Orfinex 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive orfinex review examines a forex and CFD broker that has been operating since 2015. The review presents a mixed picture for potential traders who want to understand this platform. Orfinex is registered in Port Louis, Mauritius, and operates under the regulation of the Mauritius Financial Services Commission with Global Business License GBC196665. While the company has been recognized as one of the best forex brokers in Asia and the Middle East regions, user feedback tells a different story that traders should know.

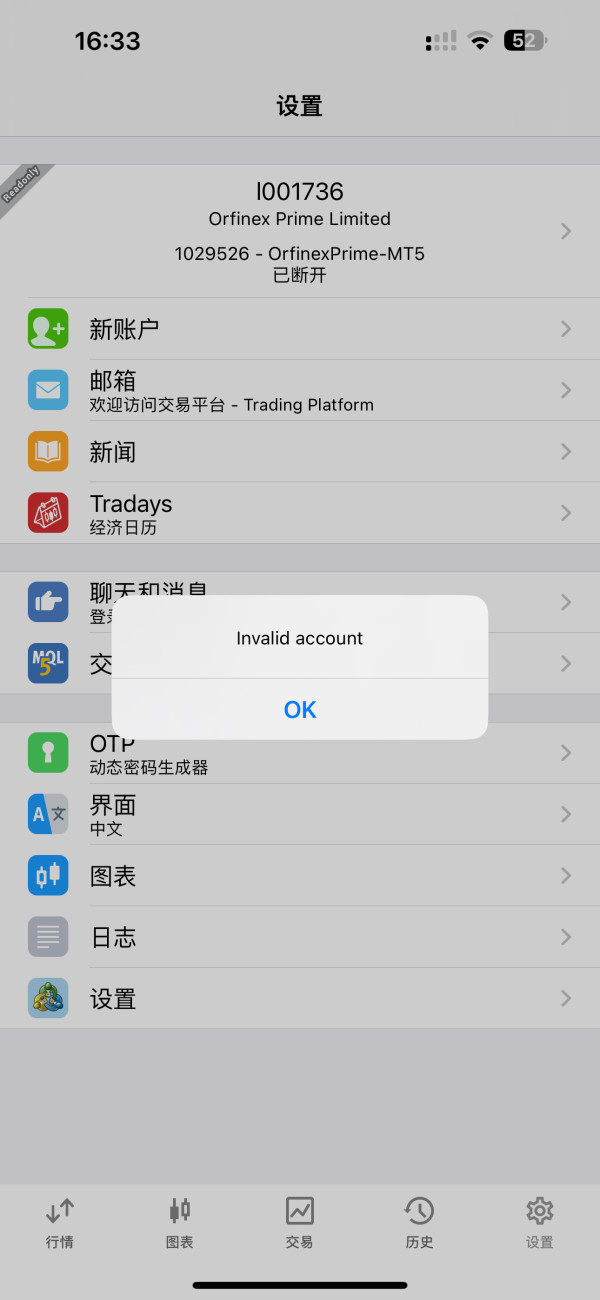

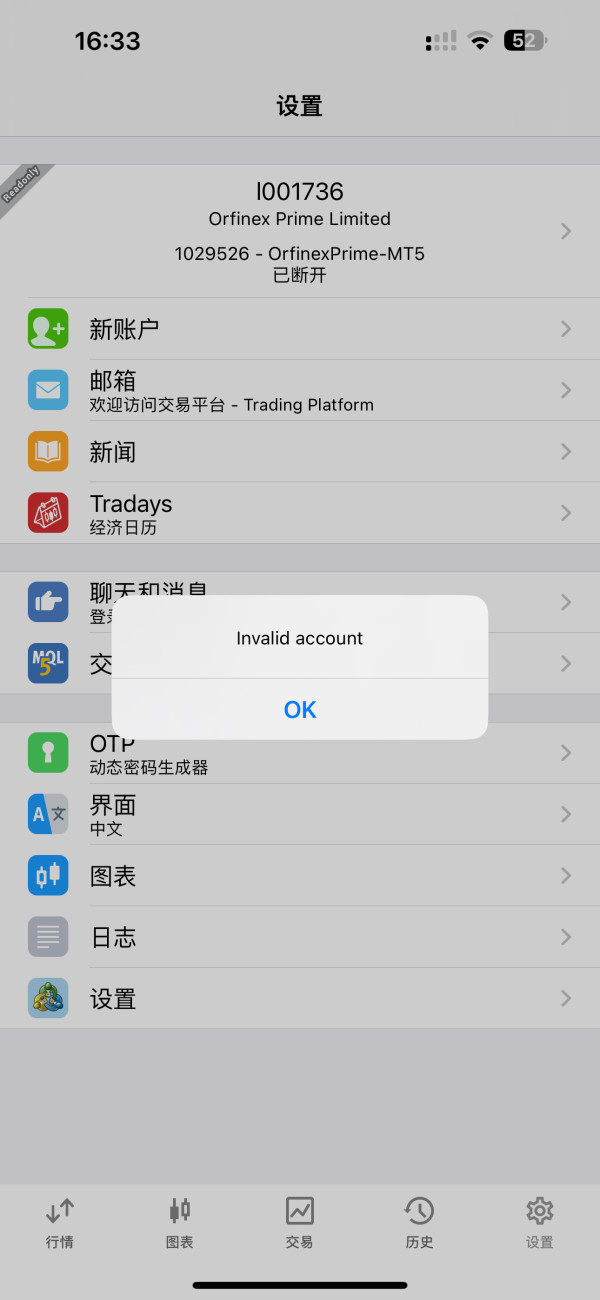

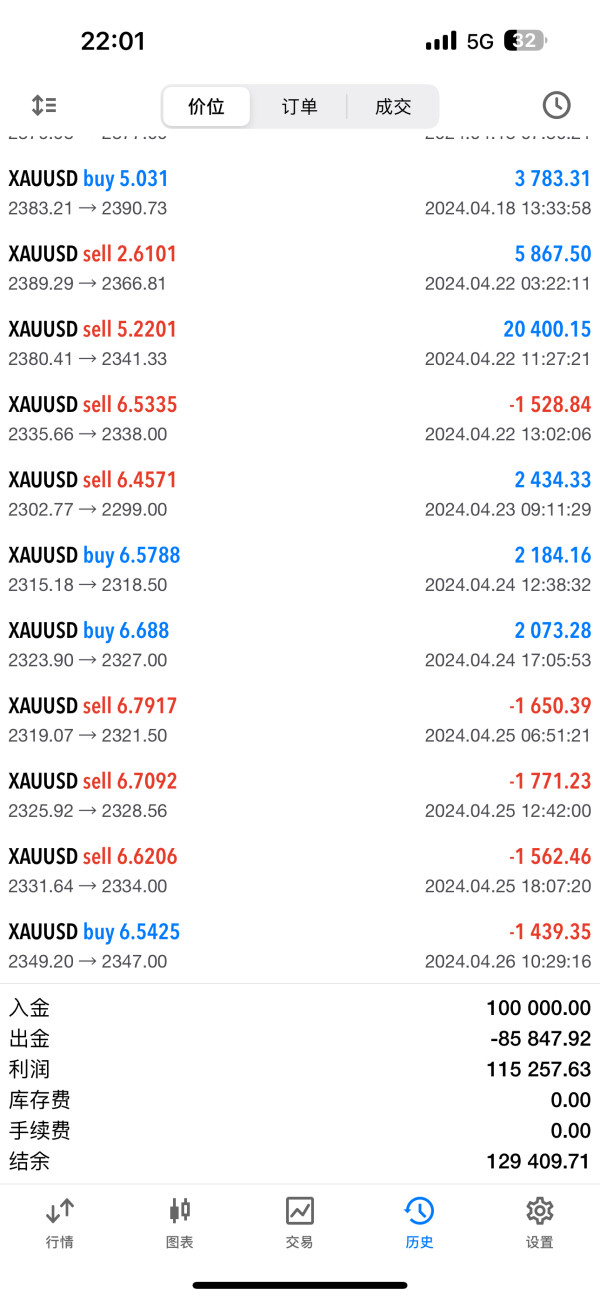

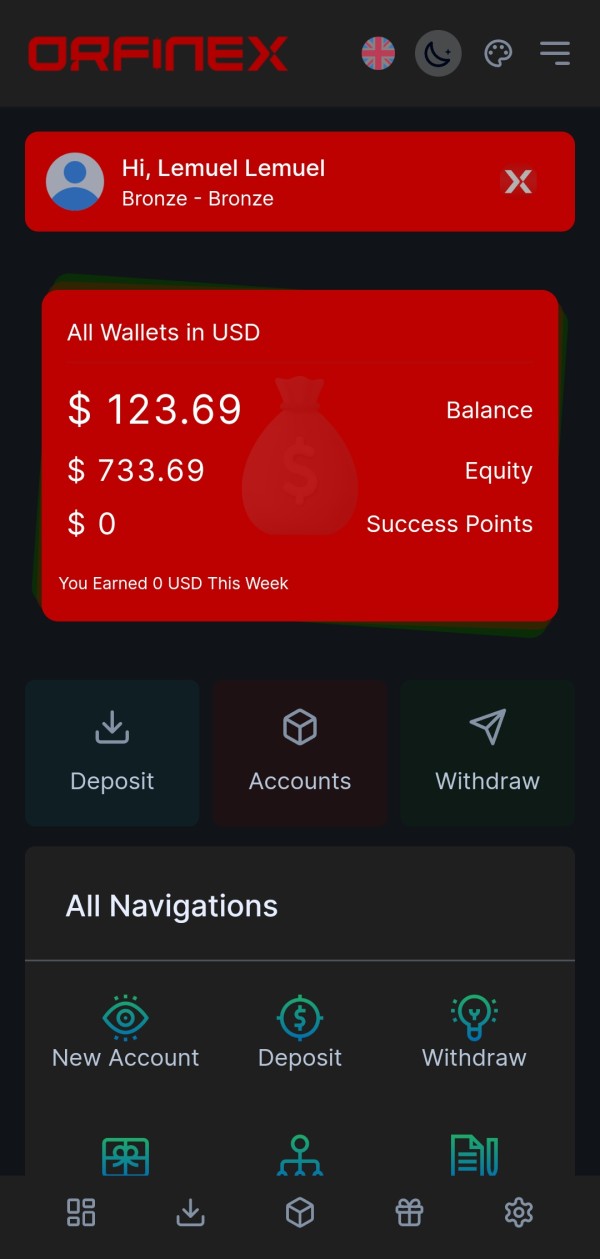

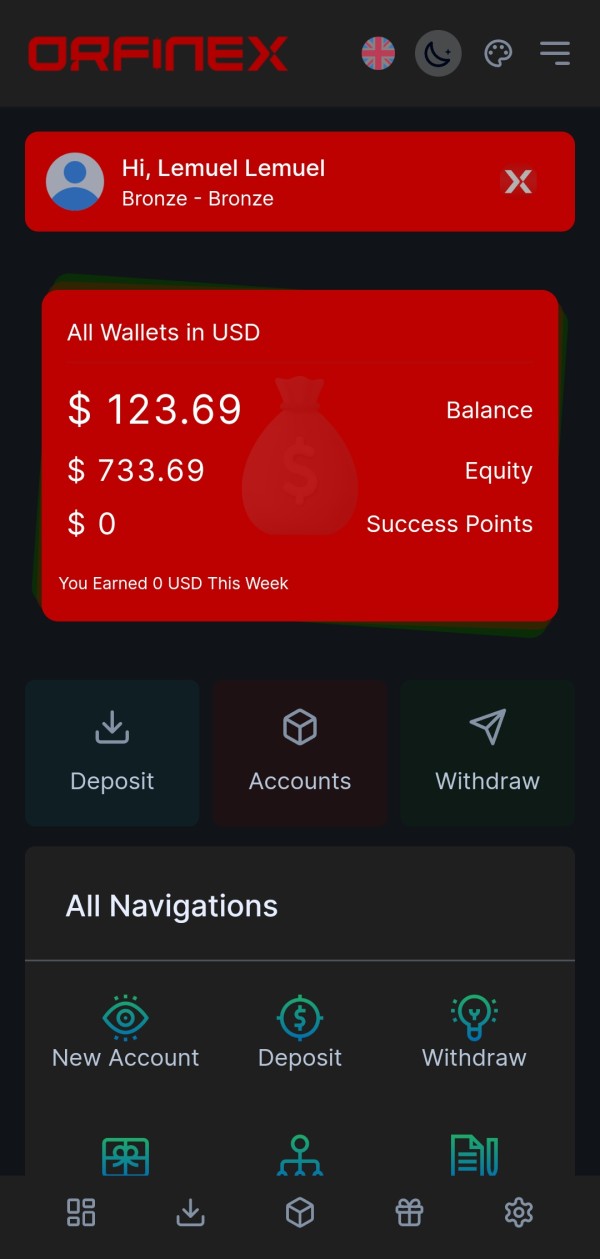

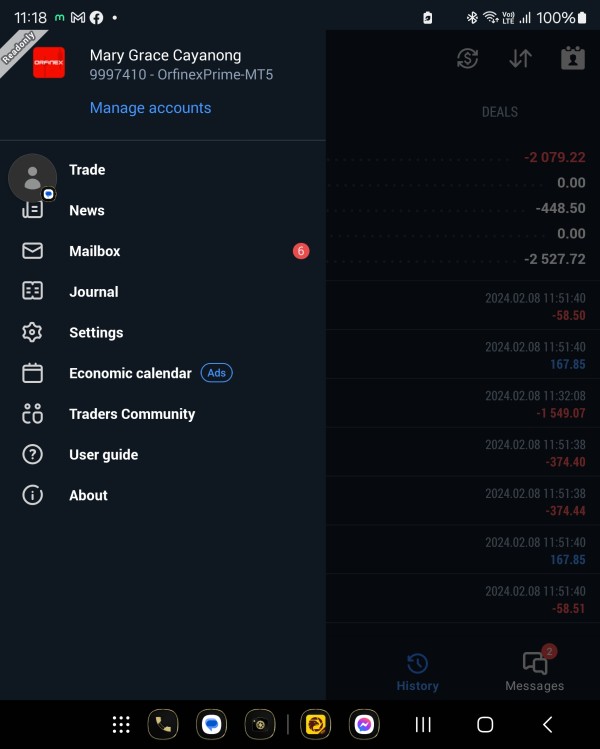

According to available user data, Orfinex maintains a concerning overall rating of 2.4 out of 5 stars across 24 reviews. Only 33% of reviewers recommend the platform to other traders. Multiple sources have raised red flags about high-risk operations and potential fraudulent activities, creating significant concerns for prospective clients who are considering this broker. The broker primarily offers forex and CFD trading through the MetaTrader 5 (MT5) platform. It targets investors seeking exposure to currency markets and contract for difference instruments.

