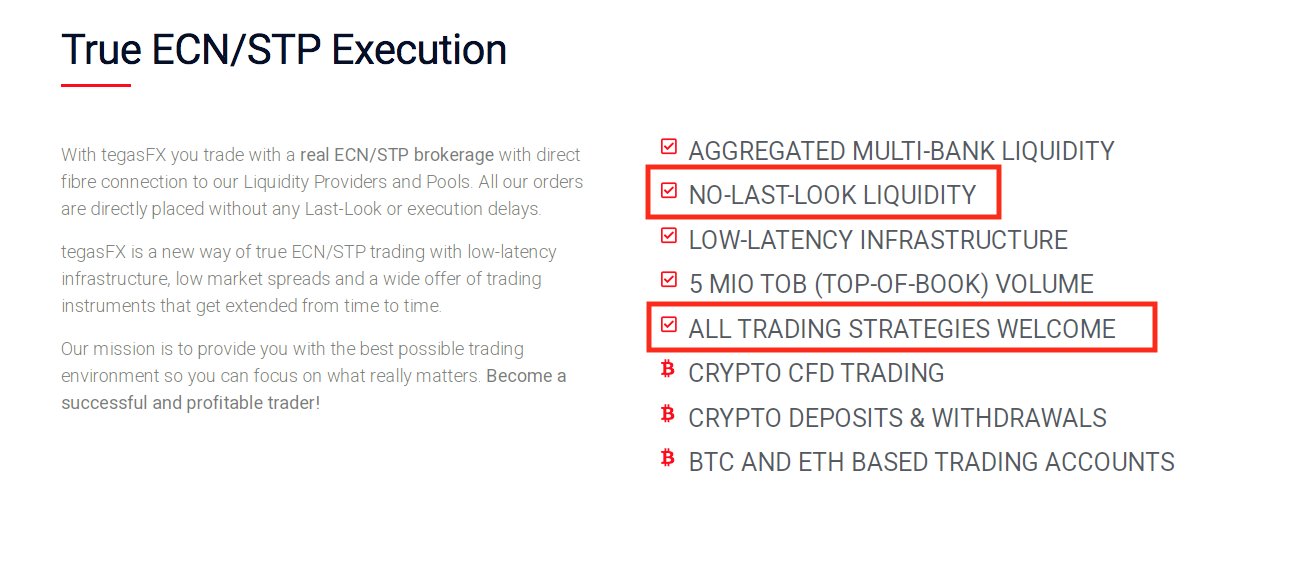

The broker focuses on ECN/STP technology to provide direct market access with little dealer interference. This could appeal to serious traders who want professional execution quality.

Important Notice

Regional Entity Differences: TegasFX works under rules from the Vanuatu Financial Services Commission, which may not protect traders as well as authorities in major financial centers like the FCA, ASIC, or CySEC. Traders should think carefully about regulatory protection in their area before opening an account.

Review Methodology: This review uses public information, user feedback from sources like Trustpilot, and industry analysis. The assessment tries to give a complete overview while noting that some trading details may need direct checking with the broker.

Rating Framework

Broker Overview

TegasFX started in the forex industry in 2016. The company works as a global financial trading platform for retail and institutional traders. TegasFX focuses on technology and uses a True ECN/STP execution model to give direct market access without dealing desk interference. The broker has built a client base of over 400,000 traders worldwide over its years of operation, showing growing market presence in the competitive forex space.

The company's business model uses ECN and STP execution, which should allow faster order processing and clearer pricing. This approach appeals to professional traders and institutions that need reliable execution with minimal slippage and re-quotes. TegasFX markets itself as offering instant funding solutions, which could attract traders who want quick account setup and trading abilities.

