Regarding the legitimacy of CapitalXtend forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is CapitalXtend safe?

Pros

Cons

Is CapitalXtend markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

CAPITALXTEND (MAURITIUS) LLC

Effective Date: Change Record

2023-06-15Email Address of Licensed Institution:

Shareholder@capitalxtend.comSharing Status:

Website of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

40 Silicon Avenue Cybercity Ebene The Catalyst Building, MauritiusPhone Number of Licensed Institution:

0035799936877Licensed Institution Certified Documents:

Is CapitalXtend A Scam?

Introduction

CapitalXtend is a forex broker that has emerged in the competitive landscape of online trading since its inception in 2020. It positions itself as a provider of a wide range of trading instruments, including forex pairs, cryptocurrencies, commodities, and indices. Given the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the credibility and safety of any broker they consider. This article aims to provide a thorough investigation into CapitalXtend, examining its regulatory status, company background, trading conditions, and customer experiences. The analysis is based on a comprehensive review of multiple sources, including user feedback, regulatory databases, and expert evaluations.

Regulation and Legitimacy

Regulation is a key factor in determining the safety and reliability of a forex broker. CapitalXtend claims to be regulated by the Financial Services Commission (FSC) of Mauritius, as well as being a member of the Financial Commission, which provides some level of investor protection. However, it is essential to note that the FSC is considered a tier-3 regulatory authority, which means that its oversight may not be as stringent as that of tier-1 regulators like the FCA or ASIC.

| Regulator | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSC | Not specified | Mauritius | Verified |

| SVG FSA | Not specified | St. Vincent and the Grenadines | Verified |

| Financial Commission | Not specified | International | Verified |

The regulatory quality of CapitalXtend raises concerns, particularly because tier-3 regulators often have minimal requirements for broker registration. While the presence of an investor protection fund through the Financial Commission is a positive aspect, it is essential to understand that this does not equate to the same level of protection offered by more reputable regulatory bodies. The lack of a robust regulatory framework can expose traders to higher risks, including potential fraud or mismanagement of funds.

Company Background Investigation

CapitalXtend is owned by CapitalXtend LLC, a company that claims to have over 15 years of experience in the trading industry, although its official registration dates back only to 2020. The company operates from St. Vincent and the Grenadines, a jurisdiction known for its lenient regulations regarding financial services. This raises questions about the authenticity of its claims and the transparency of its operations.

The management team of CapitalXtend includes individuals with backgrounds in finance and trading; however, specific details about their professional experiences are not readily available. This lack of transparency can be a red flag for potential investors. The company has made efforts to present itself as a trustworthy entity, but the absence of verifiable information about its leadership and operational history may deter cautious traders.

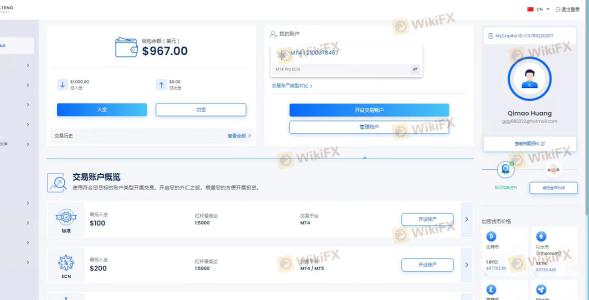

Trading Conditions Analysis

CapitalXtend offers a variety of trading accounts, each with different conditions and fee structures. The brokers overall fee model appears competitive, but potential clients should be aware of any hidden costs or unusual fee policies. The broker claims to provide tight spreads and high leverage, which can be appealing to traders seeking to maximize their returns.

| Fee Type | CapitalXtend | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | $3 per side (Pro-ECN) | $2 per side |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by CapitalXtend can be competitive, particularly for the Pro-ECN account, the commission structure may not be as straightforward as suggested. Traders should carefully review the terms associated with any bonuses or promotional offers, as these can often come with restrictive conditions that could affect withdrawal capabilities.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. CapitalXtend claims to implement measures such as segregated accounts and negative balance protection to safeguard client deposits. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, which is a standard practice in the industry. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory standards.

Historically, CapitalXtend has not reported any significant incidents regarding fund safety, but the absence of a robust regulatory framework raises concerns about the overall security of client funds. Traders should remain vigilant and consider the potential risks associated with depositing funds in an offshore broker.

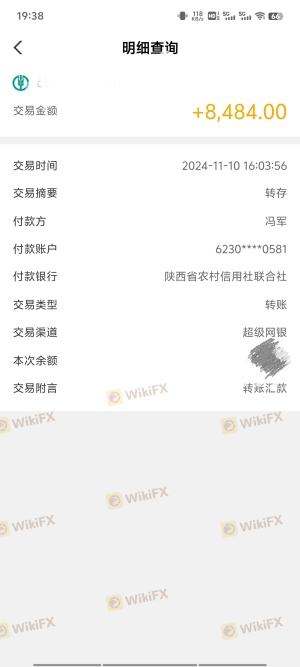

Customer Experience and Complaints

Customer feedback provides valuable insights into the reliability of a broker. Reviews of CapitalXtend are mixed, with some users praising its trading conditions and customer support, while others have raised serious complaints, particularly regarding withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Execution Delays | Medium | Fair |

| Customer Service Quality | Medium | Fair |

Common complaints include delays in processing withdrawals and difficulties in reaching customer support. For example, one user reported that after submitting a withdrawal request, the process took significantly longer than expected, leading to frustration and distrust. Another user noted that while the platform's execution speed was satisfactory, responsiveness from the support team was lacking.

Platform and Execution

CapitalXtend utilizes popular trading platforms, including MetaTrader 4 and MetaTrader 5, which are well-regarded for their reliability and user-friendly interfaces. However, the quality of order execution can vary. Some users have reported issues with slippage and order rejections, which can significantly impact trading performance.

Traders should be cautious and monitor their execution quality closely, especially during periods of high volatility. The absence of clear evidence of platform manipulation is a positive aspect, but traders should remain vigilant and conduct thorough testing of the platform before committing significant funds.

Risk Assessment

Using CapitalXtend presents several risks that traders should consider before opening an account. The lack of stringent regulatory oversight, combined with mixed customer feedback and potential withdrawal issues, creates a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight |

| Withdrawal Risk | Medium | Complaints regarding withdrawal delays |

| Execution Risk | Medium | Potential slippage and rejections |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining a cautious approach to funding and trading with only what one can afford to lose is essential.

Conclusion and Recommendations

In conclusion, while CapitalXtend presents itself as a legitimate forex broker with various trading options, the overall assessment indicates that potential clients should proceed with caution. The absence of tier-1 regulatory oversight, coupled with mixed customer feedback regarding withdrawals and support, raises red flags.

Traders seeking a reliable broker may want to consider alternatives with stronger regulatory frameworks and proven track records. Reputable brokers such as IG Markets, OANDA, or Forex.com offer more robust protections and a history of positive customer experiences. Ultimately, thorough research and due diligence are critical steps for any trader looking to navigate the forex market safely.

Is CapitalXtend a scam, or is it legit?

The latest exposure and evaluation content of CapitalXtend brokers.

CapitalXtend Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CapitalXtend latest industry rating score is 7.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.