Golden Rain 2025 Review: Everything You Need to Know

Executive Summary

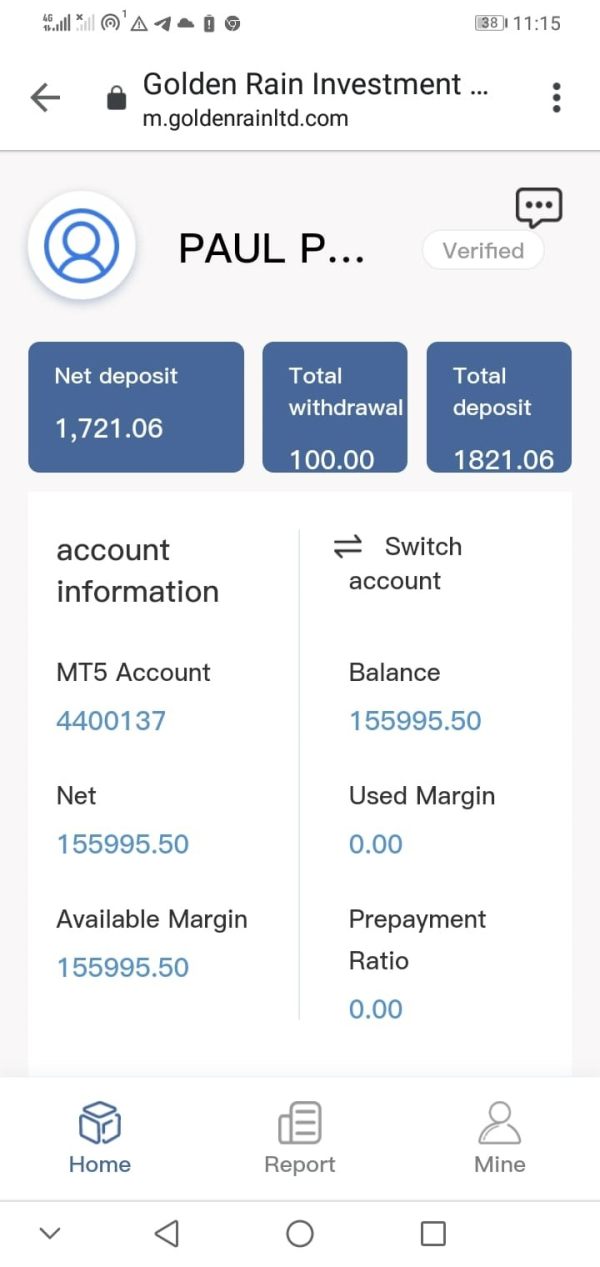

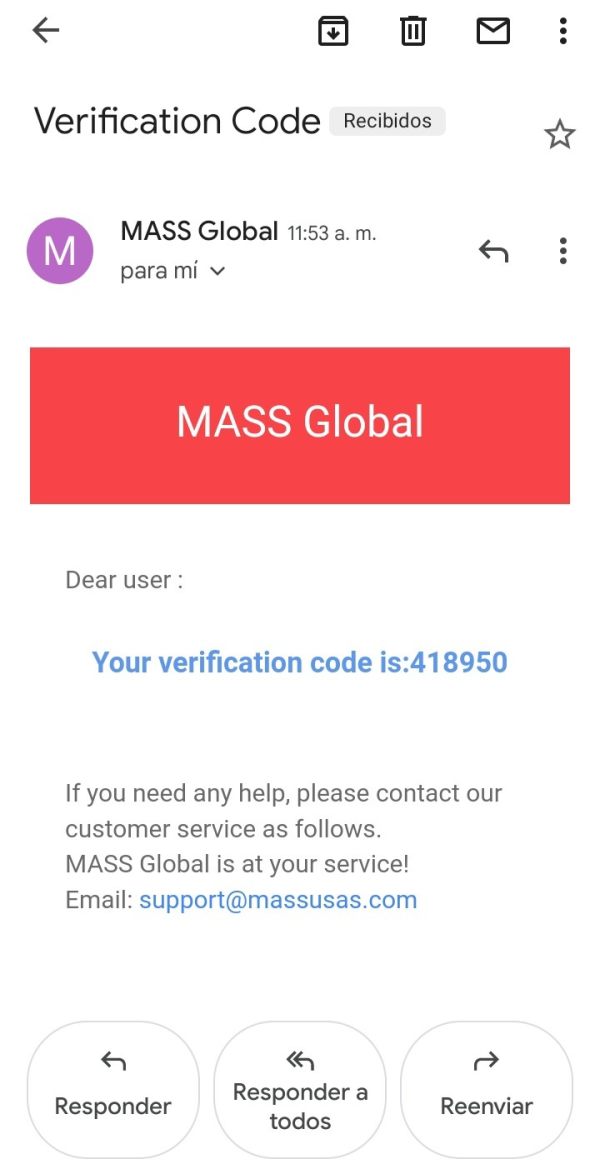

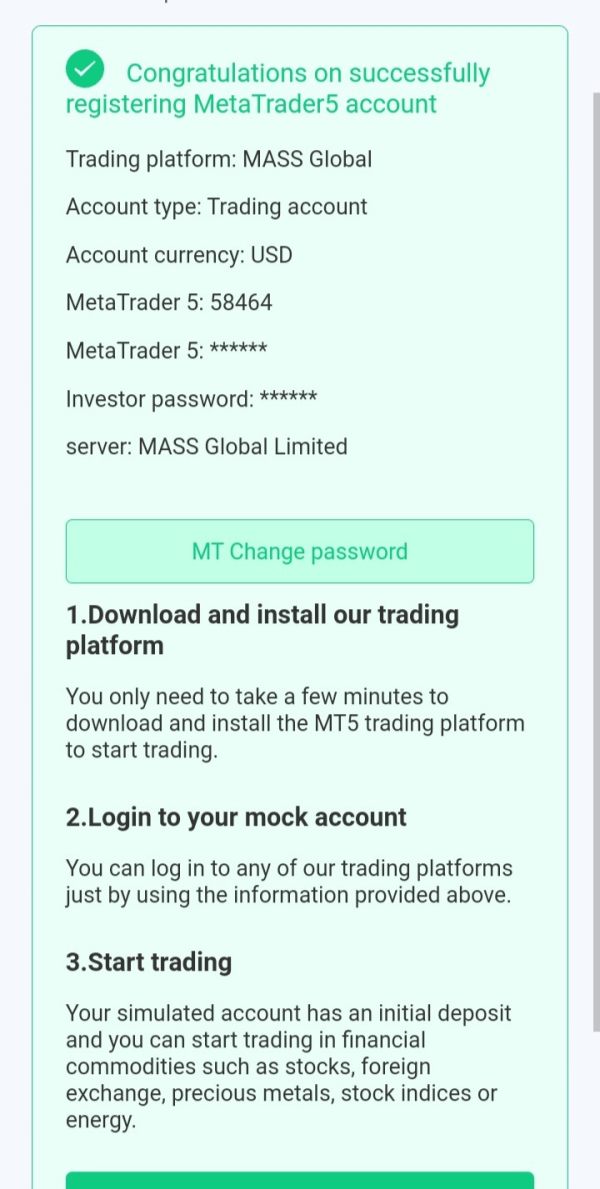

Golden Rain started in 2021. It presents itself as a forex broker that offers trading services through MetaTrader platforms and automated trading solutions. However, this golden rain review reveals serious concerns about the company's regulatory status and overall credibility.

Golden Rain's Australian Securities and Investments Commission license has been revoked. This greatly impacts its trustworthiness as a financial services provider.

