Nardo 2025 Review: Everything You Need to Know

Executive Summary

This nardo review looks at a forex broker that has gotten a lot of attention in the trading world. The attention hasn't been positive, though. Based on information from industry sources, Nardo seems to be an online financial services company that has faced questions about how open and regulated it is. Various consumer review sites and industry watchdogs show mixed feedback from users, with special concerns about business practices and customer service.

The broker works in financial services and offers trading-related services. However, specific details about trading platforms, types of assets, and account conditions are hard to find in public information. Consumer review websites have recorded different user experiences, and some people question how reliable the company is and how well it delivers services. Industry monitoring services have also pointed out certain parts of the broker's operations that potential clients should think about carefully before using their services.

This complete evaluation wants to give traders the important information they need to decide if Nardo fits their trading needs and how much risk they can handle.

Important Disclaimer

Regional Entity Differences: This review uses publicly available information from consumer review platforms and industry sources. Trading rules and broker operations can be very different across different areas. Potential clients should check the specific regulatory status and service offerings in their region before making trading decisions.

Review Methodology: This assessment comes from consumer feedback, industry reports, and publicly available information. The evaluation is not financial advice, and traders should do their own research before picking any broker for trading.

Rating Framework

Based on available information and industry standards, here are our ratings for Nardo across six key dimensions:

Broker Overview

Nardo seems to work as a financial services provider, but complete details about when it started, how it's organized, and what its main business focus is are limited in public sources. Consumer review platforms show that the company has received various user feedback and industry scrutiny, with mixed reports about service quality and business practices.

The broker's operational model and service offerings are not clearly defined in available public information. This lack of clarity raises questions about transparency and corporate communication. Industry watchdog services have recorded various parts of the company's operations, and some sources show concerns about regulatory compliance and customer service standards.

This nardo review shows that the broker operates in a very competitive financial services world where transparency, regulatory compliance, and customer satisfaction are extremely important for success. The limited publicly available information about the company's main operations, regulatory status, and service offerings may worry potential clients who want reliable trading partners.

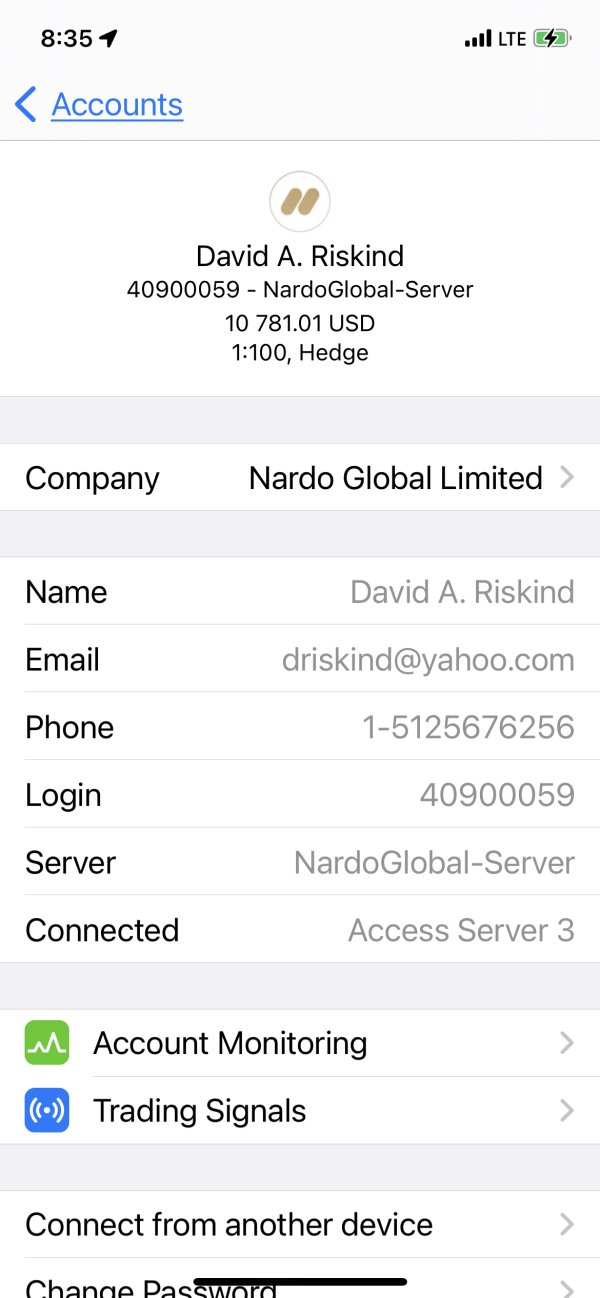

Regulatory Status: Specific regulatory information is not clearly recorded in available public sources. This represents a big concern for potential clients seeking regulated trading environments.