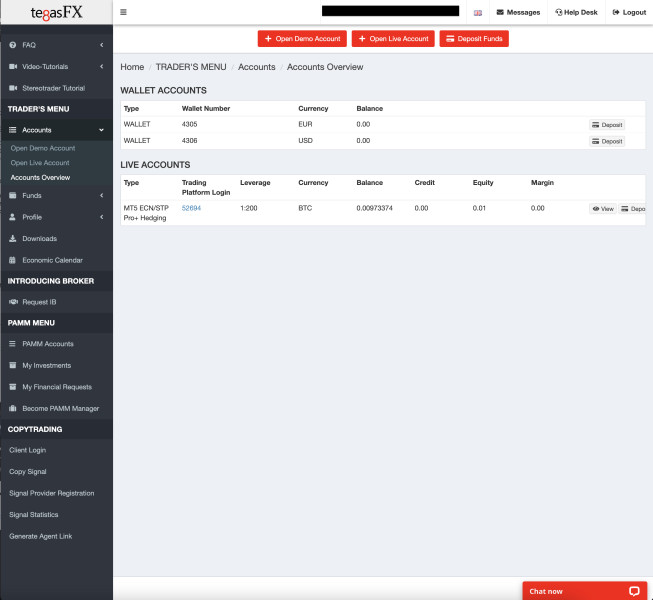

TegasFX provides access to multiple asset classes beyond forex pairs. The broker offers CFD trading across various markets and social trading features that let new traders follow and copy successful strategies. TegasFX operates under the Vanuatu Financial Services Commission, though specific license numbers need further checking. This tegasfx review notes that while VFSC regulation provides some oversight, it may not offer the same investor protection as more established regulatory bodies in major financial centers.

Regulatory Jurisdiction: TegasFX operates under the Vanuatu Financial Services Commission. This provides some regulatory oversight, but traders should know that VFSC regulation may not offer the same comprehensive investor protection available through major regulatory bodies like the FCA, ASIC, or CySEC.

