CapitalXTend 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

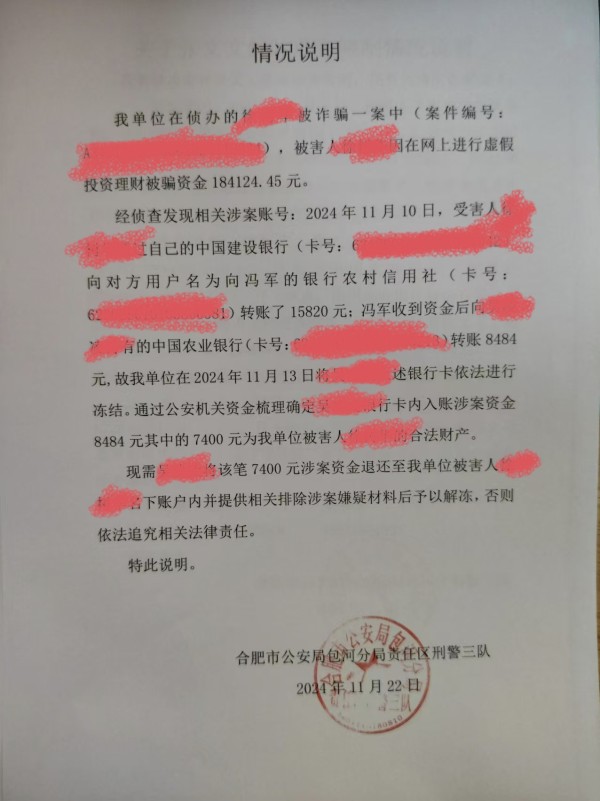

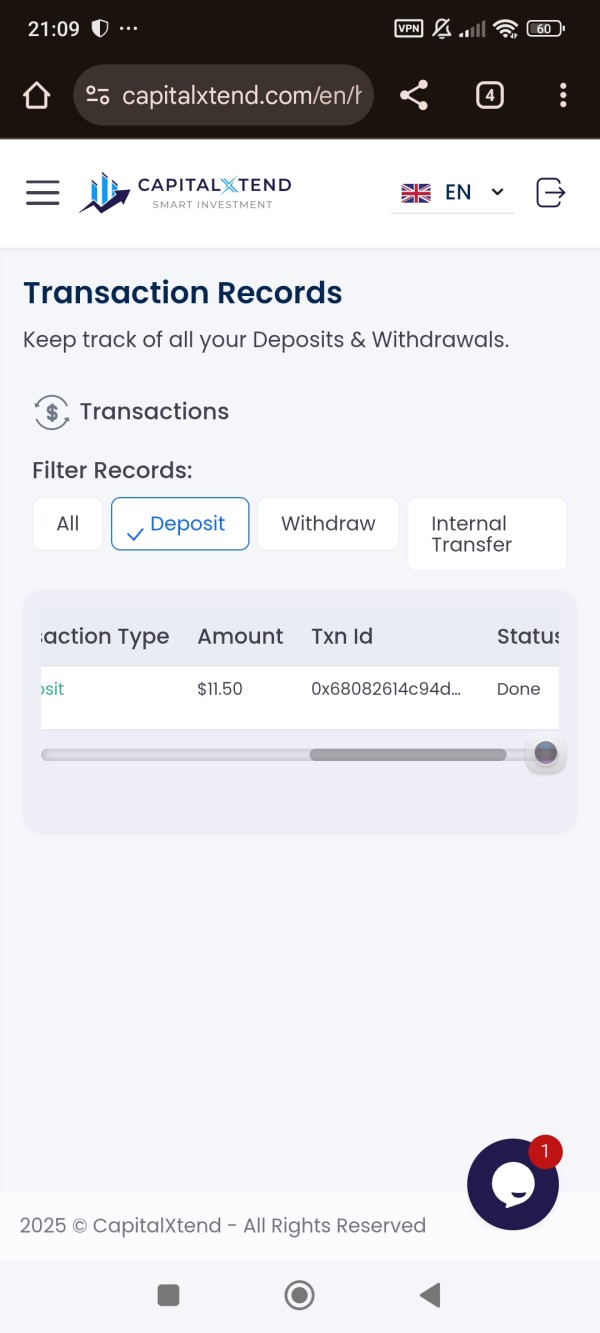

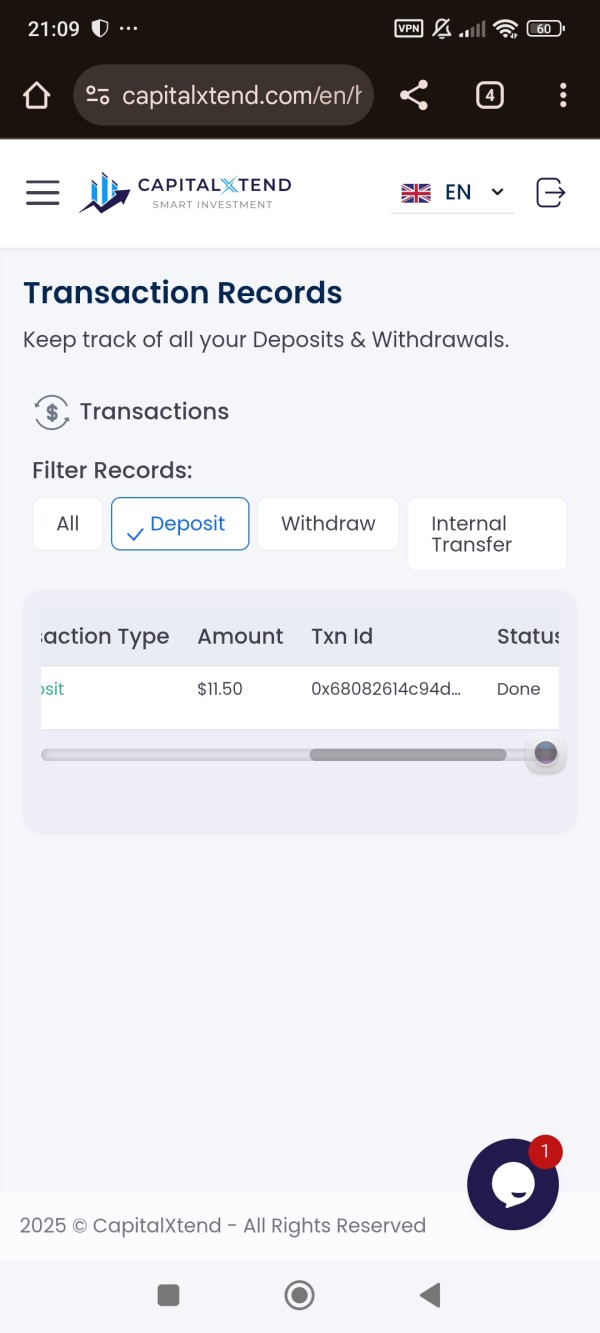

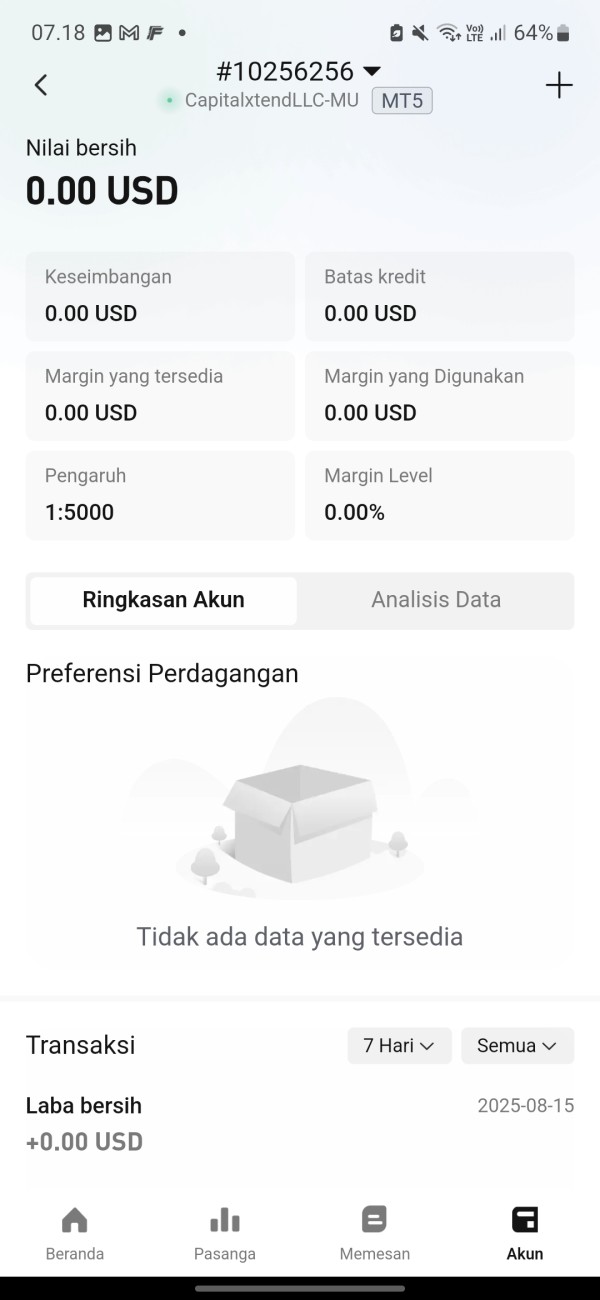

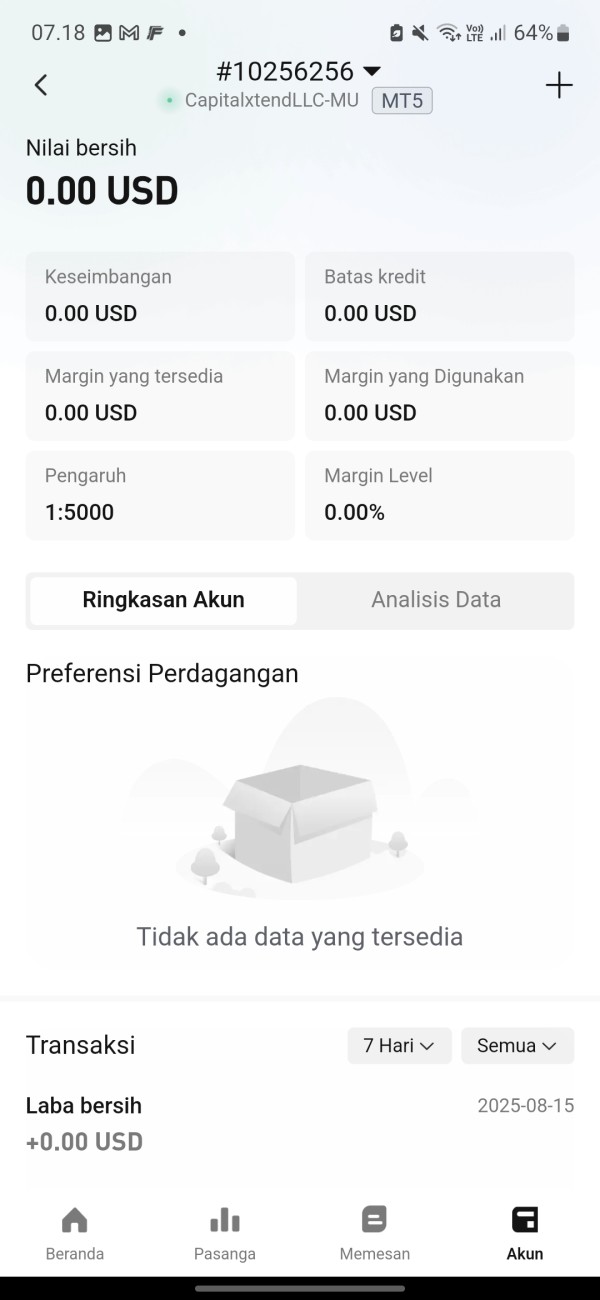

CapitalXTend emerges as an attractive online forex broker targeting retail traders with a promising array of trading instruments and exceptionally high leverage options. Traders can access more than 350 financial assets including forex pairs, commodities, stocks, and cryptocurrencies with leverage going as high as 1:5000. The allure of minimal initial deposits—starting at just $12—adds to the broker's appeal. However, substantial risks loom. The broker operates under relatively low-tier regulation, specifically by the Financial Services Commission of Mauritius (FSC) and the Financial Services Authority of St. Vincent and The Grenadines. This regulatory backdrop has sparked significant concerns about fund safety and withdrawal reliability. Furthermore, user feedback has been polarized, with numerous reports highlighting withdrawal issues and fund safety challenges.