The broker focuses mainly on forex trading. It offers Forex Expert Advisor software for automated trading strategies. While these features may appeal to traders seeking algorithmic trading solutions, the regulatory issues raise serious questions about the platform's reliability and safety for retail investors.

Golden Rain targets traders interested in automated forex trading systems. The company especially focuses on those looking to use expert advisors and algorithmic strategies. However, the revoked license creates substantial uncertainty about the broker's current operational status and regulatory compliance across different jurisdictions.

Important Disclaimers

Regional Entity Differences: Golden Rain's regulatory status varies significantly across different regions. While the company previously held authorization, this license has been revoked, affecting its legitimacy in Australia and potentially other jurisdictions.

Traders must verify the current regulatory status in their specific region before engaging with this broker.

Review Methodology: This evaluation is based on publicly available information, user feedback, and regulatory records available as of 2023. The assessment has not been independently verified through direct testing of the platform's services.

Given the limited transparency and regulatory concerns, prospective users should exercise extreme caution and conduct additional due diligence.

Overall Rating Framework

Broker Overview

Golden Rain emerged in the forex trading landscape in 2021. The company positioned itself as a technology-focused broker specializing in automated trading solutions. Based in the United Kingdom, the company initially sought to differentiate itself by offering sophisticated algorithmic trading tools alongside traditional forex trading services.

The broker's business model centers on providing MetaTrader platform access combined with proprietary Expert Advisor software designed to facilitate automated trading strategies.

The company's approach targets traders who prefer systematic, algorithm-driven trading over manual market analysis. This focus on automation reflects broader industry trends toward technological solutions in forex trading. However, Golden Rain's relatively recent establishment means it lacks the track record and market presence of more established brokers in the competitive forex industry.

Golden Rain operates primarily in the forex market. The company offers currency pair trading through the widely recognized MetaTrader platform. The broker's emphasis on Expert Advisor integration suggests a commitment to serving traders who utilize automated trading systems and algorithmic strategies.

Previously regulated by the Australian Securities and Investments Commission, the broker's current regulatory standing has become questionable following the revocation of its license. This makes this golden rain review particularly relevant for potential users seeking current information.

Regulatory Status: Golden Rain previously operated under Australian Securities and Investments Commission regulation. This initially provided some level of regulatory oversight. However, the revocation of this license represents a significant red flag for potential clients.

The specific reasons for license revocation and current regulatory status remain unclear from available public information.