Despite some positive feedback regarding customer support experiences, the overwhelming user sentiment suggests caution when considering this broker. The platform appears to cater mainly to traders interested in forex and CFD markets, particularly those prioritizing platform stability and customer support quality. However, current user experiences indicate these expectations may not be consistently met by the broker.

Important Disclaimers

Regional Entity Differences: Orfinex may operate different regulatory frameworks and service offerings across various jurisdictions. Potential clients should carefully verify the specific regulatory status and available services in their region before engaging with the platform. The Mauritius-based entity discussed in this review may not represent the complete global operations structure that exists worldwide.

Review Methodology: This evaluation is based on publicly available information, user feedback, and regulatory data current as of 2025. The assessment aims to provide potential users with comprehensive insights while acknowledging that individual experiences may vary significantly from aggregated data presented here.

Rating Framework

Broker Overview

Orfinex emerged in the forex trading landscape in 2015 as a Mauritius-based financial services provider. The company established its headquarters in Port Louis under the regulatory oversight of the Mauritius Financial Services Commission. The company positioned itself as a comprehensive trading solutions provider, focusing primarily on forex and contract for difference (CFD) markets. Despite operating for nearly a decade, Orfinex has maintained a relatively low profile in the global forex community, with limited marketing presence compared to major industry players who dominate the market.

The broker's business model centers on providing retail traders access to international currency markets and CFD instruments through electronic trading platforms. According to available information, Orfinex has received recognition as one of the leading forex brokers in Asia and Middle Eastern markets. However, this achievement contrasts sharply with user feedback and risk assessments from various review platforms. The company's operational focus appears to target emerging market traders seeking entry-level access to forex markets.

