Regarding the legitimacy of GKFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is GKFX safe?

Pros

Cons

Is GKFX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Trive Financial Services UK Limited

Effective Date:

2010-02-15Email Address of Licensed Institution:

support.uk@trive.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trivepro.co.ukExpiration Time:

2024-06-14Address of Licensed Institution:

Level39 One Canada Square London E14 5AB ENGLANDPhone Number of Licensed Institution:

+442071861212Licensed Institution Certified Documents:

Is GKFX Safe or a Scam?

Introduction

GKFX is a forex and CFD broker that has been operating in the financial markets since its establishment in 2010. With its headquarters in Malta and various regulatory licenses, GKFX aims to provide a wide range of trading services to both retail and institutional clients. As the forex market continues to grow, traders must exercise caution and conduct thorough evaluations of brokers to avoid potential scams and ensure the safety of their investments. This article will explore GKFX's regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks to determine if GKFX is a reliable trading partner or a potential scam.

To conduct this investigation, a comprehensive analysis was performed based on various sources, including regulatory disclosures, user reviews, and broker assessments. The evaluation framework focuses on key aspects such as regulatory compliance, company history, trading conditions, customer fund protection, and overall user experience.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and the safety of client funds. GKFX is regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Malta Financial Services Authority (MFSA). These regulators impose strict guidelines to protect traders and ensure fair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 501320 | United Kingdom | Verified |

| MFSA | C60473 | Malta | Verified |

| BVI FSC | 1728826 | British Virgin Islands | Verified |

The FCA is known for its stringent regulatory framework, which includes requirements for client fund segregation, regular audits, and adherence to the Financial Services Compensation Scheme (FSCS). This scheme provides additional protection for clients, covering up to £85,000 in the event of broker insolvency. The MFSA also offers similar protections, ensuring that client funds are held in segregated accounts and are not mixed with the broker's operational funds.

In terms of historical compliance, GKFX has maintained a good standing with these regulatory bodies, with no significant breaches reported. However, potential clients should remain vigilant and monitor any changes in the broker's regulatory status or operational practices.

Company Background Investigation

GKFX operates under the brand name of AK FX Financial Services Ltd. Since its inception, the company has expanded its operations and now serves clients in various countries. The ownership structure includes a parent company, Global Kapital Group, which has a history of involvement in the forex and CFD brokerage industry.

The management team at GKFX consists of experienced professionals with extensive backgrounds in finance and trading. This expertise contributes to the broker's ability to provide quality services and maintain compliance with regulatory standards. The company's transparency is evident in its willingness to disclose information about its operations, regulatory status, and trading conditions, which is a positive sign for potential clients.

Despite its relatively short history, GKFX has established itself as a player in the forex market, focusing on client satisfaction and innovative trading solutions. However, the broker's rapid growth may raise concerns about its ability to maintain service quality and compliance as it expands further.

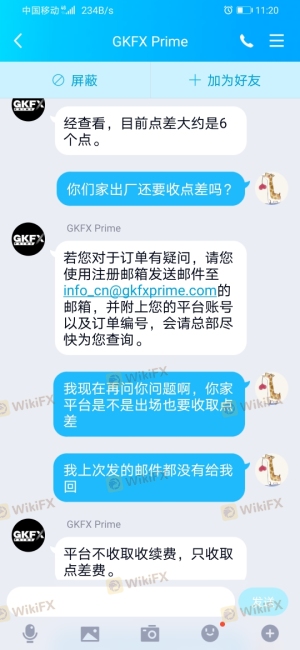

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. GKFX offers a variety of account types, including standard and premium accounts, with varying minimum deposit requirements and trading fees. The overall fee structure is competitive, with spreads starting as low as 0.6 pips for major currency pairs.

| Fee Type | GKFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While GKFX does not charge commissions on most trades, some account types may incur fees based on the trading volume. This structure can be advantageous for traders who prefer to avoid commission-based trading. However, it is essential to be aware of any potential hidden fees, such as withdrawal charges or inactivity fees, which can impact overall trading costs.

Additionally, GKFX's trading conditions may vary depending on the regulatory jurisdiction under which the account is opened. This variability can affect leverage limits, available trading instruments, and margin requirements, making it crucial for traders to understand the specific conditions applicable to their accounts.

