Regarding the legitimacy of NORD FX forex brokers, it provides VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is NORD FX safe?

Software Index

Risk Control

Is NORD FX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

NFX CAPITAL VU Inc

Effective Date:

2018-11-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Maximus Global Limited

Effective Date:

--Email Address of Licensed Institution:

support@nordfx.scSharing Status:

No SharingWebsite of Licensed Institution:

https://nordfx.scExpiration Time:

--Address of Licensed Institution:

CT House, Office 8D, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is NordFX Safe or a Scam?

Introduction

NordFX is an international forex broker that has been operating since 2008, providing a wide range of trading services in currencies, cryptocurrencies, commodities, and indices. With over 1.7 million accounts opened globally, NordFX has positioned itself as a significant player in the online trading market. However, as with any financial institution, it is crucial for traders to carefully evaluate the legitimacy and reliability of a broker before committing their funds. The forex market is rife with both reputable and dubious entities, making it essential for traders to discern between the two. This article aims to investigate the credibility of NordFX by examining its regulatory status, company background, trading conditions, and customer experiences. Our assessment is based on a thorough review of various sources, including regulatory databases, customer reviews, and expert analyses.

Regulation and Legitimacy

Regulation is a key factor in determining the safety and trustworthiness of a forex broker. A regulated broker is subject to strict oversight, which helps ensure the protection of client funds and adherence to ethical trading practices. In the case of NordFX, it is primarily regulated by the Vanuatu Financial Services Commission (VFSC). Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 15008 | Vanuatu | Active |

While the VFSC provides a regulatory framework, it is important to note that Vanuatu is considered an offshore jurisdiction with less stringent regulatory requirements compared to more reputable authorities like the FCA in the UK or ASIC in Australia. This raises concerns about the quality of oversight and the potential risks associated with trading with NordFX. Moreover, some reviews indicate that NordFX has faced scrutiny regarding its compliance history, with reports of withdrawal issues and customer complaints. Therefore, while NordFX is technically regulated, the quality of that regulation is questionable, leading to skepticism about its overall safety.

Company Background Investigation

NordFX was founded in 2008 and has since expanded its operations to serve clients in over 190 countries. The company is owned by NFX Capital VU Inc., which is registered in Vanuatu. The management team consists of professionals with experience in the financial markets, but detailed information about their backgrounds is limited. The company's transparency regarding its ownership and management structure is somewhat lacking, making it difficult for potential clients to assess the integrity of the leadership team.

Furthermore, the level of information disclosure on the NordFX website is not as comprehensive as one might expect from a reputable broker. While the website provides basic information about its services and trading conditions, it does not offer detailed insights into its financial health or operational practices. This lack of transparency can be a red flag for traders who prioritize working with brokers that openly share their financial information and operational policies.

Analysis of Trading Conditions

NordFX offers various trading accounts, each with different conditions and fee structures. The overall cost structure is crucial for traders, as it directly impacts their profitability. Below is a comparison of the core trading costs associated with NordFX:

| Fee Type | NordFX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 0.0 pips (Zero Account) | 0.1 - 0.5 pips |

| Commission Model | 0.0035% per trade (Zero Account) | 0.1% - 0.5% |

| Overnight Interest Range | Varies by position | Varies by broker |

NordFXs spreads are competitive, especially for the Zero Account, which offers spreads starting from 0.0 pips. However, traders should be cautious of the commission structure, particularly for the Zero Account, where commissions can add up significantly over time. Additionally, the Fixed Account has a higher spread starting from 2 pips, which may not be favorable for active traders.

Traders have reported mixed experiences regarding the clarity of fee disclosures, with some indicating that certain fees were not clearly communicated upfront. This lack of transparency can lead to unexpected costs, making it essential for traders to thoroughly read the terms and conditions before opening an account. Overall, while the trading conditions at NordFX may appear attractive, the potential for hidden fees warrants careful consideration.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. NordFX claims to implement several measures to protect client funds, including the use of segregated accounts to keep client deposits separate from company operating funds. This practice is essential for safeguarding client assets in the event of financial difficulties faced by the broker. Additionally, NordFX offers negative balance protection, ensuring that clients cannot lose more than their initial investment.

