MOTFX 2025 Review: Everything You Need to Know

Executive Summary

This detailed motfx review looks at a new forex broker that started in 2022. MOTFX calls itself a clear trading service provider that focuses on low spreads and no hidden fees as its main selling points. But user feedback shows a split picture, with ratings divided sharply between 5-star and 1-star reviews, which means trader experiences vary a lot.

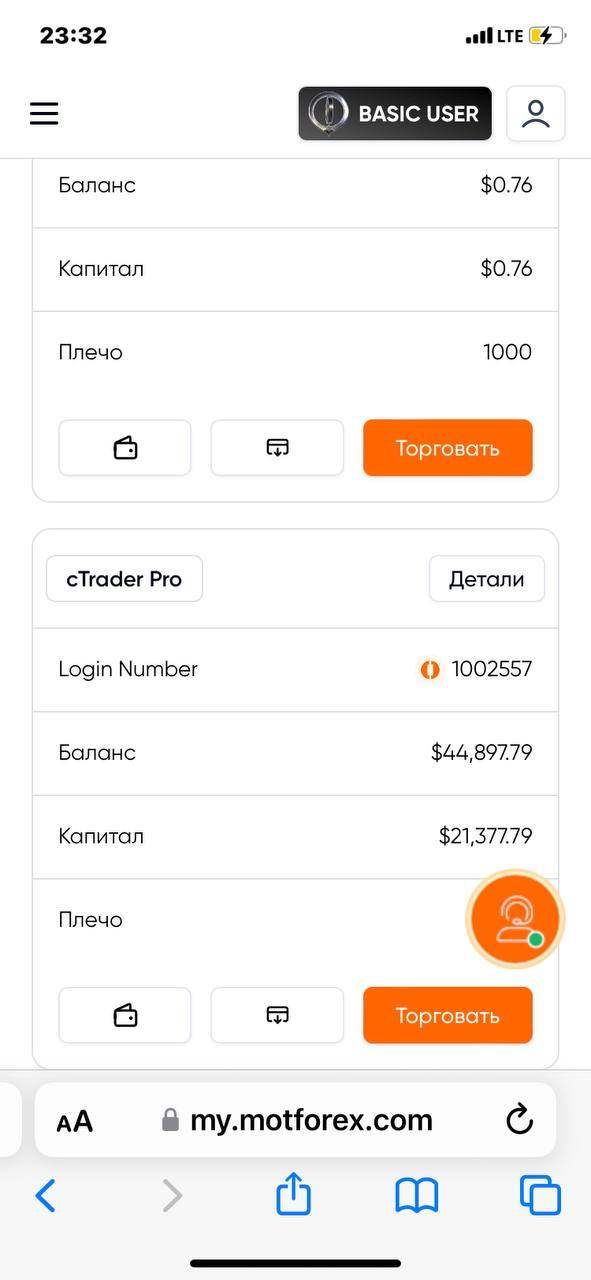

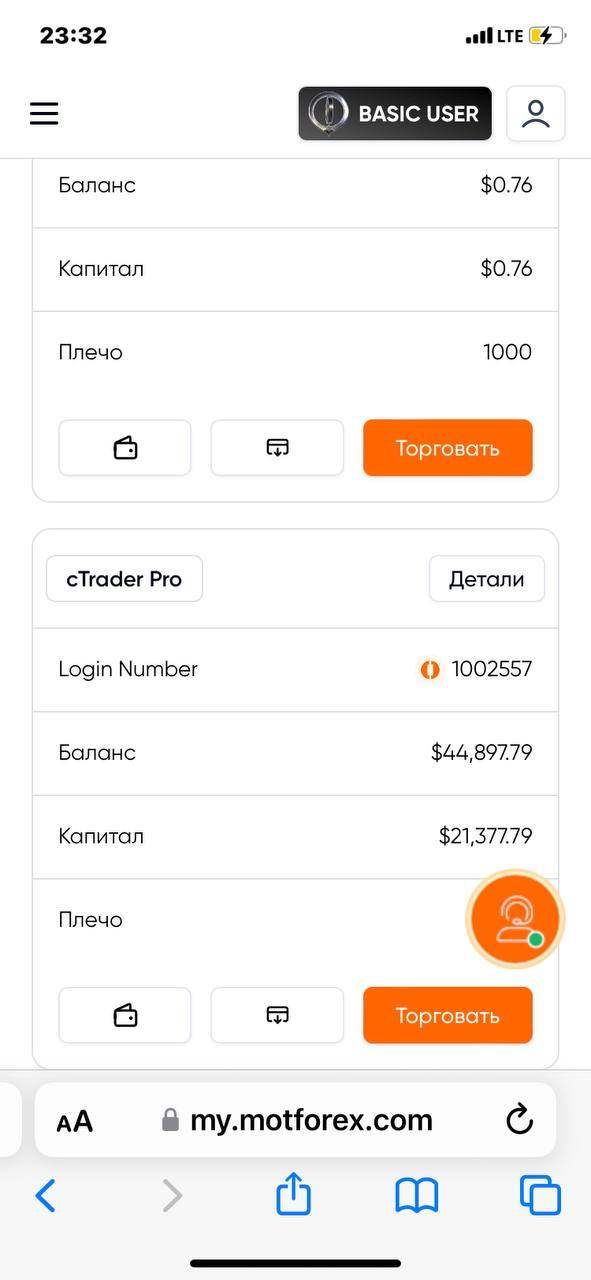

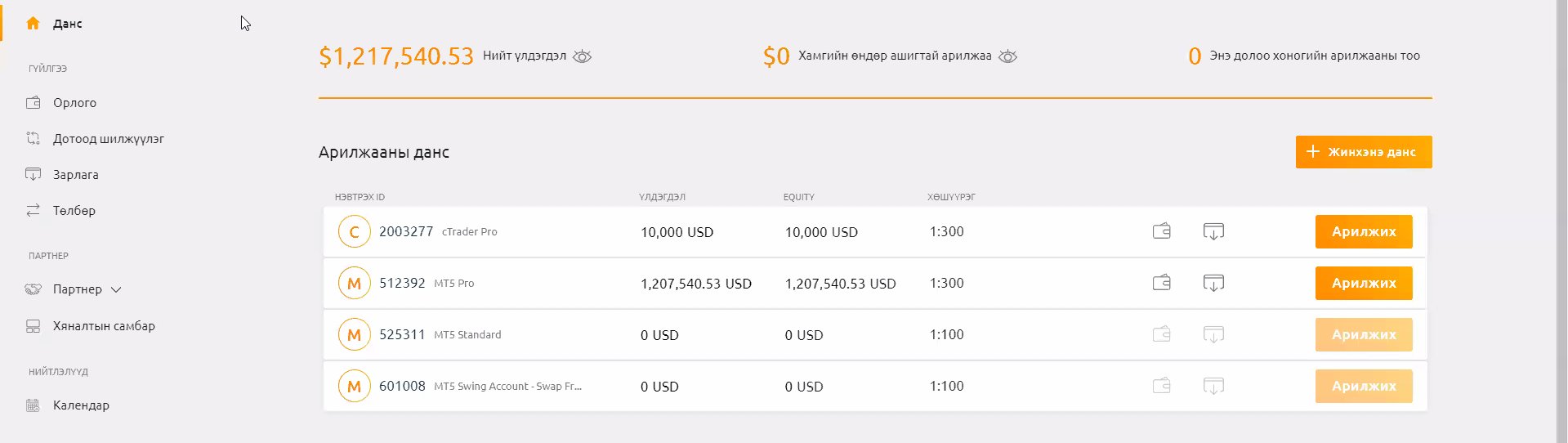

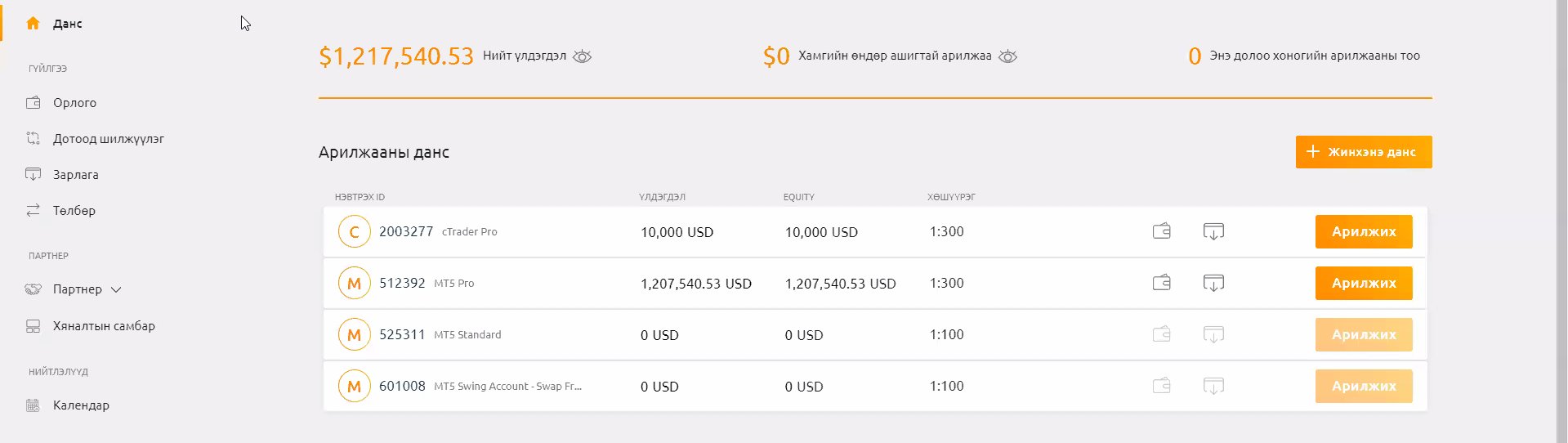

The broker offers Contract for Difference (CFD) trading through popular platforms like MetaTrader 5 and cTrader. It has a very low minimum deposit of just $25. MOTFX provides Swap-Free account options, which makes it appealing to Islamic traders and those who want Sharia-compliant trading solutions. The company works under FRC (Mongolia) regulation, but we need to check the specific license details more carefully.