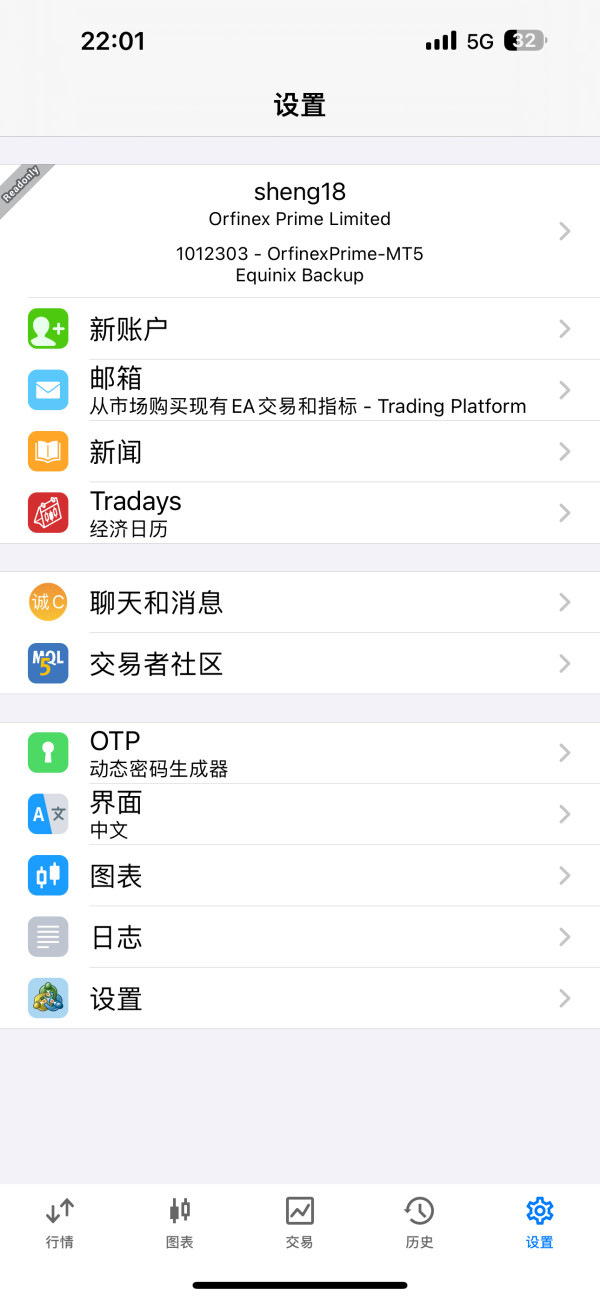

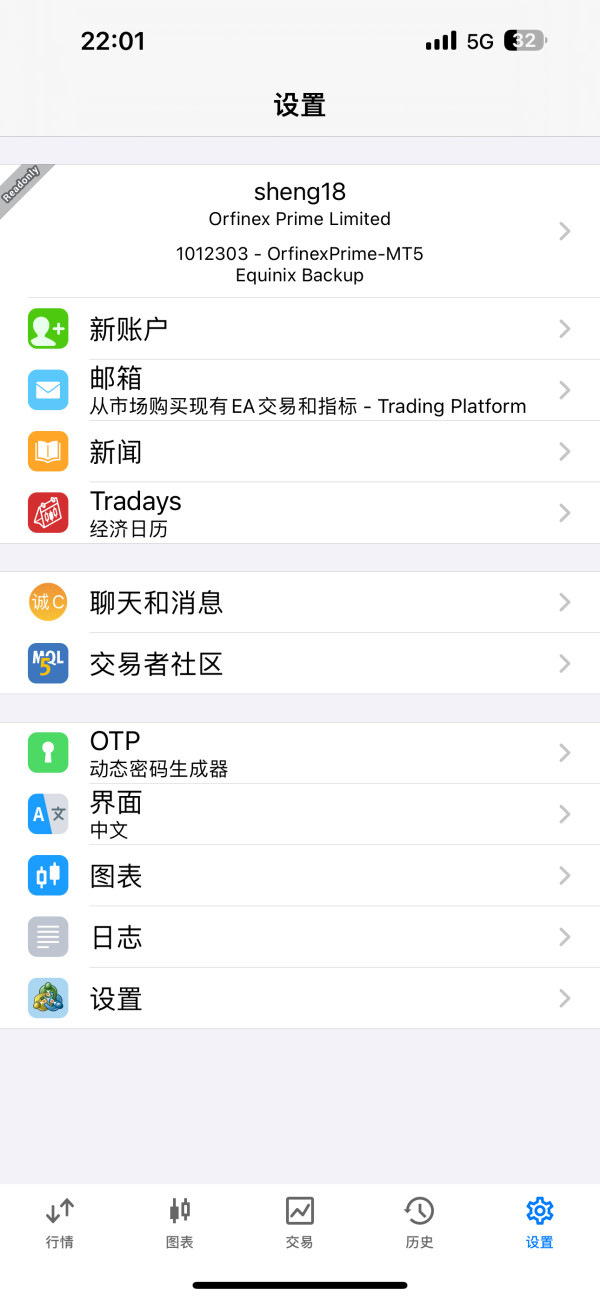

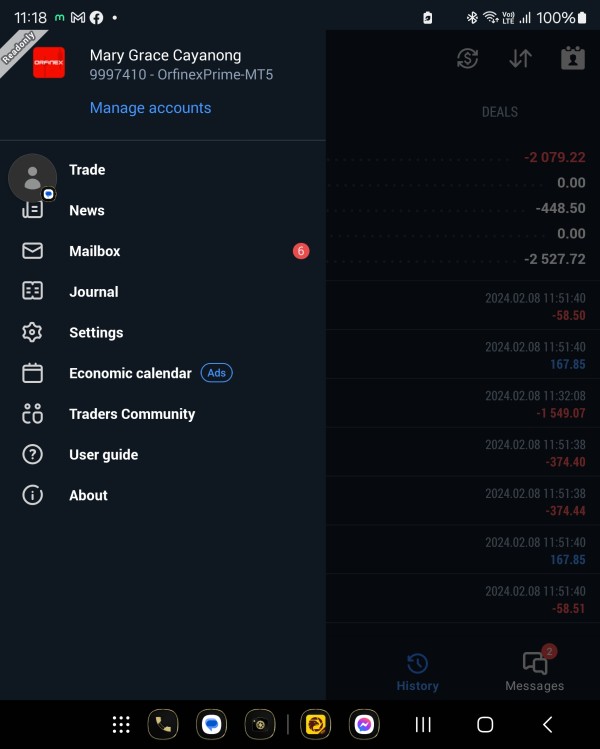

Orfinex operates exclusively through the MetaTrader 5 (MT5) trading platform. The platform offers clients access to forex pairs and CFD instruments across multiple asset classes. The broker maintains regulatory compliance through the Mauritius Financial Services Commission, holding Global Business License number GBC196665. However, specific details regarding the company's asset management, client fund segregation, and risk management protocols remain limited in publicly available documentation. This raises questions about operational transparency that potential clients should consider.

Regulatory Status: Orfinex operates under the jurisdiction of the Mauritius Financial Services Commission (FSC). The broker holds Global Business License GBC196665 for its operations. The Mauritius regulatory framework provides basic oversight for financial services companies, though it may not offer the same level of investor protection as tier-one regulatory jurisdictions such as the FCA, ASIC, or CySEC.

Trading Platform: The broker exclusively offers MetaTrader 5 (MT5) as its primary trading platform. MT5 provides advanced charting capabilities, algorithmic trading support, and comprehensive market analysis tools. This makes it suitable for both novice and experienced traders seeking sophisticated trading functionality.

Available Assets: Orfinex focuses primarily on forex trading pairs and contract for difference (CFD) instruments. The specific range of available currency pairs, commodity CFDs, index CFDs, and other tradeable instruments is not comprehensively detailed in available sources. This limits potential clients' ability to assess portfolio diversification opportunities.