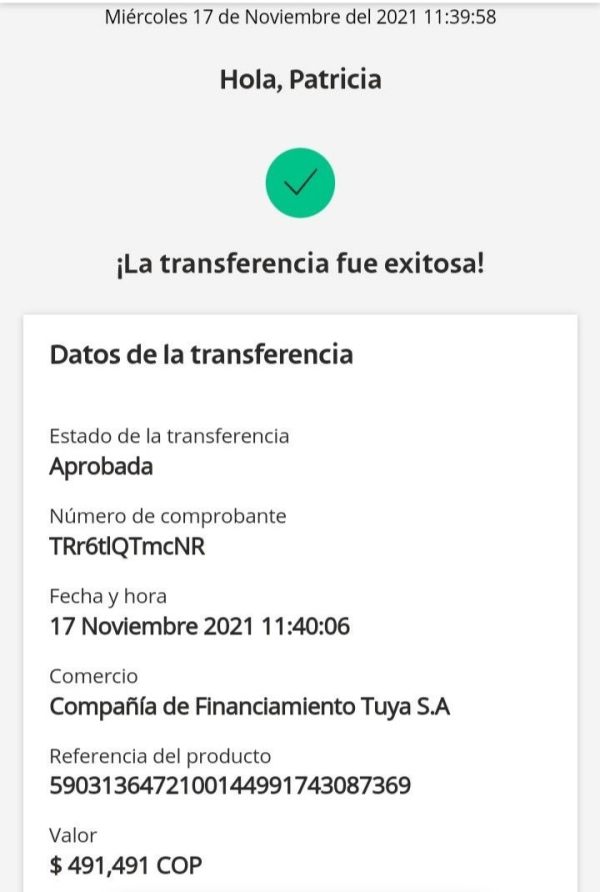

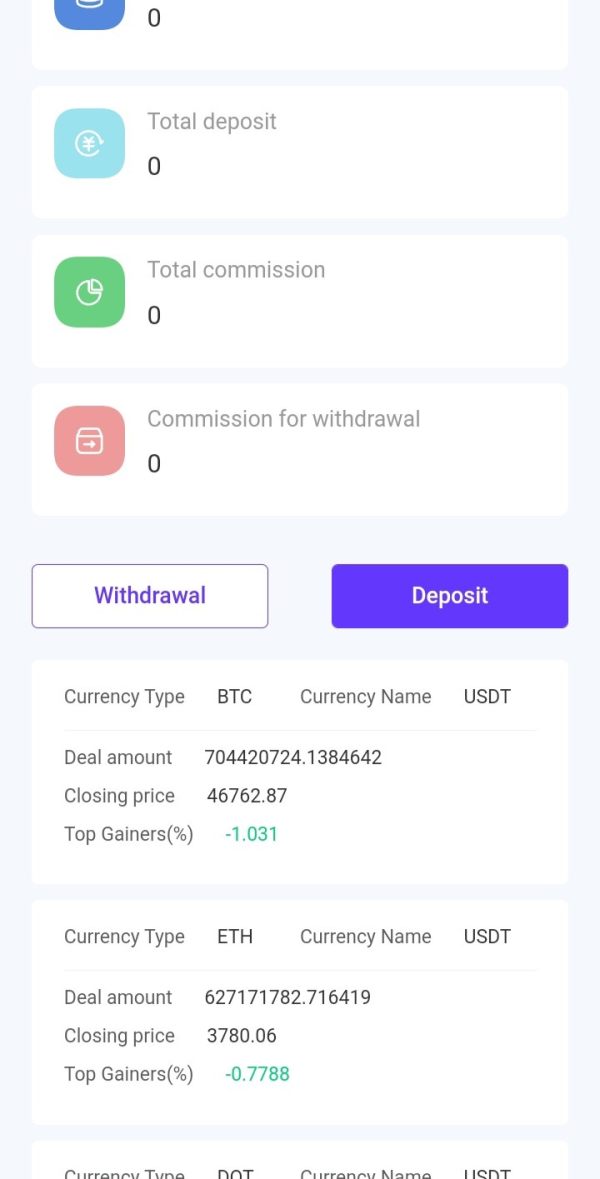

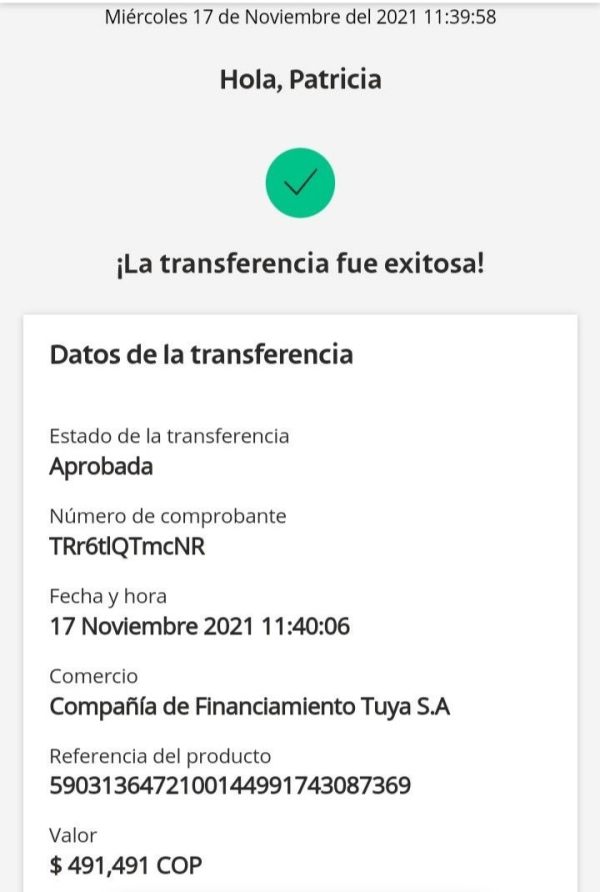

Deposit and Withdrawal Methods: Available documentation does not provide detailed information about supported payment methods, processing times, or associated fees. This lack of transparency regarding financial transactions raises concerns about operational clarity and customer service standards.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials. This makes it difficult for potential traders to assess accessibility and entry barriers.

Promotional Offers: No information regarding bonus structures, promotional campaigns, or incentive programs is available in current documentation.

Tradeable Assets: The broker focuses primarily on forex trading. However, the specific range of currency pairs and potential additional asset classes remains unspecified in available resources.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in accessible materials. This creates uncertainty about the true cost of trading with this golden rain review subject.

Leverage Ratios: Specific leverage offerings and maximum ratios available to different trader categories are not specified in current documentation.

Platform Options: MetaTrader platform is confirmed as the primary trading interface. However, specific versions and customization options remain unclear.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in current documentation.

Customer Support Languages: Available support languages and communication channels are not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Golden Rain present significant transparency issues that substantially impact the overall trading experience. Available information fails to specify the different account types available, their respective features, or the minimum deposit requirements for each tier.

This lack of clarity makes it extremely difficult for potential traders to make informed decisions about which account structure might suit their trading needs and financial capabilities.

The absence of detailed information about account opening procedures, required documentation, and verification timelines further complicates the user experience. Professional traders typically require clear understanding of account specifications, including margin requirements, position sizing limitations, and any restrictions on trading strategies or Expert Advisor usage.

Additionally, no information is available regarding specialized account features such as accounts for traders requiring specific trading conditions, VIP accounts with enhanced benefits, or demo accounts for strategy testing. This golden rain review finds the lack of account transparency particularly concerning given the broker's focus on algorithmic trading, where specific account conditions can significantly impact strategy performance.

