Is Finexey safe?

Business

License

Is Finexey A Scam?

Introduction

Finexey is an online forex broker that positions itself as a global trading platform, offering a variety of trading instruments, including forex, cryptocurrencies, and commodities. The rise of online trading has led to an influx of brokers, making it crucial for traders to carefully evaluate any platform before investing their money. With so many options available, the risk of falling victim to scams or unregulated brokers is significant. This article aims to provide a comprehensive analysis of Finexey, assessing its legitimacy, regulatory status, trading conditions, and overall reliability. The investigation is based on a review of multiple credible sources and user feedback, structured around key evaluation criteria to determine whether Finexey is safe for traders.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its reliability and safety for traders. Finexey claims to operate from Saint Vincent and the Grenadines, a jurisdiction known for its lack of robust financial regulation. This raises concerns about the broker's accountability and the protection of client funds. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unregulated |

As noted, Finexey operates without oversight from any recognized financial authority. This lack of regulation is a significant red flag, as it means there is no independent body monitoring the broker's activities or ensuring compliance with industry standards. Many brokers in similar jurisdictions have been flagged for fraudulent activities, making it imperative for potential clients to approach with caution. The absence of a regulatory framework also implies that traders have limited recourse in the event of disputes or fund mismanagement, which leads to the conclusion that Finexey is not safe for traders seeking a secure trading environment.

Company Background Investigation

Finexey's history and ownership structure play a crucial role in assessing its legitimacy. The broker claims to have been established in 2012, yet detailed information about its founders, corporate structure, and operational history is scarce. This lack of transparency can be concerning for potential investors. The management teams qualifications and experience are also critical in evaluating the broker's credibility.

While some sources suggest that Finexey has a dedicated support team and offers assistance to traders, the absence of publicly available information about the management raises questions about their expertise and commitment to ethical trading practices. Moreover, the company's website does not provide adequate disclosures regarding its ownership or operational practices, further contributing to the uncertainty surrounding its legitimacy. In light of these factors, it is prudent to conclude that Finexey may not be a safe broker for those looking for transparency and trustworthiness in their trading partnerships.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Finexey presents itself as a competitive broker with a variety of account types and trading instruments. However, a closer examination reveals some concerning features in its fee structure and trading conditions.

The following table compares core trading costs associated with Finexey against industry averages:

| Fee Type | Finexey | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High (varies) | Moderate |

While Finexey does not charge commissions, the spreads on major currency pairs are higher than the industry average, which could erode potential profits for traders. Additionally, the broker imposes various fees, including withdrawal fees and inactivity fees, which can be excessive compared to more reputable brokers. Such hidden costs can significantly impact trading profitability and suggest that Finexey may not be a safe choice for cost-conscious traders.

Client Fund Security

The security of client funds is a critical aspect of any trading platform. Finexey claims to implement various measures to protect client funds; however, the lack of regulation raises serious concerns about its practices. The broker does not provide clear information about fund segregation, investor protection schemes, or negative balance protection policies.

The absence of these safeguards means that traders' funds may not be adequately protected in the event of financial difficulties or operational failures within the brokerage. Furthermore, there have been reports of clients facing difficulties in withdrawing their funds, which is a common issue among unregulated brokers. Given these considerations, it is evident that Finexey lacks the necessary security measures to ensure the safety of client funds, making it a risky option for traders.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall experience with a broker. Reviews of Finexey indicate a mixed bag of experiences, with some users reporting satisfactory interactions, while others have raised serious complaints about fund withdrawals and customer support responsiveness.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Unclear |

| Poor Customer Support | High | Inconsistent |

Many users have reported challenges in withdrawing their funds, with some claiming that their requests were denied or delayed without proper explanation. The lack of transparency regarding fees and withdrawal processes has also led to frustration among clients. These recurring complaints suggest that Finexey may not be a reliable broker, particularly for traders who prioritize timely access to their funds.

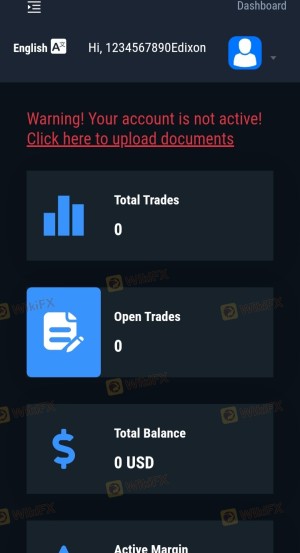

Platform and Trade Execution

The trading platform provided by a broker significantly impacts the user experience and overall trading performance. Finexey offers a web-based trading platform that lacks the advanced features commonly found in industry-standard platforms like MetaTrader 4 or 5. This limitation can hinder traders' ability to execute strategies effectively.

Additionally, reports of slippage and order rejection have surfaced, raising concerns about the quality of trade execution. Such issues can lead to significant losses, especially for traders employing high-frequency or scalping strategies. Given these platform limitations and execution concerns, it is reasonable to conclude that Finexey may not be a safe trading environment for serious traders.

Risk Assessment

Using Finexey comes with inherent risks that potential traders should be aware of. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Lack of transparency and high fees. |

| Operational Risk | Medium | Platform issues and withdrawal difficulties. |

Given these risk factors, potential traders should exercise caution when considering Finexey as their broker. It is advisable to conduct thorough research and consider alternative options with better regulatory oversight and client protections.

Conclusion and Recommendations

In conclusion, the analysis of Finexey raises significant concerns regarding its legitimacy and safety for traders. The lack of regulation, transparency issues, high fees, and negative customer feedback strongly indicate that Finexey may not be a safe broker. Traders should be particularly wary of the potential risks associated with this platform.

For those seeking reliable trading options, it is recommended to consider brokers that are regulated by reputable authorities and offer transparent fee structures, robust customer support, and proven track records of client satisfaction. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may provide a more secure trading environment. Always prioritize safety and due diligence when selecting a broker to ensure a positive trading experience.

Is Finexey a scam, or is it legit?

The latest exposure and evaluation content of Finexey brokers.

Finexey Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finexey latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.