Is MOTFX safe?

Pros

Cons

Is MOTFX A Scam?

Introduction

MOTFX is a forex broker that has emerged in the competitive landscape of online trading, offering a variety of trading instruments including forex pairs, commodities, and cryptocurrencies. Established in Mongolia, MOTFX aims to attract traders with its low minimum deposit requirements and high leverage options. However, as the forex market is rife with potential scams, it is crucial for traders to exercise caution and conduct thorough evaluations of brokers before committing their funds. This article will explore the legitimacy of MOTFX by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The analysis is based on data gathered from various online reviews and financial resources, ensuring a comprehensive overview of the broker.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a significant indicator of its legitimacy and reliability. MOTFX claims to be regulated by the Financial Regulatory Commission (FRC) of Mongolia. However, the effectiveness and recognition of this regulatory body in the international trading community is questionable. The lack of oversight by well-established regulators such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus) raises concerns about the broker's operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Regulatory Commission (FRC) | T3 106 / 1011 | Mongolia | Not adequately verified |

The FRC's limited recognition in the global financial industry suggests that traders may not receive the same level of protection and oversight that comes from more established regulatory authorities. This lack of robust regulation puts traders at risk, as it can lead to challenges in dispute resolution and fund security. Furthermore, the absence of historical compliance records raises red flags about the broker's operational practices. Overall, while MOTFX claims to be regulated, the lack of credible oversight should prompt potential clients to proceed with caution.

Company Background Investigation

MOTFX operates under the ownership of MOT Forex LLC, which was registered in Mongolia. The company is relatively new, having been established in late 2022. This short operational history may not provide sufficient evidence of its reliability or commitment to maintaining high standards in customer service and operational integrity.

The management teams experience and qualifications are not prominently disclosed, which can be a sign of potential issues regarding transparency. A lack of information about the team behind the broker can lead to skepticism about the firm's ability to manage client funds responsibly. Transparency in operations is crucial for building trust, and MOTFX appears to fall short in this regard.

Furthermore, the company's physical address is listed as Suite 609, The Minister Tower, Ulaanbaatar, Mongolia, but there are concerns regarding the authenticity of this location. A verifiable physical presence is often an indicator of a broker's legitimacy, and the inability to confirm this raises further doubts about their operations.

Trading Conditions Analysis

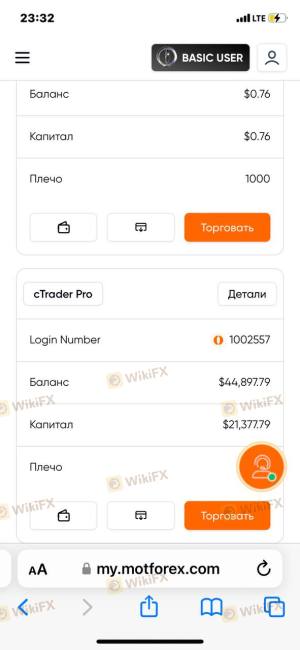

MOTFX offers competitive trading conditions, including a low minimum deposit of $25 and leverage of up to 1:1000. However, the fee structure and potential hidden costs associated with trading on this platform deserve careful scrutiny.

| Fee Type | MOTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0.2 pips | 1.0 - 2.0 pips |

| Commission Model | $3.50 per side (Pro account) | $5.0 - $10.0 per side |

| Overnight Interest Range | Varies by account type | Varies by broker |

While the spreads offered by MOTFX appear attractive, the high leverage ratio can be a double-edged sword. While it allows traders to control larger positions, it also significantly increases the risk of substantial losses. Additionally, the commission model for the pro account, while competitive, may not be favorable for all traders, particularly those who execute a high volume of trades.

The overall cost structure must be thoroughly evaluated against the potential risks involved. Traders should be cautious of any unusual fees or charges that may arise during the trading process, as these can erode profits and lead to unexpected financial burdens.

Customer Funds Security

The security of client funds is paramount when selecting a forex broker. MOTFX claims to implement various security measures, including fund segregation and negative balance protection. However, the details surrounding these measures are not explicitly stated, making it difficult for potential clients to assess their effectiveness.

Fund Segregation: It is essential for brokers to keep client funds separate from their operational funds to protect clients in case of insolvency. MOTFX's policies on fund segregation require further clarification.

Investor Protection: The absence of a compensation scheme, which is commonly provided by regulated brokers in more established jurisdictions, raises concerns about the safety of client funds.

Negative Balance Protection: While MOTFX claims to offer negative balance protection, the lack of transparency regarding the implementation of this policy can leave traders vulnerable during volatile market conditions.

Historically, there have been reports of clients experiencing difficulties in withdrawing funds, which can be a significant indicator of a broker's reliability. Such issues can lead to severe financial distress for traders and further highlight the importance of evaluating a broker's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a crucial component in assessing the reliability of a broker. Reviews of MOTFX reveal a mixed bag of experiences. Many users have reported positive interactions, particularly praising the platform's user-friendly interface and customer support. However, there are also numerous complaints regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or absent |

| Account Blocking | High | Unresponsive |

| Customer Support Quality | Medium | Mixed feedback |

Typical complaints include accounts being blocked without explanation and difficulties in withdrawing funds, which raises serious concerns about the broker's operational practices. One notable case involved a trader who reported being unable to access their account with $25,000 in it, leading to suspicions that the broker deliberately targets successful traders to block withdrawals.

Platform and Trade Execution

MOTFX offers two main trading platforms: MetaTrader 5 (MT5) and cTrader. Both platforms are widely recognized for their advanced trading features and user-friendly interfaces. However, the performance and stability of these platforms are critical for ensuring a smooth trading experience.

Traders have reported varying degrees of satisfaction with order execution quality. While some users commend the speed and reliability of trade execution, others have noted instances of slippage and rejected orders, especially during high volatility periods. Such occurrences can be indicative of potential platform manipulation or inefficiencies within the trading infrastructure.

Risk Assessment

Using MOTFX comes with inherent risks that potential traders should consider. The combination of high leverage, mixed customer feedback, and regulatory concerns creates a risk profile that necessitates careful consideration.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from recognized regulatory bodies. |

| Financial Risk | High | High leverage can lead to significant losses. |

| Operational Risk | Medium | Customer complaints about withdrawal issues. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and assess its reliability before committing real funds. Additionally, setting strict risk management parameters, such as limiting leverage and carefully monitoring trades, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while MOTFX presents itself as a competitive option in the forex market with attractive trading conditions, significant concerns regarding its regulatory status, customer fund security, and overall transparency cannot be overlooked. The mixed reviews from users highlight the potential risks associated with trading through this broker.

Recommendations:

- Caution is advised: Traders should approach MOTFX with caution, especially if they are new to forex trading.

- Consider alternative brokers: For those seeking more reliable options, brokers regulated by established authorities such as FCA, ASIC, or CySEC may offer better security and customer protection.

- Conduct thorough research: Potential clients should engage in comprehensive research and consider user reviews before making any commitments.

Ultimately, the decision to trade with MOTFX should be made with careful consideration of the outlined risks and the brokers overall credibility.

Is MOTFX a scam, or is it legit?

The latest exposure and evaluation content of MOTFX brokers.

MOTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MOTFX latest industry rating score is 1.91, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.91 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.