NordFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive NordFX review presents a balanced assessment of a broker that operates in the competitive forex and CFD trading landscape. Based on available user feedback and market analysis, NordFX demonstrates mixed results across key performance indicators that matter most to traders. The broker has garnered attention on review platforms like Trustpilot, where it maintains 68 customer reviews. Some users report trading experience spanning nearly two years with this platform. User feedback particularly highlights positive experiences regarding platform usability and trading execution quality.

However, our evaluation reveals significant information gaps regarding regulatory oversight, specific trading conditions, and transparency measures that traders typically expect. While some traders have expressed satisfaction with their trading experience, questions remain about the broker's regulatory status and comprehensive service offerings across different markets. The broker appears to target retail traders seeking accessible forex and CFD trading solutions. Those looking for lower-risk investment approaches seem to be the primary focus according to various industry discussions. NordFX continues to be evaluated for its safety credentials and overall reliability in the trading community.

Important Notice

Due to the limited availability of comprehensive regulatory and operational information in publicly accessible sources, traders should exercise additional due diligence when evaluating NordFX. Regulatory requirements and service availability may vary significantly across different jurisdictions where this broker operates. This review is based on user feedback analysis, available market reports, and industry observations rather than detailed regulatory filings or official company disclosures. Potential clients should independently verify regulatory status and trading conditions applicable to their specific location before engaging with any trading services offered by this platform.

Rating Framework

Broker Overview

NordFX operates as a forex and CFD broker in the competitive online trading market. Specific information about its founding date and corporate background remains limited in available public sources that we could access. The broker has established a presence in the trading community, with user reviews suggesting it has been serving clients for several years. According to user testimonials, some traders have maintained accounts with NordFX for extended periods, indicating a degree of operational stability that many clients value.

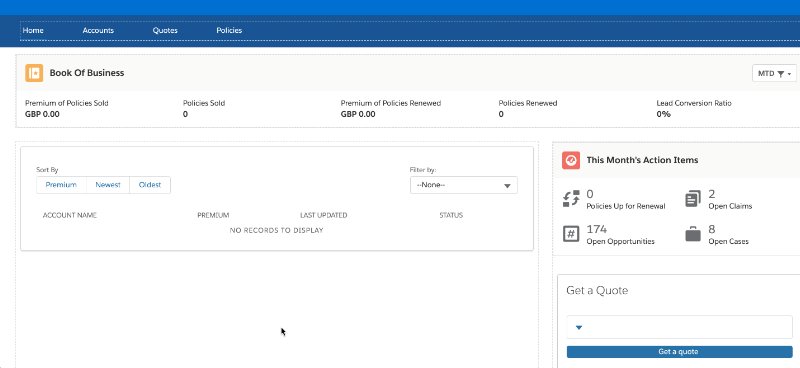

The broker's business model appears to focus on providing forex and CFD trading services to retail clients. Detailed information about its market-making or ECN execution models is not readily available in current sources we reviewed. Industry discussions suggest that NordFX positions itself as a service provider for traders seeking accessible entry points into currency and derivative markets. The company's operational structure and ownership details require further investigation through official regulatory filings that may provide more comprehensive information.

Based on user feedback patterns and industry positioning, NordFX offers trading access to major currency pairs and CFD instruments. The complete asset catalog and trading specifications are not comprehensively documented in available sources we examined. The broker's regulatory framework and compliance measures represent areas where additional transparency would benefit potential clients seeking to evaluate the service comprehensively.

Regulatory Oversight: Available information does not specify the primary regulatory authorities overseeing NordFX operations. This represents a significant consideration for traders prioritizing regulatory protection and oversight in their broker selection process.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in current available sources. This requires direct inquiry with the broker to obtain accurate and up-to-date information.