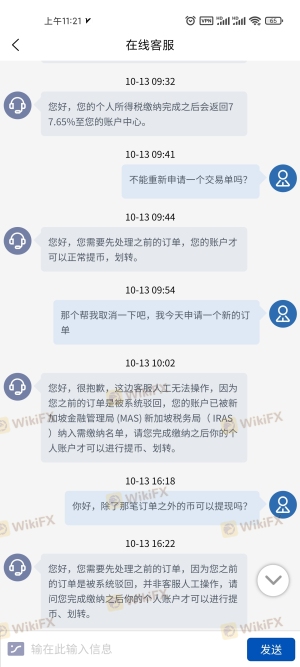

However, the effectiveness of these security measures is contingent upon the broker's financial stability and regulatory compliance. Given that NordFX operates under the oversight of the VFSC, which is not as robust as other regulatory bodies, traders may feel uncertain about the level of protection afforded to their funds. Furthermore, there have been reports of withdrawal issues and delays, which raise concerns about the broker's ability to manage client funds effectively.

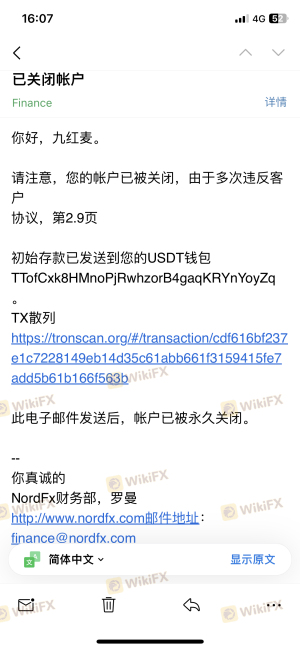

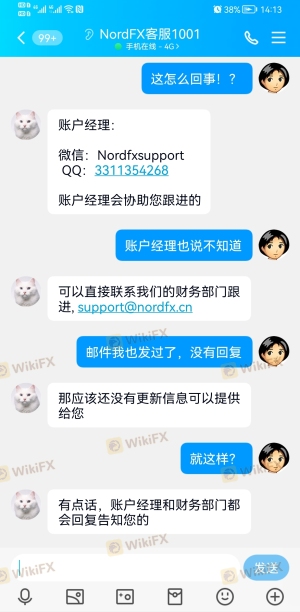

Customer Experience and Complaints

Customer feedback provides valuable insights into the operational practices of a broker. Reviews of NordFX reveal a mixed bag of experiences. Many clients praise the broker for its competitive trading conditions and user-friendly platforms, while others raise concerns about withdrawal difficulties and customer service responsiveness. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times reported |

| Unclear Fee Structure | Medium | Limited transparency |

| Customer Service Issues | High | Mixed reviews on responsiveness |

Typical cases include clients reporting delays in receiving their withdrawal requests, with some indicating that their accounts were frozen without clear communication from the broker. These issues reflect a concerning trend that potential clients should consider when evaluating whether to trade with NordFX.

Platform and Execution

The trading platforms offered by NordFX, namely MetaTrader 4 and MetaTrader 5, are well-regarded in the industry for their functionality and user experience. However, the execution quality can vary, with some traders experiencing slippage during high volatility periods. The broker claims to provide fast order execution, but the reality can differ based on market conditions and the type of account held.

Traders should be aware of the potential for order rejections or delays, particularly during peak trading hours. While NordFX does not have a reputation for platform manipulation, the mixed reviews regarding execution quality suggest that traders should remain vigilant and consider their trading strategies carefully.

Risk Assessment

Using NordFX entails certain risks that traders must evaluate. Below is a risk scorecard summarizing key risk areas associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under a less reputable regulatory authority |

| Withdrawal Issues | High | Reports of delays and account freezes |

| Transparency and Disclosure | Medium | Limited information about management and operations |

| Trading Conditions | Medium | Competitive spreads but potential hidden fees |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, while NordFX offers a range of trading services and competitive conditions, there are significant concerns regarding its regulatory status and customer experiences. The lack of robust regulation, coupled with reports of withdrawal issues, suggests that traders should exercise caution when considering this broker.

Is NordFX safe? The answer is nuanced; while it operates legally and provides certain protections for client funds, the potential risks associated with trading with an unregulated broker cannot be overlooked. For those new to trading or seeking a secure environment, it may be wise to consider alternative brokers that offer stronger regulatory oversight and proven track records.

For traders who prioritize safety and reliability, brokers such as IC Markets, Pepperstone, and AvaTrade are recommended alternatives, as they are regulated by reputable authorities and have established positive reputations in the trading community. Always conduct thorough due diligence before selecting a broker to ensure a secure trading experience.

Is NORD FX a scam, or is it legit?

The latest exposure and evaluation content of NORD FX brokers.

NORD FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NORD FX latest industry rating score is 3.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.