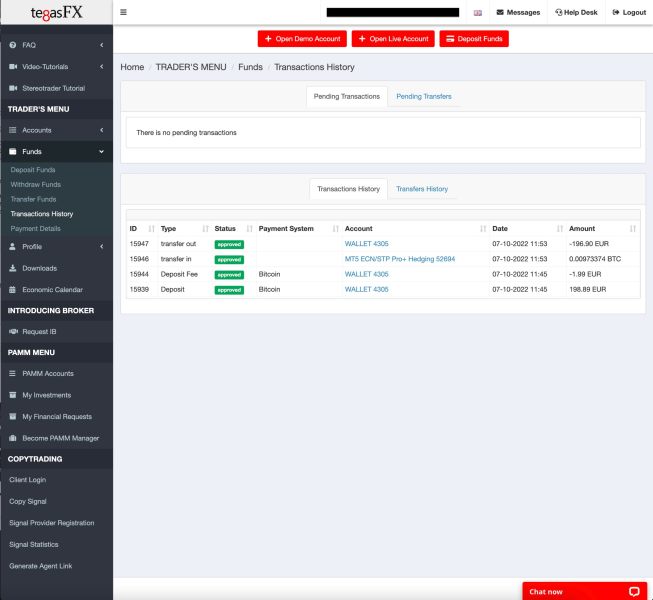

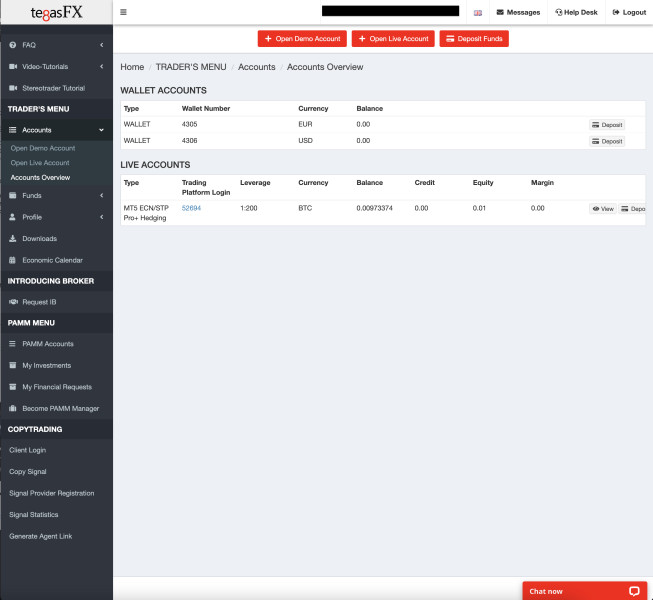

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. Traders need to verify payment methods directly with the broker.

Minimum Deposit Requirements: TegasFX requires a minimum deposit of $20,000 USD. This is much higher than many retail-focused brokers. The requirement suggests the platform targets serious traders and institutional clients rather than beginners.

Promotional Offers: Details about bonus programs and promotional offers are not specified in available review materials. This indicates either limited promotional activity or the need for direct inquiry with the broker.

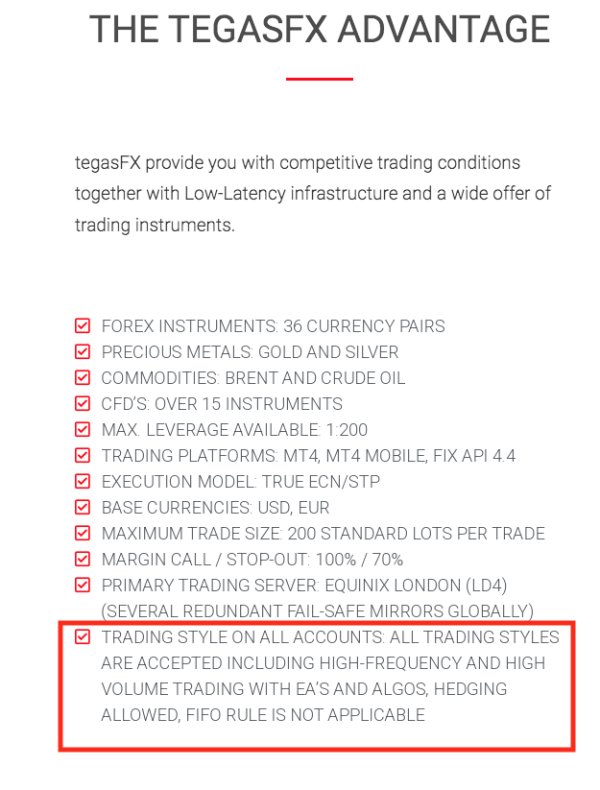

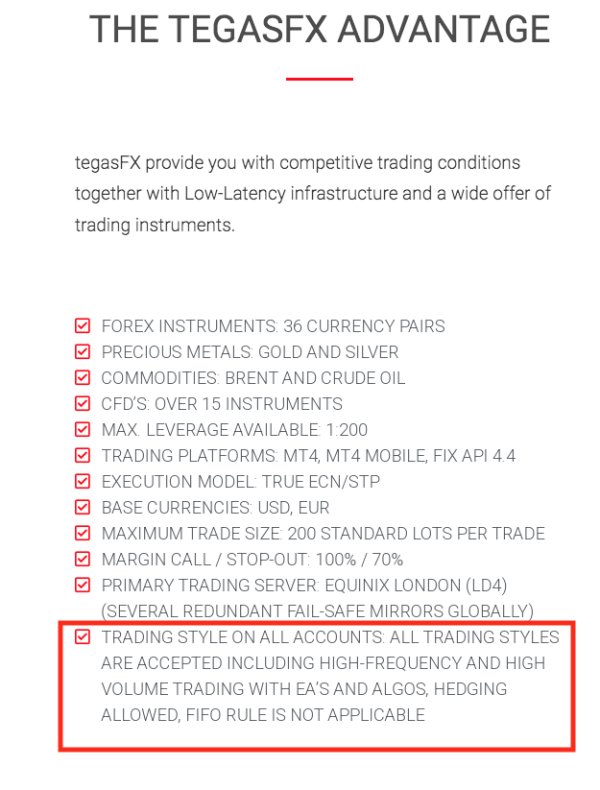

Tradeable Assets: The broker offers forex trading, CFD markets across various asset classes, and social trading capabilities. Specific details about the number of currency pairs, commodities, indices, and other instruments need further verification.

