GKFX 2025 Review: Everything You Need to Know

GKFX has emerged as a notable broker in the online trading landscape, offering a diverse range of financial instruments and trading platforms. Overall, user feedback suggests a mixed experience, with positive remarks about its user-friendly platforms and competitive spreads, while some users express concerns about customer service and the lack of certain features. Notably, GKFX operates under multiple regulatory jurisdictions, which can impact the trading conditions and offerings available to clients in different regions.

Note: The presence of different entities across jurisdictions is a relevant factor to consider, as it may lead to variations in trading conditions and regulatory protections.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data regarding trading conditions, platform usability, and customer support.

Broker Overview

Founded in 2010, GKFX is a multi-asset trading platform headquartered in Malta, operating under the brand name AK FX Financial Services Ltd. It is regulated by several authorities, including the Malta Financial Services Authority (MFSA) and the UK's Financial Conduct Authority (FCA). GKFX offers trading on popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), providing access to a wide variety of assets including forex, CFDs, commodities, and cryptocurrencies.

Detailed Sections

Regulated Geographic Areas

GKFX operates across multiple regions, including Europe, with significant regulatory oversight from the FCA and MFSA. However, it does not accept clients from the United States, which may limit its accessibility for some traders.

Deposit/Withdrawal Currencies/Cryptocurrencies

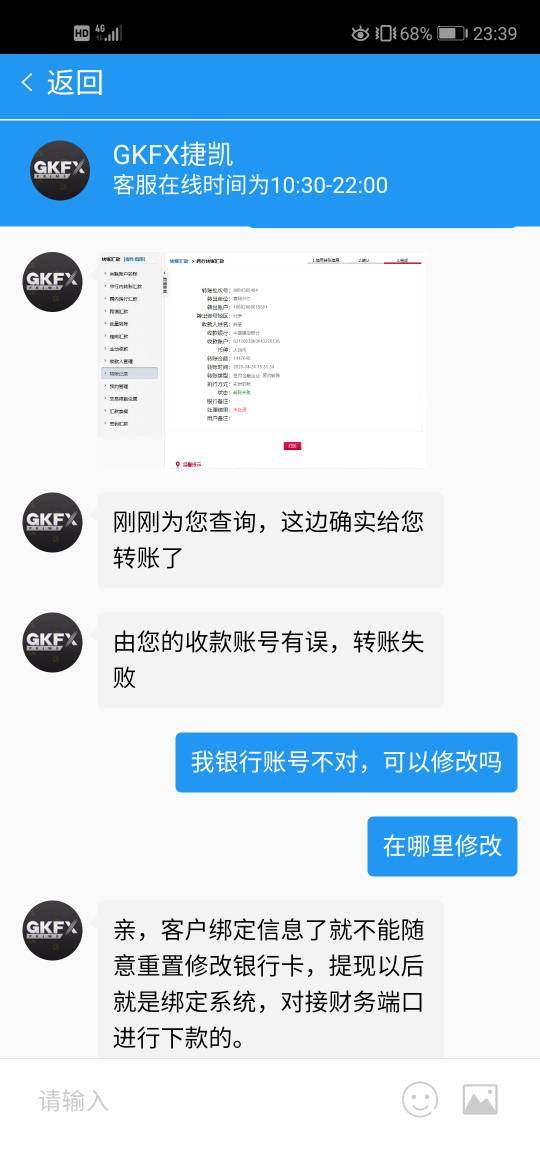

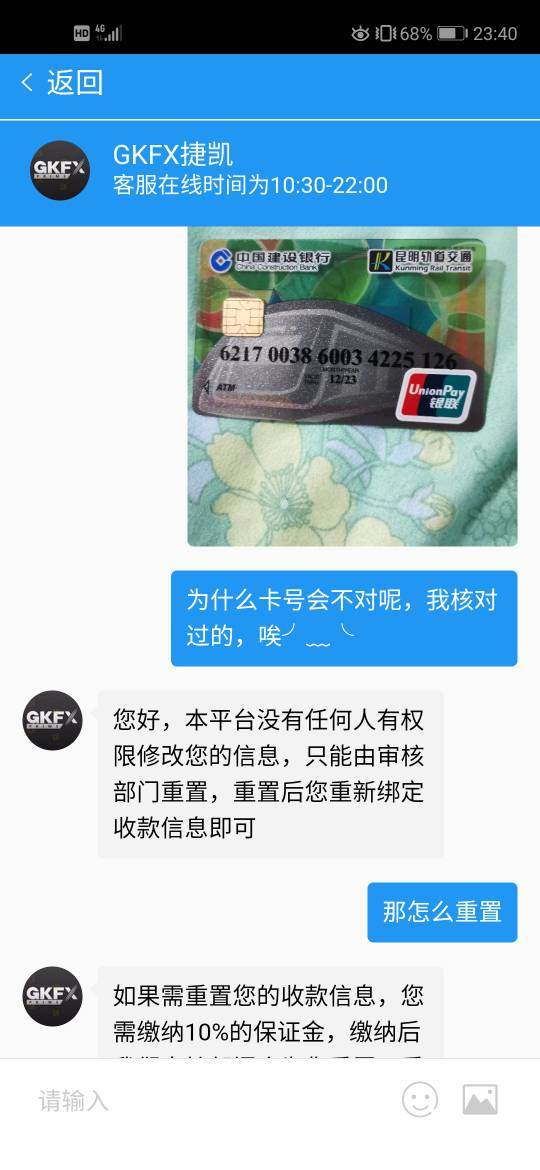

The broker supports deposits and withdrawals in several currencies, including USD, EUR, and GBP. While cryptocurrencies are available for trading, GKFX does not accept cryptocurrency as a payment method for deposits or withdrawals.

Minimum Deposit

The minimum deposit required to open an account with GKFX varies by account type. For the standard account, the minimum deposit is set at €200, while premium accounts require a minimum deposit of €25,000.

Currently, GKFX does not offer any significant bonuses or promotions, which may be a drawback for traders looking for additional incentives.

Tradable Asset Classes

GKFX provides a broad range of tradable assets, including over 50 forex pairs, various commodities, indices, stocks, and cryptocurrencies. The availability of specific instruments may vary based on the regulatory entity under which the account is opened.

