Founded in 2011, FXGlory operates primarily out of St. Vincent and the Grenadines. Its unregulated status is a double-edged sword, offering traders access to high leverage and low entry costs while simultaneously raising alarm bells regarding security and trustworthiness. The platforms foundational principle revolves around providing flexible trading conditions, which successfully attracts a broad clientele, particularly from Europe.

FXGlory is a versatile broker that offers a wide selection of asset classes, including forex, metals, and commodities. The trading platforms available, MT4 and MT5, are recognized within the industry for their robust features. Notably, FXGlory promotes high leverage options (up to 1:3000) as a core feature. However, the broker operates without the backing of established regulatory bodies, which should prompt potential clients to conduct thorough due diligence before engagement. Essential services such as margin trading and algorithmic trading through expert advisors (EAs) are also available, contributing to its universal appeal amongst traders.

FXGlory proudly claims to be registered in St. Vincent and the Grenadines, but this designation comes without credible regulatory supervision. As per multiple user reviews, the broker has faced allegations of fraudulent practices, including difficulties with account withdrawals and unresponsive customer service. Many traders have raised concerns about the potential risks associated with trading through an unregulated broker, reinforcing the critical need for self-verification before committing funds.

- Visit National Regulators: Check databases of reputable financial regulatory bodies like the NFA and FCA.

- Search the Broker Name: Utilize the databases to confirm the legitimacy of FXGlory's claims and registration.

- Review User Experiences: Browse forums and review sites for comprehensive feedback about FXGlory from existing users.