Cost Structure: Complete information about spreads, commissions, and other trading costs is not detailed in available sources. Given the ECN/STP model, traders can expect commission-based pricing, but specific rates need clarification.

Leverage Options: Maximum leverage ratios and varying leverage by asset class are not specified in current review materials. This represents an important information gap for potential clients.

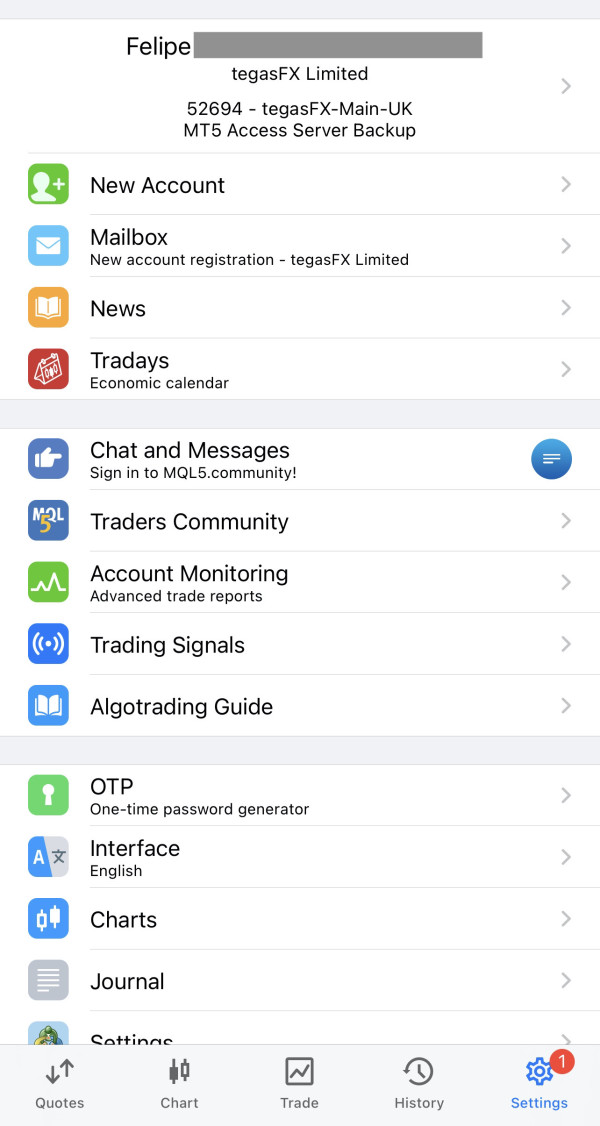

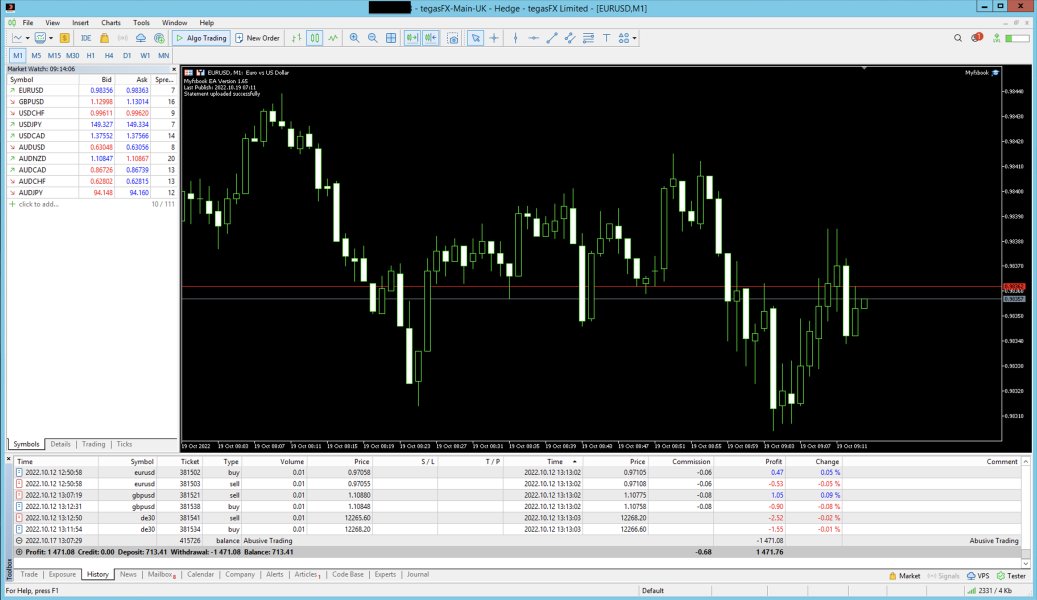

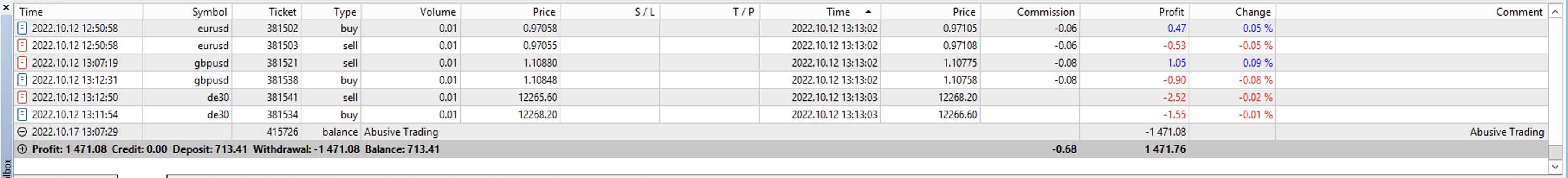

Trading Platform Options: While TegasFX emphasizes its ECN/STP technology, specific trading platform names and features are not detailed in available sources.

Geographic Restrictions: Information about restricted countries and regional limitations is not available in current review materials.

Customer Support Languages: Supported languages for customer service are not specified. The broker's global reach suggests multi-language support capabilities.

This tegasfx review highlights the need for potential clients to conduct direct research with the broker. Traders should get complete information about trading conditions, costs, and available services.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions at TegasFX present a mixed picture for potential traders. The most significant barrier is the substantial minimum deposit requirement of $20,000 USD. This immediately positions the broker as targeting serious traders and institutional clients rather than retail beginners. The high entry threshold excludes many individual traders who are starting their forex journey or those with limited capital for trading activities.

Available information does not provide details about different account types or tier structures with varying conditions based on deposit levels. The lack of transparency around account variations makes it difficult for potential clients to understand available options beyond the stated minimum requirement. Specific information about account opening procedures, document requirements, and verification timelines is not readily available in current review materials.

The absence of detailed information about Islamic accounts, demo account availability, or special features for different trader categories represents a significant information gap. Professional traders expect comprehensive account documentation that clearly outlines all terms, conditions, and available features. This tegasfx review notes that the limited publicly available information about account structures may require potential clients to engage directly with the broker for complete details.

For institutional traders, the high minimum deposit may be less concerning. However, the lack of detailed information about institutional-specific services, dedicated account management, or volume-based incentives represents missed opportunities for transparency that could attract serious trading businesses.