Geographic Restrictions: Information regarding specific geographic restrictions, prohibited jurisdictions, and regional service limitations is not clearly outlined in available documentation. Prospective clients should verify service availability in their jurisdiction before account registration.

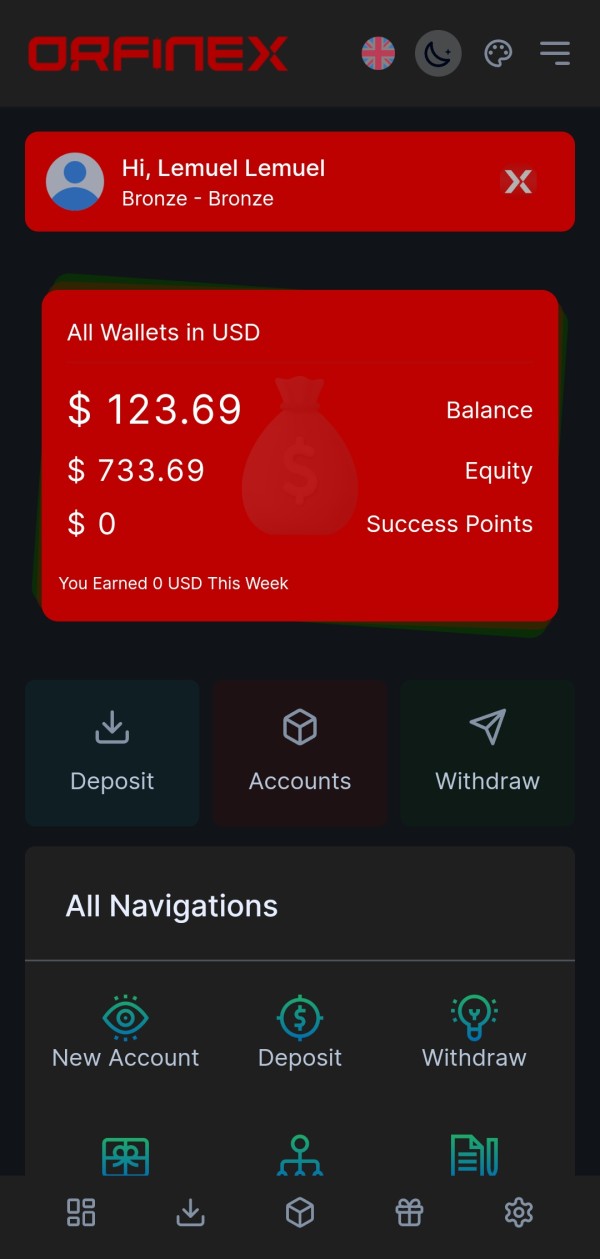

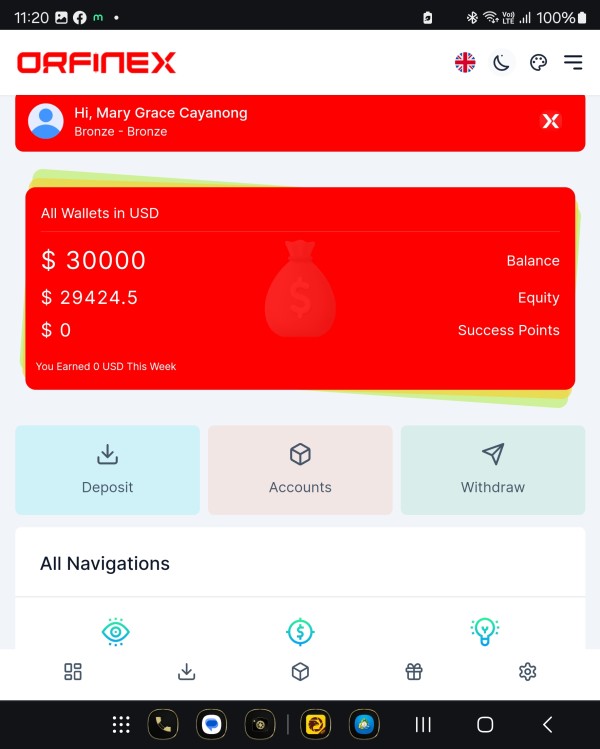

Payment Methods: Detailed information about deposit and withdrawal methods, processing times, minimum deposit requirements, and associated fees is not comprehensively covered in available sources. This lack of transparency regarding financial transactions represents a significant information gap for potential clients.

Cost Structure: Specific details about spreads, commission structures, overnight financing charges, and other trading costs are not detailed in available sources. This orfinex review cannot provide accurate cost comparisons without comprehensive fee schedules.

Account Conditions Analysis

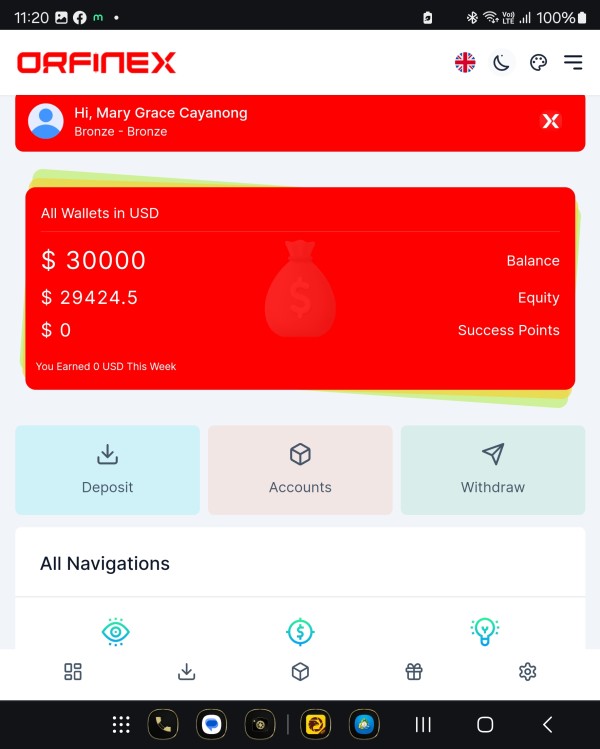

The specific account types, features, and conditions offered by Orfinex are not comprehensively detailed in available sources. This makes it challenging to provide a thorough assessment of the broker's account structure. This information gap represents a significant concern for potential clients seeking to understand minimum deposit requirements, account tiers, and associated benefits or restrictions.