The trade-off for traders seems clear: attractive trading features are counterbalanced by serious risks associated with a lack of robust regulatory oversight and a history of negative user experiences. Thus, while CapitalXTend may provide a tempting offering with its high leverage and extensive trading options, potential traders should proceed with caution, weighing the possibility of significant losses against the lure of high returns.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with CapitalXTend or any similar broker, it is crucial to conduct diligence to mitigate risks.

Risk Statement:CapitalXTend operates under low-tier regulation, posing risks to your funds.

Potential Harms:

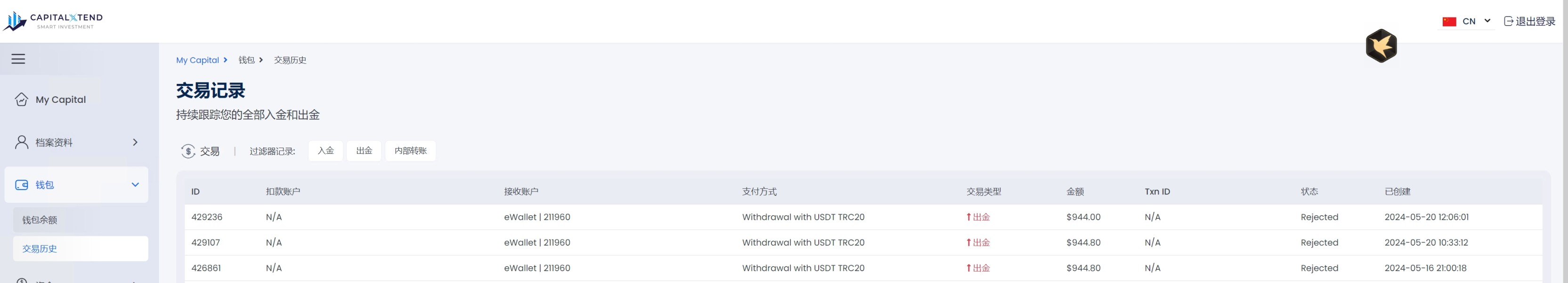

- Withdrawal delays and potential loss of funds.

For your protection, follow these self-verification steps:

- Check the brokers regulatory status on official websites.

- Review user feedback on independent platforms to gauge experiences.

- Assess the broker's transparency in fees and terms to anticipate hidden charges.

Rating Framework

Broker Overview

Company Background and Positioning

CapitalXTend is a relatively modern addition to the forex brokerage landscape, having been established in 2020 and operating its headquarters in the offshore jurisdiction of St. Vincent and The Grenadines. Its business model revolves around attracting both beginner and seasoned traders by providing a broad array of trading assets, stemming from forex to commodities and cryptocurrencies. This offshore status can bestow certain operational flexibility; however, it also casts a shadow of caution due to the accompanying lack of stringent regulatory oversight. Conducting trading activities with an offshore broker can present challenges, as many traders may find themselves without the safety typically afforded by Tier-1 regulators.