TegasFX's tools and resources offering shows promise but lacks detailed specification for comprehensive evaluation. The broker's emphasis on ECN/STP execution technology suggests a focus on providing professional-grade trading infrastructure. This is fundamental for serious trading operations. The availability of CFD trading across multiple asset classes indicates a broader toolkit beyond basic forex trading, potentially appealing to diversified trading strategies.

The social trading capabilities mentioned in broker materials suggest TegasFX recognizes the growing demand for copy trading and social investment features. However, specific details about how these social trading tools function are not clearly documented in available sources. Information about statistics for strategy providers and risk management features built into the social trading platform is also missing.

Research and analysis resources, which are crucial for informed trading decisions, are not detailed in current review materials. Professional traders expect access to economic calendars, market analysis, technical indicators, and potentially premium research content. The absence of information about educational resources also represents a gap, particularly for a broker serving retail clients alongside institutional ones.

Automated trading support, including Expert Advisor compatibility, API access for algorithmic trading, and VPS services, are not specifically mentioned in available materials. Given the broker's positioning toward serious traders, these omissions in publicly available information may indicate either limited offerings or insufficient marketing of available tools.

Customer Service and Support Analysis (5/10)

Customer service evaluation for TegasFX is challenging due to limited publicly available information about support channels, availability, and service quality metrics. For a broker handling significant client deposits and serving both retail and institutional traders, comprehensive customer support is essential. Yet details about service standards are not readily accessible.

The absence of specific information about support channels represents a significant transparency gap. Details about live chat availability, phone support hours, email response times, or dedicated account management services are not available. Professional traders and institutions require reliable, responsive support, particularly during volatile market conditions when technical issues or account queries need immediate attention.

Multi-language support capabilities are not specifically documented, while likely available given the broker's global reach to over 400,000 clients. This information gap makes it difficult for international clients to assess whether they can receive support in their preferred language. This is particularly important for complex trading or account issues.

Response time commitments, escalation procedures, and service level agreements that professional clients expect are not outlined in available materials. The lack of documented customer service standards makes it difficult to assess whether TegasFX maintains the support quality necessary for serious trading operations.

Trading Experience Analysis (6/10)