Without detailed account specifications, prospective traders cannot adequately compare Orfinex's offerings against industry standards or competitor alternatives. The absence of clear account condition information may indicate limited transparency in the broker's service documentation. This could pose challenges for clients seeking to understand their trading environment fully.

The account opening process, verification requirements, and documentation standards are not specifically outlined in available sources. This lack of procedural clarity may create uncertainty for potential clients regarding onboarding timelines and compliance requirements. Additionally, special account features such as Islamic accounts, managed accounts, or institutional trading solutions are not mentioned in accessible documentation.

Given the limited information available, potential clients are advised to contact Orfinex directly to obtain comprehensive account condition details before making any commitment. The broker's ability to provide clear, detailed account information during initial inquiries may serve as an indicator of overall service transparency and customer support quality.

This orfinex review cannot provide specific recommendations regarding account suitability without access to detailed terms and conditions. This highlights the importance of thorough due diligence before account opening.

The trading tools, research resources, and educational materials offered by Orfinex are not comprehensively detailed in available sources. This creates a significant information gap for potential clients evaluating the broker's value proposition. While the broker operates on the MetaTrader 5 platform, which inherently provides advanced charting tools and technical analysis capabilities, specific proprietary tools or enhanced features are not documented.

Research and market analysis resources, including economic calendars, market commentary, daily analysis reports, and expert insights, are not mentioned in available documentation. This absence of information suggests either limited research offerings or poor communication of available resources to potential clients. Modern traders typically expect comprehensive market analysis support, making this information gap particularly concerning.

Educational resources such as trading tutorials, webinars, e-books, and training programs are not detailed in accessible sources. The lack of educational content information may indicate limited support for novice traders seeking to develop their trading skills and market knowledge. Educational resources often serve as a key differentiator among forex brokers, particularly for retail clients.

Automated trading support, including expert advisors (EAs), copy trading services, and social trading features, is not specifically addressed in available documentation. While MT5 supports algorithmic trading, any proprietary automated trading solutions or partnerships are not mentioned. The absence of information regarding trading signals, strategy development tools, or portfolio management resources further limits the assessment of Orfinex's comprehensive service offering.

Customer Service and Support Analysis

Customer service quality at Orfinex presents a mixed picture based on available user feedback. Some clients report positive experiences while others express significant concerns. According to user reviews, certain clients have described "amazing experience with Orfinex and their customer support," indicating that the broker can provide satisfactory assistance in some instances.

However, the overall customer satisfaction metrics paint a less optimistic picture, with only 33% of reviewers recommending the broker's services. This low recommendation rate suggests that positive customer service experiences may not be consistent across the client base. The 2.4 out of 5 overall rating further indicates that customer support quality may be inconsistent or insufficient for many users' needs.

Specific customer service channels, availability hours, response times, and multilingual support options are not detailed in available sources. This lack of transparency regarding support infrastructure makes it difficult for potential clients to assess whether the broker can meet their specific communication needs and time zone requirements.

The absence of detailed customer service information, combined with mixed user feedback, suggests that prospective clients should carefully evaluate support quality during initial interactions with the broker. Response times to initial inquiries, professionalism of communications, and ability to address specific questions may serve as indicators of ongoing support quality.

Given the concerns raised in various reviews about high-risk operations and potential fraudulent activities, robust customer support becomes even more critical for client confidence and issue resolution.

Trading Experience Analysis

The specific trading experience offered by Orfinex, including platform stability, execution speed, order processing quality, and overall trading environment, is not comprehensively covered in available sources. While the broker utilizes MetaTrader 5, which is generally regarded as a stable and feature-rich platform, the specific implementation and server infrastructure quality remain unclear.

Order execution quality, including slippage rates, requote frequency, and execution speeds, are not detailed in available documentation. These technical performance metrics are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods. The absence of execution statistics makes it challenging to assess the broker's suitability for different trading styles.

Platform stability and uptime records are not mentioned in accessible sources, creating uncertainty about system reliability during critical trading periods. Server locations, redundancy measures, and technical infrastructure investments are not documented. This limits the ability to assess platform performance expectations.

Mobile trading experience, including app functionality, feature completeness, and user interface quality, is not specifically addressed in available sources. Modern traders increasingly rely on mobile platforms for market monitoring and trade execution, making this information gap particularly relevant.

The overall trading environment, including market depth, liquidity access, and institutional connectivity, remains unclear based on available documentation. This orfinex review cannot provide specific trading experience assessments without access to detailed performance data and user experience metrics.

Trust and Safety Analysis

Trust and safety concerns represent the most significant issues identified in this evaluation of Orfinex. Multiple sources raise red flags about the broker's operations. According to TraderKnows, Orfinex has been classified as "high risk (Suspected Fraud)," representing a serious warning for potential clients considering the platform. This classification suggests that independent risk assessment organizations have identified concerning patterns or practices requiring heightened caution.

The broker's regulatory status under the Mauritius Financial Services Commission provides basic oversight, though Mauritius is not considered a tier-one regulatory jurisdiction. The Global Business License GBC196665 offers some regulatory framework. However, it may not provide the same level of investor protection available through more stringent regulatory bodies such as the FCA, ASIC, or CySEC.

Client fund protection measures, including segregated accounts, deposit insurance, and compensation schemes, are not detailed in available sources. This lack of transparency regarding fund safety protocols raises additional concerns about client asset protection in case of operational difficulties or regulatory issues.

The company's operational transparency appears limited, with minimal publicly available information about management structure, financial statements, or business operations beyond basic trading services. This opacity contrasts with industry best practices where reputable brokers typically provide comprehensive company information and regulatory compliance details.

Despite recognition as one of the best forex brokers in Asia and Middle Eastern regions, the concerning user feedback and risk warnings suggest that potential clients should exercise extreme caution. Thorough due diligence should be conducted before engaging with Orfinex.