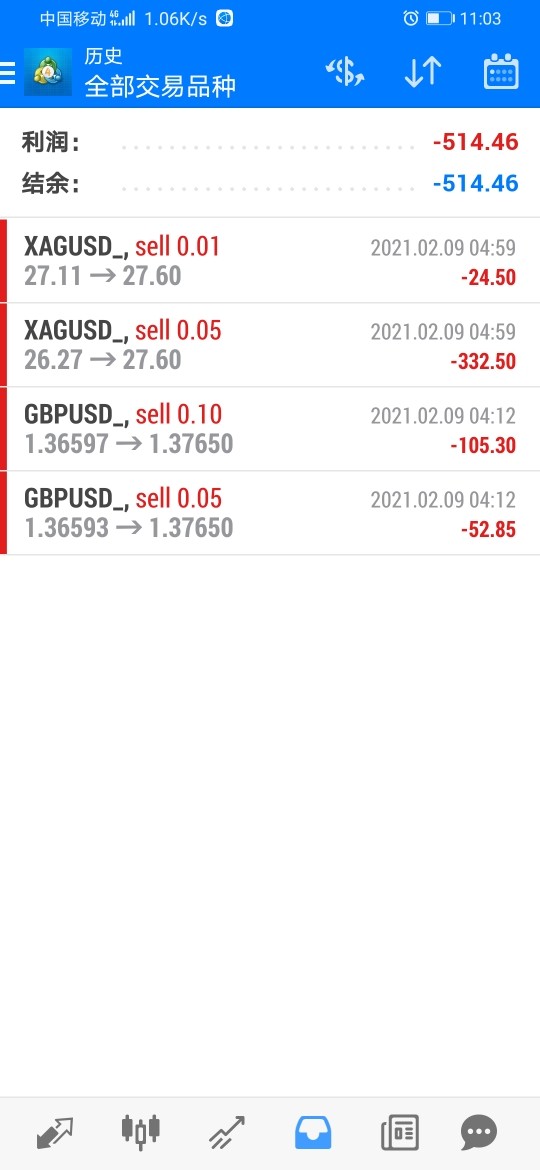

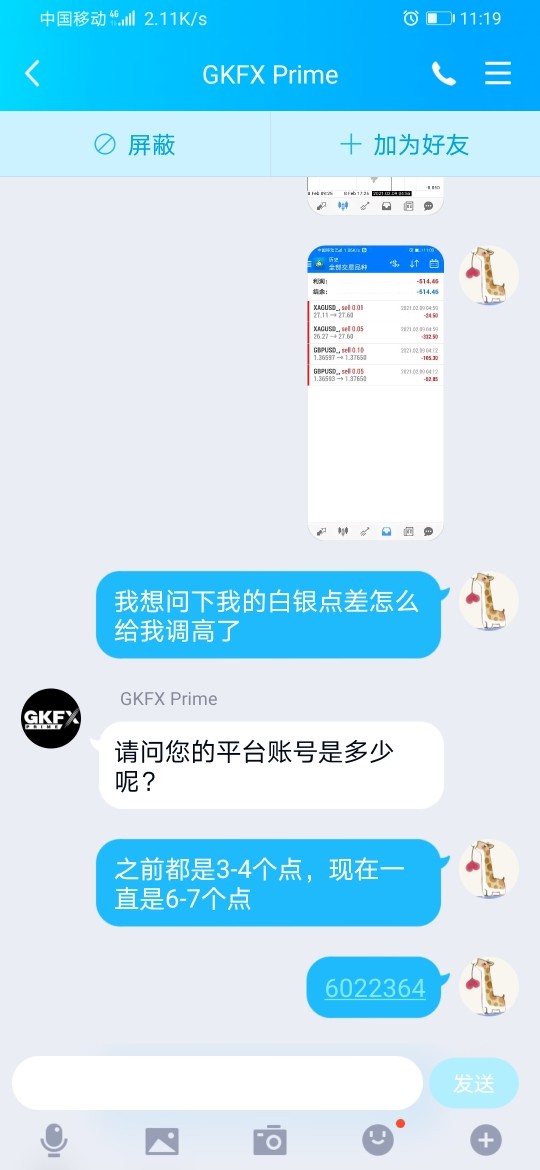

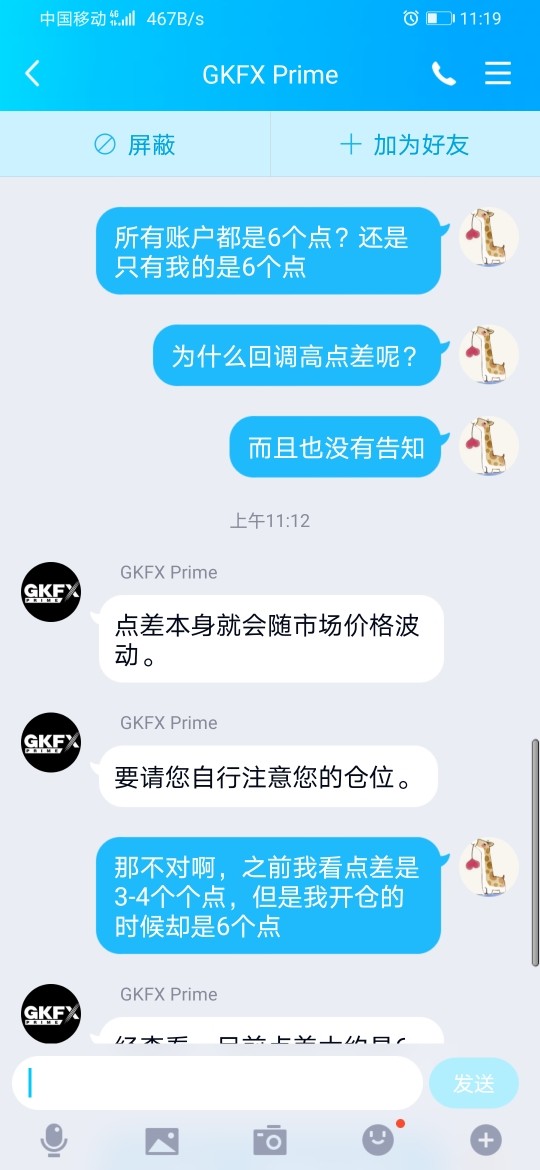

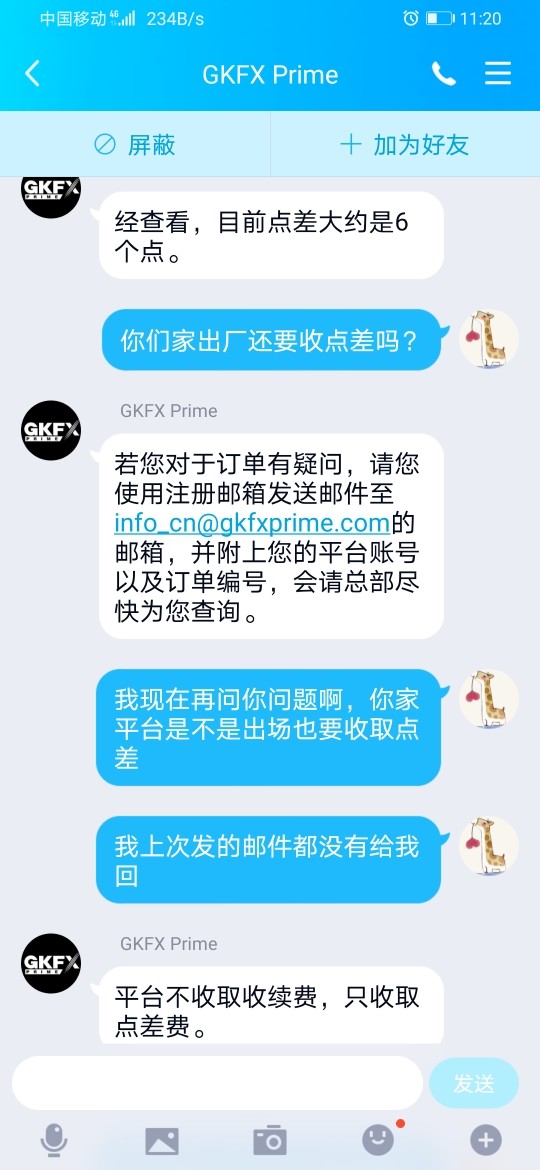

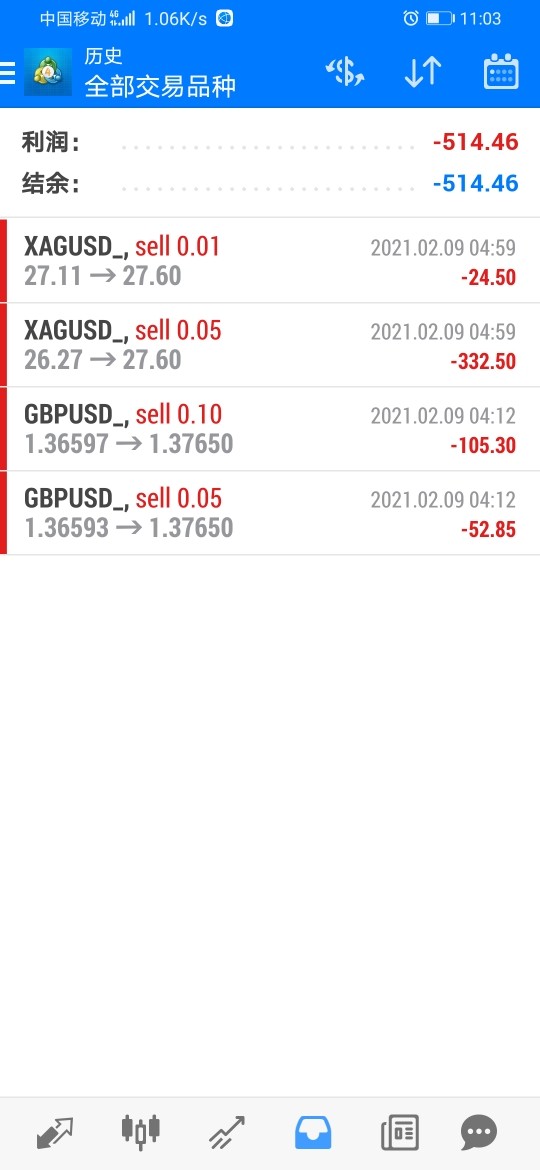

Costs (Spreads, Fees, Commissions)

GKFX offers competitive spreads starting from 0.6 pips for forex trading. There are no commissions on the standard accounts, but premium accounts incur a commission of €6 per lot. Importantly, there are no deposit or withdrawal fees, which is a positive aspect for traders.

Leverage

The maximum leverage offered by GKFX is 1:30 for retail clients, which is in line with regulatory standards set by the FCA. Higher leverage is available for professional clients, which may appeal to more experienced traders.

Traders can access GKFX through the MT4 and MT5 platforms, both of which are well-regarded in the industry for their robust features and usability. The platforms are available on desktop, web, and mobile devices, allowing for flexible trading options.