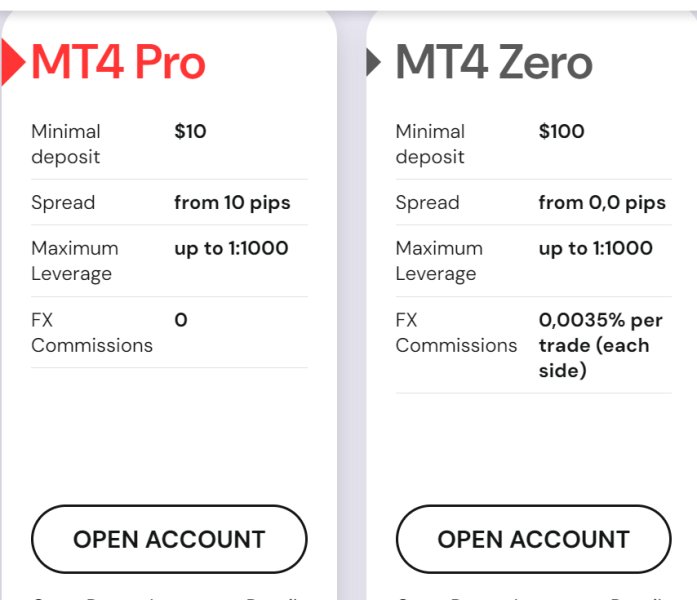

Minimum Deposit Requirements: The minimum account funding requirements are not specified in publicly available information. This makes it difficult to assess accessibility for different trader segments and budget levels.

Promotional Offerings: Details about welcome bonuses, trading incentives, or promotional campaigns are not documented in current sources we reviewed.

Trading Assets: Based on industry positioning and user feedback, NordFX appears to offer forex currency pairs and CFD instruments. The complete product range requires verification through official channels to ensure accuracy.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current sources. This represents a key area for potential client investigation before opening accounts.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation we could access.

Platform Technology: The trading platforms supported by NordFX are not detailed in current sources. User feedback suggests functional trading interfaces that meet basic trading needs.

Geographic Restrictions: Information about service availability and restrictions in specific countries or regions is not documented in available sources we reviewed.

Customer Support Languages: The range of languages supported by customer service teams is not specified in current NordFX review materials available to us.

Comprehensive Rating Analysis

Account Conditions Analysis

The evaluation of NordFX account conditions faces significant limitations due to insufficient publicly available information about account structures and requirements. Available sources do not provide detailed specifications about different account tiers, minimum deposit thresholds, or account-specific features that would typically inform trader decision-making processes. This information gap presents challenges for potential clients seeking to understand entry requirements and account progression opportunities that may be available.

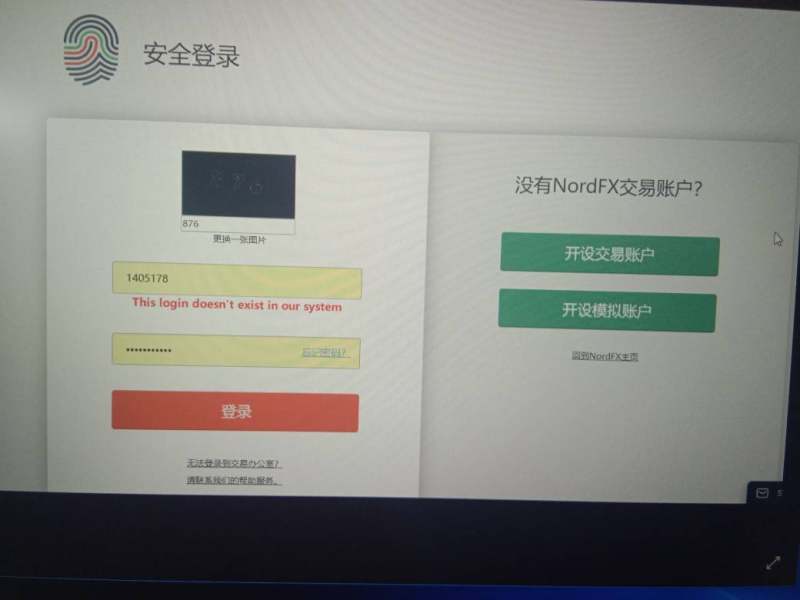

User feedback on Trustpilot suggests that account opening and management processes have been generally satisfactory for existing clients. Specific details about verification requirements, document submission procedures, and account activation timelines are not documented in available sources we examined. The absence of detailed account condition information makes it difficult to assess how NordFX compares to industry standards for account accessibility and feature differentiation across different trader segments.