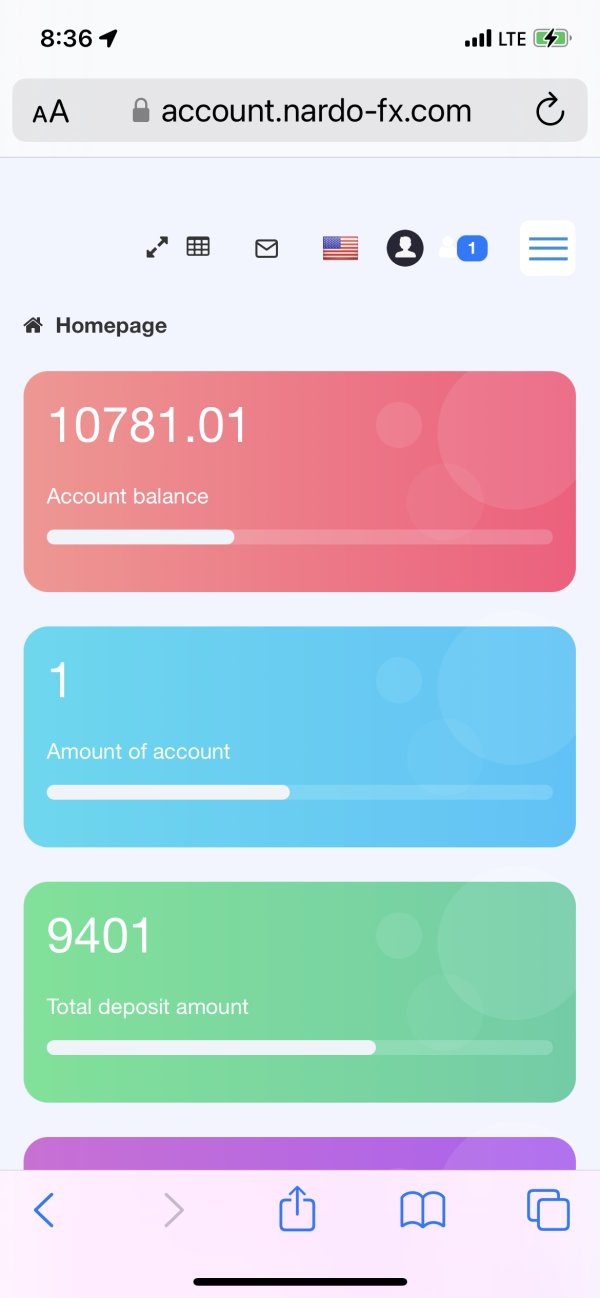

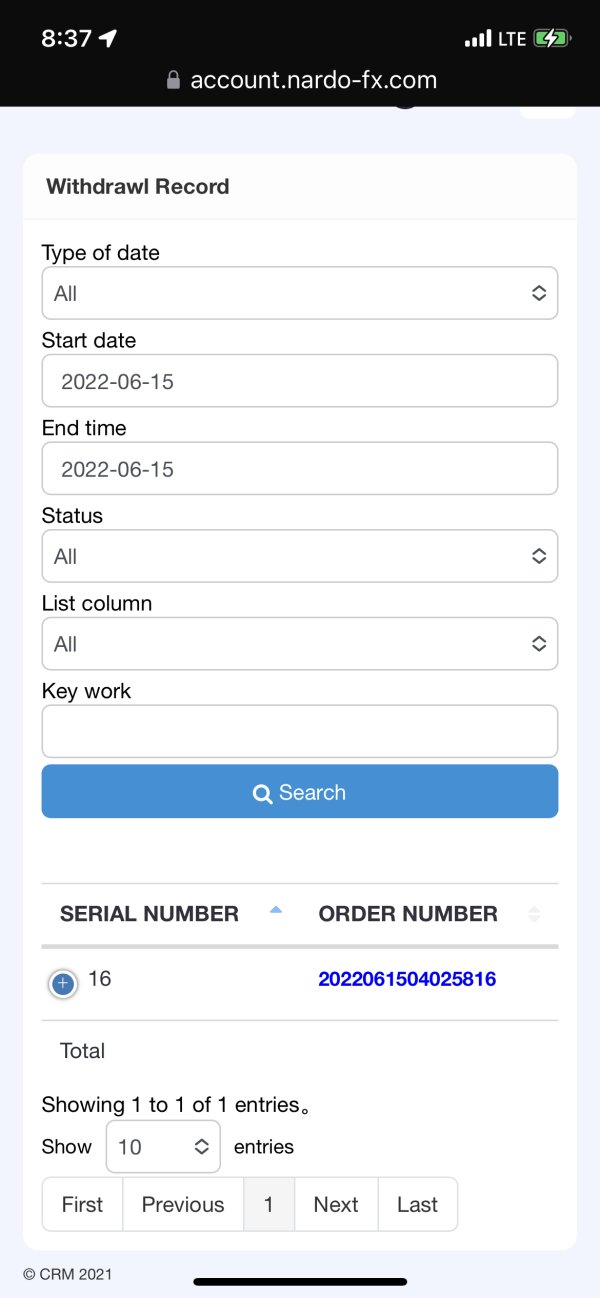

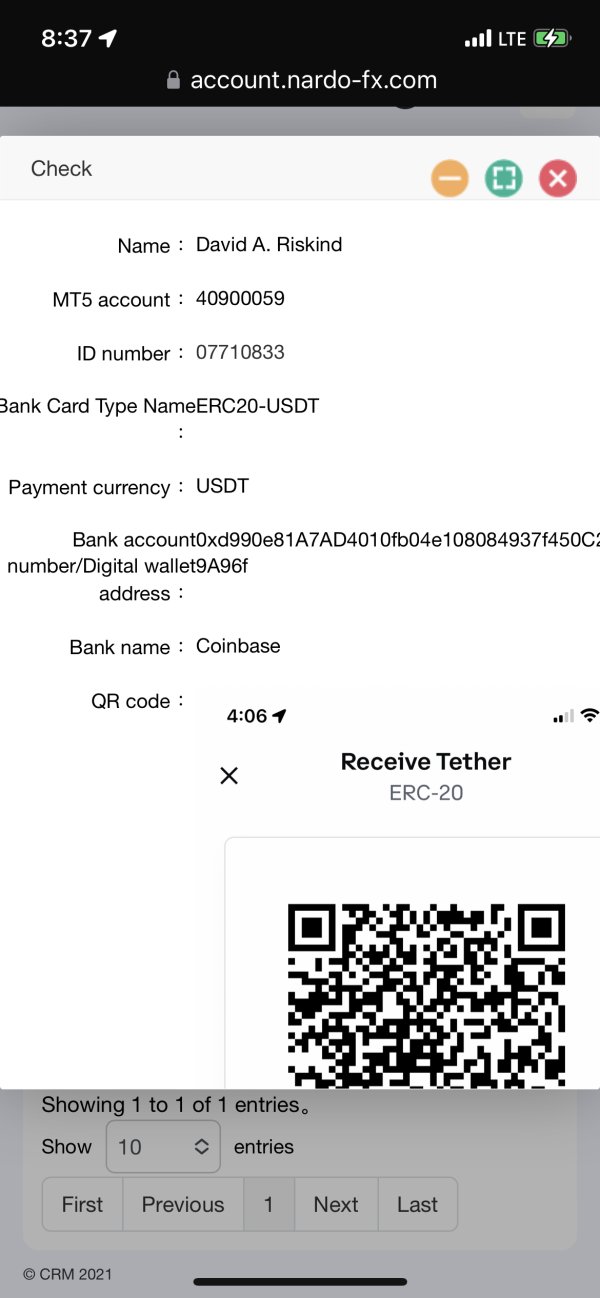

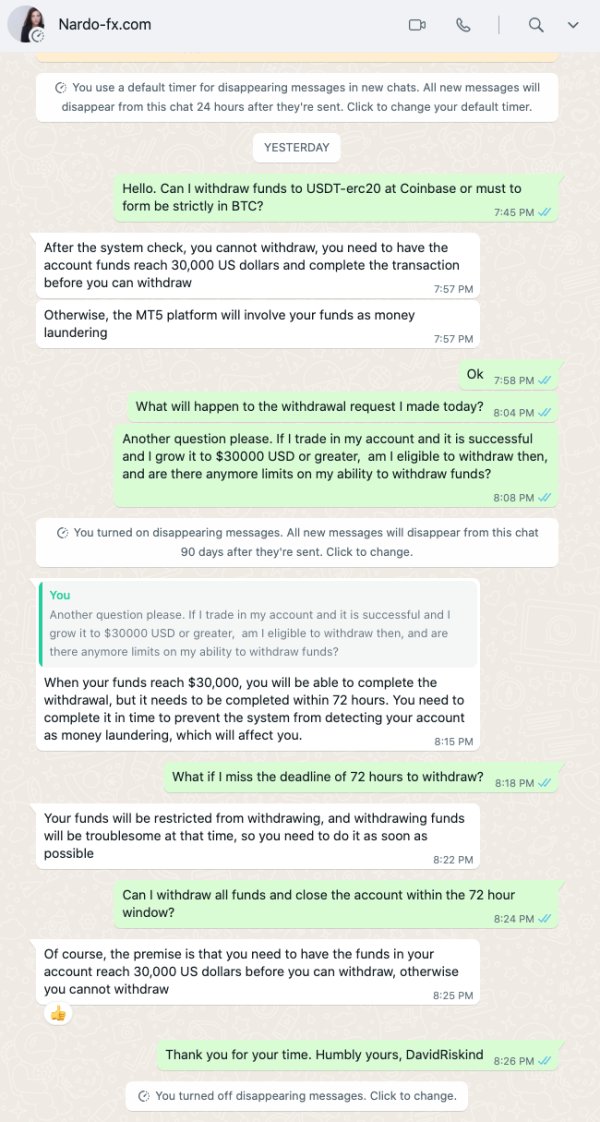

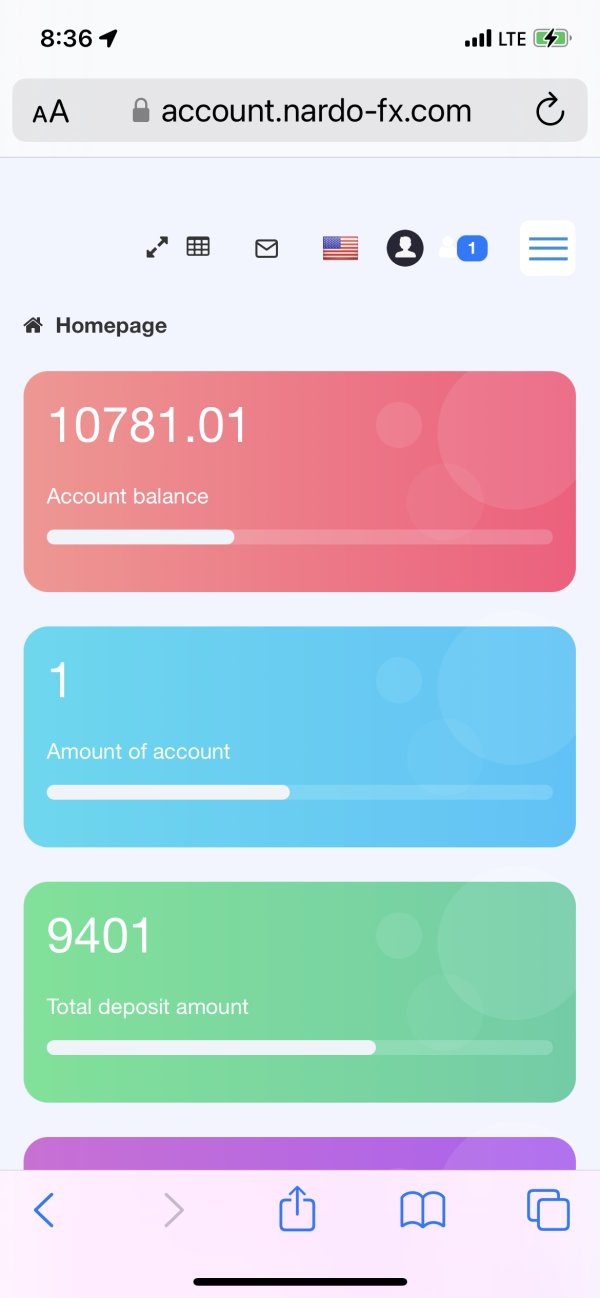

Deposit and Withdrawal Methods: Information about funding methods, processing times, and fees is not easily available in public documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available sources. This makes it hard for potential clients to assess accessibility.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers are not recorded in publicly available information.