Target audience analysis shows MOTFX mainly serves traders who care about costs and want clear, low-cost trading conditions. The broker's focus on removing hidden fees appeals to both new and experienced traders who want simple pricing. But the extreme split in user reviews - with 50% giving 5-star ratings and 50% giving 1-star ratings - shows possible service problems that future clients should think about carefully.

Important Notice

Regional Entity Differences: MOTFX operates under Mongolian law through FRC regulation, which may mean different service quality and regulatory protections compared to brokers licensed in major financial centers. Traders should know that regulatory systems in different countries offer different levels of investor protection and ways to resolve disputes.

Review Methodology: This evaluation uses available user feedback, official broker information, and public data. Since we have limited complete information sources, some parts of this motfx review rely on user-reported experiences rather than independently checked data. Readers should do additional research before making trading decisions.

Rating Framework

Broker Overview

MOTFX started in 2022 as a globally licensed forex broker with a goal to provide clear trading services to international markets. The company stands out through its promise to remove hidden fees and offer competitive spread structures. Based on available information, MOTFX operates as a Contract for Difference (CFD) provider, which lets traders access various financial markets without owning the actual assets.

The broker's business model focuses on providing low-cost trading conditions while keeping operations transparent. MOTFX specifically targets traders who have been frustrated with hidden fees and unclear pricing from other brokers. The company's focus on Swap-Free accounts shows its commitment to serving diverse trading communities, especially those who need Islamic finance-compliant solutions.