User Experience Analysis

User experience at Orfinex, based on available feedback data, indicates significant room for improvement across multiple service dimensions. The overall user rating of 2.4 out of 5 stars across 24 reviews represents below-average satisfaction levels. This suggests that many clients encounter issues that negatively impact their trading experience.

With only 33% of reviewers recommending Orfinex to other traders, the platform appears to struggle with client retention and satisfaction. This low recommendation rate is particularly concerning in the competitive forex industry, where satisfied clients typically serve as valuable referral sources for broker growth.

The user interface design, registration process efficiency, and account verification procedures are not specifically detailed in available sources. This limits the ability to assess onboarding experience quality. Smooth account opening and verification processes are crucial for positive first impressions and client satisfaction.

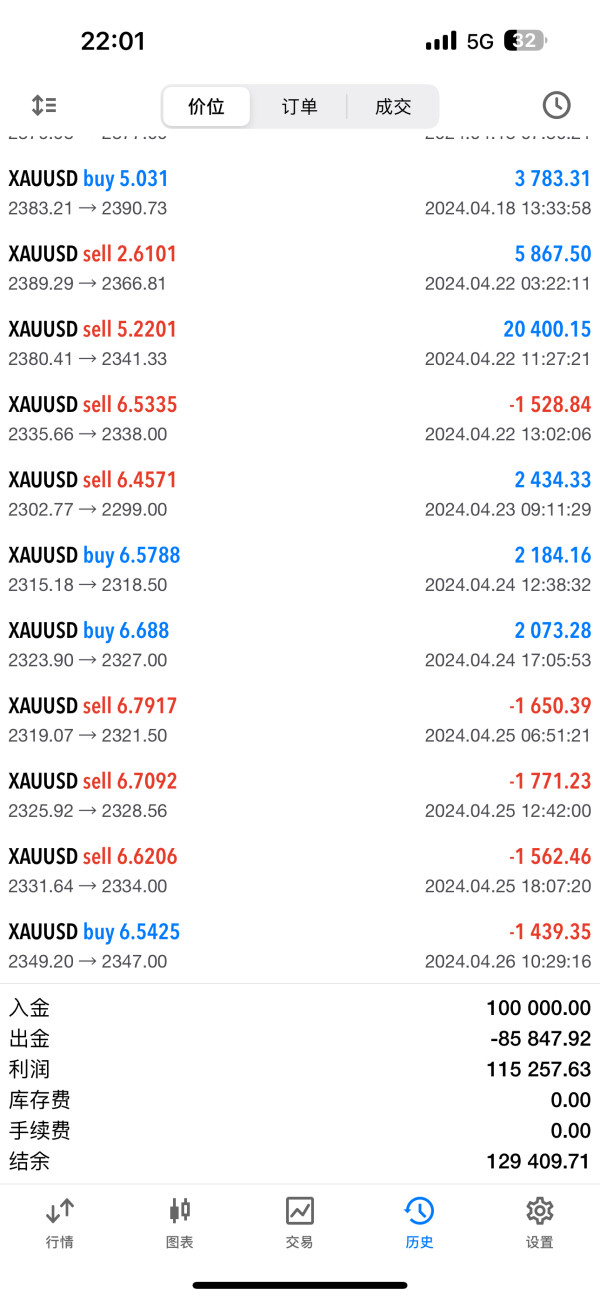

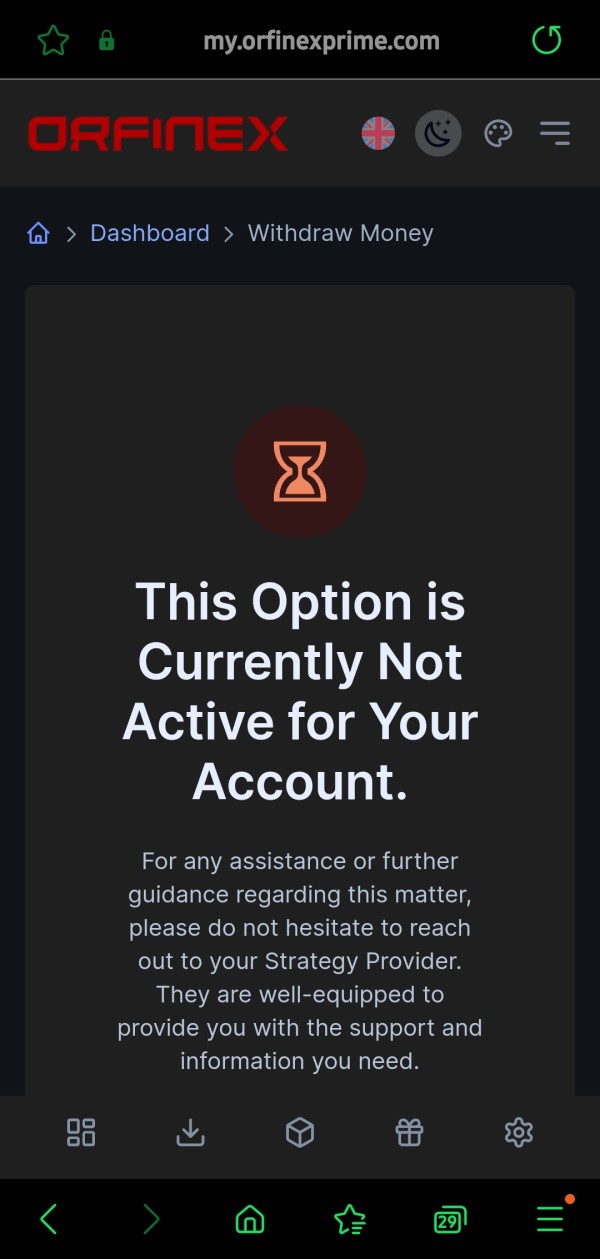

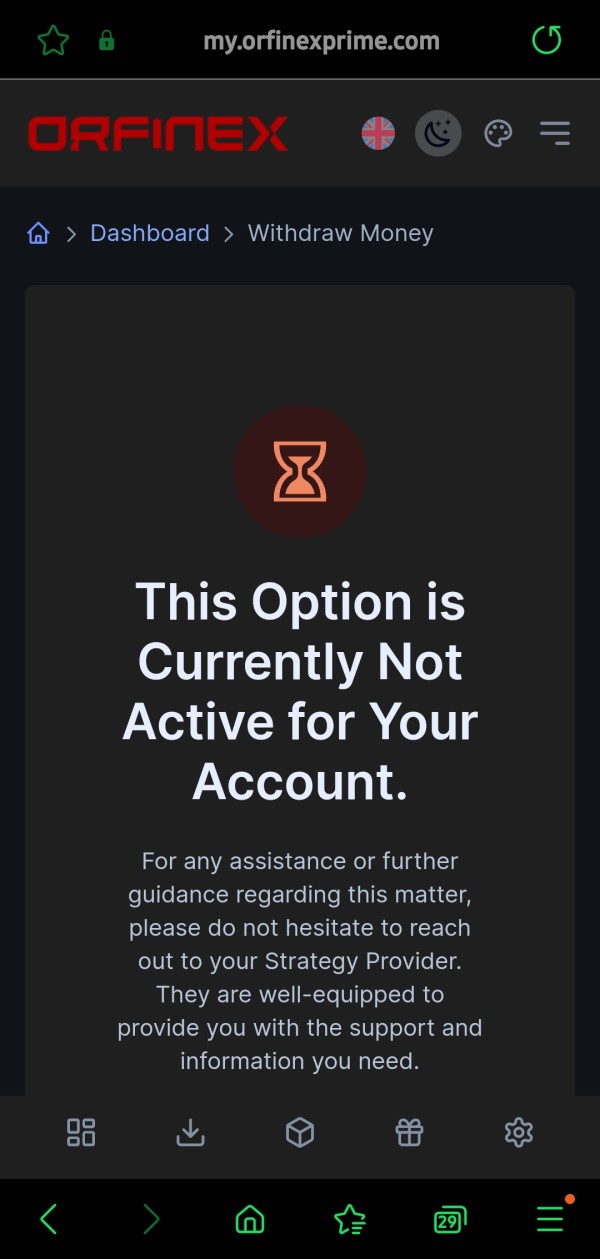

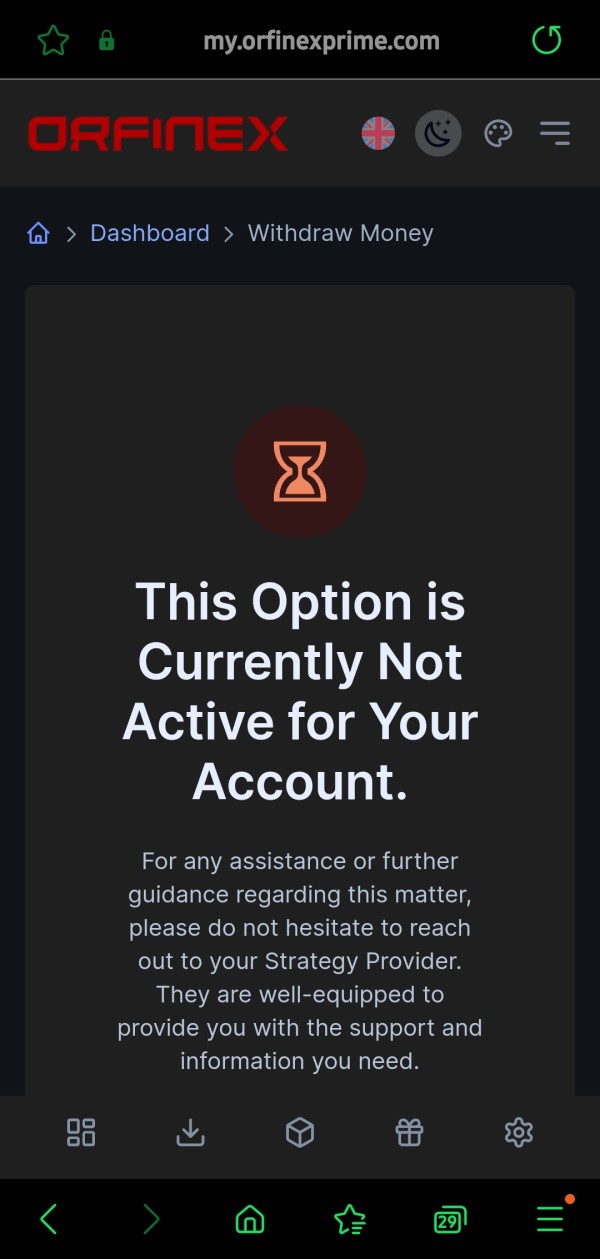

Fund deposit and withdrawal experiences, including processing times, available methods, and associated fees, are not comprehensively covered in accessible documentation. Payment processing efficiency significantly impacts user satisfaction, particularly for active traders requiring frequent fund movements.

Common user complaints appear to center around concerns about high-risk operations and potential fraudulent activities, as indicated by various review sources. These serious allegations suggest that some users have experienced significant issues beyond typical trading platform concerns. The issues potentially involve fund safety or withdrawal difficulties.

The target user profile for Orfinex appears to include traders interested in forex and CFD markets. However, current user satisfaction metrics suggest that the platform may not consistently meet client expectations regardless of trading experience level.

Conclusion

This comprehensive orfinex review reveals a broker with significant concerns that potential clients should carefully consider before making any commitment. While Orfinex operates under Mauritius regulatory oversight and has received some regional recognition, the overwhelming evidence suggests exercising extreme caution when evaluating this platform.

The combination of low user satisfaction ratings (2.4/5), minimal recommendation rates (33%), and serious risk warnings including suspected fraud allegations creates a concerning picture for potential clients. Despite offering MetaTrader 5 platform access and forex/CFD trading opportunities, these benefits are overshadowed by trust and safety concerns.

Orfinex may appeal to traders seeking basic forex and CFD market access, but the significant risks identified in this evaluation suggest that alternative brokers would likely provide superior service. Alternative brokers with stronger regulatory oversight, better user satisfaction ratings, and more transparent operations would likely provide better security for most trading requirements.