Restricted Regions

GKFX does not accept clients from certain countries, including the United States, Brazil, and Japan. This restriction may limit its appeal to a global audience.

Available Customer Service Languages

GKFX offers customer support in multiple languages, including English, Spanish, and German, which can enhance the user experience for a diverse client base.

Rating Overview (Repeated)

Detailed Breakdown

Account Conditions

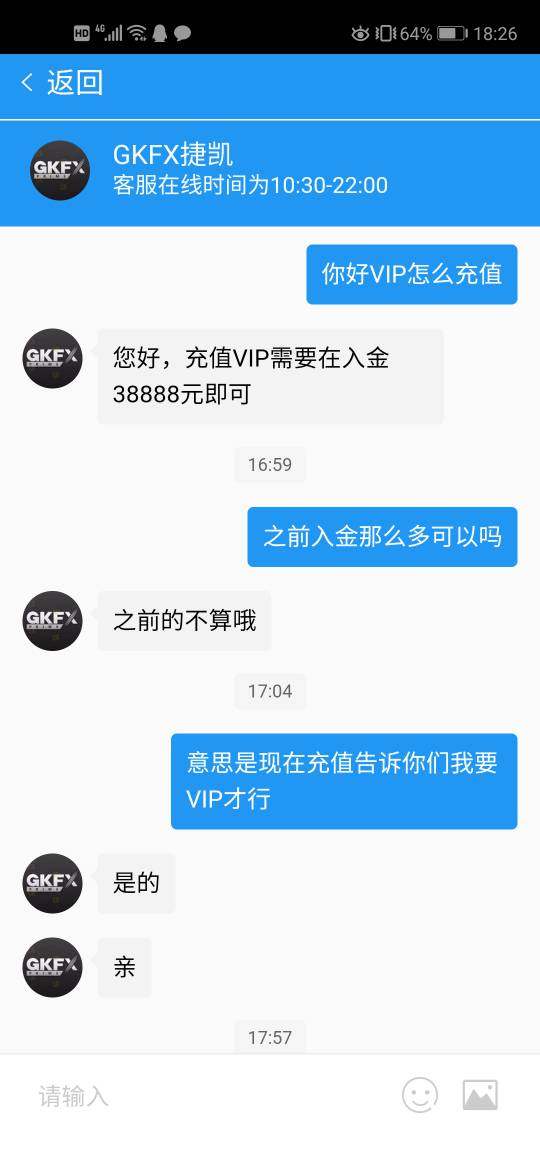

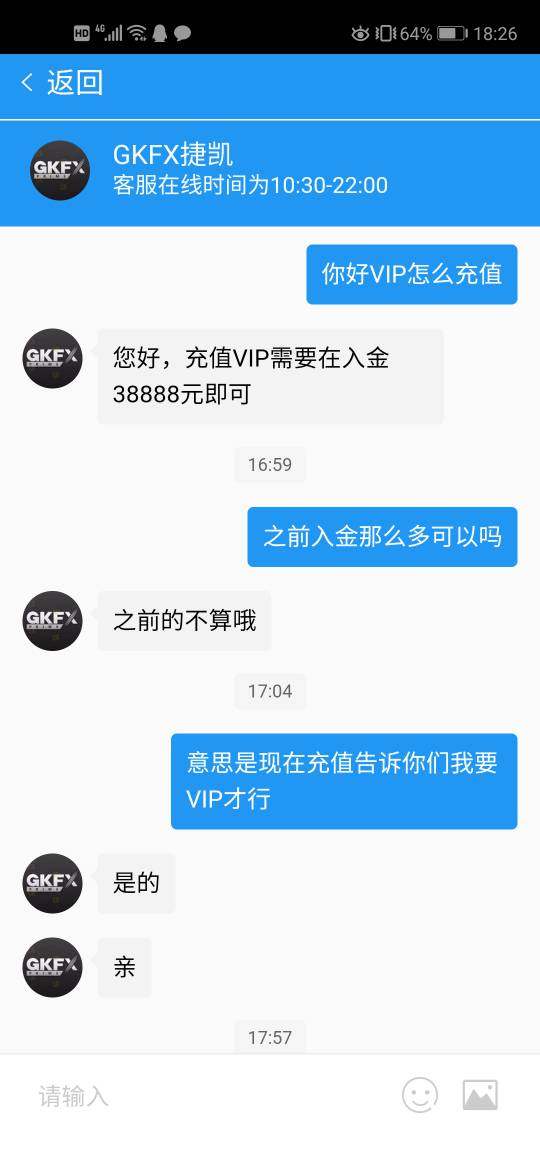

GKFX provides a range of account types, including standard, premium, and corporate accounts. The minimum deposit requirements vary significantly, which could affect accessibility for new traders. User feedback indicates that while the standard account is accessible, the premium account's high minimum deposit may deter some traders.