Platform and regulatory framework: MOTFX offers trading through MetaTrader 5 and cTrader platforms, two of the industry's most recognized trading interfaces. The broker operates under Federal Open Market Committee oversight and maintains FRC (Mongolia) regulatory status. While the specific license number wasn't detailed in available sources, the company's regulatory standing provides a basic level of operational legitimacy for its trading services.

Regulatory Jurisdiction: MOTFX operates under FRC (Mongolia) supervision, though specific license numbers and regulatory details weren't extensively detailed in available documentation. Mongolian financial regulation may offer different investor protections compared to major financial centers.

Minimum Deposit Requirements: The broker maintains an accessible $25 minimum deposit, making it particularly attractive to new traders and those testing services with limited capital commitment.

Payment Methods: Specific deposit and withdrawal options weren't fully detailed in available sources, requiring direct broker contact for complete payment method information.

Promotional Offerings: Current bonus and promotional structures weren't specified in available documentation, suggesting either limited promotional activity or information gaps in public materials.

Trading Assets: MOTFX primarily focuses on Contract for Difference (CFD) instruments, though the complete range of available assets requires verification through direct broker consultation.

Cost Structure: The broker emphasizes low spread conditions and transparent pricing without hidden fees. Specific commission structures and detailed cost breakdowns weren't fully outlined in accessible materials.

Leverage Options: Leverage ratios and maximum trading multipliers weren't specified in available sources, necessitating direct inquiry for these crucial trading parameters.

Platform Selection: MOTFX supports both MetaTrader 5 and cTrader platforms, providing traders with choice between two industry-standard trading environments.

Geographic Restrictions: Specific country limitations and service availability weren't detailed in accessible documentation.

Customer Support Languages: Available support languages weren't fully outlined in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

MOTFX shows strong accessibility through its $25 minimum deposit requirement, putting itself among the most accessible brokers for entry-level traders. This low barrier to entry especially benefits new traders who want to test services without significant financial commitment. The broker's Swap-Free account offering addresses specific needs of Islamic traders and those seeking Sharia-compliant trading solutions.

Account variety and features appear to focus on essential trading needs rather than complex tiered structures. The Swap-Free option represents a significant advantage for traders who hold positions overnight and prefer to avoid swap charges. However, detailed information about additional account types, VIP services, or premium account features wasn't fully available in reviewed sources.

Account opening processes weren't extensively detailed, though newer brokers typically implement streamlined digital onboarding to compete with established competitors. The combination of low minimum deposits and specialized account options suggests MOTFX prioritizes accessibility and inclusivity in its account structure.

User feedback regarding account conditions shows the characteristic split seen across all MOTFX services, with some traders appreciating the low-cost entry while others may have experienced challenges not detailed in available reviews. This motfx review recommends prospective clients directly verify current account terms and conditions.