The regulatory uncertainty following the license revocation adds another layer of concern regarding account safety and fund protection measures.

Golden Rain's tool offerings center around MetaTrader platform integration and Forex Expert Advisor software. This represents a reasonable foundation for automated trading strategies. The availability of Expert Advisor functionality appeals to traders seeking to implement algorithmic trading systems without developing custom software solutions.

However, the specific capabilities, customization options, and performance metrics of these tools remain unclear from available documentation.

The broker's focus on automated trading tools suggests an understanding of modern trading preferences, particularly among technically sophisticated traders. MetaTrader's widespread industry acceptance provides familiar functionality for most forex traders, including charting tools, technical indicators, and order management systems.

However, the absence of additional educational resources, market analysis tools, economic calendars, or research materials significantly limits the comprehensive trading support typically expected from professional brokers. Advanced traders often require access to market sentiment indicators, volatility analysis tools, and fundamental research to complement their automated strategies.

The lack of information about mobile trading applications, web-based platforms, or API access for custom integrations further restricts the technological ecosystem available to users.

Customer Service Analysis (5/10)

Customer service evaluation proves challenging due to limited available information about support channels, response times, and service quality standards. While approximately 110 user reviews exist, the specific content and overall sentiment of these reviews are not detailed in accessible documentation, making it difficult to assess actual service experiences.

The absence of clear information about available support channels creates uncertainty about accessibility when traders encounter issues or require assistance.

Professional forex trading often requires immediate support for technical problems, account issues, or trading-related questions, making responsive customer service essential. Without specified support hours, multilingual capabilities, or regional support teams, international traders cannot determine whether adequate assistance will be available during their active trading hours.