Without comprehensive account structure information, traders cannot effectively evaluate whether NordFX offers suitable options for different experience levels or trading volumes. This represents a significant transparency gap that potential clients should address through direct communication with the broker before making account opening decisions.

The assessment of NordFX trading tools and educational resources encounters substantial limitations due to the lack of detailed information in available sources. Current documentation does not specify the range of analytical tools, charting capabilities, or research resources provided to clients who use this platform. This information deficit makes it challenging to evaluate the broker's commitment to supporting trader development and decision-making processes that are crucial for trading success.

Available user feedback does not provide specific insights into the quality or comprehensiveness of educational materials, market analysis, or trading guides that might be available through the NordFX platform. The absence of information about automated trading support, expert advisors, or API access further complicates the evaluation of the broker's technological offerings for more advanced traders.

Professional traders typically require robust analytical tools and comprehensive market research to support their trading strategies effectively. The lack of detailed information about NordFX's tools and resources represents a significant gap that requires direct investigation by potential clients seeking to understand the platform's analytical capabilities and educational support structure.

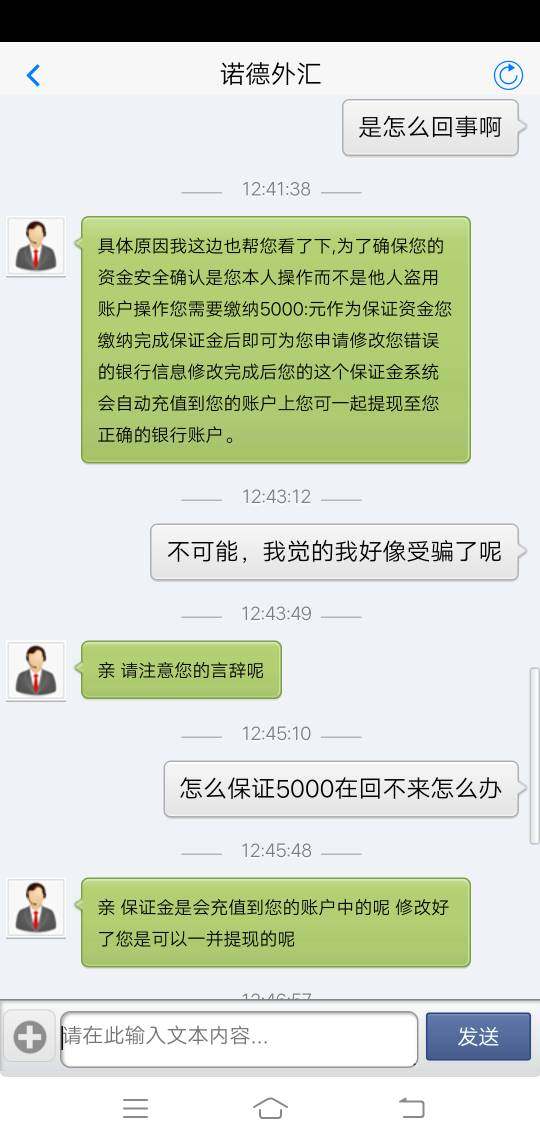

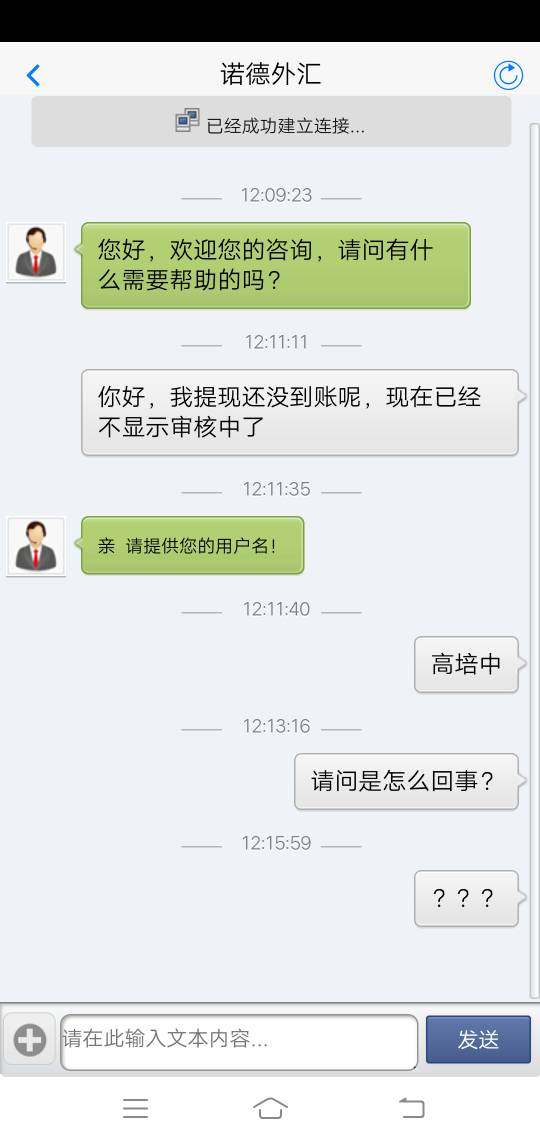

Customer Service and Support Analysis

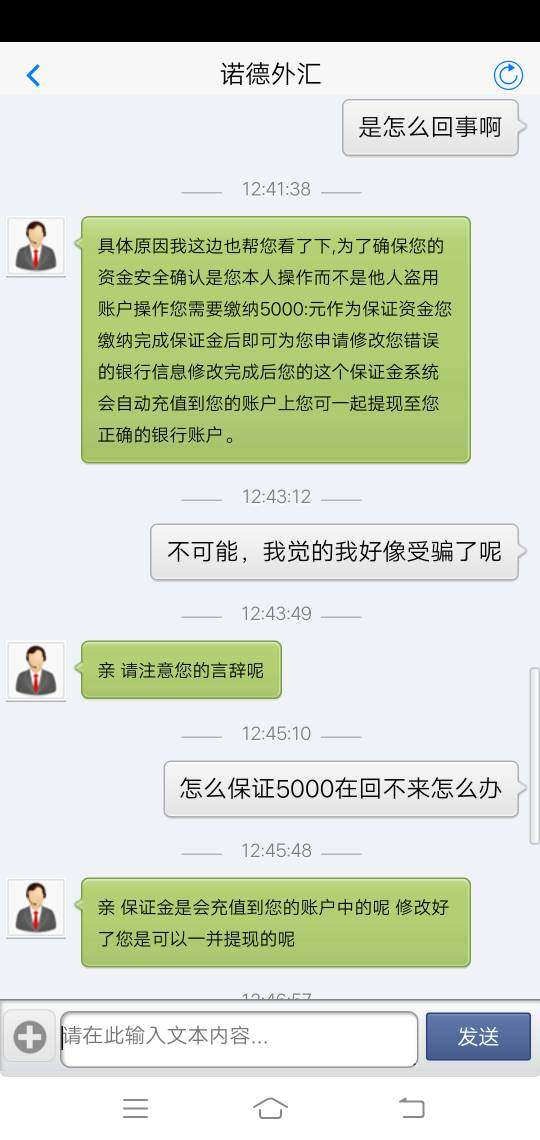

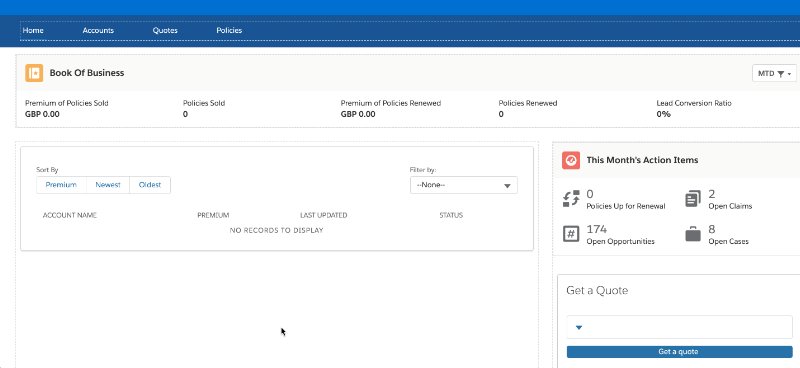

Evaluating NordFX customer service quality proves challenging due to limited specific information about support channels, response times, and service protocols in available sources. While user reviews suggest general satisfaction with support interactions, detailed assessments of customer service efficiency, problem resolution capabilities, and communication quality are not documented in current materials we reviewed. The availability of multiple communication channels, including live chat, email support, and telephone assistance, typically represents important service differentiators in the brokerage industry.

However, specific information about NordFX's customer service infrastructure, operating hours, and multilingual support capabilities is not detailed in available sources. Professional trading services require reliable customer support for technical issues, account inquiries, and trading-related problems that may arise during normal operations. The limited information about NordFX customer service capabilities represents an area where potential clients should conduct direct evaluation through test inquiries and service interaction before committing to account opening.