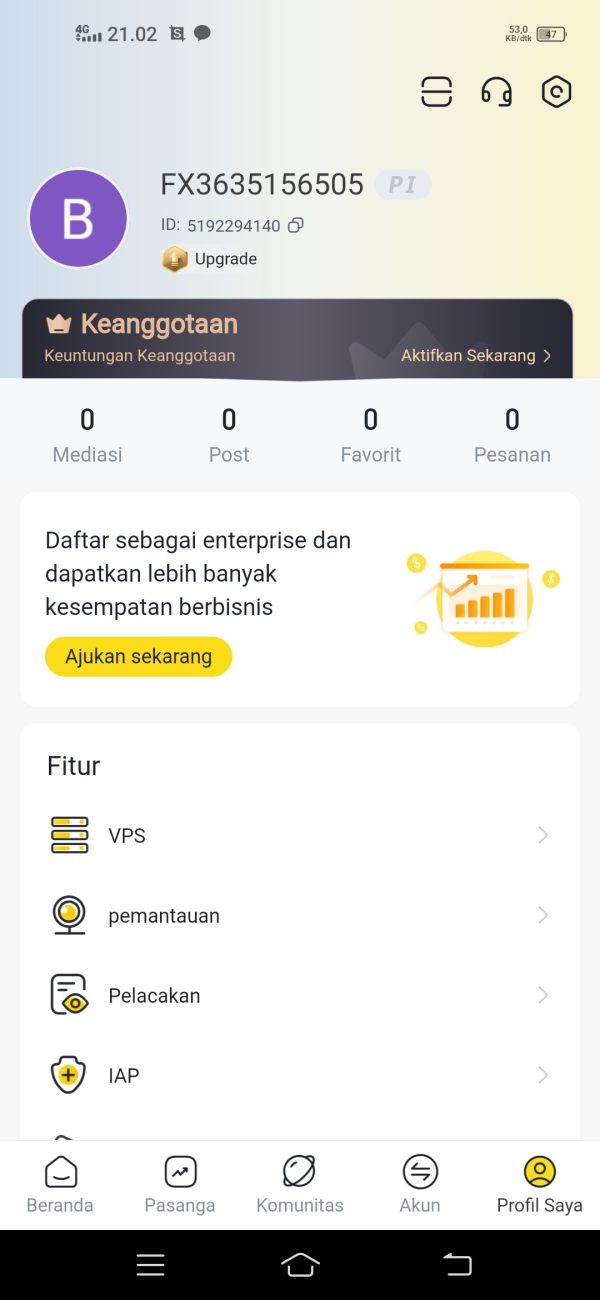

Core Business Overview

CapitalXTend offers a diverse portfolio of trading instruments: over 30 forex currency pairs, CFDs on commodities, indices, and a variety of cryptocurrencies. Supported trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are renowned for their robust trading environments. To capitalize on entry-level traders' eagerness, CapitalXTend's marketing emphasizes low fees amid promises of fast execution, but caution is warranted due to ongoing concerns regarding regulatory compliance and financial security.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

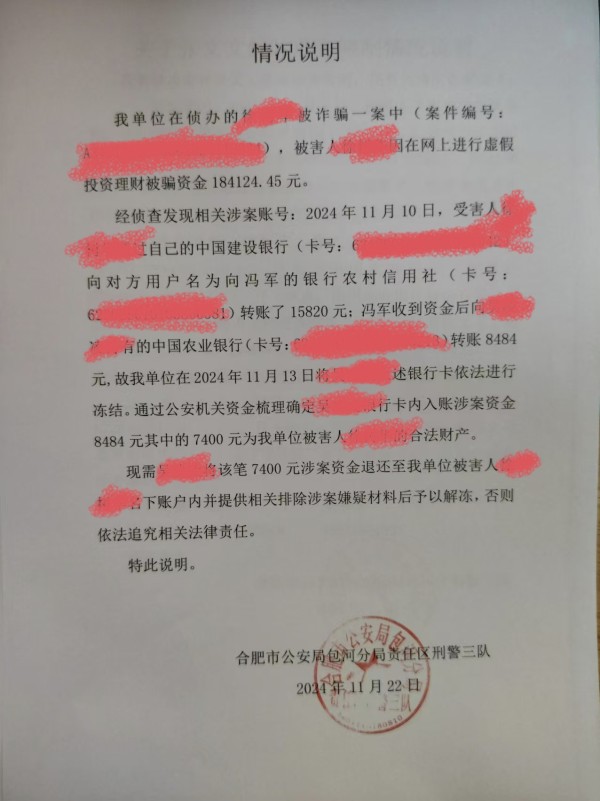

The regulatory standing of CapitalXTend is notably concerning. Operating under the FSC of Mauritius, which has been classified as a lower-tier regulatory body, raises substantial alarms regarding fund safety.

Analysis of Regulatory Information Conflicts:

Even though the broker claims to have regulatory oversight, the reality is that these regulators do not enforce the stringent guidelines upheld by higher-tier authorities like the FCA or ASIC. This can leave traders vulnerable in cases of fund mismanagement or default.

User Self-Verification Guide:

For those contemplating working with CapitalXTend, it is imperative to self-verify the legitimacy through the following steps:

Check the regulatory status on official websites including the FSC.

Review user feedback on independent review platforms such as Forex Peace Army and Trustpilot.

Analyze the transparency of the brokers fee structures.

Industry Reputation and Summary:

User reviews present a mixed picture:

"They are 100% a scam. I made a $1000 deposit, and they are not sending it back. Never do any business with this scam broker."

This exemplifies the negative sentiment surrounding CapitalXTend and highlights the need for potential traders to exercise caution.

Trading Costs Analysis

The double-edged sword effect.

While CapitalXTend advertises a competitive trading fee structure, hidden costs and unexpected charges may significantly undermine this advantage.

Advantages in Commissions:

The brokerage boasts competitive commissions, particularly on transactions involving forex pairs.

The "Traps" of Non-Trading Fees:

