Regarding the legitimacy of INGOT forex brokers, it provides ASIC, FSA and WikiBit, .

Is INGOT safe?

Pros

Cons

Is INGOT markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

INGOT AU PTY LTD

Effective Date: Change Record

2013-01-24Email Address of Licensed Institution:

t.kajiwara@ingotbrokers.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 21 60 MARGARET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0493434738Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

INGOT SC LTD

Effective Date:

--Email Address of Licensed Institution:

h.khawanky@ingotbrokers.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ingotbrokers.com, www.ingot.ioExpiration Time:

--Address of Licensed Institution:

Unit 3, 2nd Floor, Dekk Complex, Plaisance, Mahe, SeychellesPhone Number of Licensed Institution:

4345580Licensed Institution Certified Documents:

Is Ingot Safe or a Scam?

Introduction

Ingot Brokers, established in 2006, has positioned itself as a multi-asset brokerage firm that offers a variety of trading instruments, including forex, commodities, and cryptocurrencies. With operations in Australia and Seychelles, Ingot aims to cater to a diverse clientele across various regions. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the safety and reliability of their chosen brokers. This article aims to assess whether Ingot Brokers is a legitimate trading platform or a potential scam. The evaluation is based on regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a trading broker is one of the most critical factors in determining its legitimacy. Ingot Brokers is regulated by two primary authorities: the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA). ASIC is known for its stringent regulations, which require brokers to maintain high standards of transparency and client protection. In contrast, the FSA is often viewed as a less rigorous regulatory body, raising concerns about the level of protection it offers.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 428015 | Australia | Verified |

| FSA | SD 117 | Seychelles | Verified |

ASIC's oversight ensures that Ingot Brokers adheres to strict capital requirements and internal procedures, including risk management and regular audits. This regulatory quality contributes significantly to the broker's credibility. However, the presence of the offshore FSA license may introduce some risks, as offshore regulations typically provide less investor protection compared to their onshore counterparts. Overall, Ingot Brokers appears to be a legitimate entity under the ASIC regulation, but potential clients should be cautious about the implications of the FSA oversight.

Company Background Investigation

Ingot Brokers has a long-standing history in the forex trading industry, having been in operation since 2006. The company is owned by Ingot Global Ltd and operates multiple entities across different jurisdictions, including Australia, Seychelles, and Jordan. This diversified structure allows Ingot to cater to a global audience, but it also complicates the regulatory landscape.

The management team at Ingot Brokers comprises experienced professionals with backgrounds in finance and trading. Their expertise is crucial in ensuring that the brokerage operates efficiently and adheres to regulatory standards. Transparency is a vital aspect of any brokerage, and Ingot Brokers provides sufficient information about its operations and management team on its website, contributing to a sense of trustworthiness.

However, the offshore nature of some of its entities, particularly in Seychelles, raises questions about the level of oversight and the potential for operational issues. While Ingot Brokers has not been involved in any significant scandals or controversies, the mixed regulatory environment necessitates careful consideration by prospective clients.

Trading Conditions Analysis

Ingot Brokers offers a variety of trading accounts with different fee structures, which is essential for traders to understand before committing their funds. The broker employs a commission-based model for certain account types, while others operate on a spread-only basis. This flexibility allows traders to choose the account type that best suits their trading style.

| Fee Type | Ingot Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 1.2 pips |

| Commission Model | $7 per lot | $6 per lot |

| Overnight Interest Range | Variable | Variable |

The overall cost structure at Ingot Brokers appears competitive, particularly for forex trading. However, some users have reported unexpected fees, which could be a red flag. It is essential for traders to read the fine print and understand the fee structure associated with their chosen account type. Additionally, the presence of a variable overnight interest rate may lead to unforeseen costs that could impact profitability.

Client Fund Security

The safety of client funds is paramount when evaluating a brokerage. Ingot Brokers claims to implement robust security measures to protect client funds. One of the key features is the segregation of client funds, which ensures that traders' money is kept separate from the broker's operational funds. This practice is crucial for safeguarding clients' investments, particularly in the event of the broker facing financial difficulties.

Furthermore, Ingot Brokers participates in investor protection schemes, which can provide an additional layer of security for clients. However, the specifics of these protections can vary based on the regulatory jurisdiction. Notably, ASIC-regulated brokers typically offer higher levels of investor protection compared to those regulated by offshore authorities.

While Ingot Brokers has not faced significant historical issues regarding fund security, potential clients should remain vigilant and conduct thorough due diligence before depositing their funds. The mixed regulatory status and the offshore entity's presence may introduce some risks that traders should consider.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Ingot Brokers has received mixed reviews from its clients, with some praising its trading conditions and customer service, while others have raised concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Slippage Issues | Medium | Acknowledged |

| Customer Support Quality | Low | Generally positive |

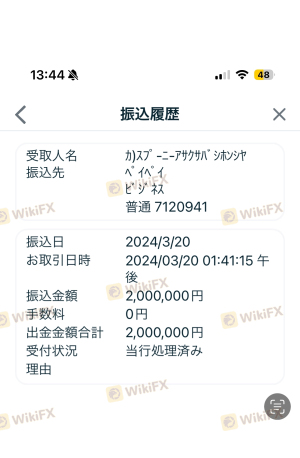

Common complaints include delays in accessing funds and difficulties in communication with customer support. While the broker has a dedicated support team available 24/5, the lack of weekend support could be a drawback for some traders. Case studies reveal that clients have experienced significant delays in withdrawals, leading to frustration and distrust.

In contrast, many users have reported positive experiences regarding the trading platform's performance and the availability of educational resources. The mixed feedback highlights the importance of conducting personal research and perhaps starting with a smaller investment to gauge the broker's reliability.

Platform and Trade Execution

Ingot Brokers primarily utilizes the popular MetaTrader 4 and MetaTrader 5 trading platforms, known for their user-friendly interfaces and advanced trading capabilities. These platforms provide traders with access to a wide range of technical analysis tools and automated trading options, enhancing the overall trading experience.

However, concerns have been raised regarding order execution quality, particularly in high-volatility market conditions. Some users have reported instances of slippage and rejected orders, which could significantly impact trading outcomes. While slippage is common in the forex market, excessive slippage could indicate underlying issues with the broker's execution practices.

Risk Assessment

When considering trading with Ingot Brokers, it is essential to evaluate the associated risks. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may offer less protection. |

| Fund Security | Medium | Segregated funds, but mixed regulatory oversight. |

| Customer Support | High | Complaints about withdrawal delays and support responsiveness. |

| Trading Conditions | Medium | Competitive fees, but potential hidden costs. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and only invest funds they can afford to lose. Engaging with the broker in a limited capacity initially can help gauge its reliability and service quality.

Conclusion and Recommendations

In conclusion, while Ingot Brokers has established itself as a legitimate brokerage with regulatory oversight from ASIC, the presence of an offshore entity raises some concerns. The mixed reviews from clients regarding fund security and customer support suggest that potential traders should exercise caution.

For those considering trading with Ingot Brokers, it is advisable to start with a smaller investment and closely monitor the trading experience. Additionally, traders may want to explore alternative brokers with stronger regulatory frameworks and more favorable customer reviews, such as IC Markets or Pepperstone, which are known for their transparency and customer service.

In summary, while Ingot Brokers is not outright a scam, there are several areas of concern that traders should be aware of. Conducting thorough research and maintaining a cautious approach will help ensure a safer trading experience.

Is INGOT a scam, or is it legit?

The latest exposure and evaluation content of INGOT brokers.

INGOT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INGOT latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.