Trading Assets: The specific range of tradeable instruments is not clearly outlined in available sources. This includes forex pairs, commodities, indices, or other financial products.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs is not transparently disclosed in public documentation.

Leverage Options: Available leverage ratios and margin requirements are not specified in accessible sources. This is crucial information for risk management.

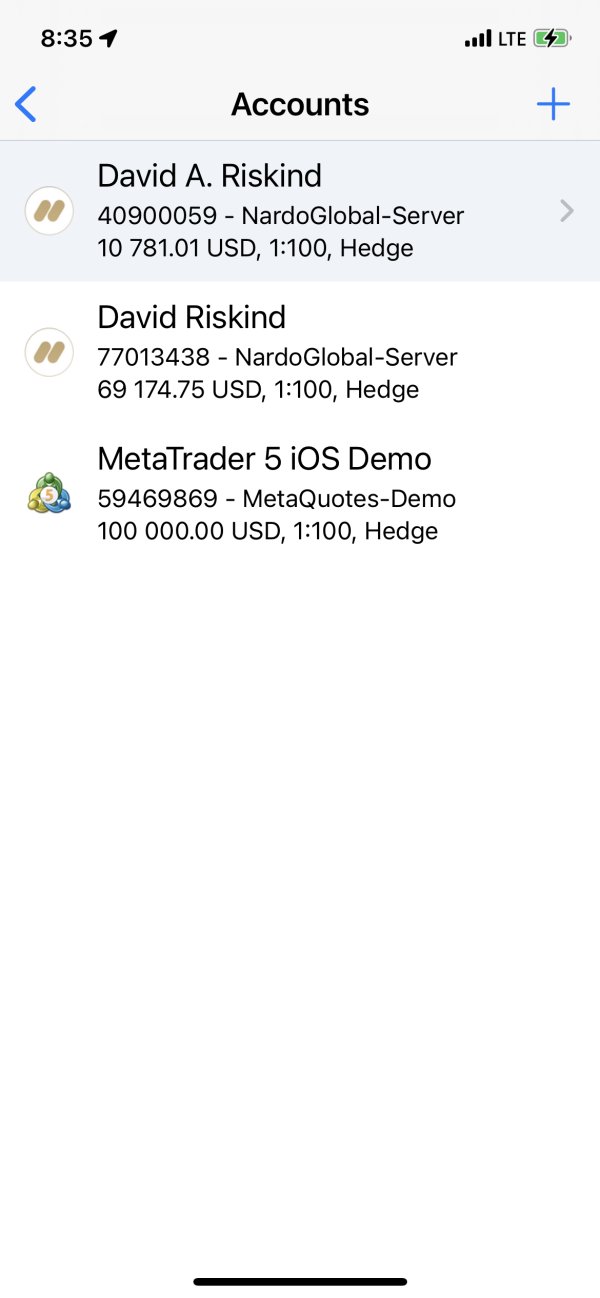

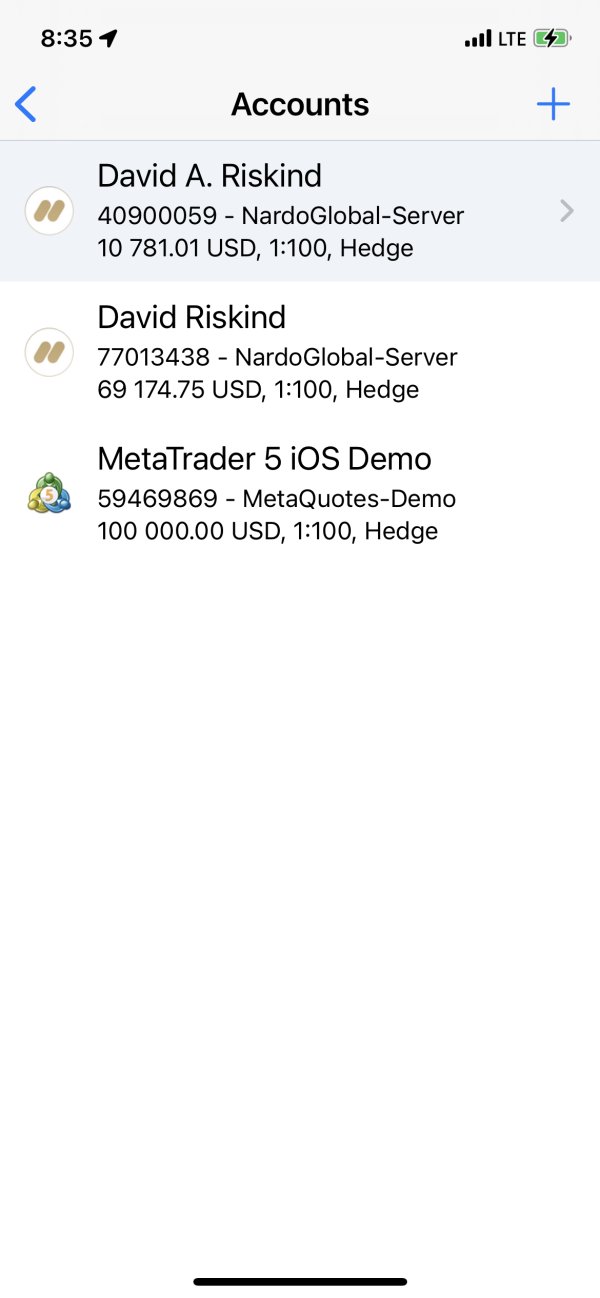

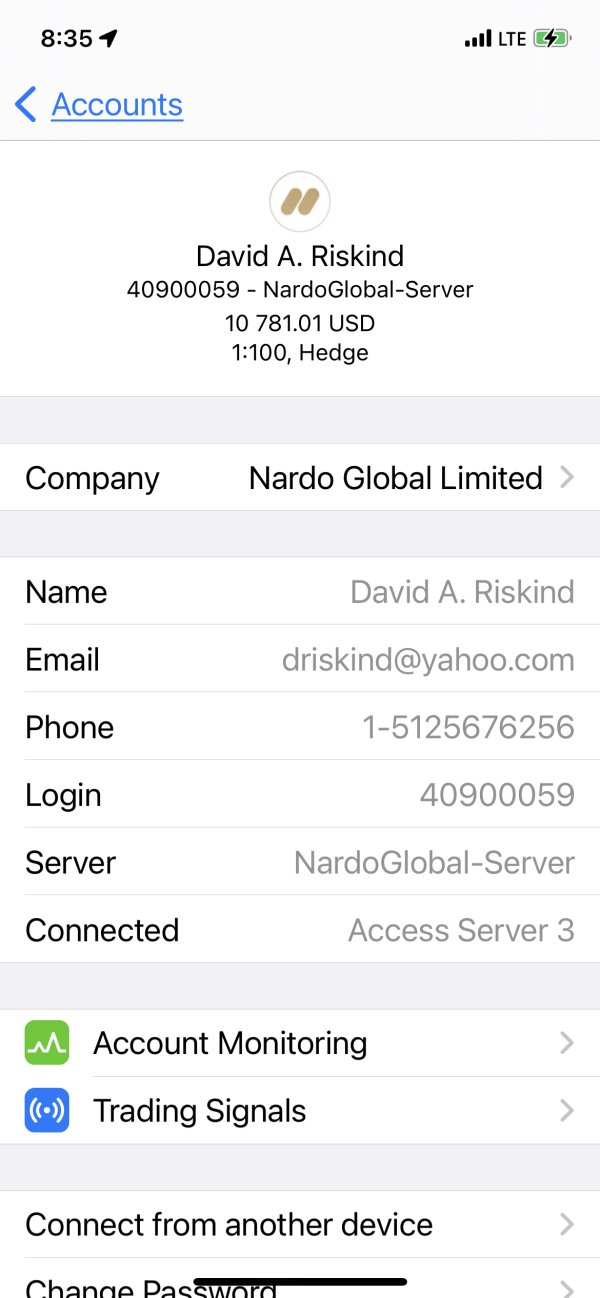

Platform Options: Details about trading platforms are not clearly documented. This includes whether they use proprietary or third-party solutions like MetaTrader.

Geographic Restrictions: Information about service availability in different countries or regions is not easily available.

Customer Support Languages: The range of supported languages for customer service is not specified in available documentation.

This nardo review highlights big gaps in publicly available information that potential clients usually need when evaluating broker services.