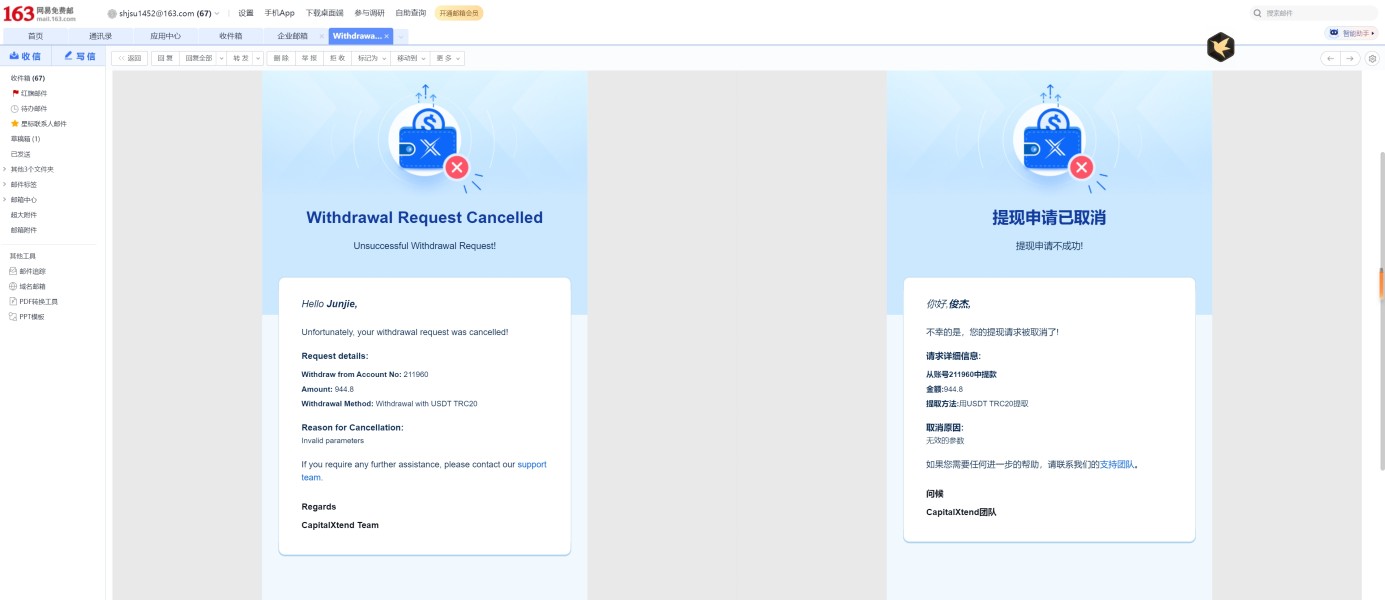

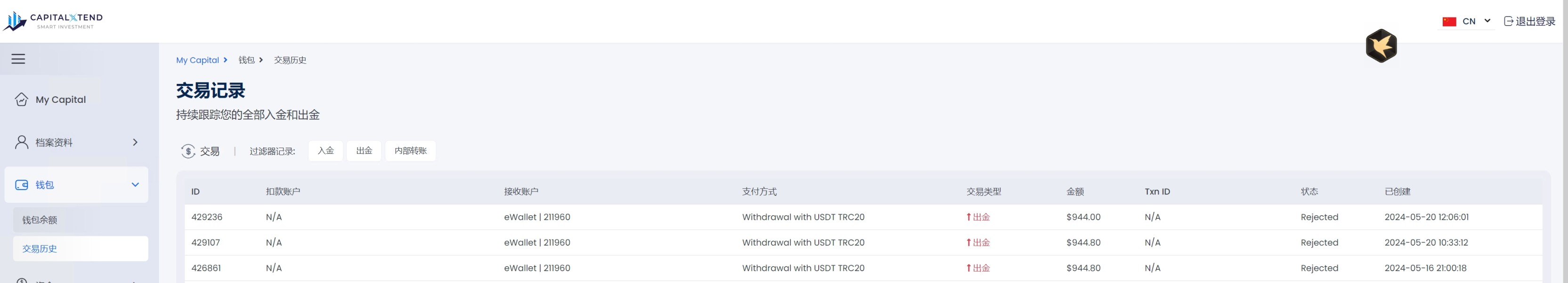

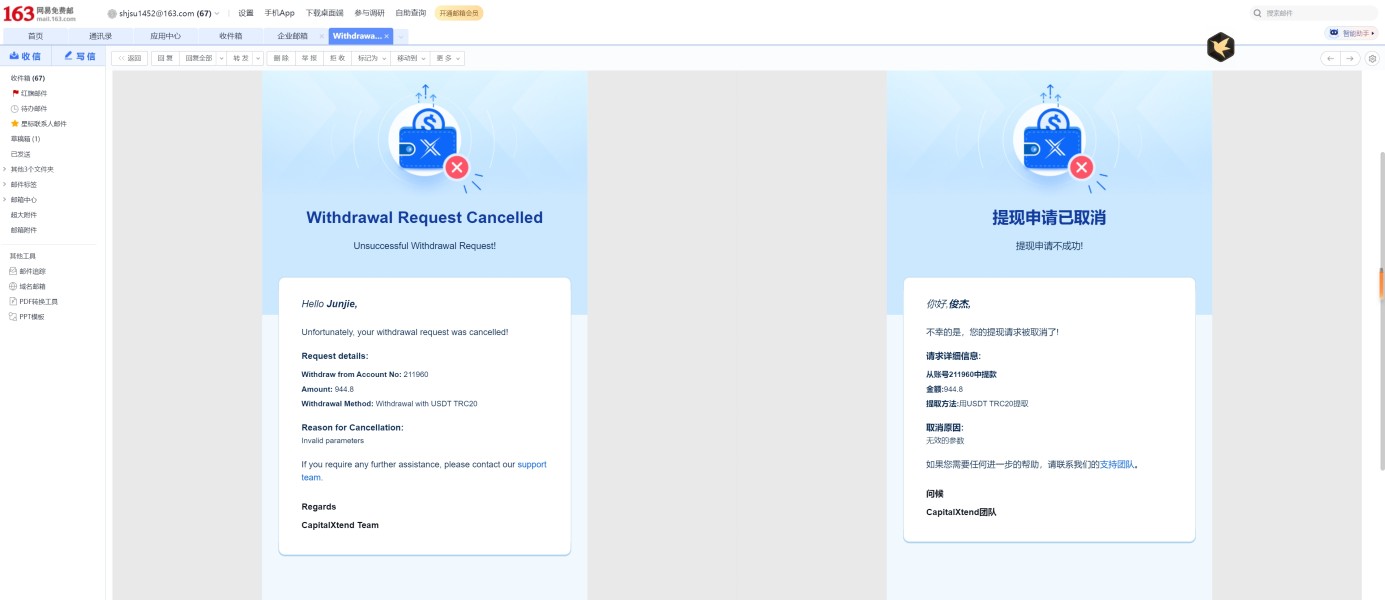

Complaints have surfaced regarding unexpected withdrawal fees, which can be restrictive:

"Withdrawal fee may apply," a disclaimer that may not be clearly communicated upfront.

- Cost Structure Summary:

For active traders, while the trading costs can be tempting, the potential for hidden fees poses a risk, especially for those inexperienced in navigating brokerage terms.