Industry Reputation and Summary

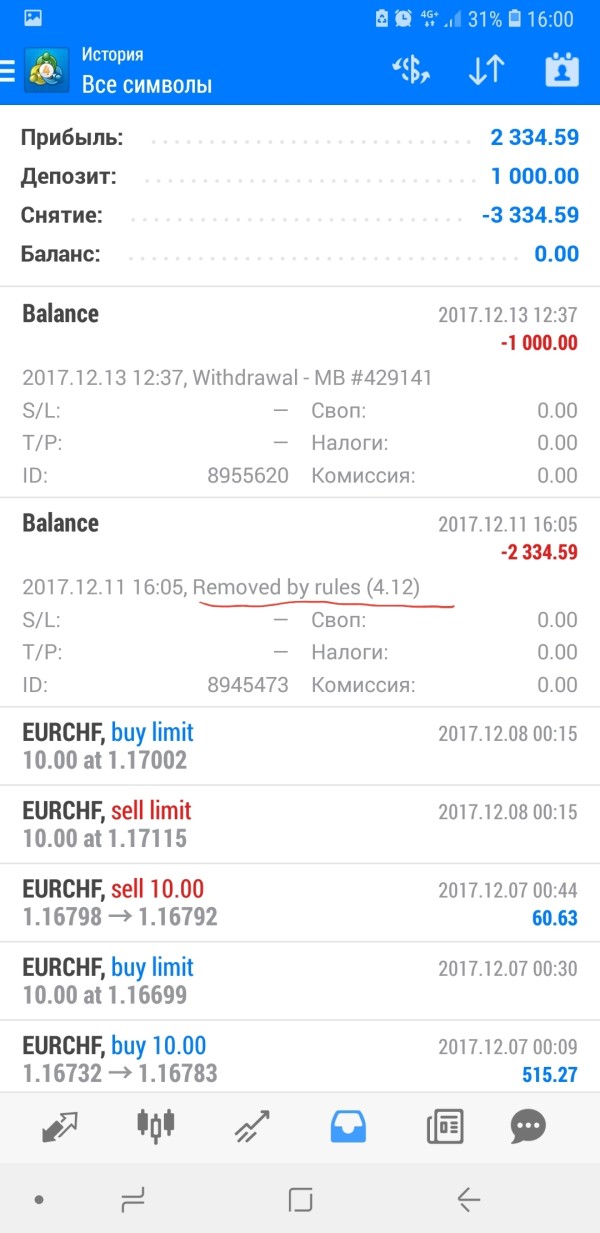

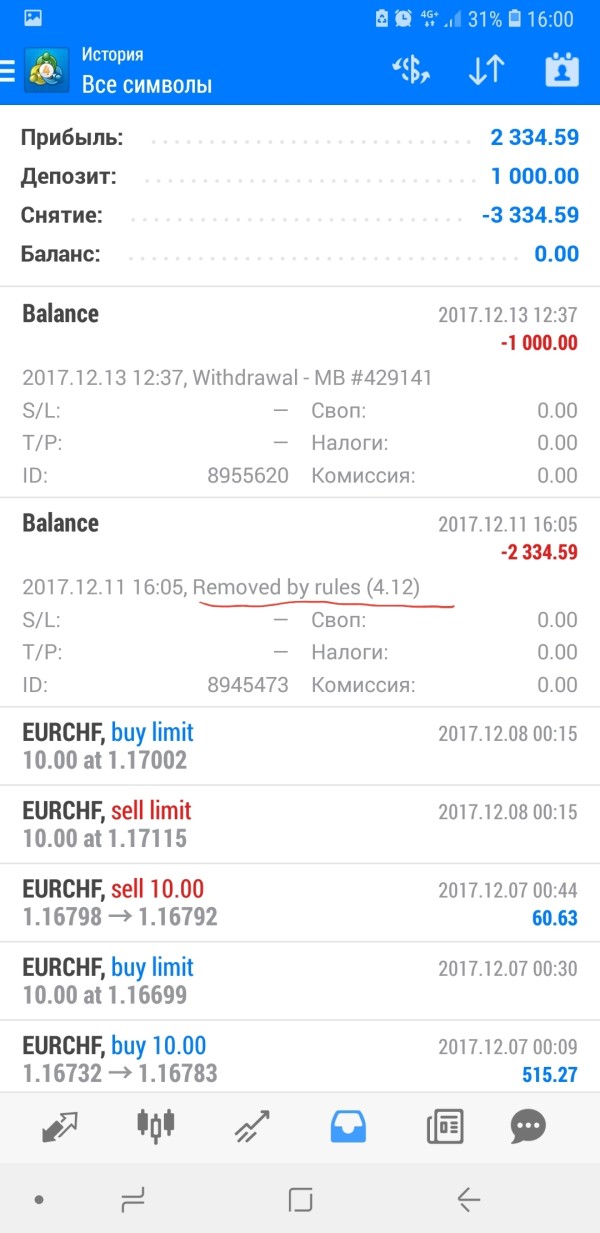

User opinions about FXGlory are starkly divided. While some traders appreciate the high leverage and low deposit requirements, many others express grave concerns regarding withdrawal issues:

"They've stolen my profit and initial deposit... I will never trade with them again." – Anonymous User

This mixed feedback underscores the importance of conducting thorough research before trading with FXGlory.

2. Trading Costs Analysis

The Double-Edged Sword Effect

Advantages in Commissions

FXGlory promotes a commission-free trading environment, which can be appealing to traders looking to minimize costs. The spreads can start from as low as 0.1 pips for higher-tier accounts, making it a competitive option within the industry.