The broker offers a variety of trading tools, including advanced charting features and market analysis resources. The presence of educational materials and a demo account is beneficial for new traders looking to familiarize themselves with the platform.

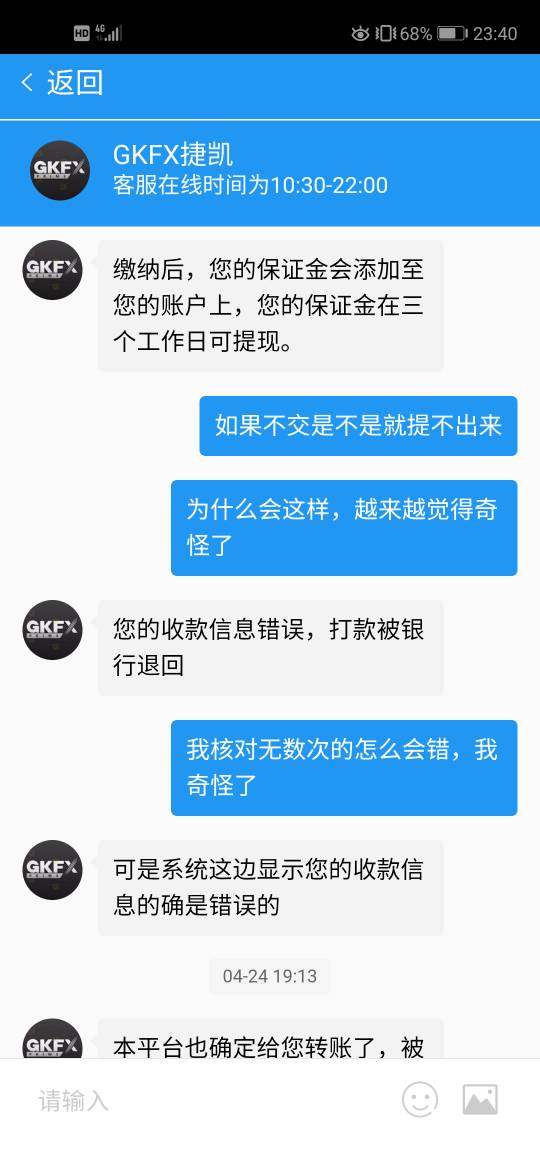

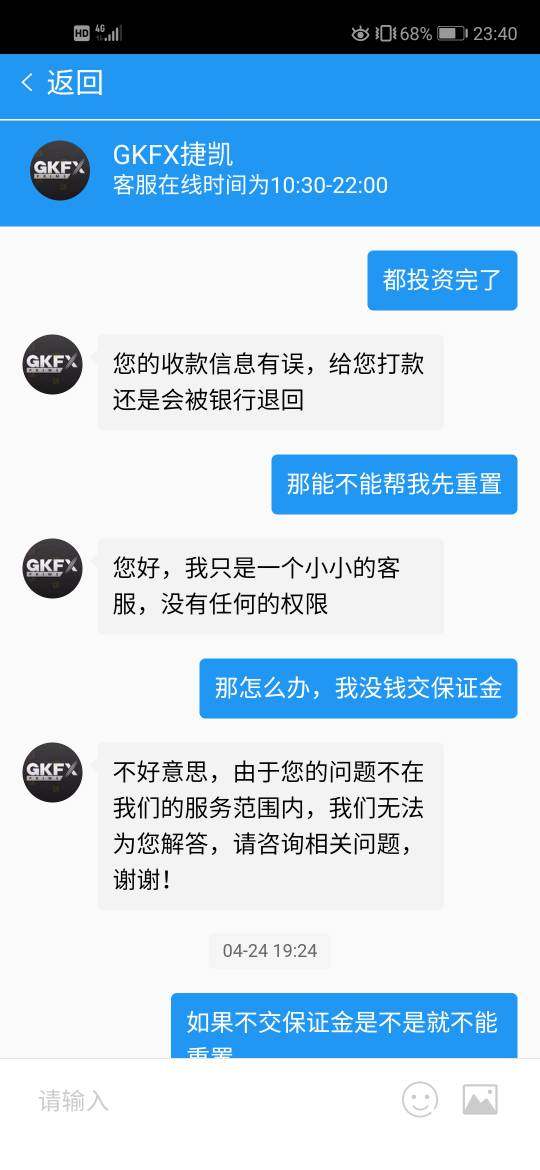

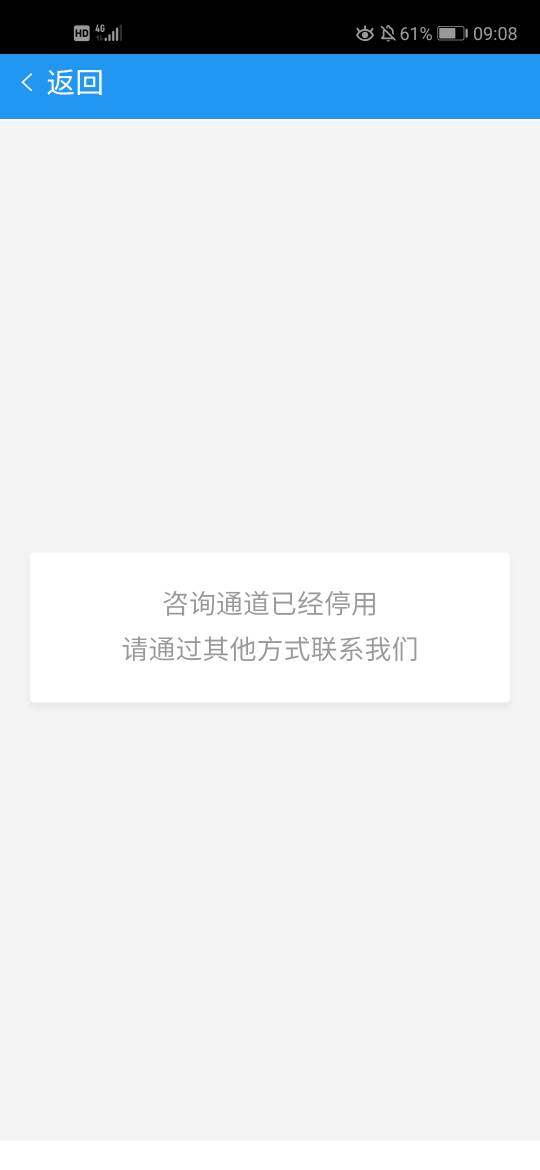

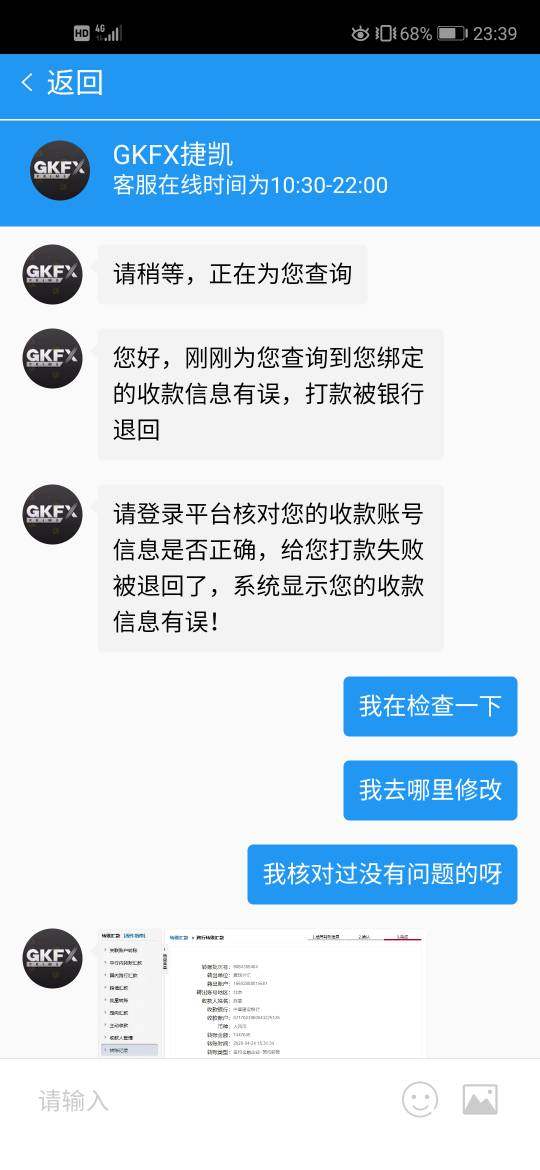

