Regarding the legitimacy of NOZAX forex brokers, it provides SCMN and WikiBit, .

Is NOZAX safe?

Pros

Cons

Is NOZAX markets regulated?

The regulatory license is the strongest proof.

SCMN Derivatives Trading License (STP)

The Capital Market Commission

The Capital Market Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Nozax a.d. Podgorica

Effective Date:

--Email Address of Licensed Institution:

admin@nozax.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Ljubovića 6, Podgorica, MontenegroPhone Number of Licensed Institution:

+382 67 798 627Licensed Institution Certified Documents:

Is Nozax A Scam?

Introduction

Nozax is an online forex broker that claims to provide a diverse range of trading services, including forex, commodities, and indices, with a focus on accessibility and user-friendly platforms. As the forex market continues to grow, it attracts both seasoned traders and novices, making it crucial for individuals to carefully evaluate brokers before committing their funds. With numerous reports of scams in the financial sector, discerning trustworthy brokers from fraudulent ones has become increasingly important. This article investigates Nozaxs credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical factor in assessing any forex broker's legitimacy, as it ensures that the broker adheres to specific operational standards, providing a level of protection for traders. Nozax claims to be regulated by the Montenegrin Capital Market Authority, which raises questions about the robustness of this regulatory body compared to more established regulators like the FCA (UK) or ASIC (Australia).

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Montenegrin Capital Market Authority | 03/2-5/5-21 | Montenegro | Verified |

While Nozax presents itself as a regulated entity, the Montenegrin regulatory framework is often viewed as less stringent than those of other jurisdictions. There are concerns about the effectiveness of the Montenegrin Capital Market Authority in enforcing compliance among its licensed brokers. This lack of rigorous oversight can potentially expose traders to significant risks, as unregulated brokers often engage in unscrupulous practices without fear of repercussions.

Company Background Investigation

Nozax is relatively new to the forex market, having emerged in 2022. The broker operates under the name Nozax AD and is registered in Montenegro. However, the details surrounding its ownership and management are not readily available, which raises transparency concerns. A reputable broker typically provides clear information about its management team and their qualifications.

The absence of such information can be a red flag, as it complicates the assessment of the broker's credibility and operational integrity. Furthermore, the company's website does not provide comprehensive information about its history or development, which is often indicative of a lack of transparency.

Trading Conditions Analysis

Nozax offers a variety of trading conditions, including leverage of up to 1:500 and a diverse selection of trading instruments. However, the costs associated with trading can significantly impact profitability.

| Cost Type | Nozax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $3.5 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Nozax are competitive, the commission structure may not be as favorable compared to industry standards. Additionally, traders should be cautious of any hidden fees that may not be explicitly stated, as these can erode potential profits.

Client Fund Security

The security of client funds is paramount when choosing a forex broker. Nozax claims to implement various measures to safeguard clients' funds, including segregated accounts. However, the lack of detailed information about their security protocols and investor protection policies raises concerns.

Traders should be wary of brokers that do not clearly outline their fund protection measures, as this can indicate a lack of commitment to safeguarding client assets. Historical issues related to fund security or withdrawals can further exacerbate these concerns.

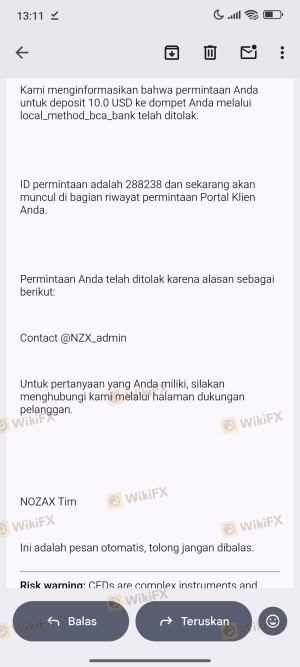

Customer Experience and Complaints

Analyzing customer feedback is essential in evaluating a broker's reliability. Reviews of Nozax present a mixed bag, with some users praising its trading conditions and customer support, while others report difficulties in withdrawing funds and lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Hidden Fees | High | Evasive |

Notably, withdrawal issues are a common complaint among users, often indicating potential problems with the broker's business practices. This trend is concerning and suggests that traders should exercise caution when considering Nozax.

Platform and Execution

Nozax utilizes the MetaTrader 5 (MT5) platform, which is well-regarded for its user-friendly interface and robust trading tools. However, concerns have been raised about the platform's stability, particularly during high volatility periods. Users have reported instances of slippage and order rejections, which can adversely affect trading outcomes.

The execution quality is a crucial factor for traders, as delays or failures in order processing can lead to significant losses. Signs of potential platform manipulation should also be taken into account when assessing the broker's reliability.

Risk Assessment

Using Nozax comes with inherent risks that traders should be aware of. The combination of limited regulation, mixed customer feedback, and potential withdrawal issues creates a precarious situation for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight |

| Fund Security Risk | Medium | Lack of transparency in fund protection |

| Execution Risk | Medium | Potential for slippage and rejections |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a demo account, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, while Nozax presents itself as a legitimate forex broker, several red flags warrant caution. The lack of strong regulation, mixed customer reviews, and potential withdrawal issues suggest that traders should approach this broker with care.

For those considering trading with Nozax, it is advisable to start with smaller amounts and closely monitor trading conditions. Alternatively, traders may want to explore more established brokers with robust regulatory oversight, transparent operations, and proven track records. Some recommended alternatives include brokers regulated by the FCA, ASIC, or NFA, which are known for their stringent compliance standards and commitment to trader protection.

Is NOZAX a scam, or is it legit?

The latest exposure and evaluation content of NOZAX brokers.

NOZAX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NOZAX latest industry rating score is 3.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.