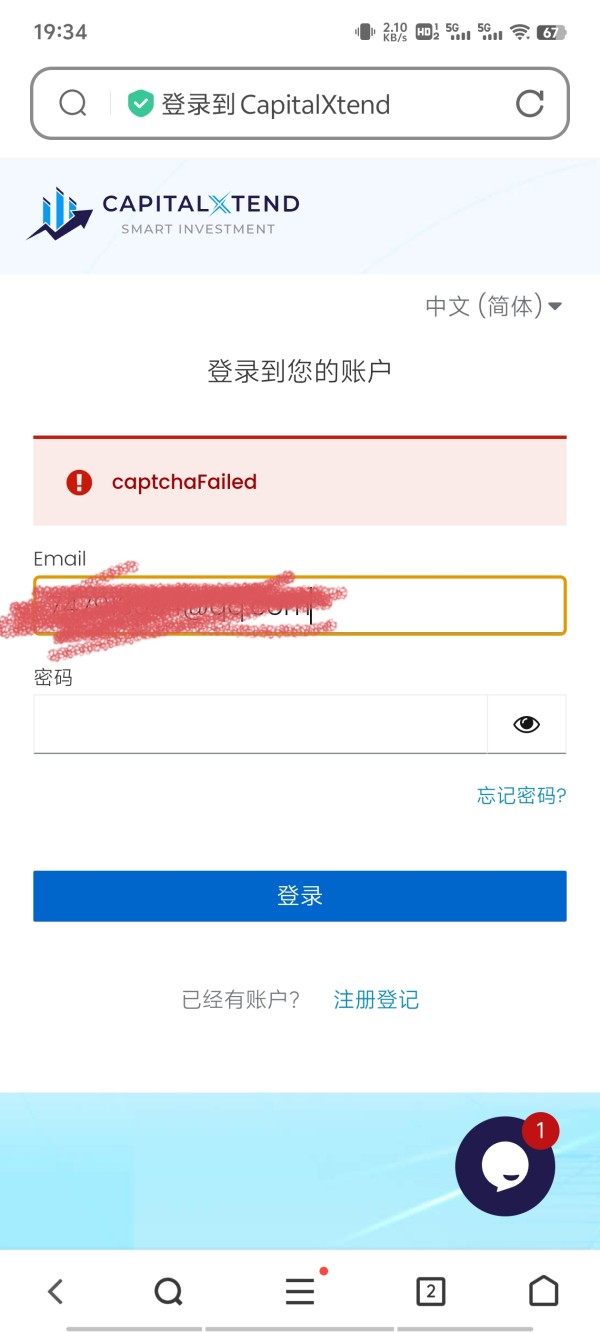

Professional depth vs. beginner-friendliness.

CapitalXTend claims to provide advanced trading platforms revered by the trading community.

Platform Diversity:

The availability of MT4 and MT5 caters to a wide range of traders, from novices to professionals seeking sophisticated trading tools.

Quality of Tools and Resources:

The presence of educational resources can facilitate better trading decisions, although the broker lacks transparency in terms of available tutorials or trading guides.

Platform Experience Summary:

Users have provided feedback indicating mixed experiences, making it imperative for prospective traders to cautiously approach the broker's offerings.