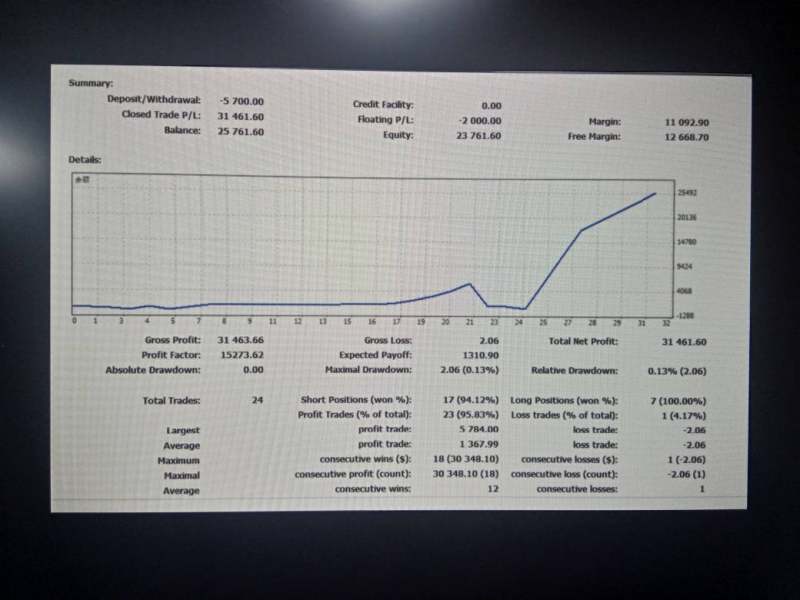

Trading Experience Analysis

User feedback available through Trustpilot provides some insight into the NordFX trading experience, with several reviewers indicating generally positive experiences with platform functionality and trade execution. Some users report maintaining trading relationships with NordFX for extended periods, suggesting adequate platform stability and execution quality for their trading needs and strategies. However, detailed information about order execution speed, slippage rates, requote frequency, and platform uptime statistics is not available in current sources we examined.

These technical performance metrics are crucial for evaluating trading experience quality, particularly for active traders who require consistent execution and minimal technical disruptions. The mobile trading experience, platform customization options, and advanced order types supported by NordFX are not detailed in available information we could access. This NordFX review identifies trading experience as an area where user feedback provides some positive indicators, though comprehensive technical performance data remains unavailable for thorough evaluation.