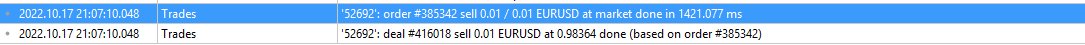

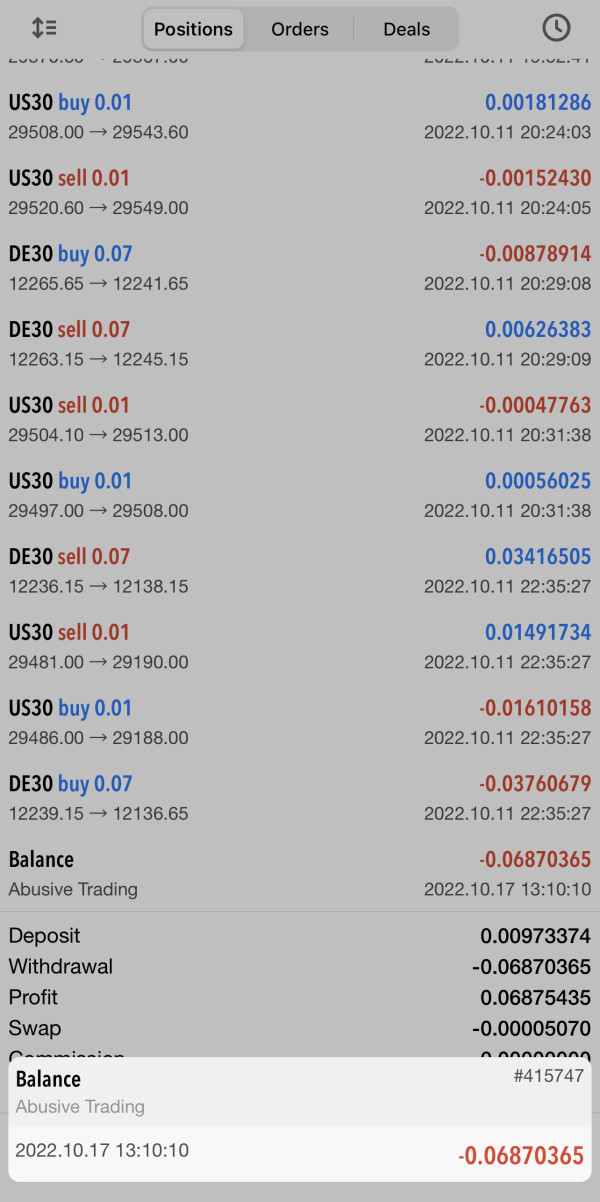

The trading experience at TegasFX centers around their ECN/STP execution model. This theoretically provides direct market access with minimal dealer intervention. The execution method is generally preferred by serious traders as it can offer faster order processing, reduced slippage, and more transparent pricing compared to market maker models. However, specific performance metrics such as average execution speeds, slippage statistics, or re-quote frequencies are not documented in available review materials.

Platform stability and reliability are crucial factors for any serious trading operation. Yet specific information about uptime statistics, server locations, or technical infrastructure is not readily available. The broker's ability to handle high-volume trading periods and maintain consistent execution quality during volatile market conditions remains undocumented in public materials.

Mobile trading capabilities, which are increasingly important for modern traders, are not specifically detailed in available sources. Given the competitive nature of the forex industry, most brokers offer mobile applications. However, the specific features, functionality, and reliability of TegasFX's mobile solutions require verification.

Order types available, advanced trading features, and platform customization options that professional traders require are not comprehensively documented. This tegasfx review notes that while the ECN/STP foundation suggests professional-grade infrastructure, the lack of detailed platform specifications makes it difficult to assess the complete trading experience quality.

Trust and Regulation Analysis (6/10)

TegasFX operates under the regulatory oversight of the Vanuatu Financial Services Commission. This provides some level of regulatory supervision but may not offer the comprehensive investor protection schemes available through major financial regulators. The VFSC regulation allows the broker to operate internationally but may not provide the same level of compensation schemes, dispute resolution mechanisms, or regulatory scrutiny that traders might expect from FCA, ASIC, or CySEC regulated entities.

The broker's Trustpilot rating of 4 out of 5 stars suggests generally positive user experiences. This indicates that clients who have worked with TegasFX have largely been satisfied with their services. However, the total number of reviews, specific feedback themes, and response to negative reviews are important factors that require deeper investigation for a complete trust assessment.

Client fund protection measures, such as segregated accounts, insurance coverage, or compensation schemes, are not detailed in available review materials. For a broker handling minimum deposits of $20,000 USD, clear documentation of fund safety measures is essential for client confidence. This is particularly important for institutional clients managing significant capital.

The company's operational transparency, including detailed company information, management team backgrounds, and financial reporting, is not readily accessible in public materials. This lack of corporate transparency may concern institutional clients or serious traders who prefer to understand the financial stability and management quality of their chosen broker.

User Experience Analysis (5/10)

User experience assessment for TegasFX is primarily based on the reported Trustpilot rating of 4 out of 5 stars. This suggests that clients who have engaged with the broker generally report positive experiences. However, the specific aspects of user experience that contribute to this rating are not detailed in available review materials. Information about account opening efficiency, platform usability, or support responsiveness is missing.

The account opening and verification process, which is often a client's first substantial interaction with a broker, is not documented in available sources. Given the high minimum deposit requirement, potential clients likely expect a streamlined, professional onboarding experience. This should reflect the premium positioning of the service.