Detailed Rating Analysis

Account Conditions Analysis

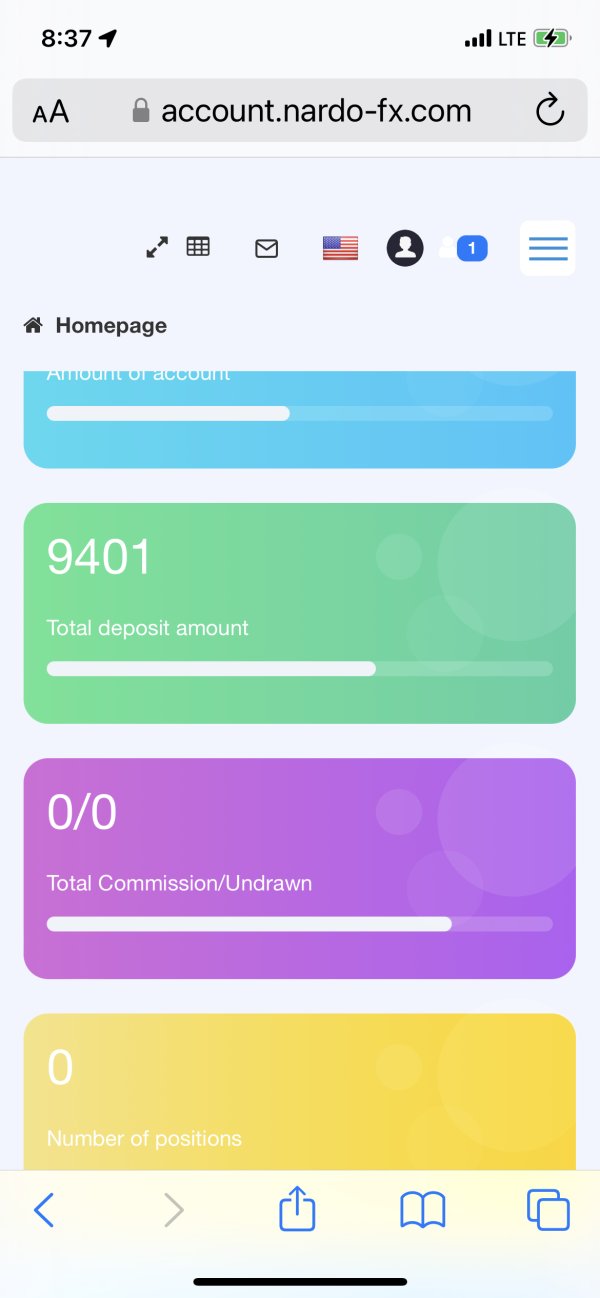

The assessment of Nardo's account conditions shows big information gaps that affect the overall evaluation. Based on available consumer feedback and industry sources, specific details about account types, minimum deposit requirements, and account features are not clearly documented or easily accessible to potential clients.

Consumer review platforms show mixed experiences about account setup and management processes. However, specific details about different account tiers, their features, and eligibility requirements remain unclear. The lack of transparent information about account conditions represents a big concern for traders who need clear understanding of terms and conditions before committing to a broker.

Industry standards usually require brokers to provide complete information about account types, minimum funding requirements, maintenance fees, and special features. These might include Islamic accounts or professional trading accounts. The absence of such detailed information in publicly available sources suggests potential transparency issues that traders should carefully consider.

This nardo review shows that prospective clients may face challenges in understanding the full scope of account conditions and requirements. This could lead to unexpected issues during the account opening or management process.

The evaluation of trading tools and resources available through Nardo presents limited information based on publicly accessible sources. Industry-standard trading tools usually include charting packages, technical analysis indicators, economic calendars, market research, and educational resources, but specific details about Nardo's offerings in these areas are not well-documented.

Consumer feedback suggests different experiences with available tools and resources. However, complete details about platform capabilities, research quality, and educational content are not clearly outlined in available sources. The absence of detailed information about trading tools may show limited offerings or poor communication about available resources.

Professional traders usually need access to advanced charting tools, real-time market data, automated trading capabilities, and complete research resources. The lack of clear documentation about these essential trading components raises questions about the broker's ability to support serious trading activities.

Educational resources are crucial for trader development and success. These include webinars, tutorials, market analysis, and trading guides. The limited information available about Nardo's educational offerings may show gaps in this important service area.

