Is Logic IQ safe?

Pros

Cons

Is Logic Iq A Scam?

Introduction

Logic Iq is a forex and cryptocurrency trading platform that has gained attention in the trading community. Operating primarily out of Hong Kong, Logic Iq positions itself as a broker offering various trading opportunities in the forex market. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially in an industry rife with scams and unregulated entities. Traders must be vigilant to ensure their investments are safe and secure. This article aims to investigate the legitimacy of Logic Iq, focusing on its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk assessment. Our evaluation is based on a comprehensive analysis of available data, including regulatory warnings, user reviews, and expert opinions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors determining its legitimacy. A well-regulated broker is typically held to high standards of transparency and accountability, providing a level of security for traders' funds. Unfortunately, Logic Iq does not appear to be regulated by any reputable financial authority. This lack of regulation raises significant concerns about the safety of trading with this broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Logic Iq is not subject to the stringent requirements imposed by top-tier regulators like the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC). Furthermore, there have been warnings issued against Logic Iq by various authorities, including the FCA and the Comisión Nacional del Mercado de Valores (CNMV) in Spain, pointing to its unregulated status and potential fraudulent activities. This history of non-compliance with regulatory standards is a significant red flag for potential investors.

Company Background Investigation

Logic Iqs corporate background is another area of concern. The company claims to operate under the name Logic Iq LLP, but there is little verifiable information about its ownership structure or management team. This lack of transparency raises questions about the legitimacy of the broker and its operations.

The company's supposed registration addresses span multiple locations, including Hong Kong, Spain, and the UK, but these claims lack corroborating evidence. The absence of reliable information about the management team further complicates the assessment of Logic Iq's credibility. A broker's management team should ideally consist of experienced professionals with a solid track record in the financial services industry. However, the anonymity surrounding Logic Iq's leadership only adds to the skepticism regarding its operations.

Trading Conditions Analysis

When assessing whether Logic Iq is safe, its crucial to evaluate its trading conditions, particularly its fee structure. A transparent and fair fee structure is vital for traders looking to maximize their profits. However, Logic Iq has been reported to have hidden fees and unfavorable trading conditions that could negatively impact traders.

| Fee Type | Logic Iq | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Unfavorable | Favorable |

The spread on major currency pairs offered by Logic Iq is reportedly higher than the industry average, which could significantly affect trading profitability. Moreover, the commission structure is vague, leaving traders uncertain about what they may incur. Such lack of clarity on fees can lead to unexpected costs, making it essential for traders to fully understand the financial implications before engaging with Logic Iq.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any broker. Logic Iqs approach to fund security is concerning, as it does not provide adequate information regarding the segregation of client funds, investor protection, or negative balance protection policies.

Without clear policies in place to safeguard clients' investments, traders face the risk of losing their funds without recourse. Additionally, the absence of a compensation scheme, which is typically provided by regulated brokers, further exacerbates these concerns. Historical reports indicate that traders have encountered difficulties when attempting to withdraw their funds, which raises further questions about the reliability of Logic Iq in safeguarding client investments.

Customer Experience and Complaints

User feedback is an invaluable resource when assessing a broker's reputation. Unfortunately, the reviews surrounding Logic Iq are predominantly negative. Many users report issues with fund withdrawals, lack of communication, and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | High | Poor |

| Transparency | Medium | Poor |

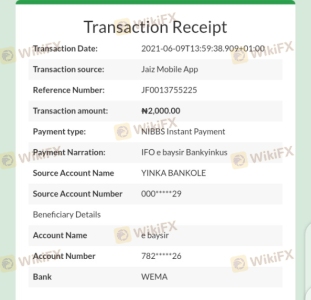

Common complaints include difficulties in withdrawing funds and a lack of transparency regarding the broker's operations. These issues reflect a broader pattern of dissatisfaction among users, highlighting the potential risks associated with trading on this platform. In particular, the case of a user who reported being unable to withdraw their funds after multiple attempts exemplifies the concerns many traders have regarding Logic Iq's reliability.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Logic Iq claims to offer a proprietary trading platform; however, reports suggest that users have experienced issues with platform stability and execution quality.

Concerns about slippage and order rejections have been raised, which can significantly impact trading outcomes. The potential for platform manipulation, such as artificially widening spreads or rejecting trades during volatile market conditions, further exacerbates the risks associated with using Logic Iq. Traders should be wary of such practices, as they can lead to substantial financial losses.

Risk Assessment

Using Logic Iq presents several risks that traders should consider before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Hidden fees and withdrawal issues. |

| Operational Risk | Medium | Platform stability and execution quality issues. |

Given the high-risk levels associated with Logic Iq, traders should exercise extreme caution. It is advisable to conduct thorough research and consider alternative brokers with a proven track record and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Logic Iq may not be a safe broker for traders. Its lack of regulation, poor customer feedback, and questionable trading conditions raise significant red flags. Traders are advised to approach Logic Iq with caution, as there are numerous alternative options available that offer more reliable services and regulatory protections.

For those seeking safer trading environments, consider brokers regulated by top-tier authorities such as the FCA, ASIC, or SEC. These brokers typically provide a higher level of security, transparency, and customer service, ensuring a more trustworthy trading experience. Ultimately, the decision to trade with Logic Iq should be made with careful consideration of the associated risks and the availability of safer alternatives.

Is Logic IQ a scam, or is it legit?

The latest exposure and evaluation content of Logic IQ brokers.

Logic IQ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Logic IQ latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.