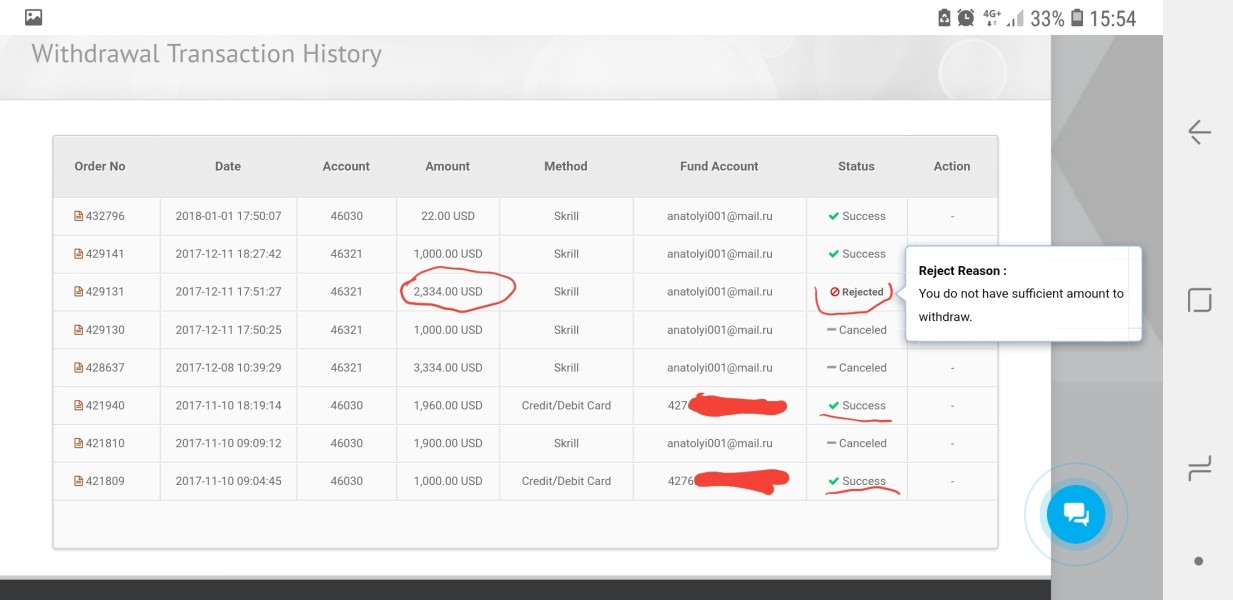

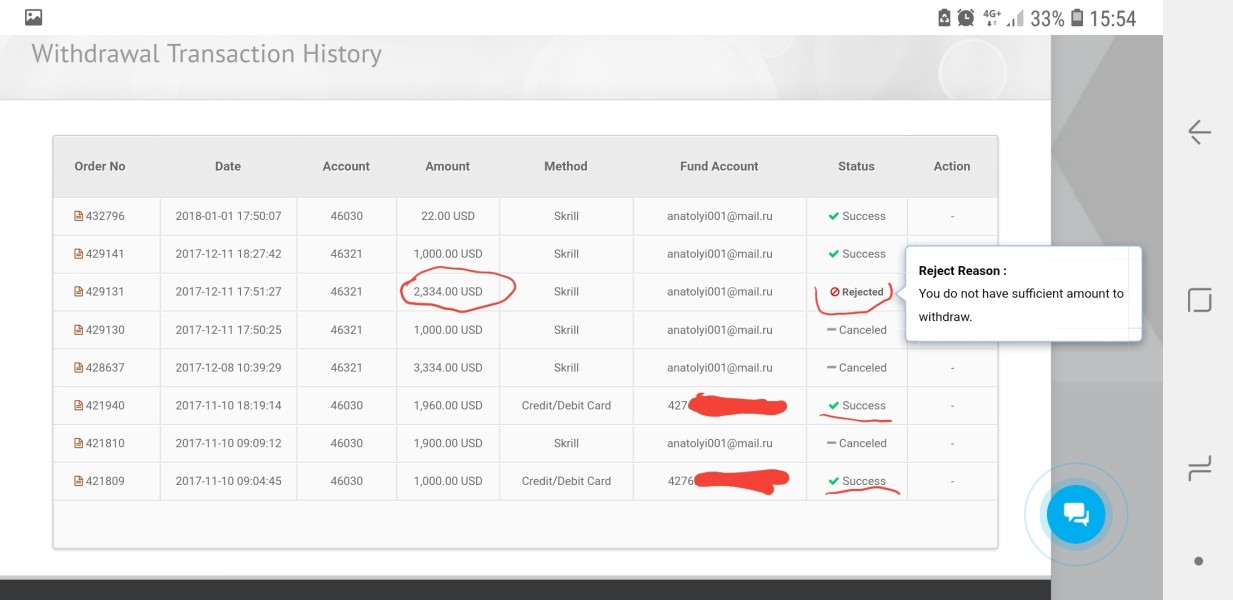

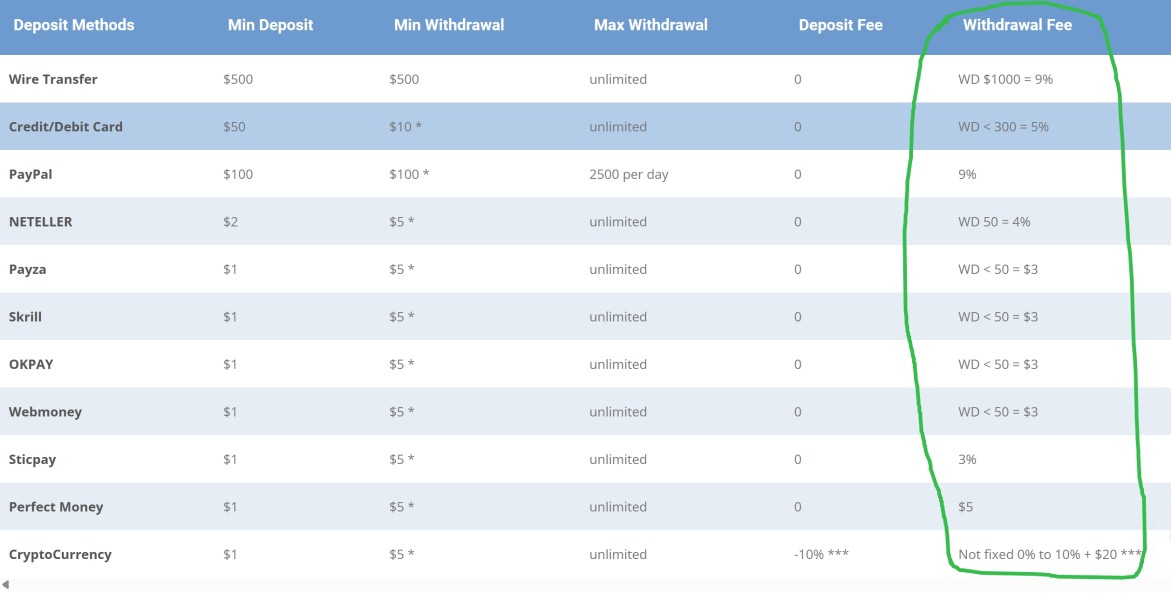

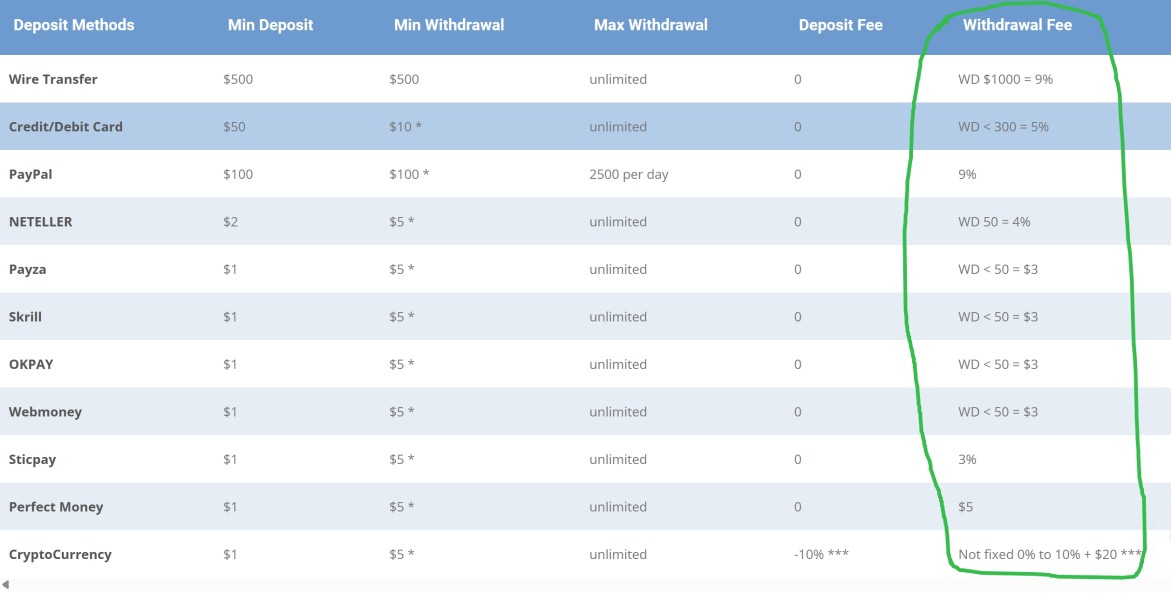

The "Traps" of Non-Trading Fees

Despite the attractive spreads, FXGlory imposes significant withdrawal fees that can range from 3% to 9% depending on the payment method, which can be a hidden cost that impacts overall profitability. Many complaints surface regarding the complex fee structure for withdrawals:

"I requested a $3100 withdrawal only to receive about $1300." – Anonymous User

This illustrates the stark contrast between the advertised benefits and the actual user experiences regarding fees.

Cost Structure Summary

The trading cost structure of FXGlory presents both advantages and disadvantages to various trader types. While commission-free trading is a major draw, the withdrawal fees can deter profit realization for some users.

Professional Depth vs. Beginner-Friendliness

FXGlory provides access to both the widely popular MT4 and its more advanced counterpart, MT5. Both platforms offer a host of features suitable for many trading strategies, but they also come with some limitations in terms of ease of access and functionality.

The platforms are lauded for their comprehensive charting tools, technical indicators, and support for automated trading via EAs. However, the educational resources are limited, which may inconvenience novice traders seeking additional insights or learning materials.

While many users appreciate the functionality of MT4 for straightforward trading, issues have been noted regarding the user experience across devices:

"The mobile app can be a bit glitchy at times; they really need to fix it." – Anonymous User

4. User Experience

Overall User Satisfaction

The combined user experiences paint a broadly mixed picture of FXGlory. While some traders value the high leverage and low entry costs, the majority raise serious concerns regarding withdrawal issues and customer service responsiveness.

Pros and Cons of User Experience

-

Pros:

User-friendly MT4 interface.

Low barriers to entry for novice traders.

Cons:

Numerous reports of withdrawal difficulties.

Limited communication from customer service during crucial periods.

5. Customer Support

Responsiveness and Effectiveness

FXGlory's customer support is available 24/5 through various channels, but many users report delayed responses and ineffective resolutions.

6. Account Conditions

Variety in Account Types

FXGlory offers various account types catering to different traders, from novices to experienced professionals. However, the lack of regulation presents inherent risks that potential clients need to consider before selecting an account.

Conclusion

FXGlory presents a compelling case for traders seeking low entry costs and high leverage in an unregulated environment. However, the alarming reports of withdrawal issues and lack of regulatory oversight raise significant concerns about fund safety. Aspiring clients should carefully evaluate their risk tolerance and perform thorough due diligence before engaging with this broker, ensuring they are fully aware of the potential pitfalls intertwined with its offerings. As is often the case in high-leverage trading, the higher the gains promised, the higher the risks involved.