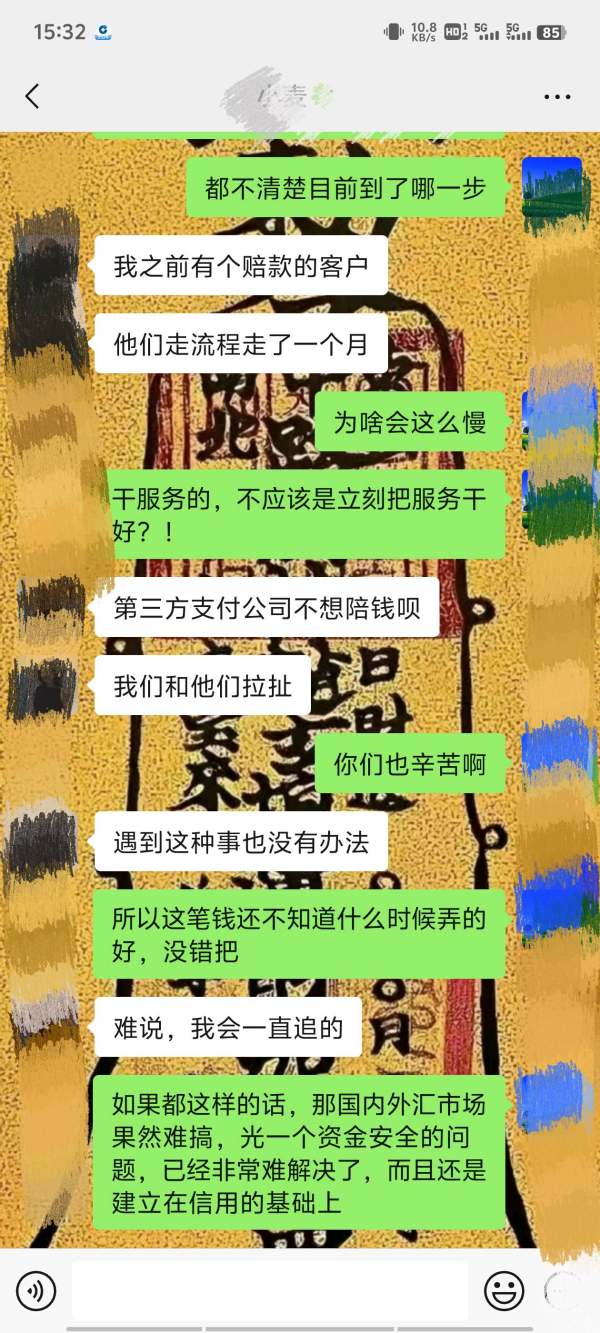

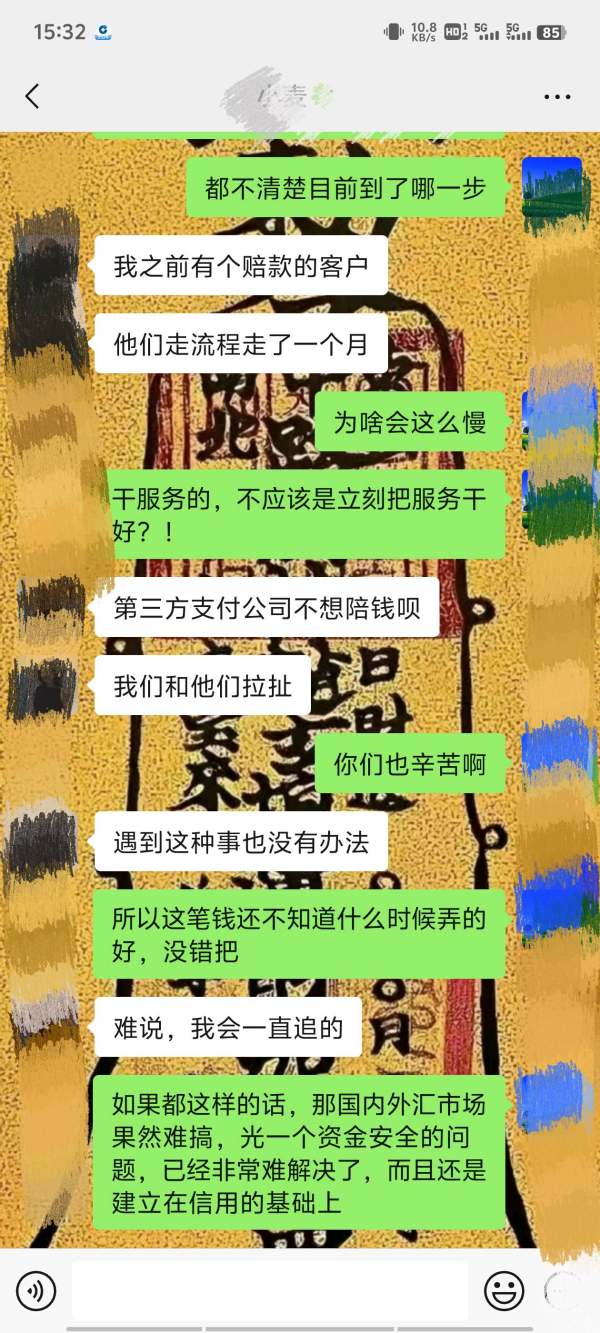

User Experience Analysis

Navigating the maze of reviews.

The user experience with CapitalXTend varies widely, with many citing operational efficiency while others flag withdrawal and support issues.

Platform Usability and Design:

Traders have noted that the platform is user-centric and generally easy to navigate, though it comes with a caveat concerning the reliability of transactions.

Customer Support Quality:

Users have characterized customer service as lacking availability and responsiveness:

“Limited support options for non-registered users,” raises a red flag for new traders needing guidance.

- User Review Summary:

The disparity in feedback indicates the necessity for traders to conduct their research and weigh experiences from other users.

Customer Support Analysis

Evaluation of support structure.

Customer support is a vital aspect of any broker, and CapitalXTend's offerings warrant a thorough assessment.

Support Options Available:

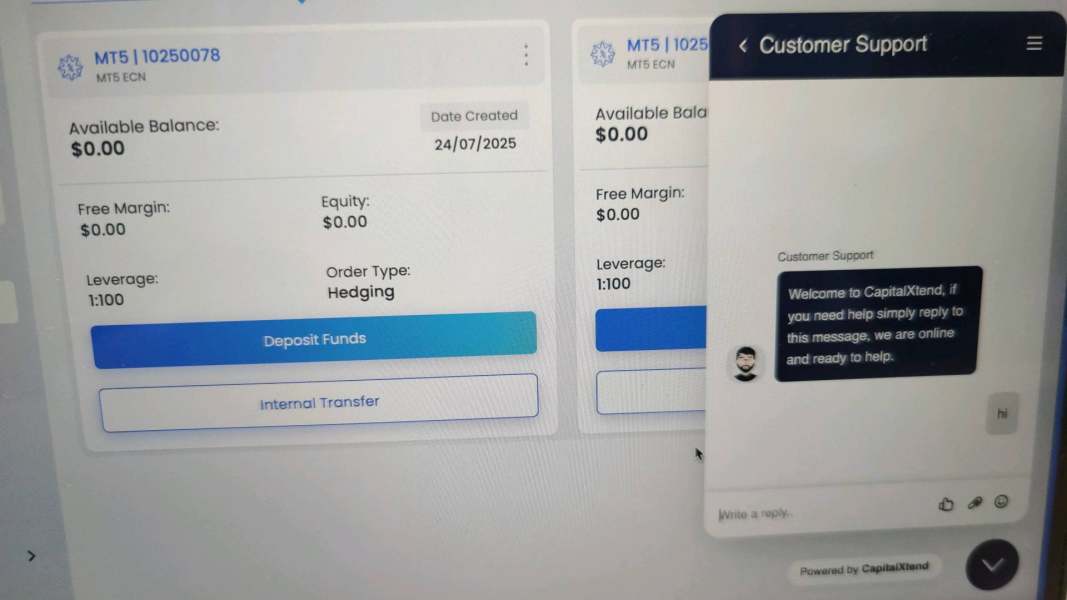

While the broker claims to provide 24/7 support, a common complaint has been the limited access to live chat unless one has an account.

User Feedback on Timeliness and Effectiveness:

Users have expressed frustration regarding response times, often citing delays during peak hours.

Support Summary:

The inconsistency in reporting reveals a pressing need for improved customer service measures which could significantly enhance the trading experience.

Account Conditions Analysis

Assessing the risk-reward landscape.

An evaluation of account conditions showcases CapitalXTends strategic positioning while flagging potential hazards for new traders.

Account Types and Their Features:

CapitalXTend offers various account types catering to different trader needs, but the minimum deposit requirements can be a barrier for entry-level traders.