The regulatory uncertainty following license revocation may also impact the quality and continuity of customer support services.

The lack of documented escalation procedures, complaint resolution processes, or dedicated account manager availability further complicates the customer service assessment.

Trading Experience Analysis (5/10)

The trading experience evaluation centers primarily on MetaTrader platform availability, which provides a solid foundation for forex trading activities. MetaTrader's established functionality includes comprehensive charting capabilities, technical analysis tools, and order execution systems familiar to most forex traders.

The platform's support for Expert Advisors aligns with Golden Rain's automated trading focus.

However, critical trading condition details remain unspecified, including spread structures, commission rates, execution speeds, and slippage characteristics. These factors significantly impact overall trading costs and strategy performance, particularly for automated systems that may execute numerous transactions.

The absence of information about order execution quality, server stability, and platform uptime statistics makes it difficult to assess the reliability of the trading environment. Professional traders require consistent platform performance and reliable order execution to maintain effective trading strategies.

Mobile trading capabilities, advanced order types, and risk management tools availability are not detailed in current documentation. This golden rain review notes that without comprehensive trading condition transparency, traders cannot adequately evaluate whether the platform meets their specific requirements.

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most significant concerns in this evaluation, primarily due to the revoked license status. Regulatory authorization provides essential consumer protections, including segregated client funds, compensation schemes, and operational oversight.

The loss of this regulatory status fundamentally undermines the broker's credibility and safety profile.

The specific circumstances surrounding the license revocation remain unclear, preventing assessment of whether the issues were technical administrative matters or more serious compliance failures. Without current regulatory oversight, traders lack essential protections typically associated with licensed financial services providers.

Fund safety measures, client money segregation policies, and dispute resolution mechanisms are not detailed in available documentation. Professional traders require clear understanding of how their deposits are protected and what recourse exists in case of operational problems or business failure.

The broker's relatively recent establishment in 2021, combined with regulatory issues, creates additional uncertainty about long-term operational stability and business continuity. Established track records and regulatory compliance are fundamental requirements for trustworthy forex brokers.

User Experience Analysis (5/10)

User experience assessment proves challenging due to limited detailed feedback from the reported 110 user reviews. Without access to specific user testimonials, satisfaction ratings, or detailed experience descriptions, it becomes difficult to evaluate the practical aspects of using Golden Rain's services.

The overall platform accessibility, account registration process, and user interface design remain unspecified in available documentation. Modern traders expect streamlined onboarding processes, intuitive platform navigation, and responsive customer interfaces across desktop and mobile devices.

Fund management experiences, including deposit and withdrawal processes, processing times, and associated fees, are not detailed in accessible materials. These operational aspects significantly impact user satisfaction and overall trading experience quality.

The absence of information about common user complaints, platform limitations, or frequently encountered issues prevents comprehensive user experience evaluation. Educational support, onboarding assistance, and ongoing user guidance availability also remain unclear from current documentation.

Conclusion

Golden Rain presents a complex case study in forex broker evaluation, combining potentially useful automated trading tools with significant regulatory and transparency concerns. While the broker's focus on MetaTrader integration and Expert Advisor functionality may appeal to traders seeking algorithmic trading solutions, the revoked license creates substantial trust and safety concerns that overshadow potential benefits.

The extensive lack of transparency regarding trading conditions, account specifications, and operational details makes it extremely difficult for potential users to make informed decisions. Professional traders require comprehensive information about costs, conditions, and protections before committing funds to any broker.

This golden rain review concludes that the regulatory issues, combined with limited transparency, make Golden Rain unsuitable for most forex traders. The revoked license status particularly raises concerns about fund safety and operational legitimacy that cannot be overlooked regardless of the technological offerings available.

Traders seeking automated trading solutions would be better served by established, properly regulated brokers with transparent operating conditions and verified track records in the competitive forex industry.