Customer Service and Support Analysis

Customer service quality represents a critical factor in broker selection, and available information about Nardo's support services presents several concerns based on consumer feedback and industry reports. The evaluation of customer service quality relies on user experiences documented across various review platforms and industry monitoring services.

Consumer review platforms show mixed experiences with customer service responsiveness, professionalism, and problem resolution capabilities. Some users have reported challenges in reaching support representatives, delayed response times, and difficulties in resolving account-related issues or technical problems.

The availability of multiple communication channels is standard in the industry. These include phone support, live chat, email assistance, and complete FAQ sections. However, specific information about Nardo's customer service infrastructure and availability is not clearly documented in accessible sources.

Language support and service hours are crucial factors for international clients, especially in the global forex market where trading happens around the clock. The limited information about multilingual support and service availability may show restrictions that could affect client experience.

Trading Experience Analysis

The assessment of trading experience with Nardo shows limited publicly available information about platform performance, execution quality, and overall trading environment. Trading experience includes platform stability, order execution speed, slippage rates, and the general reliability of trading infrastructure.

Based on available consumer feedback, experiences with trading platforms and execution quality seem to vary a lot among users. Some reports suggest technical issues, platform stability concerns, and challenges with order execution, but complete data about these issues is not easily available.

Platform functionality represents crucial components of trading experience. This includes charting capabilities, order types, risk management tools, and mobile trading options. The limited documentation about these features makes it hard to assess the broker's ability to provide professional-grade trading environment.

Market access significantly impacts trading experience. This includes available trading sessions, instrument availability, and execution models. However, specific information about these operational aspects is not clearly outlined in accessible sources.

This nardo review suggests that potential clients may face uncertainty about trading experience quality due to limited transparent information about platform capabilities and execution standards.

Trust and Reliability Analysis

Trust and reliability assessment shows big concerns based on available information from consumer review platforms and industry monitoring services. Regulatory compliance, financial stability, and operational transparency are fundamental components of broker trustworthiness, and Nardo seems to face challenges in these areas.

Regulatory oversight provides crucial protection for traders. This includes segregated client funds, dispute resolution mechanisms, and operational standards. The limited information about specific regulatory compliance raises serious questions about client protection and operational legitimacy.

Consumer review platforms record various concerns about business practices, service delivery, and company responsiveness to client issues. Industry watchdog services have also flagged certain aspects of operations that potential clients should carefully consider.

Financial transparency is essential for assessing broker reliability. This includes company ownership, financial statements, and operational history. The limited publicly available information about these crucial factors represents a big red flag for potential clients seeking trustworthy trading partners.

Negative feedback patterns and unresolved complaints recorded across multiple platforms suggest systemic issues that may affect client experience and fund security.

User Experience Analysis

User experience evaluation based on available consumer feedback shows big concerns about overall satisfaction and service quality. User experience includes the entire client journey, from initial research and account opening through ongoing trading activities and customer support interactions.

Consumer review platforms record various user experiences, and many show frustration with service quality, communication issues, and difficulty resolving problems. The pattern of negative feedback suggests systemic issues that may affect overall user satisfaction.

Interface design, platform usability, and account management processes significantly impact user experience. However, specific details about these aspects are not well-documented in available sources. The limited information about user-friendly features and intuitive design may show gaps in service delivery.

Account verification processes, funding procedures, and withdrawal experiences are crucial components of user experience. Consumer feedback suggests different experiences in these areas, with some users reporting complications and delays that affected their overall satisfaction.

The absence of complete positive feedback and the presence of documented concerns across multiple review platforms show big user experience challenges that potential clients should carefully consider.

Conclusion

This complete nardo review shows big concerns about the broker's operations, transparency, and service quality based on available information from consumer review platforms and industry sources. The evaluation shows substantial gaps in publicly available information about crucial trading conditions, regulatory compliance, and service offerings that potential clients need for informed decision-making.

The broker seems suitable mainly for traders who are comfortable with limited transparency and potential service quality issues. However, this represents a high-risk proposition for most trading requirements. The documented concerns about customer service, operational transparency, and user experience suggest that most traders would benefit from considering more established and transparent broker alternatives.

The main advantages seem limited, while big disadvantages include poor transparency, documented customer service issues, unclear regulatory status, and negative user feedback patterns that suggest systemic operational challenges.