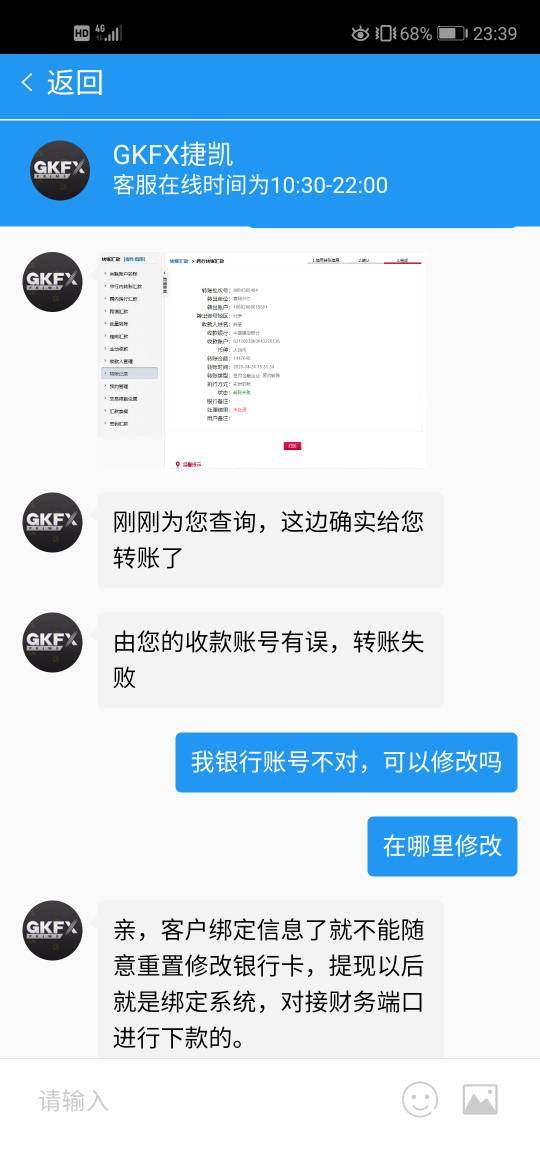

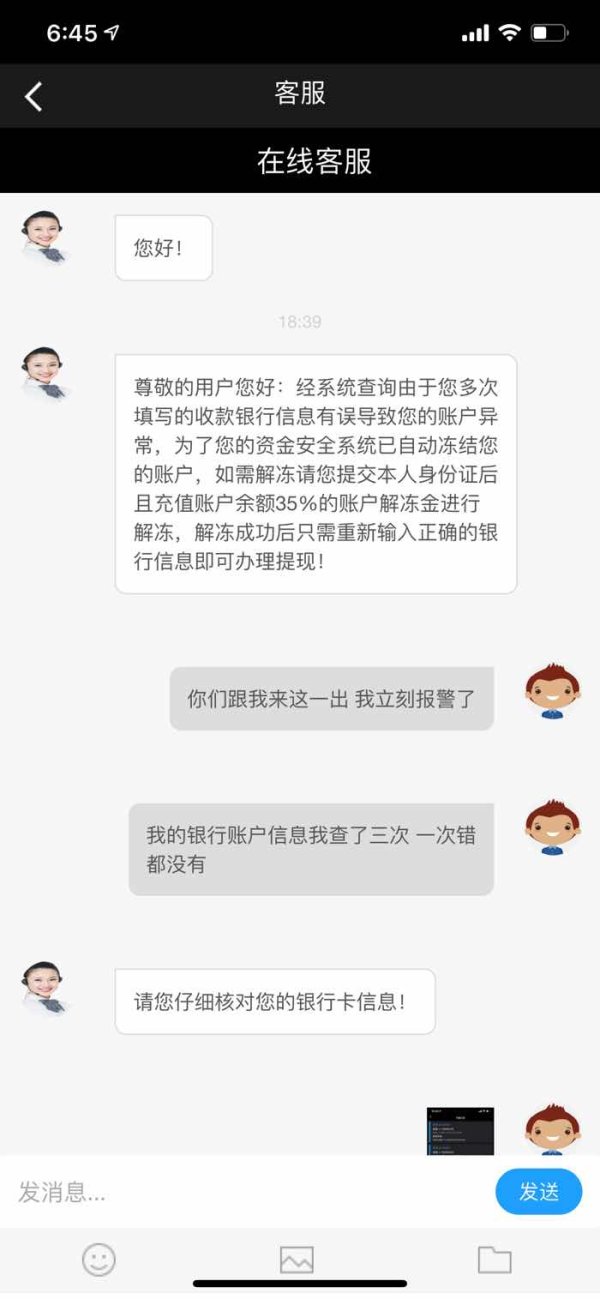

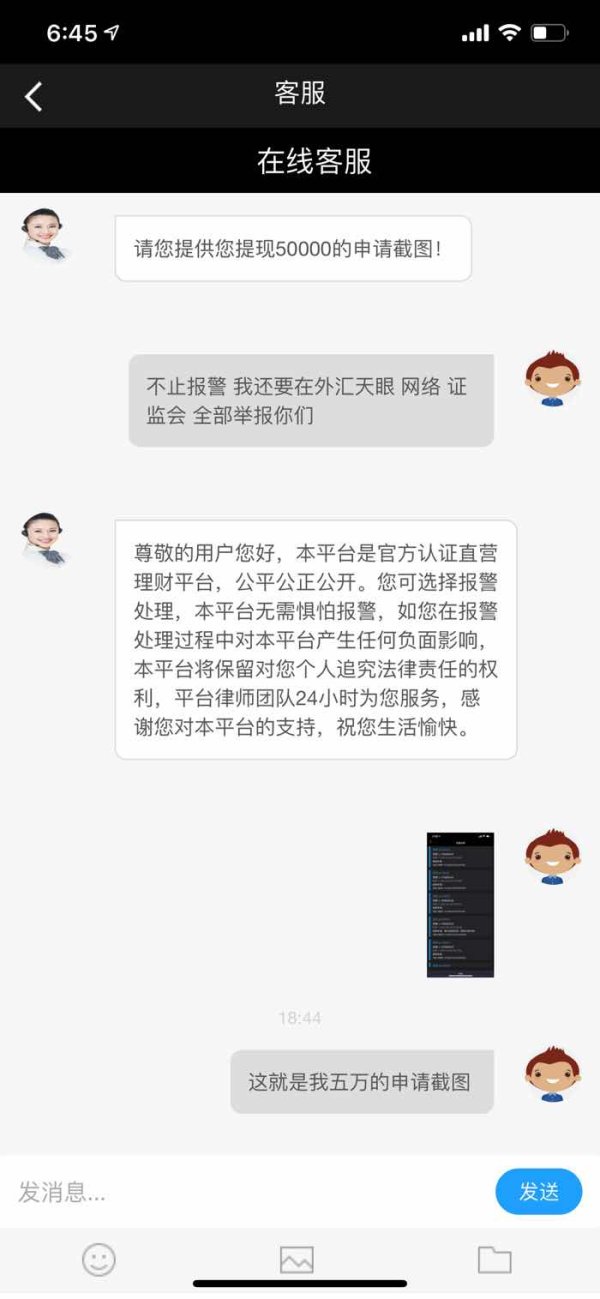

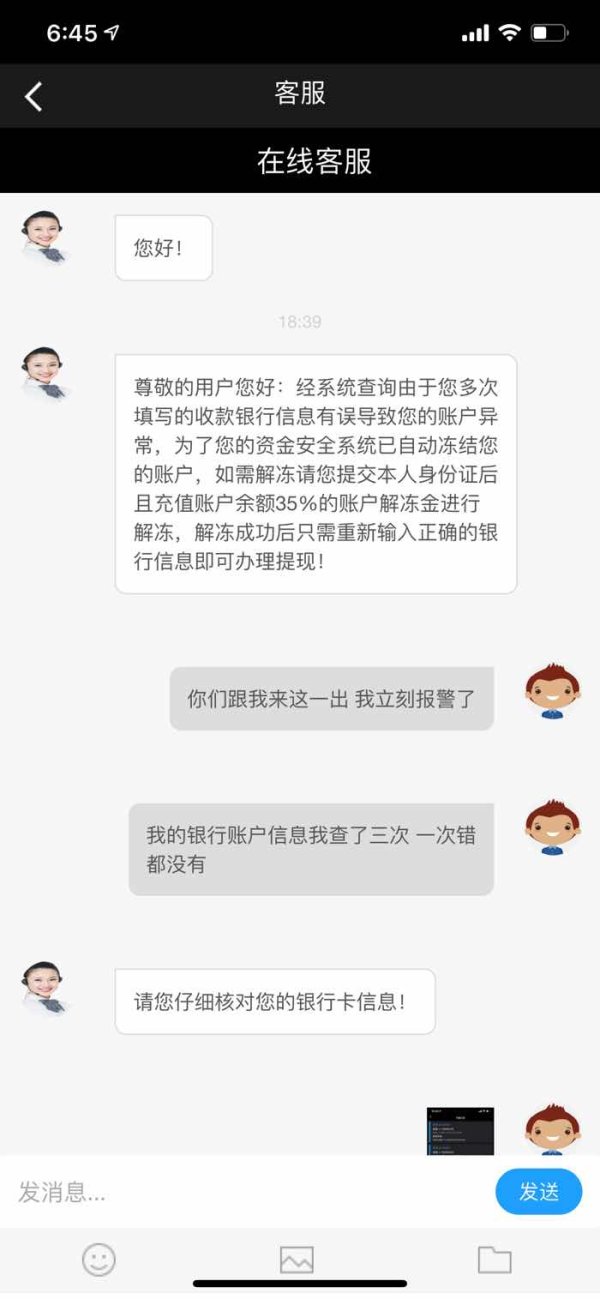

Customer Service and Support

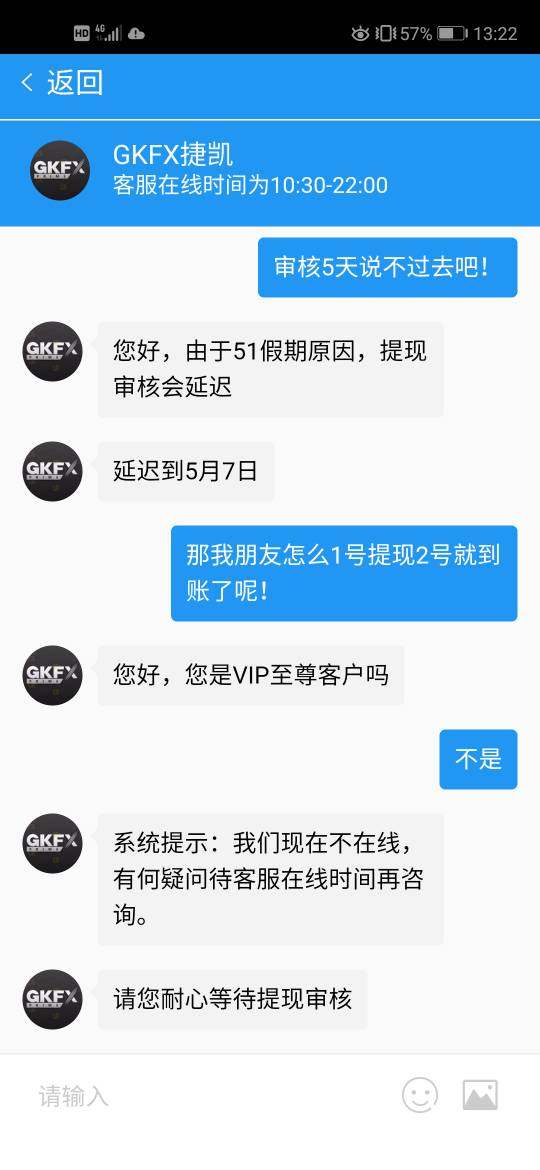

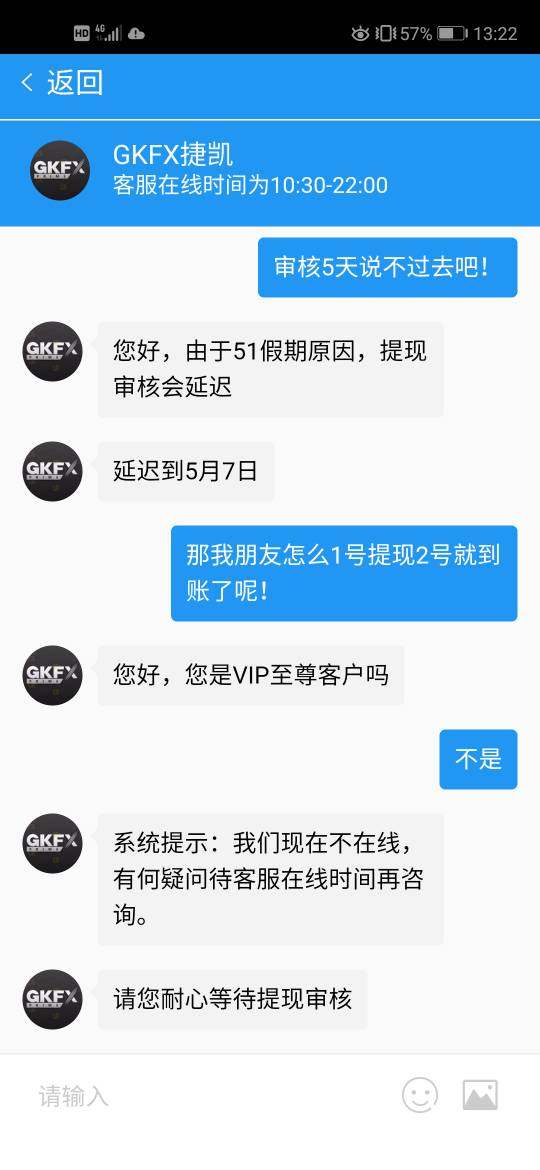

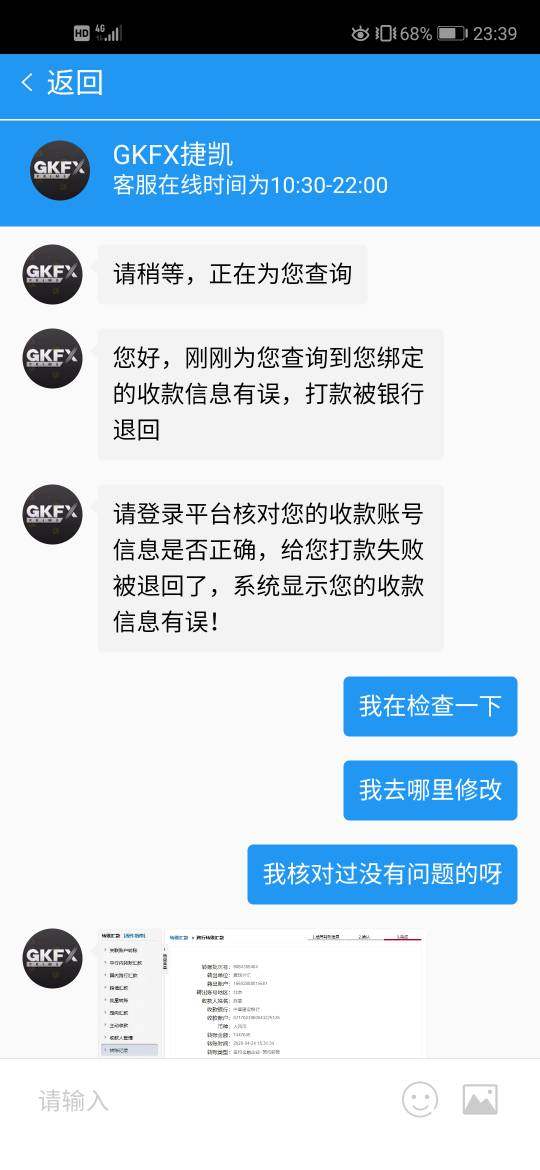

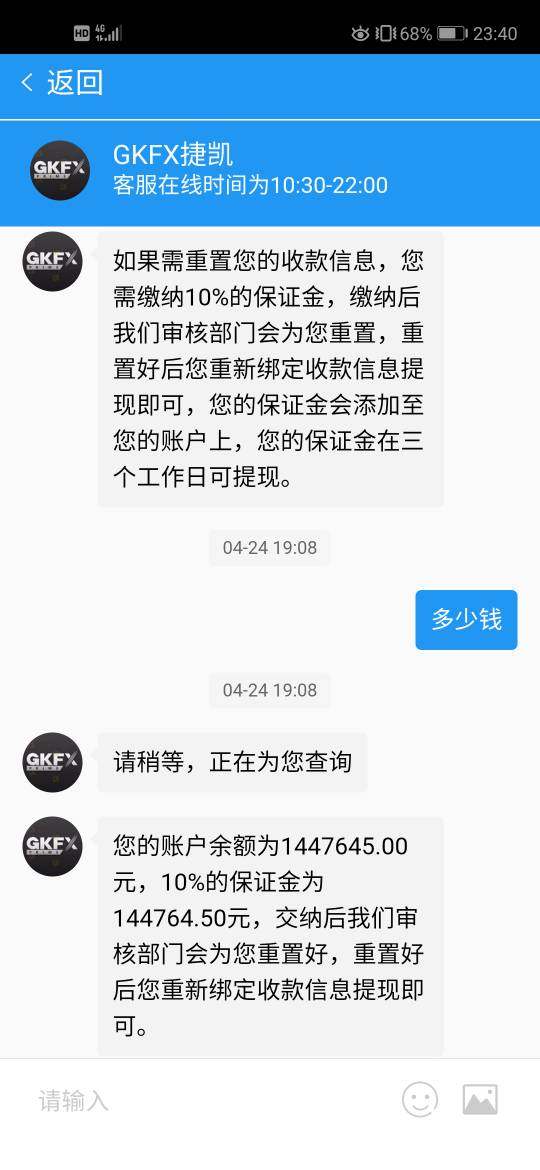

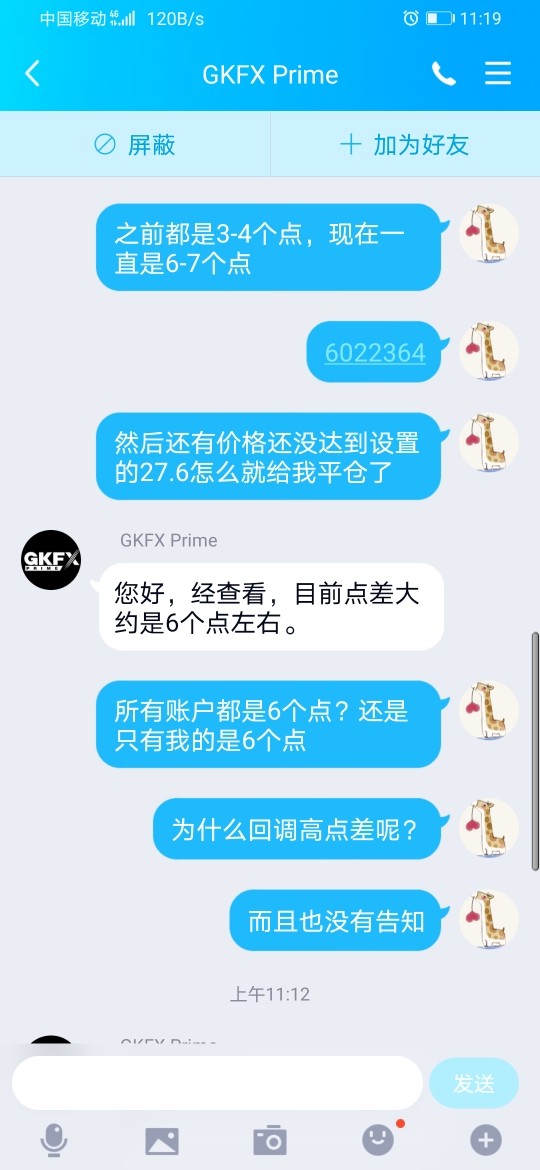

