Is Quick Investment safe?

Pros

Cons

Is Quick Investment Safe or a Scam?

Introduction

Quick Investment is a forex brokerage that has gained attention in the online trading community. Positioned as a platform for both novice and experienced traders, it claims to offer a range of trading services and instruments. However, the legitimacy of Quick Investment has come under scrutiny, prompting traders to exercise caution when evaluating this broker. The importance of assessing the credibility of a forex broker cannot be overstated, as choosing the wrong one can lead to significant financial losses. In this article, we will investigate whether Quick Investment is safe or potentially a scam. Our analysis is based on a comprehensive evaluation of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and protect client funds. In the case of Quick Investment, several sources indicate that it operates without proper regulatory oversight. This lack of regulation raises significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a license from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) suggests that Quick Investment may not comply with the necessary legal frameworks designed to protect traders. Furthermore, multiple reviews have labeled Quick Investment as unregulated and potentially blacklisted, indicating a history of non-compliance with industry standards. Overall, the lack of regulatory oversight is a significant concern that warrants caution when considering whether Quick Investment is safe.

Company Background Investigation

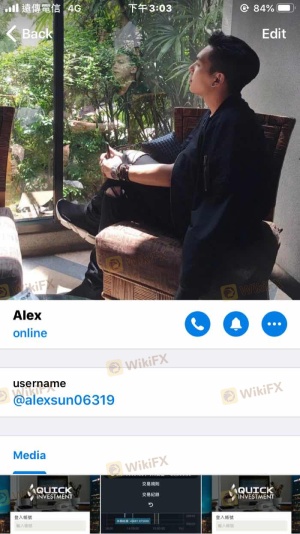

Understanding the background of a brokerage can offer insights into its credibility. Quick Investment appears to have a limited online presence, with scant information available regarding its history, ownership structure, and management team. This lack of transparency is troubling, as reputable brokers typically provide detailed information about their operations and leadership.

The company claims to have been in operation for several years, but the absence of verifiable data raises questions about its authenticity. Additionally, the management teams qualifications and experience in the financial industry remain unclear. A transparent company would usually showcase its leadership's credentials and professional backgrounds to instill confidence among potential clients. The lack of such information further complicates the assessment of whether Quick Investment is safe or a scam.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience. Quick Investment presents itself as having competitive trading fees and conditions; however, reviews suggest that its fee structure may contain unusual or hidden charges.

| Fee Type | Quick Investment | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | N/A | $0 - $10 per trade |

| Overnight Interest Range | Unknown | 0.5% - 3% |

The spread on major currency pairs is reported to be variable, which can lead to unexpected costs for traders. While many brokers maintain transparent pricing structures, the ambiguity surrounding Quick Investments fees raises concerns about potential exploitation. Traders should be wary of any broker that does not clearly outline its fee structure, as this can often be a tactic employed by less scrupulous firms. This lack of clarity is a significant factor in determining whether Quick Investment is safe.

Customer Funds Security

The security of customer funds is paramount in the forex trading industry. A reputable broker should implement robust measures to protect client deposits, including segregated accounts and investor protection policies. Quick Investment, however, has faced criticism regarding its fund security measures.

Reports indicate that Quick Investment does not provide clear information about its fund segregation practices or whether it offers negative balance protection. The absence of these essential security measures poses a substantial risk to traders, as they may find themselves vulnerable to significant losses without recourse. Furthermore, historical complaints about withdrawal issues raise additional alarms about the security of funds held with Quick Investment.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reliability. Quick Investment has received a mix of reviews, with many users expressing dissatisfaction with their experiences. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with platform reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Platform Reliability | High | Unresolved |

The severity of complaints related to withdrawal issues is particularly concerning, as it directly impacts a trader's ability to access their funds. The reported lack of responsiveness from customer support further exacerbates the situation, leaving traders feeling abandoned and frustrated. These patterns of complaints indicate that Quick Investment may not prioritize customer service, which is a critical aspect of a trustworthy brokerage.

Platform and Execution

The performance of a trading platform is essential for a positive trading experience. Users have reported mixed experiences with Quick Investment's platform, citing issues such as slow execution speeds and occasional outages. Concerns regarding slippage and order rejections have also been raised, which can significantly impact trading outcomes.

A reliable platform should provide fast execution and minimal slippage, ensuring that traders can capitalize on market opportunities. However, the reported issues with Quick Investments platform performance raise questions about its reliability. If traders cannot trust the platform to execute their orders efficiently, it undermines the entire trading experience.

Risk Assessment

Using Quick Investment carries various risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | Medium | Ambiguous fee structure may lead to unexpected costs. |

| Operational Risk | High | Reports of platform unreliability and withdrawal issues. |

The high regulatory risk associated with Quick Investment cannot be understated, as it leaves traders without the protections afforded by regulated brokers. Additionally, the operational risks linked to platform performance and customer service issues further complicate the decision to engage with this broker.

Risk Mitigation Suggestions

- Thorough Research: Always verify a brokers regulatory status and reputation before trading.

- Start Small: If you decide to use Quick Investment, begin with a small amount to mitigate potential losses.

- Alternative Brokers: Consider using well-regulated brokers with positive reviews and transparent fee structures.

Conclusion and Recommendations

In conclusion, the evidence suggests that Quick Investment may not be a safe trading option. The lack of regulatory oversight, combined with a history of customer complaints regarding withdrawals and platform reliability, raises significant concerns about its legitimacy. Traders should exercise extreme caution when considering this broker.

For those seeking to trade forex safely, it is advisable to consider reputable and well-regulated alternatives, such as brokers regulated by the FCA or ASIC, which offer robust customer protections and transparent trading conditions. By prioritizing safety and due diligence, traders can better navigate the complexities of the forex market and protect their investments.

Is Quick Investment a scam, or is it legit?

The latest exposure and evaluation content of Quick Investment brokers.

Quick Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Quick Investment latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.