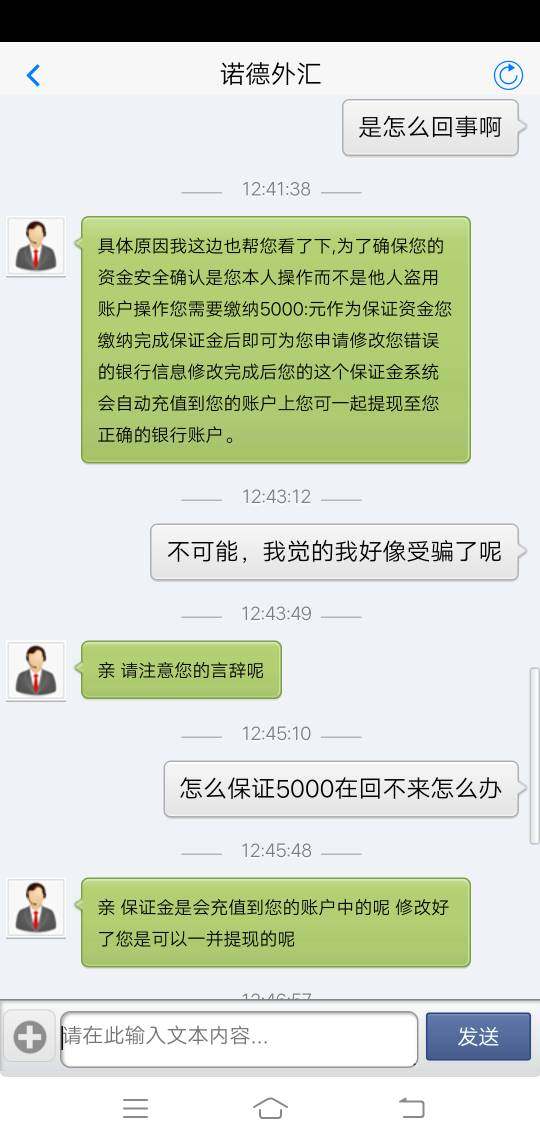

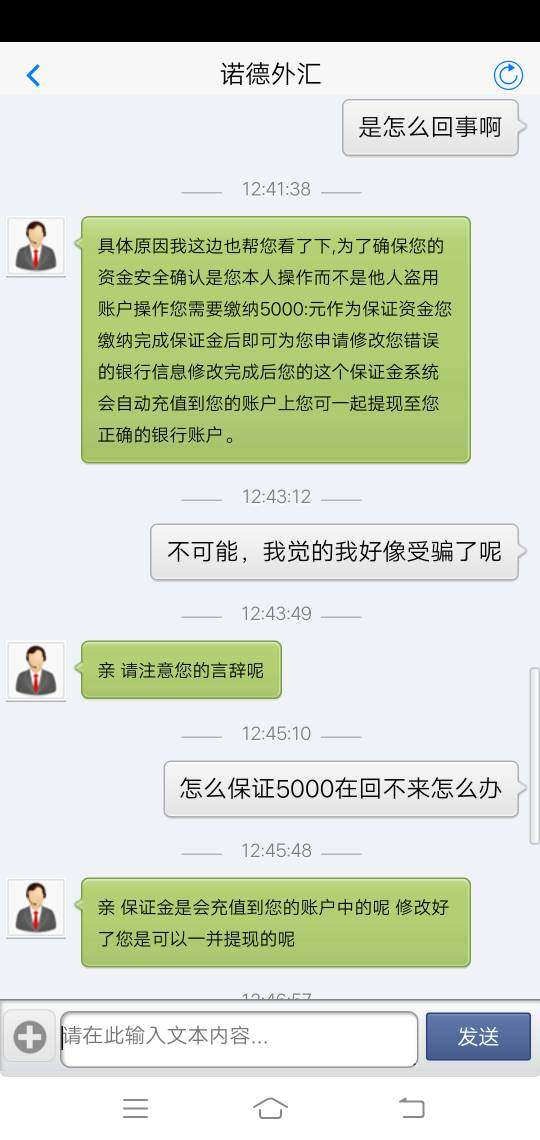

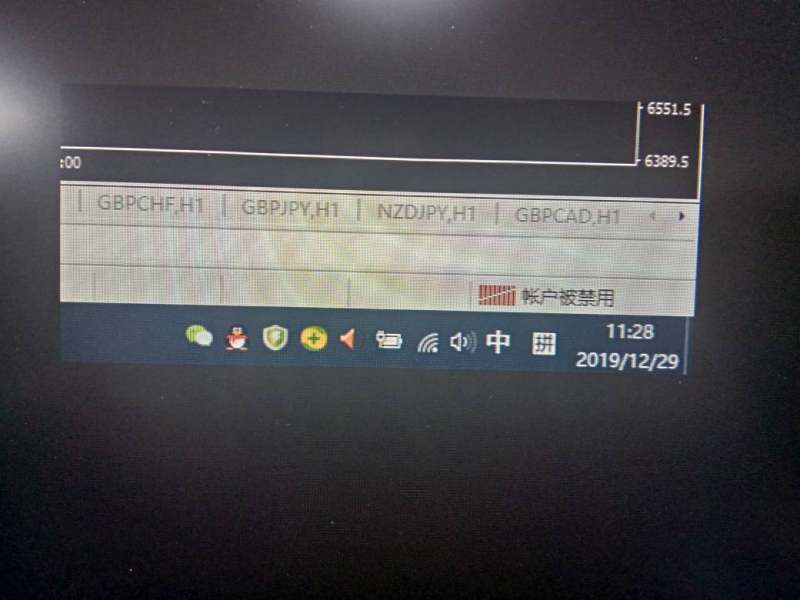

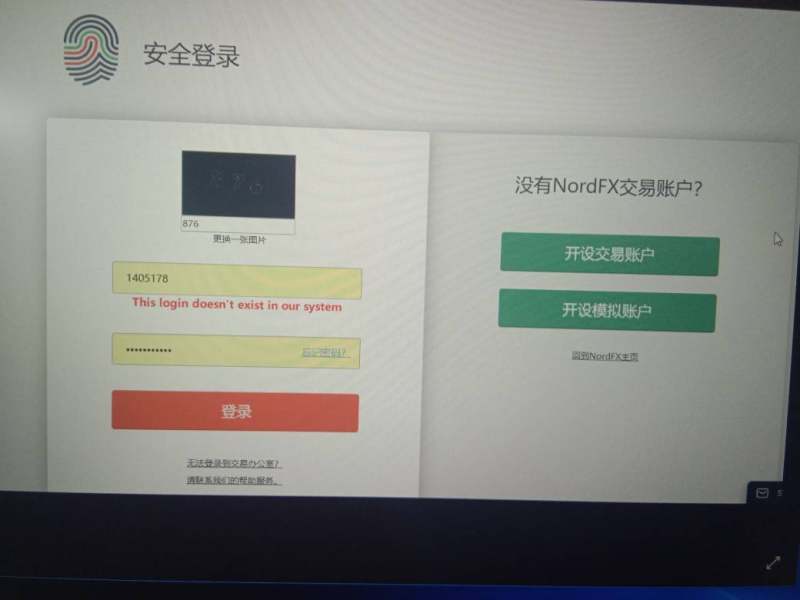

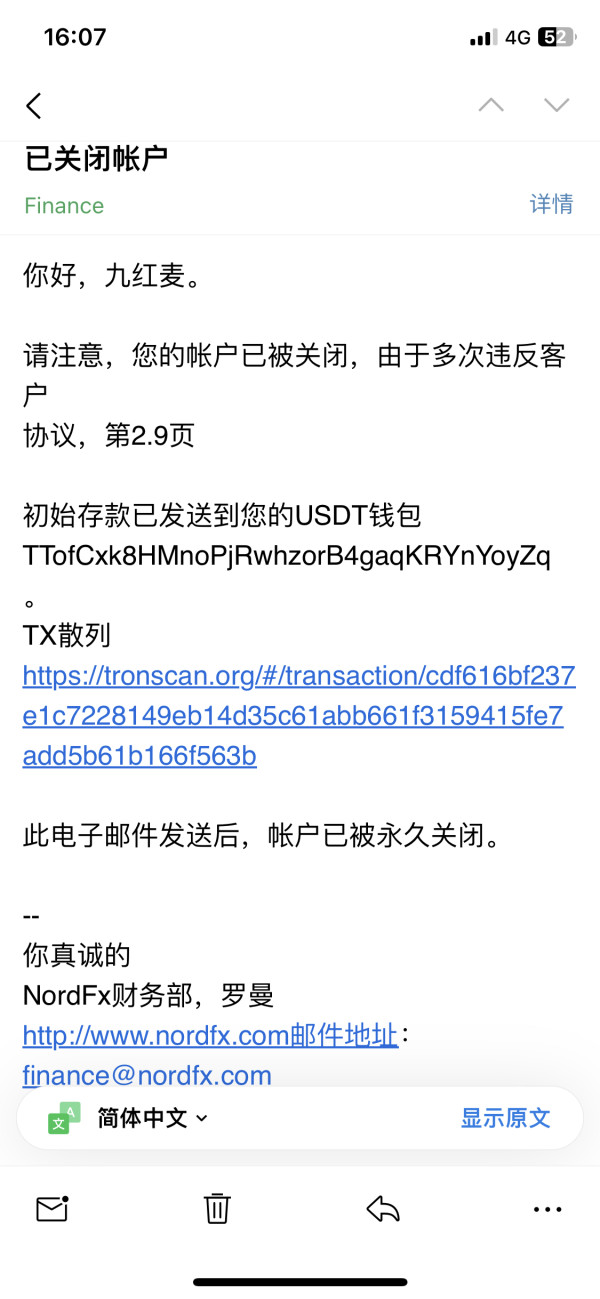

Trust and Safety Analysis

The evaluation of NordFX trust and safety credentials encounters significant challenges due to limited information about regulatory oversight, client fund protection measures, and corporate transparency. Industry discussions have raised questions about the broker's safety profile, with ongoing debates about its classification as a reliable or potentially problematic service provider in the trading community. Available sources do not provide clear information about segregated client accounts, deposit insurance coverage, or regulatory compliance measures that typically serve as trust indicators in the brokerage industry.

The absence of detailed regulatory information makes it difficult to assess the level of client protection and oversight applicable to NordFX operations. Third-party evaluations, including analysis from sources like Coin Bureau, have examined NordFX's safety credentials, though comprehensive conclusions about the broker's trustworthiness require additional investigation. The limited transparency regarding regulatory status and safety measures represents a significant consideration for risk-conscious traders evaluating the broker.