Client Fund Safety

The safety of client funds is a top priority for any reputable broker. GKFX implements several measures to ensure the security of client deposits. All client funds are held in segregated accounts at tier-1 banks, which prevents the use of these funds for the broker's operational expenses. This practice is crucial in safeguarding traders' money in case of financial difficulties faced by the broker.

Moreover, GKFX adheres to the regulations set forth by its governing bodies, which include provisions for negative balance protection. This means that traders cannot lose more than their account balance, reducing the risk of significant financial loss. The broker's commitment to fund safety is further reinforced by its compliance with the European Securities and Markets Authority (ESMA) guidelines.

While GKFX has not faced any significant fund safety issues or controversies in its operational history, potential clients should remain cautious and ensure they fully understand the broker's policies regarding fund protection and withdrawal processes before depositing their money.

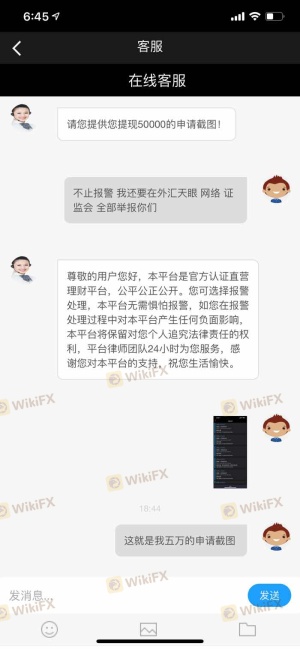

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. GKFX has received a mix of reviews from users, with many praising its trading platform, customer support, and overall trading experience. However, some customers have reported issues related to withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Account Closure Issues | Medium | Slow |

| Customer Support Responsiveness | Medium | Generally Positive |

Common complaints include delays in processing withdrawals and difficulties in accessing customer support. In some cases, clients have reported that their accounts were closed without sufficient explanation, leading to frustration and distrust.

One notable case involved a trader who experienced significant delays in withdrawing funds, prompting them to escalate the issue to regulatory authorities. The broker's response was slow, highlighting potential weaknesses in its customer service operations.

Despite these concerns, many users have reported positive experiences with GKFX, particularly regarding its trading platform and educational resources. The broker offers various tools and resources to assist traders in improving their skills and knowledge, which is a valuable asset for both novice and experienced investors.

Platform and Trade Execution

The performance of a broker's trading platform is critical to the overall trading experience. GKFX offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the industry. These platforms are known for their user-friendly interfaces, advanced charting tools, and extensive analysis capabilities.

Traders have generally reported positive experiences with GKFX's platform performance, citing stable connections and quick order execution. However, some users have raised concerns about slippage during high volatility periods and occasional execution delays. These issues can impact trading outcomes, particularly for scalpers and high-frequency traders.

In terms of manipulation, there have been no substantial allegations against GKFX regarding platform manipulation or unfair trading practices. The broker appears to maintain a transparent trading environment, allowing clients to execute trades based on market conditions.

Risk Assessment

Using GKFX for trading involves certain risks that traders should consider. While the broker is regulated and has implemented various safety measures, potential clients must remain vigilant about the following risks:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | While regulated, the broker's history of complaints raises concerns. |

| Withdrawal Issues | High | Reports of delays and issues with fund access can pose significant risks. |

| Customer Support | Medium | Inconsistent support responsiveness may lead to unresolved issues. |

To mitigate these risks, potential clients should conduct thorough research, read user reviews, and consider starting with a demo account to familiarize themselves with the platform. Additionally, maintaining realistic expectations regarding potential profits and losses can help traders navigate the inherent risks of trading in the forex market.

Conclusion and Recommendations

In conclusion, GKFX presents itself as a regulated broker with a solid foundation in the forex and CFD markets. While the broker has received positive feedback for its trading conditions and platform performance, there are notable concerns regarding customer support and withdrawal processes.

Overall, GKFX does not appear to be a scam, but potential clients should exercise caution and conduct their due diligence before opening an account. For traders seeking reliable alternatives, brokers with established reputations and consistent positive reviews, such as IG or OANDA, may be worth considering.

Ultimately, it is crucial for traders to choose a broker that aligns with their trading goals and risk tolerance while ensuring that their funds are secure and accessible.

Is GKFX a scam, or is it legit?

The latest exposure and evaluation content of GKFX brokers.

GKFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GKFX latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.