Platform interface design, navigation efficiency, and overall usability are not specifically addressed in current review materials. For traders managing significant capital, platform reliability and ease of use directly impact trading efficiency and overall satisfaction with the broker relationship.

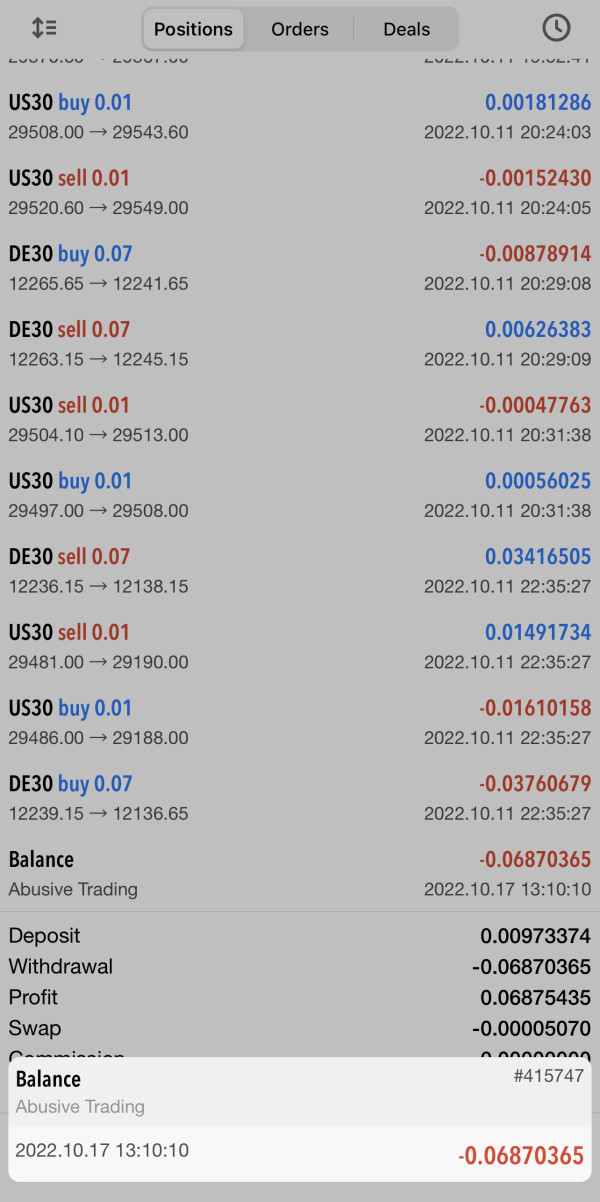

Fund management experience, including deposit processing times, withdrawal procedures, and fee transparency, represents crucial user experience factors. These are not detailed in available sources. Professional traders expect efficient fund management with clear timelines and transparent cost structures, yet this information requires direct verification with the broker.

Conclusion

This tegasfx review reveals a broker with both promising features and significant information gaps that potential clients must carefully consider. TegasFX's ECN/STP execution model and substantial client base of over 400,000 traders suggest a legitimate operation with professional-grade infrastructure. However, the high minimum deposit requirement of $20,000 USD and VFSC regulation may not suit all trader profiles. This is particularly true for those seeking lower entry barriers or stronger regulatory protection.

The broker appears most suitable for experienced traders and institutional clients who can meet the substantial minimum deposit requirements. These traders must also be comfortable with VFSC regulatory oversight. The positive Trustpilot rating of 4 stars provides some confidence in user satisfaction, though more detailed feedback analysis would strengthen this assessment.

Key advantages include the ECN/STP execution model, multiple asset class availability, and substantial client base indicating market acceptance. Primary limitations include the high minimum deposit barrier, limited transparent information about costs and features, and regulatory jurisdiction that may not provide maximum investor protection. Potential clients should conduct thorough research and direct communication with TegasFX to obtain comprehensive information about trading conditions, costs, and services before making account opening decisions.