User Experience Analysis

Available user feedback suggests that NordFX provides a generally satisfactory user experience for traders who have engaged with the platform. Trustpilot reviews indicate that some users have found the platform accessible and functional for their trading activities, with particular positive mentions regarding usability and interface design that meets their needs. However, detailed information about registration processes, account verification procedures, funding and withdrawal experiences, and platform navigation is not comprehensively documented in available sources we reviewed.

These user experience elements are crucial for evaluating the overall client journey and service quality that traders can expect. The broker appears to target retail traders seeking straightforward access to forex and CFD markets, particularly those prioritizing lower-risk investment approaches that align with conservative trading strategies. User demographic analysis suggests that NordFX may appeal to part-time traders and those seeking accessible entry points into currency trading, though comprehensive user satisfaction data requires additional investigation.

Conclusion

This NordFX review reveals a broker with mixed evaluation results, primarily due to significant information gaps regarding regulatory oversight, trading conditions, and service specifications. While available user feedback indicates generally positive experiences with platform usability and trading execution, the lack of comprehensive transparency about regulatory status, account conditions, and safety measures presents important considerations for potential clients. NordFX appears most suitable for retail traders seeking basic forex and CFD trading access, particularly those comfortable with conducting additional due diligence about regulatory protection and service terms.

The broker's strengths appear to lie in user experience and platform functionality, based on available feedback, while weaknesses include limited transparency and insufficient publicly available information about critical service aspects. Potential clients should prioritize direct communication with NordFX to verify regulatory status, trading conditions, and safety measures applicable to their specific situation before making account opening decisions.