Regarding the legitimacy of Orfinex forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is Orfinex safe?

Pros

Cons

Is Orfinex markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MOTIVE PRIME (PTY) LTD

Effective Date: Change Record

2023-08-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

UNIT 121512TH FLOORTHE LEONARDO2196Phone Number of Licensed Institution:

0825485515Licensed Institution Certified Documents:

Is Orfinex A Scam?

Introduction

Orfinex is a forex broker that has emerged in the trading landscape since its establishment in 2015. Operating out of Mauritius, it positions itself as a platform offering a wide array of trading instruments, including forex, commodities, indices, and cryptocurrencies. Given the complexities and risks associated with forex trading, it is imperative for traders to conduct thorough due diligence before engaging with any broker. This article aims to provide an objective evaluation of Orfinex, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety.

To assess the credibility of Orfinex, this investigation employs a multifaceted approach, utilizing data from various online sources, user reviews, and regulatory information. The evaluation framework includes an analysis of regulatory compliance, company history, trading costs, customer feedback, and risk factors associated with trading on this platform.

Regulation and Legitimacy

The regulatory landscape is crucial for determining the legitimacy of a forex broker. A well-regulated broker is generally considered safer for investors, as regulatory bodies impose standards that protect traders. Orfinex claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States, which oversees money services businesses, and by the Financial Services Commission (FSC) in Mauritius. However, the effectiveness of these regulations can vary significantly.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | N/A | United States | Active |

| FSC | N/A | Mauritius | Active |

While the presence of regulation is a positive sign, the quality of oversight and historical compliance is equally important. Reports indicate that Orfinex has faced scrutiny regarding its regulatory claims, with some sources labeling it as an "unregulated offshore broker." This raises concerns about the actual level of investor protection available to traders using this platform. Furthermore, the lack of transparency regarding its regulatory status and any disciplinary actions taken against it is troubling.

Company Background Investigation

Orfinex was founded in 2015 and is registered in Mauritius. The company claims to offer a transparent trading environment, yet there are questions surrounding its ownership structure and management team. The absence of publicly available information about key personnel raises red flags, as potential investors typically expect to know who is managing their funds.

The management team's background and professional experience are critical indicators of a broker's reliability. However, Orfinex has not disclosed sufficient information about its executives, which can lead to skepticism regarding their qualifications and the company's operational integrity. Additionally, the broker's website lacks comprehensive details about its corporate governance and financial health, which further diminishes transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders. Orfinex advertises competitive spreads and a variety of account types, with minimum deposits starting at just $1. However, a closer examination reveals that the trading cost structure may not be as favorable as it appears.

| Fee Type | Orfinex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 - 1.0 pips |

| Commission Model | None | $2 - $7 per lot |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs is reported to be around 1.0 pips, which is on par with industry averages but can be considered high compared to other brokers offering tighter spreads. Additionally, while Orfinex claims to have no commission on certain accounts, other accounts may incur commissions that could affect overall profitability.

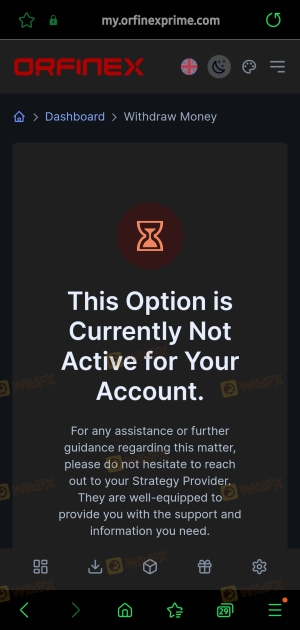

Moreover, traders should be wary of any hidden fees or unfavorable withdrawal policies that could impact their bottom line. Reports from users have highlighted concerns regarding withdrawal delays and unexpected charges, making it essential for potential clients to scrutinize the terms and conditions carefully.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Orfinex claims to implement measures such as segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable given the broker's regulatory status.

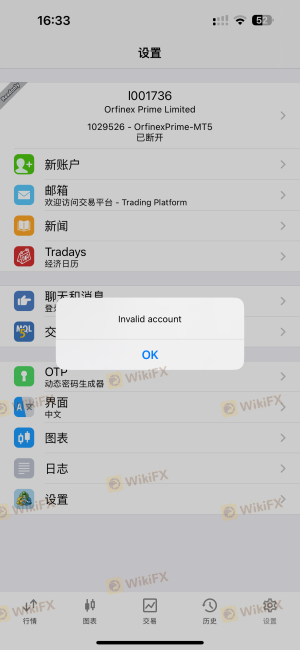

Orfinex's commitment to fund safety is under scrutiny, as there have been instances where users reported difficulties in withdrawing their funds. The lack of clear information about how customer funds are protected, especially in the event of insolvency, is a significant concern.

Additionally, reports of past disputes regarding fund withdrawals raise alarm bells about the reliability of Orfinex's security measures. Without a robust safety net for customer funds, traders may find themselves at risk of losing their investments without recourse.

Customer Experience and Complaints

Customer feedback is a critical aspect of evaluating a broker's reliability. Orfinex has garnered mixed reviews online, with some users praising its user-friendly platform while others report significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Suspension | Medium | Unresolved |

| Customer Service Quality | Medium | Inconsistent |

Common complaints include difficulties in withdrawing funds, account suspensions, and inadequate customer service. For example, one user reported that after depositing $5,000, they were unable to withdraw their funds and faced unresponsive customer service. Such experiences highlight the importance of evaluating a broker's customer support and responsiveness.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's experience. Orfinex utilizes the MetaTrader 5 (MT5) platform, which is widely regarded for its advanced features and user-friendly interface. However, the platform's reliability and execution quality are critical factors that need examination.

Traders have reported mixed experiences regarding order execution, including instances of slippage and rejected orders. These issues can adversely affect trading outcomes, especially for those employing strategies that rely on precise execution.

Moreover, any signs of platform manipulation or technical glitches could indicate deeper issues within the broker's operational framework. Traders should remain vigilant and consider these factors when assessing the overall quality of the trading environment.

Risk Assessment

Using Orfinex comes with several risks that potential traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unclear regulatory status and oversight |

| Fund Security | High | Reports of withdrawal issues and fund safety |

| Customer Support | Medium | Inconsistent response times and effectiveness |

| Trading Conditions | Medium | Potentially hidden fees and high spreads |

To mitigate these risks, traders should approach Orfinex with caution. Conducting thorough research, utilizing demo accounts, and starting with minimal investments can help manage exposure while evaluating the broker's performance.

Conclusion and Recommendations

In conclusion, the evidence suggests that Orfinex exhibits several characteristics that warrant caution. While it claims to be a regulated broker, the lack of transparency regarding its regulatory status, combined with numerous complaints about fund withdrawals and customer service, raises significant concerns.

Traders are advised to be wary of engaging with Orfinex without further investigation. If you choose to proceed, consider starting with a small amount and ensuring that you understand all fees and withdrawal policies.

For those seeking a more reliable trading experience, consider exploring alternative brokers that are well-regulated by reputable authorities, offer transparent fee structures, and have a proven track record of positive customer experiences.

Is Orfinex a scam, or is it legit?

The latest exposure and evaluation content of Orfinex brokers.

Orfinex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Orfinex latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.