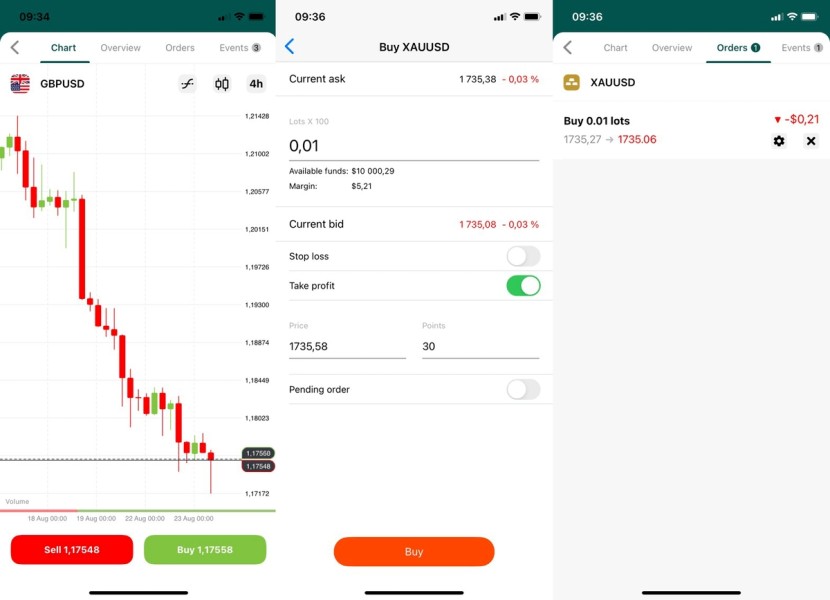

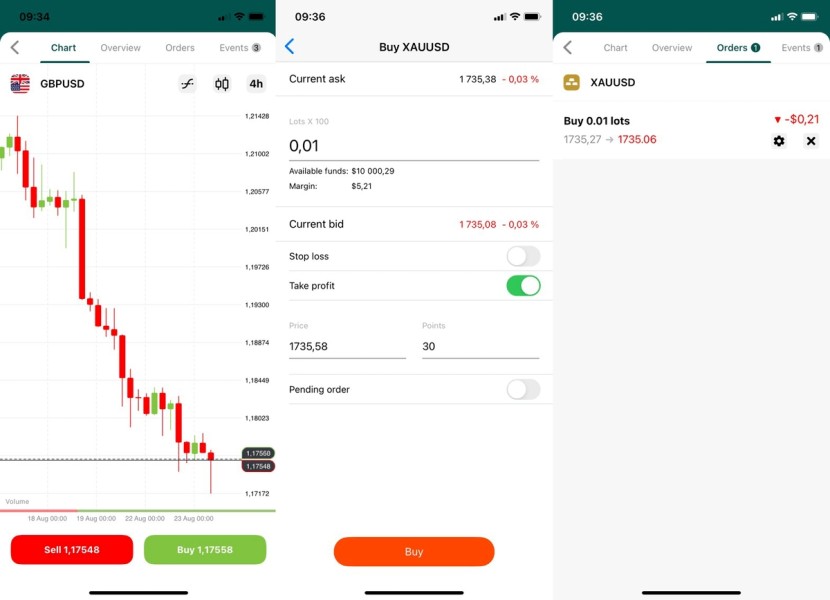

MOTFX provides access to MetaTrader 5 and cTrader platforms, two industry-leading trading environments that offer comprehensive charting, analysis, and automated trading capabilities. MT5 provides advanced technical analysis tools, multiple timeframes, and extensive indicator libraries, while cTrader offers intuitive interface design and advanced order management features.

Research and analysis resources weren't extensively detailed in available documentation, suggesting either limited additional research offerings or gaps in publicly available information. Many traders rely heavily on broker-provided market analysis, economic calendars, and trading signals, making this information gap notable for comprehensive evaluation.

Educational materials and trader development resources weren't specifically outlined in reviewed sources. Modern traders increasingly expect comprehensive educational support, particularly newer traders who benefit from trading guides, webinars, and market analysis training.

Automated trading support through Expert Advisors (EAs) and signal services would typically be available through MT5 platform integration, though specific broker policies and limitations weren't detailed. The availability of two major platforms suggests reasonable tool diversity, but additional proprietary tools or enhanced features require direct verification.

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation faces significant limitations due to insufficient detailed user feedback regarding support experiences. Available user reviews didn't provide comprehensive insights into response times, support quality, or problem resolution effectiveness, making objective assessment challenging.

Communication channels and availability weren't specifically outlined in reviewed materials, though modern brokers typically offer multiple contact methods including live chat, email, and phone support. The absence of detailed support information in available sources suggests either limited service hours or gaps in publicly available documentation.

Response time performance couldn't be adequately assessed due to limited user feedback data. Effective customer support represents a crucial element for trading success, particularly during market volatility or technical issues, making this information gap concerning for potential clients.