Customer service has received mixed reviews, with some users reporting slow response times. While GKFX offers support via live chat, phone, and email, the lack of 24/7 support may be a limitation for traders in different time zones.

Trading Experience

Overall, users have reported a positive trading experience on GKFX, particularly praising the platform's usability and the competitive spreads. However, some users have expressed concerns about the lack of features such as guaranteed stop-loss orders.

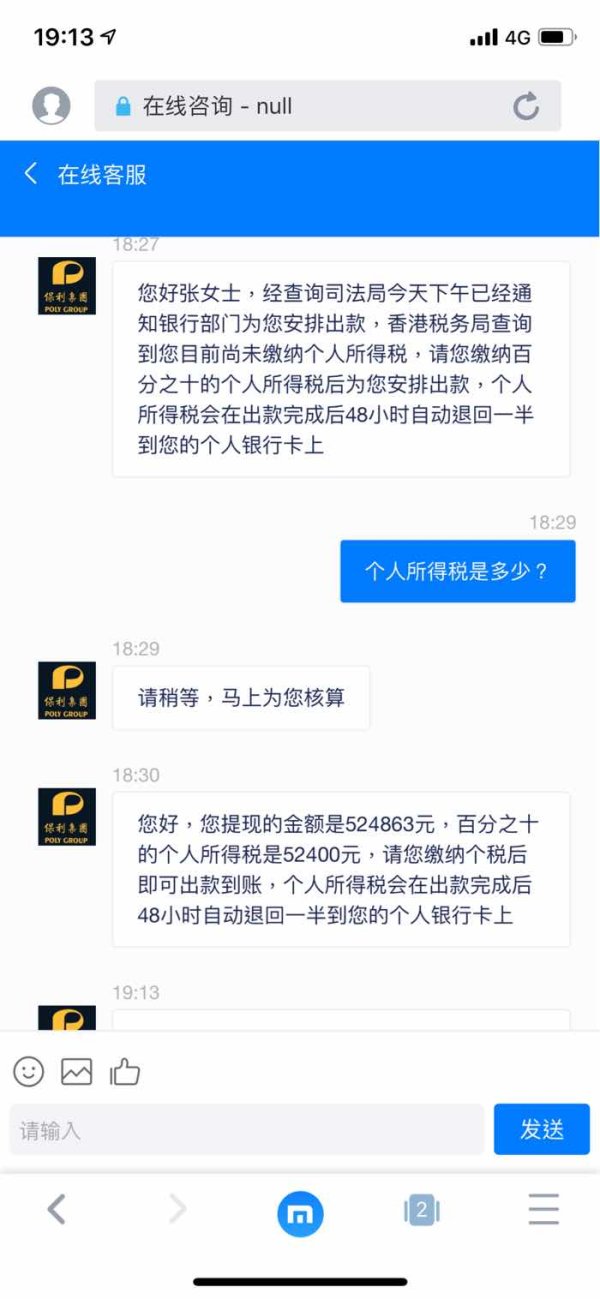

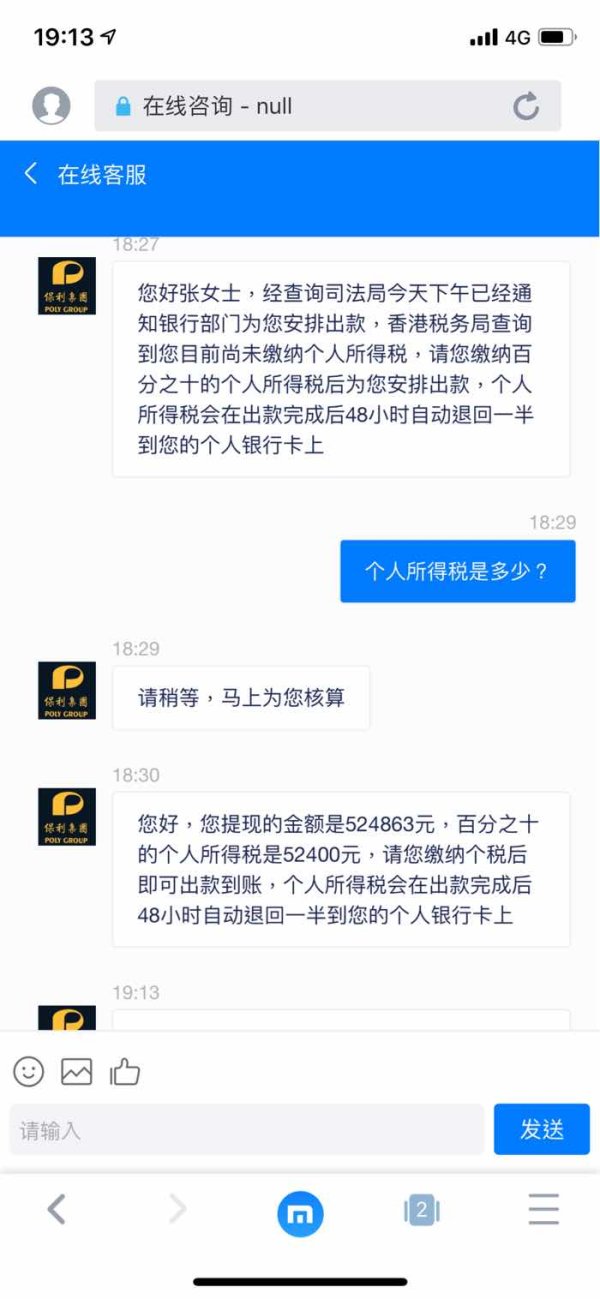

Trustworthiness

GKFX is regulated by reputable authorities, which enhances its credibility. Users generally feel safe trading with GKFX due to the regulatory oversight and the secure handling of funds.

User Experience

The user interface of the trading platforms is reported to be intuitive and user-friendly, making it easier for traders to navigate and execute trades efficiently.

In conclusion, GKFX presents itself as a competitive option for traders looking for a regulated broker with a diverse range of offerings. However, potential clients should weigh the pros and cons, particularly regarding customer service and account conditions, before making a decision.