Leverage Ratios Offered:

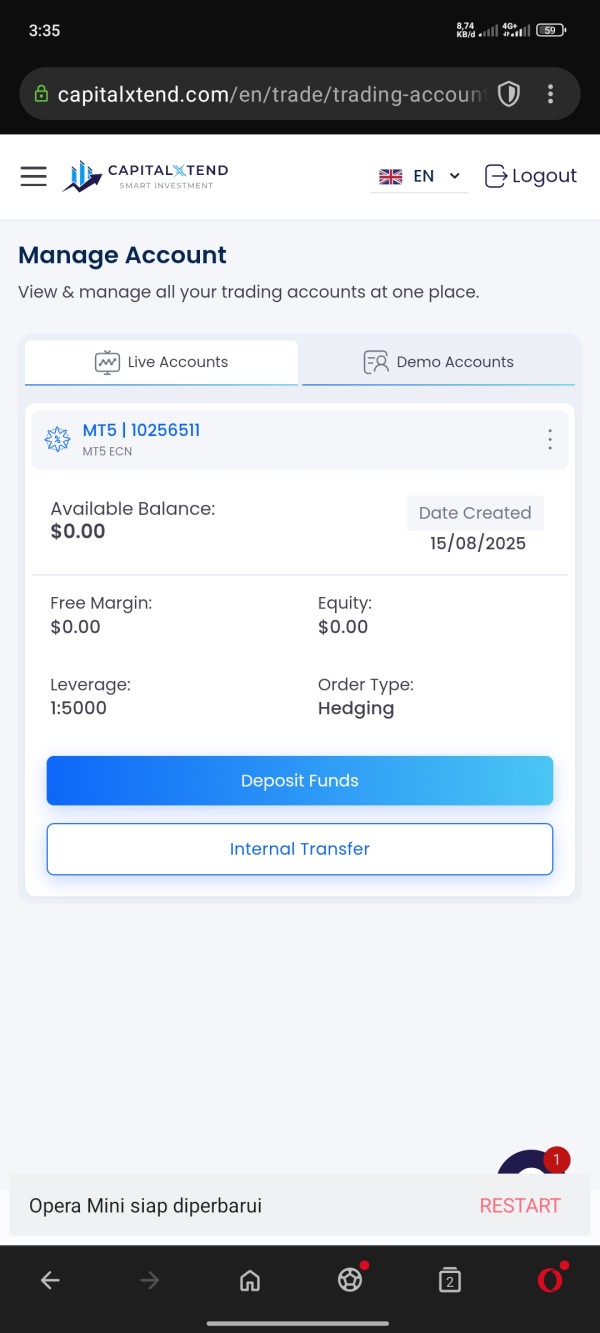

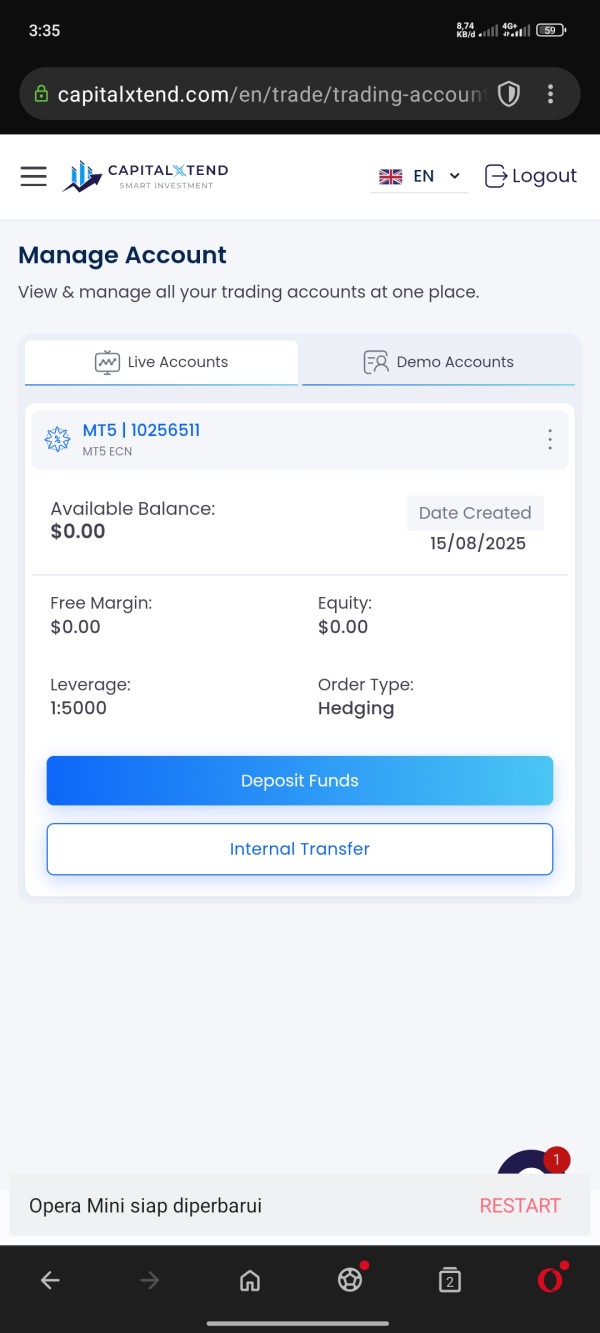

While the promise of high leverage (up to 1:5000 on certain accounts) is appealing, it inherently increases trading risks, making it crucial for traders to manage their exposure Vigilantly.

Risk for Beginners:

The availability of high leverage alongside the lack of tier-1 regulation poses a risk especially for inexperienced traders who may not fully grasp the implications of their trading decisions.

Conclusion

In closing, CapitalXTend offers a seductive package for traders seeking high leverage and expansive trading options. Still, the low-tier regulatory framework and substantial user complaints serve as significant red flags. Traders are advised to conduct thorough research, consider the risks involved, and remain vigilant in their investment strategies. CapitalXTend may be an alluring opportunity, but due diligence is essential to navigating the complexities of forex trading prudently.