Service quality indicators such as staff expertise, multilingual support, and technical problem resolution capabilities weren't fully documented. The split user rating distribution suggests potential inconsistencies in support experiences, though specific service quality details require additional investigation.

Trading Experience Analysis (Score: 7/10)

Platform stability and execution quality benefit from MOTFX's use of established MT5 and cTrader platforms, both known for reliable performance and professional-grade trading capabilities. However, user feedback shows significant split results, with experiences ranging from highly positive to severely negative, indicating potential inconsistencies in service delivery.

Order execution standards including slippage rates, requote frequency, and fill quality weren't specifically detailed in available user feedback. The broker's emphasis on low spreads and transparent pricing suggests competitive execution conditions, though real-world performance verification requires direct testing or additional user testimonials.

Trading environment quality appears to focus on cost-effectiveness and transparency, with the broker's no-hidden-fees policy addressing common trader frustrations. However, the extreme split in user ratings - divided evenly between 5-star and 1-star reviews - indicates significant variations in actual trading experiences.

Mobile trading capabilities weren't extensively detailed, though both MT5 and cTrader typically offer comprehensive mobile applications. The quality of mobile execution, feature completeness, and user interface design require direct evaluation for complete assessment. This motfx review notes the importance of mobile trading quality for modern traders.

Trust and Safety Analysis (Score: 6/10)

Regulatory framework through FRC (Mongolia) provides basic operational oversight, though the specific investor protection levels and dispute resolution mechanisms may differ from major financial centers. Mongolian financial regulation offers legitimate regulatory status but may provide different protection levels compared to FCA, ASIC, or CySEC oversight.

Fund security measures weren't fully detailed in available documentation, including segregated account policies, insurance coverage, or client fund protection mechanisms. These elements represent crucial safety considerations that require direct verification with the broker.

Company transparency receives positive marks for MOTFX's emphasis on eliminating hidden fees and providing clear pricing structures. However, detailed financial disclosures, company ownership information, and operational transparency metrics weren't extensively available in reviewed sources.

Industry reputation remains developing given the broker's 2022 establishment date. The absence of major industry awards, third-party certifications, or established track records makes comprehensive trust assessment challenging. The split user feedback pattern raises questions about service consistency and reliability.

User Experience Analysis (Score: 5/10)

Overall satisfaction metrics present a concerning picture with user ratings split exactly between 5-star and 1-star reviews, indicating either exceptional or poor experiences with little middle ground. This extreme split suggests significant inconsistencies in service delivery or potentially different user expectations.

Interface design and usability benefit from professional MT5 and cTrader platforms, both offering intuitive navigation and comprehensive functionality. However, broker-specific website design, account management interfaces, and additional user experience elements weren't fully evaluated in available sources.

Registration and verification processes weren't detailed in available documentation, though modern brokers typically implement digital onboarding for competitive advantage. The efficiency and user-friendliness of these processes significantly impact initial user experiences.

Common user concerns based on the 50% negative rating distribution suggest significant issues exist, though specific complaint details weren't fully documented. The equal distribution between highest and lowest ratings indicates either resolved issues for some users or fundamentally different service experiences.

Conclusion

This motfx review reveals a broker with both promising features and concerning inconsistencies. MOTFX offers attractive account conditions including low minimum deposits and Swap-Free options, combined with competitive spreads and transparent pricing policies. The broker's commitment to eliminating hidden fees addresses common trader frustrations and provides clear value proposition.

However, the extreme split in user feedback - with exactly 50% giving 5-star ratings and 50% giving 1-star ratings - raises significant questions about service consistency and reliability. This pattern suggests either highly variable service quality or fundamental differences in user experiences that prospective clients should carefully consider.

MOTFX appears most suitable for cost-conscious traders seeking transparent pricing and low-barrier entry, particularly those requiring Swap-Free account options. However, potential clients should thoroughly test services with minimal deposits before committing significant capital, given the mixed user experience indicators.